Abstract

In distributive bargaining, bargainers may have an impulse to bluff and thereby risk an impasse. The current paper does not explain bargaining impasses. For our purposes, it suffices to recognize that bargaining impasses may occur without assuming irrationality. The design problem is to ensure that impasses are avoided as often as possible. One possible solution is to allow for the formation of an agreement by “conduct”. The ‘agreement by conduct’ outcome as a commercial norm may coordinate bargainers’ expectations so as to enable them to perform the same contract, even if they made written demands above ½ (as a bluff). The idea that the “deal-is-on” philosophy as expressed in the “agreement-by-conduct” rule affects and promotes economic exchange is probed in the context of a modified Divide-the-Dollar game.

Similar content being viewed by others

Notes

See, Schelling (1960, Chapter 3).

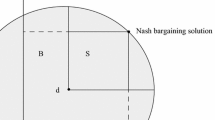

Formally, a two-person bargaining problem is described by a pair (S, d), where S ⊂ \( {\mathbb{R}}^{2} \) is the set of feasible agreements with a disagreement point d = (d1, d2) ∈ S being the allocation that results if no agreement is reached. Nash’s solution requires only that S is compact and convex, and that it contains some (x1, x2) with x1 > d1 and x2 > d2 (that is, gains from agreement are available); these conditions will be satisfied for the bargaining problems considered in this paper.

“A Nash equilibrium is a possible prediction of behavior for all players in a game such that, if every player believes that the others will behave according to this prediction, then, it is rational for each player himself to behave according to this prediction” (Myerson 2004: 93). See also Myerson (1999: 1069–1070).

See, e.g., Poel & Arnold v. Brunswick-Balke-Collender Co., 110 N.E. 619, 620 (N.Y. 1915). The Poel case is a quintessential example of the “mirror-image” approach to contract formation. This approach is modified with respect to merchants dealing in the sale of (movable) goods under the U.S. Uniform Commercial Code (1958) (UCC Section 2-207). Karl N. Llewellyn was considering cases like Poel when drafting UCC Section 2-207. To be sure, the “mirror-image” approach still applies in situations not covered by the UCC (e.g., sale of immovable goods and sale of services).

For example, Baltimore & Ohio Railroad Co. v. United States, 261 U.S. 592 (1923) is a U.S. Supreme Court case on contract formation. In this case, the Court held that an implied-in-fact contract exists as, “agreement … found upon a meeting of minds, which, although not embodied in an express contract, is inferred, as a fact, from conduct of the parties showing, in the light of the surrounding circumstances, their tacit understanding.”

For example, RTS Flexible Systems Limited v Molkerei Alois Müller GmbH& Company KG, [2010] UKSC 14 (10 March 2010) is a United Kingdom Supreme Court case on contract formation. In this case, the Court held that: “The general principles are not in doubt. Whether there is a binding contract between the parties and, if so, upon what terms depends upon what they have agreed. It depends not upon their subjective state of mind, but upon a consideration of what was communicated between them by words or conduct, and whether that leads objectively to a conclusion that they intended to create legal relations and had agreed upon all the terms which they regarded or the law requires as essential for the formation of legally binding relations. Even if certain terms of economic or other significance to the parties have not been finalised, an objective appraisal of their words and conduct may lead to the conclusion that they did not intend agreement of such terms to be a pre-condition to a concluded and legally binding agreement.”

The participation constraint is in line with Crawford’s observation that the rules which govern bargaining over mechanisms must, at some level, be imposed by a third party rather than derived within the model (1985: 823–824).

Fehr and Schmidt (2010: 103) complain that: “[O]ne important problem with this alternative approach is that the set of social norms that affect people’s behavior is not defined.”

A number of leading theories suggest that people care intrinsically about “fairness”—that is, either about the distribution of payoffs or about how the game is played. In this regard, the interested reader might refer to the discussion as featured in the Journal of Economic Behavior and Organization between, on the one hand, Binmore and Shaked (2010a, b) and, on the other, Fehr and Schmidt (2010) about the explanation of social behavior based on social (other-regarding) preferences or culturally determined social norms. See also Binmore (2010).

Levitt and List (2007: 168) observe that: “[I]n contrast to the lab, many real-world markets operate in ways that make pro-social behavior much less likely. In financial markets, for instance, the stakes are large, actors are highly anonymous, and little concern seems to exist about future analysis of one’s behavior. Individuals with strong social preferences are likely to self-select away from these markets, instead hiring agents who lack such preferences to handle their financial dealings.”

Anbarci and Feltovich (2012) modify the “standard” Nash Demand Game so that incompatible demands do not necessarily lead to the disagreement outcome. Rather, with exogenous probability q, one bargainer receives her demand, with the other getting the remainder. They use an asymmetric bargaining set (favoring one bargainer) and disagreement payoffs of zero, and they vary q over several values. In the spirit of typical results for conventional arbitration, they observe a strong chilling effect on bargaining for values of q near one, with extreme demands and low agreement rates in these treatments.

Needless to say, in actual legal practice,in view ofthe court decision of finding no agreement, a party may (for example) seek reliance damages or restitution damages (see, e.g. McKendrick 1988: 207).

