Abstract

How the growth in student debt is impacting the well-being of the larger community is explored using U.S. county level data. Using tax return data from the Internal Revenue Service (IRS) we find that higher levels of student debt tends to be associated with lower levels of community well-being. Specifically, lower rates of home ownership, higher rental market stress, lower rates of entrepreneurship and poorer health behaviors. While the decision to take on student debt is an individual decision, local communities are uniquely positioned to help students make decisions around taking on debt and repayment options.

Similar content being viewed by others

Introduction

The growth in student debt in the United States has become a cause for concern for not only the individuals with the debt but also the wider economy as well as individual communities (Goldrick-Rab and Steinbaum 2020). As noted by Webber and Burns (2020) lower income and minority communities may be particularly at risk from the rise in student debt. At the beginning of 2006, student debt, or loans taken out to pursue higher educational opportunities, was approximately $481 billion. By the beginning of 2019, that amount has grown to nearly $1.6 trillion (Fig. 1a), or more than double in inflation-adjusted dollars.

While student loan debt remains smaller than consumer credit debt ($4.1 trillion) or mortgage debt ($15.5 trillion), the rate of growth of student debt is significant. From 2006, consumer credit debt grew approximately 70% and mortgage debt grew by 24%, but student loan debt grew by 232% (Fig. 1b). At the same time, the Consumer Price Index increased only 21.1%. Although this may indicate more people attending college, the percentage of high school graduates attending college grew by just four percentage points (65.8% in 2006 to 69.7% in 2016), an increase of 38% in terms of absolute number of students (BLS 2017). Meanwhile, debt loads increased. Based on analysis by the Institute for College Access and Success (2018) of survey data from American four-year universities and colleges, the average student debt level increased from $18,650 in 2004 to $29,650 in 2016. Concerns over this rapid growth and the subsequent impacts on individuals have led some national policymakers to call for full absolution of existing student debt. Although the community-level impacts discussed here may contribute to that narrative, this study seeks to provide communities with insight and strategies to address the concern locally.

This growth in student debt has raised several issues that may affect the economic competitiveness of the U.S. as well as individual communities. First, higher education is increasingly considered a necessity in the modern labor market and people with higher education tend to be more productive, which is reflected in greater wages and salaries. The most recent data from the American Community Survey (2018 five-year estimates) shows that median income for persons with less that a high school degree was $22,609, rising for those with some college or an Associate’s degree ($36,293), Bachelor’s degree ($53,825) and a graduate or professional degree ($72,095). Assuming a 40-year working life, the difference in median income between a person with a high school degree (or GED) and a Bachelor’s degree is $930,200. Over the long term, investing in higher education can have significant impacts on earning potential.

Individuals planning on attending higher education institutions who lack funding must borrow. But some are questioning the risk-reward calculus of taking on significant debt to obtain a college degree. In a 2014 survey, 34% of former students age 18 to 40 with outstanding debt believed that their investment in a college degree will not pay off in the long run (Citizens Bank 2014). A study of willingness-to-borrow for higher education found that students from schools with lower resources are less likely to borrow funds for higher education (Perna 2008). Burdman (2005) argued that rising student debt loads may be a barrier to access for those who are averse to borrowing. Rising default rates may also contribute to a greater perception of risk associated with student loans. If a sufficient number of people decide that the risk associated with debt outweighs future earning potential, the human capital that a modern competitive economy requires may be at risk.

The second issue concerns the inability of students to repay their loans. The simple presence of student debt reduces an individual’s net worth and disposable income, driving down consumption and investment spending, and places downward pressure on the economy (Fullwiler et al. 2018). Meanwhile, if a sufficient number of people with student debt default, this could lead to a crisis in the educational financing system. Although the mortgage crisis that led to the Great Recession was much larger than the potential default level on student debt, risks to the financial system are real. Much like the weakening of the housing market resulted in the ensuing collapse of the mortgage backed asset securities market and triggered the Great Recession, some scholars such as Xu and Ortiz-Eggenberg (2020) suggest that student loan asset backed securities may equally be at risk.

Dynarski (2015) reported that while nearly seven million student loan borrowers were in default, there is a large variation in the characteristics of those students who are in default. The Institute of Educational Sciences (2018) analysis of those who had begun postsecondary education in 2003–04 found that, of students who obtained a Bachelor’s degree or higher, only 3.5% were in default after 12 years and 11% of those obtaining an associate degree were in default. But 29.9% of those that experienced some college but did not obtain a degree were in default. The same analysis found that those in the lower quartile of income after school defaulted at a rate of 21.6%, but for the highest income quartile, the default status was 11.7%.

The vast majority (92%) of student loans, however, are federal which decouples them from the traditional financial system. Higher default rates have led some to raise concern at the impact on the federal budget (Toby 2011; Edmiston et al. 2013). There are additional secondary effects on the traditional financial system. Student debt liabilities are not dischargeable and defaults impact an individual’s credit scores. Again, if student debt default rates grow, it could ripple through the financial system and impact the federal budget.

The third potential crisis is how rising student debt may affect local economies. Numerous authors (e.g., Cornelius and Frank 2015) suggest how student debt might be affecting the decisions of students post education, including postponing the purchase of a house or automobile and delaying marriage and/or having children, or starting a business. Student debt can alter the behavior of individuals which can impact the larger community in which they decide to live. But to what extent and what can communities do to minimize any potential negative outcomes?

In addition, some, such as Mascolo (2020), have suggested that rising student debt could put the future of higher education itself at some level of risk. As tuition and fees increase at rates faster than inflation or earnings more students will question the risk-reward calculus and may opt to delay or forego higher education thus reducing revenues to institutions of higher education. As we have seen with reduced enrollments due to the COVID-19 pandemic, coupled with changing age demographics, even a modest decline in enrollments can have significant impacts on the fiscal positions of colleges and universities. Further, if the student debt market becomes unsustainable for any one of a variety of reasons, students may not be able to obtain the necessary financing further eroding the underlying financing of higher education.

