Abstract

We estimate a quantile structural vector autoregressive model for the Euro area to assess the real effects of uncertainty shocks in expansions and recessions using monthly data covering the period of 1999:02–2016:05. Domestic and foreign (US) uncertainty shocks hitting during recessions are found to produce a relatively overall stronger negative impact on output growth than in expansions, with US shocks having more pronounced effects. Inflation, in general, is unaffected from a statistical perspective. Our results tend to suggest that policymakers need to implement state-dependent policies, with stimulus policies being more aggressive during recessions—something we see from our results in terms of stronger declines in the interest rate during bad times.

Similar content being viewed by others

Notes

In this regard the reader is referred to the theoretical works of Bloom (2009), Fernández-Villaverde et al. (2011, 2015), Gourio (2012), Leduc and Liu (2013), Johannsen (2013), Mumtaz and Zanetti (2013), Nakata (2013), Basu and Bundick (2014), Bloom et al. (2014), Christiano et al. (2014), Floetotto et al. (2014), and Carriero et al. (2015). While the size of the impact of uncertainty on macroeconomic variables have been analysed empirically in Alexopoulos and Cohen (2009), Bachmann and Bayer (2011), Knotek II and Khan (2011), Stock and Watson (2012), Bachmann et al. (2013), Colombo (2013), Benati (2013), Jones and Olson (2013, 2015), Born and Pfeifer (2014), Alessandri and Mumtaz (2014), Caggiano et al. (2014a, b, 2016), Foerster (2014), Furlanetto et al. (2014), Gilchrist et al. (2013), Kang et al. (2014), Karnizova and Li (2014), Nodari (2014), Pellegrino (2018), Schüler (2014), Bali et al. (2015), Carriero et al. (2015), Castelnuovo et al. (2015), Gupta and Jooste (2017), Istrefi and Piloiu (2015), Jurado et al. (2015), Ludvigson et al. (2015), Mecikovsky and Meier (2015), Rossi and Sekhposyan (2015), Baker et al. (2016), Balcilar et al. (2017, 2016a, b), Caldara et al. (2016), Cheng et al. (2016), Jones and Enders (2016), Mumtaz et al. (2016), Rossi et al. (2016), Scotti (2016), Segnon et al. (2016), Shin and Zhong (2016), and Creal and Wu (2017).

Studies by Aastveit et al. (2017) and Balcilar et al. (2017) are also somewhat related in this regard. While these studies did not directly look at the spillover effect of the uncertainty of the US economy on other major economies, they were more concerned about the domestic effectiveness of monetary policy in the wake of low and high levels of US uncertainty.

Sin (2015) depicted significant impact of Chinese uncertainty on Taiwan and Hong Kong.

In this regard, it must be mentioned that Cheng et al. (2016) analysed the impact of US partisan conflict, besides US uncertainty, on the Euro area macroeconomic variables, and showed that partisan conflict has a relatively stronger effect than economic uncertainty. In addition, Jones and Olson (2015) were concerned more with the impact of financial market uncertainty of the US economy on Japan and the UK, and not necessarily the spillover of aggregate macroeconomic uncertainty like what we do in this paper (see below in the data segment for details on our measure of uncertainty), or what Colombo (2013), Caggiano et al. (2016), Cheng et al. (2016), and Stockhammar and Österholm (2016) did.

While here we concentrate only on the Euro area, our results based on QSVAR models for the US and UK confirm the findings of the earlier studies on the asymmetric effect of uncertainty; i.e., domestic uncertainty has a relatively stronger influence during recessions than expansions. For the UK, US uncertainty also shows an asymmetric impact. Complete details of these results are available upon request from the authors.

Note that shadow interest rate data is also available for Japan based on the work of Krippner (2012, 2013), who in turn derives these rates based on a two-factor model for also the Euro area, UK and US. However, Wu and Xia (2016) indicate that the three-factor term structure model fits the data better than the corresponding model with two factors. Hence, we decided to leave Japan out, as Wu and Xia (2016) does not provide estimates for the shadow rate of Japan. So in this paper, we concentrate formally on the Euro area, and also the UK and US, with results of the latter two countries not reported explicitly in the paper, but available upon request from the authors.

