Abstract

This paper surveys models of markets in which only some consumers are “savvy”. I discuss when the presence of savvy consumers improves the deals available to all consumers (the case of search externalities), and when the non-savvy consumers fund generous deals for all consumers (ripoff externalities). I also discuss when the two groups of consumers have aligned or divergent views about market interventions. The analysis focusses on two kinds of models: (1) an indivisible product in a market with price dispersion; and (2) products that involve add-on pricing.

Similar content being viewed by others

Notes

However, as illustrated in Sect. 2.3, there are situations in which replacing a population of savvy buyers with a population of non-savvy buyers will make buyers better off. There are also cases where the two kinds of consumer obtain the same surplus. (As in Sect. 3.1, this is the case when all sellers offer the same single deal.)

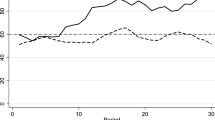

For instance, in Sect. 3.3 it may be that \(V_{N}\) increases with \(\sigma \) while \(V_{S}\) decreases with \(\sigma \).

The headline of the UK’s Daily Telegraph on 9 July 2014 was “Savvy shoppers force down prices”.

See Salop and Stiglitz (1977) for closely related analysis. (This paper appears to have introduced the term “ripoff” into the academic economic literature.)

This behaviour might occur if a consumer’s cost of search is very convex, in the sense that a consumer can visit one seller for free but finds it too costly ever to visit a second seller. A fraction \(\sigma \) are informed of each seller’s price, while the remaining \(1-\sigma \) consumers are informed of no price. An alternative interpretation of this inert behaviour is that \( 1-\sigma \) consumers are strategically naive, and mistakenly believe that competition ensures the “law of one price” operates and all sellers offer the same price.

Armstrong and Zhou (2011, section 1) extend this model of price dispersion so that, instead of purchasing from a random seller, a sales intermediary steers the non-savvy consumers towards a supplier of his choice if given an incentive by that supplier to do so. (The savvy consumers are immune to the salesman’s patter, observe the full list of retail prices, and buy from the cheapest supplier.) In equilibrium, there is a positive relationship between a supplier’s choice of retail price and per-sale commission, and non-savvy consumers buy the most expensive product. One can show that the search externality is present in this market, and savvy consumers who are able to withstand sales pressure benefit all consumers in this market for advice.

Brown and Goolsbee (2002) find evidence consistent with this, when they observe that price dispersion rises when the use of price comparison websites increases from a low level, and then decreases as their use becomes more widespread.

See Morgan et al. (2006) for further discussion of the impact of changing \(\sigma \) and n on payoffs to consumers. These authors also conduct an experiment, where human sellers face computer consumers, which exhibits the model’s predictions quite closely.

Even if (2) has a solution, it is always an equilibrium for all consumers to remain uninformed. When no one is informed, all consumers obtain the same (bad) deal in the market, and there is no point for an individual consumer to acquire information about the range of available deals.

Aggregate consumer surplus when \(\sigma \) consumers become informed is \( \sigma (V_{S}(\sigma )-\kappa )+(1-\sigma )V_{N}(\sigma )\), which is strictly increasing in \(\sigma \) at any point that satisfies (2). For this reason, Armstrong et al. (2009, section 3.2) observe that the introduction of a “do not call” database, which enables consumers to opt out of intrusive telemarketing, could make consumers worse off once the impact on equilibrium prices is taken into account.

To take an extreme example, if all consumers have a relatively high information acquisition cost \(\kappa =\frac{1}{5}\), then by examining Figs. 1 or 2 we see that the only equilibrium with duopoly involves no consumers becoming informed, in which case all consumers are charged the monopoly price and obtain no surplus. However, with four suppliers, the maximum gap between \(V_{S}\) and \(V_{N}\) is greater than \(\kappa \), and a stable equilibrium with \(\sigma \approx 0.975\) emerges where all consumers obtain surplus (net of search cost where relevant) of about 0.78. A contrasting effect is discussed in Spiegler (2011, p. 150): when a consumer is faced with a greater number of suppliers, she may suffer from “choice overload”, with the result that fewer consumers are savvy.

