Abstract

This paper empirically tests auction theory by examining how the stock market evaluates the outcome of open-bid English auctions of rights to develop residential real estate projects in Hong Kong. To do so, we deconstruct the complexity surrounding actual auction events, and empirically isolate the influence of conflicting auction theory predictions using data from expert opinion around auction events, actual auction event and outcome data, and stock market data. The empirical findings include (1) with increasing uncertainty bidders reduce bids, thus confirming predictions following the winner’s curse thesis; (2) joint bidding does not lead to increased bids based on pooled (“better”) information, but instead leads to reduced competition; while increased competition leads to increased prices at auction, as expected; (3) the market interprets auction outcomes as information events which function to signal developers’ expectations about future market prospects; but if the winning bid is considered too high, this interpretation is revised to that of the winner’s curse; (4) with joint bidding and winning, the market’s response to joint winners is better explained by concern for winner’s curse (despite supposed better informed bids) than the acquisition of a below cost development project following reduced competition at auction; and (5) the market interprets increased competition at auction as indicator of the future direction of property price movements in the secondary market—the more intense the competition, the more positive the future prospect of the property market are seen to be.

Similar content being viewed by others

Notes

The local newspapers from which we extracted details of the Hong Kong Government land auctions are Singtao Daily, Ming Pao, Apple Daily News, Oriental Daily News, Hong Kong Economic Times and Hong Kong Economic Journal.

The modern view of acquiring a development site is that it represents a call option with the developed property as the underlying asset, (see Titman 1985; Capozza and Helsley 1989). This view disaggregates the “value” of development land into two components, the “intrinsic” value of the completed development, plus the value of the option to time optimally the bringing to market of the development and possibly also selecting an optimally mixed and scaled development (Quigg 1993). In our case there is technically no expected option value, because the scope, scale and timing of the development are all prescribed conditions in the auction purchase agreement. There is no right to delay commencement of development, if allowed it is at the Lands Department's discretion. If allowed this is not a de facto option, because the same circumstance may also lead to discretionary repossession instead. In this respect our constraints differs from Ooi et al. (2006) in that they assume that developers do have some discretion.

Newspapers in Hong Kong frequently surveyed real estate agencies on asking prices of properties listed for sale immediately after land auctions. For example, on February 20, 2001, two residential sites, one in Ma On Shan and one in Sai Kung, were auctioned with the outcome price exceeding the opening bid by 24.44% and 47% respectively. Apple Daily News reported on February 21, 2001 that the auction outcome improved market sentiment and that some property owners in major residential estates in the secondary market immediately revised the listed asking prices for their properties upward by an average of 5.2%.

The market opinions are obtained by combining the survey results reported in Singtao Daily, Mingpao, and Oriental Daily News.

As reported by Oriental Daily News.

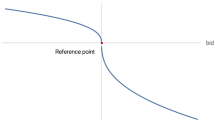

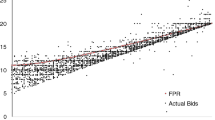

The reference price over-predicts the auction outcome whenever ln(winning bid/reference price) is less than zero and it under-predicts when ln(winning bid/reference price) is positive.

The estimation period is −100 through −6 trading days prior to auction date (day 0). Changes in the winner’s stock returns associated with each auction date, net of the market-wide influence of changes in all equity returns as proxied by changes in the Hang Seng Index returns, are calculated over an 11-day window (t = −5…+5) surrounding the auction date. This window is deemed to be sufficient to allow for both pre- and post-auction investor anticipation effects.

An example of the process at work could function to illustrate the finding. For example, Henderson Land acquired the land site at Shuen Wan (Lot TPTL 161) with the winning bid of HK$5.6 billion in the land auction on Oct 14, 1997. The opening bid was HK$3.5 billion. The premium over the opening bid is 60%. According to Table 4, this premium is the 24th highest premium in the 83 land auctions. The stock price of Henderson Land fell by 4.02% the next day. The response of the stock market did not seem to agree with the land auction outcome.

We use cumulative abnormal return from 5 days before the auction date in order to capture the potential effect of stock market speculation about auction outcomes.

The Hang Seng Index is used as the market portfolio in the calculation of the CAR. As pointed out by Ching and Fu (2003), during the sample period of from 1992 to the first quarter of 1998, no single bidder accounts for more than ten percent of the market capitalization of the index, and hence the bias of the resulting abnormal return estimates towards zero is insignificant. After the first quarter of 1998, property values began to fall due to the Asian financial crisis, market capitalization of the bidders as a percentage of the total market capitalization of the Hang Seng Index reduced, and hence the bias became even more insignificant.

The single-factor market model is Rt = α + βRmt + γD + εt, where R is the daily return of winner, Rm is the daily return of the market portfolio, α and β are coefficients of the market model, D is a dummy variable equal to one on the auction day and zero otherwise, and γ is the abnormal return on the event day.

