Abstract

It is commonly believed that spillover reduces R&D incentives of a firm. This happens because of the appropriability problem. However, some empirical literature shows the possibility of enhanced R&D incentives under spillovers. In the literature this is explained under incomplete information, but we show this theoretically under complete information. We show in particular that in a duopoly there are situations when with no spillovers only one firm invests in R&D, but under spillovers both the firms invest. This occurs when there is complementarity in research and the spillover rate lies in an interval specified by the size of R&D investment.

Similar content being viewed by others

Notes

A comprehensive analysis on the relation between R&D investment and R&D appropriability can be found in Levin et al. (1987).

This effect is actually absent in Chatterjee et al. (2018), as a result in their paper under complete information spillovers unambiguously reduce R&D incentives of a firm.

Here the parameter R is the cost associated with an innovation, hence it includes the lab set up cost, the cost of installing machines and tools, and the expenses to recruiting scientific personnel (including R&D inputs).

Following the works of d’Aspremont and Jacquemin (1988) and Kamien et al. (1992) and others, the effective cost reduction of firm \( i \) through spillover is \( \varepsilon_{i} = \phi \left( {R_{i} } \right) + \beta \phi \left( {R_{j} } \right) \), where \( \phi \left( {R_{i} } \right) \) is the amount of cost reduction if \( R_{i} \) is invested by firm \( i \); \( \phi \left( 0 \right) = 0 \) and \( 0 \le \beta \le 1 \). In our case, \( R_{i} = R_{j} = R \), \( \phi \left( R \right) = D \) and \( \beta D = d \). Alternatively, we can assume that production of the final good requires one unit of each of the two inputs, say \( X \) and \( Y \), and initial unit costs of \( X \) and \( Y \) are \( c_{X} \) and \( c_{Y} \) respectively so that its initial unit cost of production is \( c = c_{X} + c_{Y} \). Now assume that firm \( 1 \) can reduce unit cost of \( X \) by \( D \) amount if it invests \( R \) in R&D. similarly, firm \( 2 \) can reduce its unit cost of \( Y \) by the same amount by investing \( R \). By this, there is spillover of knowledge, \( d \), from one firm to the other; \( 0 \le d \le D \).

Here “x” stands for the notation of the remaining terms other than \( (a - c) \) in the numerator in the quantity and profit expressions. So \( x \) is a variable. In our paper, \( {{\varPi }}\left( {\text{x}} \right) = ({\text{q}}\left( {\text{x}} \right))^{2 } = (\frac{a - c + x}{3})^{2 } \). Suppose firm 1 has unit cost of production (\( c - D \)) and firm 2 has unit cost (\( c - d \)). Then firm 1’s payoff under Cournot competition is \( {{\varPi }}_{1} = = (\frac{a - c + 2D - d}{3})^{2} = {{\varPi }}\left( {2{\text{D}} - {\text{d}}} \right) \) and firm 2’s payoff is \( {{\varPi }}_{2} = {{\varPi }}\left( {2{\text{d}} - {\text{D}}} \right) \), and so on.

References

Arrow, K.J. 1962. Economic welfare and the allocation of resources for invention. In The rate and direction of inventive activity, ed. R.R. Nelson, 609–625. Princeton: Princeton University Press.

Bakhtiari, S., and R. Breunig. 2018. The role of spillovers in research and development expenditure in Australian industries. Economics of Innovation and New Technology 27 (1): 14–38.

Chatterjee, R., S. Chattopadhyay, and T. Kabiraj. 2018. Spillovers and R&D incentive under incomplete information. Studies in Microeconomics 6 (1–2): 50–65.

d’Aspremont, C., and A. Jacquemin. 1988. Cooperative and non-cooperative R&D in duopoly with spillovers. American Economic Review 78: 1133–1137.

De Bondt, R. 1997. Spillovers and innovative activities. International Journal of Industrial Organization 15: 1–28.

Ghosh, S., and S. Ghosh. 2014. Are cooperative R&D agreements good for the society? Journal of Business & Economics Research 12: 313–322.

Jaffe, A.B. 1986. Technological opportunity and spillovers of R&D: evidence from firms’ patents, profits and market value. American Economic Review 76: 984–1001.

Kamien, M.I., E. Muller, and I. Zang. 1992. Research joint ventures and R&D cartels. American Economic Review 82: 1293–1306.

Levin, R.C., A.K. Klevorick, R. Nelson, and S. Winter. 1987. Appropriating the returns from industrial R&D. Brookings Economic Papers on Economic Activity 18: 783–832.

Levin, R.C. 1988. Appropriability, R&D spending, and technological performance. American Economic Review 78: 424–428.

Spence, M. 1984. Cost reduction, competition and industry performance. Econometrica 52: 101–121.

Suzumura, K. 1992. Cooperative and non-cooperative R&D in an oligopoly with spillovers. American Economic Review 82: 1307–1320.

