Abstract

“Market Coupling” is currently seen as the most advanced market design in the restructuring of the European electricity market. Market Coupling, by construction, introduces what is generally referred to as an incomplete market: it leaves several constraints out of the market and hence avoids pricing them. This may or may not have important consequences in practice depending on the case on hand. Quasi-Variational Inequality problems and the associated Generalized Nash Equilibrium can be used for representing incomplete markets. Recent papers propose methods for finding a set of solutions of Quasi-Variational Inequality problems. We apply one of these methods to a subproblem of market coupling namely the coordination of counter-trading. This problem is an illustration of a more general question encountered, for instance, in hierarchical planning in production management. We first discuss the economic interpretation of the Quasi-Variational Inequality problem. We then apply the algorithmic approach to a set of stylized case studies in order to illustrate the impact of different organizations of counter-trading. The paper emphasizes the structuring of the problem. A companion paper considers the full problem of Market Coupling and counter-trading and presents a more extensive numerical analysis.

Similar content being viewed by others

Notes

A Power Exchange (PX) is an operator with the mission of organizing and economically managing (clearing) the electricity market.

Transmission System Operator (TSO) is a company that is responsible for operating, maintaining and developing the transmission system for a control area and its interconnections. See ENTSO website.

Note that in Facchinei et al. (2007), the non-common constraints (Eq. (13) and the analogous variables for the other players) are assimilated to the common constraints. Those authors say: “Note that usually there are two groups of constraints, those which depend on x and those depending on a single player’s variables x i . For notational simplicity, and following the original paper by Rosen, we include these latter constraints in the former ones”.

Directly taken from Fukushima (2008).

This relation corresponds to what we state in Proposition 1 that is presented in Section 4.2.2.

For a global view of the European electricity market see, for instance, Leuthold et al. (2010).

For instance, TenneT (Dutch TSO) and Elia (Belgian TSO) respectively acquire E.ON and Vattenfall (German TSOs) grids and the Belgian and the French TSOs (respectively Elia and RTE) founded the company “Coreso” that has been recently joined by the Italian TSO Terna and the German TSO 50Herz Transmission (see all Press Releases available at http://www.coreso.eu/press-releases.php).

See Appendix C for the formulation of the problem.

The apeces N,S of the parameters γ N,S,± indicate “North” and “South”; while the signs “+” and “−” indicate the flow directions. The positive direction is from the Northern to the Southern zone; the negative direction is from the Southern to the Northern zone.

The choice of the value of \(\gamma_{l}^{N,S,\pm}\) has been conducted in the following way. In Case 1, we first run the problem by setting all \(\gamma_{l}^{N,S,\pm}\) equal to zero. Line (1–6) is congested and assumes a marginal value (\(\lambda_{(1-6)}^{+}\)) of 40 €/MWh. Taking into account the relations among \(\lambda_{l}^{\pm}\), \(\lambda_{l}^{N,S,\pm}\) and \(\gamma_{l}^{N,S,\pm}\) defined in Proposition 1, in Case 2 we set \(\gamma_{(1-6)}^{N,S,+}\) equal to 40 €/MWh. The marginal value of line (1–6) becomes zero, but both in Cases 1 and 2, \(\lambda_{(1-6)}^{N,S,+}\) are equal to 40, while \(\lambda_{(2-5)}^{N,S,+}\) are zero. Lines (1–6) and (2–5) are not congested in the opposite direction and then \(\lambda_{(l)}^{N,S,-}\) are equal to zero. Cases 1 and 2 are equivalent and leads to the same global counter-trading costs. In fact, the two TSOs attribute the same marginal value to the common congested transmission line. Counter-trading costs increase in Case 3, 4 and 5 where the two TSOs see different prices for the common congested lines.

Starting from the results of Cases 1 and 2, the values assigned to γ are chosen in such a way that GNEs are less efficient than in Cases 1 and 2. The economical interpretation of this, that also holds for Cases 4 and 5, is the absence of a capacity market that implies additional counter-trading costs.

The approaches used to select \(\gamma_{l}^{N,S,\pm }\) is identical to that adopted in the former Section.

