Abstract

This article provides new results on the tempered multistable approach. After a preliminary section recalling the main definitions, we show the correspondence between a series representation and a characteristic function representation for asymmetrical field-based tempered multistable processes and for asymmetrical independent increments tempered multistable processes. We also show that both processes are semimartingales, which is a convenient property in finance. Next, we study the structure of autocorrelations that is conveyed by this approach. Finally, we provide an illustration showing the term structures of Value-at-Risk that can be obtained with this model.

Similar content being viewed by others

1 Introduction

If we set aside the Brownian case, the first Lévy approach to modeling speculative prices is the stable one and dates back to the sixties (see, in particular, Mandelbrot 1963; Mandelbrot and Taylor 1967). This approach is not devoid of drawbacks: it predicts an infinite variance and distribution tails that are too heavy compared to empirical observations. The Variance Gamma process (see, e.g., Madan and Milne 1991) is one of the first non-stable Lévy processes constructed for financial applications that alleviates these drawbacks. This process, which has been of ample use in the past decades, is also the root of a more recent approach: the tempered stable or CGMY model of Carr et al. (2002), which made popular in finance processes originally introduced in Koponen (1995). The tails of the marginal distributions and of the Lévy measure of tempered stable processes can be cast in the form of a ratio of exponential and power functions, which justifies their name (see Rosiński 2007). The tails of these processes are therefore semi-heavy (in the sense that their analytical form can be represented by a ratio of exponential and power functions), more general than those of the Variance Gamma process, and better adapted to empirical data than their stable counterparts whose power tails are too thick to describe most stock market return behaviors. See the contributions of Küchler and Tappe (2013, 2014), of Imai and Kawai (2011), and the book of Rachev et al. (2011) for additional important results on the tempered stable approach.

The class of multistable processes is constructed as an extension of stable processes (see Samorodnitsky and Taqqu 1994 for a reference on these latter dynamics) by making the tail thickness parameter a function of time. Multistable processes have non-stationary (and potentially dependent) increments. This class of processes is introduced in Falconer and Lévy-Véhel (2009) and Falconer et al. (2009). The field-based multistable Lévy motion is an example of such processes. Its marginal distributions are those of a stable Lévy motion but it has non-stationary and dependent increments (see Guével and Lévy-Véhel 2012). The independent increments multistable Lévy motion has non-stationary but independent increments (see Falconer and Liu 2012). In Guével et al. (2015), it is shown that these two multistable processes are semimartingales.

In this article, we study and provide results for a class of processes that extends both tempered stable processs and multistable processes by combining the characteristic features of these two dynamics. These processes are called tempered multistable and are introduced (and studied in their symmetrical form) in Lévy-Véhel and Liu (2013). The first use of these dynamics in finance is found in Lévy-Véhel (2013), which is an empirical work numerically showing the importance of taking into account non-stationarities in the Y parameter of CGMY and similar models for computing VaRs, and in Lévy-Véhel and El Mekkedem (2013), where it is shown that stock indices can be represented by a self-stabilizing tempered process. Further studies are those of Fan and Lévy-Véhel (2013), which provides a detailed construction of self-stabilizing tempered processes and applications of these dynamics to the computation of VaRs, and of Lévy-Véhel and Lévy-Véhel (2013), which considers a tempered multistable process amenable to pricing whose jump intensity follows a CIR process. Specifically here, we consider the independent increments and field-based versions of tempered multistable processes. Our article generalizes from the symmmetrical case to the asymmetrical case results obtained in Lévy-Véhel and Liu (2013) and provides several additional results for these processes including the computation of autocorrelations.

