Abstract

Clinicians are increasingly recognizing impulse control disorders (ICDs) as a complication of dopaminergic treatment in Parkinson’s disease (PD). Considering the pivotal role of dopamine in reward information processing, ICDs may originate from dysregulation of reward-oriented behavior, and the behavioral changes may be reflected in shifts of psychological risk preference during decision-making. We used a behavioral economics paradigm to evaluate quantitatively the risk preferences of PD patients in levodopa on and off states. We also examined age-matched healthy controls. We found that levodopa increased the subjective value and prolonged the decision time in PD patients. These effects are apparently not explained by kinematic improvements but are attributed to psychological shifts of risk preferences and increased attention during risky decision-making. The risk preferences of healthy controls were similar to those of PD on levodopa treatment. The risk preferences of PD patients were not correlated with the scores of routine cognitive batteries, suggesting that dopamine-sensitive risk preferences are independent of cognitive capacities as measured by conventional batteries, including general intelligence, memory, and frontal functioning. By contrast, apathy and ICD partially predicted the risk attitude in PD patients, suggesting a common background of limbic origin behind these properties. The present results demonstrated that dopamine deficiency in off-state PD leads to risk-avoiding behavior and levodopa treatment increases the risk preferences. Behavioral economics framework is useful to evaluate short-term psychological changes in response to levodopa in PD patients.

Similar content being viewed by others

Parkinson’s disease (PD) is a neurodegenerative disorder with core pathology of dopamine cell loss. PD patients suffer from motor symptoms, including bradykinesia, muscle rigidity, tremor, and gait disturbance, for which levodopa (a precursor of dopamine) and dopamine receptor agonists are the first-line treatments. Clinicians are increasingly aware that PD patients manifest various nonmotor symptoms as adverse effects of dopaminergic treatment, including excessive gambling, hypersexuality, compulsive shopping, hyperphasia, and obsessive hobbyism. These are collectively termed impulse control disorders (ICDs) and interpreted as abnormal reward-oriented behaviors (Evans, Strafella, Weintraub, & Stacy, 2009; Voon, Sohr, et al., 2011b; Weintraub et al., 2006). For example, pathological gambling may be due to excessive risk-seeking behavior, enjoying the thrill of uncertain monetary outcomes, or overestimating the small probability of financial gains.

Various aspects of reward-oriented behavior have been studied in the context of dopaminergic modulation. Previous studies have clarified the major role of the dopamine system and reward network, including the prefrontal cortex and basal ganglia by using behavioral tasks that involved incentive reward and decision-making (Abler, Hahlbrock, Unrath, Gron, & Kassubek, 2009; Kobayashi, 2012; Kobayashi & Schultz, 2008; Medic et al., 2014; Peters & Buchel, 2010). PD patients were shown to be compromised in probabilistic learning (Bodi et al., 2009; Cools, Altamirano, & D'Esposito, 2006; Djamshidian et al., 2010; Perretta, Pari, & Beninger, 2005). Voon and colleagues reported that PD patients receiving dopamine-agonists took more risks than nonmedicated patients (Voon, Gao, et al., 2011a). Based on these experimental findings, we can interpret the clinical phenomenon of ICDs as a result of disrupted reward system caused by overstimulation of the dopaminergic system.

In the field of clinical neuropsychology, financial risk attitude has been studied in PD, mainly using Iowa gambling task (IGT) with inconsistent results (Kobayakawa, Tsuruya, & Kawamura, 2010; Pagonabarraga et al., 2007; Perretta et al., 2005; Rossi et al., 2010; Thiel et al., 2003). An important aspect is that the IGT requires reinforcement learning, and it is unclear whether suboptimal performance in the IGT is a result of incomplete learning or deliberate risky choices. This is particularly problematic in PD research, because the dopamine system is critically involved in processing information related to reinforcement learning and reward risk. Another problem is that studies using the IGT often do not examine the influences of dopaminergic treatment, perhaps because the IGT is not suitable for applying multiple tests to the same subjects due to the confounding learning effect.

Behavioral economics theory provides both a theoretical framework and practical measures for investigating reward-based decision-making. Economists define financial risks in terms of statistical variance of the outcome distributions. In the presence of risky outcomes, decision-makers could use the expected value (EV) as a choice criterion. Consider the example of a choice between an uncertain (risky) gamble (a lottery in which $1,000 can be won with a probability of p) and a safe reward (obtaining $r for certain). It is financially optimal to choose an option of higher EV. However, people’s choices often deviate from the EV principle. For example, a risk-averse person would not choose to gamble even when its EV is higher than a safe reward (1,000p > r). In contrast, a risk-seeker would choose to gamble even when its EV is lower than a safe alternative (1,000p < r). The expected utility (EU) theory conveniently explains these aberrant behaviors based on a nonlinear relationship between utility and reward magnitude (von Neumann & Morgenstern, 1944). Utility is a measure of subjective value, and the probability-weighted utility corresponds to the EU, which provides an alternative to the EV for determining criteria for risky decision-making. If the EU of a gamble is equal to the utility of a safe reward [U(r) = pU(1,000) for the above example], the choice would not differ between the safe and risky options. Safe reward r that satisfies this equation is called the certainty equivalent (CE). Thus, CE is a measure of the subjective value of a gamble, and it can be used to evaluate individual risk preferences: CEs greater than, equal to, and less than the EV of the gamble correspond to risk-seeking, risk-neutral, and risk-averse behaviors, respectively.