References

Arrow KJ, Debreu G (1954) Existence of an equilibrium for a competitive economy. Econometrica 22:265–893

Cadwalader MD, Harvey SM, Hogan WW, Pope SL (1998) Market coordination of transmission loading relief across multiple regions. Available at http://www.hks.harvard.edu/fs/whogan/extr1298.pdf

Chao HP, Peck SC (1998) Reliability management in competitive electricity markets. J Regul Econ 14:198–200

Debreu G (1952) A social equilibrium existence theorem. Proc Natl Acad Sci 38:886–290

Facchinei F, Pang JS (2003) Finite-dimensional variational inequalities and complementarity problems, vols 1 and 2. Springer, New York

Facchinei F, Pang JS (2010) Nash equilibria: the variational approach. In: Palomar DP, Eldar YC (eds) Convex optimization in signal processing and communications. Cambridge University Press, Cambridge, pp 443–493

Facchinei F, Kanzow C (2007) Generalized Nash equilibrium problems. 4OR 5:173–210

Facchinei F, Sagratella S (2010) On the computation of all solutions of jointly convex generalized Nash equilibrium problems. Optim Lett. doi:10.1007/S11590-010-0218-6

Facchinei F, Fischer A, Piccialli V (2007) On generalized Nash games and variational inequalities. Oper Res Lett 35:159–164

Fukushima M (2008) Restricted generalized Nash equilibria and controlled penalty method. Comput Manag Sci. doi:10.1007/S10287-009-0097-4

Harker PT (1991) Generalized Nash games and quasi-variational inequalities. Eur J Oper Res 54:81–94

Kubota K, Fukushima M (2010) Gap function approach to the generalized Nash equilibrium problem. J Optim Theory Appl 144:511–513

Kulkarni AA, Shanbhag UV (2009) New insights on generalized Nash games with shared constraints: constrained and variational equilibria. In: Proceedings of the 48th joint IEEE conference on decision and control. Shanghai, PR China, 16–18 Dec 2009

Kulkarni AA, Shanbhag UV (2010) Revising generalized Nash games and variational inequalities. Available at https://netfiles.uiuc.edu/udaybag/www/Papers/comparison_final.pdf

Kurzidem MJ (2010) Analysis of flow-based market coupling in oligopolistic power markets. Dissertation ETH Zurich for the degree of Doctor of Sciences, No 19007. Available at http://www.eeh.ee.ethz.ch/uploads/tx_ethpublications/Kurzidem_diss.pdf

Leuthold FU, Weigt H, von Hirschhausen C (2010) A large-scale spatial optimization model of the European electricity market. Netw Spat Econ. doi:10.1007/s11067-010-9148-1

Metzler C, Hobbs BF, Pang JS (2003) Nash-Cournot equilibria in power markets on a linearized DC network with arbitrage: formulations and properties. Netw Spat Econ 3(2):123–150

Nabetani K, Tseng P, Fukushima M (2009) Parametrized variational inequality approaches to generalized Nash equilibrium problems with shared constraints. Comput Optim Appl. doi:10.1007/s10589-009-9256-3

Oggioni G, Smeers Y (2010a) Degree of coordination in market coupling and counter-trading. CORE discussion paper 01

Oggioni G, Smeers Y (2010b) Market coupling and the organization of counter-trading: separating energy and transmission again? CORE discussion paper, vol 53. Presented at the 17th power systems computation conference, Stockholm, Sweden, 22–26 Aug 2011

Pang JS, Fukushima M (2005) Quasi-variational inequalities, generalized Nash equilibria, and multi-leader-follower games. Comput Manag Sci. 2:21–56

Ralph D, Smeers Y (2006) EPECs as models for electricity markets. Invited paper, Power Systems Conference and Exposition (PSCE), pp 74–80. doi:10.1109/PSCE.2006.296252

Rosen JB (1965) Existence and uniqueness of equilibrium points for concave N-person games. Econometrica 33:520–534

Smeers Y (2003a) Market incompleteness in regional electricity transmission. Part I: the forward market. Netw Spat Econ 3(2):151–174

Smeers Y (2003b) Market incompleteness in regional electricity transmission. Part II: the forward and real time markets. Netw Spat Econ 3(2):175–196

Smeers Y, Wei JY (1999) Spatial oligopolistic electricity models with Cournot generators and regulated transmission prices. Oper Res 47:102–112