To fully understand how student debt could be affecting the community, a systems thinking approach, such as the Community Capitals (Emery and Flora 2006) or the Shaffer Star (Shaffer et al. 2006) could be employed. There are numerous simultaneous moving parts with significant feedback loops. But within the student debt literature the primary mechanism through which student debt impacts local economies is through labor market decisions. Do new entrants to the labor market limit their job search to only higher paying jobs, thus avoiding more public service-oriented jobs such as teaching or law enforcement, in order to ensure repayments of debt? Or do these new entrants take any job that is available to ensure some level of income, thus limiting future growth? More importantly, do people with student debt avoid entrepreneurship because of the inability to finance a new business and/or the income risk associated with being self-employed? This latter employment decision - to become an entrepreneur or not - is important because entrepreneurship is vital to economic growth and development (Walzer 2007; Haltiwanger et al. 2013). This is particularly true of rural communities (Deller et al. 2019).

How student debt impacts each of these questions has an impact on the whole of the community system. For example, there is also growing concern that the stress associated with student debt may harm labor productivity through poor health outcomes (Huang 2015). As levels of financial stress increases - in general and specifically with respect to student debt - workers are less focused at work, sometimes referred to as “presentism” (present at work but not focused on work), which negatively affects productivity. In the extreme case, health concerns become sufficiently severe to result in unemployment. Indeed, a growing body of research (Kim and Chatterjee 2019; Archuleta et al. 2013; Baker and Montalto 2019) has found direct connections between growth in student debt and health, particularly mental health.

In this study, we explore how student debt influences several measures of “community well-being” using U.S. county-level data. We use federal income tax data drawn from the Internal Revenue Service (IRS) to model how higher levels of student debt affect seven different measures of community well-being. To be consistent with the literature and the systems thinking approach, we define community well-being broadly to including elements related to housing, entrepreneurship and health behaviors. For our purposes, each of these are proxy measures of community well-being. For example, a higher community well-being is associated with higher rates of entrepreneurial activity, better health behaviors, higher rates of homeownership and lower rates of rental stress.

To measure student debt, we use the county summary statistics from the U.S. Internal Revenue Service. This provides data on the share of tax filers claiming student debt repayments on their taxes and the amount of interest payment. Unfortunately, these data are not without their limitations. First, not all tax filers declare student debt even if such a deduction is allowed. Second, there are income thresholds which limit the ability to declare student debt on federal taxes. While we acknowledge limitations to this data is the only consistent source of data at the community or regional (i.e., county) level. The data are for 2016.

This study is composed of four additional sections. In the next section, we provide a broad overview of the relevant literature and outline the logic behind how student debt can influence four indicators of community well-being. We then outline our empirical models and data used in the analysis. We pay particular attention to the student debt data, specifically its limitations and how the lack of quality student debt data at the community level hinders our analysis. We present our empirical results in the fourth section followed by a discussion of the implications of our findings on community economic development.

Literature

From a community economic development perspective, the relevant literature falls into four broad categories: labor market outcomes, patterns in entrepreneurship, homeownership decisions, and health outcomes associated with financial stress. While these broad categories are often discussed as separate and distinct issues, there is significant overlap among them. For example, entrepreneurship, or the decision to be self-employed, is a specific aspect of labor market outcomes. Homeownership can be both an asset that can influence the ability to start a business and be self-employed (Schmalz et al. 2017) as well as a proxy for the commitment of the person to the community compared to renters who are more mobile. Health outcomes directly and indirectly impact labor market outcomes through lower productivity. Although these four indicators are not all inclusive of metrics describing community well-being, they are tied closely to student debt and include components of various forms of capital that contribute to wealth creation in a community.

In terms of labor market outcomes, there are generally two competing lines of thinking. One is that students with higher debt levels will seek any employment opportunity to ensure some source of income. The other line of thinking is that students will seek higher paying but higher risk jobs to compensate for the debt repayment obligations. The available research (e.g., Minicozzi 2005) tends to favor the second hypothesis, but the results vary by level of education. Based on the descriptive analysis of the Institute of Educational Sciences (2018) it is clear that not all students who have student loan debt obtained the same level of educational outcomes and those differences make drawing broad generalizations about labor market outcomes difficult. Houle and Addo (2019) detail the heterogeneity in student borrowers, particularly in minority populations and first-generation students.

Weidner (2016) finds that an additional $10,000 of student debt reduces earnings by one to 2 % in the first year of employment because higher debt induces some to find a job more quickly. Thus, a person may take a lower-paying job or a job in a field unrelated to their area of study to ensure a flow of income. Price (2004) found that students with an educational debt burden above 8 % of their pre-tax monthly incomes are more likely to earn lower average salaries than their peers with debt below 8 %. This difference became more pronounced for low- or middle-income students as well as racial minorities. Gervais and Ziebarth (2019), however, find no evidence for a negative effect of student debt on earnings in the short or long run.

A study of students at the University of Virginia (Sullivan 2018) found that students with higher debt levels tended toward degrees in business and economics, perhaps with the understanding that careers in these fields would generate greater returns. Rothstein and Rouse (2011) find that debt causes graduates to choose substantially higher-salary jobs and reduces the probability that students choose low-paid “public interest” jobs. These labor market decisions are also present in specific fields. Chambers (1992) found that as a law school student’s debt increases, they are less likely to take jobs in government and legal services and more likely to take jobs in large private law firms. Rosenthal et al. (1996) found high levels of student debt had a significant and negative effect on the likelihood that medical students will pursue less lucrative family practice.

Another element of the labor market outcome question concerns entrepreneurial or self-employment activity. There are at least three potential mechanisms that could link student debt and rates of entrepreneurship. People who were inclined to start a business before assuming student debt may be deterred because of perceived success risks associated with entrepreneurship. While estimates of business survival rates vary by study, a general rule is that 50% of all new startups do not survive after five years (Deller and Conroy 2017). Second, labor income from new ventures is uncertain in the first few years. Without guaranteed income, former students may be unable to make debt payments and support living costs. Third, new businesses may be undercapitalized because student debt limits the ability of the potential entrepreneur from securing sufficient financing. Haltiwanger et al. (2015) observes that the rapid growth in student debt levels may correspond to the national slowdown in new business formation.

