Abstract

We examine the direct effect of federal and subnational fiscal policy on aggregate demand in the USA by introducing the Fiscal Effect (FE) measure. FE can be decomposed into three components. Discretionary FE quantifies the effect of discretionary or legislated policy changes on aggregate demand. Cyclical FE captures the effect of the automatic stabilizers—changes in government taxes and spending arising from the business cycle. Residual FE measures the effect of all changes in government revenues and outlays which cannot be categorized as either discretionary or cyclical; for example, it captures the effect of the secular increase in entitlement program spending due to the aging of the population. Unlike other approaches, FE is a bottom-up approach that allows for differential effects on aggregate demand depending on the type and length of the policy change. Thus, FE is arguably the most detailed and comprehensive measure available of the stance of US fiscal policy in relation to aggregate demand. We use our new metric to examine the contribution of fiscal policy to growth in real GDP over the course of the Great Recession and current expansion. We compare this contribution to the contributions to growth in aggregate demand made by fiscal policy over past business cycles. In doing so, we highlight that the relatively strong support of government policy to GDP growth during the Great Recession was followed by a historically weak contribution over the course of the current expansion.

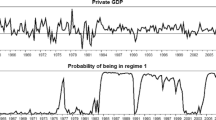

Source: Bureau of Economic Analysis

Source: Bureau of Economic Analysis, Department of Treasury, authors’ calculations

Similar content being viewed by others

Notes

The term discretionary should not be confused with discretionary spending consistent with the federal government’s unified budget accounting. For example, a legislated change to a mandatory spending program such as OASDI would be scored as a discretionary policy change under the FE measure.

In these past papers, the measure was termed Fiscal Impetus (FI). Discretionary FE and FI are equivalent, save for the change in terminology. Total FE is a broader concept than FI, as it captures the effect of cyclical and residual changes in taxes and spending in addition to discretionary changes.

For information on the FRB/US model, see Brayton et al. (2014) and the references therein.

See BEA (2014) for information on how government purchases are defined in the NIPA.

These estimates tend to be quite accurate—e.g. see CBO (2016)—and have been widely used in past research—e.g. Romer and Romer (2010) and Mertens and Montiel-Olea (2012). In many cases, these data must be adjusted somewhat for use in our methodology. First, JCT reports fiscal year estimates of the policy changes on an annual unified budget basis. We create seasonally-adjusted quarterly figures from these estimates. In addition, we look at BEA estimates that are, in part, based on information provided by the OMB and the Treasury to create their seasonally-adjusted quarterly figures. Sometimes BEA reports the policy effect embedded in its estimates and we will use those figures. Also, we examine IRS tax data to adjust the original JCT/OMB estimates. For some spending programs such as Emergency Unemployment Compensation benefits, or the initial years of Medicare Part D, we sometimes use actual budget data or BEA’s estimates.

Movements in the effective tax rate generally reflect localities making adjustments to their statutory tax rates or a change in average property assessments which differs from the rate of overall inflation (as measured by the GDP price index). Accordingly, when property values increase rapidly and local governments do not offset the increase with a decrease in the statutory tax rate, we score the change in revenue as a policy-induced tax increase. That said, we acknowledge that our treatment of property taxes is not ideal; for instance, a shift in potential output caused by factors unrelated to the property tax would induce a shift in the property tax contribution to FE (all else equal).

Hines (2010) also explores the cyclical response of federal, state, and local revenues and expenditures using NIPA data. The conclusions reached are broadly similar to those produced by the methodology used in this paper (and presented in Lutz and Follette 2010). Hines (2010) further explores heterogeneity in the cyclical response of state governments. A more general literature explores the magnitude of the automatic stabilizers and their economic effects (e.g. Auerbach and Feenberg 2000, Dolls et al. 2012 and McKay and Reis 2016).

Property tax collections are sensitive to movements in the market value of housing, albeit with a significant lag (Lutz 2008). At a national level, the market value of housing has typically not displayed strong evidence of cyclicality (at least prior to the housing boom and bust of the 2000s). Thus, we consider the property tax to be acyclical. See Lutz et al. (2011) for evidence on the response of property tax receipts to the housing boom and bust of the 2000s.

Unemployment insurance, production (excise), and import taxes follow a different process (see Russek and Kowalewski 2015).

