Abstract

This study provides a rigorous empirical comparison of structural and reduced-form credit risk frameworks. The literature differentiates between structural models that are based on modeling of the evolution of the balance sheet of the issuer, and reduced-form models that specify credit risk exogenously by a hazard rate process. Until now, there has been no common agreement in academia and practice on which model framework better captures credit risk. As major difference we focus on the discriminative modeling of the default time. In contrast to the previous literature, we calibrate both approaches to the same data set, apply comparable estimation techniques, and assess the out-of-sample prediction quality on the same time series of credit default swap prices. As our empirical implementations of both approaches rely on the same market information we are able to judge whether empirically the model structure itself makes an important difference. Interestingly, our study shows that the models’ prediction power are quite close on average indicating that for pricing purposes the modeling type does not greatly matter compared to the input data used. Still, the reduced-form approach outperforms the structural for investment-grade names and longer maturities. In contrast the structural approach performs better for shorter maturities and sub-investment grade names.

Similar content being viewed by others

Notes

However, Nashikkar et al. (2011) show that the CDS spreads might not fully capture the credit risk due to frictions in the arbitrage between the CDS and the bond market.

i.e., The firm recovers a fraction of an otherwise identical default free security. Note that in the seminal work of Merton (1974) the magnitude of default is determined endogenously from the relation between the firm value and the promised payments to the debtor. In contrast, more recent structural models and most empirical implementations relax this elegant though restrictive relation stemming from the option analogy. In this sense recent structural models including the one we are focussing on feature some kind of hybrid character. Concerning the recovery assumption, Zhang (2010) has recently shown that the risky debt data better fits to the recovery of treasury model, among other possible recovery assumptions. In a comparison of the most typical recovery types, Zhang finds that the recovery of treasury model reduces the dispersion of pricing errors best.

Collin-Dufresne and Goldstein (2001) first proposed this dynamics in the context of structural models.

For models with endogenously derived default boundaries, see the empirical study of Anderson and Sundaresan (2000).

Collin-Dufresne and Goldstein (2001) have a most general version, where the drift of the log-default threshold can be taken as a decreasing function of the spot interest rate to reflect that debt issuances drop during high interest rate periods.

See Duffie and Singleton (1999).

See Geman et al. (1995).

Gündüz et al. (2007) note that the smaller the set of deliverable bonds, the lower the delivery option, which reflects the extra premium for the buyer of CDS for the privilege of being able to deliver any bond in case of default. Recently, Jankowitsch et al. (2008) have analyzed the delivery option embedded in CDS prices.

In order to simplify notation, the firm-specific index \(i\) was not indicated, which otherwise should have been written as \(\kappa _l^{i},\theta _l^{i}\) where \(i=1,\ldots ,30\).

Although not documented, an alternative version of the intensity model has also been tested in our runs. This model estimated the \(a\) and \(c\) parameters common to all firms, instead of individual estimation. The out-of-sample prediction results were inferior to both the firm-specific intensity setup and the structural model.

Chen et al. (2009) show that a countercyclical nature of defaults, e.g. through a countercyclical default boundary, generates a better matching of historical and model-implied results. To include the business cycle impact in the risk-neutral drift rate, Huang and Yildirim (2008) extend the Collin-Dufresne and Goldstein model’s interest rate environment to a regime-switching setting.

For a comprehensive comparison of CDS-implied and actual default probabilities, see Berndt et al. (2005).

This analysis is available from the authors upon request.

Duffee (1999) finds that under the risk-neutral measure an explosive latent factor is needed to capture the steeply upward-sloping spread curves especially for low-rated firms. We thank the editor for making this point.

This analysis is available from the authors upon request.

References

Altman, E. I., & Kishore, V. M. (1996). Almost everything you wanted to know about recoveries on defaulted bonds. Financial Analysts Journal, 52, 57–64.

Anderson, R., & Sundaresan, S. (2000). A comparative study of structural models of corporate bond yields: An exploratory investigation. Journal of Banking & Finance, 24, 255–269.

Arora, N., Bohn, J. R., & Zhu, F. (2005). Reduced form versus structural models of credit risk: A case study of three models. Journal of Investment Management, 3, 43–67.

