Abstract

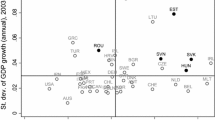

International trade flows are highly concentrated in the top units of analysis. In this paper, we study the size distribution of exports at the product level, using Comext data for the 28 EU countries over the period 2002–2014. We fit power law relationships running log rank–log size regressions. The estimated Pareto exponent may be interpreted as a single measure of the inequality between the top products; it thus constitutes an alternative to other measures of export diversification. The Pareto exponent estimates are quite stable for most EU countries between 2002 and 2014. However, some countries stand out for their increase or decrease in the Pareto exponent. Some preliminary evidence suggesting negative correlation between volatility in EU country exports and export diversification at the product level is also provided.

Similar content being viewed by others

Notes

Table 6 in the Appendix reports summarised statistics for the EU countries in 2002 and 2014.

An alternative strategy would be to fix a specific number of top products (e.g. N = 250) for all EU countries. The results are essentially the same, however, with some differences for the smallest countries like Cyprus and Malta.

High R&D intensity countries are Finland, Sweden, Denmark, Germany, Austria, France, Belgium, Slovenia and Netherlands. Medium R&D intensity countries are the United Kingdom, Luxembourg, the Czech Republic, Ireland, Estonia, Spain, Italy, Portugal, Hungary and Croatia. The low R&D intensity group is formed by Lithuania, Poland, Greece, Slovakia, Malta, Latvia, Bulgaria, Romania and Cyprus. Data for 2014 is mostly provisional. The available data for some countries have a shorter time span than 2002–2014. See http://ec.europa.eu/eurostat/statistics-explained/index.php/R_%26_D_expenditure for further details.

The Theil index is given by the expression \(T = \frac{1}{N}\sum\nolimits_{i = 1}^{N} {\left( {\frac{{X_{i} }}{{\bar{X}}}} \right)} ln\;\left( {\frac{{X_{i} }}{{\bar{X}}}} \right)\), where X i represents the exports of product i for a given country, N is the number of exported products, and \(\bar{X} = \frac{1}{4}\sum\nolimits_{i = 1}^{N} {X_{i} }\). After ranking the products by export value, the Gini index is \(G = 1 + \frac{1}{N} - \left( {\frac{2}{{\bar{X}N^{2} }}} \right)\sum\nolimits_{i = 1}^{N} {(N - i + 1)X_{i} }\). The Herfindahl index is simply the sum of squared shares of export lines, \(s_{i} = \frac{{X_{i} }}{{\sum\nolimits_{i = 1}^{N} {X_{i} } }}\). The Theil and Gini indexes were computed using the ineqdeco Stata code written by Stephen P. Jenkins.

Greece is a special case, with an exaggerated increase in its Theil index. This is highly likely due to the disproportionate weight of oil and petroleum exports, with a share over 0.3, which have grown rapidly over the last decade.

The great presence of multinationals in Ireland makes this country a special case. Approximately 90% of manufacturing exports is accounted for by foreign-owned multinationals (see, e.g., O’Brien and Scally 2012). The high concentration of Irish manufacturing exports occurs in sectors such as chemicals and pharmaceuticals. These facts are clearly important in explaining the very low level of volatility shown in Fig. 8.

References

Acemoglu D, Carvalho VM, Ozdaglar A, Tahbaz-Salehi A (2012) The network origins of aggregate fluctuations. Econometrica 80:1977–2016

Agosin MR, Alvarez R, Bravo-Ortega C (2012) Determinants of export diversification around the World: 1962–2000. World Econ 35:295–315

Amurgo-Pacheco A, Pierola MD (2008) Patterns of export diversification in developing countries: intensive and extensive margins. World Bank Policy Research Working Paper 4473

Arkolakis C, Costinot A, Rodríguez-Clare A (2012) New trade models, same old gains? Am Econ Rev 102:94–130

Axtell RL (2001) Zipf distribution of US firm sizes. Science 293:1818–1820

Black D, Henderson V (2003) Urban evolution in the USA. J Econ Geogr 3:343–372

Bottazzi G, Pirino D, Tamagni F (2015) Zipf law and the firm size distribution: a critical discussion of popular estimators. J Evol Econ 25:585–610

Cadot O, Carrère C, Strauss-Kahn V (2011) Export diversification: what’s behind the hump? Rev Econ Stat 93:590–605

Cadot O, Carrère C, Strauss-Kahn V (2013) Trade diversification, income, and growth: what do we know? J Econ Surv 27:790–812

Camanho da Costa Neto N, Romeu R (2011) Did export diversification soften the impact of the global financial crisis? IMF Working Paper WP/11/99

Canals C, Gabaix X, Vilarubia JM, Weinstein D (2007) Trade patterns, trade balances, and idiosyncratic shocks. Bank of Spain Working Papers no. 721

Carvalho VM, Gabaix X (2013) The great diversification and its undoing. Am Econ Rev 103:1697–1727

Chaney T (2008) Distorted gravity: the intensive and extensive margins of international trade. Am Econ Rev 98:1707–1721

Cirillo P, Hüsler J (2009) On the upper tail of Italian firms’ size distribution. Phys A 388:1546–1554

De Benedictis L, Gallegati M, Tamberi M (2009) Overall trade specialization and economic development: countries diversify. Rev World Econ 145:37–55

Del Rosal I (2013) The granular hypothesis in EU country exports. Econ Lett 120:433–436

Dennis A, Shepherd B (2011) Trade facilitation and export diversification. World Econ 34:101–122

Devadoss S, Luckstead J (2016) Size distribution of U.S. lower tail cities. Phys A 444:158–162

