Abstract

Game theory is used to investigate the formation of farsightedly stable climate coalitions in different time horizons. The integrated assessment model FUND provides data for different time horizons as well as the per-member partition cost-benefit function of pollution abatement. This allows the comparison of farsightedly stable climate coalitions in relation to their improvement to environmental quality and welfare for different time horizons. The amount of farsightedly stable climate coalitions is large, particularly for last time horizons, and this indicates that there are a lot of countries, which have economic incentives to join climate agreements like the Paris agreements in a “farsighted world.” The farsighted stability is not robust with respect to small changes in variables which determine it. In order to have longstanding farsightedly stable climate coalitions for different time horizons, one needs to maintain the emissions of each coalition member and the changes of marginal benefits from pollution abatement among coalition members as small as possible. However, the marginal costs and benefits from pollution abatement are governed by economic structure and environmental damages in each country, which cannot be influenced. Furthermore, the members and size of farsightedly stable climate coalitions are very fragile to the emission changes of certain coalition members from 1-year horizon to the next one. Then, it results that farsightedly stable climate coalitions cannot be maintained for long terms, which indicates that the “egoistic farsighted world” cannot assure lasting big international climate agreements.

Similar content being viewed by others

Notes

Our approach, similar to [15], is general and can be applied not only to climate games, but we focus to climate games in this paper.

For a proper cycle, there are at least three coalition structures that cannot be dominated. We are listing below two examples of cycles:

{1, 2, 3, 4} = a1 →{1, 2, 5, 6} = a2 →{1, 2, 3, 4} = a1, 2 coalitions structure cannot be dominated

{1, 2, 3, 4} = a1 →{1, 2, 5, 6} = a2 →{1, 2, 7, 8} = a3 →{1, 2, 3, 4} = a1, 3 coalitions structure cannot be dominated

The case of arbitrary coalition structure an is considered in detail in [37], so we find redundant to repeat it here as the focus of the paper is the comparison of farsightedly stable coalitions in different time horizons.

Please note that sub-coalition domination is always of indirect domination in nature; in any simple sub-coalition domination, there are always two steps: on the first step, some countries leave the coalition, and on the second one, some countries join it. External (or internal) domination can be of a direct nature too; for example, two countries join the coalition (or leave it), and the coalition domination process ends.

See Observation 3.2 of [38], which makes sure that we are able to find all farsightedly stable climate coalitions (profitable or non-profitable) even using only profitable climate coalitions as a starting point.

One point has to be made here; a farsighted country can still leave the coalition in a public good game, not only because of free-riding but for example, in a non-profitable coalition, when a country can leave the coalition if its welfare is lower than in a fully-non-cooperative structure.

70% of all countries-regions for years 2005 and 2035.

88% of all countries-regions for year 2025.

Single farsightedly coalitions include around 40% of the countries, while multiple farsighted stable coalitions include around 70% of the countries [38].

Note that only the results for the climate coalition (USA, LAM, SEA, CHI, NAF, SSA) are presented. The results for other coalitions can be provided on request.

Again, we present the results only for the climate coalition (USA, LAM, SEA, CHI, NAF, SSA). The results for other coalitions can be provided on request.

If there is only a line parallel to the x-axis for a certain country, it signifies that in order to maintain the coalition profitable, it is necessary that only beta changes. In case that there is only a point for a certain country, it indicates that in order to maintain the coalition profitable, it is compulsory that neither alpha nor beta changes.

Note that emissions level E of every coalition member does not change.

All found farsightedly stable climate coalitions are profitable too. We claim that checking farsighted stability (instead of profitability) increases significantly the number of nonlinear constraints, and it is usually not necessary to be inspected. The number of constraints for a coalition with six members, which are necessary to check only for inspecting the internal farsighted stability, are 26 − 7 (all subcoalitions of a farsightedly stable climate coalition with at least two members). Moreover, all profitable climate coalitions that we have checked are internally farsightedly stable. The size of a coalition does not vary too much from one time horizon to the next one. This implies that coalitions which are going to be discussed (which are farsightedly stable) must usually remain (but not always) externally and subcoalition farsightedly stable to the next time horizons.

