Abstract

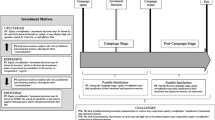

Equity crowdfunding is a unique form of entrepreneurial finance that combines elements of private and public equity. We articulate its distinctive features, then review and qualitatively analyze a large corpus of 540 public comments submitted by stakeholders in response to new US equity crowdfunding regulations. Through a qualitative content analytic approach, we combine actor (issuer, investor, and intermediary) and perspective (relational, behavioral, and technical) dimensions to develop a taxonomy of 18 categories, from which we derive and present unanswered questions and fruitful research directions in this emerging domain.

Similar content being viewed by others

Notes

While we focus on US-based equity crowdfunding, this focus is uniquely relevant, given the scale of entrepreneurial finance in the USA and the potential for equity crowdfunding to play an important and influential role in it in the future (Estrin et al. 2018). A significant advantage of the US context and this regulatory process in particular was the existence of relatively unique and transparent data from a variety of stakeholders who formally participated in the creation and modification of administrative rules governing equity crowdfunding. The USA is a relatively litigious society, so risk-mitigation strategies were perhaps more clearly thought out from the beginning (and observable to the researchers ex-ante). Nonetheless, we acknowledge that by focusing exclusively on US-based equity crowdfunding and the perceptions of US stakeholders, the generalizability of our results and accompanying research questions may be limited. However, the equity crowdfunding ecosystem in the USA shares many similarities with other crowdfunding ecosystems, suggesting that our research agenda is likely to be relevant for researchers examining equity crowdfunding in a variety of countries and jurisdictions.

We gratefully acknowledge the concerns raised by a referee about whether a single-country qualitative study of equity crowdfunding is meaningfully generalizable, given that it may represent a “special case.” As with many studies of entrepreneurial finance, where each jurisdiction and institutional context has unique as well as common elements, one could argue that any setting is in this sense a special one, and no single-country dataset has value. We find that perspective limiting. Equity and in particular crowdfunding markets differ, and even cross-country results may be incapable of generating generalizable conclusions which hold for every country or the whole crowdfunding market.

A business can participate in equity crowdfunding as long as it has a specific business plan in place and is not already considered a publicly traded company or investment company. However, there are certain “disqualifying events” aimed at prohibiting “felons and other bad actors” from participating in equity crowdfunding transactions (e.g., issuers with a felony or misdemeanor conviction within the past 5 years related to false filings with the SEC) (SEC 2016b, p. 341).

This focus allows PE investors to apply their knowledge and experience, economizing and capitalizing on the large information asymmetries.

To limit potential losses for less sophisticated investors, the amount that can be invested annually by an investor is limited to the greater of (1) $2000 or 5% of one’s annual income or net worth if these amounts are less than $100,000; and (2) 10% of one’s annual income or net worth if these amounts are $100,000 or more (SEC 2016b, p.20).

This approach is appropriate in our context, given that prior knowledge and theory related to equity crowdfunding is somewhat limited.

The SEC released its proposed rules regarding equity crowdfunding on October 23, 2013 and received comments from “professional and trade associations, investor organizations, law firms, investment companies and investment advisors, broker-dealers, potential funding portals, members of Congress, the Commission’s Investor Advisory Committee, state securities regulators, government agencies, potential issuers, accountants, individuals, and other interested parties” (SEC 2016b, p. 10).

We refer to intermediaries as a broad category of entities that facilitate the matching between entrepreneurs and investors. This is related to, but distinct from, traditional entrepreneurial finance definitions that focus on “intermediation” of financial capital because our definition is not conditioned by the financial transaction. Furthermore, while there are various types of intermediaries involved in equity crowdfunding, we choose to focus primarily on crowdfunding platforms (or “portals”). We limit the scope of intermediaries discussed in our paper not only for brevity, but also because crowdfunding platforms represent a new type of intermediary, whose multifaceted role in entrepreneurial finance is just beginning to be examined and understood by researchers. Thus, we see value in focusing our research agenda on this important intermediary group.

Note that the categorization of the comment need not necessarily align with the identity of the commenter. For example, a potential investor may make an observation or prediction about how the incentive structure of crowdfunding market intermediaries will influence their ability to accurately screen issuers. This datapoint would likely be classified as “intermediary.”

These are generated by the 3 × 3 matchup of each dimension: issuer/relational, issuer/behavioral, issuer/technical, investor/relational, investor/behavioral, etc.

For some of the perspective-actor combinations, we identified more than two sub-categories (i.e., topics). However, we limit our discussion to two topics for the sake of brevity.

