Abstract

The academic consensus is that index investment over the recent period of elevated commodity price did not affect returns. This view relies very largely on the analysis of US agricultural future markets for which the CFTC has provided index position data. That conclusion is correct but overlooks evidence that there were strong impacts on energy and metal markets where it is necessary to infer index positions from the agricultural data. Furthermore, these impacts are persistent. I follow Singleton (Management Science, 60, 300–318, 2014) in arguing that the impacts reflect changes in investor sentiment, reflected in changes in risk premia, and not informational advantage.

Similar content being viewed by others

Notes

William Sharpe remarked, “As far as picking the asset classes, that’s an art form and we all do it.” Interview (1999) with Barry Vinocur, https://web.stanford.edu/~wfsharpe/art/fa/fa.htm.

The S&P GSCI, which was originally the Goldman Sachs Commodity Index, started in 1991. The Dow Jones-UBS Commodity Index, which was originally the Dow Jones-AIG index, followed in 1998.

Following Bagehot (1971), the standard rational expectations approach to asset pricing sees price adjustment in liquid and competitive markets as driven by information arrival, either as prices adjust to public announcements or as informed traders purchase or sell. As investors attempt to disentangle the informational content of price movements, previously private information becomes impounded into market prices sell—see, for example O’Hara (1995, chapter 2). Commodity futures markets conform to the competitive and liquid paradigm. In this paradigm, differences of opinion among investors can only reflect differences in information. Within this paradigm, any impact of index investors on futures prices must reflect information available to these investors but not yet generally available in the markets.

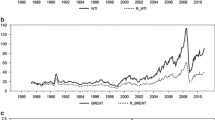

Sources for futures price: Brent crude plus agricultural futures prices—https://www.quandl.com/; WTI and natural gas—US Energy Information Agency https://www.eia.gov/; non-ferrous metals prices—Metal Bulletin https://www.metalbulletin.com/. Where a price is missing (some US and European holidays differ), it is replaced by the price on the most recent trading day.

LME prices are continuous by default since a separate contract “becomes prompt” each trading day. As a consequence, calculated returns relate to cash metal and not to a specific futures contract.

These two measures are closely related and with a sufficiently large number of assets we will generally find λ1 close to the average correlation \( \overline{\mathit{\mathsf{r}}} \). Consider an equicorrelation structure in which \( {\mathit{\mathsf{r}}}_{\mathit{\mathsf{ij}}}=\overline{\mathit{\mathsf{r}}} \) for all \( \mathit{\mathsf{i}}\ne \mathit{\mathsf{j}} \). An analytic formula is available for the eigenvalues. For a matrix with dimension k, the largest eigenvalue, once normalized, satisfies \( {\lambda}_{\mathsf{1}}=\frac{\mathit{\mathsf{k}}-\mathsf{1}}{\mathit{\mathsf{k}}}\overline{\mathit{\mathsf{r}}}+\frac{\mathit{\mathsf{k}}-\mathsf{1}}{\mathit{\mathsf{k}}} \) (Morrison 1976, page 289). With a large number of assets, this relationship holds as a good approximation provided return correlations do not differ dramatically. We should therefore expect \( {\lambda}_{\mathsf{1}}>\overline{\mathit{\mathsf{r}}} \) with the difference becoming smaller as the number of commodities analyzed increases.

Bhardwaj et al. (2015) comment on the heightened intra-commodity over the period from 2008 to mid-2012 which they attribute to a rise in the risk premium as measures by the BAA-AAA spread. While they are correct in noting that this spread is correlated with in the intra-commodity correlation, by confining their analysis to annual averages, they fail to see that the spread lags the intra-commodity correlation. This casts doubt on their claim that the rise in the correlation was caused by a rise in the risk premium and suggests, instead, that the two phenomena shared a common cause.

Commercial traders are those traders who have an interest in the underlying physical commodity. They are often regarded as hedgers. Non-commercial traders do not have such an interest. They are often termed “large speculators.” The COT reports distinguish a third category of non-reporting traders, often regarded as “small speculators.” Members of this group of traders do not have any reporting obligation to the CFTC but futures brokers are required to report the aggregated positions. Edwards and Ma (1992) discuss the COT data. The growth of swap trading has undermined the commercial/non-commercial distinction since swap traders, typically large financial institutions, will often hedge the net positions arising from granting a fixed-for-floating swap to a genuinely commercial transactor. This results in the swap provider becoming classified as commercial. In 2009, the CFTC responded to this difficulty by releasing Disaggregated Commitments of Traders (DCOT) reports which distinguish five categories of trader—producers and merchants, swap dealers, money managers (often hedge funds), other reportables and non-reportables—see CFTC (2008).

Soybean meal was added to the SCOT reports in April 2013.

