Abstract

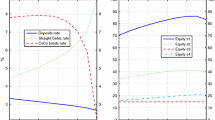

This paper develops a structural model to evaluate contingent capital notes (CCN) of Basel III under alternative regulatory closure rules. Our dynamic model has a fixed default barrier and at specific discrete time points an additional higher default barrier depending on the closure threshold. The closed-form expressions of CCN and subordinated debts (SD) in the simple Merton model are presented to understand the convex relationship between the price and capital ratio trigger of CCN and to examine the effects of closure rules on CCN and SD through their derivatives’ properties. Our numerical results in the more general model show that a lax closure rule increases the price of SD and distorts the risk information of issuing banks, but not so for CCN. The policy implications are that CCN are more effective than SD in terms of enhancing market discipline because the price/yield information of CCN is more sensitive to the issuing bank’s risk than SD and will not be distorted by regulatory closure rules.

Similar content being viewed by others

Notes

This study updates the list collected in Buergi (2012).

Some studies (e.g., Albul et al. (2010) and Chen et al. (2015)) also use the structural approach to consider the capital structure decision and endogenous default by shareholders. This contrasts with the reduced-form approach, such as McDonald (2013) who modeled the default/recovery probability directly as an exogenous process in valuing risky debt.

The time interval can be a day, a month, a quarter, or a year, depending on how often regulators update their information of a bank’s capital ratio.

Some studies, such as Albul et al. (2010) and Chen et al. (2015), consider the case that banks use a rolling debt-structure, in which old debt is retired and new debt is issued. However, for simplicity we follow most papers, e.g. Sundaresan and Wang (2010); Pennacchi (2011), and Himmelberg and Tsyplakov (2012), by considering only a fixed finite maturity bond and firms not issuing new debt.

In some empirical specifications, CCN holders either receive a fixed number of shares or shares with a fixed value.

See Kane and Yu (1995) for evidence in the U.S. S&L industry.

References

Adrian T, Shin HS (2010) Liquidity and leverage. J Financ Intermed 20:418–437

Albul, B., D. M. Jaffee and A. Tchistyi, 2010, Contingent convertible bonds and capital structure decisions, University of California, Berkeley, Working Paper.

Basel Committee on Banking Supervision, 2003, Markets for Bank Subordinated Debt and Equity in Basel committee member countries, Working Paper No. 12

Buergi, M., 2012, A tough nut to crack: on the pricing of capital ratio triggered contingent convertibles, Working Paper.

Chen, N., P. Glasserman, B. Nouri, and M. Pelger, 2015, Contingent capital, tail risk, and debt-induced collapse, Working Paper.

Cox J, Ingersoll J, Ross S (1985) The term structure of interest rates. Econometrica 53:363–384

Duan J-C, Yu M-T (1994) Forbearance and pricing deposit insurance in a Multiperiod framework, stochastic interest rate and catastrophe risk. J Risk Insur 61:575–591

Duan J-C, Yu M-T (2005) Fair insurance guaranty Premia in the presence of risk-based capital regulations, stochastic interest rate and catastrophe risk. J Bank Financ 29:2435–2454

Flannery, M. J., 2005, “No Pain, No Gain?” Effecting Market Discipline via Reverse Convertible Debentures, Scott, H. S. ed. Capital Adequacy Beyond Basel: Banking, Securities and Insurance. (Oxford University Press).

Flannery, M. J., 2009, Stabilizing large financial institutions with contingent capital certificates, University of Florida, Working Paper.

Flannery M, Rangan K (2008) What caused the bank capital build-up of the 1990s? Eur Finan Rev 12:391–429

French K, Bailey M, Campbell J, Cochrane J, Diamond D, Duffie D, Kashyap A, Mishkin F, Rajan R, Scharfstein D, et al. (2010) The squam Lake report: fixing the financial system. J Appl Corp Finance 22:8–21

Glasserman P, Nouri B (2012) Contingent capital with a capital-ratio trigger. Manag Sci 58(10):1816–1833

Goyal VK (2005) Market discipline of Bank risk: evidence from subordinated debt contracts. J Financ Intermed 14:318–350

Hanweck, G. A. and L. J. Spellman, 2003, Forbearance expectation and the subordinated debt signal of Bank insolvency, paper presented at FMA annual meeting.