For all stakeholder comment references, we adopt the numbering system used by the SEC internally and include each comment number within brackets [XXX]. See Appendix for more details.

Issuers’ advertising notices are intended to be similar to “tombstone ads” and may only include: (1) a statement that an offering is being conducted, along with the name of (and/or link to) the funding portal, (2) the terms of the offering, and (3) factual information about the business (including contact information) and a brief description of the business (SEC 2016b, p. 136).

The UK platform Crowdcube reports that 11 VCs invest in their marketplace, while SyndicateRoom requires that at least 25% of the target capital be committed by institutional and other professional investors.

While the majority of recent IPOs have been offered exclusively to institutional investors, crowdfunding investors are likely to be much more diverse. Over the last two decades, three quarters of the IPOs in Europe took place in secondary markets, such as London’s Alternative Investment Market (AIM). Most of these IPOs were offered exclusively to institutional investors (Vismara et al. 2012). Although institutional investors are being allocated the largest fraction of IPO shares (Aggarwal et al. 2002), equity crowdfunding is likely to attract a much more diverse set of investors.

In the “Intermediary curation of the offerings” section, we highlight the heterogeneous set of activities and services provided by equity crowdfunding platforms.

Signori and Vismara (2018) use the population of 212 firms that successfully raised initial equity crowdfunding on the UK’s largest equity crowdfunding platform, Crowdcube, from inception (2011) to 2015. They find that 18% of the firms failed by the end of April 2017. For firms that raised financing between 2011 and 2013, the failure rate was 32.1%. Walthoff-Borm et al. (2018) examine the failure of equity crowdfunded firms in the UK. They show that the failure rate of equity crowdfunded firms is significantly higher than the failure rate of a matched sample of UK non-equity crowdfunded firms.

In fact, such disclosures are permitted as part of the “brief description of the business” included in crowdfunding issuers’ advertising notices (i.e., “tombstone ads”) (SEC 2016b).

Knechel et al. (2010) conduct an experiment to reveal how auditors’ mental models can be influenced by performance benchmarks and the use of analytical strategies, which in turn influence auditors’ risk perceptions.

Furthermore, although funding portals must be registered with the Financial Industry Regulatory Authority (FINRA), the individuals running these portals are not subject to any licensing, testing, or qualification requirements (SEC 2016b, p. 158). This creates the risk that funding portals may be run by individuals who do not have the skills and education necessary to effectively facilitate the issuance of equity securities.

Crowdfunding platforms must disclose the manner in which they will be compensated at account opening as well as the amount of compensation received (both monetary and securities) on transaction confirmations (SEC 2016b).

Some of the required disclosures include a narrative discussion of the company’s financial condition, annual financial statements (which may require a review or audit depending on the amount of the offering), the business experience of directors and officers over the past 3 years, names of individuals holding more than 20% equity in the company, a description of the business and business plan, purpose of the offering, intended use of the offering proceeds, price, and material factors that make investment in the issuer speculative or risky (SEC 2016b).

References

Aaker, J., & Akutsu, S. (2009). Why do people give? The role of identity in giving. Journal of Consumer Psychology, 19(3), 267–270.

Adebambo, B. N., Bliss, B., & Kumar. (2015). The value of crowdsourcing: evidence from earnings forecasts. Working Paper.

Aggarwal, R., Prabhala, N. R., & Puri, M. (2002). Institutional allocation in initial public offerings: empirical evidence. The Journal of Finance, 57(3), 1421–1442.

Ahlers, G. K. C., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955–980. https://doi.org/10.1111/etap.12157.

Allen, B. J., Dholakia, U. M., & Basuroy, S. (2016). The economic benefits to retailers from customer participation in proprietary web panels. Journal of Retailing, 92(2), 147–161.

Allen, B. J., Chandrasekaran, D., & Basuroy, S. (2018). Design crowdsourcing: the impact on new product performance of sourcing design solutions from the “Crowd”. Journal of Marketing, 82(2), 106–123.

Allison, T. H., McKenny, A. F., & Short, J. C. (2013). The effect of entrepreneurial rhetoric on microlending investment: an examination of the warm-glow effect. Journal of Business Venturing, 28(6), 690–707. https://doi.org/10.1016/j.jbusvent.2013.01.003.

Allison, T. H., Davis, B. C., Short, J. C., & Webb, J. W. (2015). Crowdfunding in a prosocial microlending environment: examining the role of intrinsic versus extrinsic cues. Entrepreneurship Theory and Practice, 39(1), 53–73. https://doi.org/10.1111/etap.12108.

