Abstract

This paper examines the effects of oil price shocks on the stock market returns of the Gulf Cooperation Council countries. The empirical method used is quantile regression analysis. In addition, we allow for structural breaks and asymmetry by differentiating between positive and negative oil price changes. Unlike OLS analysis, quantile regression allows the coefficient estimates to vary throughout the distribution of the dependent variable, which provides a complete picture of the relationship between the explanatory variables and the dependent variable. Our results suggest that the coefficient estimates have not been constant throughout the distribution of stock returns; that oil price shocks have asymmetrical effects on stock returns; and that the effects of oil price shocks on stock market returns are affected by stock market conditions. Overall, the results suggest that rising oil prices increase stock returns only when stock markets are bullish (high quantiles) and normal (medium quantiles), and that falling oil prices lower stock returns only when stock markets are bearish (low quantiles) and normal (medium quantiles). This suggests that oil and stock markets are more likely to boom together or crash together.

Similar content being viewed by others

Notes

The other crude oil prices are Saharan Blend of Algeria, Minas of Indonesia, Iran Heavy, Basra Light of Iraq, Es Sider of Libya, Bonny Light of Nigeria, and BCF 17 of Venezuela.

The model and testing procedure are not explained in details due to space limitation. Interested readers are referred to the original papers mentioned in the references.

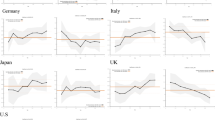

Due to the large number of graphs, only the quantile plots for oil price changes are presented. All unreported graphs are available upon request from the corresponding author.

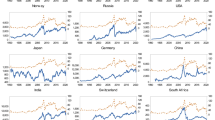

Due to the large number of graphs, only the quantile plots for positive and negative oil price changes are presented. All unreported graphs are available upon request from the corresponding author.

Results of testing the null hypothesis of equal coefficient estimates on \(o^{ + }\) and \(o^{ - }\) are not reported, but available upon request from the corresponding author.

References

Akoum I, Graham M, Kivihaho J, Nikkinen J, Omran M (2012) Co-movement of oil and stock prices in the GCC region: a wavelet analysis. Q Rev Econ Finance 52:385–394

Allegret J-P, Couharde C, Coulibaly D (2014) Current accounts and oil price fluctuations in oil-exporting countries: the role financial development. J Int Money Finance 47:185–201

Aloui C, Nguyen D, Njeh N (2012) Assessing the impacts of oil price fluctuations on stock returns in emerging markets. Econ Model 29:2686–2695

Antonakakisa N, Chatziantonioub I, Filis G (2017) Oil shocks and stock markets: dynamic connectedness under the prism of recent geopolitical and economic unrest. Int Rev Financ Anal 50:1–26

Arouri M, Rault C (2010) Causal relationships between oil and stock prices: some new evidence from the Gulf oil-exporting countries. Int Econ 122:41–56

Arouri M, Rault C (2012) Oil prices and stock markets in GCC countries: empirical evidence from panel analysis. Int J Finance Econ 17:242–253

Arouri M, Lahiani A, Nguyen D (2011) Return and volatility transmission between world oil prices and stock markets of the GCC countries. Econ Model 28:1815–1825

Awartani B, Maghyereh A (2013) Dynamic spillovers between oil and stock markets in the Gulf Cooperation Council countries. Energy Econ 36:28–42

Bahmani-Oskooee M, Halicioglu F, Mohammadian A (2017) On the asymmetric effects of exchange rate changes on domestic production in Turkey. Econ Change Restruct. doi:10.1007/s10644-017-9201-x

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometric 66(1):47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18(1):1–22

Basher S, Sadorsky P (2006) Oil price risk and emerging stock markets. Glob Finance J 17:224–251

Binder M, Coad A (2011) From Average Joe’s happiness to Miserable Jane and Cheerful John: using quantile regressions to analyze the full subjective well-being distribution. J Econ Behav Organ 79(3):275–290

Bjørnland H (2009) Oil price shocks and stock market booms in an oil exporting country. Scott J Polit Econ 56(2):232–254

Brown S, Yücel M (2002) Energy prices and aggregate economic activity: an interpretative survey. Q Rev Econ Finance 42:193–208

Chang Y, Wong J (2003) Oil price fluctuations and Singapore economy. Energy Policy 31:1151–1165

Chen SS, Chen HC (2007) Oil prices and real exchange rates. Energy Econ 29:390–404

Cologni A, Manera M (2008) Oil price, inflation and interest rates in a structural cointegrated VAR model for the G-7 countries. Energy Econ 30:856–888

Cunado J, Perez de Gracia F (2005) Oil prices, economic activity and inflation: evidence for some Asian countries. Q Rev Econ Finance 45(1):65–83

Cunado J, Perez de Gracia F (2014) Oil price shocks and stock market returns: evidence for some European countries. Energy Econ 42:365–377

Darby M (1982) The price of oil and world inflation and recession. Am Econ Rev 72(4):738–751

Diaz E, Perez de Gracia F (2017) Oil price shocks and stock returns of oil and gas corporations. Finance Res Lett 20:75–80

Dizaji S (2014) The effects of oil shocks on government expenditures and government revenues nexus (with an application to Iran’s sanctions). Econ Model 40:299–313