Note that if rα(i) = α(i)2015/α(i)2005 > 1 ⇔ α(i)2015 > α(i)2005∀α(i) > 0, and if lbx(i) = 1 ⇔ lbα(i) = α2005(i) as α(i) = x(i)α2005(i). Besides lbx(i) = rα(i) ⇔ ubα(i) = rα(i)α2005(i) = α(i)2015 as α(i) = x(i)α2005(i). So the bounds on x’s simply imply that if α(i)2015 > α(i)2005, then lbα(i) = α2005(i) and ubα(i) = α2015(i). So all bounds guarantee that alphas, betas, E’s, and Y ’s move from their value of year 2005 to their value of year 2015.

The value of v that optimization finds and its upper bounds are in bold letters.

The first climate coalition (CAN, EEU, CAM, SAS, SIS) of the year 2005 cannot be checked by the optimization proceeding because it is also profitable in the year 2015. The same phenomenon takes place for both coalitions of the year 2015 (CAN, EEU, FSU, CAM, LAM, SAS, SIS), (USA, WEU, CHI, NAF, SSA), as well as for the second climate coalition (USA, NAF, SSA) of the year 2035, which cannot be checked by the optimization proceeding because they are profitable in the following year.

Note that only the results for the climate coalition (USA, LAM, SEA, CHI, NAF, SSA) are presented. The results for other coalitions can be provided on request.

That climate coalitions (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SEA, SIS), (USA, WEU, CHI, NAF, SSA) remain profitable in the year 2035, it is necessary that FSU (form first coalition) and USA (from the second coalition) keep their emission levels lower than the levels of the year 2035. That climate coalition (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SIS) remains profitable in the year 2045, it is necessary that FSU keeps its emissions level lower than the level of the year 2045. The FSU and the USA increase their emissions and GDP more than the majority of countries of their coalitions.

For the climate coalition (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SEA, SIS), FSU decreases its beta, but it does not reach its lower bound, while ANZ increases its GDP (Y ) but not up to its upper bound (a similar phenomenon occurs with other coalitions).

Again, we present the results only for the climate coalition (USA, LAM, SEA, CHI, NAF, SSA). The results for other coalitions can be provided on request.

The relative change of alpha is equal (αop − lb(α))/(ub(α) − lb(α)), where αop is the value that optimization finds and lb(α),ub(α) are lower and upper bounds of alpha. Similarly, one speaks for the relative changes of beta, E, and Y.

If there is only a line parallel to the x-axis for a certain country, it signifies that in order to maintain the coalition profitable, it is necessary that only beta change. In case that there is only a point for a certain country, it indicates that in order to maintain the coalition profitable, it is compulsory that neither alpha nor beta changes.

Note that emissions level E of every coalition member does not change.

This is a short summary of the FUND (for a detailed description please read more the FUND webpage: http://www.fund-model.org/home

References

Asheim, B.G., Froyn, B.C., Hovi, J., Menz, C.F. (2006). Regional versus global cooperation for climate control. Journal of Environmental Economics and Management, 51, 92–109.

Asheim, G.B., & Holtsmark, B. (2009). Renegotiation-proof climate agreements with full participation: conditions for pareto-efficiency. Environmental and Resource Economics, 43(4), 519–533.

Aumann, R.J., & Myerson, R.B. (1988). Endogenous formation of links between players and of coalitions, an application of the shapley value. In A. Roth (Ed.) The Shapley Value Essays in Honor of Lloyd Shapley (pp. 175–191). Cambridge: Cambridge University Press.

Barrett, S. (1994). Self-enforcing international environmental agreements. Oxford Economic Papers, 46, 878–894.

Barrett, S. (1999). A theory of full international cooperation. Journal of Theoretical Politics, 11, 519–541.

Barrett, S. (2003). Environment and statecraft: the strategy of environmental treaty-making. Oxford: Oxford University Press.

Batjes, J.J., & Goldewijk, C.G. (1994). The IMAGE 2 hundred year (1890-1990) database of the global environment (HYDE) Report No. 410100082. RIVM Bilthoven.

Bernheim, D., & Ray, D. (1989). Collective dynamic consistency in repeated games. Games and Economic Behavior, 1(4), 295–326.