The article is organized as follows. In a first section, we recall the main existing definitions and results available for multistable and tempered multistable processes. We concentrate on the independent increments and the field-based constructions of these dynamics. These two specific processes were originally defined by their marginal characteristic functions and by their tail thickness functions. A second section shows how these processes can in fact be defined via series representations when they are asymmetrical, generalizing results obtained in the symmetrical case. This section, which also shows that these processes are semimartingales, is not only important per se, but also because the proofs of its results are useful for obtaining the results of the next section. A third section is devoted to the study of the dependence of the increments of these processes. Specifically, the multivariate characteristic function of their increments is obtained, allowing us to confirm the independence of the increments of the first process and to study the correlation of the increments of the second one. A final section is dedicated to the computation of the moments and risk indicators related to these processes. We obtain the term structure of Value-at-Risk, which is markedly different from that obtained with more classic dynamics, namely Lévy processes. This result can have interesting applications in finance, where pension funds, e. g., put forward an argument of time diversification to justify the non-increase of risk with respect to time for high maturities.

2 Preliminary Presentation

In this preliminary section, we first present the class of multistable processes. Then, we concentrate on a derived class of processes that is more suitable to the modeling of economic and financial dynamics: tempered multistable processes. See Falconer and Liu (2012), Falconer and Lévy-Véhel (2009), Guével and Lévy-Véhel (2012) and Guével et al. (2015) for seminal definitions and results.

2.1 Multistable Processes

We first recall the definition of multistable Lévy processes, as stated for instance in Guével et al. (2015). The function \(\alpha : \mathbb {R} \rightarrow [c,d] \subset (0,2)\) is any continuously differentiable function. It is a generalization of the parameter \(\alpha \) that characterizes the heaviness of the tails of stable processes. Three sequences of random variables should also be considered. First, \((\Gamma _i)_{i \ge 1}\) is a sequence of arrival times of a Poisson process with unit arrival rate. It is therefore a sequence of dependent gamma random variables. Then, \((V_i)_{i \ge 1}\) is a sequence of i.i.d. random variables with uniform distribution on [0, T]. Finally, \((\gamma _i)_{i \ge 1}\) is a sequence of i.i.d. random variables with distribution \(P(\gamma _i=1)=P(\gamma _i=-\,1)=1/2\). The three sequences \((\Gamma _i)_{i \ge 1}\), \((V_i)_{i \ge 1}\), and \((\gamma _i)_{i \ge 1}\) are assumed jointly independent.

The field-based multistable Lévy process (or motion, due to the absence of an asymmetry parameter) is defined by the following Fergusson–Klass–LePage series representation:

where

Note that, when \(\alpha (t)\) equals the constant \(\alpha \) for all t, \(L_{FB}\) is simply the series representation of an \(\alpha -\)stable Lévy motion. The process \(L_{FB}\) is called multistable because of the dependence of \(\alpha \) on time, and field-based because at each fixed time t its marginal law is that of a stable process. The joint characteristic function of \(L_{FB}\) equals

where \( m \in \mathbb {N}, (\theta _1, \ldots , \theta _m) \in \mathbb {R}^m, (t_1, \ldots , t_m) \in \mathbb {R}^m\). This process has dependent increments and is not a Markov process. At every time t, the field-based process has a stable marginal distribution of parameter \(\alpha _t\).

A second variant of multistable dynamics is an additive process: the independent increments multistable Lévy process. Its joint characteristic function is as follows:

and its series representation is

At every time t, the independent increments process has a stable marginal distribution of parameter \(\int _0^t \alpha _s ds\). The field-based and the independent increments multistable processes are both semimartingales. The two processes are related at all times as follows:

where

is a finite variation process.

The next subsection recalls the definition of the tempered (in the sense that large jumps are exponentially tempered) versions of the field-based and independent increments multistable processes.