Babbs, S. H., & Nowman, K. B. (1999). Kalman filtering of generalized vasicek term structure models. Journal of Financial and Quantitative Analysis, 34, 115–130.

Bakshi, G., Madan, D., & Zhang, F. X. (2006). Investigating the role of systematic and firm-specific factors in default risk: Lessons from empirically evaluating credit risk models. Journal of Business, 79, 1955–1987.

Beck, N., & Katz, J. N. (1995). What to do (and not to do) with time-series cross-section data. American Political Sciences Review, 89, 634–647.

Berndt, A., Douglas, R., Duffie, D., Ferguson, M., & Schranz, D. (2005). Measuring default risk premia from default swap rates and EDFs. Bank for International Settlements, No. Working paper. 173.

Bhamra, H. S., Kühn, L., & Strebulaev, I. A. (2010). The aggregate dynamics of capital structure and macroeconomic risk. Review of Financial Studies, 23, 4187–4241.

Black, F., & Cox, J. C. (1976). Valuing corporate securities: Some effects on bond indenture provisions. Journal of Finance, 31, 351–368.

Blanco, R., Brennan, S., & Marsh, I. W. (2005). An empirical analysis of the dynamic relationship between investment-grade bonds and credit default swaps. Journal of Finance, 60, 2255–2281.

Chen, L., Collin-Dufresne, P., & Goldstein, R. S. (2009). On the relation between the credit spread puzzle and the equity premium puzzle. Review of Financial Studies, 22, 3367–3409.

Chen, R. R., Cheng, X., Fabozzi, F. J., & Liu, B. (2008). An explicit, multi-factor credit default swap pricing model with correlated factors. Journal of Financial and Quantitative Analysis, 43, 123–160.

Chen, R. R., Fabozzi, F. J., Pan, G. G., & Sverdlove, R. (2006). Sources of credit risk: Evidence from credit default swaps. Journal of Fixed Income, 16, 7–21.

Collin-Dufresne, P., & Goldstein, R. S. (2001). Do credit spreads reflect stationary leverage ratios? Journal of Finance, 56, 1929–1957.

Collin-Dufresne, P., Goldstein, R. S., & Martin, J. S. (2001). The determinants of credit spread changes. Journal of Finance, 56, 2177–2208.

Crosbie, P., & Bohn, J. (2003). Modeling default risk, white paper, Moody’s KMV.

Diebold, F. X., & Mariano, R. S. (1995). Comparing predictive accuracy. Journal of Business & Economic Statistics, 13, 253–263.

Driessen, J. (2005). Is default event risk priced in corporate bonds? Review of Financial Studies, 18, 165–195.

Duan, J. C., & Simonato, J. G. (1999). Estimating and testing exponential-affine term structure models by Kalman filter. Review of Quantitative Finance and Accounting, 13, 111–135.

Duffee, G. R. (1999). Estimating the price of default risk. Review of Financial Studies, 12, 197–226.

Duffie, D., & Singleton, K. J. (1999). Modeling term structures of defaultable bonds. Review of Financial Studies, 12, 687–720.

Eom, Y. H., Helwege, J., & Huang, J. (2004). Structural models of corporate bond pricing: An empirical analysis. Review of Financial Studies, 17, 499–544.

Ericsson, J., Jacobs, K., & Oviedo, R. (2009). The determinants of credit default swap premia. Journal of Financial and Quantitative Analysis, 44, 109–132.

Ericsson, J., Reneby, J., & Wang, H. (2008). Can structural models price default risk? Evidence from bond and credit derivative markets: Working paper, McGill University.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E. F., & French, K. R. (1996). Multifactor explanations of asset pricing anomalies. Journal of Finance, 51, 55–84.

Fama, E. F., & French, K. R. (2002). Testing trade-off and pecking order predictions about dividends and debt. Review of Financial Studies, 15, 1–33.

Fan, H., & Sundaresan, S. (2000). Debt valuation, renegotiations and optimal dividend policy. Review of Financial Studies, 13, 1057–1099.