Knittel and Stango (2003) examine the credit card market in the United States in the period 1979–89, during which usury laws in some states put a ceiling on permitted interest rates. In their Table 3 they show how, for much of this period, average interest rates were higher in those states with a ceiling, and interpret this as evidence that price caps can encourage tacit collusion via a policy-induced focal point. The (static) search model presented in the text provides an alternative explanation for why a price cap might lead to high prices.

Several papers provide evidence of consumer confusion due to the way in which prices are presented. For instance, Clerides and Courty (2015) observe empirically that the same brand of detergent is sold in two sizes, where the large size contains twice as much as the smaller. Sometimes the large size is more than twice as expensive as the smaller, and yet significant numbers of consumers still buy it. An example of a tariff which may be difficult for some consumers to compare with rival tariffs is described in the Royal Mail’s“handy guide” to its prices—see www.royalmail.com/sites/default/files/RM_OurPrices_Dec2014 (visited 26 January 2015). This determines the price for delivering a parcel as a function of four physical characteristics (length, width, depth and weight). For instance, a specific price applies for international delivery of a parcel with “Height + Width + Depth no greater than 90 cm with no single side longer than 60 cm, Weight up to 2 kg”.

This discussion is based on Piccione and Spiegler (2012) and Chioveanu and Zhou (2013). Wilson (2010) takes a different approach. In his model, two sellers compete to supply a homogenous product, and each seller can choose the cost that consumers incur to discover its price. A fraction of consumers can understand prices without cost, regardless of seller strategies, while the search cost of the remaining consumers is affected by obfuscation strategies. (All consumers can observe each seller’s obfuscation strategy from the start.) Wilson shows that in equilibrium one seller chooses a high search cost in order to relax subsequent price competition.

If sellers choose their format first, and subsequently choose price, in this model the most profitable subgame-perfect equilibrium involves the two sellers choosing distinct formats for sure, since whenever they have the same format their profits will fall to zero.

Alternatively, it may be that when consumers find it hard to compare the sellers’ offers they exit the market instead of buying randomly. If so, this could discipline unregulated sellers to present their offers in a comparable format. (See Crosetto and Gaudeul (2014) for an experimental test of this possibility.)

Baye and Morgan (2002) consider a model in which sellers must pay to list on a price comparison website, and can charge different prices on this website and when they sell direct to consumers. They find that sellers choose whether to list on the website according to a mixed strategy, and if they do list the price is also chosen according to a mixed strategy. Sellers obtain positive profits there because of the possibility they are the sole listing seller. A seller’s price on the comparison website is lower than its price on its own platform.

This is similar to the previous discussion about confusing tariffs, except that here customers of the same seller can pay different prices for the product. Miravete (2013) documents when a seller offers a tariff which is dominated by other tariffs it offers—which he terms “foggy pricing”—in mobile telephony.

See Schultz (2005) for this analysis, as well as its extension to a market with horizontally differentiated products. Petrikaite (2014) analyzes an alternative model in which consumers become informed about prices and valuations by searching sequentially through their options. She finds that an increase in the cost of search—i.e., a reduction in market transparency—usually makes collusion easier to achieve.

This model with extreme horizontal differentiation is formally similar to Spiegler (2006).

I assume the product is such that if a non-savvy consumer discovers ex post that her chosen product is unsuitable, she does not return to the market to try her luck with the other product. (For instance, she discovers how much she likes the bottle of wine only when she sits down to dinner.) Likewise, I assume that a non-savvy consumer cannot, or has no incentive to, buy from both sellers in advance as a precaution against one of the products being unsuitable. (This purchasing strategy might be optimal when both seller’s prices are low. However, this possibility can be eliminated by introducing a production cost into the model.)

If condition (5) does not hold, the non-savvy are excluded from the market altogether and sellers can only generate profit from savvy consumers. Over this range, there are no externalities across consumers.

Since consumers in their model buy after discovering their match utility, i.e., the model is one with search goods rather than experience goods, the complexities mentioned in footnote 25 are avoided.

Shapiro (1995) discusses four potential sources of market failure in aftermarkets, including a lack of ability to commit to future prices and the presence of consumers who are poorly informed or myopic about future prices. My focus in this section is on the latter possibility. In other markets, it might be that add-on prices are more easily observed than is the core price. For example, consumers might know that an airline does not charge for stowing luggage in the hold, but have to invest effort to discover the airfare for the particular route. In such cases, the outcome might be that equilibrium add-on prices are low.

