Abstract

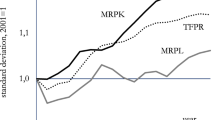

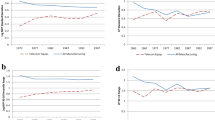

This paper evaluates misallocation of resources in Latvia during 2007–2014 using firm-level data. I find that misallocation of resources increased before 2010 and declined afterwards. Initially, output distortion was the major source of misallocation, while the importance of capital distortions increased after the financial crisis. Determinants of changes in allocation efficiency may include growing competition in domestic markets, tighter credit supply and legal issues. However, I show that fragmentation of production induces bias to the estimates of firm-specific distortions, leading to the overestimation of gains from reallocation. Thus, in the absence of inter-firm trade data, the conclusions on misallocation should be treated with caution.

Similar content being viewed by others

Notes

The 2016 release of the World Input-Output database available at http://www.wiod.org/database/wiots16.

Contributions for individual distortions are estimated by eliminating variation in respective distortion and fixing the other inputs. See Dias et al. (2015) Appendix B5 for technical details and derivations.

Dias et al. (2016b) argue that the knowledge of firm-specific distortions is not necessary to evaluate the contribution of misallocation, since one can estimate TFPR si from Eq. (10) and TFPR s * from Eqs. (12)–(15). However, in my view, the discussion about the evaluation of firm-specific distortions provides additional intuition to the reader.

Braukša and Fadejeva (2016) analyse micro data from the Labour Force Survey (LFS) and conclude that part-time employment and temporary contracts were actively used in Latvia during 2009–2010.

I exclude several sectors from the empirical analysis due to the lack of data or specific nature of the sector, namely: agriculture, forestry and fishing (A), financial and insurance activities (K), public administration and defence (O), education (P), health (Q), arts, entertainment and recreation (R), and other services activities (S).

Usually researchers trim observations below/above the 1st and 99th percentile (see e.g. Hsieh and Klenow, 2009; Dias et al. 2016b; Garcia-Santana et al. 2016). I use a more conservative approach, trimming observations below Q1 − 1.5 IQR and above Q3 + 1.5 IQR, where Q1 and Q3 denote the 1st and 3rd quartiles, and IQR stands for the interquartile range. I check the role of alternative outlier detection procedures in the robustness section.

Defined as turnover net of change in stocks and purchases of goods and services for resale plus capitalised production and other operating income from the economic activity.

Fixed capital and investment deflators are split into four categories: intellectual capital, dwelling and other buildings, machinery and equipment, and other capital. Investment deflators are provided by the CSB (deflator for total investment used for other capital). Since deflators for dwelling and other buildings as well as total investment were highly volatile during 2007–2010, I filter them by the Christiano-Fitzgerald filter (leaving oscillations above 2 years). This allows excluding the short-term (speculative) component of real estate prices.

Industry-specific depreciation rate is set according to industry capital structure, assuming an 8% depreciation rate for intellectual capital, 5% for dwelling and other buildings, 13% for machinery and equipment, and 10% for other capital. Real interest rate is defined as the long-term credit rate minus change in the price of investment.

The report is available at http://www.doingbusiness.org/reports/global-reports/doing-business-2014.

Note that in this case (P s Y s )* = P s Y s .

This number significantly exceeds the share of intermediate inputs in gross output from the World Input-Output Database. On the one hand, this can be driven by the exclusion of sectors with low share of intermediate inputs: public administration and defence (O), education (P), health (Q) arts, entertainment and recreation (R) and other services activities (S). On the other hand, this may be due to positive industry average distortions that lead to underestimation of α s and β s .

The overview of results in Table 3 suffers from the fact that researchers use various strategies for parametrisation and outlier detection. Also, different time periods and sectoral focuses reduce the comparability.

This to some extent goes in line with Calligaris (2015), who finds the highest TFP gains for low-technology enterprises in Italy.

See Peters (2013) for the model that studies the relationship between firm-specific markups and misallocation.

In 2011–2014, the right to pay this tax existed, if the following criteria were complied with: (a) turnover per calendar year did not exceed 99,600 euro, (b) number of employees at any time did not exceed five, and (c) income of a micro-enterprise employee did not exceed 711 euro per month. See the Law of Microenterprise Tax for more details at https://likumi.lv/ta/en/id/215302-micro-enterprise-tax-law.

Using the data published by the Bureau of Economic Analysis for 2007–2014 and assuming the same production function for all 4-digit NACE sectors within respective 3-digit NAICS sectors.

This is the simplest possible value chain or production network—“vertical economy with a source and a sink” using the terminology of Carvalho (2014). While there exist more complicated networks with more firms involved (e.g. star economy with a central node), these can be viewed as specific cases when several firms provide intermediate inputs for a final good producer.

Namely,\(P_{2,s}^M{\mathrm{ < }}\frac{{R_sK_{1,si}\left( {1 + \tau _{Ksi}} \right){\mathrm{ + }}w_sL_{1,si}\left( {1 + \tau _{Lsi}} \right) + P_s^MM_{1,si}}}{{M_{2,si}}}\).