Though it does not hold in our case, since we only have one economic activity variable, namely output, quantiles of which we condition our analysis on; but in a QSVAR, in the presence of more than one variable capturing economic activity, multiple variables can be simultaneously used as a measure of business cycle indicators. This, however, is not a possibility in other parametric nonlinear models, where we need to specify a particular variable as an indicator of business cycle.

Chuliá et al. (2017) used bivariate QSVAR models to analyze the impact of domestic and US uncertainty on equity markets of both mature and emerging countries.

Further details on the EPU measure for the US can be found here: http://www.policyuncertainty.com/us_monthly.html, while that of the Euro area is available here: http://www.policyuncertainty.com/europe_monthly.html.

Based on the suggestion of an anonymous referee, we also ordered the Euro area EPU after the US EPU. Given this ordering of the variables, our results were both qualitatively and quantitatively similar (barring the first period for inflation, industrial production growth and interest rate) to those reported below following a shock to the domestic EPU. Complete details of these results are available upon request from the authors.

When we looked at confidence bands, we observed that the impacts are statistically significant only for output and interest rates, but not the inflation, following a statistically significant increase in the domestic EPU.

When we looked at the confidence bands, this effect was statistically significant.

Spillovers of EPU across countries have been studied by various papers in detail [see, Gupta et al. (2016) for a detailed literature review in this regard].

A variance decomposition analysis showed that the cumulative effect (over horizons 0 to 10-month-ahead) of US EPU on output growth at τ = 0.25, 0.50 and 0.75 is 14.65, 13.40, and 13.63% respectively, which were consistently higher (especially at τ = 0.25) when we compared to the corresponding values of 3.20, 13.07 and 9.87% respectively following a shock to the domestic EPU. These results, complete details of which are available upon request from the authors, basically confirm the finding from the impulse response analyses.

Our results are qualitatively similar if we use τ = 0.1 and 0.9 to characterize the recessionary and expansionary regimes respectively. Complete details of these results are available upon request from the authors.

Based on the suggestions of an anonymous referee, we conducted two additional robustness checks: (a) first, we included the shadow rate of the US [derived from Wu and Xia (2016)] and ordered it before the US EPU, and; (b) second, we included changes in net exports (as it was non-stationary in levels) of the Euro area (derived from the OECD’s MEIs database) and ordered it before the domestic EPU. Under (b), results were qualitatively and quantitatively the same, as a shock to US EPU failed to have a statistically significant impact on changes in net exports (though it was positive), while under (a), our results were qualitatively similar, but the severity of the effects were marginally reduced, since an increase in US EPU, resulted in a statistically significant decline in the US shadow rate, thus nullifying to some extent the negative influence of the US EPU shock on the Euro area variables. Complete details of these results are available upon request from the authors.

References

Aastveit KA, Natvik GJ, Sola S (2017) Macroeconomic uncertainty and the effectiveness of monetary policy. J Int Money Finance 76:50–67

Abadir K, Caggiano G, Talmain G (2013) Nelson–Plosser revisited: the ACF approach. J Econom 175:22–34

Alessandri P, Mumtaz H (2014) Financial regimes and uncertainty shocks. School of Economics and Finance, Queen Mary University of London Working Paper No. 729

Alexopoulos M, Cohen J (2009) Uncertain times, uncertain measures. University of Toronto, Department of Economics Working Paper No. 325

Azzimonti M (2015) Partisan conflict and private investment. NBER Working Paper No. w21273

Bachmann R, Bayer C (2011) Uncertainty business cycles-really? National Bureau of Economic Research Working Paper No. w16862

Bachmann R, Elstner S, Sims E (2013) Uncertainty and economic activity: evidence from business survey data. Am Econ J Macroecon 5:217–249