Williamson OE (1981) The economics of organization: the transaction cost approach. Am J Sociol 87(3):548–577

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Market Coupling model

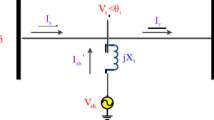

Market Coupling (MC) organizes a partial integration of PXs and TSOs: PXs clear the energy markets on the basis of a simplified representation of the transmission grid given to them by TSOs. Market Coupling is the most advanced version of cross-border trade implemented in continental Europe. It currently links the electricity markets of France, Belgium, The Netherlands and since November 2010 Germany. Our problem formulation (realistically) assumes that PXs operate in a coordinated way to clear a two zone market organized as depicted in Fig. 2. The objective function (95) includes an average re-dispatching cost α that is here interpreted as part of the access change to the network. This levy is proportional to the quantity injected in the energy market. Because demand is equal to generation, this uniform access charge to the grid can equally be interpreted as paid by generators or consumers. Conditions (96) and (97) express the energy balance in the Northern and Southern zones respectively. The free variable I indicates the import/export between the two zones. The shadow variables ϕ N,S are the marginal energy prices of the Northern and Southern zones respectively. Constraints (98) and (99) impose that flow I does not exceed the transfer limit \(\overline{I}\) of the interconnecting line in the two possible directions. The dual variables δ 1 and δ 2 are the marginal costs of utilization of this zonal link. Finally, variables q n are non-negative.

s.t.

Appendix B: Complementarity conditions of the optimized counter-trading model

Consider the complementarity formulation of problem (53)–(59), as indicated below, where \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\)

where \(c_{i}(q_{i}+\Delta q_{i})=\frac{\partial \int_{q_{i}}^{q_{i}+\Delta q_{i}}c_{i}}{\partial \Delta q_{i}}\) for i = 1,2,4 and \(\omega _{j}(q_{j}+\Delta q_{j})=\frac{\partial \int_{q_{j}}^{q_{j}+\Delta q_{j}}w_{j}}{\partial \Delta q_{j}}\) for j = 3,5,6.

Appendix C: TSOS’ s problem in the decentralized counter-trading Model 1

The problem (107)–(112) solved by TSOS is similar to that of the TSON. Its formulation is as follows:

s.t.

where l = (1 − 6),(2 − 5)

Appendix D: Complementarity conditions of the decentralized counter-trading Model 1

We here present the mixed complementarity formulation of the decentralized counter-trading Model 1 (66)–(74). Setting \(\gamma _{l}^{N}=(-\gamma _{l}^{N,+}+\gamma _{l}^{N,-})\); \( \gamma _{l}^{S}=(-\gamma _{l}^{S,+}+\gamma _{l}^{S,-})\) and \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\) for l = ((1 − 6),(2 − 5)), the complementarity conditions are as follows:

where i = 1,2,4; j = 3,5,6 and the dual variables μ N,1, μ S,1, μ N,2 and μ S,2 associated with equality constraints are free variables. Note that:

Note that conditions (113), (114), (119) and (120) exclusively refer to TSON, while (115), (116), (121) and (122) are those of TSOS. Finally, (117) and (118) are the common transmission constraints.

Appendix E: Proof of Proposition 1

Consider the KKT conditions (113)–(116) of the decentralized counter-trading Model 1 (66)–(74) reported in Appendix D and compare them to the KKT conditions of the two TSOs’ problems (namely (60)–(65) for TSON and (107)–(112) for TSOS) computed with respect to \(\Delta q_{n}^{N}\) and \(\Delta q_{n}^{S}\) that we here report:

where \(\lambda_l^N=(-\lambda_l^{N,+}+ \lambda_l^{N,-})\) and \(\lambda_l^S=(-\lambda_l^{S,+}+ \lambda_l^{S,-})\).

The comparison between conditions (125)–(128) and (113)–(116) shows that

Following Theorem 3.3 of Nabetani et al. (2009) and thanks to the constraint qualification, the following relation (129)

is a necessary and sufficient condition for a solution x∗ to problem VI(F γ,K) to be a GNE. Note that g(x∗) refers to a transmission constraint shared by the two TSOs. Suppose this property holds for a solution of the parametrized problem (66)–(74) and bearing in mind that each transmission line can be congested in one direction only, we obtain:

□

Appendix F1: Proof of Proposition 2

Because all constraints are linear, constraint qualification holds. As already indicated,

is a necessary and sufficient condition for a solution x∗ to problem VI(F γ,K) to be a GNE.

