Abstract

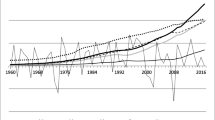

We examine the value relevance of inflation-adjusted (IA) and historical cost (HC) amounts in a hyperinflationary economy. Using a unique dataset drawn from annual reports of firms listed on the Zimbabwe Stock Exchange from 2000 to 2005, we find that both sets of amounts are value relevant but HC amounts are superior to IA amounts. We also show that inflation gains and losses provide incremental information content beyond that provided by the HC amounts and that the power of this incremental content model is equivalent to that of the HC model but superior to that of the IA model. Further analyses indicate that, in periods of relatively low inflation, HC amounts are more value relevant, while in periods of relatively high inflation, the two sets of amounts are equally value relevant. Finally, we show that HC amounts have a greater ability to predict future cash flows than IA amounts, which suggests that the superiority of their value relevance stems from this.

Similar content being viewed by others

Notes

IAS 29 states that an economy is hyperinflationary if (inter alia) “the cumulative inflation rate over three years is approaching, or exceeds, 100%” (IASB 2011, p. A938).

The distortions arise primarily because the HC measurement system (a) violates the monetary unit assumption of a stable currency or constant purchasing power over time, (b) impairs comparability across firms and over time (given the mixing of dollars from different periods with different purchasing power), and (c) ignores inflation gains and losses such as gains that accumulate over time in nonmonetary assets (Konchitchki 2011, 2013).

These studies included, among many others, those by Beaver et al. (1980), Gheyara and Boatsman (1980), Beaver et al. (1983), Beaver and Landsman (1983), and Board and Walker (1984) (discussed in Section 3) and were a response to the 1970s and 1980s debate, particularly in the United States and United Kingdom, about the value of HC accounting amounts in periods of high inflation.

ZAPB members are drawn from accounting professional bodies, the business community and the ZSE (Chamisa 2000).

In our sample, all ZSE listed firms (except one) were audited by one of the Big Four accounting firms (Deloitte and Touche, Ernest &Young, KPMG, and PwC).

In addition, listed firms are required by the Companies Act (Chapter 24:03) (1996) to publish their results (in summary form) in national newspapers.

The standards include Statement of Standard Accounting Practices (SSAP) 16 in the United Kingdom and Statement of Financial Accounting Standard (SFAS) 33 in the United States, both of which are now defunct. During the 1970s and 1980s, the inflation rates ranged between 3.43 and 24.24% in the United Kingdom and between 1.86 and 13.51% in the United States (Bartley and Boardman 1990; International Monetary Fund 2010).

For a general summary of this work, see Konchitchki (2016).

Our decision to limit the sample period to 2005 is underpinned by the fact that the post-2005 period saw the Zimbabwean dollar being revalued in 2006, 2008, and 2009 before it was scrapped and a multi-currency system was introduced (see Section 2.1). Thus including data for the post-2005 period would have been problematic in drawing conclusions from the analyses.

Computed as the change in the adjusted R2s of the low inflation period relative to high inflation period.

Due to the small number of observations, we do not run yearly regressions for 2000.

Mandating an IA reporting system in a low inflation country like the US “may impose public- and firm-level costs that do not necessarily outweigh the benefits” (Konchitchki 2011, p. 1048).

References

African Development Bank (2007). Zimbabwe—Country Dialogue Paper. https://www.afdb.org/fileadmin/uploads/afdb/Documents/Project-and-Operations/ADB-BD-WP-2007-40-EN-ZIMBABWE-2007-COUNTRY-DIALOGUE-PAPER.PDF. Accessed March 9, 2017.

American Institute of Certified Public Accountants. (2010). Monitoring inflation status of certain countries. http://www.aicpa.org. Accessed January 18, 2011.

Appleyard, A. R., & Strong, N. C. (1984). The impact of SSAP 16 current cost disclosures on security prices. In B. Carsberg & M. Page (Eds.), Current cost accounting: The benefits and costs (pp. 235–244). London: Prentice-Hall International.

Ashton, D., Peasnell, K., & Wang, P. (2011). Residual income valuation models and inflation. European Accounting Review, 20(3), 459–483.

Barniv, R. (1999). The value relevance of inflation-adjusted and historical cost earnings during hyperinflation. Journal of International Accounting, Auditing and Taxation, 8(2), 269–287.

