Abstract

In practice, stock investment is one of the most important decisions made by households. The primary goal of this paper is to explain family investment decisions under the assumptions of household member’s preferences and efficient risk sharing based on the collective household model. In particular, by examining the absolute (relative) risk aversion of the household welfare function, we demonstrate how household’s portfolio allocation in stocks changes with family wealth. We examine two types of preference heterogeneity between family members: parameter heterogeneity and functional form heterogeneity. This study offers an alternative explanation of household portfolio choice corresponding with the observation that wealthier households tend to hold greater share of their wealth in risky assets. Specifically, if two decision-makers have standard constant relative risk aversion preference with different relative risk aversions in a household, family’s relative risk aversion decreases as household wealth increases (decreasing relative risk aversion).

Similar content being viewed by others

Notes

See, for example, the Proposition 4.2 in [10].

For detailed early contribution on the household models, please refer to Chiappori’s paper [8]

See chapter 10 in [10].

We use bond as an example of risk-free asset, and stock as the example of risky asset throughout this paper.

See “Appendix 1” for detailed derivations.

See “Appendix 2” for detailed derivations.

For detailed explanation and implication of linex utility function, please refer to [9].

We obtain Eq. (7) by differentiating H(z) w.r.t. z and using the relation of \(c_{1}^{\prime } (z)\) + \(c_{2}^{\prime } (z)\) = 1.

\(c_i^{\prime } ({z}) > 0\) as long as both two individuals are risk averse, see Eq. (6)

Power utility function takes the form of

is the constant relative risk aversion, quadratic utility function takes the form of \(u\left( w \right) =aw-bw^{2}\), where w is the wealth level, a and b are constants.

is the constant relative risk aversion, quadratic utility function takes the form of \(u\left( w \right) =aw-bw^{2}\), where w is the wealth level, a and b are constants.See detailed explanations of linear sharing rule in Sect. 3. Linear sharing rule is a special case of efficient risk sharing.

See, for example, chapter 1 in [10].

See the Proposition 4.2 in [10].

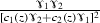

The portfolio share in risky assets is approximated by equation: \(\frac{a^{*}}{w}=\frac{\mu _{\tilde{x}} }{\sigma _{\tilde{x}}^2 }\frac{1}{R\left( w \right) }\), where \(\mu _{\tilde{x}}\) and \(\sigma _{\tilde{x}}^2 \) is expected stock return and variance of stock return respectively, and \(R\left( w \right) \) is the relative risk aversion. As long as the inequality

holds, household’s share in risky assets falls somewhere between two member’s share in risky assets.

holds, household’s share in risky assets falls somewhere between two member’s share in risky assets.since

is positive, thus the sign of \(R_R^{\prime } \left( z \right) \) is determined by the sign of \(c_1 \left( z \right) -c_1^{\prime } \left( z \right) z\) as we assume

is positive, thus the sign of \(R_R^{\prime } \left( z \right) \) is determined by the sign of \(c_1 \left( z \right) -c_1^{\prime } \left( z \right) z\) as we assume

We use k to denote absolute (relative) risk aversion to avoid notation confusions with previous sections.

Note that each individual’s consumption is a monotonic and increasing function of family wealth.

References

Apps, P., Andrienko, Y., Rees, R.: Risk and precautionary saving in two-person households. Am. Econ. Rev. 104(3), 1040–1046 (2014)

Barsky, B., Juster, F.T., Kimball, M., Shapiro, M.: Preference parameters and behavioral heterogeneity: an experimental approach in the health and retirement study. Q. J. Econ. 112(2), 537–579 (1997)

Bertaut, C., Starr-McCluer, M.: Household Portfolios, Chap. 5. The MIT Press, Cambridge (2002)

Bourguignon, F., Chiappori, P.A.: Collective models of household behavior: an introduction. Eur. Econ. Rev. 36(1992), 355–365 (1992)

Browning, M.: The saving behavior of a two-person household. Scand. J. Econ. 102(2), 235–251 (2000)