Suppose this property holds for a solution of the parametrized problem (66)–(74). It is then a GNE and we can write the KKT conditions of that parametrized problem (see the complementarity conditions in Appendix D). Suppose that \(q_{n}+\Delta q_{n}^{N}+\Delta q_{n}^{S}>0\) for all n and note \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\), \(\gamma _{l}^{N}=(-\gamma _{l}^{N,+}+\gamma _{l}^{N,-})\) and \(\gamma _{l}^{S}=(-\gamma _{l}^{S,+}+\gamma _{l}^{S,-})\) in order to simplify the discussion. Then the optimality condition in (113)–(116) are binding and it follows that:

Subtracting (133) from (131) and (134) from (132) leads to the following conditions:

Because node 6 is the hub, we have PTDF 6,l = 0 and hence (μ N,1 + μ N,2) − (μ S,1 + μ S,2) = 0 in (136). This in turn implies \((\gamma _{(1-6)}^{N}-\gamma _{(1-6)}^{S})PTDF_{j,(1-6)}+(\gamma _{(2-5)}^{N}-\gamma _{(2-5)}^{S})PTDF_{j,(2-5)}=0\) for j = 3,5 and then:

This is verified only when \(\gamma _{l}^{N}=\gamma _{l}^{S}\) because the ratio \(\frac{PTDF_{j,(2-5)}}{PTDF_{j,(1-6)}}\) assumes a positive and a negative value. Taking stock of condition (130), we can deduce that:

□

Appendix F2: Generalizing Proposition 2

Assume now that the market is sub-dived in z = 1,...,Z zones each controlled by a TSO. The expressions \( q_{i}+\Delta q_{i}^{N}+\Delta q_{i}^{S} \) and \(q_{j}+\Delta q_{j}^{N}+\Delta q_{j}^{S}\) are respectively substituted by \(q_{i}+\sum_{z=1}^{Z}\Delta q_{i}^{z}\) and \(q_{j}+\sum_{z=1}^{Z}\Delta q_{j}^{z}\) where \(\Delta q_{i}^{z} \) and \(\Delta q_{j}^{z}\) are the variations operated by TSOz on power respectively produced and consumed in nodes i ∈ I and j ∈ J. Following former discussions in the now resolved flowgate/nodal pricing debate in the US and current discussions on the European “flow based” approach (see De Jong et al., Effects of flow-based market coupling for the CWE region. Available at http://www.nextgenerationinfrastructures.eu/download.php?field=document&itemID=449543 and Kurzidem 2010) we assume that the lines subject to congestion are few in the overall transmission infrastructure: we let L be this subset of potentially congested lines and adopt a European like terminology to refer to them as critical infrastructures (this terminology is used for the energy market in the European MC). We introduce the following NTF problem that generalizes the corresponding two zone problem (71)–(72).

s.t.

We can then state the following proposition that extends Proposition 2.

Proposition 9

Denote transmission constraints (141) and (142) respectively as \( g_{l}^{+}\) and \(g_{l}^{-}\) . Suppose that the optimization problem (138)–(143) has a solution that satisfies the conditions \(\left\langle g_{l}^{+}(x^{\ast}),\gamma _{l}^{z,+}\right\rangle =0\) and \(\left\langle g_{l}^{-}(x^{\ast }),\gamma _{l}^{z,-}\right\rangle =0\) defined by Theorem 3.3 of Nabetani et al. (2009). Suppose that the sum of the number of counter-trading resources and critical infrastructures traded among TSOs in the counter-trading market is greater or equal to the total number of critical infrastructures (cardinality of L .) Then, the solution of problem (138)–(143) exists if and only if \(\gamma _{l}^{z,+}=\gamma _{l}^{z^{\prime },+}\) and \(\gamma _{l}^{z,-}=\gamma _{l}^{z^{\prime },-}\) for all z . If so, then the optimal solution of that NTF problem is a GNE.