Many studies have evaluated the risk preferences of healthy subjects using behavioral economics paradigms, but studies on PD patients are limited (Djamshidian et al., 2010; Levin et al., 2012; Voon, Gao, et al., 2011a). To our knowledge, no previous study has examined the effect of levodopa, which is a first-line treatment for PD, on risk preferences in a behavioral economics framework.

The present study investigated the influence of levodopa on the risk-taking behaviors of PD patients using an economic choice task and estimated how these patients value different levels of economic risks when they are in the on and off states of levodopa treatment. We also applied the same tests to a group of age-matched healthy controls (HCs) for comparisons.

Methods

Participants

We prospectively recruited 46 subjects. The PD patients included in the study met the diagnostic criteria for probable PD from the U.K. Parkinson’s Disease Society Brain Bank. We also recruited HCs who were matched with the PD group for age and education duration (see Table 1 for demographic details). Exclusion criteria for both the PD and HC groups were the presence of dementia (Mini Mental State Examination [MMSE] score < 24) and major depression or mania (based on Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition [DSM-IV] criteria). ICDs were an exclusion criterion for HC but not for PD. All participants provided written, informed consent, and the study was approved by the ethics committee of Fukushima Medical University. The PD group consisted of 25 patients, of which 5 received levodopa monotherapy, 18 received levodopa and dopamine agonists, and 2 were not receiving treatment. All patients were screened for ICDs defined as problem gambling (DSM-IV criteria) or compulsive shopping (McElroy, Keck, Pope, Smith, & Strakowski, 1994), and ten PD patients had ICDs. The remaining 15 PD patients were classified as PD patients without ICDs. The HC group consisted of 21 subjects.

Background cognitive and motor assessments

Participants completed standard cognitive batteries including the MMSE, Frontal Assessment Battery (FAB), Raven Colored Progressive Matrices (RCPM); Rey-Osterrieth Complex Figure Test (ROCFT), numerical digit span (forward and backward), and our bespoke economic choice task. We applied the ROCFT for sample copying with following 3-minute recall and scored the performance according to the standard guidelines. We measured the apathy level based on a questionnaire modified from the 14-item Starkstein Apathy Scale (Starkstein et al., 1992). The greater apathy score indicated the more apathetic state. We screened for ICDs based on the short form of the Questionnaire for Impulsive-Compulsive Disorders in Parkinson’s disease (Weintraub, Papay, Siderowf, & Parkinson's Progression Markers, 2013). We evaluated motor symptoms in PD patients using the Movement Disorder Society (MDS)-sponsored revision of the Unified Parkinson’s Disease Rating Scale (UPDRS) part III (Goetz et al., 2008). The same MDS-trained neurologist (S.K.) evaluated each patient during the levodopa on and off states. The maximal points of these clinical scales are indicated in Table 1.

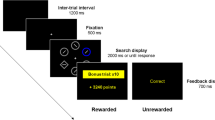

Economic choice task

Subjects were required to choose between safe and risky options displayed on a computer display by pressing one of two buttons (Fig. 1). The safe option was presented on one side of the display, with a vertical bar and numeric value indicating the amount of reward that could be obtained by choosing it. The amount of the safe reward changed in each trial over the range from ¥0 to ¥1,100 based on the parameter estimation procedure (see below). The risky option was presented on the other side of the display using a vertical bar, numeric value, and pie chart. The height of the bar and the numeric value indicated the prize of lottery fixed at ¥1,000 in every trial, while the pie chart indicated the probability of winning the lottery, which randomly changed in each trial (5%, 10%, 25%, 50%, 75%, and 90%). Subjects were required to choose between the safe and risky options by pressing one of the two buttons placed in front of the computer display. We counterbalanced the left-versus-right configuration of the safe-versus-risky choices across subjects.

A trial started with the presentation of safe and risky options on the display. When the subject chose the safe option by pressing the appropriate button, the safe option remained on the display for another 1,200 ms labeled as “you won ¥x” and while playing an 800-Hz pure tone. In the special case of choosing the safe option when its price was ¥0, a low-pitched 200-Hz tone was played. When the subject chose the risky option, the computer assigned a win or loss based on the reward probability in each trial. Upon winning, 320 ms after pressing the button, a bar plot indicating ¥1,000 was presented in red and labeled as “you won ¥1,000” while playing a 800-Hz pure tone for 1,200 ms. Upon losing, 320 ms after pressing the button, a bar plot indicating ¥1,000 was presented in black and labeled as “you lost” while playing a 200-Hz pure tone for 1,200 ms.