2.2 Tempered Multistable Processes

In economic and financial applications, the fact that stable and multistable processes have infinite variance can appear quite problematic. This is not the case of the tempered versions of these processes introduced by Lévy-Véhel and Liu (2013) and Lévy-Véhel (2013), which are more realistic from a modeling viewpoint. One of the most popular financial models with jumps is the CGMY model introduced by Carr et al. (2002). This model is based on a pure jump Lévy process (denoted for instance by Z) whose characteristic function is equal to

and is described by the following Lévy measure

that defines the arrival rate of the jumps of this process w.r.t. their size. This Lévy measure parameters are such that C, G, M > 0 and \(Y \in (-\,\infty ,2)\). In the remainder of this text, we assume \(Y \in (0,1)\), except explicitly stated.

We shall now consider an independent increments tempered multistable process \(Z_{II}\) endowed by the following marginal characteristic function:

where the constant parameter Y of the CGMY process has been replaced by a continuously differentiable function \(Y: [0,+\,\infty ) \rightarrow (0,1)\). This function is analogous to the function \(\alpha \) of multistable processes.

We shall also consider a field-based tempered multistable process \(Z_{FB}\) endowed with the marginal characteristic function

At each fixed time t, the marginal distribution of this process is that of a CGMY—or tempered stable—process. However, its increments are neither stationary nor independent: it is not a Lévy process.

Note that the field-based and independent increments tempered multistable processes were originally defined as processes having the above characteristic functions (10) and (11). We show in the next section how a definition via a series representation is able to give these characteristic functions as an output.

3 Results

In this section, we introduce series representations associated with both the independent increments and the field-based tempered multistable processes when these processes are asymmetrical. Specifically, the first and second propositions of this section extend the results of Lévy-Véhel and Liu (2013) that deal with the symmetrical case. We also show that both the independent increments and the field-based tempered multistable processes are semimartingales, extending the result of Guével et al. (2015) who show the semimartingale property for the independent increments and field-based non-tempered multistable processes.

The series representations of tempered multistable processes can be expressed in terms of five independent sequences of random variables. \(\{\Gamma \}_{j\ge 1}\) is a sequence of arrival times of a Poisson process with unit arrival rate. \(\{U\}_{j\ge 1}\) is a sequence of i.i.d random variables with uniform distribution on [0, T]. \(\{V\}_{j\ge 1}\) is a sequence of i.i.d. random variables with uniform distribution on [0, 1], \(\{e\}_{j\ge 1}\) is a sequence of i.i.d. exponential random variables with parameter 1, and \(\{\gamma \}_{j\ge 1}\) is a sequence of i.i.d random variables with distribution \(\mathbb {P}(\gamma _j=1)=\mathbb {P}(\gamma _j=-1)=1/2\).

We assume that Y takes values in (0, 1) and we allow the processes to be asymmetrical (\(G \ne M\)). We obtain representations that produce the characteristic functions given in Eqs. (10) and (11). We start with the independent increments tempered multistable process.

Proposition 3.1

(Series representation of the asymmetrical independent increments tempered multistable process) The process defined by the following representation:

where C, G, M > 0 and \(Y \in (0,1)\) has the characteristic function (10).

Proof

See “Appendix”. \(\square \)

Using a similar method, we define the field-based tempered multistable process via a series representation.

Proposition 3.2

(Series representation of the asymmetrical field-based tempered multistable process) The process defined by the following representation:

where C, G, M > 0 and \(Y \in (0,1)\) has the characteristic function (11).

Proof

See “Appendix”. \(\square \)

Remark 3.1

(Truncation) An important question for the simulation of the series (13) is that of the order of truncation. It appears that a truncation at \(j_\text {max} = 10^6\) yields a reasonable degree of precision. This is confirmed by Table 1, which shows the convergence of one simulation of \(Z_{FB}(T)\) with respect to \(j_\text {max}\) when \(T=20\), \(C=1\), \(G=30\), \(M=30\), and \(Y(T)=0.5\) (similar conclusions are reached with other parameter sets).

Although \(10^6\) does not seem a small number, it takes only approximately a tenth of a second to simulate \(Z_{FB}(T)\) when the series is truncated at this order. Also, one should note a big advantage of the method. The random numbers in the series need to be simulated only once for obtaining all the trajectory. This is particularly useful for problems solvable by Monte-Carlo simulations.