Ashforth, B. E., & Mael, F. (1989). Social identity theory and the organization. Academy of Management Review, 14(1), 20–39.

Baker, H. K., & Nofsinger, J. R. (2002). Psychological biases of investors. Financial Services Review, 11(2), 97–116.

Balachandra, L., Briggs, T., Eddleston, K., & Brush, C. (2017). Do not pitch like a girl! How gender stereotypes influence investor decisions. Entrepreneurship Theory and Practice. https://doi.org/10.1177/1042258717728028.

Bamberger, P. A. (2018). AMD—clarifying what we are about and where we are going. Academy of Management Discoveries, 4(1), 1–10. https://doi.org/10.5465/amd.2018.0003.

Bammens, Y., & Collewaert, V. (2014). Trust between entrepreneurs and angel investors: exploring positive and negative implications for venture performance assessments. Journal of Management, 40(7), 1980–2008.

Bandura, A. (1977). Social learning theory Englewood Cliffs. NJ: Prentice-Hall.

Banerjee, A. V. (1992). A simple model of herd behavior. The Quarterly Journal of Economics, 107(3), 797–817.

Barber, B. M., & Odean, T. (2002). Online investors: do the slow die first? Review of Financial Studies, 15(2), 455–488. https://doi.org/10.1093/rfs/15.2.455.

Baron, R. A. (2007). Behavioral and cognitive factors in entrepreneurship: entrepreneurs as the active element in new venture creation. Strategic Entrepreneurship Journal, 1(1–2), 167–182.

Batjargal, B., & Liu, M. (2004). Entrepreneurs’ access to private equity in China: the role of social capital. Organization Science, 15(2), 159–172. https://doi.org/10.2307/30034721.

Baum, J. A. C., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 19(3), 411–436.

Bergh, D. D., Connelly, B. L., Ketchen, D. J., & Shannon, L. M. (2014). Signalling theory and equilibrium in strategic management research: an assessment and a research agenda. Journal of Management Studies, 51(8), 1334–1360. https://doi.org/10.1111/joms.12097.

Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy, 100(5), 992–1026.

Block, J., Hornuf, L., & Moritz, A. (2018). Which updates during an equity crowdfunding campaign increase crowd participation? Small Business Economics, 50(1), 3–27.

Bogers, M., Afuah, A., & Bastian, B. (2010). Users as innovators: a review, critique, and future research directions. Journal of Management, 36(4), 857–875. https://doi.org/10.1177/0149206309353944.

Brabham, D. C. (2008). Crowdsourcing as a model for problem solving: an introduction and cases. Convergence, 14(1), 75–90.

Bradford, C. S. (2014). Shooting the messenger: the liability of crowdfunding intermediaries for the fraud of others. University of Cincinnati Law Review, 83, 371.

Bradford, C. S. (2017). Online Arbitration as a Remedy for Crowdfunding Fraud. SSRN Working Paper, No. 3014148. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3014148. Accessed 25 Sep 2018.

Brockmyer, B., & Fox, J. (2015). Assessing the evidence: the effectiveness and impact of public governance-oriented multi-stakeholder initiatives. https://www.opengovpartnership.org/sites/default/files/assessing-the-evidence-msis.pdf. Accessed 25 Sep 2018.

Brush, C. G., Greene, P. G., & Hart, M. M. (2001). From initial idea to unique advantage: the entrepreneurial challenge of constructing a resource base. The Academy of Management Executive, 15(1), 64–78. https://doi.org/10.5465/AME.2001.4251394.

Burtch, G., Ghose, A., & Wattal, S. (2015). The hidden cost of accommodating crowdfunder privacy preferences: a randomized field experiment. Management Science, 61(5), 949–962. https://doi.org/10.1287/mnsc.2014.2069.

Byrne, O., & Shepherd, D. A. (2015). Different strokes for different folks: entrepreneurial narratives of emotion, cognition, and making sense of business failure. Entrepreneurship Theory and Practice, 39(2), 375–405.

Cacciotti, G., Hayton, J. C., Mitchell, J. R., & Giazitzoglu, A. (2016). A reconceptualization of fear of failure in entrepreneurship. Journal of Business Venturing, 31(3), 302–325. https://doi.org/10.1016/j.jbusvent.2016.02.002.