We assessed the subjective value of each gamble by using the Parameter Estimation by Sequential Testing (PEST) procedure adapted from Luce (Luce, 2000). CE is the price of the safe option when a subject chose between the safe and risky options indifferently. The PEST procedure allowed estimating the indifferent point by adjusting the reward amount of the safe option depending on the choices made by the subject in sequential trials. The amount of the safe reward in trial j for a given reward probability of risky option p is denoted as x(j, p). On the initial trial of a PEST sequence, the amount of safe reward x(1, p) was chosen randomly from either −6% or 6% of the EV of the risky option (1,000p). If the subject chose the gamble in trial j, then the safe amount was incremented by ε in trial j+1. However, if the subject chose the safe reward in trial j, the safe amount was reduced byεin trial j+1. Initially ε was large. After the third trial, it was adjusted according to the following doubling and halving rules: ε was doubled every time two consecutive choices were the same, and it was halved every time the subject switched from one option to the other. This procedure converged by locating subsequent safe offers on either side of the true indifference value and reducing ε until the interval containing the indifference value was smaller than a certain cutoff. The size of this interval is a parameter set by the experimenter, called the exit rule, and it was ε = 10 in this study. The PEST was terminated when ε became smaller than the exit rule.

Six separate PEST algorithms corresponding to different risk probabilities (p = 0.05, 0.1, 0.25, 0.5, 0.75, and 0.9) ran concurrently and were interleaved pseudorandomly. When one of the PEST algorithms exited, the remaining conditions ran pseudorandomly until all of the PEST algorithms had terminated. Thus, the number of total trials changed with the subjects’ choice behaviors. The behavioral task was controlled by a PC using Inquisit 4 Lab for Windows (Millisecond Software, Seattle, WA).

Each subject performed the task in multiple sessions on different days with and without levodopa (100/25 mg of levodopa/carbidopa). Before each session, subjects received task instruction and completed a short practice session. They were told that they would receive payment after completing the experiments through bank transfer, with the payment comprising a proportion of the reward they won in the choice task plus a show-up fee and an hourly wage. PD patients were tested with levodopa in randomized open-label design. Drug treatment was open-label, because (1) motor improvement by levodopa often is too clear to make it blinded for both the patients and the experimenter, and (2) implementing blinding would make it difficult to schedule medication after the behavioral session. To examine the reproducibility of the levodopa effect, 21 of 26 PD patients (11 PD without ICDs and 10 PD with ICDs) participated in the second on-levodopa (ON2) experiment. For the on-levodopa experiment, the patients took levodopa 1 hour before starting the task. For the off-levodopa experiment, regular levodopa medication was stopped overnight (>12-hour withdrawal) in all of the patients except for four who could not tolerate overnight levodopa washout, in which levodopa treatment was withdrawn at least 5 hours before the task. Eighteen patients were taking anti-Parkinsonian drugs other than levodopa, including pramipexole, ropinirole, and zonisamide. We studied the acute effect of levodopa keeping daily intake of other anti-Parkinsonian drugs unchanged for each patient.

Data analysis

We used a measure of risk aversion, termed the coefficient of relative risk aversion (RRA coefficient) or the Arrow-Pratt measure of relative risk aversion (Arrow, 1965; Pratt, 1964). For an individual with a utility of consumption function denoted u(c), the RRA is defined as follows:

where u’(c) and u”(c) denote the first and second derivatives with respect to c of u(c). If we assume a constant level of risk aversion during each pairwise comparison of outturn utilities in our task, it implies the power family of utility functions, expressed most generally as:

The parameter ε is called coefficient of relative risk aversion (RRA coefficient), whose larger value indicates greater risk aversion. We estimated ε based on the obtained CEs for six different risk probabilities (p = 0.05, 0.1, 0.25, 0.5, 0.75, and 0.9) by using a least squares method.

We used an alternative measure of risk aversion. For risk-neutral subjects, subjective value of a gamble (CE) is equal to the objective value of the gamble (gamble EV), by definition. Therefore, plotted against the gamble EV, the CEs of risk-neutral subjects should be on the main diagonal line. By contrast, the CEs of risk-seeking and risk-averse subjects should be above and below the main diagonal line, respectively. We used the proportion of the area under the CE curve (AUC) as a measure of risk preference. We calculated the AUC under the constraints that CE is 0 and 1,000 for gamble probabilities of 0% and 100%, respectively.