We now come to the semimartingale property of the independent increments tempered multistable process presented in this article. This result is not a priori obvious: for instance, not all independent increments processes are semimartingales, contrary to Lévy processes.

We first concentrate on the field-based tempered multistable process.

Proposition 3.3

Assume that Y is differentiable and that its derivative is bounded. Further assume that Y takes values in \([c,d] \in (0,1)\). Then, the field-based tempered multistable process is a semimartingale.

Proof

See “Appendix”. \(\square \)

We obtain a similar result in the case of the independent increments tempered multistable process.

Proposition 3.4

The independent increments tempered multistable process is a semimartingale.

Proof

See “Appendix”. \(\square \)

These results guarantee the tractability of tempered multistable models as a class of financial models. The next section uses the general results obtained in this section to derive more applied results concerning the dependence structure of these models.

4 Dependence

In order to study the dependence of increments of tempered multistable processes, we compute in this section their multivariate characteristic functions. We first confirm that \(Z_{II}\) is an independent increments process, and then we concentrate on \(Z_{FB}\). We are particularly interested in the dependence structure that this latter process conveys. Specifically, we examine how the autocorrelation that it bears decreases with the passage of time.

To start with, we set out the following proposition.

Proposition 4.1

The multivariate characteristic function of the independent increments tempered multistable process can be written as follows:

This proposition is obtained using the expression

in the proof of Proposition 3.1, keeping the bound of the integral in u equal to T until the end of that proof, and substituting \(\theta \mathbb {1}_{(U_j \le t)}\) by \(\sum \nolimits _{k=1}^K \theta _k \mathbb {1}_{(U_j \le t_k)}\). The proofs of the results shown in this section are simple and are thus only sketched for brevity reasons.

Based on this result, we compute the characteristic function associated with an increment of \(Z_{II}\) by setting \(K=2\), \(\theta _1=\theta \), \(\theta _2=-\theta \), \(t_1=t\), and \(t_2 = s\). We obtain:

Corollary 4.1

The characteristic function associated with an increment of the independent increments tempered multistable process can be written as follows:

The multiplicative form of this characteristic function confirms that this process has independent increments.

We can now concentrate on the dependence of the increments of the process \(Z_{FB}\). We define

We obtain the multivariate characteristic function of \(Z_{FB}\) in the following general form that can be computed numerically.

Proposition 4.2

The multivariate characteristic function of the field-based tempered multistable process can be written as follows:

To obtain this proposition, we use the expression

and we follow the lines of the proof of Proposition 3.1, where we express in plain form the integrals with respect to the distributions of \(\gamma _j\), \(e_j\), \(V_j\), and \(U_j\).

We can now derive the characteristic function associated with an increment of the process \(Z_{FB}\). For this purpose, we set \(K=2\), \(\theta _1=\theta \), \(\theta _2=-\,\theta \), \(t_1=t\), and \(t_2 = s\) in Proposition 4.2.

Corollary 4.2

The characteristic function associated with one increment of the field-based tempered multistable process can be written as follows:

The non-multiplicative form of this characteristic function confirms that this process has dependent increments.

Then, we give the characteristic function associated with two increments of the process \(Z_{FB}\), which is useful for the study of the autocorrelation of this process. For this purpose, we set \(K=4\), \(\theta _1=\theta \), \(\theta _2=-\,\theta \), \(\theta _3=\eta \), \(\theta _4=-\,\eta \) , \(t_1=t\), \(t_2 = s\), \(t_3=\tau \), and \(t_4 = \zeta \) in Proposition 4.2.

Corollary 4.3

The characteristic function associated with two increments of the field-based tempered multistable process can be written as follows:

We can now examine the autocorrelation, or dependence of increments, that is borne by the field-based tempered multistable process.