Cardon, M. S., Stevens, C. E., & Potter, D. R. (2011). Misfortunes or mistakes?: Cultural sensemaking of entrepreneurial failure. Journal of Business Venturing, 26(1), 79–92. https://doi.org/10.1016/j.jbusvent.2009.06.004.

Collewaert, V. (2012). Angel Investors’ and entrepreneurs’ intentions to exit their ventures: a conflict perspective. Entrepreneurship Theory and Practice, 36(4), 753–779. https://doi.org/10.1111/j.1540-6520.2011.00456.x.

Collewaert, V., & Manigart, S. (2016). Valuation of angel-backed companies: the role of investor human capital. Journal of Small Business Management, 54(1), 356–372.

Colombo, M. G., Franzoni, C., & Rossi-Lamastra, C. (2015). Internal social capital and the attraction of early contributions in crowdfunding. Entrepreneurship Theory and Practice, 39(1), 75–100.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011). Signaling theory: a review and assessment. Journal of Management, 37(1), 39–67.

Courtney, C., Dutta, S., & Li, Y. (2017). Resolving information asymmetry: signaling, endorsement, and crowdfunding success. Entrepreneurship Theory and Practice, 41(2), 265–290. https://doi.org/10.1111/etap.12267.

CrowdBureau (2017). About Us. CrowdBureau. http://crowdbureau.com/about-us/. Accessed 29 Dec 2017.

Cumming, D. (2008). Contracts and exits in venture capital finance. The Review of Financial Studies, 21(5), 1947–1982. https://doi.org/10.1093/rfs/hhn072.

Cumming, D., & Dai, N. (2013). Why do entrepreneurs switch lead venture capitalists? Entrepreneurship Theory and Practice, 37(5), 999–1017.

Cumming, D. J., & Zhang, Y. (2016). Are crowdfunding platforms active and effective intermediaries? (SSRN Scholarly Paper No. ID 2819845). Rochester, NY: Social Science Research Network. http://papers.ssrn.com/abstract=2819845. Accessed 11 Oct 2016.

Cumming, D. J., Hornuf, L., Karami, M., & Schweizer, D. (2016). Disentangling crowdfunding from fraudfunding (SSRN Scholarly Paper No. ID 2828919). Rochester, NY: Social Science Research Network. http://papers.ssrn.com/abstract=2828919. Accessed 11 Oct 2016.

Cumming, D., Johan, S., & Schweizer, D. (2017). Information systems, agency problems, and fraud. Information Systems Frontiers, 19(3), 421–424.

Cyr, D., Head, M., Larios, H., & Pan, B. (2009). Exploring human images in website design: a multi-method approach. MIS Quarterly, 33(3), 539–566. https://doi.org/10.2307/20650308.

Dennis, A. R., Fuller, R. M., & Valacich, J. S. (2008). Media, tasks, and communication processes: a theory of media synchronicity. MIS Quarterly, 32(3), 575–600.

Ding, Z., Au, K., & Chiang, F. (2015). Social trust and angel investors’ decisions: a multilevel analysis across nations. Journal of Business Venturing, 30(2), 307–321. https://doi.org/10.1016/j.jbusvent.2014.08.003.

Drover, W., Wood, M. S., & Zacharakis, A. (2017). Attributes of angel and crowdfunded investments as determinants of VC screening decisions. Entrepreneurship Theory and Practice, 41(3), 323–347. https://doi.org/10.1111/etap.12207.

Elo, S., & Kyngäs, H. (2008). The qualitative content analysis process. Journal of Advanced Nursing, 62(1), 107–115.

eRulemaking Management Office. (2016). About Us. Regulations.gov . https://www.regulations.gov/aboutProgram. Accessed 26 Dec 2016.

Estrin, S., Gozman, D., & Khavul, S. (2018). The evolution and adoption of equity crowdfunding: entrepreneur and investor entry into a new market. Small Business Economics, 1–15. https://doi.org/10.1007/s11187-018-0009-5.

Farrell, J., & Rabin, M. (1996). Cheap talk. The Journal of Economic Perspectives, 10(3), 103–118.

Fernandes, D., Lynch, J. G., Jr., & Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60(8), 1861–1883.

Fleming, L., & Waguespack, D. M. (2007). Brokerage, boundary spanning, and leadership in open innovation communities. Organization Science, 18(2), 165–180.

Forbes, D. P., Korsgaard, M. A., & Sapienza, H. J. (2010). Financing decisions as a source of conflict in venture boards. Journal of Business Venturing, 25(6), 579–592. https://doi.org/10.1016/j.jbusvent.2009.03.001.

