Abstract

Discounted utility theory and its generalizations (e.g., quasihyperbolic discounting, generalized hyperbolic discounting) use discount functions for weighting utilities of outcomes received in different time periods. We propose a new simple test of convexity–concavity of discount function. This test can be used with any utility function (which can be linear or not) and any preferences over risky lotteries (expected utility theory or not). The data from a controlled laboratory experiment show that about one third of experimental subjects reveal a concave discount function and another one third of subjects reveal a convex discount function (for delays up to two month).

Similar content being viewed by others

Notes

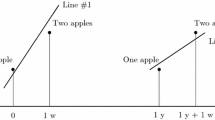

Stationarity is a behavioral axiom that can be directly tested on empirical data since it is formulated in terms of revealed preferences. Convexity of discount function is a property of an unobserved theoretical function that cannot be directly tested on empirical data. From this point of view, the contribution of our paper is to formulate the convexity property (Jensen’s inequality) in terms of revealed preferences so that it can be directly tested on empirical data.

The distractor task was cognitive reflection test (Frederick, 2005) consisting of three questions.

Wilcoxon signed-rank tests were used as normality of distributions was not supported by the data.

An alternative \(L\equiv ({l}_{0},{l}_{1},{l}_{2})\) second-order dominates an alternative \(R\equiv ({r}_{0},{r}_{1},{r}_{2})\) when \({l}_{0}+{l}_{1}+{l}_{2}\ge {r}_{0}+{r}_{1}+{r}_{2}\) as well as \({l}_{0}\ge {r}_{0}\), \({2l}_{0}+{l}_{1}\ge 2{r}_{0}+{r}_{1}\) and \(3{l}_{0}+{2l}_{1}+{l}_{2}\ge {3r}_{0}+{2r}_{1}+{r}_{2}\) and at least one of these inequalities holds as a strict inequality.

References

Attema, A. E., Bleichrodt, H., Rohde, K. I. M., & Wakker, P. P. (2010). Time-tradeoff sequences for analyzing discounting and time inconsistency. Management Science, 56(11), 2015–2030.

Attema, A. E., Han Bleichrodt, Yu., Gao, Z. H., & Wakker, P. P. (2016). Measuring discounting without measuring utility. American Economic Review, 106, 1476–1494.

Blavatskyy, P. (2016). A monotone model of intertemporal choice. Economic Theory, 62(4), 785–812.

Blavatskyy, P. (2018). Temporal dominance and relative patience in intertemporal choice. Economic Theory, 65(2), 361–384.

Blavatskyy, P., & Maafi, H. (2018). Estimating representations of time preferences and models of probabilistic intertemporal choice on experimental data. Journal of Risk and Uncertainty, 56(3), 259–287.

Bleichrodt, H., Rohde, K. I. M., & Wakker, P. P. (2009). Non-hyperbolic time inconsistency. Games and Economic Behavior, 66(1), 27–38.

Bøhren, Ø., & Hansen, T. (1980). Capital budgeting with unspecified discount rates. Scandinavian Journal of Economics, 82(1), 45–58.

Chapman, G. B. (1996). Expectations and preferences for sequences of health and money. Organizational Behavior and Human Decision Processes, 67(1), 59–75.

Chesson, H., & Viscusi, K. W. (2003). Commonalities in time and ambiguity aversion for long-term risk. Theory and Decision, 54, 57–71.

Coller, M., & Williams, M. (1999). Eliciting individual discount rates. Experimental Economics, 2, 107–127.

Ebert, J.E.J. and Drazen Prelec,. (2007). The fragility of time: Time-insensitivity and valuation of the near and far future. Management science, 53(9), 1423–1438.

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic Perspectives, 19(4), 25–42.

Frederick, S., Loewenstein, G., & O’Donoghue, T. (2002). Time discounting and time preference: A critical review. Journal of Economic Literature, 40(2), 351–401.

Koopmans, T. (1960). Stationary ordinal utility and impatience. Econometrica, 28, 287–309.

Krantz, D. H., Luce, R. D., Suppes, P., & Tversky, A. (1971). Foundations of measurement, Vol. 1 (Additive and Polynomial Representations). New York: Academic Press.

Loewenstein, G. (1987). Anticipation and the valuation of delayed consumption. Economic Journal, 97(387), 666–684.

Loewenstein, G., & Prelec, D. (1992). Anomalies in intertemporal choice: Evidence and an interpretation. Quarterly Journal of Economics, 107, 573–597.

Onay, S., & Öncüler, A. (2007). Intertemporal choice under timing risk: An experimental approach. Journal of Risk and Uncertainty, 34, 99–121.

Pan, J., Webb, C. S., & Zank, H. (2015). An extension of quasi-hyperbolic discounting to continuous time. Games and Economic Behavior, 89, 43–55.

Phelps, E., & Pollak, R. (1968). On second-best national saving and game-equilibrium growth. The Review of Economic Studies, 35, 185–199.

Rohde, K. I. M. (2010). The hyperbolic factor: A measure of time inconsistency. Journal of Risk and Uncertainty, 41(2), 125–140.