This elastic demand for the add-on service could be generated if each consumer has a unit demand for the add-on with incremental valuation v, and the probability that v is above p is q(p). With this interpretation, the realization of v is not known to the consumer (even a savvy consumer) until after she buys the core product.

For instance, if \(q(p)=1-p\) and \(C=c=0\), the second-order condition is satisfied for all \(\sigma \) and t.

As Shapiro (1995, p. 493) puts it: “Poorly informed buyers may be protected by informed buyers, whose presence forces sellers to compete on a [total cost of ownership] basis and penalizes sellers with high aftermarket charges, especially since it may be difficult for sellers to identify the poorly informed buyers so as to price discriminate against them.”

These are known as “wary beliefs”, following McAfee and Schwartz (1994). By contrast, with “passive beliefs” a consumer’s anticipated add-on price does not depend on the seller’s choice of core price. Passive beliefs are perhaps less plausible in this context, since if a seller deviates in its core price and rational-but-uninformed consumers do not change their beliefs about the add-one price, the seller in fact has an incentive to deviate in both prices. Nevertheless, it is considerably easier to solve models with passive than wary beliefs. (In this context, if the rational consumers had passive beliefs, the outcome is exactly as just described in the Hotelling model with naive consumers.)

Ellison (2005) presents an alternative Hotelling model of add-on pricing, where consumers vary in both their transport cost parameter t and their value for the add-on product. (Consumers with higher value for the add-on have stronger brand preferences.) He analyzes two games: one where the two firms reveal both of their prices ex ante and another where neither firm reveals its add-on price until consumers buy the core product. Using the current notation, these two cases correspond to situations with \(\sigma =1\) and \(\sigma =0\) respectively. In his model, industry profits are higher when no consumer is informed of add-on prices, in contrast to the model presented in the text.

Scitovsky (1950, p. 50) made this point long ago: “the ignorant buyer’s habit of judging quality by price weakens […] price competition. […] In such markets a price change will lead few buyers to transfer their customer from one producer to another. Hence, the price elasticity of demand will be low in such markets.”

For example, some people may underestimate the costs of owning a dog (in terms of dog food, say), while others accurately forecast such costs. If the market for dog food is competitive, the price for a dog is not subsidized by aftermarket profits, and does not depend on the fraction of savvy types in the market.

Ignoring transport costs, a savvy consumer’s net surplus with the savvy contract is \(s(c)-(C+t)\), while her net surplus with the naive contract is \( s(p^{M})-(C+t-\pi (p^{M}))\), and the latter is smaller since add-on welfare \( s(\cdot )+\pi (\cdot )\) is maximized at \(p=c\).

We can think of sellers each offering a menu of contracts, or separate sellers each offering a single contract. In the latter case we require at least four sellers, so that there are at least two sellers which offer savvy contracts and two which offer naive contracts.

This distinction did not matter with the previous Hotelling model, since naive consumers purchased from one seller or the other regardless of their anticipated surplus from the aftermarket.

See Grubb (2015b) for an account of policy interventions when consumers have biased beliefs.

Spiegler (2006) presents a model in which a number of “experts” provide advice which in fact has no value, but naive consumers are willing to purchase this advice if they hear from another consumer that a seller’s advice “worked”. If the model was extended to include a number of savvy consumers who understood the nature of the advice, such consumers would never purchase advice and their presence would have no impact on the deals offered to the naive.

See Sandroni and Squintani (2007) for a model along these lines.

See Landier and Thesmar (2009).

Gabaix and Laibson (2006) is perhaps the first and most prominent paper which discusses this phenomenon (See also Ellison (2005, sect. V.C)). Their approach differs slightly from that presented here. They suppose that a seller decides whether to advertise or to “shroud” its add-on price. When a seller advertises its price, this acts as an “eye-opener” and consumers realize they will have to pay the charge unless they take evasive action in advance. If sellers decide to shroud, they will choose monopolistic terms for the add-on. Savvy consumers anticipate this incentive, and take evasive action, while naive types do not. In many cases, an equilibrium exists in which all sellers shroud their add-on price, and naive consumers end up paying it. See Köszegi (2015, sec. 6) for a detailed survey of models of this sort.