As expected, Krishnan and Wang (2018a, b) find that higher levels of student debt did deter levels of entrepreneurship for two reasons. First, there is the added risk of insufficient income and business failure to the potential entrepreneur. Second, a potential entrepreneur can have insufficient access to capital due to student debt burdens. For the latter, the potential entrepreneur is unable to invest their own capital, as it is servicing their student loan debt. In addition, the potential entrepreneur may be unable to secure more traditional bank financing due to their greater existing liabilities. Krishnan and Wang (2018a, b) also found significant adverse effects of student loans on venture capital back startups, particularly high venture capital investment from reputed firms. Ambrose et al. (2015) find this is especially true for smaller startups (one to four employees), which is particularly troublesome because most startups tend to be small (Conroy and Deller 2015; Haltiwanger et al. 2013). This cause and effect pattern related to student debt burdens and rates of new business formation could be a fundamental explanation for why the U.S. has experienced increasingly low rates of entrepreneurship (Conroy et al. 2018).

Another manner in which student debt can affect the larger community is through homeownership. For many communities, particularly smaller and more rural communities, the decision to purchase a home is viewed as a commitment to the community. Renters, on the other hand, can be more transient. Further, homeownership has been found to be important in helping understand rates of entrepreneurship. This comes both from the commitment to the community as well as a source of potential financing for a business startup or expansion. The latter is due to the impact of homeownership on an individual’s growth in wealth through equity over time. Some argue that high student debt levels are a deterrent to homeownership because of the inability to secure financing as well as the desire for the person to be more footloose if alternative employment opportunities become available, among other factors (Xu et al. 2015).

The predominance of the empirical analysis testing this hypothesis seems to support the notion that higher levels of student debt is a deterrent to homeownership (e.g., Cooper and Wang 2014; Elliott and Lewis 2015). There are a handful of studies (e.g., Houle and Berger 2015; Sommer 2020) that challenge this “conventional wisdom” and find little evidence that young adults are not buying homes because of student debt. Young adults who are willing to assume student debt may be taking a longer-term view surrounding the decision to purchase a home. The higher life-time earnings potential of those with higher education outweighs the short-term burden of student debt repayment. This debt burden, however, is becoming increasingly long-term, given that a sample of students with debt still owed 22% of the principal after 20 years (Institute of Education Sciences 2018).

The final element of community well-being that is considered in this study focuses on student debt and health outcomes. It is widely accepted within the public health literature and the social sciences literatures more broadly that there is a strong link between personal financial stress and health (O'Neill et al. 2005). In a study of 4897 college undergraduate students over a three-year period in the United Kingdom, Cooke and colleagues (2004) found that demographic and economic background did not explain differences in perceived mental wellness but self-reported perceptions of their finances and debt did differentiate mental health scores. Generally, higher levels of financial stress caused poorer mental health outcomes. This is consistent with Stradling (2001) who found that students who perceived their anticipated student debt as ‘excessive’ were more likely to be anxious or depressed than students who viewed their anticipated debt as ‘manageable’. Bemel et al. (2016) and their study of undergraduates at a U.S. university found that fiscal stress impacts many elements of mental health including concentration, ability to make decisions, general happiness and perceptions of usefulness.

Walsemann et al. (2015) also find that poorer financial conditions of students and recent graduates leads to poorer mental health outcomes, but they note that care must be taken not to make overly general statements about student debt and health. Concurrent with Huang (2015), risk attitudes towards debt and perceptions of future income earning potential plays a significant role. For example, a student who assumes significant levels of debt and has more modest life-long earnings potential will view debt very differently than a student with higher expected life-long earnings. Also, students that come from families that are more comfortable assuming debt for major purchases (e.g., homeownership) or as a means to finance a business will view student debt differently than a first-generation student whose family discourages debt. This observation is consistent with the findings of Dynarski (2015) and The Institute of Educational Sciences (2018), who found significant variations in the characteristics of people who defaulted on their student debts.

Methods

The intent of this study is to explore the impact of student debt on the well-being of communities, where communities are measured at the county level. We explore the county as a unit of analysis because of the availability of student debt data and business start-up rates at the county level. While using county level data masks important socioeconomic and demographic differences within a county, particularly geographically large counties, the IRS data is not available below the county level. Further, most of the community well-being measures that we model are only available at the county level in any consistent manner across the U.S. Based on the available literature, we anticipate that higher levels of student debt will be linked to lower overall community well-being. While we do not formally adopt a systems thinking approach (e.g., Community Capitals or Shaffer Star) to think about the impact of student debt on community well-being, we do define well-being broadly and to be consistent with much of the student debt literature.

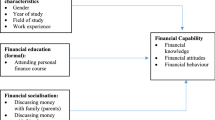

We can express our simple model as:

Here, CWBi is a measure of community well-being for community (county) i, COMi, j is a set of k community characteristics reflecting social, demographic and economic conditions, ϵi is the regression error term and α, βjand are γ parameters to be estimated. The variable of interest here is SDi which are measures of student debt for community i. Our central hypothesis is that higher levels of student debt will be associated with poorer levels of community well-being.

Measuring community well-being is subjective because of the normative nature of what defines well-being. For this study, we define well-being across three blocks of variables, housing, entrepreneurship and health, to complement the predominance of the literature on student debt and community outcomes. There are two measures of housing, two of entrepreneurship and three on health. Naturally, if we adopted a more comprehensive systems thinking approach to community well-being, there are numerous other measures that could be included such as social capital, financial capital, and political capital amongst others. The number of categories of potential characteristics as well as the number of potential variables within each category could become unmanageable. Indeed, just within the health category there are dozens of potential individual variables. To be most consistent with the available student debt literature we have elected to focus on these three categories.

The two housing measures are percent of housing that is owner occupied - a direct measure of homeownership - and the share of income devoted to rent. Based on the available literature tying student debt to lower homeownership rates (Mezza et al. 2016; Xu et al. 2015) and the logic that higher student debt limits the ability of people to secure a down payment and mortgage financing, we expect higher student debt to place downward pressure on homeownership. Additionally, individuals with high levels of student debt might be unwilling to assume yet more debt in the form of a mortgage. If individuals with student debt are unwilling or unable to purchase a home, they must turn to the rental market. Here there is upward pressure on rental prices that may result in higher rents for a given level of income. We hypothesize that communities, again measured by counties, with higher student debt levels will tend to see higher shares of income devoted to rents. The housing data comes from the 2016 five-year average American Community Survey (see Table 1 for descriptive data and data sources).

