Abstract

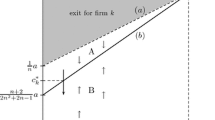

This study analyzes a mixed duopoly composed of a social welfare-maximizing public firm and a relative profit-maximizing private firm wherein the owners of both firms hire relative profit-maximizing managers biased with respect to the market size they face. In particular, we explore the quantity competition that gives a result different from that obtained in a standard mixed duopoly that differentiates between ownership and management, as considered by (Nakamura, Theor Econ Lett 4(3), 889–896, 2014a), which follows the approach of (Englmaier, and Reisinger, Manag Decis Econ 35(5), 350–356, 2013). More precisely, when we introduce the degree of importance of each firm’s relative performance into quantity competition, we see that the owner of the private firm reverts to a less aggressive manager when the degree of importance is relatively high, which is similar to how the classical strategic managerial delegation works. Furthermore, we consider the influence of an increase in degree of importance of each firm’s relative performance on the aggressiveness of managers hired by both the public and private firm. Moreover, we explore the case in which the owner hires his manager with salary based on social welfare.

Similar content being viewed by others

Notes

Hoernig (2012) provided a theoretical foundation for why firms’ owners hire aggressive managers even in price competition by introducing network effects à la Katz and Shapiro (1985). This differs from the classical studies on strategic managerial delegation such as Fershtman and Judd (1987), Sklivas (1987), and Vickers (1985).

The relative performance approach has frequently been used in the context of macroeconomics as well (for example, Corneo and Jeanne (1997), Corneo and Jeanne (1999), and Futagami and Shibata (1998)). Moreover, in laboratory and experimental works, Cason et al. (2002), Brandts et al. (2004), and Coats and Neilson (2005) considered spiteful behavior and reciprocal or altruistic behavior. Both behaviors are closely related to the firms’ objective functions based on relative performances; more precisely, the positive value of α corresponds to spiteful behavior whereas the negative value of α corresponds to reciprocal or altruistic behavior. On the basis of relative performance, Alchian (1950) and Vega-Redondo (1997) considered evolutionary stability.

The analysis of price competition is available upon request. In price competition, an increase in degree of importance of each firm’s relative performance is seen to make the owners of both the public firm and private firm more likely to hire a less aggressive manager.

More concretely, this is the inverse demand function the owners of firms face. Thus, although the objective functions of the owners are explained in detail in Section 3, the social welfare that the owner of firm 0 and the relative profit that the owner of firm 1 maximize in the first stage are calculated as the functions of k 0 and k 1 based on this “true” inverse demand function the owner of firm i faces, \({p^{o}_{i}} \left (q_{i}, q_{j} \right )\). \({q^{m}_{0}} \left (k_{0}, k_{1} \right )\), and \({q^{m}_{1}} \left (k_{0}, k_{1} \right )\), which are set by the managers of firms 0 and 1 in the second stage.

b∈(0,1)indicates that the goods produced by firms 0 and 1 are substitutable.

Firm i’s manager is not biased when k i = 1,(i = 0,1).

We assume that a>c≥0 and α∈[0,1) in order to ensure the non-negativity of all equilibrium outcomes.

As in Matsumura and Okamura (2010), Nakamura and Saito (2013a, 2013b), we regard social welfare as the sum of consumer surplus and the profit of firms 0 and 1, rather than the sum of consumer surplus and the relative profit of firms 0 and 1. Although the CEOs of firms emphasize their relative profit rather than original profit, since their relatively good performance would raise their current and future income, we consider this simply an income transfer. Therefore, in this paper, social welfare is the sum of consumer surplus and the profit of firms 0 and 1.

As indicated in Englmaier and Reisinger (2013), Nakamura (2014a, 2014b), the type of rival manager is observable to both firms 0 and 1. Since the identity of the manager of each firm is public information, the type of manager is also observable to the manager of the rival firm; this factor becomes important in the market competition stage.

In this paper, we deal with the degree of importance of each firm’s relative performance as exogenous variable, since we investigate the influence of the intensity of competition based on the type of the managers of firms 0 and 1, k 0 and k 1. In another strand of the research on the relative performance approach, Miller and Pazgal (2001) considered the situation in which each firm’s owner endogenously sets the degree of importance of his relative performance as the weight between his absolute profit and the absolute profit of his rival firm in his relative profit.