Proposition 4.3

Let \(\Psi (\theta ,\eta ) = \Psi _{s,t,\delta }(\theta ,\eta )\) denote the bivariate characteristic function defined in (19). Let \(s<t\). The correlation between the increments \(Z_{FB}(t)-Z_{FB}(s)\) and \(Z_{FB}(t + \delta )-Z_{FB}(s + \delta )\) satisfies

where the partial derivatives are computed for frozen values of s, t and \(\delta \).

Recalling that \(\tau = t + \delta \) and \(\zeta = s + \delta \), the proof of this proposition is direct, noting for instance that

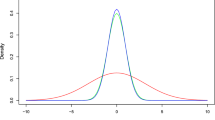

We now give an illustration of the correlation structure that is conveyed by the field-based tempered multistable process. A first increment is defined over the time lag \([s=0,t=1]\). A second increment is defined over the time lag \([\zeta , \zeta +1]\). Note that \(\zeta \) takes the values \(1, 2, \ldots , 5\) in the illustration, which shows the correlation of these two increments.

We model Y as follows:

and we set the model parameters as in Table 2. The horizon T is given for the sake of exhaustiveness but has no impact on the results.

The results of this experiment are shown in Fig. 1. The correlations of increments are computed by numerically estimating the derivatives of Eq. (19) and by inserting them in equation (20). The abscissa represents \(\zeta \) and the coordinate represents the correlation.

We observe negative autocorrelations that are equal to approximately \(-80\%\) for consecutive returns, so when \(\zeta =1\). These negative autocorrelations vanish out when the time lag between increments becomes large. This experiment is useful from an empirical viewpoint because the logarithmic returns of stock indexes often display negative autocorrelations that decrease in absolute value with the time lag.

5 Illustration

This section is devoted to the computation of the moments of tempered multistable processes and of a key risk indicator: Value-at-Risk. For a first empirical study on VaR and tempered multistable processes, see Lévy-Véhel and El Mekkedem (2013).

5.1 Moments

We can compute the moments of both types of tempered multistable processes using the well-known and general equality

that links the non-centered moments \(\mu _n\) of a distribution to the derivatives at 0 of its characteristic function \(\varphi \).

We start with the moments of the independent increments tempered multistable process. We readily obtain:

Proposition 5.1

The first four moments of the independent increments tempered multistable process are given by

and

By construction, the moments of the field-based tempered multistable process are equal to those of a CGMY process (see, e.g., Küchler and Tappe 2013) at each time t, whereas those of the independent increments tempered multistable process involve integrals with respect to Y(v). Indeed, in the field-based case, the characteristic functions are identical at each time t, without the field-based tempered multistable process being a Lévy process. Thus, we have:

Proposition 5.2

The first four moments of the field-based tempered multistable process are given by

and

As an illustration, we compute the kurtosis of a field-based tempered multistable process as a function of time. We set \(C=1\), \(G=30\), \(M=30\), and we assume that

with \(a=0.8\).

The results of the experiment are shown in Fig. 2 for two values of b, set respectively to 0.1 and 1. We observe that, excepting a hump at short times, kurtosis decreases with time for both values of b. Kurtosis can display large values at small times, but also quite important values at intermediate times and the asymptotic decrease to the value of three can be quite slow. Hence, even for large values of t, the process’ marginal distributions do not become identical to those of a Gaussian process.

We see that higher values of b are equivalent to a slower decrease of kurtosis with respect to the time horizon. So, for higher values of b, the process exhibits a higher persistence of extreme risks.

5.2 VaR

The most classic risk indicators can be computed using Fourier transform formulas. For example, Value-at-Risk is a quantile of the cumulative distribution function F under study. This latter quantity can be obtained from the characteristic function \(\Phi \) as follows:

where \(\alpha \) is any positive real number. See Courtois and Walter (2014) for more details on how to obtain Eq. (22).