Botteon, M., & Carraro, C. (2001). Environmental coalitions with heterogeneous countries: burden-sharing and carbon leakage. In A. Ulph (Ed.) Environmental Policy, International Agreements, and International Trade, Oxford, O.U.P.

Carraro, C. (2000). The economics of coalition formation. In J. Gupta, & M. Grubb (Eds.) Climate Change and European Leadership (pp. 135–156): Kluwer Academic Publishers.

Chander, P. (2007). The gamma-core and coalition formation. International Journal of Game Theory, 35(4), 379–401.

Chander, P., & Tulkens, H. (1995). A core-theoretic solution for the design of cooperative agreemnets on transfrontier pollution. International Tax and Public Finance, 2, 279–293.

Chander, P., & Tulkens, H. (1997). The core of an economy with multilateral environmental externalities. International Journal of Game Theory, 26(3), 379–401.

Chander, P., & Tulkens, H. (2006). Self-enforcement in international environmental agreements: a conceptual discussion. Working Papers FEEM, 34.

Chwe, M. (1994). Farsighted coalitional stability. Journal of Economic Theory, 63, 299–325.

d’Aspremont, C.A., Jacquemin, J., Gabszeweiz, J., Weymark, J.A. (1983). On the stability of collusive price leadership. Canadian Journal of Economics, 16, 17–25.

De Zeeuw, A. (2008). Dynamic effects on the stability of international environmental agreements. Journal of Environmental Economics and Management, 55(2), 163–174.

Diamantoudi, E., & Sartzetakis, E. International environmental agreements the role of foresight. mimeo.

Diamantoudi, E., & Xue, L. (2003). Farsighted stability in hedonic games. Social Choice and Welfare, 21, 39–61.

Dutta, B., & Vohra, R. (2017). Rational expectations and farsighted stability. Theoretical Economics, 12, 1191–1227.

Eyckmans, J. (2003). On the farsighted stability of international climate agreements mimeo.

Eyckmans, J., & Tulkens, H. (2003). Simulating coalitionally stable burden sharing agreements for the climate change problem. Resource and Energy Economics, 25, 299–327.

Fehr, E., & Gaechter, S. (2000). Cooperation and punishment in public goods experiments. American Economic Review, 90, 980–994.

Fehr, E., Fischbacher, U., Gaechter, S. (2002). Strong reciprocity, human cooperation and the enforcement of social norms. Human Nature, 13, 1–25.

Finus, M. (2004). Stability and design of international environmental agreements: the case of global and transboundary pollution H. Folmer, & T. Tietenberg (Eds.)

Finus, M., van Ierland, E., Dellink, R. (2006). Stability of climate coalitions in a cartel formation game. Economics of Governance, 7, 271–291.

Froyn, C.B., & Hovi, J. (2008). A climate agreement with full participation. Economics Letters, 99, 317–319.

Gintis, H. (2000). Strong reciprocity and human sociality. Journal of Theoretical Biology, 206, 315–318.

Harsanyi, J. (1974). An equilibrium-point interpretation of stable sets and a proposed alternative definition. Management Science, 20, 1472–1495.

Heitzig, J. (2012). Bottom-up strategic linking of carbon markets: which climate coalitions would farsighted players form? SSRN paper: https://doi.org/10.2139/ssrn.2119219.

Heitzig, J., Lessmann, K., Zou, Y. (2011). Self-enforcing strategies to deter free-riding in the climate change mitigation game and other repeated public good games. Proceeding of the National Academy of Science of the United States of America, 108(38), 15739–15744.

Herings, J.J., Mauleon, A., Vannetelbosch, V. (2009). Farsightedly stable networks. Games and Economic Behavior, 67, 526–541.

Konishi, H., & Ray, D. (2003). Coalition formation as a dynamic process. Journal of Economic Theory, 110, 1–41.

Leggett, J., Pepper, W.J., Swart, R.J. (1992) In J.T. Houghton, B.A. Callander, S.K. Varney (Eds.), Emissions scenarios for the ipcc: an update, in climate change 1992, 1st edn. Vol. 1. Cambridge: Cambridge University Press.