Furthermore, we have

$$\begin{array}{@{}rcl@{}} \partial {p^{o}_{i}} \left( k_{i}, k_{j} \right) / \partial k_{i} = a \left[2 - b^{2} \left( 1 - \alpha\right) \right] / \left[4 - b^{2} \left( 1 - \alpha\right)^{2} \right] < 0. \end{array} $$Thus, as k i increases, p i decreases, implying that market competition becomes more intense as k i increases, (i = 0,1). In addition, we obtain

$$\begin{array}{@{}rcl@{}} \partial {p^{m}_{i}} \left( k_{i}, k_{j} \right) / \partial k_{j} = - a b \left( 1 + \alpha\right) / \left[4 - b^{2} \left( 1 - \alpha\right)^{2} \right] < 0. \end{array} $$We thank the anonymous referee for suggesting an extended analysis in this section.

References

Alchian AA (1950) Uncertainty evolution, and economic theory. J Polit Econ 57:211–221

Bertrand N, Schoar A (2003) Managing with style: the effect of managers on firm policies. Q J Econ 118:1169–1208

Bennedsen M, Perez-Gonzalez F, Wolfenzon D (2007) Do CEOs matter? mimeo

Brandts J, Saijo T, Schram A (2004) How universal is behavior? A four country comparison of spite and cooperation in voluntary contribution mechanisms. Public Choice 119:381–424

Cason TN, Saijo T, Yamato T (2002) Voluntary participation and spite in public good provision experiments: an international comparison. Exp Econ 5:133–153

Coats JC, Neilson WS (2005) Beliefs about other-regarding preferences in a sequential public goods game. Econ Inq 43:614–622

Corneo G, Jeanne O (1997) On relative wealth effects and the optimality of growth. Econ Lett 54:87–92

Corneo G, Jeanne O (1999) Pecuniary emulation, inequality and growth. Eur Econ Rev 43:1665–1678

Dixit A (1979) A model of duopoly suggesting a theory of entry barriers. Bell J Econ 10:20–32

Drucker P (1967) The effective executive. Harper Collins, New York

Englmaier F, Reisinger M (2013) Biased managers as strategic commitment. Manag Decis Econ 34:350–940

Fershtman C, Judd K (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77:927–940

Futagami K, Shibata A (1998) Keeping one step ahead of the joneses: status, the distribution of wealth and long run growth. J Econ Behav Organ 36:109–126

Graham JR, Harvey RH, Puri M (2013) Managerial attitudes and corporate actions. J Financ Econ 109:103–121

Hoernig S (2012) Strategic delegation under price competition and network effects. Econ Lett 117:487–489

Katz M, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econ Rev 75:424–440

Matsumura T, Okamura M (2010) Competition and privatization policy: the relative performance approach. mimeo

Matsumura T, Matsushima N (2012) Competitiveness and stability of collusive behavior. Bull Econ Res 64(Supplement s1):22–31

Matsumura T, Matsushima N, Cato S (2013) Competitiveness and R&D competition revisited. Econ Model 31:541–547

Miller NH, Pazgal AI (2001) The equivalence of price and quantity competition with delegation. RAND J Econ 32:284–301

Nakamura Y (2014a) Biased managers as strategic commitment in a mixed duopoly. Theor Econ Lett 4:889–896

Nakamura Y (2014b) Biased managers as strategic commitment: the relative profit approach. Res Econ 68:230–238

Nakamura Y, Saito M (2013a) Capacity choice in a mixed duopoly: the relative performance approach. Theor Econ Lett 3:124–133

Nakamura Y, Saito M (2013b) Capacity choice in a price-setting mixed duopoly: the relative performance approach. Mod Econ 4:273–280

Sklivas SD (1987) The strategic choice of management incentives. RAND J Econ 18:452–458

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15:546–554

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147

Vega-Redondo F (1997) The evolution of walrasian behaviour. Econometrica 65:375–384

Acknowledgments

We are deeply grateful to anonymous referees for helpful comments and suggestions. This research is financially supported by KAKENHI (25870113). All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Nakamura, Y. Biased Managers as Strategic Commitment in a Mixed Duopoly with Relative Profit-Maximizers. J Ind Compet Trade 15, 323–336 (2015). https://doi.org/10.1007/s10842-015-0198-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-015-0198-4