The two measures of entrepreneurship are the percent of households that are reporting any self-employment income and the number of business start-ups per 1000 population. The self-employment income data comes from the American Community Survey and the start-up rate data comes from Business Information Tracking System (BITS) generated by the U.S. Census Bureau. The reported self-employment income data, unfortunately, does not capture the level of household dependency on self-employment income. For example, does someone in the household have a “side-line” business that generates a modest amount of income while the household’s primary source of income is wage and salary employment? Or is self-employment the predominate source of household income? This simplistic measure cannot provide any insight into this subtle but important point. The BITS data is built on the same database that is used to generate the County Business Patterns and as such only captures those businesses that have at least one employee. Thus, the sole proprietor that is operating a home-based business with no paid employees are not included in this analysis.Footnote 1 Consistent with Krishnan and Wang (2018a, b), we expect communities with higher levels of student have lower levels of entrepreneurship.

We have three measures of health that are aimed at serving as proxy measures for stress related behavior: percent of the population that smokes, the percent of the population that drinks excessively, and percent of the population with insufficient sleep. We maintain that these characteristics are known to result in long-term poor health outcomes and are associated with higher levels of stress. Thus, consistent with the literature described, if higher levels of student debt leads to higher levels of stress, we would expect that higher level of stress to manifest in these measures. For example, we would expect higher levels of stress to be associated with higher levels of drinking, higher levels of smoking, and insufficient sleep. These data are drawn from the County Health Rankings database maintained by the University of Wisconsin Population Health Institute.Footnote 2

The challenge with selecting the block of k control variables (COMi, j) is that the drivers of the different measures of community well-being vary across each measure. For example, community characteristics that tend to be associated with smoking and excessive drinking may be very different than rates of entrepreneurship. As such, we elect to use a general set of control variables that capture broad community characteristics such as age and education profiles, ethnic and income characteristics, and structure of the local economy.

The age profile is measured by the shape of the distribution of the age structure, specifically the 3rd moment of the distribution, or the level of skewness.Footnote 3 If the data is skewed to the right (3rd moment is negative) this means that a larger share of the population falls into older age categories whereas if the data are skewed to the left (3rd moment is positive) then the county will tend to be younger.

Our education profile measure employs the same approach looking at the distribution of educational attainment across seven categories (less than a 9th grade education to graduate or professional degree). If the education index takes on a negative value, then the data is skewed toward higher levels of education whereas a positive value implies that the data is skewed toward lower levels of education. Both the age and education data is from the American Community Survey.

Two ethnic variables are used, a standard measure of ethnic diversity (Simpson Index) as well as the percent of the population that is non-white. The ethnic diversity index equals the probability that two people taken at random from the community have the same ethnic heritage. Therefore, a higher value of the index means a more homogenous (less diversified) population whereas a small value means a more heterogeneous (more diversified) population.

The income characteristics are captured by the Gini Coefficient of income inequality as well as the poverty rate. Again, these data are from the American Community Survey. Finally, the economic structure variable is a simple Herfindahl Index of the distribution of employment shares across 20 industrial categories. A lower value of the index means that employment is more evenly distributed across the 20 industries and the economy is said to be more diversified. At the extreme, if the index is equal to one then all employment is in one industry and the economy is highly specialized. These data are drawn from Woods and Poole, Inc. in order to take advantage of their methodology to “fill in” missing data that is due to disclosure problems.

We do not offer any specific hypotheses related to these control variables because of the wide variation in our measures of community well-being. We could make broad pronouncements about expecting higher rates of poverty to be associated with lower levels of community well-being, or lower levels of education also being associated with lower levels of well-being, but this would be speculation and outside the scope of this study on student debt.

The challenge that any study of student debt at the community level faces is the quality of the student debt data itself. Unfortunately, the Federal Government does not consistently collect or report student loan data at the community or regional level. Most studies of student debt are based on a handful of colleges and universities that collect and make available such data on their alumni. One data source that is widely available and is consistent over time and across regions is the summary tax file information provided by the Internal Revenue Service (IRS). These data represent summary data from individual tax returns aggregated to the county level and is available from 1989 to 2016. Included in the 2016 data are the number of tax returns declaring student loan interest deductions and the amount of the interest deductions. For example, there were 148,585,680 income tax filers and 12,271,080 (8.2%) declared student debt interest on their tax returns. Of those declaring student debt, approximately $13.15 billion in interest payments were reported, or $1072 per declaring return. Unfortunately, this only captures individuals who itemized for their federal taxes and reflects interest payments and not level of debt. This reliance on itemization may bias the underlying data. For example, low-income individuals who are more likely to take the standard deduction are undercounted, whereas homeowners may be over reported due to the mortgage interest deduction increasing the likelihood for itemization. In addition, disclosure rules apply which means for some counties, especially the least populated rural counties, there is no available data (i.e., it is suppressed). Despite these limitations to the student debt data, these are the only data that are widely available to researchers that have sufficient geographic detail (counties) and breath (all U.S. counties).

For this study, we use the IRS data to derive three measures of student debt: (1) share of all federal tax returns that declare student debt interest payments, (2) student debt interest payments per return that declared such debt, and (3) the share of total income within the community that is going toward student debt interest payment. We use all three measures for two reasons. First, we have no reason to select one measure over another. Second, using all three provides a simple robustness check on the results. In other words, we can be more confident in our results if all three student debt measures provide consistent results on community well-being.

Before moving onto the empirical results, consider the spatial distribution of our three measures of student debt. Two of our measures, percent of returns with student debt interest payments declared (Map 1a) and percent of total community income to student debt interest payments (Map 1c), have very similar spatial patterns, whereas the interest payment per return (Map 1b) appears more spatially dispersed.Footnote 4 For the former two measures (Map 1a, c) there are clear concentrations of higher values in the Northeastern and the upper Midwest states and concentrations of lower values in the southern states. For interest payments per return (Map 1b) the concentration of higher levels in the band from Michigan to New England is still evident, but outside that region the pattern appears more random or dispersed. Somewhat surprising is the apparent clustering of lower values of student debt in the central part of California, particularly the larger San Francisco region. One would expect with the concentration of college graduates in this region that there would be higher levels of student debt.

One must be careful, however, with how we are measuring student debt: declarations of student debt interest on federal tax returns, which only include those individuals who itemize their tax returns and does not include education financing from other means such as private or family loans. It should be noted that under federal tax law in 2016 there was an income threshold where such deductions could be declared. Indeed, tax filers with income above $200,000 are above the eligibility threshold thus student debt interest payments by very high-income earners are not present in the data. It may be the case that in this part of the country, incomes are sufficiently high that our measure of student debt undercounts actual levels of debt.