Link, P.M., & Tol, R.S. (2004). Possible economic impacts of a shutdown of the thermohaline circulation: an application of fund. Portuguese Economic Journal, 3, 99–114.

McGinty, M. (2007). International environmental agreements among asymmetric nations. Oxford Economic Papers, 59, 45–62.

Osmani, D. (2017). A note on computational aspects of farsighted coalitional stability. Working Paper FNU-194 (submitted in Journal of Environmental Economics and Management).

Osmani, D., & Tol, R.S.J. (2009). Towards farsightedly stable international environmental agreements. Journal of Public Economic Theory, 11(3), 455–492.

Osmani, D., & Tol, R.S.J. (2010). The case of two self-enforcing international agreements for environmental protection with asymmetric countries. Computational Economics, 36(2), 93–119.

Osmani, D., & Tol, R.S.J. (2018). On the farsightedly and myopically stable international environmental agreements. Natural Resource Modeling, 31(2), e12154.

Ostrom, E. (2000). Collective action and the evolution of social norms. The Journal of Economic Perspectives, 14(3), 137–158.

Ray, D. (2007). A game theoretic perspective on coalition formation. Oxford: Oxford University Press.

Ray, D., & Vohra, R. (1999). A theory of endogenous coalition structures. Games and Economic Behavior, 26, 286–336.

Ray, D., & Vohra, R. (2014). Coalition formation. In H. Peyton Young, & S. Zamir (Eds.) Handbook of Game Theory, (Vol. 4 pp. 239–326).

Ray, D., & Vohra, R. (2015). The farsighted stable set. Econometrica, 83, 977–1011.

Rubio, J.S., & Casino, B. (2005). Self-enforcing international environmental agreements with a stock pollutant. Spanish Economic Review, 7(2), 89–109.

Rubio, J.S., & Ulph, U. (2006). Self-enforcing international environmental agreements revisited. Oxford Economic Papers, 58, 223–263.

Rubio, J.S., & Ulph, U. (2007). An infinite-horizon model of dynamic membership of international environmental agreements. Journal of Environmental Economics and Management, 54(3), 296–310.

Tol, R.S.J. (1999). Spatial and temporal efficiency in climate change an application of FUND. Environmental and Resource Economics, 58(1), 33–49.

Tol, R.S.J. (1999). Kyoto, efficiency, and cost-effectiveness. An Application of FUND. Energy Journal Special Issue on the Costs of the Kyoto Protocol: a Multi-Model Evaluation pp. 130– 15.

Tol, R.S. (2001). Equitable cost-benefit analysis of climate change. Ecological Economics, 36(1), 71–85.

Tol, R.S. (2002). Estimates of the damage costs of climate change - part 1: Benchmark estimates. Environmental and Resource Economics, 21, 47–73.

Tol, R.S. (2002). Estimates of the damage costs of climate change - part 2: Benchmark estimates. Environmental and Resource Economics, 21, 135–160.

Tol, R.S.J. (2002). Welfare specifications and optimal control of climate change: an application of FUND. Energy Economics, 24, 367–376.

Tol, R.S. (2006). Multi-gas emission reduction for climate change policy. An Application of FUND. Energy Journal, in Volume: Multi-Greenhouse Gas Mitigation and Climate Policy: Special Issue 3.

W.R.I. World Resources Database. World Resources Institute, Washington, DC., 2000-2001.

Xue, L. (1998). Coalitional stability under perfect foresight. Journal of Economic Theory, 11, 603–627.

Acknowledgments

I am grateful to Richard Tol, Anke Gerber, and especially two anonymous referees of this journal for their comments and suggestions.

Funding

This study is financially supported by Max Planck Research School on Earth System Modelling (IMPRS-ESM) and Integrated Climate System Analysis and Prediction (CliSAP).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Disclaimer

The views in this paper belong to the author and do not necessarily reflect the views of the IMPRS-ESM or CliSAP.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Discussion and Optimization Problems which Analyze the Farsightedly Stable Climate Coalition for Different Time Horizons

In this section, we discuss the variation of farsightedly stable climate coalitions for different time horizons as a function of variation of alphas, betas, E’s, and Y ’s of coalition members. In order to analyze this question, an optimization problem is constructed.