Baker S, Bloom N, Davis S (2016) Measuring economic policy uncertainty. Q J Econ. https://doi.org/10.1093/qje/qjw024

Balcilar M, Gupta R, Jooste C (2016a) Long memory, economic policy uncertainty and forecasting US inflation: a Bayesian VARFIMA approach. Appl Econ. https://doi.org/10.1080/00036846.2016.1210777

Balcilar M, Gupta R, Segnon M (2016b) The role of economic policy uncertainty in predicting U.S. recessions: a mixed-frequency markov-switching vector autoregressive approach. Economics 10(27):1–20

Balcilar M, Demirer R, Gupta R, van Eyden R (2017) Effectiveness of monetary policy in the Euro area: the role of US economic policy uncertainty. J Policy Model 39(6):1052–1064

Bali TG, Brown SJ, Tang Y (2015) Macroeconomic uncertainty and expected stock returns. Georgetown McDonough School of Business Research Paper No. 2407279

Basu S, Bundick B (2014) Uncertainty shocks in a model of effective demand. Federal Reserve Bank of Kansas City Research Working Paper No. 14-15

Benati L (2013) Economic policy uncertainty and the great recession. University of Bern, Mimeo

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98:85–106

Blanchard O (2009) (Nearly) nothing to fear but fear itself. The economist, economics focus (guest article), January 29

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bloom N, Floetotto M, Jaimovich N, Saporta-Eksten I, Terry SJ (2014) Really uncertain business cycles. Stanford University, Mimeo

Born B, Pfeifer J (2014) Policy risk and the business cycle. J Monet Econ 68:68–85

Brogaard J, Detzel A (2015) The asset-pricing implications of government economic policy uncertainty. Manag Sci 61:3–18

Caggiano G, Castelnuovo E (2011) On the dynamics of international inflation. Econ Lett 112(2):189–191

Caggiano G, Castelnuovo E, Groshenny N (2014a) Uncertainty shocks and unemployment dynamics in US recessions. J Monet Econ 67:78–92

Caggiano G, Castelnuovo E, Nodari G (2014b) Uncertainty and monetary policy in good and bad times. Dipartimento di Scienze Economiche “Marco Fanno”, Working Paper No. 0188

Caggiano G, Castelnuovo E, Figueres JM (2016) Economic policy uncertainty spillovers in booms and busts. University of Padova and University of Melbourne, Mimeo

Caldara D, Iacoviello M (2016) Measuring geopolitical risk. Working Paper, Board of Governors of the Federal Reserve Board

Caldara D, Fuentes-Albero C, Gilchrist S, Zakrajsek E (2016) The macroeconomic impact of financial and uncertainty shocks. Eur Econ Rev 88:185–207

Carriero A, Mumtaz H, Theophilopoulou A, Theodoridis K (2015) The impact of uncertainty shocks under measurement error: a proxy SVAR approach. J Money Credit Bank 47(6):1223–1238

Castelnuovo E, Caggiano G, Pellegrino G (2015) Estimating the real effects of uncertainty shocks at the zero lower bound. Dipartimento di Scienze Economiche “Marco Fanno”, Working Paper No. 0200

Cecchetti S, Li H (2008) Measuring the impact of asset price booms using quantile vector autoregressions. Brandeis University, Department of Economics, Mimeo

Cheng C-HJ, Hankins WA, Chiu C-WJ (2016) Does US partisan conflict matter for the Euro area? Econ Lett 138:64–67

Christiano L, Motto R, Rostagno M (2014) Risk shocks. Am Econ Rev 104(1):27–65

Chuliá H, Gupta R, Uribe JM, Wohar ME (2017) Impact of US uncertainties on emerging and mature markets: evidence from a quantile-vector autoregressive approach. J Int Financ Mark Inst Money 48:178–191

Colombo V (2013) Economic policy uncertainty in the US: does it matter for the Euro area? Econ Lett 121:39–42

Creal DD, Wu C (2017) Monetary policy uncertainty and economic fluctuations. Int Econ Rev 58(4):1317–1354