Bartley, J. W., & Boardman, C. M. (1990). The relevance of inflation adjusted data to the prediction of corporate takeovers. Journal of Business Finance and Accounting, 17(1), 53–72.

Barth, M., Beaver, W., & Landsman, W. (1998). Relative valuation roles of equity book value and net income as a function of financial health. Journal of Accounting and Economics, 25(1), 1–34.

Barth, M., Cram, D. P., & Nelson, K. K. (2001a). Accruals and the prediction of future cash flows. The Accounting Review, 76(1), 27–58.

Barth, M. E., Beaver, W. H., & Landsman, W. R. (2001b). The relevance of the value relevance literature for financial accounting standards setting: Another view. Journal of Accounting and Economics, 31(1–3), 77–104.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467–498.

Bartov, E., Goldberg, S. R., & Kim, M. (2001). The valuation-relevance of earnings and cash flows: An international perspective. Journal of International Financial Management and Accounting, 12(2), 103–132.

Basu, S., Markov, S., & Shivakumar, L. (2010). Inflation, earnings forecasts, and post-earnings announcement drift. Review of Accounting Studies, 15(2), 403–440.

Beaver, W. H., Christie, A. A., & Griffin, P. A. (1980). The information content of SEC accounting series release no. 190. Journal of Accounting and Economics, 2(2), 127–157.

Beaver, W. H., Christie, A. A., & Landsman, W. R. (1983). How well does replacement cost income explain stock return? Financial Analysts Journal, 39(2), 26–30.

Beaver, W. H., & Landsman, W. R. (1983). Incremental Information Content of Statement 33 Disclosures. FASB research report. Norwalk, CT: FASB.

Berliner, R. W. (1983). Do analysts use inflation-adjusted information? Results of a survey. Financial Analysts Journal, 39(2), 65–72.

Biddle, G. C., Seow, G. S., & Siegel, A. F. (1995). Relative versus incrémental information content. Contemporary Accounting Research, 12(1), 1–23.

Board, J. G. L., & Walker, M. (1984). The information content of SSAP 16 earnings changes. In B. Carsberg & M. Page (Eds.), Current cost accounting: The benefits and costs (pp. 245–252). London: Prentice-Hall International.

Brayshaw, R. E., & Miro, A. R. O. (1985). The information content of inflation-adjusted financial statements. Journal of Business Finance and Accounting, 12(2), 249–261.

Brixiova, Z., & Ncube, M. (2014). The real exchange rate and growth in Zimbabwe: Does the currency regime matter? Working Paper, African Development Bank.

Carsberg, B., & Day, J. (1984). The use of current cost accounting information by stockbrokers. In B. Carsberg & M. Page (Eds.), Current cost accounting: The benefits and the costs (pp. 149–171). London: Prentice-Hall International.

Chamisa, E. (2000). The relevance and observance of the IASC standards in developing countries and the particular case of Zimbabwe. The International Journal of Accounting, 35(2), 267–286.

Chamisa, E. (2007). The use and perceived usefulness of IAS 29 restated financial statements by Zimbabwean investment analysts. South African Journal of Accounting Research, 21(1), 57–79.

Chamisa, E., Mangena, M., Pamburai, H. H., & Changunda, S. (2012). Financial reporting in hyperinflationary economies: Some determinants of accounting policy preferences by Zimbabwean corporates. Working paper, University Cape of Town.

Collins, D. W., Maydew, E. L., & Weisis, I. S. (1997). Changes in the value-relevance of earnings and book values over the past 40 years. Journal of Accounting and Economics, 24, 39–67.

Collins, D. W., Pincus, M., & Xie, H. (1999). Equity valuation and negative earnings: The role of book value of equity. The Accounting Review, 74(1), 29–61.

Companies Act (Chapter 24:03). (1996). Harare: Government Printers.

Curtis, A., Lewis-Western, M. F., & Toynbee, S. (2015). Historical cost measurement and the use of DuPont analysis by market participants. Review of Accounting Studies, 20(3), 1210–1245.

Dechow, P. M. (1994). Accounting earnings and cash flows as measures of firm performance—The role of accounting accruals. Journal of Accounting and Economics, 18(1), 3–42.

Dechow, P. M., Kothari, S. P., & Watts, R. L. (1998). The relation between earnings and cash flows. Journal of Accounting and Economics, 25(2), 133–168.

