Abstract

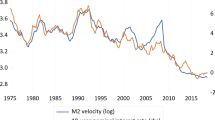

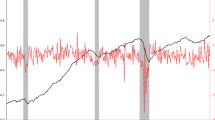

In this paper we provide an update regarding the effects of money growth variability on real economic activity in the United States using monthly data and the new CFS Divisia monetary aggregates, extending the work in Serletis and Shahmoradi (Macroecon Dyn 10:652–666 2006) and Serletis and Rahman (Open Econ Rev 20:607–630 2009, Macroecon Dyn 17:1638–1658 2013). We present evidence that increased uncertainty about the growth rate of the CFS Divisia M1, M2M, and M4+ monetary aggregates is associated with a lower average growth rate of real economic activity in the United States. We also argue that optimal monetary aggregation, as suggested over thirty years ago by Barnett (J Money Credit Bank 14:687–710 1982), will further improve our understanding of how money affects the economy.

Similar content being viewed by others

References

Anderson RG, Buol J (2005) Revisions to User Costs for the Federal Reserve Bank of St, Louis Monetary Services Indices.Federal Reserve Bank of St. Louis. Review 87:735–749

Anderson RG, Jones BE, Nesmith TD (1997a) Monetary Aggregation Theory and Statistical Index Numbers. Federal Reserve Bank of St.Louis. Review 79:31–51

Anderson RG, Jones BE, Nesmith TD (1997b) Building New Monetary Services Indexes:Concepts, Data and Methods. Federal Reserve Bank of St. Louis. Review 79:53–82

Anderson RG, Jones BE (2011) A Comprehensive Revision of the U.S. Monetary Services (Divisia) Indexes.Federal Reserve Bank of St. Louis. Review 93:325–359

Barnett WA (1980) Economic Monetary Aggregates: An Application of Aggregation and Index Number Theory. J Econ 14:11–48

Barnett WA (1982) The Optimal Level of Monetary Aggregation. J Money Credit Bank 14:687–710

Barnett WA (2014) Friedman and Divisia Monetary Measures. In: Cord R, Hammond D (eds) Milton Friedman: Contributions to Economics and Public Policy. Oxford University Press forthcoming

Barnett WA, Chauvet M (2009) International Financial Aggregation and Index Number Theory: A Chronological Half-century Empirical Overview. Open Econ Rev 20:1–37

Barnett WA, Liu J, Mattson RS, van den Noort J (2013) The New CFS Divisia Monetary Aggregates: Design, Construction, and Data Sources. Open Econ Rev 24:101–124

Belongia MT, Ireland PN (2013) Instability: Monetary and Real. Boston College Working Papers in Economics 830. Department of Economics, Boston College

Blinder AS (2013) Exit to What? The Status Quo Ante or Some New Normal? In Exit Strategy. Geneva Reports on the World Economy 15.Geneva: International Center for Monetary and Banking Studies, pp 5–11

Bloom N (2014) Fluctuations in Uncertainty. J Econ Perspect 28:153–176

Cesa-Bianchi A, Pesaran MH, Rebucci A (2014) Uncertainty and Economic Activity: A Global Perspective. CESIFO Work Pap No: 4736

Chrystal KA, MacDonald R (1994) Empirical Evidence on the Recent Behavior and Usefulness of Simple-Sum and Weighted Measures of the Money Stock. Federal Reserve Bank of St. Louis. Review 76:73–109

Friedman M (1960) A Program for Monetary Stability. Fordham University Press, New York

Friedman M (1983) Monetary Variability:The United States and Japan. J Money Credit Bank 15:339–343

Friedman M (1984) Lessons fron the 1979–1982 Monetary Policy Experiment. Am Econ Rev Pap Proc 74:397–400

Grier KB, Henry ÓT, Olekalns N, Shields K (2004) The Asymmetric Effects of Uncertainty on Inflation and Output Growth. J Appl Econ 19:551–565

(2008). International Monetary Fund. Divisia Money, Monetary and Financial Statistics:Compilation Guide. International Monetary Fund Publications Services, Washington,D.C

Ljung T, Box G (1979) On a Measure of Lack of Fit in Time Series Models. Biometrica 66:66–72

Mishkin FS (2013) Exit to What? In Exit Strategy. Geneva Reports on the World Economy 15.Geneva: International Center for Monetary and Banking Studies

Serletis A, Gogas P (2014) Divisia Monetary Aggregates, the Great Ratios, and Classical Money Demand Functions. J Money, Credit Bank 46:229–241

Serletis A, Rahman S (2009) The Output Effects of Money Growth Uncertainty: Evidence from a Multivariate GARCH-in-Mean VAR. Open Econ Rev 20:607–630

Serletis A, Rahman S (2013) The Case for Divisia Money Targeting. Macroecon Dyn 17:1638–1658

Serletis A, Shahmoradi A (2006) Velocity the Variability of Money Growth:Evidence from a VARMA, GARCH-M Model. Macroecon Dyn 10:652–666

Simons HC (1936) Rules versus Authorities in Monetary Policy. J Polit Econ 64:1–30

Tavlas GS (2014) In Old Chicago: Simons, Friedman and the Development of Monetary-Policy Rules. Becker Friedman Institute Working Paper No. 2014-02

Wyplosz C (2013) Introduction and Acknowledgements In Exit Strategy. Geneva Reports on the World Economy 15. Geneva: International Center for Monetary and Banking Studies: 1

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank the Editor, George Tavlas, for comments that greatly improved the paper.

Rights and permissions

About this article

Cite this article

Serletis, A., Rahman, S. On the Output Effects of Monetary Variability. Open Econ Rev 26, 225–236 (2015). https://doi.org/10.1007/s11079-014-9325-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-014-9325-9