At the time of writing, Ryanair charges £70 to check in at the airport. See www.ryanair.com/en/fees for details (visited 21 May, 2014).

Armstrong and Vickers (2012) discuss unauthorized overdraft fees in the UK, which help fund the prevailing “free if in credit” charging model for bank accounts. (In 2006, about 30 % of current account revenue came from these charges.) About 75 % of account holders did not pay these fees, while 1.4 million customers paid more than £500 in such fees in 2006. The great majority of customers say they do not consider the level of these charges when choosing their bank, and few of those who paid these charges in 2006 anticipated beforehand having to pay them.

See Grubb (2015a) for analysis of this form of bill shock, and the possible interventions to overcome the problem.

For instance, CMA (2015, para. 104) suggests that when major UK energy suppliers set “the price of a cheap non-standard product […] they assume that a certain proportion of customers will revert to the [standard variable tariff] (for which there is a bigger margin) at the end of the product’s fixed term. [The suppliers] have argued that it is only because this happens that they can offer the cheapest of their non-standard products.”

Even the consumer rights body in the UK, Which?, employs this tactic. One can sign up for one month’s service for just £1, which is automatically rolled-over for £10.75 each month until cancelled. See www.which.co.uk/signup for further details (visited 21 May 2014).

If R is large enough, the price in (11) is negative. If a negative price is not feasible, the outcome is then that the product is offered for free, and the firm’s costs are covered entirely by exploiting the naive. Sellers are then less able to dissipate profits, and profits may be positive even in a competitive market. In these cases, sellers as well as savvy consumers can have an incentive to lobby against constraints on ripoffs. However, in the credit card and banking contexts, it may be possible for sellers in effect to set a negative price for their product. For example, “cashback” contracts (where a consumer is paid by her credit card for each transaction) or current accounts which pay interest to customers have this flavour.

See Spiegler (2011, sec. 8.3) and the references listed there for further discussion of markets when consumers have limited understanding of adverse selection.

See Anderson and Renault (2006) for a model which makes use of this insight.

References

Akerlof, G. (1970). The market for lemons: Quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84(3), 488–500.

Anderson, S., & Renault, R. (2000). Consumer information and firm pricing: Negative externalities from improved information. International Economic Review, 41(3), 721–742.

Anderson, S., & Renault, R. (2006). Advertising content. American Economic Review, 96(1), 93–113.

Armstrong, M. (2008). Interactions between competition and consumer policy. Competition Policy International, 4(1), 97–147.

Armstrong, M., & Vickers, J. (2012). Consumer protection and contingent charges. Journal of Economic Literature, 50(2), 477–493.

Armstrong, M., Vickers, J., & Zhou, J. (2009). Consumer protection and the incentive to become informed. Journal of the European Economic Association, 7(2–3), 399–410.

Armstrong, M., & Zhou, J. (2011). Paying for prominence. Economic Journal, 121(556), F368–395.

Baye, M., & Morgan, J. (2002). Information gatekeepers and price discrimination on the internet. Economics Letters, 76(1), 47–51.

Bronnenberg, B., Dub, J.-P., Gentzkow, M., & Shapiro, J. (2015). Do pharmacists buy Bayer? Informed shoppers and the brand premium. Quarterly Journal of Economics (forthcoming).

Brown, J., & Goolsbee, A. (2002). Does the internet make markets more competitive? Evidence from the life insurance industry. Journal of Political Economy, 110(3), 481–507.

Burdett, K., & Judd, K. (1983). Equilibrium price dispersion. Econometrica, 51(4), 955–969.

Chioveanu, I., & Zhou, J. (2013). Price competition with consumer confusion. Management Science, 59(11), 2450–2469.

Clerides, S., & Courty, P. (2015). Sales, quantity surcharge, and consumer inattention. Review of Economics and Statistics (forthcoming).

CMA. (2015). Energy market investigation: Provisional findings report. London: Competition and Markets Authority.