Geman, H., El-Karoui, N., & Rochet, J. (1995). Change of numeraire, changes of probability measures and pricing of options. Journal of Applied Probability, 32, 443–458.

Geyer, A. L., & Pichler, S. (1999). A state space approach to estimate and test multifactor Cox-Ingersoll-Ross models of the term structure. Journal of Financial Research, 22, 107–130.

Gündüz, Y., Lüdecke, T., & Uhrig-Homburg, M. (2007). Trading credit default swaps via interdealer brokers. Journal of Financial Services Research, 32, 141–159.

Gündüz, Y., & Uhrig-Homburg, M. (2011). Predicting credit default swap prices with financial and pure data-driven approaches. Quantitative Finance, 11, 1709–1727.

Hackbarth, D., Miao, J., & Morellec, E. (2006). Capital structure, credit risk, and marcoeconomic conditions. Journal of Financial Economics, 82, 519–550.

Helwege, J., & Turner, C. M. (1999). The slope of the credit yield curve for speculative-grade issuers. Journal of Finance, 54, 1869–1884.

Houweling, P., & Vorst, T. (2005). Pricing default swaps: Empirical evidence. Journal of International Money and Finance, 24, 1200–1225.

Huang, H., & Yildirim, Y. (2008). Leverage, option liabilities, and corporate bond pricing. Review of Derivatives Research, 11, 245–276.

Huang, J., & H. Zhou, (2008). Specification analysis of structural credit risk models, working paper, AFA 2009 San Francisco Meetings.

Hull, J. C., Predescu, M., & White, A. (2004). The relation between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking & Finance, 28, 2789–2811.

Jankowitsch, R., Pullirsch, R., & Veza, T. (2008). The delivery option in credit default swaps. Journal of Banking & Finance, 32, 1269–1285.

Janosi, T., Jarrow, R., & Yildirim, Y. (2003). Estimating default probabilities implicit in equity prices. Journal of Investment Management, 1, 1–30.

Jarrow, R. (2001). Default parameter estimation using market prices. Financial Analysts Journal, 57, 75–92.

Jarrow, R. A., & Protter, P. (2004). Structural versus reduced form models: A new information based perspective. Journal of Investment Management, 2, 1–10.

Jones, E. P., Mason, S. P., & Rosenfeld, E. (1984). Contingent claims analysis of corporate capital structures: An empirical investigation. Journal of Finance, 39, 611–625.

Lando, D. (1998). Cox processes and credit risky securities. Review of Derivatives Research, 2, 99–120.

Leland, H. E. (1994). Corporate debt value, bond covenants, and optimal capital structure. Journal of Finance, 49, 1213–1252.

Leland, H. E. (2004). Predictions of default probabilities in structural models of debt. Journal of Investment Management, 2, 5–21.

Leland, H. E., & Toft, K. B. (1996). Optimal capital structure, endogenous bankruptcy and the term structure of credit spreads. Journal of Finance, 51, 987–1019.

Longstaff, F. A., Mithal, S., & Neis, E. (2005). Corporate yield spreads: Default risk or liquidity? New evidence from the default swap market. Journal of Finance, 60, 2213–2253.

Longstaff, F. A., & Schwartz, E. S. (1995). A simple approach to valuing risky fixed and floating rate debt. Journal of Finance, 50, 789–819.

Lyden, S., & Saraniti, D. (2000). An empirical examination of the classical theory of corporate security valuation. Barclays global investors: Working paper.

Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance, 29, 449–470.

Nashikkar, A., Subrahmanyam, M. G., & Mahanti, S. (2011). Liquidity and arbitrage in the market for credit risk. Journal of Financial and Quantitative Analysis, 46, 627–656.

Ogden, J. P. (1987). Determinants of the ratings and yields on corporate bonds: Tests of the contingent claims model. Journal of Financial Research, 10, 329–339.

Ronn, E. I., & Verma, A. K. (1986). Pricing risk-adjusted deposit insurance: An option-based model. Journal of Finance, 41, 871–895.

Schaefer, S. M., & Strebulaev, I. A. (2008). Structural models of credit risk are useful: Evidence from hedge ratios on corporate bonds. Journal of Financial Economics, 90, 1–19.