Cass, D., Stiglitz, J.: The structure of investor preferences and asset returns, and separability in portfolio allocation: a contribution to the pure theory of mutual funds. J. Econ. Theory 1970(2), 122–160 (1970)

Chiappori, P.A.: Rational household labor supply. Econometrica 56(1), 63–90 (1988)

Chiappori, P.A.: Collective labor supply and welfare. J. political Econ. 100(3), 437–467 (1992)

Denuit, M., Eeckhoudt, L., Schlesinger, H.: When Ross meets Bell: the linex utility function. J. Math. Econ. (2013)

Eeckhoudt, L., Gollier, C., Schlesinger, H.: Economic and Financial Decisions under Risk. Princeton University Press, Princeton NJ (2005)

Eeckhoudt, L., Schlesinger, H.: Putting risk in its proper place. Am. Econ. Rev. 96, 280–289 (2006)

Gollier, C.: Economics of Risk and Time. The MIT Press, Cambridge (2001)

Gollier, C.: What Does the Classical Theory Have to Say About Household Portfolios?. The MIT Press, Cambridge (2002)

Huang, C., Litzenberg, R.: Foundations for Financial Economics. Elsevier Science Publishing Co., Inc, London (1988)

Kimball, S.M.: Precautionary saving in the small and in the large. Econometrica 58(1), 53–73 (1990)

Mazzocco, M.: Saving, risk sharing, and preferences for risk. Am. Econ. Rev. 94(4), 116–182 (2004)

Merton, R.C.: Lifetime portfolio selection under uncertainty: the continuous-time case. Rev. Econ Stat. 51(3), 247–257 (1969)

Neelakantan, U., Lazaryan, N., Lyons, A., Nelson, C.: Portfolio Choice in a Two-Person Household. Working paper (2013)

Polkovnichenko, V.: Life-cycle portfolio choice with additive habit formation preferences and uninsurable labor income risk. Rev. Financ. Stud. 20(1), 83–124 (2007)

Samuelson, P.A.: Lifetime portfolio selection by dynamic stochastic programming. Rev. Econ. Stat. 51(3), 239–246 (1969)

Wachter, J.A., Yogo, M.: Why do household portfolio shares rise in wealth? Rev. Financ. Stud. 23(11), 3929–3965 (2010)

Acknowledgements

I would like to thank the editor, Dr. Ulrich Horst, the associate editor and the anonymous referee for their valuable comments and suggestions towards the improvement of this paper. I am deeply indebted to my former advisor, Dr. Harris Schlesinger, for the guidance and encouragement along the way. All errors are my own.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

The household welfare function: H(z) = \(\mathop \sum \nolimits _{i=1}^2 \lambda _i u_i \left( {c_i \left( z \right) } \right) ,\) where z = w +ax;

Second Order Condition:

The above inequality holds due to \(\lambda _1 u_1^{\prime } (c_1 \left( z \right) )=\lambda _2 u_2^{\prime } (c_2 \left( z \right) )\) and Eqs. (25) and (26).

Therefore, the second order condition is satisfied.

Appendix 2

Rewrite Eq. (27) as:

where \(t_1 \left( {c_i \left( z \right) } \right) =-\frac{u_i^{\prime } \left( {c_i \left( z \right) } \right) }{u_i^{{\prime }{\prime }} \left( {c_i \left( {z} \right) } \right) }\) is individual i’s risk tolerance, \(i=1,2\). We derive Eq. (29) using (25),

Rights and permissions

About this article

Cite this article

Zhang, W. Household risk aversion and portfolio choices. Math Finan Econ 11, 369–381 (2017). https://doi.org/10.1007/s11579-017-0184-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11579-017-0184-1

is the constant relative risk aversion, quadratic utility function takes the form of

is the constant relative risk aversion, quadratic utility function takes the form of  holds, household’s share in risky assets falls somewhere between two member’s share in risky assets.

holds, household’s share in risky assets falls somewhere between two member’s share in risky assets. is positive, thus the sign of

is positive, thus the sign of