As an illustration, we compute the term structure of VaR over 1 year. We first set \(C=1\), \(G=30\), \(M=30\), and consider a horizon of 1 year. We represent in Fig. 3 the term structure of VaR for three processes. The plain line represents the VaR of a CGMY process with \(Y=0.8\). The dashed line is for a field-based tempered multistable process with \(a=0.8\) and \(b=0.1\) and the dotted line is for a field-based tempered multistable process with \(a=0.8\) and \(b=1\), where we have modeled the function Y as follows:

which is an example of a function taking values in (0, 1). Note that the case \(Y=0.8\) corresponds to \(a=0.8\) and \(b=0\). In this illustration, Y converges to zero with respect to time t when \(b \ne 0\), so that the process marginals are asymptotically distributed as variance gamma random variables for both the dashed and dotted lines.

We observe that with field-based tempered multistable processes, VaR does not necessarily increase at long horizons. This observation is in sharp contrast with the square root of time feature that is observed with many standard stochastic processes. However, this observation is consistent with an idea of time diversification: an investor endowed with a sufficiently long horizon can control and limit his or her risks when he or she invests in stocks.

We now freeze the following values: \(a=0.8\) and \(b=0.1\), and we allow G and M to vary. We show in Fig. 4 the term structure of VaR for various levels of G and M. Note that high values of the G and M parameters correspond to small proportions of jumps of negative and positive size, respectively. Therefore, the plain curve, associated with \(G=20\) and \(M=40\), corresponds to an important proportion of negative jumps and a small proportion of positive jumps. Accordingly, Value-at-Risk is high in such a scenario. When we move to the dashed and dotted curves, we increase G and we decrease M, so we decrease the proportion of negative jumps in the process and we increase the proportion of positive jumps. Consistently, we see that the VaR term structure is decreased in these scenarios.

6 Conclusion

We have shown the correspondence between a series representation and a characteristic function representation—and the semimartingale property—for both field-based and independent increments asymmetrical tempered multistable processes. The form of these characteristic functions have allowed us to compute and study the autocorrelation function that is attached to the increments of such processes. Interestingly, these autocorrelation structures could be useful for the modeling of actual dependence properties for stock data. We have also computed the moments and the term structure of Value-at-Risk that are associated with tempered multistable processes. The features observed could be useful in risk management for explaining, for instance, the time diversification effect that is put forward by pension funds for massively investing in stocks in the long run.

As a natural extension of this article, more applied research should be conducted. For example, a statistical study on tempered multistable processes could be conducted and an algorithm for the estimation of the process parameters could be elaborated. It could also be interesting to compare the behaviors of various risk indicators, including, e.g., the tail conditional expectation, when such models are postulated.

Change history

31 August 2018

The article Some Further Results on the Tempered Multistable Approach, written by Olivier Le Courtois, was originally published electronically on the publisher’s internet portal (currently SpringerLink) on 11 April 2018 without open access.

31 August 2018

The article Some Further Results on the Tempered Multistable Approach, written by Olivier Le Courtois, was originally published electronically on the publisher���s internet portal (currently SpringerLink) on 11 April 2018 without open access.

References

Carr, P., Geman, H., Madan, D. B., & Yor, M. (2002). The fine structure of asset returns: An empirical investigation. Journal of Business, 75(2), 305–332.

Falconer, K., Le Guével, R., & Lévy-Véhel, J. (2009). Localisable moving average stable multistable processes. Stochastic Models, 25, 648–672.

Falconer, K., & Lévy-Véhel, J. (2009). Multifractional, multistable, and other processes with prescribed local form. Journal of Theoretical Probability, 22, 375–401.

Falconer, K., & Liu, L. (2012). Multistable processes and localisability. Stochastic Models, 28, 503–526.

Fan, X., & Lévy-Véhel, J. (2013). Self-stabilizing tempered processes in financial modelling. Working Paper.

Imai, J., & Kawai, R. (2011). On finite truncation of infinite shot noise series representation of tempered stable laws. Physica A: Statistical Mechanics and Its Applications, 390(23–24), 4411–4425.