Franke, N., Gruber, M., Harhoff, D., & Henkel, J. (2006). What you are is what you like--similarity biases in venture capitalists’ evaluations of start-up teams. Journal of Business Venturing, 21(6), 802–826. https://doi.org/10.1016/j.jbusvent.2005.07.001.

Franke, N., Gruber, M., Harhoff, D., & Henkel, J. (2008). Venture capitalists’ evaluations of start-up teams: Trade-offs, Knock-out criteria, and the impact of VC experience. Entrepreneurship Theory and Practice, 32(3), 459–483. https://doi.org/10.1111/j.1540-6520.2008.00236.x.

Freeman, R. E. (2010). Strategic management: a stakeholder approach. Cambridge university press.

Gibson, B., & Sanbonmatsu, D. M. (2004). Optimism, pessimism, and gambling: the downside of optimism. Personality and Social Psychology Bulletin, 30(2), 149–160.

Guenther, C., Johan, S., & Schweizer, D. (2018). Is the crowd sensitive to distance?—how investment decisions differ by investor type. Small Business Economics, 50(2), 289–305. https://doi.org/10.1007/s11187-016-9834-6.

Hahn, R., & Lülfs, R. (2014). Legitimizing negative aspects in GRI-oriented sustainability reporting: a qualitative analysis of corporate disclosure strategies. Journal of Business Ethics, 123(3), 401–420. https://doi.org/10.1007/s10551-013-1801-4.

Hallen, B. L., & Eisenhardt, K. M. (2012). Catalyzing strategies and efficient tie formation: how entrepreneurial firms obtain investment ties. Academy of Management Journal, 55(1), 35–70. https://doi.org/10.5465/amj.2009.0620.

Hornuf, L., & Schwienbacher, A. (2017). Should securities regulation promote equity crowdfunding? Small Business Economics, 49(3), 579–593.

Hornuf, L., & Schwienbacher, A. (2018). Market mechanisms and funding dynamics in equity crowdfunding. Journal of Corporate Finance, 50, 556–574.

Huang, L., & Knight, A. P. (2017). Resources and relationships in entrepreneurship: an exchange theory of the development and effects of the entrepreneur-investor relationship. Academy of Management Review, 42(1), 80–102.

Huang, L., & Pearce, J. L. (2015). Managing the unknowable: the effectiveness of early-stage investor gut feel in entrepreneurial investment decisions. Administrative Science Quarterly, 60(4), 634–670.

Islam, M., Fremeth, A., & Marcus, A. (2018). Signaling by early stage startups: US government research grants and venture capital funding. Journal of Business Venturing, 33(1), 35–51. https://doi.org/10.1016/j.jbusvent.2017.10.001.

Ivković, Z., & Weisbenner, S. (2007). Information diffusion effects in individual investors’ common stock purchases: covet thy neighbors’ investment choices. The Review of Financial Studies, 20(4), 1327–1357. https://doi.org/10.1093/revfin/hhm009.

Jääskeläinen, M., & Maula, M. (2014). Do networks of financial intermediaries help reduce local bias? Evidence from cross-border venture capital exits. Journal of Business Venturing, 29(5), 704–721.

Janney, J. J., & Folta, T. B. (2006). Moderating effects of investor experience on the signaling value of private equity placements. Journal of Business Venturing, 21(1), 27–44.

Jasperson, J. S., Carter, P. E., & Zmud, R. W. (2005). A comprehensive conceptualization of post-adoptive behaviors associated with information technology enabled work systems. MIS Quarterly, 29(3), 525–557. https://doi.org/10.2307/25148694.

Kahneman, D. (2003). Maps of bounded rationality: psychology for behavioral economics. The American Economic Review, 93(5), 1449–1475.

Kamis, A., Koufaris, M., & Stern, T. (2008). Using an attribute-based decision support system for user-customized products online: an experimental investigation. MIS Quarterly, 32(1), 159–177. https://doi.org/10.2307/25148832.

Kanter, J. (2017). Google offers concessions to Europe after record antitrust fine. New York Times. https://www.nytimes.com/2017/09/27/business/google-eu-antitrust.html. Accessed 12 Nov 2017.

Kanze, D., Huang, L., Conley, M. A., & Higgins, E. T. (2018). We ask men to win & women not to lose: closing the gender gap in startup funding. Academy of Management Journal, 61(2), 586–614.

Kasper-Fuehrera, E. C., & Ashkanasy, N. M. (2001). Communicating trustworthiness and building trust in interorganizational virtual organizations. Journal of Management, 27(3), 235–254. https://doi.org/10.1177/014920630102700302.