We statistically examined the CEs of PD patients by using within-subjects two-factor analysis of variance (ANOVA) with main factors of Gamble EV (¥50, ¥100, ¥250, ¥500, ¥75, ¥900) and Medication (levodopa on, off). We also conducted a post-hoc Tukey HSD test. To examine the changes of the RAA coefficient across groups (PD on, PD off, and HC), the coefficient was submitted to one-factor ANOVA (group) and post-hoc Tukey HSD tests. The AUC and RRA coefficient of PD patients were independently submitted to a mixed-design two-factor ANOVA with a within-subjects factor of levodopa effect (on, off) and a between-subjects factor of ICD. To evaluate potential contribution of clinical symptoms to behavioral risk aversion, the RRA coefficient was submitted to a multiple linear regression with explanatory variables of medication (levodopa on, off), Levodopa Equivalent Daily Dosage (LEDD), apathy score, presence of ICD, Hoen-Yahr grade, MMSE score, FAB score, and ROCFT delayed recall score. These scores were selected from the available demographic data to best represent motor symptom, and cognitive function in the global, frontal, and memory domains.

We measured the decision time as the time between the onset of choice presentation and when the chosen button was pressed. We first removed outliers (>2.5 SD and <100 ms). Because the distribution of the decision time was skewed and not normally distributed, the data underwent an inverse Gaussian transformation. To examine the changes of the decision time across groups (PD on, PD off, and HC), we submitted the transformed decision time to one-factor ANOVA and post-hoc Tukey HSD tests. To examine decision time taking into account within-subjects variance, we built a mixed-model with the fixed effects of medication (on, off) and ICD (present, absent), the random effects of Subject and Choice (safe, risky), and covariates of clinical scores (apathy score, Hoen-Yahr grade, MMSE score, FAB score, and ROCFT delayed recall score) (Bates, Maechler, Bolker, & Walker, 2014). Significance of the fixed effect parameters were tested by using likelihood ratio comparing the fit of the full model against two null models in which one of the two fixed effects were reduced. Data analyses were conducted by using MATLAB (MathWorks, Massachusetts) and R (R Development Core Team, 2008).

Results

Results of cognitive screening tests

We recruited subjects with MMSE scores ≥24. Both PD and HC groups scored above the cutoff levels on standard cognitive batteries (Table 1). However, an independent-samples t-test indicated that PD patients (mean [M ] = 14.6, standard deviation [SD] = 2.75) underperformed in the FAB compared with HCs (M = 16.7, SD = 1.31), t(44) = 3.28, p = 0.002, d = 0.97. The result suggests the presence of subclinical frontal dysfunction.

Financial risk preference

By using the choice task, we obtained the CEs that measured the subjective value (utility) of the gambles. Upward or downward deviation of CEs from the gamble EV indicated how much reward value was added or discounted, respectively, by the outcome uncertainty or risk. Fig. 2a compares the CEs between the five groups (PD with ICDs on, PD with ICDs off, PD without ICDs on, PD without ICDs off, and HC). For all the groups, the CE curves appeared below the main diagonal line (CE < gamble EV), indicating risk-averse behavior. A two-factor ANOVA with Gamble EV (¥50, ¥100, ¥250, ¥500, ¥750, ¥900) and Medication (on, off) as within-subjects factors revealed the main effects of Gamble EV, F(5, 120) = 4.24, p < 0.001, ηp2 = 0.82, and Medication, F(1, 24) = 10.2, p < 0.0039, ηp2 = 0.16. Interaction between Gamble EV and Medication was also significant, F(5, 120) = 4.24, p = 0.0014, ηp2 = 0.15. Tested at each gamble EV level, CE was larger in levodopa on state than off state when gamble EV was ¥500 and ¥900 (p < 0.05, post-hoc Tukey HSD test).

Certainty equivalent (CE) and the indices of behavioral risk preferences obtained from the economic choice task. a Mean CE plotted against the expected value (EV) of the gamble. Red lines, Parkinson’s disease (PD) with impulse control disorders (ICDs); blue lines, PD without ICD; black line, healthy controls (HCs). Solid lines, levodopa on state; dashed lines, levodopa off state. Error bars, SE. b Subjective utility curve estimated from the CEs by fitting into the power family of utility functions. The ordinate is in arbitrary unit. Blue line, PD off levodopa; red line, PD on levodopa; black line, HC. Shaded area indicates confidence interval of 2 SE for each condition. c The coefficient of relative risk avoidance (RRA). Higher coefficient indicates more risk-avoiding behavior. Data are mean and standard error of the mean. PD patients were tested in the levodopa on state twice (ON1 and ON2) and off state (OFF). See Table 2 for statistical data. d The AUC analysis. Higher AUC indicates greater risk-seeking behavior. Conventions are the same as in c See Table 2 for statistics