Emergency Unemployment Compensation (EUC) benefits are excluded from our calculation of cyclical UI because they are set on a discretionary basis and are therefore scored as a discretionary change in fiscal policy. The tiny, permanent extended UI benefits are included in the cyclical portion.

Many states increased employer taxes and some tightened benefit eligibility and disqualification provisions in efforts to maintain or restore the solvency of their unemployment insurance programs in the wake of the early 1980’s recessions.

Based on regressing the GDP Gap on the Cyclical Deficit over the period 1970–2015.

It is our judgment that the empirical literature finds relatively little support for quantitatively important announcement effects on aggregate demand. Poterba ( 1988) and Watanabe et al. (2001) examine consumption responses to several U.S. and Japanese tax policy changes, respectively, and find little evidence that consumption responded to announcement of the policy changes. Furthermore, the consumption literature generally finds that consumers respond to changes in disposable income when the changes occur, even when the changes were predictable (e.g. Wilcox 1989, Shea 1995, Stephens 2008; Jappelli and Pistaferri 2010 for a review). Many of these studies which conclude that consumption responds to changes in disposable income exploit tax changes—e.g. Shapiro and Slemrod (1995), Parker (1999), Souleles (1999), Johnson et al. (2006), Agarwal et al. (2007), Parker et al. (2013) and Broda and Parker (2014). Moreover, the recent literature on fiscal multipliers has tended to find that output responds to a tax change at the time of implementation, but not at the time of announcement (e.g. Romer and Romer 2010 and Perotti 2012).

Alternatively, there is some empirical support for a more rapid response. In a comment on Davis and Palumbo (2001) and Lettau and Ludvigson (2001) employ a different statistical methodology and obtain results that suggest consumption responds to movements in wealth and income not over periods of many quarters, but rather within roughly one quarter.

For discretionary changes in property and sales taxes, we use the same MPCs that we chose for personal income tax changes. Note that the MPC is negative because a tax increase should reduce consumption, and vice versa.

Using Italian household survey data, Jappelli and Pistaferri (2006, 2008) find the MPC out of a permanent income shock is approximately 1. Cashin and Unayama (2016) exploit an unanticipated VAT rate increase in Japan and find that household consumption fell in proportion to this particular permanent income shock upon its announcement.

However, given that most estimates from the literature focus on non-durables only and find MPC estimates smaller than 0.5 (e.g. Poterba 1988; Sahm et al. 2010), and the fact that the FRB/US estimate of the MPC out of a transitory personal income tax shock is close to zero, we examined the sensitivity of our FE results to a smaller MPC out of temporary tax changes of 0.25 (not shown). The effect on our FE estimates was trivial.

To obtain \( \frac{W}{R} \cdot \in_{W\tau } \) from \( \frac{\Delta W}{\Delta R} \), note that \( \frac{\Delta W}{\Delta R} = \frac{\Delta W}{{\Delta \left( {\tau \pi } \right)}} = \frac{1}{\pi } \cdot \frac{\Delta W}{\Delta \tau } \), where \( \pi \) is corporate profits. Further note that \( \in_{W\tau } = \frac{\Delta W}{\Delta \tau } \cdot \frac{\tau }{W} \), so it follows that \( \frac{\Delta W}{\Delta \tau } = \in_{W\tau } \cdot \frac{W}{\tau } \). We are left with \( \frac{\Delta W}{\Delta R} = \frac{1}{\pi } \cdot \frac{\Delta W}{\Delta \tau } = \frac{1}{\pi } \cdot \in_{W\tau } \cdot \frac{W}{\tau } = \frac{W}{\tau \pi } \cdot \in_{W\tau } = \frac{W}{R} \cdot \in_{W\tau } \).

The value of household wealth in the U.S. stock market comes from the Financial Accounts of the United States: Fourth Quarter 2016. Corporate tax revenue for 2016 is reported by the Congressional Budget Office.

Specifically, we estimate the effect on share prices of a 30-year reduction in the effective corporate tax rate with quarterly dividend payments equal to 0.5 percent of the share price, annual dividend growth of 3.6 percent, and a discount rate equal to 5.77 percent.

House and Shapiro (2008) argue that Cohen and Cummins (2006) fail to find a strong investment response to bonus depreciation because their chosen treatment group, seven-year capital, did not sufficiently benefit from bonus depreciation. Patel and Seegert (2015) provide additional evidence for the strong investment response found in House and Shapiro (2008)—namely that the amount of market concentration (which is correlated with the magnitude of the investment response) is an important determinant of how firms respond to investment tax credits.