Proof of Proposition 9

Accounting for the above modifications and, in order to simplify the presentation, assuming that \(q_{i}+\sum_{z=1}^{Z}\Delta q_{i}^{z}>0\) and \( q_{j}+\sum_{z=1}^{Z}\Delta q_{j}^{z}>0\) and setting \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\), \(\gamma _{l}^{N}=(-\gamma _{l}^{N,+}+\gamma _{l}^{N,-})\) and \(\gamma _{l}^{S}=(-\gamma _{l}^{S,+}+\gamma _{l}^{S,-})\), one can deduce that conditions (131)–(134) can be generalized as follows:

Consider two different zones that we denote as z and z′. Subtracting (144) for zone z′ ≠ z from (144) for zone z and doing the same for (145), we obtain:

Assuming that n ∈ J is the hub node, we then have PTDF n,l = 0 and hence \((\mu ^{z,1}+\mu ^{z,2})-(\mu ^{z^{\prime },1}+\mu ^{z^{\prime },2})=0\) in Eq. (147). This in turn implies:

Note that now condition (148) denotes a homogeneous system. If the number of j ≠ n nodes is greater or equal to the number of the terms of the sum \(\sum_{l}(\gamma _{l}^{z}-\gamma _{l}^{z^{\prime }})PTDF_{j,l}\) for each of the Z − 1 independent couples \( \gamma _{l}^{z}-\gamma _{l}^{z^{\prime }}\) then \(\gamma _{l}^{z}=\gamma _{l}^{z^{\prime }}\) and thus \(\gamma _{l}^{z,+}=\gamma _{l}^{z^{\prime },+}\) , \(\gamma _{l}^{z,-}=\gamma _{l}^{z^{\prime },-}\). This particular solution corresponds to the case where a market for line capacity exists. In the opposite case, the system has infinite number of solutions. Suppose however that one creates a market of line capacities where the number of lines in that market is such that the number of j ≠ n nodes plus the line in the transmission market is equal to the number of the terms of the sum \( \sum_{l}(\gamma _{l}^{z}-\gamma _{l}^{z^{\prime }})PTDF_{j,l}\) for each of the Z − 1 independent couples , then \(\gamma _{l}^{z,-}=\gamma _{l}^{z^{\prime },-}\). □

Appendix G1: Proof of Proposition 3

In order to simplify the discussion, assume again that \(q_{n}+\Delta q_{n}^{N}+\Delta q_{n}^{S}>0\) ∀ n and define \(\lambda _{l}^{N}=(-\lambda _{l}^{N,+}+\lambda _{l}^{N,-})\) and \(\lambda _{l}^{S}=(-\lambda _{l}^{S,+}+\lambda _{l}^{S,-})\) for l = ((1 − 6),(2 − 5)). Replace \(q_{n}+\Delta q_{n}^{N}+\Delta q_{n}^{S}\) with \( q_{n}+\sum_{z=N,S}\Delta q_{n}^{z}\) ∀ n. The KKT conditions of the two TSOs’ problems (namely (60)–(65) for TSON and (107)–(112) for TSOS) obtained by deriving with respect to the variables \(\Delta q_{n}^{N}\) and \(\Delta q_{n}^{S}\) are as follows:

Summing (149) to (150), we have:

Since condition (151) holds for both TSOs, we can rewrite it in an explicit way:

Subtracting (153) from (152), we get:

We now subtract (150) from (149) and apply the above reasoning. We get:

that can be substituted by these two conditions:

Subtracting (157) from (156), one yields:

The combination of conditions (154) and (158) leads to the following equalities:

By setting, α = (μ N,1 + μ N,2) − (μ S,1 + μ S,2) and β = (μ N,1 − μ N,2) − (μ S,1 − μ S,2) conditions (159) and (160) become:

We observe that PTDF 6,l = 0. This implies that α = 0. If α = 0, then it holds that:

This corresponds to:

But \(\frac{PTDF_{j,(2-5)}}{PTDF_{j,(1-6)}}\) assumes a positive and a negative value respectively for j = 3,5 and then \(\mathbf{\lambda }_{l}^{N} \mathbf{=\lambda }_{l}^{S}\). This result means that the marginal values of transmission lines are identical for both TSOs. Consequently, the two TSOs are implicitly coordinated and there is no arbitrage. This also implies that α = β = 0 and then:

These can be rewritten as follows:

This implies that μ N,1 = μ S,1 and μ N,2 = μ S,2. □

Appendix G2: Generalizing Proof of Proposition 3

In this appendix, we generalize the results of Proposition 3. Assume again that the market is sub-dived in z = 1,...,Z zones each controlled by a TSO. The expressions \(q_{i}+\Delta q_{i}^{N}+\Delta q_{i}^{S}\) and \(q_{j}+\Delta q_{j}^{N}+\Delta q_{j}^{S}\) can be respectively substituted by \( q_{i}+\sum_{z=1}^{Z}\Delta q_{i}^{z}\) and \(q_{j}+\sum_{z=1}^{Z}\Delta q_{j}^{z}\) where \(\Delta q_{i}^{z}\) and \(\Delta q_{j}^{z}\) are the variations operated by TSOz on power respectively produced and consumed in nodes i ∈ I and j ∈ J.

Proposition 10

Suppose that the sum of the number of counter-trading resources and critical infrastructures that are explicitly traded among TSOs in counter-trading (for which there is an organized market) is greater or equal to the total number of critical infrastructures (cardinality of L .). If the solution of the GNE problem (138)–(143) exists, then it satisfies \(\gamma _{l}^{z,\pm }=\gamma _{l}^{z^{\prime },\pm }\) and \(\mu ^{z,1}=\mu ^{z^{\prime },1}\) and \(\mu ^{z,2}=\mu ^{z^{\prime },2}\).

Proof of Proposition 10

Assume again in order to simplify the discussion that \(q_{n}+\sum_{z=1}^{Z} \Delta q_{n}^{z}>0\) ∀ n and define \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\) for l ∈ L. We state the KKT conditions of the generalized parametrized problem (138)–(143). We get:

Summing (170) to (171), we have:

Since condition (172) holds for all TSOs, we can rewrite it as follows:

Subtracting (174) from (173), we get:

We now subtract (171) from (170) and apply the above reasoning. We get:

that can be substituted by these two conditions:

Again, subtracting (178) from (177), one yields:

The combination of conditions (175) and (179) leads to the following equalities:

By setting, \(\alpha =(\mu ^{z,1}+\mu ^{z,2})-(\mu ^{z^{\prime },1}+\mu ^{z^{\prime },2})\) and \(\beta =(\mu ^{z,1}-\mu ^{z,2})-(\mu ^{z^{\prime },1}-\) \(\mu ^{z^{\prime },2})\) conditions (180) and (181) become:

Assuming that n ∈ J is the hub node. This implies that α = 0. If α = 0, then it holds that:

Note that now condition (184) denotes a homogeneous system. If the number of j ≠ n nodes is greater or equal to the number of the terms of the sum \(\sum_{l}(\gamma _{l}^{z}-\gamma _{l}^{z^{\prime }})PTDF_{j,l}\) for each of the Z − 1 independent couples, then \( \lambda _{l}^{z}-\lambda _{l}^{z^{\prime }}\) then \(\lambda _{l}^{z}=\lambda _{l}^{z^{\prime }}\) and thus \(\lambda _{l}^{z,+}=\lambda _{l}^{z^{\prime },+} \), \(\lambda _{l}^{z,-}=\lambda _{l}^{z^{\prime },-}\). This particular solution corresponds to the case where a market for line capacity exists. In the opposite case, the system has infinite number of solutions. Suppose however that one creates a market of line capacities where the number of lines in that market is such that the number of j ≠ n nodes plus the line in the transmission market is equal to the number of the terms of the sum \(\sum_{l}(\gamma _{l}^{z}-\gamma _{l}^{z^{\prime }})PTDF_{j,l}\) for each of the Z − 1 independent couples , then \(\lambda _{l}^{z,-}=\lambda _{l}^{z^{\prime },-}\). Consequently, the TSOs are implicitly coordinated and there is no arbitrage. This also implies that α = β = 0 and then:

These can be rewritten as follows:

This implies that \(\mu ^{z,1}=\mu ^{z^{\prime },1}\) and \(\mu ^{z,2}=\mu ^{z^{\prime },2}\). □

Appendix H: Proof of Corollary 1

Corollary 3.2 of Nabetani, Tseng and Fukushima’s paper (see Nabetani et al. (2009)) proves that if the dual problem has solution then

We first consider the case where γ = 0. Under this assumption VI(F,K) = VI(F γ = 0,K) and the parametrized problem is identical to the optimized counter-trading problem. This can be easily done by imposing \(\Delta q_{n}^{N}+\) \(\Delta q_{n}^{S}\) = Δq n .