Himmelberg, C. P and S. Tsyplakov, 2012, Incentive effects of contingent capital, Moore School of Business, University of South Carolina, Working Paper.

Kane EJ (2007) Basel II: a contracting perspective. J Financ Serv Res 32:39–53

Kane EJR, Yu M-T (1995) Measuring the true profile of taxpayer losses in the S&L Insurance Mess. J Bank Financ 19:1459–1477

Lo C-L, Lee J-P, Yu M-T (2013) Valuation of insurers’ contingent capital with counterparty risk and price endogeneity. J Bank Financ 37:5025–5035

McDonald R (2013) Contingent capital with a dual price trigger. J Financ Stab 9:230–241

Memmel C, Raupach P (2010) How do banks adjust their capital ratios? J Financ Intermed 19:509–528

Merton R (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29:449–470

Merton R (1976) Option pricing when underlying stock returns are discontinuous. J Financ Econ 3:125–144

Pennacchi, G., 2011, A structural model of contingent Bank capital, Working Paper.

Ronn E, Verma A (1986) Pricing risk-adjusted deposit insurance: an option-based model. J Financ 41:871–895

Sironi A (2003) Testing for market discipline in the European banking industry: evidence from subordinated debt issues. J Money, Credit, Bank 35(3):443–472

Sundaresan, S. and Z. Wang, 2010, Design of Contingent Capital with a stock price trigger for mandatory conversion, staff report 448, Federal Reserve Bank of New York

Vasicek OA (1977) An equilibrium characterization of the term structure. J Financ Econ 5:177–188

Von Furstenberg, G. M., 2011, Contingent capital to strengthen the safety net for financial institutions: Cocos to the rescue? Paper 01/2011, deutsche Bundesbank, Frankfurt am Main, Germany

Acknowledgments

The authors thank seminar participants at CCER, Peking University, Feng Chia University, Jiangxi Normal University, and National Taiwan Normal University for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

When R is negative, the payoffs of the CCN, P CCN (t), become:

Here, CCN is the face amount of the contingent capital certificate; k is the conversion ratio of capital specified in CCN; and R is the threshold ratio implied by the regulatory closure rule under which the regulator will intervene and liquidate the bank, and it may not be the same as the minimum capital requirement q set by regulators.

When R is negative, the payoffs of the subordinated debt (SD), P SD (t), at time t are:

Here, SD is the face amount of subordinated debt, and R is the regulatory capital threshold under which regulators would close the bank.

Appendix 2

The payoffs of CCN, assuming defaults can only happen at discrete auditing times, are:

Similarly, the payoffs of SD, assuming defaults can only happen at discrete auditing times, are:

Using the asset and deposit processes of Eqs. (4) and (5) under a risk-neutral pricing measure Q, the solutions for the first term to the third term of CCN and SD payoffs can be derived in a simple Merton-type model with a constant interest rate. For the fourth term of CCN and SD, by using the change of measure from Qto Q', the dynamics of a bank’s assets under the risk-neutralized measure Q' are:

\( A\left({t}_i\right)=A\left({t}_0\right) \exp \left(\left(r-\lambda \kappa +0.5{\sigma}_A^2\right){t}_i+{\sigma}_A{W}_{A,{t}_i}^{Q\hbox{'}}+{\displaystyle \sum_{n={N}_{t_0}}^{N_{t{t}_i}} \ln {Y}_n}\right) \).

Using a similar pricing procedure, the solution to the fourth term can also be obtained.

The immediate impact of granting a higher capital ratio trigger k is best demonstrated by the following derivative property:

Using the chain rule, the solution of the first term in the above equation can be obtained as:

The other terms can also be derived by the same pricing technique.