Nevertheless, as is clear from the above discussion, there is a fair amount of uncertainty over the appropriate MPC to apply to temporary corporate tax changes, and our choice of 0.2 may very well overstate the effect given the estimates of revenue changes to which they are applied. For example, applying an MPC of 0.2 to BEA’s estimate of the reduction in corporate tax liability resulting from bonus depreciation likely overstates the effect of the policy’s contribution to GDP growth because firms that would have made investments in the absence of bonus depreciation still benefitted from its passage in the form of lower tax liabilities. Given this possibility, we perform a robustness check where we set the MPC out of a temporary corporate tax change to 0 (not shown). Doing so does not qualitatively affect our FE results.

Temporary corporate tax changes may also have large, but transitory effects on investment which fully offset each other over time. For example, just prior to the completion of a period of temporary partial expensing, one might expect to observe a surge in investment that unwinds in the next period, as businesses alter only the timing of their investments as opposed to the level.

While ‘Other Transfers’ is primarily comprised of programs for retired households, the cyclical portion of this category is comprised of Medicaid and SNAP, programs that are targeted primarily at low-income households. Misra and Surico (2014) find that low-income households have an MPC out of the 2001 and 2008 tax rebates (which were temporary) of roughly 0.5. Accordingly, we apply an MPC of 0.5 for cyclical ‘Other Transfers’, which coincidentally is equal to the MPC for discretionary temporary ‘Other Transfers’.

The contribution to GDP growth is calculated on chain-weighted basis consistent with BEA methodology.

Moreover, if potential GDP is mismeasured, the β coefficient in Eq. (1) may be upwardly biased due to “division bias.”

In general, these financial flows are instead captured in the Financial Accounts of the U.S. The NIPA does, though, capture some aspects of government credit programs—e.g. it books interest payments from the student loan program as federal receipts.

In a similar vein to the decomposition of FE into discretionary, cyclical, and residual components, Dauchy and Seegert (2015) decompose insurance against income shocks into active (legislated changes in the tax code), passive (changes in the income distribution and its interaction with a nonlinear tax schedule), and residual behavioral (e.g. changes in the marginal propensity to consume out of tax refunds) components. The purpose of their decomposition, however, is to examine the link between the tax code and households’ ability to insure against income shocks.

See Follette and Lutz (2011) for an exception.

Additional papers using the Romer and Romer (2010) narrative tax shock measure include Perotti (2012), Favero and Giavazzi (2012), Mertens and Ravn (2012) and Zidar (2015). Ramey and Shapiro (1998) develop a narrative measure of military buildups; the measure was subsequently used by multiple authors including Edelberg et al. (1999), Burnside et al. (2004) and Cavallo (2005).

See Perotti (2012) for an extended discussion.

It is possible for FE to be positive with a balanced budget over an extended period since the MPC on government purchases is one and the MPC on taxes is generally less than one.

In addition to the drag from the secular increase in taxes, residual FE will also pick up the boost to aggregate demand from the secular increase in transfers. We find that the former dominates.

One reason capital gains were more cyclical during the last two recessions is that these recessions were associated with larger equity price movements.

The “other” category in Fig. 6 captures all other discretionary policy actions. Most notably over this period they include budget actions at the state and local level and the drawdown of overseas military operations.

These policies include the 2008 Economic Stimulus Act; 2009 American Recovery and Reinvestment Act; and the 2010 Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act.

The cyclical effect was somewhat dampened relative to the severity of the contraction due to the fact that potential GDP fell by more in the most recent cycle than it did on average in previous cycles.

See also Seegert (2015), who documents that the volatility of state government revenue has increased in recent years.

The FE methodology defines all changes in state and local purchases as discretionary, as these outlays are generally determined by annual legislation. However, a reasonable alternative would be to allow non-capital purchases to be partially cyclical. (Capital expenditures are not subject to balanced budget constraints, can be funded by debt, and are therefore more unambiguously discretionary.) Specifically, any changes in non-capital purchases that arise due to cyclical changes in tax revenues interacting with binding balance budget constraints could be defined as cyclical. However, the appropriate way to identify the cyclical component of non-capital purchases is unclear.

Annual pension funding affects the net savings of state and local governments in the NIPA, but does not affect purchases, taxes or transfers. Thus, the boost in pension funding does not boost FE.

