Abstract

Longevity and mortality risks are daily issues for the actuarial community. To monitor this risk, various, accurate and efficient tools have been developed (e.g. Shiryaev in Theory Probab Appl 8(1):22–46, 1963; Roberts in Technometrics 8(3):411–430, 1966; Polunchenko and Tartakovsky in Ann Stat 38(6):3445–3457, 2010). A particular attention is usually spent on the detection of a change-point, i.e. the time where the level of mortality changes (El Karoui et al. in Minimax optimality in robust detection of a disorder time in poisson rate (working paper or preprint), 2015; Croix et al. in Bulletin Français d’Actuariat 15(29):75–112, 2015). A common assumption in all these works is that the distribution of the deaths is well known not only before the change-point but also after. In the present paper, we consider a parametric framework for the distribution after the changer and we suppose that we do not know its parameter after the change-point. Thus we focus on its estimation. Our method is derived from the sequential Shiryaev–Roberts procedure. The paper starts with a presentation of this procedure and our methodology in a general framework. We provide a specific Poisson model, designed here for the study of the mortality as in Rhodes and Freitas (Advanced statistical analysis of mortality. AFIR papers. Boston Colloquia. MIB inc., Westwood, 2004) and Planchet and Tomas (Insur Math Econ 63:169–190, 2015). Two versions are analysed: in the first one, we assume that the current mortality is stable and we look for a sudden but persistent change of level. In the second model, we introduce a new set-up: the mortality evolves at a steady pace and we look for a change of the trend. Variants of these approaches are also widely expressed and are compared to benchmark methodologies. An important part of this work is devoted to the application of our methodology on real data, in a context where the change is obvious, using specific methodologies to adjust the data as in Mei et al. (Stat Sin 597–624, 2011). We also study a real insurance portfolio where no specific information might help us to understand the change, and where the change itself does not seem perceptible. For the given examples, the main results allow us to identify the change-points of the mortality when they happen and to measure the lag before clear identification of the phenomena.

Similar content being viewed by others

Notes

Where \(E_k\) is the expectancy when \(\nu =k\).

In the detection procedure for the level, our approach does not require to know the time of the change for the estimation of the change coefficient \(\rho\), see Sect. 2.

As a matter of fact, MLE algorithms might converge towards a local optimum and looking for improvements on the first observations of the sample. In general, we recommend a careful implementation of the estimation algorithms and a specific study of their convergence. In addition, when the computing time is reasonable, we recommend scanning all possible time changes and estimating \(\rho _0\) alone; this might improve considerably the likelihood.

This rescaling restores the right quantile for the application of a Poisson model. Notice that in the case of actuarial applications for insurer portfolios, data quality and full understanding are required to assess the use of such a methodology.

Human Mortality Database, http://www.mortality.org/.

See [1], page 44.

In order to focus on this event, the procedure is set to raise an alarm only in the case of an increased mortality level.

The same study on civilian men show that the mortality tripled from 1914 to 1918 before coming back to the same level as during the beginning of the century. The detection results are similar as for women: the alarm is raised in 1914 due to the war. Therefore, even if the change is persistent, it is detected the first year it occurs.

Q1 is the first quarter of the year, Q2 the second quarter of the year, etc.

Legend of Fig. 7d. Point = mean. Box plots with 0.05, 0.1, 0.25, 0.5, 0.75, 0.9 and 0.95 probabilities.

Each scenario indicates first the methodology for the calibration of the sequential estimator (IC confidence Interval i.e. without any estimation of the change coefficient, LE maximum of likelihood estimator, LSE least square estimator, SRour estimator,Rhocase where the change coefficient is known) and then the procedure applied for the detection (Cusum or Shiryaev–Roberts).

