Abstract

This article assesses the effectiveness of the labour market reforms implemented in Portugal as part of the Troika’s structural reform package. Using an ARDL-bounds test model to perform the econometric estimation, this investigation examines the long-run relationship between unemployment, capital accumulation and labour market variables for the 1985–2013 period. The econometric estimation suggests that capital accumulation has been the main driver of long-run unemployment, whilst labour market variables have played a minor explanatory role. These results suggest that Portuguese NAIRU is endogenous to capital accumulation and do not support the Troika’s emphasis on labor market reforms as a strategy to reduce long-term unemployment.

Similar content being viewed by others

Notes

For an extensive analysis of the measures proposed by Troika and their social and economic implications see ILO (2013).

Some series are not published on a quarterly basis. In these situations, we used the interpolation methods calculated by Eviews 9 software. For each case, the chosen interpolation method was the one that better preserved the original series behavior. We used linear interpolation for SEPR, SEPT and UD and quadratic interpolation for GRR and TOT.

Another possible source of concern would be the presence of serial correlation in the error term. However, we have already ruled out that possibility.

References

Arestis P, Biefang-Frisancho Mariscal I (2000) Capital stock, unemployment and wages in the UK and Germany. Scott J Polit Econ 47(5):487–503

Arestis P, Sawyer M (2005) Aggregate demand, conflict and capacity in the inflationary process. Camb J Econ 29(6):959–974

Arestis P, Baddeley M, Sawyer M (2007) The relationship between capital stock, unemployment and wages in nine EMU countries. Bull Econ Res 59(2):125–148

Baccaro L, Rei D (2005) Institutional determinants of unemployment in OECD countries: a time series cross-section analysis (1960–98). International Institute for Labour Studies, Geneva

Baker D, Glyn A, Howell DR, Schmitt J (2004) Labor market institutions and unemployment: assessment of the cross-country evidence. The limits of free market orthodoxy. Fight Unempl 3:72–118

Ball LM (2014) Long-term damage from the great recession in oecd countries. Technical report, National Bureau of Economic Research

Ball LM, Mazumder S (2011) Inflation dynamics and the great recession. Technical report, National Bureau of Economic Research

Ball L, Mankiw NG, Nordhaus WD (1999) Aggregate demand and long-run unemployment. Brook Pap Econ Act 1999(2):189–251

Barnes ML, Olivei GP (2003) Inside and outside bounds: threshold estimates of the Phillips curve. N Engl Econ Rev 4:3–18

Barradas R, Lagoa S, Leão E, Mamede RP (2018) Financialization in the European periphery and the sovereign debt crisis: the Portuguese case. J Econ Issues 52(4):1056–1083

Bewley RA (1979) The direct estimation of the equilibrium response in a linear dynamic model. Econ Lett 3(4):357–361

Blanchard O, Jimeno JF (1995) Structural unemployment: spain versus portugal. Am Econ Rev 85(2):212–218

Blanchard O, Wolfers J (2000) The role of shocks and institutions in the rise of european unemployment: the aggregate evidence. Econ J 110(462):1–33

Blanchard O, Cerutti E, Summers L (2015) Inflation and activity-two explorations and their monetary policy implications. Technical report, National Bureau of Economic Research

Bozani V, Drydakis N (2011) Studying the Nairu and its implications. Technical report, Discussion Paper series, Forschungsinstitut zur Zukunft der Arbeit

Carlin W, Soskice DW (2014) Macroeconomics: institutions, instability, and the financial system. Oxford University Press, Oxford

Carnevali E (2018) Price mechanism and endogenous productivity in an open economy stock-flow consistent model. Technical report, University of Leeds

Chatelain J-B (2010) The profit-investment-unemployment nexus and capacity utilization in a stock-flow consistent model. Metroeconomica 61(3):454–472

EC (2003) Wage flexibility and wage interdependencies in EMU. In: European economy: 2003 Report, Chapt. 4. European Comission

ECB (2015) Progress with structural reforms across euro area and their possible impacts. ECB, Strasbourg

Eggertsson GB, Krugman P (2012) Debt, deleveraging, and the liquidity trap: a fisher-minsky-koo approach. Q J Econ 127(3):1469–1513

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econom J Econom Soc 55:251–276

Fontana G, Palacio-Vera A (2007) Are long-run price stability and short-run output stabilization all that monetary policy can aim for? Metroeconomica 58(2):269–298

Friedman M (1977) Nobel lecture: inflation and unemployment. J Polit Econ 85(3):451–472

Godley W, Lavoie M (2016) Monetary economics: an integrated approach to credit, money, income, production and wealth. Springer, Berlin

