Abstract

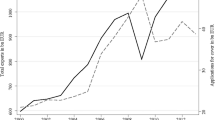

This paper endeavours to find out in how far public export insurance schemes foster international trade. Thereto, a gravity equation is derived, which accounts for the risk of financial losses in case firms contract defaulting foreign buyers. Empirical results suggest that OECD countries issuing trade credits with generous state-guarantees did not, during the 1999 to 2005 period, witness more exports towards politically and commercially more unstable low-income countries. Rather, publicly indemnified trade finance has promoted exports, to a modest degree, towards high and middle-income countries, where financial intermediaries and markets provide viable alternatives to hedge against payment risks.

Similar content being viewed by others

Notes

Other trade regulators have adopted rules on the legal conduct of public export insurance schemes. The WTO’s “Agreement on Subsidies and Countervailing Measures” outlaws bailing out unprofitable export insurance schemes with public funds as illegitimate industry subsidisation. By means of the Council Directive 98/29/EC, the European Union attempts to harmonise the rules underlying the public provision of medium and long-term export credit insurance across member countries.

Based on a slightly different model where export credit is offered at below market interest rates rather than covered by subsidised insurance, Carmichael (1987) reaches a similar conclusion.

For further details on this see e.g. Anderson and Van Wincoop (2003, pp. 174–175).

To see this, observe that the second term on the right hand side of Eq. 1 contributes maximally to expected profits in case (r j < λ j ) and (γ ij = 1). According to Abraham and Dewit (2000) as well as Dewit (2001), exporters exhibiting some degree of risk aversion desire to insure fully even if premiums are actuarially fair.

See Baltensperger and Herger (2007) for detailed discussion.

Gravity equations typically draw on more comprehensive bilateral trade flows (see e.g. Baldwin and Taglioni 2006). However, the present study looks into the extent to which ECAs impact upon domestic exports wherefore the policy target of unilateral trade flows will serve as dependent variable.

To measure subsidies rather profits on insurance policies, the original measure proposed by Dewit (2001) has been reversed. Alternatively, premiums could be related to the volume of newly underwritten business to proxy for average export insurance conditions. This leaves the amount of disbursed claims and retrieved recoveries unaccounted for. Nevertheless, the undermentioned results are by and large not sensitive to employing alternative proxies for the level of premium subsidies.

This figure has been calculated for the 1999 to 2004 period as figures for 2005 are not available from the latest edition of the Yearbook of the Berne Union.

Note that a 1 is added to export values to avoid zero-valued observations from dropping out when applying a logarithmic transformation.

Alternatively, nominal variables might be deflated by means of price indices. The caveat against this lies in the excessive amount of information needed to correctly adjust for price changes accruing to trade and income variables as inherent in the variables P j and Ω j of Eq. 4. Indeed, most countries do not publish separate price indices for traded goods and services (Baldwin and Taglioni 2006).

In high-income countries, RISK enters with a positive sign. Countries scoring a default risk higher than 2 despite having relatively high incomes include Bahrain, Cyprus, Israel, Qatar, and Saudi Arabia. Potentially, in oil-rich countries and countries located in areas with a history of armed conflict, some of the trade-off between exporting and payment risks remains opaque. Indeed, excluding these countries yields a negative and significant sign on RISK. Likewise, employing the RET framework suggests that exports across high income countries tend to decrease in the probability of default.

The results of this and the previous paragraph are by and large robust towards interacting insurance policy variables with default RISK in order to reflect the more comprehensive protection typically offered when trade is directed towards affluent countries.

References

Abraham F, Dewit G (2000) Export promotion via official export insurance. Open Econ Rev 11:5–26

Acemoglu D, Johnson S (2005) Unbundling institutions. J Polit Econ 113:949–995

Alsem K, Antufjew J, Huizingh E, Koning R, Sterken E, Woltil M (2003) Insurability of export credit risks. SOM Research Report 03F07. Groningen

Anderson JE, Wincoop EV (2003) Gravity with gravitas: a solution to the border puzzle. The Amer Econ Rev 93:170–192

Baldwin R, Taglioni D (2006) Gravity for dummies and dummies for gravity equations. NBER Working Paper 12516, Cambridge, MA

Baltensperger E, Herger N (2007) Exporting against risk? Theory and evidence from public export insurance schemes in OECD countries. NCCR Working Paper No 2007/29

Berne Union (2006) Yearbook 2006. London

Boote AR, Ross DC (1998) Officially supported export credits: recent developments and prospects. World Economic and Financial Surveys. International Monetary Fund, Washington

Carmichael C (1987) The control of export credit subsidies and its welfare consequences. J Int Econ 23:1–19

Dewit G (2001) Intervention in risky export markets: insurance, strategic action or aid? European J Polit Econ 17:575–592

Dewit G (2002) Risky business: multinationals, uncertainty and asymmetric insurance. Economica 69:357–370

Fingerand MK, Schuknecht L (1999) Trade, finance and financial crisis. WTO Special Studies 3. World Trade Organisation, Geneva

Henry DP (1987) The financial cost of export credit guarantee programs. Rand Publication Series, Santa Monica

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny RW (1997) Legal determinants of external finance. The J Finance 52:1131–1150

North D (1990) Institutions, institutional change, and economic performance. Cambridge Univ. Press, Cambridge

OECD (various years) Export Credit Activities. Paris

OECD (various years) Export Credit Financing Systems in OECD Member Countries and Non-Member Countries. Paris

Stephens M (1998) Export credit agencies, trade finance and South East Asia. IMF Working Paper 78/175. Washington

Acknowledgements

This paper has benefited from valuable comments and suggestions by seminar participants at the WTI in Berne, Susan Kaplan, and a thoughtful referee. Financial support of the Ecoscientia and the Swiss National Science Foundation is acknowledged with thanks. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Baltensperger, E., Herger, N. Exporting against Risk? Theory and Evidence from Public Export Insurance Schemes in OECD Countries. Open Econ Rev 20, 545–563 (2009). https://doi.org/10.1007/s11079-007-9076-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-007-9076-y