The following example is introduced for illustration: take the climate coalition (USA, LAM, SEA, CHI, NAF, SSA), which we call the second coalition of 2005, namely \(\text {Coal}^{2}_{2005}\); \(\text {Coal}^{2}_{2005}\) is farsightedly stable in year 2005 but it is not farsightedly stable in year 2015 (see Fig. 2). The coalition members are indexed for simplifying the presentation of optimization problem USA i= 1, LAM i= 2, SEA i= 3, CHI i= 4, NAF i= 5, SSA i= 6. We define α(i) = x(i)α2005(i), β(i) = z(i)β2005(i), E(i) = v(i)E2005(i), and Y (i) = w(i)Y2005(i) for each member i of the coalition \(\text {Coal}^{2}_{2005}\); x, z, v, and w are the variables; the subscript 2005 indicates that the values of alphas, betas, E’s, and Y ’s from the year horizon 2005 are used as a starting point. πfncs(i), is the profit in fully non-cooperative structure (FNcS) (see equation 1); and πcoal(i) is the profit when the above coalition is formed. The optimization problem is stated below:

where

under constraints:

The lower bounds, lb and the upper bounds, ub of variables are introduced. Let us define rα(i) = α(i)2015/α(i)2005, then:

The same clarifications can be made if we define rβ(i) = β(i)2015/β(i)2005, rE(i) = E(i)2015/E(i)2005, and rY(i) = Y (i)2015/Y (i)2005.

Let us have a closer look at the objective function which maximizes the deviation of x, z, v, w from their starting point. Let us explain the construction of S1 and S2. In order to build S1 and S2, the members of a coalition are divided into two groups. The members of the first group satisfy rα(i) < 1 ⇒ x(i) < 1 (see Eq. 10b). In order to maximize the deviation of x from his starting point 1, the sum of the amounts (1 − x(i)) from 1 to k1 is maximized (see Eq. 7a). This implies the maximization of deviation α(i) from α(i)2005 for members of the first group.

The members of the second group satisfy rα(i) > 1 ⇒ x(i) > 1 (see Eq. 10a). In order to maximize the deviation of x from his starting point 1, the sum of the amounts x(i) from 1 to (6-k1) is maximized (see Eq. 7b). This implies the maximization of deviation α(i) from α(i)2005 for the members of the second group.

The S2 is similarly built for variable z, which is related to rβ. It is not necessary to introduce similar transformations for v and w as rE and rY are always bigger than 1. The maximization of the sum of (1-x’s), (1-z’s), v’s, and w’s implies maximizing the variation of alphas, betas, E’s, and Y ’s. The six constraints of Eq. 8 request that the coalition must be profitable and profitability is a necessary condition (but not sufficient) for being a farsightedly stable climate coalition.Footnote 15 The starting point is x0 = 1,z0 = 1,v0 = 1 and w0 = 1, that is, we use the values of alphas, betas, E’s, and Y ’s from year 2005 and this is a feasible starting point. The bounds imply that we allow the alphas, betas, E’s, and Y ’s to move in the interval from their value of year 2005 to year 2015Footnote 16 (or from value of year 2015 to year 2005, depending on which value is bigger). As a conclusion, the optimization process finds the maximum deviation of sums of alphas, betas, E’s, and Y ’s of the coalition members keeping the coalition profitable in year 2015 (which implies giving a chance of being a farsightedly stable climate coalition) by letting alphas, betas, E’s, and Y ’s vary from their values of year 2005 to year 2015.