We further investigate the effect of a regulatory closure rule with a mixture of CCN and SD. If the bond portfolio of the bank has only CCN (w 1 = 1), then by using the chain rule we have:

Given the condition of \( c{1}_{\left\{{d}_{k,{t}_i}>{d}_{R,{t}_i}\right\}}<1 \), i.e., c<1 is the coupon rate, we now have:

\( \frac{\partial {e}^{-r{t}_i}PO\left({t}_i\right)}{\partial R}>0, \) where \( {Z}_{R,{t}_i}=\frac{1}{\sqrt{2\pi }}{e}^{-0.5{d}_{R,{t}_i}^2}\frac{1}{\sigma_m\sqrt{t_i}} \).

If the bank’s bond portfolio has equal amounts of CCN and SD (w 1 = 0.5), then we have:

Given the condition of \( c\left(1+{1}_{\left\{{d}_{k,{t}_i}>{d}_{R,{t}_i}\right\}}\right)\le 1 \), i.e., c ≤ 0.5 is the coupon rate, we thus have:

Appendix 3 Simulation Method and Procedure

In this section we provide the numerical procedures that estimate the prices for SD and CCN using Eq. (9). Based on the risk-neutralized process for the assets’ value in Eq. (2), we apply Ito’s lemma to the logarithm of the value of the bank’s assets as follows:

The risk-neutral process for the assets-to-deposits ratio, Eq. (2) minus Eq. (3), is:

\( \frac{d{y}_t}{y_t}=\frac{d{A}_t}{A_t}-\frac{d{D}_t}{D_t}=\left({r}_t-\lambda \kappa -g\left({y}_t-{\overline{y}}_t\right)\right)dt+{\sigma}_Ad{W}_{A,t}^Q+d{\displaystyle \sum_{n=0}^{N_t}{Y}_n} \).

Using Ito’s lemma for the jump diffusion process, we have:

In accordance with any point in time of a default event, we assume the daily time interval and time are measured in years, Δt = 1/360. Hence, the solution of (B.3), for any Δt, is:

The solution for the assets-to-deposits ratio, for any Δt, is:

These solutions suggest a simple way of simulating asset values at any point in time. First, we simulate the risk-neutralized interest rate process from time t to time t + Δt as:

where ε ~ N(0, 1) is a white noise representing the Brownian motion risk of the interest rate. This allows us to compute the form of interest: \( {\displaystyle {\int}_t^{t+\varDelta t}{r}_s}ds. \) Second, we simulate z ~ N(0, 1), which is a white noise representing the Brownian motion risk of the bank’s assets. Given the correlation coefficient of the bank’s assets and the interest rate ρ A , r ,we further compute \( \left({W}_{A,t+\varDelta t}^Q-{W}_{A,t}^Q\right)={\rho}_{A,r}\sqrt{\varDelta t}\varepsilon +\sqrt{1-{\rho}_{A,r}^2}\sqrt{\varDelta t}z. \). Term (N t + Δt − N t ) stands for a Poisson distribution with an intensity of λΔt. For a given value of (N t + Δt − N t ), we then simulate \( {\displaystyle \sum_{n={N}_t}^{N_{t+\varDelta t}} \ln {Y}_n} \), where lnY n is normal random variables with mean μ y and variance \( {\sigma}_y^2 \). Combining \( {\displaystyle {\int}_t^{t+\varDelta t}{r}_s}ds \), \( \left({W}_{A,t+\varDelta t}^Q-{W}_{A,t}^Q\right) \), and \( {\displaystyle \sum_{n={N}_t}^{N_{t+\varDelta t}} \ln {Y}_n} \) yields a simulated value for A t + Δt as described in Eq. (B.4).

Rights and permissions

About this article

Cite this article

Chang, CC., Yu, MT. Bank Contingent Capital: Valuation and the Role of Market Discipline. J Financ Serv Res 54, 49–80 (2018). https://doi.org/10.1007/s10693-016-0259-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-016-0259-9