Dixit AK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press, Princeton

Fernández-Villaverde J, Guerrón-Quintana P, Rubio-Ramírez JF, Uribe M (2011) Risk matters: the real effects of volatility shocks. Am Econ Rev 101:2530–2561

Fernández-Villaverde J, Guerrón-Quintana P, Kuester K, Rubio-Ramírez JF (2015) Fiscal volatility shocks and economic activity. Am Econ Rev 105(11):3352–3384

Foerster A (2014) The asymmetric effects of uncertainty on employment. Fed Reserve Bank Kans City Econ Rev Quart 3:5–26

Furlanetto F, Ravazzolo F, Sarferaz S (2014) Identification of financial factors in economic fluctuations. Norges Bank Working Paper No. 09/2014

Gilchrist S, Sim JW, Zakrajek E (2013) Uncertainty, financial frictions, and irreversible investment. Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Finance and Economics Discussion Series, Paper No. 2014-69

Gourio F (2012) Disaster risk and business cycles. Am Econ Rev 102(6):2734–2766

Gupta R, Jooste C (2017) Unconventional monetary policy shocks in OECD countries: how important is the extent of policy uncertainty? Int Econ Econ Policy. https://doi.org/10.1007/s10368-017-0380-8

Gupta R, Pierdzioch C, Risse M (2016) On international uncertainty links: BART-based empirical evidence for Canada. Econ Lett 143:24–27

Istrefi K, Piloiu A (2015) Economic policy uncertainty and inflation expectations. Banque de France, Mimeo

Johannsen BK (2013) When are the effects of fiscal policy uncertainty large. Northwestern University, Mimeo

Jones PM, Enders W (2016) The asymmetric effects of uncertainty on macroeconomic activity. Macroecon Dyn 20(5):1219–1246

Jones PM, Olson E (2013) The time-varying correlation between uncertainty, output and inflation: evidence from a DCC-GARCH model. Econ Lett 118:33–37

Jones PM, Olson E (2015) The international effects of US uncertainty. Int J Finance Econ 20:242–252

Jurado K, Ludvigson SC, Ng S (2015) Measuring Uncertainty. Am Econ Rev 105(3):1177–1216

Kang W, Lee K, Ratti RA (2014) Economic policy uncertainty and firm-level investment. J Macroecon 39:42–53

Karnizova L, Li JC (2014) Economic policy uncertainty, financial markets and probability of US recessions. Econ Lett 125:261–265

Kilian L, Park C (2009) The impact of oil price shocks on the US stock market. Int Econ Rev 50:1267–1287

Knotek ES II, Khan S (2011) How do households respond to uncertainty shocks. Fed Reserve Bank Kans City Econ Rev 96:5–34

Koenker RW, d’Orey V (1987) Algorithm AS 229: computing regression quantiles. J R Stat Soc Ser C (Appl Stat) 36(3):383–393

Krippner L (2012) Modifying Gaussian term structure models when interest rates are near the zero lower bound. Reserve Bank of New Zealand Discussion Paper 2012/02

Krippner L (2013) A tractable framework for zero lower bound gaussian term structure models. Australian National University CAMA Working Paper 49/2013

Leduc S, Liu Z (2013) Uncertainty shocks are aggregate demand shocks. Federal Reserve Bank of San Francisco, Working Paper 2012-10

Linnemann L, Winkler R (2016) Estimating nonlinear effects of fiscal policy using quantile regression methods. Oxf Econ Pap. https://doi.org/10.1093/oep/gpw020

Ludvigson SC, Ma S, Ng S (2015) Uncertainty and business cycles: exogenous impulse or endogenous response? National Bureau of Economic Research, Working Paper No. w21803

Manela A, Moreira A (2017) News implied volatility and disaster concerns. J Financ Econ 123(1):137–162

Mecikovsky AM, Meier M (2015) Do plants freeze upon uncertainty shocks?. University of Bonn, Mimeo

Morley J, Piger J (2012) The asymmetric business cycle. Rev Econ Stat 94(1):208–221