Coase, R. (1972). Durability and monopoly. Journal of Law and Economics, 15(1), 143–149.

Crosetto, P., & Gaudeul, A. (2014). Choosing whether to compete: Price and format competition with consumer confusion. Jena Economic Research Papers 2014-026.

DellaVigna, S., & Malmendier, U. (2004). Contract design and self-control: Theory and evidence. Quarterly Journal of Economics, 119(2), 353–402.

Diamond, P. (1971). A model of price adjustment. Journal of Economic Theory, 3(2), 156–168.

Ellison, G. (2005). A model of add-on pricing. Quarterly Journal of Economics, 120(2), 585–637.

Fershtman, C., & Fishman, A. (1994). The perverse effects of wage and price controls in search markets. European Economic Review, 38(5), 1099–1112.

Gabaix, X., & Laibson, D. (2006). Shrouded attributes, consumer myopia, and information suppression in competitive markets. Quarterly Journal of Economics, 121(2), 505–540.

Grossman, S., & Stiglitz, J. (1980). On the impossibility of informationally efficient markets. American Economic Review, 79(3), 393–408.

Grubb, M. (2015a). Consumer inattention and bill-shock regulation. Review of Economic Studies, 82(1), 219–257.

Grubb, M. (2015b). Overconfident consumers in the marketplace. Journal of Economic Perspectives (forthcoming).

Knittel, C., & Stango, V. (2003). Price ceilings as focal points for tacit collusion: Evidence from credit cards. American Economic Review, 93(5), 1703–1729.

Köszegi, B. (2015). Behavioral contract theory. Journal of Economic Literature, 52(4), 1075–1118.

Landier, A., & Thesmar, D. (2009). Financial contracting with optimistic entrepreneurs. Review of Financial Studies, 22(1), 117–150.

McAfee, R. P., & Schwartz, M. (1994). Opportunism in multilateral vertical contracting: Nondiscrimination, exclusivity and uniformity. American Economic Review, 84(1), 210–230.

Milgrom, P. (1981). Good news and bad news: Representation theorems and applications. Bell Journal of Economics, 12(2), 380–391.

Miravete, E. (2013). Competition and the use of foggy pricing. American Economic Journal: Microeconomics, 5(1), 194–216.

Morgan, J., Orzen, H., & Sefton, M. (2006). An experimental study of price dispersion. Games and Economic Behavior, 54(1), 134–158.

Petrikaite, V. (2014). Collusion with costly consumer search, mimeo, University of Groningen.

Piccione, M., & Spiegler, R. (2012). Price competition under limited comparability. Quarterly Journal of Economics, 127(1), 97–135.

Salop, S., & Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. Review of Economic Studies, 44(3), 493–510.

Sandroni, A., & Squintani, F. (2007). Overconfidence, insurance and paternalism. American Economic Review, 97(5), 1994–2004.

Schultz, C. (2005). Transparency on the consumer side and tacit collusion. European Economic Review, 49(2), 279–297.

Scitovsky, T. (1950). Ignorance as a source of oligopoly power. American Economic Review, 40(2), 48–53.

Shapiro, C. (1995). Aftermarkets and consumer welfare: Making sense of Kodak. Antitrust Law Journal, 62(2), 484–511.

Spiegler, R. (2006). The market for quacks. Review of Economic Studies, 73(4), 1113–1131.

Spiegler, R. (2011). Bounded rationality and industrial organization. Oxford: Oxford University Press.

Varian, H. (1980). A model of sales. American Economic Review, 70(4), 651–659.

Wilson, C. (2010). Ordered search and equilibrium obfuscation. International Journal of Industrial Organization, 28(5), 496–506.

Author information

Authors and Affiliations

Corresponding author

Additional information

Early versions of this paper were presented to the 2013 Annual Meeting of German Economic Association in Düsseldorf and to the 2014 conference on Industrial Organization: theory, empirics and experiments organized by the University of Salento. I am grateful for discussions on this topic to Kyle Bagwell, Renaud Foucart, Michael Grubb, Andrew Rhodes, Tom Ross, Marius Schwartz, Rani Spiegler, Vic Tremblay, John Vickers, Larry White, and Jidong Zhou.