We estimated individual utility curves by fitting the obtained CE values to the power family of utility functions (Fig. 2b, see Methods). Utility curve of the PD group was more concave in off (blue line) compared with on (red line) state. The utility curve of the HC (black line) was close to that of on-state PD (red line). More concave utility curve was associated with larger RRA coefficient, hence greater risk aversion. Fig. 2c shows the RRA coefficient averaged for each group and each medication state (levodopa on, off). For both subgroups of PD patients (with and without ICDs), the coefficient was larger in off-levodopa sessions as compared with on-levodopa sessions, indicating increased risk aversion when off medication. In the levodopa retest sessions (ON2), the RRA coefficient decreased to the level similar to that in the first levodopa session (ON1). Analysis of variance on RAA coefficient showed a main effect of Group (PD on, PD off, HC), F(2, 78) = 3.99, p = 0.022, ηp2 = 0.093. Post-hoc Tukey HSD test confirmed significant difference of the coefficient between levodopa on and off states (p = 0.020). The coefficient of the HCs did not differ significantly from that of the PD patients either in on (p = 0.88) or off (p = 0.12) state. We also examined a two-factor ANOVA with Medication (on, off) as a within-subjects factor and ICD (present, absent) as a between-subjects factor. The main effect of Medication was significant, F(1,23) = 7.48, p = 0.012, ηp2 = 0.070. The main effect of ICD and the interaction effect were nonsignificant (ICD main effect, F(1,21) = 2.93, p = 0.10, ηp2 = 0.078; interaction, F(1, 21) = 0.39, p = 0.54, ηp2 = 0.010). These results statistically confirm levodopa-induced change in risk aversion.

To evaluate potential contribution of clinical symptoms to behavioral risk aversion, we conducted a multiple linear regression analysis on the RRA coefficient with eight explanatory variables (medication, LEDD, apathy, ICD, Hoen-Yahr grade, MMSE, FAB, and ROCFT; Table 2). We found that the RRA coefficient decreased with levodopa treatment (beta = −0.62; p = 0.02) and ICD (beta = −0.59; p = 0.04), and it increased with apathy (beta = 0.05; p = 0.05). The results indicate that PD patients were more risk-seeking during the behavioral economics task on levodopa, with clinical ICD, and when less apathetic.

Additionally, we evaluated the behavioral risk preferences by measuring the area under the CE curve (AUC) (Fig. 2d). The AUC showed strong negative correlation with the RRA coefficient (Spearman’s rank correlation coefficient ρ = −0.90, p < 0.001), thus served as an alternative indicator of risk aversion (smaller AUC value indicated lower risk aversion). Replicating the result with the RRA coefficient, two-factor ANOVA on AUC (medication × ICD) confirmed a significant main effect of medication, F(1, 23) = 23.6, p < 0.001, ηp2 = 0.10).

Decision time

We examined the speed of decision-making during the performance of the choice task. Figure 3 shows that decision time was generally longer for risky trials compared with safe trials and also longer in levodopa on state compared with off state. One-factor ANOVA on the decision time revealed a significant main effect of group (PD on, PD off, and HC), F(2, 731) = 13.8, p < 0.001, ηp2 = 0.036. Post-hoc Tukey HSD test specified that decision time of PD in on state was significantly longer than that in off state and that of HCs (p < 0.001).

Decision time in the economic choice task. Decision time in HCs (black), PD without ICD (blue), and PD with ICD (red) are shown separately for the trials in which subjects chose risky and safe options and in the levodopa on and off states. Data are mean and standard error of the mean. See Table 3 for statistics

These ANOVA results are based on statistics on transformed decision time averaged for each subject. To take into account the within-subjects variance, we additionally conducted a mixed-model analysis (Table 3). The model included the fixed effects of medication and ICD, the random effects of subject and choice, and covariates of clinical scores (apathy, Hoen-Yahr, MMSE, FAB, and ROCFT). The mixed-model approach confirmed the significant impact of levodopa treatment on decision time (p < 0.001, likelihood ratio test) after controlling for variabilities originating from clinical factors of motor and cognitive symptoms.

Discussion

We investigated the individual risk preferences of PD patients and age-matched HCs based on a behavioral economics framework. We required economical decision-making under uncertainty in a laboratory situation and quantified individual risk preferences. Our study has yielded empiric evidence that levodopa treatment changes the risk attitude of PD patients. Previous studies attributed the abnormal reward-related behavior to D2/3 selective overstimulation in PD (Ahlskog, 2011; Claassen et al., 2011). Altered risk preferences were reproduced by administration of D2/3 dopaminergic agonists in PD-model animals (Johnson, Madden, Brewer, Pinkston, & Fowler, 2011; Rokosik & Napier, 2012; Tremblay et al., 2017) and healthy human subjects (Riba, Kramer, Heldmann, Richter, & Munte, 2008). Our study suggests that nonselective dopaminergic stimulation has an acute effect to enhance risk-taking behaviors when PD patients are gambling in a controlled laboratory environment. The level of risk preference in PD patients with levodopa was similar to that of age-matched HCs. Thus, it appears that dopamine depletion makes PD patients risk averse and levodopa treatment resumes the risk preference. Pathological gambling, a type of ICDs, is a strong risk-seeking behavior, which would be associated with convex utility curve or negative RRA coefficient (Ligneul, Sescousse, Barbalat, Domenech, & Dreher, 2013). Although PD patients with ICDs did not show strong risk seeking behavior in this study, levodopa had a significant effect to drive behavior less risk averse. In actual clinical settings, co-medication of dopamine agonists and levodopa may have supra-additive effects on risk preference, as it does on motor symptoms (Brodsky, Park, & Nutt, 2010).

