Abstract

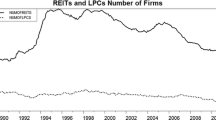

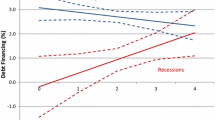

This paper investigates whether corporate diversification by property type and by geography reduces the costs of debt capital. It employs asset-level information on the portfolios of U.S. REITs to measure diversification and looks at two of their main sources of debt capital: 1,173 commercial mortgages and 952 bank loans. The paper finds that diversification across different property types does indeed dependably reduce the cost of these different types of debt. The effect is about 7 basis points for bank loans if a firm’s property Herfindahl Index is lowered by one standard deviation and this effect gets stronger for REITs with worse financial health – as measured by the interest coverage ratio. The corresponding effect for commercial mortgages is around 22 basis points for collateral diversification by property type. After the crisis, the salience of the collateral asset increases. For diversification across regions, we do not find a consistent relationship between real asset diversification and loan pricing.

Similar content being viewed by others

Notes

Capozza and Seguin (1999) also briefly touch upon the relationship between diversification and interest expenses, but the data they use are quite limited in scope and time, covering only a subset of listed REITs and only eight years. Furthermore, their analysis lacks appropriate control variables needed for solid conclusions in this matter.

Higgins and Schall (1975) refine this coinsurance hypothesis in a theoretical framework.

The empirical evidence for the impact of international diversification on firm value is mixed. Denis et al. (2002) find that, internationally diversified firms tend to trade at a discount relative to a portfolio of single-segment, domestic firms. On the other hand, Morck and Yeung (1991) find that multinationality has no significant impact on shareholder value as measured by firms’ q ratio. Goerzen and Beamish (2003) find a positive association between economic performance and international asset dispersion.

As an alternative measure of diversification, we also calculate the number of property types and regions with non-zero portfolio shares. Also, our results are robust to HHI definitions based on five property types (Apartment, Industrial, Office, Retail and Others) and on states rather than regions.

Alternatively, Firm HHI can be calculated based on the number of properties rather than book value shares. Our results are robust to these alternative definitions of HHI based on portfolio fraction of property types and regions.

Alternatively, in order to control for the changes in the yield curve across time, we also calculate the mortgage spread by subtracting the Treasury rate with the closest time to maturity from the interest rate of encumbrance at origination. We obtain constant maturity treasury rates from the U.S. Treasury. Our unreported findings demonstrate similar results to using the spread over 1-year LIBOR.

SNL only provides the maturity date but not the origination date. We assume that the origination year is the year when a mortgage contract with the same maturity date first appears in a given collateral for a given REIT.

Our results are robust to the inclusion of fully focused REITs by both property type and region (Firm HHI= 1) and the inclusion of mortgages collateralized by single property.

The mortgage sample mainly consists of fixed-rate mortgages, which on average have higher spreads than floating rate loans such as those in our bank loan sample. When we limit our mortgage sample to floating-rate mortgages, the mean of spread declines to 183 basis points which is similar to the mean of bank loan sample.

There is a negative correlation between Firm HHI by property type and by region. However, including both variables in the same regression does not change our results.

NCREIF property index return measures the investment performance (income and capital value return) of a very large pool of individual commercial real estate properties.

In the mortgage analysis, we estimate our models by collateral observations to be able to control for property type and region fixed effects. One potential problem with that approach could be that if there are more assets collateralizing a given mortgage, the number of observations in the analysis by the same mortgage will be increasing by the number of collateral assets. We also run the regressions by mortgage observations in Table 12 in the Appendix. Our findings are robust.

Our unreported tabulations show that there is a significant overlap between the property type with the highest portfolio share and the sector reported by the REIT.

References

Aivazian, V.A., Qiu, J., Rahaman, M.M. (2015). Bank loan contracting and corporate diversification: does organizational structure matter to lenders? Journal of Financial Intermediation, 24(2), 252–282.

Alcock, J., Steiner, E., Tan, K.J.K. (2014). Joint leverage and maturity choices in real estate firms: the role of the REIT status. Journal of Real Estate Finance and Economics, 48(1), 57–78.

Berger, P.G., & Ofek, E. (1995). Diversification’s effect on firm value. Journal of Financial Economics, 37(1), 39–65.

Bharath, S.T., Sunder, J., Sunder, S.V. (2008). Accounting quality and debt contracting. Accounting Review, 83(1), 1–28.

Capozza, D.R., & Seguin, P.J. (1999). Focus, transparency and value: The REIT evidence. Real Estate Economics, 27(4), 587–619.

Carey, M., & Hrycray, M. (1999). Credit flow, risk, and the role of private debt in capital structure. Working Paper, Federal Reserve Board.

Chava, S., & Roberts, M.R. (2008). How does financing impact investment? The role of debt covenants. Journal of Finance, 63(5), 2085–2121.

Deng, S.E., Elyasiani, E., Mao, C.X. (2007). Diversification and the cost of debt of bank holding companies. Journal of Banking Finance, 31(8), 2453–2473.

Denis, D.J., Denis, D.K., Yost, K. (2002). Global diversification, industrial diversification, and firm value. Journal of Finance, 57(5), 1951–1979.

Eichholtz, P., Holtermans, R., Yönder, E. (2016). The economic effects of owner distance and local property management in US office markets. Journal of Economic Geography, 16(4), 781–803.

