Abstract

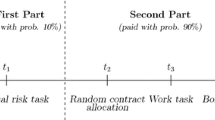

In contrast to the assumptions of standard economic theory, recent experimental evidence shows that the income of peers has a systematic impact on observed degrees of risk aversion. This paper reports the findings of two experiments examining the impact of income inequality on risk preferences and whether the knowledge of inequality mediates the decisions. In Experiment 1, participants who were recruited for a real-effort task were paid either a low wage or a high wage. Half of the participants were aware of the income inequality, while the other half were not. After completing their task, they were invited to invest a part of their salary in a risky asset. In Experiment 2, we replicated the same experiment in the laboratory with windfall endowments to test the consistency of results in the laboratory settings. The results of the first experiment show that high-wage subjects take higher risks than low-wage participants do if they are aware of the inequality in wages. This finding supports the idea that income comparisons shape risky decisions. In Experiment 2, on the other hand, we did not observe any significant differences in decisions. This may suggest that the income comparison is sensitive to house-money effect.

Similar content being viewed by others

Notes

Lietuvos Nacionalinė Vartotojų Federacija.

References

Antonovics, K., Arcidiacono, P., & Walsh, R. (2009). The effects of gender interactions in the lab and in the field. Review of Economics and Statistics, 91, 152–162.

Arrow Kenneth, J. (1965). Aspects of the theory of risk-bearing. Helsinki: Yrjö Hahnsson Foundation.

Becker, G., Murphy, K., & Werning, I. (2005). The equilibrium distribution of income and the market for status. Journal of Political Economy, 113, 282–301.

Carlsson, F., He, H., & Martinsson, P. (2013). Easy come, easy go. Experimental Economics, 16(2), 190–207.

Carpenter, J., Burks, S., & Verhoogen, E. (2005). Comparing students to workers: The effects of social framing on behavior in distribution games. In J. Carpenter, G. Harrison, & J. List (Eds.), Field experiments in economics. Greenwich and London: JAI/Elsevier.

Cherbonnier, F., & Gollier, C. (2015). Decreasing aversion under ambiguity. Journal of Economic Theory, 157, 606–623.

Croson, R., & Gneezy, U. (2009). Gender differences in preferences. Journal of Economic Literature, 47(2), 448–474.

Eckel, C. C., & Grossman, P. J. (2008). Men, women and risk aversion: Experimental evidence. Handbook of experimental economics results, 1, 1061–1073.

Fehr, E., & Schmidt, K. M. (1999). A theory of fairness, competition, and cooperation. Quarterly Journal of Economics, 114, 817–868.

Festinger, L. (1954). A theory of social comparison processes. Human Relations, 7(2), 117–140.

Filippin, A., & Crosetto, P. (2016). A reconsideration of gender differences in risk attitudes. Management Science, 62(11), 3138–3160.

Gamba, A., Manzoni, E., & Stanca, L. (2014). Social comparison and risk taking behavior. Theory and Decision, 82, 221–248.

Gill, D., & Prowse, V. (2012). A structural analysis of disappointment aversion in a real effort competition. American Economic Review, 102(1), 469–503.

Gneezy, U., Niederle, M., & Rustichini, A. (2003). Performance in competitive environments: Gender differences. Quarterly Journal of Economics, 118(3), 1049–1074.

Guiso, L., & Paiella, M. (2008). Risk aversion, wealth, and background risk. Journal of the European Economic Association, 6(6), 1109–1150.

Hill, S. E., & Buss, D. M. (2010). Risk and relative social rank: Positional concerns and risky shifts in probabilistic decision-making. Evolution and Human Behavior, 31, 219–226.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–291.

Konow, J. (2000). Fair shares: Accountability and cognitive dissonance in allocation decisions. American Economic Review, 90, 1072–1091.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121, 1133–1165.

Kőszegi, B., & Rabin, M. (2007). Reference-dependent risk attitudes. The American Economic Review, 97, 1047–1073.

Lahno, A. M., & Serra-Garcia, M. (2015). Peer effects in risk taking: Envy or conformity? Journal of Risk and Uncertainty, 50(1), 73–95.

Levitt, S. D., & List, J. A. (2007). What do laboratory experiments measuring social preferences reveal about the real world? Journal of Economic Perspectives, 21(2), 153–174.

Levy, H. (1994). Absolute and relative risk aversion: An experimental study. Journal of Risk and uncertainty, 8(3), 289–307.

Linde, J., & Sonnemans, J. (2012). Social comparison and risky choices. Journal of Risk and Uncertainty, 44, 45–72.

List, J. (2006). The behaviouralist meets the market: Measuring social preferences and reputation effects in actual transactions. Journal of Political Economy, 114, 1–37.

Mishra, S., Hing, L. S. S., & Lalumière, M. L. (2015). Inequality and risk-taking. Evolutionary Psychology, 13(3), 280–307.

Parker, S. C. (2004). The economics of self-employment and entrepreneurship. New York: Cambridge University Press.

Payne, B. K., Brown-Iannuzzi, J. L., & Hannay, J. W. (2017). Economic inequality increases risk taking. Proceedings of the National Academy of Sciences, 114(18), 4643–4648.

Perotti, R. (1993). Political equilibrium, income distribution, and growth. Review of Economic Studies, 60, 755–776.

Piketty, T. (2014). Capital in the twenty-first century. Cambridge: Harvard University Press.

Pratt, J. W. (1964). Risk aversion in the small and in the large. Econometrica: Journal of the Econometric Society, 32, 122–136.

Ray, D., & Robson, A. (2012). Status, intertemporal choice and risk taking. Econometrica, 80, 1505–1531.

Rohde, I., & Rohde, K. (2011). Risk attitudes in a social context. Journal of Risk and Uncertainty, 43, 205–225.

Schmidt, U., Friedl, A., & Lima de Miranda, K. (2015). Social comparison and gender differences in risk taking. Kiel Working paper No. 2011.

Schwerter, F. (2013). Social reference points and risk taking. Bonn Econ. Discussion Papers No. 11.

Sinn, H.-W. (1994). A theory of the welfare state. NBER Working Paper No. 4856.

Sutter, M., & Weck-Hannemann, H. (2003). Taxation and the veil of ignorance—A real effort experiment on the Laffer curve. Public Choice, 115, 217–240.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice. Management Science, 36(6), 643–660.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5, 297–323.

Veblen, T. (1899). The theory of the leisure class. New York: McMillan.

Vendrik, M., & Woltjer, G. B. (2007). Happiness and loss aversion: Is utility concave or convex in relative income? Journal of Public Economics, 91, 1423–1448.

Vieider, F. M., Chmura, T., Fisher, T., Kusakawa, T., Martinsson, P., Thompson, F. M., et al. (2015a). Within- versus between-country differences in risk attitudes: Implications for cultural comparisons. Theory and Decision, 78(2), 209–218.

Vieider, F. M., Lefebvre, M., Bouchouicha, R., Chmura, T., Hakimov, R., Krawczyk, M., et al. (2015b). Common components of risk and uncertainty attitudes across contexts and domains: Evidence from 30 countries. Journal of the European Economic Association, 13(3), 421–452.

Wilkinson, R. G., & Pickett, M. (2009). The spirit level: Why more equal societies almost always do better. London: Penguin.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Schmidt, U., Neyse, L. & Aleknonyte, M. Income inequality and risk taking: the impact of social comparison information. Theory Decis 87, 283–297 (2019). https://doi.org/10.1007/s11238-019-09713-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-019-09713-8