We assume that this debt is issued at the average interest rate and duration and that the counterfactual fiscal policy changes have no effects on these rates. Moreover, we do not account for any changes to the tax base or transfer spending due to the additional growth in GDP.

The income bins can be seen in the SOI summary tables and range from $1-$5000 through to $10,000,000 or more with the largest group by income being non-single returns $100,000-$200,000 in 2013.

Roughly the average weighted maturity of treasury debt at the time.

References

Agarwal, S., Liu, C., & Souleles, N. S. (2007). The reaction of consumer spending and debt to tax rebates—evidence from consumer credit data. Journal of Political Economy, 115(6), 986–1019.

Auerbach, A. (1988). Capital gains taxation in the United States. Brookings Papers on Economic Activity, 2, 595–631.

Auerbach, A. J. (2000). Formation of fiscal policy: The experience of the past 25 Years. Federal Reserve Bank of New York Economic Policy Review, 6(1), 9–23.

Auerbach, A., & Feenberg, D. (2000). The significance of federal taxes as automatic stabilizers. Journal of Economic Perspectives, 14, 37–56.

Auerbach, A. J., & Gorodnichenko, Yuriy. (2012). Measuring the output responses to fiscal policy. American Economic Journal: Economic Policy, 4(2), 2012.

BEA. (2014). “Concepts and Methods of the U.S. National Income and Product Accounts.” February 2014.

Bernanke, BS. (2014). The federal reserve: Looking back, looking forward. In Speech at the annual meeting of the american economic association, Philadelphia, PA.

Blanchard, O., & Perotti, R. (2002). An empirical characterization of the dynamic effects of changes in government spending and taxes on output. The Quarterly Journal of Economics, 117(4), 1329–1368.

Blundell, R., Pistaferri, L., & Preston, I. (2008). Consumption inequality and partial insurance. American Economic Review, 98, 1887–1921.

Boyd, D., & Dadayan, L. (2016). Slow tax revenue growth, rising pension contributions, and Medicaid growth lead state and local governments to reshape their finances. In Rockefeller Institute of Government, working paper.

Brayton, F., Laubach, T., & Reifschneider, D. (2014). The FRB/US model: A tool for macroeconomic policy analysis. FEDS Notes.

Broda, C., & Parker, J. A. (2014). The economic stimulus payments of 2008 and the aggregate demand for consumption. Journal of Monetary Economics, 68, 20–36.

Burnside, C., Eichenbaum, M., & Fisher, J. (2004). Fiscal shocks and their consequences. Journal of Economic Theory, 115, 89–117.

Campell, J., & Mankiw, N. G. (1989). Consumption, income and interest rates: Reinterpreting the time series evidence. NBER Macroeconomics Annual, 4, 185–216.

Cashin, D., & Unayama, T. (2016). The impact of a permanent income shock on consumption: Evidence from Japan’s 2014 VAT increase. In Discussion Paper 16052, Research Institute of Economy, Trade, and Industry (RIETI).

Cavallo, M. (2005). Government employment expenditure and the effects of fiscal policy shocks. Federal Reserve Bank of San Francisco Working Paper.

CBO (2016) The budget and economic outlook: 2016 to 2026.

Chirinko, R. S., Fazzari, S. M., & Meyer, A. P. (1999). How responsive is business capital formation to its user cost? An exploration with micro data. Journal of Public Economics, 74, 53–80.

Cohen, D. S., & Cummins, J. G. (2006). A retrospective evaluation of the effects of temporary partial expensing. In FEDS Working Paper No. 2006–19.

Cohen, D. S. & Follette, G (1999). The automatic fiscal stabilizers: Quietly doing their thing. In FEDS Working Paper No. 1999–64, Economic Policy Review, April 2000, Federal Reserve Bank of New York.

Cummins, J. G., Hassett, K. A., & Hubbard, G. R. (1994). A reconsideration of investment behavior using tax reforms as natural experiments. Brookings Papers on Economic Activity, 2, 1–74.

Dauchy, E., & Seegert, N. (2015). Taxation and inequality: Active versus passive channels. Available at SSRN: http://ssrn.com/abstract=2599062. Accessed 15 Nov 2017.

Davis, M. A., & Palumbo, M. G. (2001). A primer on the economics and time series econometrics of wealth effects. Washington, D.C: Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board.