The results of the optimization process for the climate coalition (USA, LAM, SEA, CHI, NAF, SSA) are presented in Tables 12 and 13. The first column of Table 12 presents coalition-members, the next two columns introduce values of x’s and z’s that the optimization process finds, and the last four columns present the lower and upper bounds for x’s and z’s. Table 13 is identical with Table 12, but it presents variables v’s and w’s that optimization process finds. The optimal value of alphas, betas, and Y of each coalition member (variables x’s, z’s, and w’s in Tables 12 and 13, respectively) are their values of the year 2015, which are their upper bounds. The optimal values of E’s (the variables v’s in Table 13, respectively) are their value of year 2015, except for South East Asia (SEA). In order to keep our coalition profitable, it is only necessary that SEA keeps emissions (variable v for SEA, respectively) lower than the value of year 2015, namely lower than its upper boundFootnote 17 (all other v’s as well as x’s, z’s, and w’s can take the values of year 2015). The optimization problem (6) shows that the farsightedly stability of the climate coalition (USA, LAM, SEA, CHI, NAF, SSA) is sensitive to the variation of emissions E’s, even to the variation of E for only one country, namely SEA. The same phenomenonFootnote 18 takes place when we consider the climate coalitions (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SEA, SIS)(USA, WEU, CHI, NAF, SSA) of the year horizon 2025,Footnote 19 and the coalition (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SIS) of year horizons 2035.Footnote 20 We receive only one highlight from the optimization problem (6), namely that profitability and farsighted stability are sensitive to variations of emissions, even to emissions of one country.

In order to investigate further why farsightedly stable climate coalitions are varying from 1-year horizon to the next one, we change a bit the optimization problem that it is already introduced by placing a different objective function (the bounds of variables are identical, so we do not rewrite them). We put the sum of constraints as the objective function:

The optimization process (11) finds the maximum satisfaction of the profitability constraints keeping the coalition profitable in year 2015 by letting alphas, betas, E’s, and Y ’s vary their values from 2005 to 2015. The results are presented in Tables 14 and 15, which have the same structure as Tables 12 and 13. The new optimization problem requests that the coalition is kept as much profitable as possible, and it realizes this aim in two ways: the first one, by decreasing betas (marginal benefits from pollution abatement) for all coalition members except for China (China cannot decrease its beta as its lower bound is 1), which keeps small the variation in marginal benefits (MB) among coalition members from pollution abatement; the second one, by not increasing the emissions E (equivalently keeping the variables v constant at their lower bound 1) of participants of coalition. The similar trend (with some minor differencesFootnote 21) occurs when we discuss the climate coalitions (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SEA, SIS), (USA, WEU, CHI, NAF, SSA) of the year horizon 2025, and the climate coalition (ANZ, EEU, FSU, MDE, CAM, LAM, SAS, SIS) of the year horizon 2035.Footnote 22

The optimization problem (11) shows that the E’s and betas play the important role in keeping the coalitions profitable and in giving a chance of being farsightedly stable in the next year horizons, while the Y ’s (GDP) and alphas play a minor role in maintaining the coalitions profitable from one year horizon to the next one.

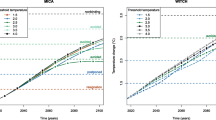

The results of the optimization (11) are presented also in Figs. 3, 4, and 5. The relative change intervalsFootnote 23 of alphas and betas are introduced in Fig. 3. In the y-axis, alpha values that are cost parameter and unitless are placed; in the x-axis, beta values that are MB from pollution abatements in dollars for tonnes of carbon are placed. If there is a circle for a certain country, then the alpha and beta of this country can change their value from the year 2005 to the value of the year 2015 and the climate coalition (USA, LAM, SEA, CHI, NAF, SSA) remains profitable,which implies giving a chance of being a farsightedly stable climate coalition. Moreover, the diameter of the circle which is parallel to the y-axis represents the relative interval change of alpha; and the diameter of the circle which is parallel to the x-axis represents the relative interval change of beta. If there is only a line instead of a circle parallel to the y-axis for a certain country, it indicates that for maintaining the coalition profitable, it is compulsory that only alpha of this country changes its value, but not beta.Footnote 24 As alphas and betas vary from their lower bounds to their upper bounds, or they do not vary at all, we receive circles with diameter one or lines with length one. The same explanation can be carried out for Fig. 4, where relative changes for emissions E in billion metric tonnes of carbon, and Y in billion US dollars are presented. There are only lines with length one and no circles in Fig. 4 as emissions E of every participant coalition do not change.

Figure 5 presents the absolute variation intervals of the alphas in the x-axis, the betas in the y-axis and the Y ’s in the z-axis, simultaneously.Footnote 25 There is an ellipsoid for every coalition member except for China, which has an ellipse in a plane parallel to the zy-plan, as MB-beta of China does not vary.