Granger CW, Newbold P (1974) Spurious regressions in econometrics. J Econ 2(2):111–120

Howell DR, Baker D, Glyn A, Schmitt J (2007) Are protective labor market institutions at the root of unemployment? A critical review of the evidence. Capital Soc 2(1):5

ILO (2013) Tackling the jobs crisis in Portugal. Technical report, International Labour Organization

ILO (2018) Decent work in Portugal 2008–18: From crisis to recovery. Technical report, International Labour Organization

IMF (2003) Unemployment and labor market institutions: why reforms pay off. In: World Economic Outlook 2003, Chapt. 4. IMF

IMF (2011) Portugal letter of intent, memorandum of economic and financial policies, and technical memorandum of understanding. Technical report, IMF

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52(2):169–210

Kalecki M (1971) Selected essays on the dynamics of the capitalist economy. CUP, Cambridge, pp 1933–1970

Kuttner K, Robinson T (2010) Understanding the flattening phillips curve. N Am J Econ Finance 21(2):110–125

Layard R, Nickell S, Jackman R (1991) Unemployment. Macroeconomic performance and the labour market. Oxford University Press, Oxford

Lindbeck A, Snower D (1988) Cooperation, harassment, and involuntary unemployment: an insider-outsider approach. Am Econ Rev 78:167–188

Mankiw NG (1992) The reincarnation of Keynesian economics. Eur Econ Rev 36(2–3):559–565

Marchionatti R, Sella L, et al (2015) Is neo-walrasian macroeconomics a dead end? Technical report, University of Turin

Nickell S (1998) Unemployment: questions and some answers. Econ J 108(448):802–816

Nickell S, Nunziata L (2001) Labour market institutions database. CEP, LSE, London

OECD (1994) The OECD jobs study. Technical report, OECD

OECD (2016) Labour market reforms in portugal 2011–2015. Technical report, OECD

Of Portugal B (2015) Bank of portugal economic bulletin. Technical report, Bank of Portugal

Palacio-Vera A, Martínez-Cañete AR, Aguilar IP-S, de la Cruz EM (2011) Capital stock and unemployment in Canada. J Post Keynes Econ 34(1):113

Pesaran MH, Shin Y (1998) An autoregressive distributed-lag modelling approach to cointegration analysis. Econ Soc Monogr 31:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Robinson J (1956) The accumulation of capital. Palgrave Macmillan, Basingstoke

Rowthorn R (1995) Capital formation and unemployment. Oxf Rev Econ Policy 11(1):26–39

Rowthorn R (1999) Unemployment, wage bargaining and capital-labour substitution. Camb J Econ 23(4):413–425

Said SE, Dickey DA (1984) Testing for unit roots in autoregressive-moving average models of unknown order. Biometrika 71(3):599–607

Shapiro C, Stiglitz JE (1984) Equilibrium unemployment as a worker discipline device. Am Econ Rev 74(3):433–444

Siebert H (1997) Labor market rigidities: at the root of unemployment in Europe. J Econ Perspect 11(3):37–54

Solow RM (1997) Is there a core of usable macroeconomics we should all believe in? Am Econ Rev 87(2):230–232

Sousa POP et al (2015) A stock-flow consistent model of the portuguese economy. Master’s thesis, ISCTE-IUL

Stockhammer E (2004) Explaining european unemployment: testing the nairu hypothesis and a keynesian approach. Int Rev Appl Econ 18(1):3–23

Stockhammer E (2008) Is the nairu theory a monetarist, new keynesian, post keynesian or a marxist theory? Metroeconomica 59(3):479–510

Stockhammer E (2011) Wage norms, capital accumulation, and unemployment: a post-keynesian view. Oxf Rev Econ Policy 27(2):295–311

Stockhammer E, Klär E (2010) Capital accumulation, labour market institutions and unemployment in the medium run. Camb J Econ 35:437

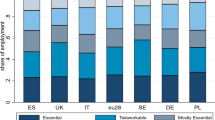

Stockhammer E, Guschanski A, Köhler K (2014) Unemployment, capital accumulation and labour market institutions in the great recession. Eur J Econ Econ Policies 2:182–194

Wickens MR, Breusch TS (1988) Dynamic specification, the long-run and the estimation of transformed regression models. Econ J 98(390):189–205

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Martins, D., Damásio, B. One Troika fits all? Job crash, pro-market structural reform and austerity-driven therapy in Portugal. Empirica 47, 495–521 (2020). https://doi.org/10.1007/s10663-019-09433-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-019-09433-w