Abstract

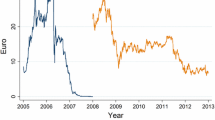

This article considers the evidence for threshold effects in the relationship between electricity and emission-permit prices in France and Germany during the second phase of the EU ETS. Specifically, we compare linear and non-linear threshold models of electricity prices using the sample-splitting and threshold estimation approach in Hansen (Econometrica, 64 575–603 2000). We find evidence of non-linear threshold effects in both countries. The estimated carbon-price thresholds are 14.94€ and 12.57€ in France and Germany respectively. The carbon-price threshold in France perfectly matches the well-known carbon spot-price structural break of October 2008. This is not the case for the carbon-price threshold in Germany. Further analysis reveals that carbon prices before October 2008 were not reflected in electricity prices in either country. This is mainly due to uncertainty about the future of the EU ETS that led electricity producers to adopt a wait-and-see attitude. After October 2008, French electricity producers passed the price of emission permits through to electricity prices in a linear way, while their German counterparts did so non-linearly. Finally, we suggest improvements to the design of the EU ETS. Our recommendations are to strengthen the price signal to make it more clear and reliable and provide sufficient incentives for energy transition.

Similar content being viewed by others

Notes

Figure 9 in 1 shows the amount of electricity produced in both countries from various primary energy sources in 2004 and 2009. These shares describe the energy-source mix in electricity generation. While in Germany more than 50% of electricity is generated from coal and lignite, France produces almost 80% of its electricity from nuclear energy, with fossil fuels accounting for only 9 to 10%. Moreover, producing electricity from fossil-fuel plants is more costly and emits more CO2 compared to nuclear plants. Consequently, the electricity and carbon price relationships may be different in the two countries.

Hansen [10] reviews a considerable number of applications of TAR models in empirical economics.

We only consider weekdays in our analysis, as the CO2 market is shut over the weekend.

The analysis of the correlograms and partial correlograms of the disturbances in preliminary regressions reveals seasonality of order five in French and German electricity prices. This seasonality is daily during the week, as the data are weekday frequencies.

The electricity base-load price is the price on the block for 24 hours. This is an arithmetic average price over the 24 hours of the day (from 0h to 23h).

EPEX Spot exchange is a holding company created by the collaboration between EEX Power Spot and Powernext SA, respectively, the German and French electricity stock exchanges.

Klein Tank et al., “Daily dataset of 20th-century surface air temperature and precipitation series for the European Climate Assessment”, 2011, available at http://eca.knmi.nl.

This break date is detected using the additive outlier (AO) procedure of the unit-root test with a change in the mean by Perron and Vogelsang [17].

The 2030 climate and energy framework is an extension of the 2020 Energy and Climate Package. This sets three key targets for 2030: (i) at least 40% cuts in greenhouse-gas emissions (from 1990 levels); (ii) at least a 27% share for renewable energy; and (iii) at least a 27% improvement in energy efficiency. This is in line with the longer-term perspective set out in the Roadmap for moving to a competitive low-carbon economy in 2050, the Energy Roadmap 2050 and the Transport White Paper.

References

Ahamada, I, & Kirat, D. (2015). The impact of phase II of the EU ETS on wholesale electricity prices. Revue d’Economie Politique, 125, 887–908.

Bessec, M, & Fouquau, J. (2008). The non-linear link between electricity consumption and temperature in Europe: a threshold panel approach. Energy Economics, 30, 2705–2721.

Bunn, D W., & Fezzi, C. (2008). A vector error correction model of the interactions among gas, electricity and carbon prices: an application to the cases of Germany and United Kingdom. In Gulli, F. (Ed.) Markets for carbon and power pricing in Europe: theoretical issues and empirical analyses (pp. 145–159): Edward Elgar Publishing.

Carrasco, M. (2002). Misspecified structural change, threshold, and Markov-switching models. Journal of Econometrics, 109, 239–273.

Durlauf, S. N., & Johnson, P. A. (1995). Multiple regimes and cross-country growth behavior. Journal of Applied Econometrics, 10, 365–384.

Engle, R.F., Granger, C.W.J., Rice, J., Weiss, A. (1986). Semiparametric estimates of the relation between weather and electricity sales. Journal of the American Statistical Association, 394, 310–320.

Fabra, N, & Reguant, M. (2014). Passthrough of emission costs in electricity markets. American Economic Review, 104, 2872–2899.

Fattouh, B. (2010). The dynamics of crude oil price differentials. Energy Economics, 32, 334–342.

Hahn, W. R. (1984). Market power and tradable property rights. Quarterly Journal of Economics, 99, 753–765.

Hansen, BE. (2011). Threshold autoregression in economics. Statistics and its Interface, 4, 123–127.

Hansen, B.E. (2000). Sample splitting and threshold estimation. Econometrica, 64, 575–603.

Hansen, B.E. (1996). Inference when a nuisance parameter is not identified under the null hypothesis. Econometrica, 64, 413–430.

Honkatukia, J, Mälkönen, V, Perrels, A. (2008). Impacts of the European emission trade system on Finnish wholesale electricity prices. In Gulli, F (Ed.) Markets for carbon and power pricing in europe: theoretical issues and empirical analyses (pp. 160–192): Edward Elgar Publishing.

Kirat, D, & Ahamada, I. (2011). The impact of the European Union emission trading scheme on the electricity-generation sector. Energy Economics, 33, 995–1003.

Lardic, S, & Mignon, V. (2008). Oil prices and economic activity: an asymmetric cointegration approach. Energy Economics, 30, 847–855.

Misiolek, W. S., & Elder, H. W. (1989). Exclusionary manipulation of markets for pollution rights. Journal of Environmental Economics and Management, 16, 156–166.

Perron, P, & Vogelsang, T. (1992). Nonstationarity and level shifts with an application to purchasing power parity. Journal of Business and Economic Statistics, 10, 301–320.

Sijm, J P M, Chen, Y, Hobbs, B F. (2012). The impact of power market structure on CO2 cost pass-through to electricity prices under quantity competition: a theoretical approach. Energy Economics, 34, 1143–1152.

Sijm, JPM, Chen, Y, Donkelaar, M, Hers, JS, Scheepers, MJJ. (2006). CO2 price dynamics: a follow-up analysis of the implications of EU emissions trading for the price of electricity, ECN report No. ECN-C-06-015.

Sijm, JPM, Chen, Y, Bakker, SJA, Harmsen, H, Lise, W. (2005). CO2 price dynamics: the implications of EU emissions trading for the price of electricity, ECN report No. ECN-C–05-081.

Stavins, R.N. (1995). Transaction costs and tradeable permits. Journal of Environmental Economics and Management, 29, 133–148.

Tong, H. (1983). Threshold models in non-linear time series analysis. Berlin: Springer-Verlag Inc.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ahamada, I., Kirat, D. Non-linear Pass-Through of the CO2 Emission-Allowance Price onto Wholesale Electricity Prices. Environ Model Assess 23, 497–510 (2018). https://doi.org/10.1007/s10666-018-9603-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-018-9603-9