For interest we also conducted an analysis based on the third measure, which could be viewed as a joint test of our propositions and the Riley and Samuelson (1981) auction revenue model. The results were statistically weak and are not included.

From Eq. (5), the first order condition (dCAR/dB = 0) based on opening bid implies that the maximum turning point for CAR is when B [=In(winning bid/opening bid)] is equal to −(estimated β 1 )/(2*estimated β 2 ) = 0.6698, that is the winning bid is equal to 1.95 times (= e0.6698) the opening bid. Similarly, the first order condition based on average market opinion indicates that the winner’s curse effect is likely to affect the stock return of the winner if the winning bid is 1.51 times the average market opinion or more.

References

Asquith, P. (1983). Merger bids, uncertainty and stockholder returns. Journal of Financial Economics, 11(1–4), 51–83.

Capozza, D. R., & Helsley, W. R. (1989). The fundamentals of land prices and urban growth. Journal of Urban Economics, 26(3), 295–306.

Ching, S., & Fu, Y. (2003). Contestability of the urban land market: an event study of Hong Kong land auctions. Regional Science and Urban Economics, 33(6), 695–720. doi:10.1016/S0166-0462(03)00005-X.

Davis, D. D., & Holt, C. A. (1993). Experimental economics. Princeton: Princeton University Press.

DeBrock, L. M., & Smith, J. L. (1983). Joint bidding, information pooling, and the performance of petroleum lease auctions. Bell Journal of Economics, 14(2), 395–404.

Gilberto, S. M., & Varaiya, N. P. (1989). The winner’s curse and bidder competitions in acquisitions: evidence from failed bank auctions. Journal of Finance, 44(1), 59–75.

Hendricks, K., & Porter, R. H. (1988). An empirical study of auction with asymmetric information. American Economic Review, 78(5), 865–883.

Hendricks, K., Porter, R. H., & Boudreau, B. (1987). Information, returns and bidding behavior in OCS auctions: 1954–1969. Journal of Industrial Economics, 35(4), 517–42.

James, C. (1987). An analysis of FDIC failed bank auctions. Journal of Monetary Economics, 20(1), 141–153.

McAfee, R. P., & McMillan, J. (1987). Auctions and bidding. Journal of Economic Literature, 25(2), 699–738.

Mikkelson, W., & Partch, M. (1988). Withdrawn security offerings. Journal of Financial and Quantitative Analysis, 23(2), 119–133.

Ooi, J. T. L., & Sirmans, C. F. (2004). The wealth effects of land acquisition. Journal of Real Estate Finance and Economics, 29(3), 277–294.

Ooi, J. T. L., Sirmans, C. F., & Turnbull, G. K. (2006). Price formation under small numbers competition: evidence from land auction in Singapore. Real Estate Economics, 34(1), 51–76.

Pruitt, S. W., Hoffer, G. E., & Tse, K. S. M. (1997). The United States international air route award process: shareholder wealth effects and policy implications. Journal of Regulatory Economics, 12(2), 197–217.

Quan, D. C. (1994). Real estate auctions: a survey of theory and practice. Journal of Real Estate Finance and Economics, 9(1), 23–49.

Quigg, L. (1993). Empirical testing of real option pricing models. Journal of Finance, 48(2), 621–640.

Riley, J. G., & Samuelson, W. F. (1981). Optimal auctions. American Economic Review, 71(3), 381–392.

Simon, D. P. (1994). Markups, quantity risk, and bidding strategies at treasury coupon auctions. Journal of Financial Economics, 35(1), 43–62.

Thaler, R. (1988). The winner’s curse. Journal of Economic Perspectives, 2(1), 191–202.

Thiel, S. E. (1988). Some evidence on the winner’s curse. American Economic Review, 78(5), 884–895.

Titman, S. (1985). Urban land prices under uncertainty. American Economic Review, 75(3), 505–514.

Wilson, R. (1977). A bidding model of perfect competition. Review of Economic Studies, 44(3), 511–518.

Wong, S. K., Yiu, C. Y., Tse, M. K. S., & Chau, K. W. (2006). Do the forward sales of real estate stabilize spot prices? Journal of Real Estate Finance and Economics, 32(3), 289–304.

Acknowledgement

We gratefully acknowledge the financial support provided by the Research Grant Council of the Hong Kong Special Administrative Region (RGC Reference Number: HKU 7112/05E) and a grant from the University Grants Committee of the Hong Kong Special Administrative Region, China (Project No. AoE/H-05/99).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tse, M.K.S., Pretorius, F.I.H. & Chau, K.W. Market Sentiments, Winner’s Curse and Bidding Outcome in Land Auctions. J Real Estate Finan Econ 42, 247–274 (2011). https://doi.org/10.1007/s11146-009-9211-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-009-9211-1