Results

The results of the base models of community well-being - models that do not contain any of the student debt measures - are provided in Table 2. Because of the spatial patterns in the three measures of student debt, we use heteroscedasticity-consistent standard errors for our hypothesis testing. In short, the assumption that the regression error variance term is constant across all observations is likely incorrect because of the spatial patterns observed in Map 1. The approach we adopted corrects for the error variance term not being constant across geography. In addition, to make comparisons of the magnitudes of the effects across variables we report the standardized coefficients. Finally, we step in each of the three separate measures of student debt independently. Thus, given seven measures of community well-being and three measures of student debt, a total of 21 separate models are estimated beyond the base models. The results for the student debt variables are summarized in Table 3.Footnote 5

While a detailed discussion of the results of the control variables on our measures of community well-being is beyond the scope of this study, there are some patterns that warrant mentioning. First, the eq. F statistics are significant above the 99.9% level for all seven measures of community well-being. This lends confidence that the base models, in aggregate, are performing well. In terms of the power of the models in explaining the variation in the well-being models, it ranges for a low of 30.3% for the percent of households reporting self-employment income to a high of 66.1% for the percent of the population smoking. Combining the eq. F statistics and the R2, the base models are the strongest for the well-being measures associated with health, the next strongest are the two housing measures, and the lowest performing are the two entrepreneurship measures.

The three control variables that are statistically significant at the conventional 95% level in each measure of well-being are the education index, poverty rate and the degree of economic industrial diversity. Higher educated communities tend to be associated with weaker housing outcomes in terms of lower rates of home ownership and greater renting fiscal stress, higher self-employment and start-up rates, but generally poorer health behaviors such as higher smoking rates and less sleep. It may be the case that more highly educated people are more mobile and thus, all else held constant, are less likely to own their home. A more highly educated community is also associated with higher levels of self-reported excessive drinking. Higher poverty rates tend to be associated with poorer housing outcomes, lower rates of entrepreneurship and generally poorer health associated activity, except for excessive drinking where higher poverty is associated with lower excessive drinking.Footnote 6 The higher the Herfindahl Index of economic diversity, which is associated with a more specialized economy, tends to be associated with lower rates of homeownership, lower rental fiscal stress, lower rates of entrepreneurship and higher rates of poorer health practices (smoking, excessive drinking and insufficient sleep). This latter result is consistent with the generally held policy conclusion that more diversified economies tend to out-perform more specialized economies. As the community (county) becomes younger, there is no impact on housing, but there are higher levels of entrepreneurship, lower rates of smoking and insufficient sleep but higher rates of excessive drinking. These results are generally unsurprising and what one might expect when comparing a younger and older community.

The three weaker performing control variables are income inequality, ethnic diversity and percent of the population non-white. Higher income inequality, for example, is associated with lower rates of homeownership, higher levels of rental fiscal stress, higher rates of entrepreneurship, but is generally not associated with health behaviors. A more ethnically homogenous community tends to have higher rates of homeownership, higher rates of rental fiscal stress, higher share of self-employment income but no effect on business start-up rates, and no effect on smoking or excessive drinking while a lower effect on insufficient sleep. A higher share of the population that are from minority populations has no effect on homeownership, lower rates of rental fiscal stress, higher self-employment income but lower business start-up rates, lower rates of smoking and excessive drinking, but weakly higher levels of insufficient sleep.

Keep in mind that we are not attempting to offer any policy guidance based on the results of these control variables, but rather review the results to evaluate the overall performance of our community well-being models. In general, we find that the base models perform as expected, as the coefficients have the expected signs, the overall fit of the model (R2) is good and our core hypotheses are supported. This lends confidence to the results on our variables of interest concerning student debt. While one could challenge an individual control variable result, for example the relationship between tendencies toward lower education levels and homeownership is somewhat unexpected, the overall performance of the models is reasonable.

Turning attention to the effect of student debt on community well-being, we find that most of the student debt measures are statistically significant (Table 3). The measure of student debt is statistically significant in 17 out of 21 separate models. Generally, higher levels of student debt are tied to lower levels of homeownership while at the same time linked to higher levels of rental fiscal stress. These results are as expected and largely consistent with the available literature. The reported coefficients are standardized, thus allowing for direct comparison of the magnitudes of the individual effects and we also included the change in R2, or the change in the percent of the variation in each measure of community well-being that each student debt measure contributes. For example, the change in R2 for including the percent of tax returns declaring student debt on homeownership rates is 0.0866, which means that including this student debt measure increased the explanatory power of the model by 8.66%. Whereas including the same variable in the percent of income going to rent (rental fiscal stress) increased the explanatory power of the model by only 0.9%. These differences in the change in R2 closely aligns with the differences in the magnitude of the estimated model coefficients.

There appears to be mixed results on self-employment and rates of new business formation. For example, the percent of tax returns declaring student debt has no effect on self-employment income or business start-up rates. The higher the percent of total income in the community going to student debt has a positive effect on the percent of households reporting self-employment income, but a negative effect on new business formation. Of the six models here – three measures of student debt and two measures of entrepreneurship – three are statistically significant with the expected negative coefficient, two are statistically insignificant and one has an unexpected positive and significant coefficient. Looking to the changes in the model’s R2, or explanatory power, by including the student debt measures, student debt interest payment per tax return explains about 3.5% of the variation in our two measures of entrepreneurship. The other two measures explain less than 1 % in the variation in entrepreneurship. Based on these results, one could conclude that student debt is putting some downward pressure on business entrepreneurial activity.

Turning to the three health measures, or behavior that influences health outcomes, there are nine total models estimated and the student debt measures are statistically significant in seven of the models. In each case where the student debt measure is statistically significant, higher levels of student debt are associated with poorer health behaviors. Higher levels of student debt are linked to higher rates of smoking, excessive drinking, and insufficient sleep. The two models where the student debt results are statistically insignificant are both insufficient sleep. The data clearly support that notion that higher student debt leads to higher levels of stress, and these data suggest higher rates of behavior associated with stress (smoking, excessing drinking, and insufficient sleep).