As a conclusion, the profitability condition of farsightedly stable climate coalitions is very sensitive and, as a consequence, the farsighted stability is very sensitive to variations of coalition-member emissions. In order to have robust profitable climate coalitions, it is necessary that the disproportional variations on marginal benefits from pollution abatement among coalition members are prevented, and that emissions are not increased. Nevertheless, emissions and marginal costs and benefits from pollution abatement are controlled by economic structure and environmental damages in each country, which cannot be influenced.

Appendix 2: Simple Algorithms for Finding Single Farsightedly-Stable Coalitions

Here, the algorithms for finding farsightedly stable coalitions are presented. The first algorithm is described in Table 1. It tests a coalition for external farsighted stability (EFS); the definition (2.7) of external indirect domination becomes the definition of EFS if we replace the general coalition structure with a single coalition. Suppose we would like to check coalition Cn ≡ (1, 2...n) for EFS.

If the algorithm of Table 1 finds an i member-coalition Ci for which the main condition [π2(1) > π1(1) ∧ π2(2) > π1(2) ∧ ... ∧ π2(i − 1) > π1(i − 1) ∧ π2(i) > π1(i)] holds, then our initial coalition Cn is not externally farsightedly stable. But if the main condition is never satisfied (for i=(n + 1) to m), then we say that no external inducement is possible. If no external inducement is possible, then the coalition (Cn in our case) is externally farsightedly stable (EFS).

The algorithm for internal farsighted stability will be presented below. Suppose again, that we have a coalition with n countries Cn ≡ (1, 2 ...n). We need to find every sub-coalition (of 2 countries, 3 countries ... and (n-1) countries). We name by π′(1)...π′(m) the profits when the sub-coalitions are formed, and π(1)...π(i1)...π(i5)...π(16) the profits when only the n member coalition Cn is formed. Then, if the condition below is satisfied (for any sub-coalition of Cn with i members where i= 2 to (n-1)): [π′(1) > π(1) ∧ π′(2) > π(2) ∧ π′(i − 1) > π(i − 1) ∧ π′(i) > π(i)], we say that an internal inducement is possible. If an internal inducement is possible then the coalition is not internally farsightedly stable (IFS); the definition (2.6) of internal indirect domination becomes the definition of IFS if we replace the general coalition structure with a single coalition. All steps in this algorithm are presented in Table 2.

Testing sub-coalition stability of coalition C is similar to testing every sub-coalition of coalition C for external farsighted stability.

Appendix 3: Example

The full example of computation of single farsightedly stable climate coalitions is presented in Section 4, but here, we present a small part of the numerical computations which test and find the three-member coalitions that are not farsightedly stable, and illustrate numerically the concept of internal, external and sub-coalition stability presented in Section 2. We use the per member partition function taken from the Climate Framework for Uncertainty, Negotiation, and Distribution (FUND) model developed by Richard Tol [49,50,51, 54] (see Section 4 for a detailed description of per member partition function). The parameters of per member partition function estimated by FUND model, and 16 regions-countries (United States of America, USA; Canada, CAN; Western Europe, WEU; Japan and South Korea, JPK; Australia and New Zealand, ANZ; Central and Eastern Europe, EEU; the former Soviet Union, FSU; the Middle East, MDE; Central America, CAM; South America, LAM; South Asia, SAS; Southeast Asia, SEA; China, CHI; North Africa, NAF; Sub-Saharan Africa, SSA; and Small Island States, SIS) that FUND takes into account for the single year horizon 2005, which this example considers. The FUND model is briefly described in Appendix 4. The members of coalition behave cooperatively with each other and maximize their joint welfare, and take the welfare of single countries as given; every single country behaves non-cooperatively by maximizing its own welfare and taking the welfare of coalition members and the rest of single countries as given.

Firstly, we note that all profitable climate coalitions are internally farsightedly stable (including the three-member coalitions). Three-member coalitions which are not externally farsightedly stable are presented in Tables 3, 4, and 5.