DeLeeuw, F., Holloway, T., Johnson, D., McClain, D., & Waite, C. (1980). The high-employment budget: New estimates, 1955–1980. Survey of Current Business, 60(11), 13–43.

DeLong, B., & Summers, L. (2014). Fiscal policy and full employment.

Dobridge, C. L. (2016). Fiscal stimulus and firms: A tale of two recessions. In FEDS Working Paper No. 2016–013.

Dolls, M., Fuest, C., & Peichl, A. (2012). Automatic stabilizers and economic crisis: US vs Europe. Journal of Public Economics, 96(3–4), 279–294.

Edelberg, W., Eichenbaum, M., & Fisher, J. D. (1999). Understanding the effects of a shock to government purchases. Review of Economic Dynamics, 2(1), 166–206.

Favero, C., & Giavazzi, F. (2012). Measuring tax multipliers: The narrative method in fiscal VARs. American Economic Journal: Economic Policy, 4(2), 2012.

Follette, G., Kusko, A., & Lutz, B. F. (2008). State and local finances and the macroeconomy: The high–employment budget and fiscal impetus. National Tax Journal, 531–545.

Follette, G., & Lutz, B. (2011). Fiscal policy in the United States: Automatic stabilizers, discretionary fiscal policy actions, and the economy. Fiscal policy: Lessons from the crisis (Vol. Feb, p. 2011). Perugia: Banca d’Italia.

Gross, T., Notowidigdo, M. J., & Wang, J. (2016). The marginal propensity to consume over the business cycle. In NBER Working Paper No. 22518.

Hassett, K. A., & Hubbard, R. G. (2002). Tax policy and business investment. Handbook of Public Economics, 3.

Hines, J. R. (2010). State fiscal policies and transitory income fluctuations. Brookings Papers on Economic Activity, 2010(2), 313–337.

House, C. L., & Shapiro, M. D. (2008). Temporary investment tax incentives: Theory with evidence from bonus depreciation. American Economic Review, 98(3), 736–768.

Jappelli, T., & Pistaferri, L. (2006). Intertemporal choice and consumption mobility. Journal of the European Economic Association, 4, 75–115.

Jappelli, T., & Pistaferri, L. (2010). The consumption response to income changes. Annual Review of Economics, 2(1), 479–506.

Jappelli, T., & Pistaferri, L. (2011). Financial integration and consumption smoothing. The Economic Journal, 121, 678–706.

Johnson, D. S., Parker, J. A., & Souleles, N. S. (2006). Household expenditure and the income tax rebates of 2001. American Economic Review, 96(5), 1589–1610.

Kaplan, G., Violante, G. L., & Wiedner, J. (2014). The wealthy hand-to-mouth. In Brookings papers on economic activity, Springer (pp. 77–153).

Knight, B., Kusko, A., & Rubin, L. (2003). Problems and prospects for state and local governments. State Tax Notes, 29(6), 427–439.

Kodrzycki, Y. K. (2014). Smoothing state tax revenues over the business cycle: Gauging fiscal needs and opportunities. Federal Reserve Bank of Boston, WP 14–11.

Lang, M. H., & Shackelford, D. A. (2000). Capitalization of capital gains taxes: evidence from stock price reactions to the 1997 rate reduction. Journal of Public Economics, 76(1), 69–85.

Laubach, T., & Williams, J. C. (2016). Measuring the natural rate of interest redux. Business Economics, 51(2), 57–67.

Lettau, M., & Ludvigson, S. (2001). Consumption, aggregate wealth, and expected stock returns. The Journal of Finance, 56(3), 815–849.

Lucas, D. (2016). Credit policy as fiscal policy. In Brookings Papers on Economic Activity, BPEA Conference Draft.

Lutz, B. (2008). The connection between house price appreciation and property tax revenue. National Tax Journal, 3.

Lutz, B. F., & Follette, G. R. (2010). Fiscal policy in the United States: Automatic stabilizers, discretionary fiscal policy actions, and the economy. Available at SSRN: https://doi.org/10.2139/ssrn.1684810. Accessed 15 Mar 2016.

Lutz, B., Molloy, R., & Shan, H. (2011). The housing crisis and state and local government tax revenue: Five channels. Regional Science and Urban Economics, 41(4), 306–319.

Mankiw, N. G. (2000). The savers-spenders theory of fiscal policy. American Economic Review, 90(2), 120–125.