Part of the difference may be due to asynchrony—the Special Call data relate to the final trading day of the month while, on a monthly basis, the SCOT measure used in Fig. 4 relates to the final Tuesday of the month.

That is, \( \mathit{\mathsf{E}}\left[{\mathit{\mathsf{y}}}_{\mathit{\mathsf{t}}}\left|{\mathit{\mathsf{X}}}_{\mathit{\mathsf{t}}-\mathsf{1}},{\mathit{\mathsf{Y}}}_{\mathit{\mathsf{t}}-\mathsf{1}}\right.,{\mathit{\mathsf{Z}}}_{\mathit{\mathsf{t}}-\mathsf{1}}\right]=\mathit{\mathsf{E}}\left[{\mathit{\mathsf{y}}}_{\mathit{\mathsf{t}}}\left|{\mathit{\mathsf{Y}}}_{\mathit{\mathsf{t}}-\mathsf{1}},{\mathit{\mathsf{Z}}}_{\mathit{\mathsf{t}}-\mathsf{1}}\right.\right] \) despite the fact that \( \mathit{\mathsf{E}}\left[{\mathit{\mathsf{y}}}_{\mathit{\mathsf{t}}}\left|{\mathit{\mathsf{X}}}_{\mathit{\mathsf{t}}-\mathsf{1}},{\mathit{\mathsf{Y}}}_{\mathit{\mathsf{t}}-\mathsf{1}}\right.\right]\ne \mathit{\mathsf{E}}\left[{\mathit{\mathsf{y}}}_{\mathit{\mathsf{t}}}\left|{\mathit{\mathsf{Y}}}_{\mathit{\mathsf{t}}-\mathsf{1}}\right.\right] \). Granger (1969, page 429) wrote “If relevant data has not been included in this [information] set, then spurious causality could arise.”

In their widely used textbook, Stock and Watson (2003) state “Granger causality has little to do with causality in the sense ... of an ideal randomized controlled experiment ... Granger causality means that if X Granger-causes Y, then X is a useful predictor of Y, given the other variables in the regression. ... ‘Granger predictability’ is a more accurate term than ‘Granger causality’.”

The maximum lag in the tests using monthly data is set at 3 months.

I do not discuss the possibility of rational bubbles in this paper. See Etienne et al. (2014) who used a long sample of daily data to look for bubbles in agricultural futures markets. Rational bubbles must eventually burst (otherwise prices would become infinite). The Etienne et al. bubbles had very short lifetimes and might be regarded as little more than market froth. Figuerola-Ferretti et al. (2015), who analyzed bubbles in non-ferrous metals markets, concluded that explosive prices were attributable to tight market conditions and were compatible with fundamentally-based trading.

It is important to include the zero lag since part of the impact of index investment may be contemporaneous. The zero lag is correctly nevertheless excluded from the Granger-causality test because causation may be in either direction.

If m = 0, the distributed lag \( \sum \limits_{i=\mathsf{1}}^m{\beta}_j\left(\Delta \ln {z}_{t-i}-\Delta \ln {z}_t\right) \) drops out of Eq. (5).

Suppose the actual lag length is \( p\le n \) so that \( {\beta}_{p+\mathsf{1}}=\dots ={\beta}_n=\mathsf{0} \). Estimates of the coefficients \( {\beta}_{\mathsf{0}}\dots {\beta}_p \) will be unbiased while the estimated coefficients \( {\beta}_{p+\mathsf{1}}\dots {\beta}_n \) will relate to irrelevant regressors and have expectation zero. It follows that the estimate of the sum \( {b}_{\mathsf{0}}=\sum \limits_{j=\mathsf{0}}^n{\beta}_j \) will also be unbiased.

We address this through simulation by estimating reversion using Eq. (5) on 1000 datasets generated by the data generating process \( \Delta \ln {f}_t=\kappa +\sum \limits_{j=\mathsf{0}}^q{\beta}_j\Delta \ln {z}_{t-j}+{\varepsilon}_t \) for each commodity. The total impact \( \sum \limits_{j=\mathsf{0}}^q{\beta}_j \) is set equal to the estimate of b0 for that commodity with coefficients declining linearly as \( {\beta}_j=\frac{\left(q+\mathsf{1}-j\right){b}_{\mathsf{0}}}{\frac{\mathsf{1}}{\mathsf{2}}\left(q+\mathsf{1}\right)\left(q+\mathsf{2}\right)} \). The estimates of Eq. (5) also generate upward biased estimates of the maximum impact lag m. I set the lag length q equal to the minimum value of m found for each commodity group (7 for agricultural commodities, 11 for energy commodities, and 8 for the non-ferrous metals). The disturbance term \( {\varepsilon}_t\sim NII\left(\mathsf{0},{\sigma}^{\mathsf{2}}\right) \) where σ is the estimated standard error of Eq. (3) for that commodity. The values for the index process are generated by an estimated AR(4) over the same sample as the estimates of Eq. (3).