Kautonen, T., van Gelderen, M., & Fink, M. (2015). Robustness of the theory of planned behavior in predicting entrepreneurial intentions and actions. Entrepreneurship Theory and Practice, 39(3), 655–674. https://doi.org/10.1111/etap.12056.

Khoury, T. A., Junkunc, M., & Deeds, D. L. (2013). The social construction of legitimacy through signaling social capital: exploring the conditional value of alliances and underwriters at IPO. Entrepreneurship Theory and Practice, 37(3), 569–601.

Kirsch, D. A., Goldfarb, B., & Gera, A. (2009). Form or substance: the role of business plans in venture capital decision making. Strategic Management Journal, 30(5), 487–515. https://doi.org/10.1002/smj.751.

Knechel, W. R., Salterio, S. E., & Kochetova-Kozloski, N. (2010). The effect of benchmarked performance measures and strategic analysis on auditors’ risk assessments and mental models. Accounting, Organizations and Society, 35(3), 316–333. https://doi.org/10.1016/j.aos.2009.09.004.

Krause, R., & Bruton, G. (2014). Agency and monitoring clarity on venture boards of directors. Academy of Management Review, 39(1), 111–114.

Leyden, D. P., Link, A. N., & Siegel, D. S. (2014). A theoretical analysis of the role of social networks in entrepreneurship. Research Policy, 43(7), 1157–1163. https://doi.org/10.1016/j.respol.2014.04.010.

Manigart, S., & Wright, M. (2013). Reassessing the relationships between private equity investors and their portfolio companies. Small Business Economics, 40(3), 479–492.

Manigart, S., Lockett, A., Meuleman, M., Wright, M., Landström, H., Bruining, H., et al. (2006). Venture capitalists’ decision to syndicate. Entrepreneurship Theory and Practice, 30(2), 131–153.

Martin, G., Gómez-Mejía, L. R., Berrone, P., & Makri, M. (2017). Conflict between controlling family owners and minority shareholders: much ado about nothing? Entrepreneurship Theory and Practice, 41(6), 999–1027.

Matland, R. E., & Murray, G. R. (2012). An experimental test for “Backlash” against social pressure techniques used to mobilize voters. American Politics Research, 1532673X12463423. https://doi.org/10.1177/1532673X12463423.

Maxwell, A. L., & Lévesque, M. (2011). Trustworthiness: a critical ingredient for entrepreneurs seeking investors. Entrepreneurship Theory and Practice, no–no. https://doi.org/10.1111/j.1540-6520.2011.00475.x.

McKenny, A. F., Allison, T. H., Ketchen, D. J., Short, J. C., & Ireland, R. D. (2017). How should crowdfunding research evolve? A survey of the entrepreneurship theory and practice editorial board. Entrepreneurship Theory and Practice, 41(2), 291–304.

Meuleman, M., Jääskeläinen, M., Maula, M. V., & Wright, M. (2017). Venturing into the unknown with strangers: substitutes of relational embeddedness in cross-border partner selection in venture capital syndicates. Journal of Business Venturing, 32(2), 131–144.

Mitteness, C., Sudek, R., & Cardon, M. S. (2012). Angel investor characteristics that determine whether perceived passion leads to higher evaluations of funding potential. Journal of Business Venturing, 27(5), 592–606. https://doi.org/10.1016/j.jbusvent.2011.11.003.

Mohammadi, A., & Shafi, K. (2018). Gender differences in the contribution patterns of equity-crowdfunding investors. Small Business Economics, 50(2), 275–287. https://doi.org/10.1007/s11187-016-9825-7.

Murnieks, C. Y., Cardon, M. S., Sudek, R., White, T. D., & Brooks, W. T. (2016). Drawn to the fire: the role of passion, tenacity and inspirational leadership in angel investing. Journal of Business Venturing, 31(4), 468–484. https://doi.org/10.1016/j.jbusvent.2016.05.002.

Nambisan, S. (2016). Digital entrepreneurship: toward a digital technology perspective of entrepreneurship. Entrepreneurship Theory and Practice. https://doi.org/10.1111/etap.12254.

Nevin, S., Gleasure, R., O’Reilly, P., Feller, J., Li, S., & Cristoforo, J. (2017). Social identity and social media activities in equity crowdfunding. In Proceedings of the 13th International Symposium on Open Collaboration (p. 11). ACM.