Mattoon, R., & McGranahan, L. (2012). Revenue bubbles and structural deficits: What’s a state to do? Federal Reserve Bank of Chicago, WP 2008–15.

McKay, A., & Reis, R. (2016). The role of automatic stabilizers in the U.S. business cycle. Econometrica, 84, 141–194.

Mertens, K., & Ravn, M. O. (2012). Empirical evidence on the aggregate effects of anticipated and unanticipated US tax policy shocks. American Economic Journal: Economic Policy, 4(2), 2012.

Miller, P., & Ozanne, L. (2000). Forecasting capital gains realizations. In Technical Paper Series 2000–5, Congressional Budget Office.

Misra, K., & Surico, P. (2014). Consumption, income changes, and heterogeneity: Evidence from two fiscal stimulus programs. American Economic Journal: Macroeconomics, 6(4), 84–106.

OECD (2016). Economic Outlook.

Parker, J. A. (1999). The reaction of household consumption to predictable changes in social security taxes. American Economic Review, 89(4), 959–973.

Parker, J. A., Souleles, N., Johnson, D. S., & McClelland, R. (2013). Consumer spending and the economic stimulus payments of 2008. American Economic Review, 103(6), 2530–2553.

Patel, E., & Seegert, N. (2015). Corporate investment policies: Market power, strategic incentives, and tax incentives. Available at SSRN: http://ssrn.com/abstract=2682827. Accessed 15 Mar 2016.

Perotti, R. (2012). The effects of tax shocks on output: Not so large, but not small either. American Economic Journal: Economic Policy, 4(2), 2012.

Pistaferri, Luigi. (2001). Superior information, income shocks, and the permanent income hypothesis. The Review of Economics and Statistics, 83(3), 465–476.

Ramey, V. A. (2011). Identifying government spending shocks: It’s all in the timing. The Quarterly Journal of Economics, 126(1), 1–50.

Ramey, V., & Shapiro, M. (1998). Costly capital reallocation and the effects of government spending. In Carnegie-Rochester Conference Series on Public Policy, 48.

Romer, C. D., & Romer, D. H. (2010). The macroeconomic effects of tax changes: Estimates based on a new measure of fiscal shocks. American Economic Review, 100(3), 763–801.

Russek, F., & Kowalewski, K. (2015). How CBO estimates automatic stabilizers. In CBO Working Paper Series.

Sahm, C. R., Shapiro, M. D., & Slemrod, J. (2010). Household response to the 2008 tax rebate: Survey evidence and aggregate implications. Tax Policy and the Economy, 24(1), 69–110.

Seegert, N. (2015). The performance of state tax portfolios during and after the great recession. National Tax Journal, 68(4), 901–918.

Shapiro, M. D., & Slemrod, J. (1995). Consumer response to the timing of income: Evidence from a change in tax withholding. American Economic Review, 85(1), 274–283.

Shea, J. (1995). Union contracts and the life-cycle/permanent-income hypothesis. American Economic Review, 85(1), 186–200.

Sheiner, L. (2014). The hutchins center’s fiscal impact measure. Retrieved from https://www.brookings.edu/research/the-hutchins-centers-fiscal-impact-measure/.

Sinn, H. W. (1991). Taxation and the cost of capital: The” old” view, the” new” view, and another view. Tax policy and the economy, 5, 25–54.

Souleles, N. S. (1999). The response of household consumption to income tax refunds. American Economic Review, 89(4), 947–958.

Summers, L. H. (2014). U.S. economic prospects: Secular stagnation, hysteresis, and the zero lower bound. Business Economics, 49(2), 65–73.

U.S. Congressional Budget Office (2011). Improving CBO’s methodology for projecting individual income tax revenues. Washington D.C.

U.S. Congressional Budget Office (2016). The budget and economic outlook. Washington D.C.

Watanabe, K., Watanabe, T., & Watanabe, T. (2001). Tax policy and consumer spending: Evidence from Japanese fiscal experiments. Journal of International Economics, 53(2), 261–281.

Wilcox, D. (1989). Social security benefits, consumption expenditure, and the life cycle hypothesis. Journal of Political Economy, 97, 288–304.

Yagan, D. (2015). Capital Tax Reform and the Real Economy: The Effects of the 2003 Dividend Tax Cut. American Economic Review, 105(12), 3531–3563.