Jacod, J., & Shiryaev, A. S. (2003). Limit theorems for stochastic processes (2nd ed.). Berlin: Springer.

Kingman, J. F. C. (1993). Poisson processes. Oxford: Oxford University Press.

Koponen, I. (1995). Analytic approach to the problem of convergence of truncated Lévy flights towards the Gaussian stochastic process. Physical Review E, 52(1), 1197–1199.

Küchler, U., & Tappe, S. (2013). Tempered stable distributions and processes. Stochastic Processes and Their Applications, 123(12), 4256–4293.

Küchler, U., & Tappe, S. (2014). Exponential stock models driven by tempered stable processes. Journal of Econometrics, 181(1), 53–63.

Le Courtois, O., & Walter, C. (2014). The computation of risk budgets under the Lévy process assumption. Finance, 35(4), 87–108.

Le Guével, R., & Lévy-Véhel, J. (2012). A Ferguson–Klass–LePage series representation of multistable multifractional processes and related processes. Bernoulli, 18(4), 1099–1127.

Le Guével, R., Lévy-Véhel, J., & Liu, L. (2015). On two multistable extensions of stable Lévy motion and their semimartingale representation. Journal of Theoretical Probability, 28(3), 1125–1144.

Lévy-Véhel, J. (2013). Financial modelling with tempered multistable motions. In International workshop on statistical modeling, financial data analysis and applications, Venice.

Lévy-Véhel, J., & El Mekkedem, H. (2013). Value at risk with tempered multistable motions. In 30th international french finance association conference, Lyon.

Lévy-Véhel, K., & Liu, L. (2013). On symmetrical tempered multistable processes (Preprint)

Lévy-Véhel, P. -E., & Lévy-Véhel, J. (2013). Tempered multistable processes with Heston-type evolution of the local intensity of jumps. Working Paper.

Madan, D. B., & Milne, F. (1991). Option pricing with VG martingale components. Mathematical Finance, 1(4), 39–55.

Mandelbrot, B. (1963). The variation of certain speculative prices. Journal of Business, 36, 394–419.

Mandelbrot, B., & Taylor, H. (1967). On the distribution of stock price differences. Operations Research, 15, 1057–1062.

Rachev, S. T., Kim, Y. S., Bianchi, M. L., & Fabozzi, F. J. (2011). Financial models with Lévy processes and volatility clustering. Hoboken: Wiley.

Rosiński, J. (2007). Tempering stable processes. Stochastic Processes and Their Applications, 117, 677–707.

Samorodnitsky, G., & Taqqu, M. S. (1994). Stable non-gaussian random processes, stochastic models with infinite variance. London: Chapmann and Hall.

von Bahr, B., & Esseen, C.-G. (1965). Inequalities for the rth absolute moment of a sum of random variables, \(1 \le r \le 2\). Annals of Mathematical Statistics, 36(1), 299–303.

Acknowledgements

The author wishes to thank Jacques Lévy-Véhel for many fruitful discussions on the topic of the paper and for introducing him to this field of research. The author also thanks Philippe Desurmont, Abdou Kelani, Mohamed Majri, François Quittard-Pinon, Andrea Roncoroni, Hubert Rodarie, Bertrand Tavin, and Christian Walter for their useful comments on the paper, which is the outcome of a collaboration with the SMA Group.

Author information

Authors and Affiliations

Corresponding author

Additional information

The original version of this article was revised due to the retrospective open access.