References

Caselli G, Vallin J, Vaupel JW, Yashin A (1987) Age-specific mortality trends in france and italy since 1900: period and cohort effects. Eur J Popul Revue européenne de démographie 3(1):33–60

Croix J, Planchet F, Therond P (2015) Mortality: a statistical approach to detect model misspecification. Bulletin Français d’Actuariat 15(29):75–112

Csörgő M, Horváth L (1997) Limit theorems in change-point analysis. Wiley series in probability and statistics. Wiley, Chichester

Cutler D, Meara E (2001) Changes in the age distribution of mortality over the 20th century. Technical report, National Bureau of Economic Research

De Jong P, Boyle PP (1983) Monitoring mortality: a state-space approach. J Econom 23(1):131–146

Didou, M. (2011). Amélioration de la mortalité : tendances passées et projections en france, en espagne, au royaume-uni et aux etats-unis

El Karoui N, Loisel S, Salhi Y (2015) Minimax optimality in robust detection of a disorder time in Poisson rate. https://hal.archives-ouvertes.fr/hal-01149749

Foster DP, George EI (1993) Estimation up to a change-point. Ann Stat 21(2):625–644

Frick K, Munk A, Sieling H (2014) Multiscale change point inference. J R Stat Soc Ser Stat Methodol 76(3):495–580

Gandy A, Jensen U, Lütkebohmert C (2005) A Cox model with a change-point applied to an actuarial problem. Braz J Probab Stat 19(2):93–109

Karr A (1993) Probability. Springer texts in statistics, Springer, New York

Knaus J, Porzelius C, Binder H, Schwarzer G (2009) Easier parallel computing in R with snowfall and sfCluster. R J 1(1):54–59

Lopez O, Do Huu D (2011) Étude de stabilité et élaboration de procédures de détection de rupture dans le cadre de la modélisation de sinistres automobiles

Matthews D, Farewell V, Pyke R et al (1985) Asymptotic score-statistic processes and tests for constant hazard against a change-point alternative. Ann Stat 13(2):583–591

Mei Y, Han SW, Tsui K-L (2011) Early detection of a change in Poisson rate after accounting for population size effects. Stat Sin 21(2):597–624

Mouyopa Djitta L (2015) Etude de l’aggravation du risque dépendance dans un contexte de réassurance

Olivieri A, Pitacco E et al (2002) Inference about mortality improvements in life annuity portfolios. In: 27th International congress of actuaries, Cancun, Mexico

Planchet F, Tomas J (2014) Constructing entity specific mortality table: adjustment to a reference. Eur Actuar J 4(2):247–279

Planchet F, Tomas J (2014) Construction et validation des références de mortalité de place. Institut des Actuaires, Note de travail, II(1291-11,v1.4)

Planchet F, Tomas J (2015) Prospective mortality tables: taking heterogeneity into account. Insur Math Econ 63:169–190

Pollack M, Tartakovsky AG (2009) Optimality properties of the Shiryaev–Roberts procedure. Stat Sin 19:1729–1739

Pollak M (2009) The Shiryaev–Roberts change-point detection procedure in retrospect—theory and practice. In: Proceedings of the 2nd international workshop on sequential methodologies, University of Technology of Troyes, Troyes, France

Polunchenko AS, Tartakovsky AG (2010) On optimality of the Shiryaev–Roberts procedure for detecting a change in distribution. Ann Stat 38(6):3445–3457

Rhodes TE, Freitas SA (2004) Advanced statistical analysis of mortality. AFIR papers. Boston Colloquia. MIB inc., Westwood

Roberts SW (1966) A comparison of some control chart procedures. Technometrics 8(3):411–430

Servier A (2010) Etude de la stabilité et de la fiabilité des données nécessaires á la construction de tables d’expérience

Shiryaev AN (1963) On optimum methods in quickest detection problems. Theory Probab Appl 8(1):22–46

Fotopoulos SB, Jandhyala VK, Khapalova E (2010) Exact asymptotic distribution of change-point mle for change in the mean of gaussian sequences. Ann Appl Stat 4(2):1081–1104

Vallin J, Meslé F (2010) Espérance de vie : peut-on gagner trois mois par an indéfiniment ? Population et Sociétés (473)

Wu Y (2007) Inference for change point and post change means after a CUSUM test, vol 180. Springer Science & Business Media, Berlin

Wu Y (2016a) Inference after truncated one-sided sequential test. Commun Stat Theory Methods 45(10):3076–3094

Wu Y (2016b) Inference for post-change parameters after sequential CUSUM test under ar(1) model. J Stat Plan Inference 168:52–67

Zucchini W, MacDonald I (2009) Hidden markov models for time series: an introduction using R. Monographs on statistics & applied probability. CRC Press, Chapman & Hall/CRC, Boca Raton