The use of a rolling regression allows coefficients to vary over time. The distributed lag starts at zero. Lag length (either 1 or 2) is chosen using the BIC. I prefer the BIC over the AIC in this context since although the two criteria generally gave the same result, in a small proportion of cases the AIC selects very long lags.

Sources: Crude oil and natural gas—International Energy Authority, World Energy Statistics, 2017. Non-ferrous metals—World Bureau of Metal Statistics, World Metal Statistics (various issues). Grains and oilseeds, USDA, World Agricultural Supply and Demand Estimates (WASDE), various issues. China includes Hong Kong which is a major transit point for Chinese metal imports. The agricultural estimates are on a crop year basis. Because of high annual variability they report averages for 3 years such that the 2000 figures are the averages of crop years 1998–1999, 1999–2000, 2000–2001, etc. Aluminum is traded as bauxite and alumina as well as smelted metal. I report figures on a meal content basis supposing that 5 t of bauxite yields 2 t of alumina which in turn yields 1 t of aluminum. I also suppose that 10% of bauxite imports go to non-metallic (mainly abrasive) uses. Copper aggregates refined metal, concentrates and blister and anode (all reported in terms of copper content). Nickel aggregates refined metal, powder (reported as metal content), and ferronickel, which I take as being largely laterite and having a 1.5% nickel content.

References

Aulerich NM, Irwin SH, Garcia P (2013) Bubbles, food prices, and speculation: evidence from the CFTC’s daily large trader data files. In: Chavas J-P, Hummels D, Wright BD (eds) The economics of food price volatility. University of Chicago Press, Chicago, pp 211–259

Bagehot W (1971) The only game in town. Financ Anal J 27:12–14

Bhardwaj G, Gorton G, Rouwenhorst G (2015) Facts and fantasies about commodity futures ten years later. NBER Working Paper #21243. NBER, Cambridge

Brunetti C, Büyükşahin B (2009) Is speculation destabilizing? In: Working Paper, Carey Business School. Johns Hopkins University, Washington DC. https://doi.org/10.2139/ssrn.1393524

Capelle-Blancard G, Coulibaly D (2011) Index trading and agricultural commodity prices: a panel Granger causality analysis. Int Econ 126-7:51–72

Carter CA, Rausser G, Smith A (2011) Commodity booms and busts. Ann Rev Resour Econ 3(1):87–118. https://doi.org/10.1146/annurev.resource.012809.104220

CFTC (2006). Commission actions in response to the “Comprehensive Review of the Commitments of Traders Reporting Program” (June 21, 2006). Washington DC: CFTC

CFTC (2008) Staff report on commodity swap dealers and index traders with commission recommendations. CFTC, Washington DC

Edwards FM, Ma CW (1992) Futures and options. McGraw-Hill, New York

Etienne XL, Irwin SH, Garcia P (2014) Bubbles in food commodity markets: four decades of evidence. J Int Money Financ 42:129–155. https://doi.org/10.1016/j.jimonfin.2013.08.008

Figuerola-Ferretti I, Gilbert CL, McCrorie JR (2015) Testing for mild explosivity and bubbles in LME non-ferrous metals prices. J Time Ser Anal 36(5):763–782. https://doi.org/10.1111/jtsa.12121

Friedman M (1953) Essays in positive economics. University of Chicago Press, Chicago

Erten B, Ocampo JA (2013) Super cycles of commodity prices since the mid-nineteenth century. World Dev 44:14–30. https://doi.org/10.1016/j.worlddev.2012.11.013

Gale F (2017) “China’s pork imports rise along with production costs”. LDPM-271-01. USDA Economic Research Service, Washington DC

Gilbert CL (2010a) How to understand high food prices. J Agric Econ 61(2):398–425. https://doi.org/10.1111/j.1477-9552.2010.00248.x

Gilbert CL (2010b) Speculative influence on commodity prices 2006–08. Discussion Paper #197. UNCTAD, Geneva

Gilbert CL, Pfuderer S (2014) The role of index trading in price formation in the grains and oilseeds markets. J Agric Econ 65(2):303–332. https://doi.org/10.1111/1477-9552.12068

Gorton G, Rouwenhorst GK (2006) Facts and fantasies about commodity futures. Financ Anal J 62(2):47–68. https://doi.org/10.2469/faj.v62.n2.4083

Granger CWJ (1969) Testing for causality and feedback. Econometrica 37(3):424–438. https://doi.org/10.2307/1912791

Granger CWJ (2007) Causality in economics. In: Chapter 15. In: Machamer P, Wolters G (eds) Thinking about causes. University of Pittsburgh Press, Pittsburgh