The first column of Table 3 presents the members of five-member final coalitions. The three countries of the coalition that are inspected are labeled in bold letters, while the members that join the initial coalition are labeled in normal typeface. The second column of Table 3, Pr3, displays the profits (in billions of dollars) of the final coalition members when only the three-member coalition exists, while the third column Pr5 shows the profits of final coalition members when only the five-member coalition exists. The profits of each country are higher when the five-member coalition is formed (Pr5) in comparison to the profits when the three-member coalition is formed (Pr3). As a result, the three member coalition (USA,LAM,CHI) is not externally farsightedly stable. Columns four, five, and six of Table 3 are similar to columns one, two and three, and Tables 4 and 5 are similar to Table 3.

Tables 6 and 7 introduce the three-member coalitions which are not sub-coalition farsightedly stable. In the first column, the country members which change their position (join or leave the initial coalition) are placed. The three countries of a primary coalition which is inspected are labeled in bold letters, while the three members of the final coalition are marked with an asterisk on the top-right. It is clear that countries in bold letters who have an asterisk on the top-right are simultaneous members of a primary and final coalition. The second column of Table 3, Pr3old, presents the profits of final coalition members when only the primary three-member coalition is formed, while the third column of Table 3, Pr3new, introduces the profits when the final three-member coalition is built. The profits of members of final three-member coalitions (with an asterisk on the top-right) are greater when the final three-member coalition is formed Pr3new compared to the primary three-member coalition Pr3old. It follows that the three-member coalition (JPK,NAF,SSA) is not sub-coalition farsightedly stable. Finally, Table 7 is similar to Table 6.

Appendix 4: FUND Model

This paper uses version 2.8 of the Climate Framework for Uncertainty, Negotiation and Distribution (FUND). Version 2.8 of the FUND corresponds to version 1.6, described and applied by [49,50,51, 54], except for the impact module, which is described by [52, 53] and updated by [35]. A further difference is that the current version of the model distinguishes 16 instead of 9 regions. Finally, the model considers emission reductions of methane and nitrous oxide as well as carbon dioxide, as described by [55].

Essentially, the FUND consists of a set of exogenous scenarios and endogenous perturbations. The model distinguishes 16 major regions of the world, viz. the United States of America (USA), Canada (CAN), Western Europe (WEU), Japan and South Korea (JPK), Australia and New Zealand (ANZ), Central and Eastern Europe (EEU), the former Soviet Union (FSU), the Middle East (MDE), Central America (CAM), South America (LAM), South Asia (SAS), Southeast Asia (SEA), China (CHI), North Africa (NAF), Sub-Saharan Africa (SSA), and Small Island States (SIS). The model runs from 1950 to 2300 in time steps of 1 year. The primary reason for starting in 1950 is to initialize the climate change impact module. In the FUND, the impacts of climate change are assumed to depend on the impact of the previous year, in this way reflecting the process of adjustment to climate change. Because the initial values to be used for the year 1950 cannot be approximated very well, both physical and monetized impacts of climate change tend to be poorly represented in the first few decades of the model runs. The period 1950–1990 is used for the calibration of the model, which is based on the IMAGE 100-year database [7]. The period 1990–2000 is based on observations of the World Resources Databases [56]. The climate scenarios for the period 2010–2100 are based on the EMF14 Standardized Scenario, which lies somewhere in between IS92a and IS92f [34]. The 2000–2010 period is interpolated from the immediate past, and the period 2100–2300 is extrapolated.

The scenarios are defined by the rates of population growth, economic growth, autonomous energy efficiency improvements, as well as the rate of the decarbonization of energy use (autonomous carbon efficiency improvements), and emissions of carbon dioxide from land use change, methane, and nitrous oxide. The scenarios of economic and population growth are perturbed by the impact of climatic change.Footnote 26).

1.1 4.1 Proofs of Observations 3.1 and 3.2

Proof of Obervation 3.1

That there are no profitable coalitions means that there is no direct or indirect domination process that originates from the full-non-cooperative structure (Nash equilibrium). This completes the proof. □

Proof of Observation 3.2:

If the superadditivity property is never satisfied, it implies that there are no profitable coalitions. This completes the proof. □

Rights and permissions

About this article

Cite this article

Osmani, D. Comparison of Farsightedly Stable Climate Coalitions in Different Time Horizons. Environ Model Assess 25, 73–95 (2020). https://doi.org/10.1007/s10666-019-09667-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-019-09667-9