Appendix

Appendix

Details for the model presented in Sect. 2.3: There are two kinds of equilibria to consider: those where sellers only ever serve the savvy consumers, and those where sellers sometimes serve non-savvy consumers.

First, look for an equilibrium where the minimum price satisfies \(p_{\min }>\alpha v\), so that non-savvy consumers never participate in the market. As discussed in the main text, the equilibrium profit for a seller is \(\sigma \alpha v(1-\alpha )\). If a seller deviated and instead set the lower price \( p=\alpha v\) it would sell to \(1-\sigma +\sigma \alpha \) consumers, and so obtain profit \(\alpha v[1-\sigma +\alpha \sigma ]\). For this deviation to be unprofitable we require \(\sigma \alpha v(1-\alpha )\ge \alpha v[1-\sigma +\alpha \sigma ]\), i.e., that condition (5) in the main text is violated. The CDF for a seller’s mixed strategy for price, F, satisfies

which does not depend on \(\sigma \). The minimum price in the support, which makes \(F=0\), is therefore

which given that (5) is violated is indeed greater than \( \alpha v\). Here, the support of prices is \([p_{\min },v]\), which has no gap. Subject to \(\sigma \) remaining outside the range (5), prices do not depend on \(\sigma \) and there is neither a search nor a ripoff externality present.

Next, look for an equilibrium where the minimum price satisfies \(p_{\min }<\alpha v\), so that non-savvy consumers are sometimes served. In this case, the price support will consist of two disjoint segments, with a gap in between, so that the support takes the form \([p_{\min },\alpha v]\cup [p^{*},v]\) where \(p^{*}>\alpha v\). Again, a seller obtains equilibrium profit \(\sigma \alpha v(1-\alpha )\), and so \(p_{\min }\) satisfies

which indeed implies that \(p_{\min }\le \alpha v\) when (5) holds. The CDF for a seller’s mixed strategy for price, F, again satisfies (12) in the upper segment \([p^{*},v]\), while in the lower segment \([p_{\min },\alpha v]\) it satisfies

Since \(F(\alpha v)=F(p^{*})\), expression (13) implies that

so that the probability a seller caters only to the savvy, \(1-F(p^{*})\), is

(Note that \(1-F(p^{*})=1\) when (5) just binds, while \( 1-F(p^{*})=0\) when \(\sigma =0\).) It follows from (12) that \(p^{*}\) satisfies

which lies between \(\alpha v\) and v. This completes the derivation of the equilibrium.

Note that \(p^{*}\) in (14) decreases with \(\sigma \). Moreover, one can check that F in (13) decreases with \(\sigma \). This implies that a seller’s price weakly increases with \(\sigma \) in the sense of first-order stochastic dominance. (If (5) does not hold, F does not depend on \(\sigma \), while if (5) holds prices strictly increase with \(\sigma \).) Because of this, a consumer of either type is weakly better off when \(\sigma \) falls, and a ripoff externality is present.

Details for the model with rational consumers presented in Sect. 3.1: Given \(\sigma \), suppose that \((P^{*},p^{*})\) is the equilibrium price pair in this market, and write \( U=s(p^{*})-P^{*}\) for consumer surplus gross of transport costs in this equilibrium. Suppose one seller considers choosing the price pair (P, p) , while its rival plays the equilibrium strategy \((P^{*},p^{*})\). Savvy consumers see both of this seller’s prices, and so the fraction of them who buy from it is

Non-savvy consumers do not observe p, and form rational expectations about this price given P. Suppose they anticipate add-on price \(\hat{p}\), in which case the fraction of non-savvy who buy from the seller is

Similarly to expression (6), the seller’s total profit is therefore

Given P and \(\hat{p}\), the seller chooses its add-on price p to maximize this profit. For the non-savvy consumers to have rational expectations about the add-on price, we require that choosing \(p=\hat{p}\) maximizes profit in (15). This implies that the equilibrium add-on price given P satisfies the first-order condition

Given equilibrium surplus U, expression (16) characterizes the relationship off the equilibrium path between a seller’s core price and its rationally anticipated add-on price.