Grilli ER, Yang MC (1988) Primary commodity prices, manufactured goods prices, and the terms of trade of developing countries: what long run shows. World Bank Econ Rev 2(1):1–47. https://doi.org/10.1093/wber/2.1.1

Grosche S-C (2014) What does Granger causality prove? A critical examination of the interpretation of Granger causality on price effects of index trading in agricultural commodity markets. J Agric Econ 65(2):279–302. https://doi.org/10.1111/1477-9552.12058

Hamilton JD, Wu JY (2015) Effects of index-fund investing on commodity futures prices. Int Econ Rev 56(1):187–205. https://doi.org/10.1111/iere.12099

Henderson BJ, Pearson ND, Wang L (2015) New evidence on the financialization of commodity markets. Rev Financ Stud 28(5):1285–1311. https://doi.org/10.1093/rfs/hhu091

IMF (2015) World economic outlook. IMF, Washington DC

Irwin SH, Sanders DR (2011) Index funds, financialization, and commodity futures markets. Appl Econ Perspect Policy 33(1):1–31. https://doi.org/10.1093/aepp/ppq032

Irwin SH, Sanders DR (2012) Financialization and structural change in commodity futures markets. J Agric Appl Econ 44(03):371–396. https://doi.org/10.1017/S1074070800000481

Keynes JM (1936) The general theory of employment, interest and money. Macmillan, London

Masters MW (2008) Testimony before the U.S. Senate Committee of Homeland Security and Government Affairs, Washington, DC, 20 May 2008. US Senate, Washington DC

Masters MW, White AK (2008) The accidental Hunt Brothers. How institutional investors are driving up food and energy prices. http://www.loe.org/images/content/080919/Act1.pdf

Morrison DF (1976) Multivariate statistical methods, 2nd edn. McGraw-Hill, New York

O’Hara M (1995) Market microstructure theory. Blackwell, Oxford

Powell A (2015) Commodity prices: over a hundred years of booms and busts. Vox, 28 April 2015. http://voxeu.org/article/commodity-booms-bust-evidence-1900-2010

Radetzki M (2006) The anatomy of three commodity booms. Resour Policy 31(1):56–64. https://doi.org/10.1016/j.resourpol.2006.06.003

Radetzki M, Wårell L (2017) A handbook of primary commodities in the global economy. Cambridge University Press, Cambridge. https://doi.org/10.1017/9781316416945

Roache SK (2012) China’s impact on world commodity markets. IMF Working Paper 12/2015. IMF, Washington

Rouwenhorst GK, Tang K (2012) Commodity investing. Annu Rev Financ Econ 4(1):447–467. https://doi.org/10.1146/annurev-financial-110311-101716

Sanders DR, Irwin SH, Merrin RP (2010) The adequacy of speculation in agricultural futures markets: too much of a good thing? Appl Econ Perspect Policy 32(1):77–94. https://doi.org/10.1093/aepp/ppp006

Sanders DR, Irwin SH (2011) The impact of index funds in commodity futures markets: a systems approach. J Altern Invest 14(1):40–49. https://doi.org/10.3905/jai.2011.14.1.040

Scherer V, He L (2008) The diversification benefits of commodity futures indexes: a mean-variance spanning test. In: Fabozzi FJ, Füss R, Kaiser DG (eds) The handbook of commodity investing. Wiley, Hoboken, pp 241–265

Sims CA (1972) Money, income, and causality. Am Econ Rev 62:540–552

Singleton KJ (2014) Investor flows and the 2008 boom/bust in oil prices. Manag Sci 60(2):300–318. https://doi.org/10.1287/mnsc.2013.1756

Stock JH, Watson MW (2003) Introduction to econometrics. Addison-Wesley, Boston

Stoll HR, Whaley RE (2010) Commodity index investing and commodity futures prices. J Appl Fin 20:7–46

Tang K, Xiong W (2010) Index investment and financialization of commodities. Working Paper #16385. NBER, Cambridge

Yan L, Irwin SH, Sanders DR (2017) Mapping algorithms, agricultural futures, and the relationship between commodity investment flows and crude oil futures prices. Preprint. University of Illinois at Urbana-Champaign, Urbana

Ying D (2000) China’s agricultural restructuring and system reform under its accession to the WTO. ACIAR China Grain Market Policy Project Paper 12, ACIAR, Canberra

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has been prepared for a special issue of Mineral Economics to honor Marian Radetzki. I am grateful to an anonymous referee for useful comments.

Rights and permissions

About this article

Cite this article

Gilbert, C.L. Investor sentiment and market fundamentals: the impact of index investment on energy and metals markets. Miner Econ 31, 87–102 (2018). https://doi.org/10.1007/s13563-017-0135-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13563-017-0135-6