Newbert, S. L., & Tornikoski, E. T. (2013). Resource acquisition in the emergence phase: considering the effects of embeddedness and resource dependence. Entrepreneurship Theory and Practice, 37(2), 249–280. https://doi.org/10.1111/j.1540-6520.2011.00461.x.

Nguyen, T. V., & Rose, J. (2009). Building trust—evidence from Vietnamese entrepreneurs. Journal of Business Venturing, 24(2), 165–182. https://doi.org/10.1016/j.jbusvent.2008.03.004.

Nixon, D. C., Howard, R. M., & DeWitt, J. R. (2002). With friends like these: rule-making comment submissions to the securities and exchange commission. Journal of Public Administration Research and Theory, 12(1), 59–76.

Olivera, F., Goodman, P. S., & Tan, S. S.-L. (2008). Contribution behaviors in distributed environments. MIS Quarterly, 32(1), 23–42. https://doi.org/10.2307/25148827.

Orlikowski, W. J. (2002). Knowing in practice: enacting a collective capability in distributed organizing. Organization Science, 13(3), 249–273.

Palmer, J. W. (2002). Web site usability, design, and performance metrics. Information Systems Research, 13(2), 151–167. https://doi.org/10.1287/isre.13.2.151.88.

Piva, E., & Rossi-Lamastra, C. (2018). Human capital signals and entrepreneurs’ success in equity crowdfunding. Small Business Economics, 51(3), 667–686, 2018. https://doi.org/10.1007/s11187-017-9950-y

Pollack, J. M., & Bosse, D. A. (2014). When do investors forgive entrepreneurs for lying? Journal of Business Venturing, 29(6), 741–754. https://doi.org/10.1016/j.jbusvent.2013.08.005.

Ramanathan, S., & Dhar, S. K. (2010). The effect of sales promotions on the size and composition of the shopping basket: regulatory compatibility from framing and temporal restrictions. Journal of Marketing Research, 47(3), 542–552.

Rawhouser, H., Cummings, M. E., & Crane, A. (2015). Benefit corporation legislation and the emergence of a social hybrid category. California Management Review, 57(3), 13–35. https://doi.org/10.1525/cmr.2015.57.3.1.

Rawhouser, H., Villanueva, J., & Newbert, S. L. (2017). Strategies and tools for entrepreneurial resource access: a cross-disciplinary review and typology. International Journal of Management Reviews, 19(4), 473–491. https://doi.org/10.1111/ijmr.12105.

Rawhouser, H., Cummings, M., & Newbert, S. L. (2018). Social impact measurement: current approaches and future directions for social entrepreneurship research. Entrepreneurship Theory and Practice. https://doi.org/10.1177/1042258717727718.

Rezaee, Z. (2005). Causes, consequences, and deterence of financial statement fraud. Critical Perspectives on Accounting, 16(3), 277–298.

Rosenbusch, N., Brinckmann, J., & Müller, V. (2013). Does acquiring venture capital pay off for the funded firms? A meta-analysis on the relationship between venture capital investment and funded firm financial performance. Journal of Business Venturing, 28(3), 335–353. https://doi.org/10.1016/j.jbusvent.2012.04.002.

Rossi, A., & Vismara, S. (2018). What do crowdfunding platforms do? A comparison between investment-based platforms in Europe. Eurasian Business Review, 8(1), 93–118. https://doi.org/10.1007/s40821-017-0092-6.

Scarbrough, H., Swan, J., Amaeshi, K., & Briggs, T. (2013). Exploring the role of trust in the deal-making process for early-stage technology ventures. Entrepreneurship Theory and Practice, 37(5), 1203–1228.

SEC (2016a). Regulation crowdfunding: a small entity compliance guide for issuers. https://www.sec.gov/info/smallbus/secg/rccomplianceguide-051316.htm.

SEC (2016b). Final rule: regulation crowdfunding - adopting release. https://www.sec.gov/rules/final/2015/33-9974.pdf

Sen, S., Bhattacharya, C. B., & Korschun, D. (2006). The role of corporate social responsibility in strengthening multiple stakeholder relationships: a field experiment. Journal of the Academy of Marketing Science, 34(2), 158–166.

Signori, A., & Vismara, S. (2018). Does success bring success? The post-offering lives of equity-crowdfunded firms. Journal of Corporate Finance, 50, 575–591.

Smith, J. A., & Osborn, M. (2004). Interpretative phenomenological analysis. In G. M. Breakwell (Ed.), Doing social psychology research (pp. 229–254). Leicester: British Psychological Society.

Simon, H. A. (1957). Models of man; social and rational. Oxford: Wiley.