As already observed, the optimized counter-trading problem has a unique solution because of the convexity of the set K and the strict convexity of its objective function. This implies that the solution of the decentralized counter-trading problem (66)–(74) coincides with that of the optimized counter-trading model (53)–(59) when γ = 0.

We now show that the solution set of problem VI(F γ,K) when \( \gamma _{l}^{N,\pm }=\gamma _{l}^{S,\pm}\) and μ Z,1 = μ Z,2 reduces to a unique solution that is the solution of the optimized counter-trading problem (53)–(59).

Compare now the KKT conditions of the optimized counter-trading problem with those of the decentralized counter-trading problem. Denote \(\Delta q_{n}=\Delta q_{n}^{N}+\Delta q_{n}^{S}\) for all n and \(\lambda _{l}=(-\lambda _{l}^{+}+\lambda _{l}^{-})\), the optimality conditions of the optimized counter-trading model are as follows (compare complementarity conditions in Appendix B):

Denoting similarly \(\gamma _{l}^{N}=(-\gamma _{l}^{N,+}+\gamma _{l}^{N,-})\) \( \gamma _{l}^{S}=(-\gamma _{l}^{S,+}+\gamma _{l}^{S,-})\) and knowing that \( \gamma _{l}^{N,\pm }=\gamma _{l}^{S,\pm }\), the optimality conditions of the decentralized counter-trading Model 1 are as follows:

Setting \(\lambda_l=\lambda _{l}+\gamma_{l}^{N}\) one can easily see that the two groups of optimality conditions are identical and then the corresponding problems admit the same solution set.

Appendix I: Proof of Proposition 6

Let us denote the NTF’s formulation of problem (75)–( 85) as to \(VI(F^{\gamma },K_{2})\). The primal solution of problem \(VI(F^{\gamma =0},K_{2})\) is unique when all \(\gamma _{l}^{N/S}=0\). This is because both the objective function (75) and the set defined by the constraints are convex. Due to the lack of perfect arbitrage between the two TSOs, the equality \( \gamma _{l}^{N}=\gamma _{l}^{S}\) is no more ensured and then when \(\gamma _{l}^{N/S}\neq 0\) we have two different cases.

If \(\gamma _{l}^{N/S}\neq 0\) and \(\gamma _{l}^{N}=\gamma _{l}^{S}\), then the transformations applied to λ l in the complementarity version of problem (75)–(81) are simply translations (as we already seen in the Proof of Corollary 1 in Appendix H). This means that:

and implies that under this assumption the solution set of problem \( VI(F^{\gamma },K_{2})\) coincides with that of problem \(VI(F^{\gamma =0},K_{2})\). Since the solution set of the primal problem of \(VI(F^{\gamma =0},K_{2})\) contains one solution, this is also the unique solution of \( VI(F^{\gamma =0},K_{2})\).

This does not happen when \(\gamma _{l}^{N/S}\neq 0\) and \(\gamma _{l}^{N}\neq \gamma _{l}^{S}\) because the translations operated on the problems are now different. In other words:

respectively for the TSON and TSOS. As a consequence, the solution set can admit several solutions. However, from conditions (193) and (194), one immediately deduces that \( \lambda^{N} _{l}=\lambda _{l}=\lambda^{S} _{l}\) when \(\gamma_{l}^{N/S}=0\) and that

□

Appendix J: Proof of Proposition 8

The proof is parallel to that of Proposition 6 (see Appendix I).

Rights and permissions

About this article

Cite this article

Oggioni, G., Smeers, Y., Allevi, E. et al. A Generalized Nash Equilibrium Model of Market Coupling in the European Power System. Netw Spat Econ 12, 503–560 (2012). https://doi.org/10.1007/s11067-011-9166-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-011-9166-7

Keywords

- Generalized Nash Equilibrium

- Quasi-Variational Inequalities

- Market coupling

- Counter-trading

- European electricity market