Samuelson, P. (1937). A note on measurement of utility. The Review of Economic Studies, 4, 155–161.

Sayman, S., & Öncüler, A. (2009). An investigation of time-inconsistency. Management Science, 55(3), 470–482.

Takeuchi, K. (2011). Non-parametric test of time consistency: Present bias and future bias. Games and Economic Behavior, 71(2), 456–478.

Takeuchi, K. (2012). Time discounting: the concavity of time discount function: An experimental study. Journal of Behavioral Economics and Finance, 5, 2–9.

Thaler, R. H. (1981). Some empirical evidence on dynamic inconsistency. Economics Letters, 8, 201–207.

Warner, J., & Pleeter, S. (2001). The personal discount rate: Evidence from military downsizing programs. American Economic Review, 91(1), 33–53.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Pavlo Blavatskyy is a member of the Entrepreneurship and Innovation Chair, which is part of LabEx Entrepreneurship (University of Montpellier, France) and funded by the French government (Labex Entreprendre, ANR-10-Labex-11-01).

Appendices

Appendix A

See Table 2.

Appendix B

2.1 Instructions

Thank you for participating in this experiment. The experiment is designed to study individual decisions. You will make your choice on the computer. The computer will communicate your gains at the end of the experiment. Your decisions in the experiment are private. Please do not communicate with others during the experience.

The instructions are simple, if you follow them carefully, you could earn a considerable amount of money. Your winnings will depend on the decisions you make.

The experiment is divided into three parts and a questionnaire:

-

1.

In a first part, we will ask you to choose between two options, and this several times. Each option offers you a given amount of money at three different delays.

-

2.

In a second part, we will ask you respond to three questions of logic.

-

3.

In a third part, we will ask you to choose between two options several times. Each option offers you a given amount of money at three different delays.

-

4.

Finally, you will answer questions about your personal situation.

2.2 Payment

At the end of the experiment, one question of Parts 1 or 3 will be randomly selected and played for real. Part 2 will offer you a bonus per correct answer.

2.3 Detailed instructions

-

Part 1: In this part, you will choose between two options that offer you three amounts of money at three different dates: an amount today, an amount in one month and an amount in 2 months.

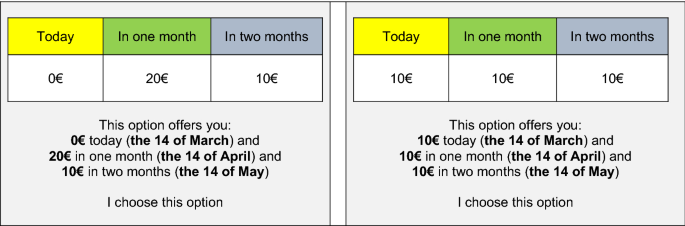

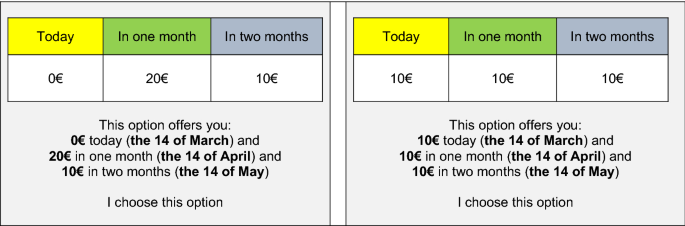

Example:

In this question, you will make a choice between two options: a right option and a left option. You save your choices on the computer. Click on the option you prefer. Your preferred option will be highlighted in red, and then click on the bottom OK to confirm your choice.

For this example, if you choose the left option, you will receive nothing today, but you will receive €20 in one month and €10 in two months. If you prefer the right option, you will receive €10 today, €10 in one month and €10 in two months.

In this first part, you are asked to make 100 choices similar to the example above.

To avoid you to come back to receive your future earnings, the amounts you will receive in one month and/or in two months will be deposited in your internal mailbox on the scheduled date or will be sent to you to another address (if you prefer) so that they arrive in your mailboxes on the scheduled date. Please inform the experimenter of what suits you for future payments.

The following text was not printed on the instructions, but was read by the experimenter:

On the right side of your computer, there are two envelopes: one white and one brown. You will receive the white envelope with your earlier payment in one month and the brown envelope with the later payment in two months. Inside each envelope, there is a letter reminding you your participation in the experiment one (two) month(s) ago and your payment. After the payment information at the end of the experiment, you have to address the envelope(s) to yourselves and write your future payment(s) in the reminder letter of the corresponding envelope.

-

Part 2: In this part, you will answer 3 questions of logic. You will receive 0.50 € per correct answer.

-

Part 3: In this part, you will make the same 100 choices similar of Part 1. You will choose between two options that offer you three amounts of money at three different dates: an amount today, an amount in one month and an amount in 2 months.

Do you have any questions?

-

Appendix C

See Table 3 .

Rights and permissions

About this article

Cite this article

Blavatskyy, P.R., Maafi, H. A new test of convexity–concavity of discount function. Theory Decis 89, 121–136 (2020). https://doi.org/10.1007/s11238-020-09747-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-020-09747-3