Delta Corporation (Zimbabwe) Ltd (2007). Annual Report. http://www.delta.co.zw. Accessed September 12, 2013.

Easton, P. D., & Harris, T. S. (1991). Earnings as explanatory variables for returns. Journal of Accounting Research, 29(1), 19–36.

Feyr, E., & Tyran, J. R. (2001). Does money illusion matter? American Economic Review, 91(5), 1239–1262.

Filip, A., & Raffournier, B. (2010). The value relevance of earnings in a transition economy: The case of Romania. The International Journal of Accounting, 45, 77–103.

Finger, C. A. (1994). The ability of earnings to predict future earnings and cash flow. Journal of Accounting Research, 32(2), 210–223.

Francis, J., & Schipper, K. (1999). Have financial statements lost their relevance? Journal of Accounting Research, 37(2), 319–352.

Gallo, L. A., Hann, R. N., & Li, C. (2016). Aggregate earnings surprises, monetary policy, and stock returns. Journal of Accounting and Economics, 62(1), 103–120.

Gheyara, K., & Boatsman, J. (1980). Market reaction to the 1976 replacement cost disclosures. Journal of Accounting and Economics, 2(2), 107–125.

Gordon, E. (2001). Accounting for changing prices: The value relevance of historical cost, price level, and replacement cost in Mexico. Journal of Accounting Research, 39(1), 177–200.

Hellstrom, K. (2006). The value relevance of financial accounting information in a transitional economy: The case of the Czech Republic. European Accounting Review, 15(3), 325–349.

Hughes, J., Liu, J., & Zhang, M. (2004). Valuation and accounting for inflation and foreign exchange. Journal of Accounting Research, 42(4), 731–754.

Holthausen, R. W., & Watts, R. L. (2001). The relevance of the value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics, 31(1–3), 3–73.

International Accounting Standards Board. (2011). A guide through international financial reporting standards (IFRSs): Parts A and B. London: International Financial Reporting Standards Foundation.

International Monetary Fund (2008). Report for selected countries and subjects: Zimbabwe. World Economic Outlook Database. http://www.imf.org/external/pubs/ft/weo/2008/02/weodata/weorept.aspx. Accessed December 17, 2014.

International Monetary Fund (2010). Financial statistics. http://www.imfstatistics.org. Accessed July 15, 2011.

Kirkulak, B., & Balsari, C. K. (2009). Value relevance of inflation-adjusted equity and income. The International Journal of Accounting, 44(4), 363–377.

Konchitchki, Y. (2011). Inflation and nominal financial reporting: Implications for performance and stock prices. The Accounting Review, 86(3), 1045–1085.

Konchitchki, Y. (2013). Accounting and the macroeconomy: The case of aggregate price-level effects on individual stocks. Financial Analysts Journal, 69(6), 40–54.

Konchitchki, Y. (2016). Accounting valuation and cost of capital dynamics: The theoretical and empirical macroeconomic aspects. Discussion of Callen. Abacus, 52(1), 26–34.

Konchitchki, Y., & Patatoukas, P. N. (2014a). Taking the pulse of the real economy using financial statement analysis: Implications for macro forecasting and stock valuation. The Accounting Review, 89(2), 669–694.

Konchitchki, Y., & Patatoukas, P. N. (2014b). Accounting earnings and gross domestic product. Journal of Accounting and Economics, 57(1), 76–88.

Konchitchki, Y., Luo, Y., Ma, M. L. Z., & Wu, F. (2016). Accounting-based downside risk, cost of capital, and the macroeconomy. Review of Accounting Studies, 21(1), 1–36.

Kothari, S. P., & Zimmerman, J. L. (1995). Price and return models. Journal of Accounting and Economics, 20(2), 155–192.

Kothari, S. P. (2001). Capital market research in accounting. Journal of Accounting and Economics, 31(1–3), 105–231.

Li, N., Richardson, S., & Tuna, I. (2014). Macro to micro: Country exposures, firm fundamentals and stock returns. Journal of Accounting and Economics, 58(1), 1–20.

Mangena, M., & Tauringana, V. (2007). Disclosure, corporate governance and foreign share ownership on the Zimbabwe stock exchange. Journal of International Financial Management and Accounting, 18(2), 53–85.

Mangena, M., Tauringana, V., & Chamisa, E. (2012). Corporate boards, ownership structure and firm performance in an environment of severe political and economic uncertainty. British Journal of Management, 23(Suppl), 23–41.