Because levodopa treatment was not blinded to the PD patients, a placebo effect may have at least partially contributed to the observed behavioral changes, and this represents a limitation of the present study. Due to ethical reasons and the robust drug effect that makes a blind design difficult, it is not uncommon to examine the effect of dopaminergic treatment on PD patients in studies with an open-label design (Abler et al., 2009; Kapogiannis et al., 2011; Voon et al., 2010). In addition, there was no a priori reason for the placebo effect leading to increased risk preference and longer decision time in the present study.

Our choice task explicitly indicated reward probabilities, and so there was a minimal requirement for probability learning. This is one of the advantages of our approach over the IGT. The test–retest results validated that our task could reliably test risk preferences without substantial confounding by the learning effect.

We found that PD patients exhibited a longer decision time than HCs, particularly in the levodopa on state. At first glance, prolonged reaction time in the on state is counterintuitive considering the therapeutic effect of levodopa on motor symptoms (cf., UPDRS part III scores in the on and off states in Table 1). Indeed, acute oral levodopa is known to shortened reaction time when PD patients perform simple reaction time tasks (Djamshidian et al., 2014; Zappia, Montesanti, Colao, & Quattrone, 1994) and a perceptual decision task (Djamshidian et al., 2014). Considering these results, prolonged decision time in our study appears to be paradoxical. Our result may be explained if we assume that the time for processing risk evaluation is extended by dopaminergic stimulation. Inclination of PD patients to choose the safe option may have resulted in them paying less attention to the risky option, hence quick choice of the safe option in the off state. By contrast, PD patients may have evaluated the risky option more carefully in the on state, leading to a longer decision time. Thus, prolonged risk-based decision with levodopa may reflect a reduced decision bias toward the safe choice and more vigorous engagement in decision-making.

We found that the RAA coefficient was lower on average in PD with ICDs relative to PD without ICDs (Fig. 2), although statistical significance was modest (Table 2 CD). There might be a discrepancy between ICDs in daily life and risk preference measured in the laboratory, because clinically defined ICDs includes a wide spectrum of impulsive behaviors. Small number of PD patients with ICDs is a limitation of the present study and larger cohort studies are needed to clarify the sensitivity and specificity of behavioral economic paradigms to the diagnosis of ICDs.

According to the EU theory, the curvature of the utility function reflects risk preferences. The present study demonstrated that levodopa changes the curvature in PD patients (Fig. 2b). Whether and how the central nervous system represents utility is a fundamental question in the field of neuroeconomics. Together with recent neurophysiological studies, the findings of the present study suggest that dopamine plays a major role in shaping the utility curve. Applying a behavioral economics approach to neurological disorders will enhance our understanding of both clinical symptoms (e.g., ICDs in PD) and neural correlates of reward decision-making.

Conclusions

We examined risk preferences in PD patients and demonstrated acute behavioral changes induced by levodopa. PD patients chose risky gambles more frequently, hence valued them higher, with levodopa treatment. Further research is needed with neurological patients to extend our understandings of behavioral economics and to clarify neural correlates of reward-based decision-making.

References

Abler, B., Hahlbrock, R., Unrath, A., Gron, G., & Kassubek, J. (2009). At-risk for pathological gambling: imaging neural reward processing under chronic dopamine agonists. Brain, 132(Pt 9), 2396-2402.

Ahlskog, J. E. (2011). Pathological behaviors provoked by dopamine agonist therapy of Parkinson's disease. Physiol Behav, 104(1), 168-172.

Arrow, K. J. (1965). Aspects of the theory of risk-bearing. Helsinki: Yrjö Jahnssonin Säätiö.

Bates, D., Maechler, M., Bolker, B., & Walker, S. (2014). lme4: Linear mixed-effects models using Eigen and S4. R package version 1.0-6.

Bodi, N., Keri, S., Nagy, H., Moustafa, A., Myers, C. E., Daw, N., Dibo, G., Takats, A., Bereczki, D., & Gluck, M. A. (2009). Reward-learning and the novelty-seeking personality: a between- and within-subjects study of the effects of dopamine agonists on young Parkinson's patients. Brain, 132(Pt 9), 2385-2395.