Wakker (2010) provides a comprehensive and accessible textbook treatment of the way decisions are made both when we have the statistical probabilities associated with uncertain future events (risk) and when we lack them (ambiguity).

References

Anbarci N, Feltovich N (2012) Bargaining with random implementation: an experimental study. Games Econ Behav 76:495–514

Baird DG, Weisberg R (1982) Rules, standards, and the battle of the forms: a reassessment of § 2-207. Va Law Rev 68:1217–1247

Battigalli P, Maggi G (2002) Rigidity, discretion, and the costs of writing contracts. Am Econ Rev 92:798–817

Ben-Shahar O (2004) Contracts without consent: exploring a new basis for contractual liability. Univ Pa Law Rev 152:1829–1872

Binmore K (1998) Game theory and the social contract II. The MIT Press, Cambridge

Binmore K (2005) Natural justice. Oxford University Press, Oxford

Binmore K (2010) Social norms or social preferences? Mind Soc 9:139–157

Binmore K, Shaked A (2010a) Experimental economics: where next? J Econ Behav Organ 73:87–100

Binmore K, Shaked A (2010b) Experimental economics: where next? Rejoinder. J Econ Behav Organ 73:120–121

Binmore K, Samuelson L, Young PH (2003) Equilibrium selection in bargaining models. Games Econ Behav 45:296–328

Burke MA, Young HP (2011) Social norms. In: Benhabib J, Jackson MO, Bisin A (eds) Handbook of social economics, vol 1A. Elsevier, Amsterdam, pp 312–338

Crawford VP (1982) A theory of disagreement in bargaining. Econometrica 50:607–638

Crawford VP (1985) Efficient and durable decision rules: a reformulation. Econometrica 53:817–835

Davies PS (2010) Anticipated contracts: room for agreement. Camb Law J 69:467–475

Davies PS (2018) Contract formation and implied terms. Camb Law J 77:22–25

Fehr E, Schmidt KM (1999) A theory of fairness, competition, and cooperation. Q J Econ 114:817–868

Fehr E, Schmidt KM (2010) On inequity aversion: a reply to Binmore and Shaked. J Econ Behav Organ 73:101–108

Goldberg VP (2007) Framing contract law: an economic perspective. Harvard University Press, Cambridge

Greif A, Kings C (2011) Institutions: rules or equilibria? In: Schofield N, Caballero G (eds) Political economy of institutions, democracy and voting. Springer, Berlin, pp 13–43

Kahneman D (1992) Reference points, anchors, norms, and mixed feelings. Organ Behav Hum Decis Process 51:296–312

Levitt SD, List JA (2007) What do laboratory experiments measuring social preferences reveal about the real world. J Econ Perspect 21:153–174

McKendrick E (1988) The battle of the forms and the law of restitution. Oxf J Legal Stud 8:197–221

Murray JE (2000) The definitive “battle of the forms”: chaos revisited. J Law Commerce 20:1–48

Myerson RB (1999) Nash equilibrium and the history of economic theory. J Econ Lit 37:1067–1082

Myerson RB (2004) Justice, institutions, and multiple equilibria. Chic J Int Law 5:91–107

Rabin M (1993) Incorporating fairness into game theory and economics. Am Econ Rev 83:1281–1302

Rong K (2012) Alternating-offer games with final-offer arbitration. Games Econ Behav 76:596–610

Schelling TC (1960) The strategy of conflict. Harvard University Press, Cambridge

Teraji S (2017) Understanding coevolution of mind and society: institutions-as-rules and institutions-as-equilibria. Mind Soc 16:95–112

Tirole J (1999) Incomplete contracts: where do we stand? Econometrica 67:741–781

Tirole J (2009) Cognition and incomplete contracts. Am Econ Rev 99:265–294

von Mehren AT (1990) The “battle of the forms”: a comparative view. Am J Comp Law 38:265–298

Wakker PP (2010) Prospect theory—for risk and ambiguity. Cambridge University Press, Cambridge

White JJ (2004) Contracting under amended 2-207. Wis Law Rev 2004:723–751

Williamson OE (2002) The lens of contract: private ordering. Am Econ Rev 92:438–443

Yildiz M (2011) Nash meets Rubinstein in final offer arbitration. Econ Lett 110:226–230

Young HP (1991) Negotiation analysis. The University of Michigan Press, Ann Arbor

Young HP (1996) The economics of convention. J Econ Perspect 10:105–122

Young HP (1998a) Social norms and economic welfare. Eur Econ Rev 42:821–830

Young HP (1998b) Conventional contracts. Rev Econ Stud 65:773–792

Young HP (2008) Social norms. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave Macmillan, London

Young HP (2015) The evolution of social norms. Annu Rev Econ 7:359–387

Acknowledgements

I wish to acknowledge valuable comments from Jean-Jacques Herings and Peter Wakker. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kanning, A.J. Agreement by conduct as a coordination device. Mind Soc 19, 77–90 (2020). https://doi.org/10.1007/s11299-020-00225-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11299-020-00225-5

Keywords

- Bluff

- Bargaining impasse

- Focal point

- Fairness norm

- Commercial norm

- Agreement by conduct

- Coordination device

- Equilibrium selection

- Divide the dollar