Note that if \(\sigma =0\), the equilibrium add-on price satisfies \(\pi ^{\prime }(p)=0\), so that \(p=p^{M}\) regardless of the core price P and the equilibrium add-on price is \(p^{*}=p^{M}\). At the other extreme, if \( \sigma =1\) the outcome as discussed in the text involves \(p^{*}=c, P^{*}=C+t\) and \(U=s(p^{*})-P^{*}\), which satisfies (16).

Expression (16) can be written as

where \(\eta (p)\equiv -pq^{\prime }(p)/q(p)\) is the elasticity of add-on demand (which is increasing given that q is logconcave). Since \(\eta \) is increasing, the left-hand side of (17) is decreasing with p (at least in the range \(c\le p\le p^{M}\)), while the right-hand side is increasing. Thus, there is a unique price p which solves (17). Since the left-hand side of (17) decreases with P, while the right-hand side is increasing with P, it follows that the equilibrium add-on price p is a decreasing function of P. Intuitively, when the seller undercuts the equilibrium core price, this reduces its incentive to gain market share from the savvy consumers with a low add-on price. For this reason, the market is less competitive when sellers face a mixed population of consumers.

If \(\sigma >0\), from (16) we can write the core price P which implements a given add-on price p as

The seller then chooses its add-on price p and associated core price P(p) to maximize its profit

The remaining condition is to ensure that U in (18–19) is the equilibrium level of consumer surplus, i.e., that \(U=s(p^{*})-P^{*}\). In sum, \((P^{*},p^{*})\) constitutes a symmetric equilibrium if:

- (1)

-

(2)

\(P^{*}=P(p^{*})\), and

-

(3)

\(U=s(p^{*})-P^{*}\).

It is hard to make further progress at this level of generality, and so I illustrate the analysis with the example where \(q(p)=1-p\) and \(C=c=0\), so that \(s(p)=\frac{1}{2}(1-p)^{2}, \pi (p)=p(1-p)\) and \(p^{M}=\frac{1}{2}\). Expression (18) then implies

Substituting this into profit (19) shows that the seller’s profit with add-on price p is

and the (relevant) first-order condition for maximizing this expression is that p satisfies

or

Given that \(U=\frac{1}{2}(1-p)^{2}-P\), expression (18) implies that

and substituting this value of U into (20) reveals that the equilibrium add-on price \(p^{*}\) given \(\sigma \) satisfies

When \(\sigma =0\), this expression has solution \(p^{*}=\frac{1}{2}\), while when \(\sigma =1\) the expression has solution \(p^{*}=0\). From (22), we can write the \(\sigma \) which implements a given add-on price \( p^{*}\in [0,\frac{1}{2}]\) as

Unless t is very small indeed (below 0.01 or so), the above expression decreases with \(p^{*}\) in the range \(p^{*}\in [0,\frac{1}{2}]\) , and so there is a one-to-one decreasing relationship between \(\sigma \) and the equilibrium add-on price \(p^{*}\). When \(\sigma \) satisfies (23), equilibrium consumer surplus with add-on price \(p^{*}\), which is U in (21), simplifies to

This is “U-shaped” in \(p^{*}\) in the relevant range \(p\in [0,\frac{1}{2}]\), and hence U-shaped as a function of \(\sigma \). This market has a ripoff externality when the initial \(\sigma \) is small, while for large \(\sigma \) the market has a search externality. However, consumer surplus when \(\sigma =1\) (i.e., when \(p=0\)) is above that when \(\sigma =0\), i.e., when \(p=\frac{1}{2}\). Likewise, industry profit when the equilibrium add-on price is \(p^{*}, P(p^{*})+\pi (p^{*})\), in this example is

which is hump-shaped in \(p^{*}\). Thus, industry profit is maximized with a mixed population of consumers, rather than when all consumers are savvy or all are non-savvy. It is hard analytically to invert expression (23) to obtain the add-on price \(p^{*}\) as an explicit function of \( \sigma \). It is straightforward to do this numerically, however, and Table 1 in the text reports outcomes for a range of \(\sigma \) when \(t=1\).

Rights and permissions

About this article

Cite this article

Armstrong, M. Search and Ripoff Externalities. Rev Ind Organ 47, 273–302 (2015). https://doi.org/10.1007/s11151-015-9480-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-015-9480-1