Our results tend to be robust across several measures of community well-being and student debt: higher levels of student debt are associated with poorer community well-being outcomes. Of the 21 modeling results, only one is unexpected: higher percentage of community income going to student debt interest payments is linked to a higher share of households reporting self-employment income. For this one unexpected result, however, the student debt measures increased the explanatory power of the model by 0.1%. So, while the estimated coefficient is positive and statistically significant, the magnitude of the relationship could be deemed as economically unimportant.

Discussion and Conclusions

Student debt associated with higher education has grown as tuition and fee costs rise. The growing awareness of this trend is causing many to be concerned about how higher levels of student debt are affecting not only the individuals but also the communities in which these people live. The results of this study are reasonably consistent: higher levels of student debt are associated with lower levels of community well-being. While some of the results are statistically insignificant, and one provides a result opposite of expectations, the majority of our results support the central hypothesis. As student debt increases, rates of homeownership decline, fiscal stress in the rental markets increases, rates of entrepreneurship - specifically self-employment income and new business formation rates - decline, and there are higher levels of poorer health behaviors (smoking, excessive drinking, and insufficient sleep). These results are largely consistent with the available literature.

The student loan crisis is a central component of national policy discussions. During the 2020 Democratic primary process several candidates proposed full absolution of student debt. Such a policy is not something that local communities could adopt and, at the national level, such a policy could lead to distortions in the economy through what economists refer to as “rent seeking behavior”, or the manipulation of policy for economic gain with no real increase in their own costs. In other words, a person would seek more education than he or she would otherwise without necessarily incurring the costs associated with that additional education. The federal government does maintain a Public Service Loan Forgiveness (PSLF) program, established in 2007, to incentivize an educated workforce to take jobs in the public and non-profit sector, which typically return a lower wage. Given the launch of the program in 2007 and the required ten years of service, only a few thousand people have completed the program and had their debt forgiven, so it is not yet clear how the program has affected communities.

Some states have developed smaller, targeted debt forgiveness programs. Mississippi offers up to $12,000 over four years to indebted graduates who work as teachers in underserved areas of the state (MOSFA 2019). Minnesota has programs for nurses, dentists and physicians (AAMC). Dozens of states have similar programs and many of them are targeted toward supporting rural areas. The Learning Policy Institute (2016) found that state programs were generally effective at recruiting and retaining high-quality teachers in underserved areas.

There are also opportunities for local communities to address the problem. It is well understood that an important part of a dynamic and vibrant local community is human capital. Human capital can be in the form of leadership and rates of volunteerism, but, at its core, human capital is about the ability of the community residents. Education is a vital piece of the human capital puzzle. Local schools are a primary vehicle for a community to invest in its human capital, because they not only make the community more attractive to potential residents and businesses, but they also build the stock of human capital. An increasingly important part of that investment is higher education.

That investment, however, is requiring higher levels of student debt. The applied research presented in this study confirms that higher levels of student debt can have a negative outcome on community well-being. Some have argued in the popular press that the return on investment for higher education is not sufficient to offset the costs of student debt. While this may be true for some, generally the rate of return on higher education is significantly higher than current average debt levels. Communities should therefore be looking to strategies that create greater financial opportunities for local students and mechanisms to help students, or former students, in the community manage their student debt.

This endemism of student debt has birthed a focus on people when it comes to solving the student debt crisis. Although the student debt crisis may be more concentrated in certain regions and - due to the mobility of debtholders - the causes are not necessarily related to a community in which an individual resides, there are steps a community can take to improve their quality of place, which in turn improves the quality of life for its residents and encourages migration to the community.

Specific examples include local high schools devoting more resources to helping students identify and apply for scholarships and educational grants. Some (e.g., Andruska et al. 2014; Johnson et al. 2016; Perry and Spencer 2018) have effectively argued that many, if not most, students lack an adequate understand of personal finances and are not positioned to make the long-term analysis of assuming debt and potential future earnings. Indeed, predatory lending institutions, including some for-profit colleges, take advantage of some students’ lack of financial knowledge. Communities and high schools can work with students to improve their personal financial skills and encourage students who are more likely to be dependent on student debt to pay for higher education to explore low cost options such as local/regional technical schools or junior colleges for an Associate degree then transfer to a four-year institution.

The exploration of technical schools and junior colleges should not be viewed as a replacement for those seeking a Bachelor’s degree at a four-year institution, but rather a consideration in the financial equation, just as a student would consider costs of tuition, room and board, and expected salary after graduation. The concern is that younger students, particularly those in high school, are strongly encouraged to pursue a four-year degree and as a result may steer students into accumulating debt when more financially sound alternatives are possible. In many states there are transfer agreements between technical schools, junior colleges, and four-year institutions where completing course work at less expensive institutions does not delay graduation schedules.

For students that choose not to attend college and instead enter the local workforce immediately, the student and the community will both be better served by having another financially literate individual. Communities and high schools can also make students aware of existing state and federal debt forgiveness programs, including a list of local jobs and organizations that would qualify for the programs. Communities then benefit from greater retention of students who left for college and return home to work after graduation in public-service jobs that qualify for debt forgiveness.

Communities can work to make the community attractive for those people that have student debt by offering programs to help manage that debt. Communities frequently provide financial consulting or technical assistance to new and small businesses. They can similarly provide services to former students who may still lack adequate personal financial management skills. Programs to improve financial management skills have value beyond the management of student debt. Given the negative relationship between student debt and entrepreneurship, we might expect the benefit of increased financial management skills to have compounding benefits of reducing student debt burdens and improving the likelihood of entrepreneurship, of which financial management is key. Communities can work with local banks to encourage the banks to help refinance student loan debt with more favorable terms. Beyond the immediate benefits to the individual debtholder, building relationships between community members and their local financial institutions can improve the business ecosystem and reduce the lender’s risk in offering mortgage or business loans. In the absence of reducing debt burdens, communities can target people with high levels of student debt for health-related counseling, particularly preventive mental health counseling to address issues associated with stress. These strategies therefore not only improve the management of student debt for the individual, but they also generate social and human capital that spills over into the rest of the community.

This study is but one modest attempt to better understand how the growth in student debt can have detrimental effects on local communities, which reinforce the calls for concern over growing student debt. Perhaps more importantly, this study highlights the shortcomings in our understanding of the impact of student debt on local communities. Talking in terms of aggregate or average student debt burdens masks significant differences across students who take on debt and may lead to incorrect policy options. While we need to refine our understanding of how student debt impacts local communities, there are several strategies that can be undertaken at the community level to mitigate the negative outcomes of student debt.