Appendix

Appendix

1.1 Proof of Propositions 3.1 and 3.2

The goal here is to check that the characteristic function associated with the series representation (12) is in the form of Eq. (10). Using an extension of Campbell’s theorem to marked Poisson processes (see Kingman 1993, p. 28 and 55), we can write the characteristic function of (12) as follows:

where

denotes an integral with respect to the probability distribution of four representative random variables \(\gamma _j\), \(e_j\), \(V_j\), and \(U_j\). We first set out the integration with respect to the distribution of \(U_j\):

that yields

Then, we perform the integration w.r.t. the distribution of \(\gamma _j\):

We have:

where

We now write the integration w.r.t. the distribution of \(e_j\):

and then the integration w.r.t. the distribution of \(V_j\):

We first perform the integration w.r.t. g:

that yields

and then,

that can be simplified as follows:

and, using Fubini’s theorem,

Making the change of variable \(z=M \left( \frac{Y(u)v}{2CT}\right) ^{-1/Y(u)} x^{-1/Y(u)}\), we get

Recalling that \(Y(u)\in (0,1)\), and for any \(A \in \mathbb {R}\), an integration by parts yields

Therefore, we obtain

that can be simplified as follows:

Elementary computations yield

or

The value of \(\Lambda (-\,\theta ,G)\) follows along the same lines. The insertion of these quantities in Eq. (24) gives the characteristic function (10) of the independent increments tempered multistable process.

The characteristic function (11) of the field-based tempered multistable process is recovered in a similar way.

1.2 Proof of Proposition 3.3

We prove here that the field-based tempered multistable process is a semimartingale. This proof extends the proof in Guével et al. (2015), where it is shown that a field-based multistable process is a semimartingale. We set as before \( 0<t\le T\) and

where the indexation in j is made consistent with an a.s. non-null first time \(\Gamma _1\).

Thus, the goal here is to show that the quantity

where \(s_k < t_k\) cover [0, t] and for all k the \(\xi _k\) are \(\mathcal {F}_{s_k}\)-measurable and \(|\xi _k| \le 1\), is bounded in probability. The Bichteler–Dellacherie theorem will then guarantee the semimartingale property.

We start by defining:

For simplicity, this function is denoted as g(t) or as \(g(t,\omega )\) in the remainder of this proof and where convenient. The series representation of \(Z_{FB}(t)\) becomes

so that

or

We first want to bound in probability the first term in the r.h.s. of the previous equation. We write:

For greater clarity, we use integrals, so that

For a given \(\omega \), we observe that the sequence \(\Gamma _j(\omega )\) is strictly increasing. Therefore, \(J(\omega )\) exists such that

and

Thus, we can decompose the integral in Eq. (26) into two components:

where g is as in Eq. (27), and

where g is as in Eq. (28).

We readily see that the first of these integrals converges. We need to show the convergence of the second of these integrals. We have:

where the inequality stems from a simple adaptation of Theorem 2 in Bahr and Esseen (1965). Using the mean value theorem, we can now write:

where for each j, \(s_k \le w_k^j \le t_k\) and \(w_k^j\) depends on \(\Gamma _j(\omega )\) but not on \(\gamma _j(\omega )\) or \(U_j(\omega )\).

Then, we observe that the boundedness of \(Y'\) and Y yields

Using the fact that \(|\xi _k| \le 1\), we have:

which converges (with \(p>d>c\)), thanks to standard results on Bertrand series, so that

Next, we bound in probability the second term in the r.h.s. of Eq. (25). We write:

which gives the result. Aggregating the previous results, we obtain:

which yields the semimartingale property.

1.3 Proof of Proposition 3.4

For a process with independent increments to be a semimartingale, it is sufficient that its characteristic function, viewed as a function of time, be of bounded variation on finite intervals. See Jacod and Shiryaev (2003, p. 106). Then, note that any function with a bounded derivative on a finite interval is of bounded variation on this interval. Therefore, given the form of the characteristic function (10), very mild conditions (such as the continuous differentiability assumed in this article) need to be imposed on the function Y for the process to be a semimartingale.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Le Courtois, O. Some Further Results on the Tempered Multistable Approach. Asia-Pac Financ Markets 25, 87–109 (2018). https://doi.org/10.1007/s10690-018-9240-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-018-9240-y