Maksy, M. M. (1984). The use of inflation-adjusted accounting data by US banks. Accounting and Business Research, 15(57), 37–43.

Murdoch, B. (1986). The information content of FAS 33 returns on equity. The Accounting Review, 61(2), 273–287.

Noko, J. (2011). Dollarization: The case of Zimbabwe. Cato Journal, 31(2), 339–365.

Ohlson, J. A. (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research, 11(2), 661–687.

Oppong, A. (1993). Price-earnings research and the emerging capital markets: The case of Zimbabwe. The International Journal of Accounting, 28(10), 71–77.

Owusu-Ansah, S. (2000). Timeliness of corporate financial reporting in emerging capital markets: Empirical evidence from the Zimbabwe stock exchange. Accounting and Business Research, 30(3), 241–254.

Patatoukas, P. N. (2014). Detecting news in aggregate accounting earnings: Implications for stock market valuation. Review of Accounting Studies, 19(1), 134–160.

Ritter, J. R., & Warr, R. S. (2002). The decline of inflation and the bull market of 1982–1999. Journal of Financial and Quantitative Analysis, 37(1), 29–61.

Rivera, J. M. (1987). Price-adjusted financial information and investment returns in a highly inflationary economy: An evaluation. Advances in International Accounting, 1, 287–304.

Robertson, J. (2003). The Zimbabwean Economy: The current position and the way forward. In R. Cornwell (Ed), Zimbabwe’s Turmoil: Problems and Prospects. http://www.iss.co.za/Pubs/Monographs/No87?Chap3.pdf. Accessed June 9, 2008.

Senbet, L., & Otchere, I. (2008). African stock markets. African finance for the 21st century high-level seminar. IMF Institute and joint African institute. https://www.imf.org/external/np/seminars/eng/2008/afrfin/pdf/senbet.pdf. Accessed March 10, 2017.

Skerratt, L. C. L., & Thompson, A. P. (1984). The market reaction to SSAP 16 current cost disclosures. In B. Carsberg & M. Page (Eds.), Current cost accounting: The benefits and costs (pp. 289–319). London: Prentice-Hall International.

Sloan, R. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review, 71(3), 289–316.

Thies, C. F., & Sturrock, T. (1987). What did inflation accounting tell us? Journal of Accounting, Auditing and Finance, 2(4), 375–391.

Vuong, Q. H. (1989). Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica, 57(2), 307–333.

Watts, R. L., & Zimmerman, J. L. (1980). On the irrelevance of replacement cost disclosures for security prices. Journal of Accounting and Economics, 2(2), 95–106.

World Bank (2003). Report on the observance of standards and codes (ROSC): Corporate governance-Zimbabwe. http://www.worldbank.org/ifa/rocs_cg_zimbabwe.html. Accessed June 9, 2008.

World Bank (2016). Zimbabwe. http://data.worldbank.org/country/zimbabwe Accessed March 10, 2017.

Zimbabwe Stock Exchange (2000-2005). Zimbabwe stock exchange handbooks, Harare.

Zimbabwe Stock Exchange Listing Rules (2002). Zimbabwe stock exchange, Harare.

Acknowledgements

We appreciate the invaluable comments and suggestions made to earlier versions of this paper by the anonymous reviewers and the manuscript editor, Professor Stephen Penman. We are also grateful to participants at the 2011 Southern African Accounting Association Conference in George, South Africa, 2014 African Accounting and Finance Association Conference at Stellenbosch University, South Africa, and seminar hosted by the Accounting, Governance and Risk Research Group at the Nottingham Business School, Nottingham Trent University, UK, for the helpful comments and suggestions. We also acknowledge the research assistance by Shingirai Changunda and research funding award from the University Research Committee, Faculty of Commerce Block Grant, University of Cape Town.

Author information

Authors and Affiliations

Corresponding author

Appendix 1

Appendix 1

An example of IA and HC financial statements presentation format

Source: Delta Corporation (Zimbabwe) Ltd (2007, pp. 27 and 44).

Rights and permissions

About this article

Cite this article

Chamisa, E., Mangena, M., Pamburai, H.H. et al. Financial reporting in hyperinflationary economies and the value relevance of accounting amounts: hard evidence from Zimbabwe. Rev Account Stud 23, 1241–1273 (2018). https://doi.org/10.1007/s11142-018-9460-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-018-9460-4