Notes

This data detail raises a challenging question from a community economic development perspective. From a pure data perspective, not including non-employer business eliminates “side-line” businesses that, in aggregate, contribute very little to the economy. This focuses attention to only those business that have the short-term potential to make a larger contribution to the economy. . From a policy perspective, should the limited economic growth and development resources be devoted to helping those small “side-line” businesses with the hope that they grow become viable businesses or should those limited resources be devoted to those “larger” start-ups. . Here “larger” is defined as having at least one paid employee. . There is no clear answer to this policy choice and largely hinges on the skill sets that economic development practitioners bring to the table. . The policy issue here is beyond the scope of this study.

The data are available for several years and updated annually. It should be noted that many of these health measures are based on self-reporting and there could be implicit biases in how some of these data are reported. The data can be examined and downloaded from: https://www.countyhealthrankings.org/

For this study, the 3rd moment is calculated as \( \left({\sum}_{i=,1\dots, v}{s}_i^3\right)v \) where si is the percent of the population in age category i and v is the number of age categories. There are 18 age categories (v = 18) progressing in five year intervals.

Note that the mapping reveals large parts of the Great Plains, which include some of the most rural and least populated counties in the U.S., where data are unavailable. Despite these limitations, the IRS data is a better alternative to the piecemeal college and university sourced data and credit rating agency data, which is difficult to source.

We tested for multicollinearity and found that the highest variance inflation factor was only 4.2 and the condition index was 66.7. Both are a little high but well below standard thresholds so we can conclude collinearity is not a concern.

This result may appear to be counter-intuitive, but one must keep in mind that these health measures are self-reported and there may be implicit biases in the data. It may be the case that what defines “excessive drinking” could be influenced by income or education. Given the lack of serious issues with multicollinearity, we do not believe that this is the case, but rather a plausible explanation.

References

Ambrose, B.W., Cordell, L., & Ma, S. (2015). The impact of student loan debt on small business formation. Federal Reserve Bank of Philadelphia, Working Paper No. 15-26.

Archuleta, K. L., Dale, A., & Spann, S. M. (2013). College students and financial distress: Exploring debt, financial satisfaction, and financial anxiety. Journal of Financial Counseling and Planning, 24(2), 50–62.

Andruska, E. A., Hogarth, J. M., Needles Fletcher, C., Forbes, G. R., & Wohlgemuth, D. R. (2014). Do you know what you owe? Students’ understanding of their student loans. Journal of Student Financial Aid., 44(2), 125–148.

Baker, A. R., & Montalto, C. P. (2019). Student loan debt and financial stress: implications for academic performance. Journal of College Student Development, 60(1), 115–120.

Bemel, J. E., Brower, C., Chischillie, A., & Shepherd, J. (2016). The impact of college student financial health on other dimensions of health. American Journal of Health Promotion., 30(4), 224–230.

Burdman, P. (2005). The student debt dilemma: debt aversion as a barrier to college access. Center for Studies in Higher Education, 27.

Bureau of Labor Statistics. (2017). 69.7 percent of 2016 high school graduates enrolled in college in October 2016. U.S. Bureau of Labor Statistics.

Chambers, D. L. (1992). Burdens of educational loans: the impacts of debt on job choice and standards of living for students at nine American law schools. The. Journal of Legal Education., 42, 187–231.

Citizens Bank. (2014). Informed: The Student Loan Landscape. https://www.citizensbank.com/images/erl-social/ctz_INFORMED_Index_Report.pdf

Conroy, T., & Deller, S.C. (2015). Employment growth in Wisconsin: Is it younger or older businesses, smaller or larger? Patterns of economic growth and development study series no. 3. Department of Agricultural and Applied Economics, University of Wisconsin – Madison/Extension.

Conroy, T., Chen, I.-C., Chriestenson, C., Kures, M., & Deller, S. (2018). Slow churn: Declining dynamism in America’s Dairyland. Slow Churn: Declining dynamism in America’s Dairyland. UW-Madison, Division of Extension Center on Community Economic Development.

Cooper, D., & Wang, J.C. (2014). Student Loan Debt and Economic Outcomes. Current Policy Perspectives No. 14–7. Boston, MA: Federal Bank of Boston. Retrieved from https://eric.ed.gov/?id=ED558180

Cornelius, L. M., & Frank, S. A. (2015). Perspectives on student loan debt levels: student loan debt levels and their implications for borrowers, society, and the economy. Educational Considerations, 42(2). https://doi.org/10.4148/0146-9282.1052.

Deller, S. C., & Conroy, T. (2017). Business survival rates of across the urban-rural divide. Community Development., 24(1), 67–85.

Deller, S. C., Kures, M., & Conroy, T. (2019). Rural entrepreneurship and migration. Journal of Rural Studies., 66(February), 30–42.

Dynarski, S. (2015). Degrees of Debt: Why Students with Smallest Debts have the Larger Problem. The New York Times. p. A3. (August 31).

Edmiston, K. D., Brooks, L., & Shepelwich, S. (2013). Student Loans: Overview and Issues (Update). Federal Reserve Bank of Kansas City, 12–05 (Research Working Paper), 43.

Elliott, W., & Lewis, M. (2015). Student debt effects on financial well-being: Research and policy implications. Journal of Economic Surveys., 29(4), 614–636.

Emery, M., & Flora, C. (2006). Spiraling-up: mapping community transformation with community capitals framework. Community Development., 37(1), 19–35.

Fullwiler, S., Kelton, S., Ruetschlin, C., & Steinbaum, M. (2018). The Macroeconmic effects of student debt cancellation. Levy Economics Institute of Bard College, 68.

Gervais, M., & Ziebarth, N. L. (2019). Life after debt: postgraduation consequences of Federal Student Loans. Economic Inquiry., 57(3), 1342–1366.

Goldrick-Rab, S., & Steinbaum, M. (2020). What is the problem with student debt? Journal of Policy Analysis and Management., 39(2), 534–540.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2013). Who creates jobs? Small versus large versus young. Review of Economics and Statistics., 95(2), 347–361.