Zidar, O. (2015). Tax cuts for whom? Heterogeneous effects of income tax changes on growth and employment. In NBER Working Paper #21035.

Zwick, E., & Mahon, J. (2017). Tax policy and heterogeneous investment behavior. American Economic Review, 107(1), 217–248.

Acknowledgements

We thank Brad Delong, Eric Engen, Glenn Follette, Francesco Saraceno, Louise Sheiner, Christian Wittneben, Andreas Peichl, two anonymous referees, and numerous conference participants for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

The analysis and conclusions set forth are those of the authors and do not indicate concurrence by other members of the research staff or the Board of Governors of the Federal Reserve.

Appendix

Appendix

1.1 A1. FRB/US Estimates of MPCs

Table 8 presents marginal propensity to consume (MPC) estimates obtained by introducing exogenous fiscal shocks into the FRB/US model. These estimates were generated with monetary policy held constant—i.e., monetary policy is not allowed to offset the fiscal shocks. Our baseline MPCs were informed by the estimates in Table 8.

1.2 A.2 Cyclical elasticities example: Federal personal income tax (\( {\varvec{\updelta}}_{{\mathbf{t}}} ) \)

The elasticity of taxes to changes in AGI, δtr, is calculated as the income tax weighted average of δtrg, the elasticity of each AGI income group g denoted in the Statistics of Income (SOI) summary tables for federal personal income taxes. δtrg is calculated as follows:

where x is the log of average income, y is the log of average tax paid and g is SOI income bin (indexed from lowest to highest).Footnote 44 Essentially we calculate the local elasticities of the slopes illustrated in Figure 13 and then aggregate to one elasticity \( \delta_{tr} \); this process is calculated for single and non-single returns and repeated for each year.

The elasticity of AGI to changes in the NIPA measure of personal income, δtu is calculated by regressing the log difference of annual NIPA income against the log difference of AGI while controlling for major tax events in 1986, 2001, 2002, 2008 and 2013. The elasticities indicated by these regressions are shown in Table 9.

Finally the elasticity δt is calculated in each year by multiplying δtu and δtu and weighting between non-single and single filers based on taxes paid.

1.2.1 Capital gains and residual FE

Figure 14 illustrates the possible share of capital gains in the residual change in individual income tax collections under the strong assumption that our cyclical measure does not pick up any of the cyclical effect of capital gains. In reality, however, we are likely picking up some of the cyclical movements in capital gains through our elasticity of AGI to NIPA income.

1.3 A3. Counterfactual GDP

In order to consider the impact of fiscal consolidation on GDP and Public Debt we construct a simple counterfactual whereby the government follows fiscal policy in line with previous recoveries. In order to do this we assume a fiscal multiplier of 1.0 such that our counterfactual GDP growth \( \widetilde{{gdp_{t} }} \) is calculated as follows:

where gdpt is actual GDP growth and \( {\text{FEprior}}_{t} \) is average FE at the same point in time relative to the trough in prior expansions (1970–2007) as illustrated in Fig. 8. We assume this additional FE is produced through discretionary purchases financed through newly issued Federal Public Debt. We calculate counterfactual borrowing in each quarter in the recovery as the change in actual debt (Δdebtt) plus the difference in counterfactual and observed nominal GDP \( \left( {{\text{N}}\widetilde{{GDP_{t} }} - NGDP_{t} } \right) \), and assume the GDP deflator is unchanged. Finally we assume the interest rate on our counterfactually issued debt (ct) is issued at the average quarterly market yield on five-yearFootnote 45 constant maturity treasury securities at the time, giving us a new Federal debt \( \widetilde{{gdp_{t} }} \) calculated as follows:

where c is interest payments or interest savings on the counterfactual borrowing due to the different level of GDP in previous periods. The results and major assumptions are detailed in Table 10.

1.4 A.4 Subcomponents of Fiscal Effect

Rights and permissions

About this article

Cite this article

Cashin, D., Lenney, J., Lutz, B. et al. Fiscal policy and aggregate demand in the USA before, during, and following the Great Recession. Int Tax Public Finance 25, 1519–1558 (2018). https://doi.org/10.1007/s10797-018-9497-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-018-9497-0

Keywords

- Fiscal policy

- Great Recession

- Fiscal multipliers

- Public debt and national budget

- Public economics

- Taxation

- Automatic stabilizers