Brodsky, M. A., Park, B. S., & Nutt, J. G. (2010). Effects of a dopamine agonist on the pharmacodynamics of levodopa in Parkinson disease. Arch Neurol, 67(1), 27-32.

Claassen, D. O., van den Wildenberg, W. P., Ridderinkhof, K. R., Jessup, C. K., Harrison, M. B., Wooten, G. F., & Wylie, S. A. (2011). The risky business of dopamine agonists in Parkinson disease and impulse control disorders. Behav Neurosci, 125(4), 492-500.

Cools, R., Altamirano, L., & D'Esposito, M. (2006). Reversal learning in Parkinson's disease depends on medication status and outcome valence. Neuropsychologia, 44(10), 1663-1673.

R Development Core Team. (2008). R: A language and environment for statistical computing. Vienna, Austria: R Foundation for Statistical Computing.

Djamshidian, A., Jha, A., O'Sullivan, S. S., Silveira-Moriyama, L., Jacobson, C., Brown, P., Lees, A., & Averbeck, B. B. (2010). Risk and learning in impulsive and nonimpulsive patients with Parkinson's disease. Mov Disord, 25(13), 2203-2210.

Djamshidian, A., O'Sullivan, S. S., Lawrence, A. D., Foltynie, T., Aviles-Olmos, I., Magdalinou, N., Tomassini, A., Warner, T. T., Lees, A. J., & Averbeck, B. B. (2014). Perceptual decision-making in patients with Parkinson's disease. J Psychopharmacol, 28(12), 1149-1154.

Evans, A. H., Strafella, A. P., Weintraub, D., & Stacy, M. (2009). Impulsive and compulsive behaviors in Parkinson's disease. Mov Disord, 24(11), 1561-1570.

Goetz, C. G., Tilley, B. C., Shaftman, S. R., Stebbins, G. T., Fahn, S., Martinez-Martin, P., Poewe, W., Sampaio, C., Stern, M. B., Dodel, R., Dubois, B., Holloway, R., Jankovic, J., Kulisevsky, J., Lang, A. E., Lees, A., Leurgans, S., LeWitt, P. A., Nyenhuis, D., Olanow, C. W., Rascol, O., Schrag, A., Teresi, J. A., van Hilten, J. J., LaPelle, N., & Movement Disorder Society, U. R. T. F. (2008). Movement Disorder Society-sponsored revision of the Unified Parkinson's Disease Rating Scale (MDS-UPDRS): scale presentation and clinimetric testing results. Mov Disord, 23(15), 2129-2170.

Johnson, P. S., Madden, G. J., Brewer, A. T., Pinkston, J. W., & Fowler, S. C. (2011). Effects of acute pramipexole on preference for gambling-like schedules of reinforcement in rats. Psychopharmacology (Berl), 213(1), 11-18.

Kapogiannis, D., Mooshagian, E., Campion, P., Grafman, J., Zimmermann, T. J., Ladt, K. C., & Wassermann, E. M. (2011). Reward processing abnormalities in Parkinson's disease. Mov Disord, 26(8), 1451-1457.

Kobayakawa, M., Tsuruya, N., & Kawamura, M. (2010). Sensitivity to reward and punishment in Parkinson's disease: an analysis of behavioral patterns using a modified version of the Iowa gambling task. Parkinsonism Relat Disord, 16(7), 453-457.

Kobayashi, S. (2012). Organization of neural systems for aversive information processing: pain, error, and punishment. Front Neurosci, 6, 136.

Kobayashi, S., & Schultz, W. (2008). Influence of reward delays on responses of dopamine neurons. J Neurosci, 28(31), 7837-7846.

Levin, I. P., Xue, G., Weller, J. A., Reimann, M., Lauriola, M., & Bechara, A. (2012). A neuropsychological approach to understanding risk-taking for potential gains and losses. Front Neurosci, 6, 15.

Ligneul, R., Sescousse, G., Barbalat, G., Domenech, P., & Dreher, J. C. (2013). Shifted risk preferences in pathological gambling. Psychol Med, 43(5), 1059-1068.

Luce, R. D. (2000). Utility of Gains and Losses: Measurement-Theoretical, and Experimental Approaches. Mahwah, NJ: Lawrence Erlbaum Associates.

McElroy, S. L., Keck, P. E., Jr., Pope, H. G., Jr., Smith, J. M., & Strakowski, S. M. (1994). Compulsive buying: a report of 20 cases. J Clin Psychiatry, 55(6), 242-248.

Medic, N., Ziauddeen, H., Vestergaard, M. D., Henning, E., Schultz, W., Farooqi, I. S., & Fletcher, P. C. (2014). Dopamine modulates the neural representation of subjective value of food in hungry subjects. J Neurosci, 34(50), 16856-16864.

von Neumann, J., & Morgenstern, O. (1944). Theory of Games and Economic Behavior. Princeton, NJ: Princeton University Press.