Haltiwanger, J., Decker, R., & Jarmin, R. (2015). Top ten signs of declining business dynamism and entrepreneurship in the U.S. In Kauffman Foundation New Entrepreneurial Growth Conference. (August). http://econweb.umd.edu/~haltiwan/Haltiwanger_Kauffman_Conference_August_1_2015.pdf. Accessed 2 Jan 2021.

Houle, J., & Addo, F. (2019). Racial disparities in student loan debt and the reproduction of the fragile black middle class. Sociology of Race and Ethnicity., 5(4), 562–577.

Houle, J. N., & Berger, L. (2015). Is student loan debt discouraging homeownership among young adults? Social Service Review., 89(4), 589–621.

Huang, Y. (2015). Education loan debt and health of young adults. Department of Sociology Center for Social and Demographic Analysis University at Albany State University of New York.

Institute for College Access and Success. (2018). Student debt and the class of 2017. Washington DC. https://ticas.org/wp-content/uploads/legacy-files/pub_files/classof2017.pdf

Institute of Education Sciences. (2018). Repayment of student loans as of 2015 among 1995–96 and 2003–04 first-time beginning students first look. U.S. Department of Education: Washington DC. https://nces.ed.gov/pubs2018/2018410.pdf

Johnson, C. L., O’Neill, B., Worthy, S. L., Lown, J. M., & Bowen, C. F. (2016). What are student loan borrowers thinking? Insights from focus groups on college selection and student loan decision making. Journal of Financial Counseling and Planning., 27(2), 184–198.

Kim, J., & Chatterjee, S. (2019). Student loans, health, and life satisfaction of US households: evidence from a panel study. Journal of Family and Economic Issues, 40(1), 36–50.

Krishnan, K., & Wang, P. (2018a). The cost of financing education: can student debt hinder entrepreneurship? Management Science., 65(10), 4522–4554.

Krishnan, K., & Wang, P. (2018b). The Impact of Student Debt on High Value Entrepreneurship and Venture Success. https://ssrn.com/abstract=3240607

Mascolo, M. (2020). Transforming higher education: responding to the coronavirus and other looming crises. Pedagogy and the Human Sciences., 7(1), 1–24.

Mezza, A.A., Ringo, D.R., Sherlund, S.M., & Sommer, K. (2016). Student Loans and Homeownership. Finance and Economics Discussion Series 2016–010. Washington: Board of Governors of the Federal Reserve System. https://doi.org/10.17016/FEDS.2016.010r1.

Minicozzi, A. (2005). The short term effect of educational debt on job decisions. Economics of Education Review., 24(4), 417–430.

Mississippi Office of Student Financial Aid. (2019). MTLR-MS Teacher Loan Repayment. Retrieved from https://www.msfinancialaid.org/mtlr/

O'Neill, B., Sorhaindo, B., Xiao, J. J., & Garman, E. T. (2005). Financially distressed consumers: their financial practices, financial well-being, and health. Journal of Financial Counseling and Planning., 16(1), 73–87.

Perna, L. W. (2008). Understanding high school students’ willingness to borrow to pay college prices. Research in Higher Education., 49(7), 589–606.

Perry, A., & Spencer, C. (2018). College didn’t prepare me for this: the realities of the student debt crisis and the effect it is having on college graduates. The William and Mary Educational Review, 6(1), 1.

Price, D. V. (2004). Educational debt burden among student borrowers: an analysis of the baccalaureate and beyond panel, 1997 follow-up. Research in Higher Education., 45(7), 701–737.

Rosenthal, M. P., Marquette, P. A., & Diamond, J. J. (1996). Trends along the debt-income axis. Academic Medicine., 71(6), 675–677.

Rothstein, J., & Rouse, C. E. (2011). Constrained after college: student loans and early-career occupational choices. Journal of Public Economics., 95(1–2), 149–163.

Schmalz, M. C., Sraer, D. A., & Thesmar, D. (2017). Housing collateral and entrepreneurship. The Journal of Finance., 72(1), 99–132.

Shaffer, R., Deller, S. C., & Marcouiller, D. W. (2006). Rethinking community economic development. Economic Development Quarterly., 20(1), 59–74.

Sommer, K. (2020). Student debt overhang: imprint on homeownership and the economy. Business Economics., 55(3), 134–137.

Stradling, S. G. (2001). Psychological effects of student debt. In A. Scott, A. Lewis, and S. Lea (Eds.), Student debt: The causes and consequences of undergraduate borrowing in the UK. (pp. 59–75). Economic and Social Research Council. Bristol: The Policy Press.

Sullivan, Z. (2018). The impacts of student loan debt on college and early-career decisions. University of Virginia.

Toby, J. (2011). Student loans for dummies. The American, the online magazine of the American enterprise institute. October 4. Retrieved July 16, 2012 from http://american.com

Walsemann, K. M., Gee, G. C., & Gentile, D. (2015). Sick of our loans: student borrowing and the mental health of young adults in the United States. Social Science and Medicine, 124, 85–93.

Walzer, N. (Ed.). (2007). Entrepreneurship and local economic development. U.K.: Lexington Books.

Webber, K.L., & Burns, R. (2020). Increases in graduate student debt in the US: 2000 to 2016. Research in Higher Education (published first on-line October 6, 2020).

Weidner. J. (2016). Does Student Debt Reduce Earnings? Working paper, Department of Economics, Princeton University. (November 11).

Xu, X.E., & Ortiz-Eggenberg, M. (2020). Student loan asset-backed securities: the next market in crisis?. The Journal of Fixed Income. (Published first on-line March 27, 2020).

Xu, Y., Johnson, C., Bartholomae, S., O'Neill, B., & Gutter, M. S. (2015). Homeownership among Millennials: the deferred American dream? Family and Consumer Sciences Research Journal., 44(2), 201–212.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Summary Statement

Financial assistance made available through the United States Department of Commerce Economic Development Administration in support of Economic Development Authority University Center (Award No. ED16CHI3030030). Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views of the U.S. Department of Commerce Economic Development Administration. All errors are the responsibility of the authors.

Conflict of interest

The authors have no conflict of interest with respect to this work. All errors are the responsibility of the authors.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Deller, S., Parr, J. Does Student Loan Debt Hinder Community Well-Being?. Int. Journal of Com. WB 4, 263–285 (2021). https://doi.org/10.1007/s42413-020-00107-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s42413-020-00107-1