Morley J, Piger J, Tien P-L (2013) Reproducing business cycle features: are nonlinear dynamics a proxy for multivariate information? Stud Nonlinear Dyn Econ 17(5):483–498

Mumtaz H, Surico P (2013) Policy uncertainty and aggregate fluctuations. Queen Mary University of London, School of Economics and Finance, Working Paper No. 708

Mumtaz H, Theodoridis K (2015) Common and country specific economic uncertainty. Queen Mary University of London, School of Economics and Finance, Working Paper No. 752

Mumtaz H, Theodoridis K (2016) The changing transmission of uncertainty shocks in the us: an empirical analysis. J Bus Econ Stat. https://doi.org/10.1080/07350015.2016.1147357

Mumtaz H, Zanetti F (2013) The impact of the volatility of monetary policy shocks. J Money Credit Bank 45:535–558

Mumtaz H, Sunder-Plassmann L, Theophilopoulou A (2016) The state level impact of uncertainty shocks. Queen Mary University of London, School of Economics and Finance, Working Paper No. 793

Nakata T (2013) Uncertainty at the zero lower bound. Federal Reserve Board, Finance and Economics Discussion Series Working Paper No. 2013-09

Nodari G (2014) Financial regulation policy uncertainty and credit spreads in the U.S. J Macroeconomics 41:122–132

Orlik A, Veldkamp L (2014) Understanding uncertainty shocks and the role of black swans. NBER Working Paper No. 20445

Pellegrino G (2018) Uncertainty and the real effects of monetary policy shocks in the Euro area. Econ Lett 162:177–181

Rossi B, Sekhposyan T (2015) Macroeconomic uncertainty indices based on nowcast and forecast error distributions. Am Econ Rev Pap Proc 105(5):650–655

Rossi B, Sekhposyan T, Soupre M (2016) Understanding the sources of macroeconomic uncertainty. Universitat Pompeu Fabra - Centre de Recerca en Economia Internacional (CREI), Mimeo

Schüler YS (2014) Asymmetric effects of uncertainty over the business cycle: a quantile structural vector autoregressive approach. University of Konstanz, Department of Economics, Working Paper Series No. 2014-02

Scotti C (2016) Surprise and uncertainty indexes: real-time aggregation of real-activity macro surprises. J Monet Econ 82:1–19

Segnon M, Gupta R, Bekiros S, Wohar ME (2016) Forecasting US GNP growth: the role of uncertainty. University of Pretoria, Department of Economics, Working Paper No. 201667

Shin M, Zhong M (2016) A new approach to identifying the real effects of uncertainty shocks. Finance and Economics Discussion Series 2016-040. Washington: Board of Governors of the Federal Reserve System

Sin CYC (2015) The economic fundamental and economic policy uncertainty of Mainland China and their impacts on Taiwan and Hong Kong. Int Rev Econ Finance 40(C):298–311

Stock JH, Watson MW (2012) Disentangling the channels of the 2007–2009 recession. Brookings Papers on Economic Activity, Spring, 81–135

Stockhammar P, Österholm P (2016) Effects of US policy uncertainty on Swedish GDP growth. Empir Econ 50(2):443–462

Strobel J (2015) On the different approaches of measuring uncertainty shocks. Econ Lett 134:69–72

Wu JC, Xia FD (2016) Measuring the macroeconomic impact of monetary policy at the zero lower bound. J Money Credit Bank 48(2–3):253–291

Acknowledgements

We would like to thank an anonymous referee for many helpful comments. However, any remaining errors are solely ours.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

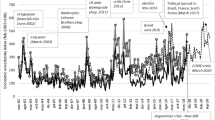

See Fig. 3.

Rights and permissions

About this article

Cite this article

Gupta, R., Lau, C.K.M. & Wohar, M.E. The impact of US uncertainty on the Euro area in good and bad times: evidence from a quantile structural vector autoregressive model. Empirica 46, 353–368 (2019). https://doi.org/10.1007/s10663-018-9400-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-018-9400-3