Pagonabarraga, J., Garcia-Sanchez, C., Llebaria, G., Pascual-Sedano, B., Gironell, A., & Kulisevsky, J. (2007). Controlled study of decision-making and cognitive impairment in Parkinson's disease. Mov Disord, 22(10), 1430-1435.

Perretta, J. G., Pari, G., & Beninger, R. J. (2005). Effects of Parkinson disease on two putative nondeclarative learning tasks: probabilistic classification and gambling. Cogn Behav Neurol, 18(4), 185-192.

Peters, J., & Buchel, C. (2010). Neural representations of subjective reward value. Behav Brain Res, 213(2), 135-141.

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica, 32(1/2), 122-136.

Riba, J., Kramer, U. M., Heldmann, M., Richter, S., & Munte, T. F. (2008). Dopamine agonist increases risk taking but blunts reward-related brain activity. PLoS One, 3(6), e2479.

Rokosik, S. L., & Napier, T. C. (2012). Pramipexole-induced increased probabilistic discounting: comparison between a rodent model of Parkinson's disease and controls. Neuropsychopharmacology, 37(6), 1397-1408.

Rossi, M., Gerschcovich, E. R., de Achaval, D., Perez-Lloret, S., Cerquetti, D., Cammarota, A., Ines Nouzeilles, M., Fahrer, R., Merello, M., & Leiguarda, R. (2010). Decision-making in Parkinson's disease patients with and without pathological gambling. Eur J Neurol, 17(1), 97-102.

Starkstein, S. E., Mayberg, H. S., Preziosi, T. J., Andrezejewski, P., Leiguarda, R., & Robinson, R. G. (1992). Reliability, validity, and clinical correlates of apathy in Parkinson's disease. J Neuropsychiatry Clin Neurosci, 4(2), 134-139.

Thiel, A., Hilker, R., Kessler, J., Habedank, B., Herholz, K., & Heiss, W. D. (2003). Activation of basal ganglia loops in idiopathic Parkinson's disease: a PET study. J Neural Transm (Vienna), 110(11), 1289-1301.

Tremblay, M., Silveira, M. M., Kaur, S., Hosking, J. G., Adams, W. K., Baunez, C., & Winstanley, C. A. (2017). Chronic D2/3 agonist ropinirole treatment increases preference for uncertainty in rats regardless of baseline choice patterns. Eur J Neurosci, 45(1), 159-166.

Voon, V., Gao, J., Brezing, C., Symmonds, M., Ekanayake, V., Fernandez, H., Dolan, R. J., & Hallett, M. (2011a). Dopamine agonists and risk: impulse control disorders in Parkinson's disease. Brain, 134(Pt 5), 1438-1446.

Voon, V., Pessiglione, M., Brezing, C., Gallea, C., Fernandez, H. H., Dolan, R. J., & Hallett, M. (2010). Mechanisms underlying dopamine-mediated reward bias in compulsive behaviors. Neuron, 65(1), 135-142.

Voon, V., Sohr, M., Lang, A. E., Potenza, M. N., Siderowf, A. D., Whetteckey, J., Weintraub, D., Wunderlich, G. R., & Stacy, M. (2011b). Impulse control disorders in Parkinson disease: a multicenter case--control study. Ann Neurol, 69(6), 986-996.

Weintraub, D., Papay, K., Siderowf, A., & Parkinson's Progression Markers, I. (2013). Screening for impulse control symptoms in patients with de novo Parkinson disease: a case-control study. Neurology, 80(2), 176-180.

Weintraub, D., Siderowf, A. D., Potenza, M. N., Goveas, J., Morales, K. H., Duda, J. E., Moberg, P. J., & Stern, M. B. (2006). Association of dopamine agonist use with impulse control disorders in Parkinson disease. Arch Neurol, 63(7), 969-973.

Zappia, M., Montesanti, R., Colao, R., & Quattrone, A. (1994). Usefulness of movement time in the assessment of Parkinson's disease. J Neurol, 241(9), 543-550.

Acknowledgements

The authors thank Ms. Ayako Yusa, Ms. Yukiko Akutsu, and Ms. Yumiko Tanji for technical assistance and Dr. Philippe Tobler for discussion. This work was supported by a grant from the Japan Society for the Promotion of Science (JSPS) to S.K.

Funding

Work in the authors’ laboratory was supported by the JSPS grant (KAKENHI #22800052, 23500393)

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing financial interests.

Rights and permissions

About this article

Cite this article

Kobayashi, S., Asano, K., Matsuda, N. et al. Dopaminergic influences on risk preferences of Parkinson’s disease patients. Cogn Affect Behav Neurosci 19, 88–97 (2019). https://doi.org/10.3758/s13415-018-00646-3

Published:

Issue Date:

DOI: https://doi.org/10.3758/s13415-018-00646-3