Eichholtz, P., Op ’t Veld, H., Schweitzer, M. (2000). REIT performance: does managerial specialization pay. The performance of financial institutions (pp. 199–220). Cambridge: Cambridge University Press.

Feng, Z., Ghosh, C., Sirmans, C.F. (2007). On the capital structure of real estate investment trusts (REITs). Journal of Real Estate Finance and Economics, 34(1), 81–105.

Franco, F., Urcan, O., Vasvari, F.P. (2010). The value of corporate diversification: a debt market perspective. Working Paper.

Geltner, D., & Kluger, B. (1998). REIT-based pure-play portfolios: the case of property types. Real Estate Economics, 26(4), 581–612.

Goerzen, A., & Beamish, P.W. (2003). Geographic scope and multinational enterprise performance. Strategic Management Journal, 24(13), 1289–1306.

Graham, J.R., Lemmon, M.L., Wolf, J.G. (2002). Does corporate diversification destroy value? Journal of Finance, 57(2), 695–720.

Hann, R.N., Ogneva, M., Ozbas, O. (2013). Corporate diversification and the cost of capital. Journal of finance, 68(5), 1961–1999.

Hardin III, W.G., Highfield, M.J., Hill, M.D., Kelly, G.W. (2009). The determinants of REIT cash holdings. Journal of Real Estate Finance and Economics, 39(1), 39–57.

Hartzell, J.C., Sun, L., Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: evidence from real estate investment trusts. Journal of Corporate Finance, 25, 61–72.

Hertzel, M.G., & Officer, M.S. (2012). Industry contagion in loan spreads. Journal of Financial Economics, 103(3), 493–506.

Higgins, R.C., & Schall, L.D. (1975). Corporate bankruptcy and conglomerate merger. Journal of Finance, 30(1), 93–113.

Lang, L.H., & Stulz, R.M. (1994). Tobin’s Q, Corporate diversification, and firm performance. Journal of Political Economy, 102(6), 1248–1280.

Lewellen, W.G. (1971). A pure financial rationale for the conglomerate merger. Journal of Finance, 26(2), 521–537.

Ling, C.D., Naranjo, A., Petrova, M.T. (2016). Search costs, behavioral biases, and information intermediary effects. Journal of Real Estate Finance and Economics, Forthcoming.

Matsusaka, J.G., & Nanda, V. (2002). Internal capital markets and corporate refocusing. Journal of Financial Intermediation, 11(2), 176–211.

Morck, R., & Yeung, B. (1991). Why investors value multinationality. Journal of Business, 64(2), 165–187.

Nagarajan, N.J., & Sridhar, S.S. (1996). Corporate responses to segment disclosure requirements. Journal of Accounting and Economics, 21(2), 253–275.

Ott, S.H., Riddiough, T.J., Yi, H.C. (2005). Finance, investment and investment performance: evidence from the REIT sector. Real Estate Economics, 33 (1), 203–235.

Rajan, R., Servaes, H., Zingales, L. (2000). The cost of diversity: the diversification discount and inefficient investment. Journal of Finance, 55(1), 35–80.

Scharfstein, D.S., & Stein, J.C. (2000). The dark side of internal capital markets: divisional rent seeking and inefficient investment. Journal of Finance, 55 (6), 2537–2564.

Servaes, H. (1996). The value of diversification during the conglomerate merger wave. Journal of Finance, 51(4), 1201–1225.

Villalonga, B. (2004). Diversification discount or premium? New evidence from the business information tracking series. Journal of Finance, 59(2), 479–506.

Waldron, D.G. (2011). International diversification and the cost of capital: is more necessarily better? International Business Economics Research Journal (IBER), 5 (12).

Acknowledgments

We are grateful to the Real Estate Research Institute (RERI) for financial support and thank David C. Ling, Eva Steiner, Andy Naranjo, the participants of the 2016 Real Estate Finance and Investment Symposium at the University of Cambridge and the 2017 AREUEA Annual Conference for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

As an alternative to Firm HHI based on the net book value shares, we calculate Firm HHI using the number of distinct types of properties and regions in a portfolio. Panels A and B in Table 10 report the results for all loans and for the secured loan subsample, respectively. Our conclusions are robust to this alternative definition of HHI based on the number of properties.

Our Firm HHI variable has a low sample variation and a high sample mean especially when it is calculated based on property types rather than geographical regions. This raises the concern that the results could be driven by one or a few property types. In order to address this, we split our sample into quartiles based on Firm HHI within the property type or region that has the highest share in a REIT’s portfolio. Then, we define a dummy variable Least Concentrated Quartile that equals one for REITs that are in the most diversified quartile and zero otherwise. This allows us to distinguish between diversified and concentrated REITs within each property type and region category. Columns 1 and 4 in Table 11 report the results for this alternative concentration measure calculated based on eight property types and regions, respectively. After controlling for the property types and regions with the highest share in a REIT’s portfolio, we continue to find a significant relationship between concentration and spreads. While the REITs in the highest diversification quartile pay about 11 basis points less relative to others in loan spreads, those in the lowest geographical concentration quartile are associated with about 10 basis points higher loan spreads.

Rights and permissions

About this article

Cite this article

Demirci, I., Eichholtz, P. & Yönder, E. Corporate Diversification and the Cost of Debt. J Real Estate Finan Econ 61, 316–368 (2020). https://doi.org/10.1007/s11146-017-9645-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-017-9645-9