Schönbucher, P. J. (2003). Credit deriavatives pricing models: Models, pricing and implementation. West Sussex: Wiley.

Shyam-Sunder, L., & Myers, S. C. (1999). Testing static trade-off against pecking order models of capital structure. Journal of Financial Economics, 51, 219–244.

Svensson, L. E. (1994). Estimating and interpreting forward interest rates: Sweden 1992–1994, Working paper, IMF, 94/114.

Uhrig-Homburg, M. (2002). Valuation of defaultable claims: A survey. Schmalenbach Business Review, 54, 24–57.

Vasicek, O. (1977). An equilibrium characterization of the term structure. Journal of Financial Economics, 5, 177–188.

Vasicek, O. (1984). Credit valuation, white paper. Moody’s KMV.

Zhang, F. X. (2010). An emprirical analysis of alternative recovery risk models and implied recovery rates. Review of Derivatives Research, 13, 101–124.

Acknowledgments

We thank Michael Brennan, Wolfgang Bühler, Jean Helwege, David Lando, Markus Konz, Natalie Packham, Christoph Memmel, participants of the International conference on price, liquidity, and credit risks 2008 Konstanz, the Campus for Finance 2009 Vallendar and seminar participants at Aarhus School of Business for helpful comments and suggestions. Financial support by the Deutsche Forschungsgemeinschaft (DFG) through the Graduate School IME Information Management and Market Engineering is gratefully acknowledged. The views expressed herein are our own and do not necessarily reflect those of the Bundesbank.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Stochastic intensity model solution

The values for \(A(t,T)\), \(B(t,T)\), and \(C(t,T)\) can be derived as:

with

Appendix 2: Structural model solution

Utilizing the framework provided by Longstaff and Schwartz (1995) and Collin-Dufresne and Goldstein (2001), Eom et al. (2004) arrive at the below formulation (pp. 537–539):

In deriving this formula, \(t_0\) is set equal to \(0\) and the time is discretized into \(n\) intervals as \(t_i=iT/n\), for \(i=1, 2,\ldots , n,\)

The sum on the right hand-side of the equation becomes zero when \(i=1\). \(N\) is the cdf of Normal distribution. Values for \(a\) and \(b\) are required to compute \(Q^{F_T}(r_0,l_0,T)\) in the structural model. They are given as:

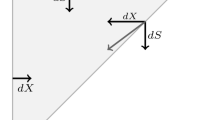

\(X=V/K\) is the inverse of the leverage ratio, where \(M\) and \(S\) are

What remains is to have closed form solutions for \(E^{F_T}_0[ln{X_t}]\) and \(cov^{F_T}_0[ln{X_t},ln{X_u}]\) which are computed in Eom/Helwege/Huang (pp. 538–539).

where

From these equations one can obtain \(Q^{F_T}(r_0,l_0,T)\) required for pricing the bond.

Appendix 3: List of bonds used in analysis

See Table 13

Appendix 4: Estimation results

Appendix 5: Simulation algorithm

For the structural model, paths of the short rate and the leverage ratio are simulated where default occurred at the first time when the log-leverage is larger than zero (leverage is greater than or equal to 1). For a typical 5-year horizon of the maturity of the CDS, the simulation algorithm generates paths and at each time point the log-leverage is checked for whether it has a value higher than zero:

-

(i)

At first step, the short rate is simulated using an Euler discretization of the Vasicek process: Start with \(r_{t}=r_0\), and generate \(r_{t+1}\) through

$$\begin{aligned} r_{t+1}=r_t+ \kappa _r(\theta _r-r_t)\Delta t + \sigma _r \sqrt{\Delta t} \epsilon ^1_t \end{aligned}$$(39)where \(\epsilon ^1_t \sim N(0,1)\).