Simonsohn, U., & Ariely, D. (2008). When rational sellers face nonrational buyers: evidence from herding on eBay. Management Science, 54(9), 1624–1637.

Sorenson, O., & Stuart, T. E. (2001). Syndication networks and the spatial distribution of venture capital investments. American Journal of Sociology, 106(6), 1546–1588.

Spence, M. (1973). Job market signaling. The Quarterly Journal of Economics, 87(3), 355–374.

Starr, J. A., & MacMillan, I. C. (1990). Resource cooptation via social contracting: resource acquisition strategies for new ventures. Strategic Management Journal, 11, 79–92.

Suddaby, R. (2006). From the editors: what grounded theory is not on JSTOR. Academy of Management Journal, 49(4), 633–642.

Talbot, D., & Boiral, O. (2018). GHG reporting and impression management: an assessment of sustainability reports from the energy sector. Journal of Business Ethics, 147(2), 367–383. https://doi.org/10.1007/s10551-015-2979-4.

Torres, L. H. (2007). Citizen sourcing in the public interest. Knowledge Management for Development Journal, 3(1), 134–145.

Van de Ven, A. H. (2007). Engaged scholarship: a guide for organizational and social research. Oxford University Press on Demand.

Venkatesh, V., Shaw, J. D., Sykes, T. A., Wamba, S. F., & Macharia, M. (2017). Networks, technology, and entrepreneurship: a field quasi-experiment among women in rural India. Academy of Management Journal, 60(5), 1709–1740. https://doi.org/10.5465/amj.2015.0849.

Verwaal, E., Bruining, H., Wright, M., Manigart, S., & Lockett, A. (2010). Resources access needs and capabilities as mediators of the relationship between VC firm size and syndication. Small Business Economics, 34(3), 277–291.

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46(4), 579–590. https://doi.org/10.1007/s11187-016-9710-4.

Vismara, S. (2018). Information cascades among investors in equity crowdfunding. Entrepreneurship Theory and Practice, 42(3), 467–497. https://doi.org/10.1111/etap.12261.

Vismara, S., Paleari, S., & Ritter, J. R. (2012). Europe’s second markets for small companies. European Financial Management, 18(3), 352–388.

Vismara, S., Benaroio, D., & Carne, F. (2017). Gender in entrepreneurial finance: Matching investors and entrepreneurs in equity crowdfunding. In A. Link (Ed.), Gender and entrepreneurial activity (pp. 271–288). Cheltenham: Edward Elgar.

Vulkan, N., Åstebro, T., & Sierra, M. F. (2016). Equity crowdfunding: a new phenomena. Journal of Business Venturing Insights, 5, 37–49.

Walthoff-Borm, X., Schwienbacher, A., & Vanacker, T. (2018). Equity crowdfunding: first resort or last resort? Journal of Business Venturing, 33(4), 513–533. https://doi.org/10.1016/j.jbusvent.2018.04.001.

Warburton, D., Wilson, R., & Rainbow, E. (2006). Making a difference: a guide to evaluating public participation in central government. London: Involve.

Welch, I. (1992). Sequential sales, learning, and cascades. The Journal of Finance, 47(2), 695–732.

Wilson, J. M., Straus, S. G., & McEvily, B. (2006). All in due time: the development of trust in computer-mediated and face-to-face teams. Organizational Behavior and Human Decision Processes, 99(1), 16–33. https://doi.org/10.1016/j.obhdp.2005.08.001.

Wright, M., & Zahra, S. (2011). The other side of paradise: examining the dark side of entrepreneurship. Entrepreneurship Research Journal, 1(3). https://doi.org/10.2202/2157-5665.1043.

Zaheer, S., Albert, S., & Zaheer, A. (1999). Time scales and organizational theory. The Academy of Management Review, 24(4), 725–741.

Zhang, J., Soh, P., & Wong, P. (2010). Entrepreneurial resource acquisition through indirect ties: compensatory effects of prior knowledge. Journal of Management, 36(2), 511–536.

Zhao, E. Y., & Wry, T. (2016). Not all inequality is equal: deconstructing the societal logic of patriarchy to understand microfinance lending to women. Academy of Management Journal, 59(6), 1994–2020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cummings, M.E., Rawhouser, H., Vismara, S. et al. An equity crowdfunding research agenda: evidence from stakeholder participation in the rulemaking process. Small Bus Econ 54, 907–932 (2020). https://doi.org/10.1007/s11187-018-00134-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-018-00134-5