According to World Bank (2017), the largest number of micro-enterprise workers were employed in legal and accounting activities sector in 2015.

Note that if all firms within an industry outsource to the same degree, the researcher observes α2,s and β2,s, thus being able to use Eqs. (A10)–(A12) and estimate true capital, labour and output distortions.

Of course, more complicated functional forms are possible if there exist several ways of outsourcing.

References

Acemoglu D, Carvalho VM, Ozdaglar A, Tahbaz-Salehi A (2013) The network origins of aggregate fluctuations. Econometrica 80(5):1977–2016

Asker J, Collard-Wexler A, De Loecker J (2014) Dynamic inputs and resource (mis)allocation. J Political Econ 122(5):1013–1063

Bartelsman E, Haltiwanger J, Scarpetta S (2009) Measuring and analyzing cross-country differences in firm dynamic. In: Dunne T, Jensen JB, Roberts MJ (eds) Producer dynamics: new evidence from micro data (National Bureau of Economic Research Studies in Income and Wealth), vol 69. University of Chicago Press, Chicago, pp 15–76

Bellone F, Mallen-Pisano J (2013) Is misallocation higher in france than in the United States? GREDEG Working Paper No. 2013-38, Groupe de Recherche en Droit, Economie, Gestion (GREDEG CNRS), University of Nice-Sophia Antipolis, Nice

Benkovskis K, Berzina S, Zorgenfreija L (2016) Evaluation of Latvia’s re-exports using firm-level data. Balt J Econ 16(1):1–20

Benkovskis K, Fadejeva L, Kalnberzina K (2012) Price setting behaviour in Latvia: econometric evidence from CPI micro data. Econ Model 29(6):2115–2124

Benkovskis K, Tkačevs O (2016) Everything you always wanted to know about Latvia’s service exporters (but were afraid to ask). Latvijas Banka Working Paper No. 6/2015

Bernard AB, Moxnes A, Ulltveit-Moe KH (2014) Two-sided heterogeneity and trade. NBER Working Paper No. 20136

Berthou A, Dhyne E, Bugamelli M, Cazacu A-M, Demian C-V, Harasztosi P, Lalinsky T, Meriküll J, Oropallo F, Soares AC (2015) Assessing European firms’ exports and productivity distributions: the CompNet trade module. ECB Working Paper No. 1788.

Braukša I, Fadejeva L (2016) Internal labour market mobility in 2005–2014 in Latvia: the micro data approach. Balt J Econ 16(2):152–174

Broda C, Weinstein DE (2006) Globalization and the gains from variety. Q J Econ 121(2):541–585

Calligaris S (2015) Misallocation and total factor productivity in Italy: evidence from firm-level data. Labour 29(4):367–393

Carvalho VM (2014) From micro to macro via production networks. J Econ Perspect 28(4):23–48

Dias D, Robalo Marques C, Richmond C (2015) Misallocation and productivity in the lead up to the Eurozone crisis. International Finance Discussion Papers 1146, https://doi.org/10.17016/IFDP.2015.1146, last accessed 14 July 2017

Dias D, Robalo Marques C, Richmond C (2016a) A tale of two sectors: why is misallocation higher in services than in manufacturing? IMF Working Paper WP/16/220

Dias D, Robalo Marques C, Richmond C (2016b) Misallocation and productivity in the lead up to the Eurozone crisis. J Macroecon 49(C):46–70

Di Giovanni J, Levchenko A, Mejean I (2014) Firms, destinations, and aggregate fluctuations. Econometrica 82(4):1303–1340

Fadejeva L, Krasnopjorovs O (2015) Labour market adjustment during 2008–2013 in Latvia: firm level evidence. Latvijas Banka Working Paper No. 2/2015

Fontange L, Santoni G (2015) Firm level allocative inefficiency: evidence from France. CEPII Working Paper, No. 2015-12

Foster L, Haltiwanger J, Syverson C (2008) Reallocation, firm turnover, and efficiency: selection on productivity or profitability? Am Econ Rev 98(1):394–425

Foster K, Grim C, Haltiwanger J, Wolf Z (2016) Firm-level dispersion in productivity: is the devil in the details? Am Econ Rev 106(5):95–98

Gamberoni E, Giordano C, Lopez-Garcia P (2016) Capital and labour (mis)allocation in the euro area: some stylized facts and determinants. ECB Working Paper No. 1981

Garcia-Santana M, Moral-Benito E, Pijoan-Mas J, Ramos R (2016) Growing like Spain: 1995-2007. CEPR Discussion Paper DP11144

Hsieh C-T, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 74(4):1403–1448

Inklaar R, Lashitew A, Timmer MT (2017) The role of resource misallocation in cross-country differences in manufacturing productivity. Macroecon Dyn 21(3):733–756

Jones CI (2011) Misallocation, economic growth, and input-output economics. In: Acemoglu D, Arellano M, Dekel E (eds) Advances in economics and econometrics, Tenth World Congress, vol II. Cambridge University Press, Cambridge, pp 419–455