-

(ii)

Substitute the simulated \(r_{t+1}\) into

$$\begin{aligned} \theta _l(r_{t+1})=-\bar{\nu }-\frac{r_{t+1}}{\kappa _l} \end{aligned}$$(40) -

(iii)

Generate \(l_{t+1}\) through Euler discretization of the leverage process:

$$\begin{aligned} l_{t+1}=l_t+ \kappa _l(\theta _l-l_t)\Delta t- \sigma _v \sqrt{\Delta t}(\rho \epsilon ^1_t+\sqrt{1-\rho ^2}\epsilon ^2_t) \end{aligned}$$(41)Here, note that the Brownian motions of the two processes are correlated with a factor of \(\rho \) and \(\epsilon ^2_t \sim N(0,1)\).

-

a.

If \(l_{t+1} < 0 \) (log leverage having a negative sign) then no default occurs. The CDS premiums up to this time point are cumulated, when a quarter is complete (typical quarterly payments is assumed). This accumulation constitutes the “Premium Leg” of a CDS.

$$\begin{aligned} PremLeg_{i} = PremLeg_{i-1} + \Big ( e^{- \sum \limits _{0}^{t_i} r_{t_i} \Delta t}\Big ) \end{aligned}$$(42)Here, \(t_i\) is the ith premium date. Simulation continues with step (iv).

-

b.

If \(l_{t+1} \ge 0\), default happens. Simulation is terminated and the recovery leg is computed to constitute the numerator of the fair price of a CDS. \(\tau =t+1\) and

$$\begin{aligned} RecLeg = \Big ( e^{- \sum \limits _{0}^\tau r_{t} \Delta t} (1- \varphi \cdot b(r_{\tau },T-\tau ))\Big ) \end{aligned}$$(43)In addition, the accrued premium since the last premium payment is calculated and added to the premium leg. In this implementation, the recovered bond maturity \((T)\) is taken to be the longest dated bond’s maturity. According to the intuition, with no recovery on coupons, the longest available bond should be delivered in case the “cheapest-to-deliver” option is available.

-

a.

-

(iv)

Go back to step (i) to generate \(r_{t+2}\).

For simulating the fair price of a CDS in the reduced-form case, Euler discretizations for the short rate and leverage process as in Eqs. (39) and (41) have been used. Following Schönbucher (2003), a uniform random variate \(U\) is generated as the trigger level. Let \(\gamma \) be the default countdown process, which is initiated by letting \(\gamma (0)=1\). Different from the structural model described above, step (iii) is replaced by:

-

(iii)

Generate \(l_{t+1}\) through Euler discretization of the leverage process:

$$\begin{aligned} l_{t+1}=l_t+ \kappa _l(\theta _l-l_t)\Delta t- \sigma _v \sqrt{\Delta t}(\rho \epsilon ^1_t+\sqrt{1-\rho ^2}\epsilon ^2_t) \end{aligned}$$(44)Compute the associated default intensity as:

$$\begin{aligned} \lambda (t+1)=a+cl_{t+1} \end{aligned}$$(45)Then at each time step, the default countdown process is decreased by,

$$\begin{aligned} \gamma (t+1)=\gamma (t)e^{\lambda (t+1)\Delta t} \end{aligned}$$(46) -

a.

If \(U < \gamma (t+1)\) then no default occurs. Similar to the structural side, the CDS premiums up to this quarter are cumulated, when a quarter is complete. This is the premium leg of the CDS.

$$\begin{aligned} PremLeg_{i} = PremLeg_{i-1} + \Big ( e^{- \sum \limits _{0}^{t_i} r_{t_i} \Delta t}\Big ) \end{aligned}$$(47) -

b.

If \( U \ge \gamma (t+1)\), default happens and the recovery leg is computed.

$$\begin{aligned} RecLeg = \Big ( e^{- \sum \limits _{0}^\tau r_{t} \Delta t} (1- \varphi \cdot b(r_{\tau },T-\tau ))\Big ) \end{aligned}$$(48)Accrued premiums are taken into account since the last premium payment date, as well.

Rights and permissions

About this article

Cite this article

Gündüz, Y., Uhrig-Homburg, M. Does modeling framework matter? A comparative study of structural and reduced-form models. Rev Deriv Res 17, 39–78 (2014). https://doi.org/10.1007/s11147-013-9090-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-013-9090-8

Keywords

- Credit risk

- Structural models

- Reduced-form models

- Default intensity

- Stationary leverage

- Credit default swaps