Acknowledgements

Authors would like to thank two anonymous referees of this journal for important comments and suggestions. However, the usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Given the numerical values of the parameters in Example, further assume that \( d = 3 \). The we have: \( A = 18 \), \( \varPi \left( { - {\text{D}}} \right) = 9,\;\varPi \left( 0 \right) = 36,\;\varPi \left( {\text{D}} \right) = 81,\;\varPi \left( {2{\text{D}}} \right) = 144,\;\varPi \left( {{\text{D}} + {\text{d}}} \right) = 100 \), \( \varPi \left( {2{\text{d}} - {\text{D}}} \right) = 25,\;\varPi \left( {2{\text{D}} - {\text{d}}} \right) = 121 \)

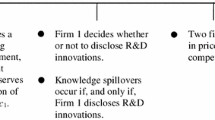

Given above, the payoff matrix when there is no spillover is:

For this payoff matrix, (Y, N) and (N, Y) are two Nash equilibria. The payoff matrix when there is spillover is given below:

Clearly in this game (Y, Y) is the unique Nash equilibrium.

Appendix 2

Let the demand function as faced by firm i be given by \( q_{i} = a - p_{i} + \gamma p_{j} \) where \( i = 1, 2 (i \ne j) \) and \( \gamma \in (0, 1) \). For the marginal costs c1 and c2 of firm 1 and firm 2 respectively, the profit function of firm i is \( \pi_{i} = (p_{i} - c_{i} )q_{i} \). Then under price competition, the equilibrium prices and quantities are respectively, \( p_{i} = \frac{{\left( {2 + \gamma } \right)a + 2c_{i} + \gamma c_{j} }}{{4 - \gamma^{2} }} \) and \( q_{i} = \frac{{\left( {2 + \gamma } \right)a - (2 - \gamma^{2} )c_{i} + \gamma c_{j} }}{{4 - \gamma^{2} }} \), therefore, \( \pi_{i} = (q_{i} )^{2} \).

Define \( K = \left( {2 + \gamma } \right)a - (2 - \gamma - \gamma^{2} )c \) and \( \pi \left( x \right) = \left( {\frac{K + x}{{4 - \gamma^{2} }}} \right)^{2} \). Then the payoff matrix under no spillover is given by:

We have \( S\left( {WS} \right) = \pi \left( {(2 - \gamma - \gamma^{2} )D} \right) - \pi \left( { - \gamma D} \right) - R \) and \( NS\left( {WS} \right) = \pi \left( {(2 - \gamma^{2} )D} \right) - \pi \left( 0 \right) - R \), then \( NS\left( {WS} \right) > S(WS) \).

The payoff matrix under spillover is given by:

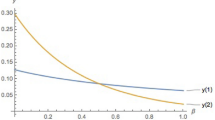

Here, \( S\left( {SS} \right) = \pi \left( {(2 - \gamma - \gamma^{2} )(D + d)} \right) - \pi \left( {\left( {2 - \gamma^{2} } \right)d - \gamma D} \right) - R \), and \( NS\left( {SS} \right) = \pi \left( {\left( {2 - \gamma^{2} } \right)D - \gamma d} \right) - \pi \left( 0 \right) - R \). Then, \( S\left( {SS} \right) \frac{ < }{ > }NS\left( {SS} \right) \Leftrightarrow d\frac{ < }{ > }\frac{\gamma }{{2 - \gamma^{2} }}D \). Further, at d = 0, we have \( NS\left( {SS} \right) > S\left( {SS} \right), \) and at d = D we have \( NS\left( {SS} \right) < S\left( {SS} \right) \). Finally, \( S\left( {SS} \right) \) is maximized at \( \widehat{d} = \frac{{\left[ {\left( {2 - \gamma - \gamma^{2} } \right)^{2} - \gamma \left( {2 - \gamma^{2} } \right)} \right]D - \gamma K}}{{\left( {2 - \gamma^{2} } \right)^{2} - \left( {2 - \gamma - \gamma^{2} } \right)^{2} }} \) iff \( \left[ {\left( {2 - \gamma - \gamma^{2} } \right)^{2} - \gamma \left( {2 - \gamma^{2} } \right)} \right]D > \gamma K \), otherwise, \( \widehat{d} = 0 \).

Following our earlier notation, \( E = S\left( {WS} \right) + R \), \( B\left( d \right) = S\left( {SS} \right) + R \) and \( C\left( d \right) = NS\left( {SS} \right) + R \). Therefore, \( B\left( 0 \right) = E \) and \( C\left( D \right) < E \).

Finally, if \( \left[ {\left( {2 - \gamma - \gamma^{2} } \right)^{2} - \gamma \left( {2 - \gamma^{2} } \right)} \right]D > \gamma K \) holds, then we have a range of R and correspondingly an interval of d for which \( (Y, N) \) or \( (N, Y) \) is a NE under no spillover but \( (Y, Y) \) is the unique NE under spillover. The relevant condition is necessarily satisfied, for example, for \( D = 2, K = 4 \) and \( \gamma = 0.25 \).

Rights and permissions

About this article

Cite this article

Chatterjee, R., Chattopadhyay, S. & Kabiraj, T. When Spillovers Enhance R&D Incentives. J. Quant. Econ. 17, 857–868 (2019). https://doi.org/10.1007/s40953-019-00161-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-019-00161-3