Banka L (2015) Euro area bank lending survey of June 2015: main results for Latvia, Latvijas Banka, Riga. https://www.bank.lv/images/stories/pielikumi/publikacijas/BLS_6_2015_en.pdf, last accessed 14 July 2017

Libert T (2016) Misallocation and aggregate productivity: evidence from the French manufacturing sector (unpublished document). https://afse2016.sciencesconf.org/98660/document, last accessed 14 July 2017

Los B, Timmer M, de Vries G (2015) Global value chains: ʽFactory World’ is emerging. In: Amador J and di Mauro F (eds) The age of global value chains: maps and policy issues, VoxEU.org eBook. CEPR Press, London, pp. 36–47. http://www.voxeu.org/content/age-global-value-chains-maps-and-policy-issues

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Olley SG, Pakes A (1996) The dynamics of productivity in the telecommunications equipment industry. Econometrica 64(6):1263–1297

Peters M (2013) Heterogeneous mark-ups, growth and endogenous misallocation. LSE Working Paper. http://eprints.lse.ac.uk/54254/, last accessed 14 Jul 2017

Putnins T, Sauka A (2011) Size and determinants of shadow economies in the Baltic States. Balt J Econ 11(2):5–25

World Bank (2017) Latvia tax review, Ministry of Finance of the Republic of Latvia, Riga. http://www.fm.gov.lv/files/files/2017-05-12_10_53_48_Latvia%20Tax%20Review.pdf, last accessed 15 Mar 2018

Wooldridge J (2009) On estimating firm-level production functions using proxy variables to control for unobservables. Econ Lett 104(3):112–114

Acknowledgements

This research was performed within the ESCB Competitiveness Research Network (CompNet). I am grateful to Richard Baldwin, Fabrizio Coricelli, Carlos Robalo Marques, Sašo Polanec and two referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that they have no conflict of interest.

Appendices

Appendix A: Two-stage production framework

A.1 Both stages of production performed in one firm

Production process includes two stages and both stages occurs in one firm. The production function looks the following way:

where \(M_{2,si}{\mathrm{ = }}A_{1,si}K_{1,si}^{\alpha _{1,s}}L_{1,si}^{\beta _{1,s}}M_{1,si}^{1 - \alpha _{1,s} - \beta _{1,s}}\). The profit maximisation problem evolves into

Firm i maximises profits subject to production function and demand constraints given by Eqs. (A1) and (3). This leads to the following first order conditions:

After re-arranging one can express capital, labour and output distortions as a function of observable variables:

A.2 Outsourcing first stage of production

Assume that output is still produced in two stages, but the first stage of production is outsourced to a different firm. Instead of producing M2,si itself, the firm i buys it at the price PM2,s. The production function transforms into:

where Y′ si , K′2,si, L′2,si and M′2,si denote the real output, capital, labour and intermediate inputs in the case of outsourced first-stage. As before, the firm faces downward sloping demand:

where P′ si stands for the output price of the firm i under outsourcing. Profit maximisation problem is similar to Eq. (5):

After solving the maximisation problem, the true capital, labour and output distortions should be derived as

When data on firm-to-firm trade is unavailable and most of the firms in the industry still perform both stages of production, the researcher does not observe α2,s and β2,s. Instead, researcher observes \(\alpha _s = \alpha _{2,s} + \alpha _{1,s}\left( {1 - \alpha _{2,s} - \beta _{2,s}} \right)\) and \(\beta _s = \beta _{2,s} + \beta _{1,s}\left( {1 - \alpha _{2,s} - \beta _{2,s}} \right)\) from the data. As a result, capital, labour and output distortions are going to be evaluated using Eqs. (A4)–(A6), creating a bias:

where τ′ Ksi , τ′Lsi, and τ′ Ysi are estimated capital, labour and output distortions in the case of outsourced first stage of production.

Appendix B: Figures

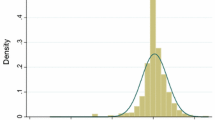

Relationship between relative output distortions (1 – τ* Ysi )/(1 – τ Ys ) and several firms’ characteristics in 2014. Source: Latvia’s firm-level database, author’s calculations. Notes: Firm-level output distortions are estimated using Eq. (22), while the average industry output distortions—Eq. (15). Higher value corresponds to the larger output distortion relative to the industry average. Obtained by the kernel-weighted local polynomial smoothing

Alternative estimates of gains from reallocation to aggregate gross output. Source: Latvia’s firm-level database, author’s calculations. Notes: Gains to total gross output are determined as 100 × (Y*/Y – 1). Contributions for output, capital and labour distortions are estimated by eliminating variation in respective distortion. The residual is attributed to interactions between various distortions

Rights and permissions

About this article

Cite this article

Benkovskis, K. Misallocation, productivity and fragmentation of production: the case of Latvia. J Prod Anal 49, 187–206 (2018). https://doi.org/10.1007/s11123-018-0530-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-018-0530-1