Di Giovanni J, Levchenko AA (2012) Country size, international trade, and aggregate fluctuations in granular economies. J Polit Econ 120:1083–1132

Di Giovanni J, Levchenko AA, Ranciere R (2011) Power laws in firm size and openness to trade: measurement and implications. J Int Econ 85:42–52

Di Giovanni J, Levchenko AA, Mejean I (2014) Firms, destinations, and aggregate fluctuations. Econometrica 82:1303–1340

Easterly W, Reshef A (2016) African export successes: surprises, stylized facts, and explanations. In: Edwards S, Johnson S, Weil DN (eds) African successes, Volume III: Modernization and development. University of Chicago Press, Chicago (forthcoming)

Easterly W, Reshef A, Schwenkenberg J (2009) The power of exports. World Bank Policy Research Working Paper 5081

Eaton J, Kortum S, Kramarz F (2011) An anatomy of international trade: evidence from French firms. Econometrica 79:1453–1498

Eeckhout J (2004) Gibrat’s law for (all) cities. Am Econ Rev 94:1429–1451

Eurostat (2015) User guide on European statistics on international trade in goods. Publications Office of the European Union, Luxembourg

Feenstra RC (1994) New product varieties and the measurement of international prices. Am Econ Rev 84:157–177

Funke M, Ruhwedel R (2001) Export variety and export performance: empirical evidence from East Asia. J Asian Econ 12:493–505

Funke M, Ruhwedel R (2002) Export variety and export performance: empirical evidence for the OECD Countries. Rev World Econ 138:97–114

Gabaix X (2009) Power laws in economics and finance. Annu Rev Econ 1:255–293

Gabaix X (2011) The granular origins of aggregate fluctuations. Econometrica 79:733–772

Gabaix X (2016) Power laws in economics: an introduction. J Econ Perspect 30:185–206

Gabaix X, Ibragimov R (2011) Rank-1/2: a Simple way to improve the OLS estimation of tail exponents. J Bus Econ Stat 29:24–39

Giesen K, Suedekum J (2014) City age and city size. Eur Econ Rev 71:193–208

Head K, Mayer T (2014) Gravity equations: workhorse, toolkit, and cookbook. In: Gopinath G, Helpman E, Rogoff K (eds) Handbook of international economics, vol 4. Elsevier, Amsterdam, pp 131–195

Helpman E, Melitz MJ, Yeaple SR (2004) Export versus FDI with heterogeneous firms. Am Econ Rev 94:300–316

Hinloopen J, Van Marrewijk C (2006) Comparative advantage, the rank-size rule, and Zipf’s law. Tinbergen Institute Discussion Paper TI 2006-100/1

Hinloopen J, Van Marrewijk C (2012) Power laws and comparative advantage. Appl Econ 44:1483–1507

Hummels D, Klenow PJ (2005) The variety and quality of a nation’s exports. Am Econ Rev 95:704–723

Imbs J, Wacziarg R (2003) Stages of diversification. Am Econ Rev 93:63–86

Klinger B, Lederman D (2004) Discovery and development: an empirical exploration of “new” products. World Bank Policy Research Working Paper 3450

Klinger B, Lederman D (2006) Diversification, innovation, and imitation inside the Global Technological Frontier. World Bank Policy Research Working Paper 3872

Koren M, Tenreyro S (2007) Volatility and development. Q J Econ 122:243–287

Mau K (2015) Export diversification and income differences reconsidered: the extensive product margin in theory and application. Rev World Econ 152:351–381

Melitz M (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71:1695–1725

Melitz M, Redding S (2014) Heterogeneous firms and trade. In: Gopinath G, Helpman E, Rogoff K (eds) Handbook of international economics, vol 4. Elsevier, Amsterdam, pp 1–54

Minondo A (2011) Does comparative advantage explain countries’ diversification level? Rev World Econ 147:507–526

Neary JP (2010) Two and a half theories of trade. World Econ 33:1–19

O’Brien D, Scally J (2012) Cost competitiveness and export performance of the Irish economy. Cent Bank Irel Q Bull 3:86–102

Parteka A (2010) Employment and export specialisation along the development path: some robust evidence. Rev World Econ 145:615–640

Parteka A (2013) Trade diversity and stages of development-evidence on EU countries. Ekonomia 30:23–44

Parteka A, Tamberi M (2013a) What determines export diversification in the development process? Empirical assessment. World Econ 36:807–826

Parteka A, Tamberi M (2013b) Product diversification, relative specialisation and economic development: import export analysis. J Macroecon 38:121–135

Peng G (2010) Zipf’s law for Chinese cities: rolling sample regressions. Phys A 389:3804–3813

Regolo J (2013) Export diversification: how much does the choice of the trading partner matter? J Int Econ 91:329–342

Schaffar A, Dimou M (2012) Rank-size city dynamics in China and India, 1981–2004. Reg Stud 46:707–721

Segarra A, Teruel M (2012) An appraisal of firm size distribution: does sample size matter? J Econ Behav Organ 82:314–328

Shepotylo O (2013) Export diversification across countries and products: do Eastern European (EE) and Commonwealth of Independent States (CIS) countries diversify enough? J Int Trade Econ Dev 22:605–638

Acknowledgements

I would like to thank the editor for his help and two anonymous referees for their comments that substantially improved the paper. Financial support from the Consejería de Educación, Cultura y Deporte del Principado de Asturias, is acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

del Rosal, I. Power laws in EU country exports. Empirica 45, 311–337 (2018). https://doi.org/10.1007/s10663-016-9362-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-016-9362-2