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendices

1.1 A Benchmarking

1.1.1 A.1 Change of level

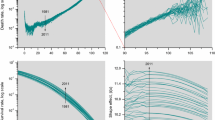

The first intuition about the usefulness of an estimator that maximises the Shiryaev–Roberts sequence is well illustrated in this paragraph. From simulations, the estimator converges faster to the true parameter (Fig. 7a) with lower variance (Fig. 7b). So far, for all the studied cases, we always observed this property despite the fact that it is not mathematically proven yet. In both figures, the suggested estimator (ArgMaxSR) is compared to the Maximum Likelihood Estimator of the change-point model (MLE) and the ordinary least square estimator (LSE). This property is illustrated for parameters value from the 2003 French heatwave phenomenon. Figure 7c illustrates one observation of the random sequence, where no change is perceptible: the detection procedure is the only way to identify a persistent change. Here the estimator converges slowly toward a stable value since the change is very small.

Notice that Fig. 7a would not be sufficient to identify a change in the context of stable data because we illustrated here average sequential estimates for the change coefficient: a single simulation of the sequential estimation is still quite volatile in practice.

With 10,000 simulations of a sequence of Poisson random variables with a change at the time step \(\nu = 10\) and \(\rho _0=1.1\), we also observed that, in addition to a faster and more stable convergence to the true parameter, for a given sample size, the last value of the Shiryaev–Roberts sequence of the suggested estimator is always greater than the one from the MLE. This seems natural since the suggested estimator maximises this value.

In addition, because we control the probability of false detection for each time step through the calibration of the threshold, with consideration of the methodology, the choice of estimator does not affect the probability of false detection. Figure 7d (Footnote 16) shows that not knowing the post change parameter affects strongly the delay before detection, especially the variance of the alarm time. It also shows that our estimator is still the best among the pool of three candidates. Since we measure here the average delay of detection, the Cusum procedure is optimal as expected (or close to it since El Karoui et al. [7] proved it for the continuous time case). Therefore, the best strategy (in terms of what we studied, not in general) would be to use our estimator and then to detect the change with the Cusum procedure, for minimizing the average delay before detection.

1.1.2 A.2 Change of trend

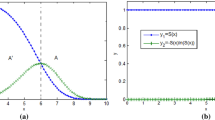

In this paragraph, we show that estimating the change of trend with the MLE for both the time of change and the change coefficient is more adequate than using the methodology applied for the level. In order to illustrate this point, we chose to replicate the case of the application of the methodology for the clear change of trend in the 1960s given in Sect. 4.2. Then we set \(\nu =50\), \(\alpha = 98.47\%\), \(\alpha ' = 98.27 \%\) and thus \(\rho _0=99.79\%\).

Figure 8a illustrates two simulations of the setup. Here again, the change is not noticeable and the detection procedure is required to identify it. Figure 8b, c shows that the best estimator is the MLE (and no longer the one that maximises the Shiryaev–Roberts sequence). In fact, in the level context, our estimator did not involve any estimation of the time of change \(\nu\) while the MLE did it. Consequently, the variance was much lowered. Here, both methods have to estimate \(\nu\). Therefore maximizing the Shiryaev–Roberts sequence does not bring any improvement and the MLE is the best estimator to use. We also compared it to the Least Square Estimator (LSE) that minimizes the quadratic error and the Norm1 estimator that minimizes the absolute error.

Hence we recommend the use of the MLE for this framework.

1.2 B Application of the weighted likelihood ratio procedures

The extensions suggested in Sect. 5, are illustrated in Table 1 for the level procedure and in Table 2 for the trend procedure.

It appears that, in our examples, taking into account the population weights did not impact significantly the results. However, results provided in [15] show that when the population size varies (at a steady pace in the examples provided by the authors), the detection lag can be significantly different. Therefore, we expect those weighting to be crucial in the context of low and/or unstable data.

Rights and permissions

About this article

Cite this article

Abgrall, D., Habart, M., Rainer, C. et al. Exploring the longevity risk using statistical tools derived from the Shiryaev–Roberts procedure. Eur. Actuar. J. 8, 27–51 (2018). https://doi.org/10.1007/s13385-018-0168-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-018-0168-4