Du L, He Y, Wei C (2010) The relation between oil price shocks and China’s macro-economy: an Empirical analysis. Energy Policy 38(8):4142–4151

Dufrenot G, Ospanova A, Sand-Zantman A (2014) Small macro econometric model for Kazakhstan: a retrospective of alternative economic policies undertaken during the transition process. Econ Change Restruct 47(1):1–39

Fan G, He L, Wei X, Han L (2013) China’s growth adjustment: moderation and structural changes. Econ Change Restruct 46(1):9–24

Fuinhas J, Marques A, Couto A (2015) Oil rents and economic growth in oil producing countries: evidence from a macro panel. Econ Change Restruct 48(3):257–279

Hamilton J (1983) Oil and the macroeconomy since World War II. J Polit Econ 91(2):228–248

Hamilton J (1996) This is what happened to the oil price-macroeconomy relationship. J Monet Econ 38(2):215–220

Hammoudeh S, Aleisa E (2004) Dynamic relationship among GCC stock markets and NYMEX oil futures. Contemp Econ Policy 22(2):250–269

Henriques I, Sadorsky P (2008) Oil prices and the stock prices of alternative energy companies. Energy Econ 30:998–1010

Jones C, Kaul G (1996) Oil and the stock markets. J Finance 51(2):463–491

Joo Y, Park S (2017) Oil prices and stock markets: does the effect of uncertainty change over time? Energy Econ 61:42–51

Jouini J (2013) Stock markets in GCC countries and global factors: a further investigation. Econ Model 31:80–86

Jouini J, Harrathi N (2014) Revisiting the stock and volatility transmissions among GCC stock and oil markets: a further investigation. Econ Model 38:486–494

Kang W, Perez de Gracia F, Ratti R (2017) Oil price shocks, policy uncertainty, and stock returns of oil and gas corporations. J Int Money Finance 70:344–359

Khalifa A, Alsarhan A, Bertuccelli P (2017) Causes and consequences of energy price shocks on petroleum-based stock market using the spillover asymmetric multiplicative error model. Res Int Bus Finance 39:307–314

Kilian L (2008) The economic effects of energy price shocks. J Econ Lit 46(4):871–909

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46(1):33–50

Lardic S, Mignon V (2008) Oil prices and economic activity: an asymmetric cointegration approach. Energy Econ 30:847–855

Le T-H, Chang Y (2015) Effects of oil price shocks on the stock market performance: do nature of shocks and economies matter? Energy Econ 51:261–274

Lee C-C, Zeng J-H (2011) The impact of oil price shocks on stock market activities: asymmetric effect with quantile regression. Math Comput Simul 81:1910–1920

Lee K, Ni S, Ratti R (1995) Oil shocks and the macroeconomy: the role of price variability. Energy J 16(4):39–56

Maghyereh A, Al-Kandari A (2007) Oil prices and stock markets in GCC countries: new evidence from nonlinear cointegration analysis. Manag Finance 33(7):449–460

Mensi W, Hammoudeh S, Reboredo J, Nguyen D (2014) Do global factors impact BRICS stock markets? A quantile regression approach. Emerg Market Rev 19:1–17

Mohanty S, Nandha M, Turkistani A, Alaitani M (2011) Oil price movements and stock market returns: evidence from Gulf Cooperation Council (GCC) countries. Glob Finance J 22:42–55

Momani B (2008) Gulf Cooperation Council oil exporters and the future of the dollar. New Polit Econ 13(3):293–314

Mork K (1989) Oil and the macroeconomy when prices go up and down: an extension of Hamilton’s results. J Polit Econ 97(3):740–744

Mosteller F, Tukey J (1977) Data analysis and regression: a second course in statistics. Addison-Wesley Publishing Company, Boston

Naifar N (2015) Do global risk factors and macroeconomic conditions affect global Islamic index dynamics? A quantile regression approach. Q Rev Econ Finance. doi:10.1016/j.qref.2015.10.004

Naifar N, Al Dohaiman M (2013) Nonlinear analysis among crude oil prices, stock markets’ return and macroeconomic variables. Int Rev Econ Finance 27:416–431

Narayan P, Narayan S (2010) Modelling the impact of oil prices on Vietnam’s stock prices. Appl Energy 97:356–361

Nasseh A, Elyasiani E (1984) Energy price shocks in the 1970s: impact on industrialized economies. Energy Econ 6(4):231–244

Nusair S (2016) The effects of oil price shocks on the economies of the Gulf Co-operation Council countries: nonlinear analysis. Energy Policy 91:256–267

Papapetrou E (2013) Oil prices and economic activity in Greece. Econ Change Restruct 46:385–397

Rafailidis P, Katrakilidis C (2014) The relationship between oil prices and stock prices: a nonlinear asymmetric cointegration approach. Appl Financ Econ 24(12):793–800

Rafiq S, Salim R, Bloch H (2008) Impact of crude oil price volatility on economic activities: an empirical investigation in the Thai economy. Resour Policy 34(3):121–132

Sim N, Zhou H (2015) Oil prices, US stock returns, and the dependence between their quantiles. J Bank Finance 55:1–8

Sotoudeha M-A, Worthington A (2016) Estimating the effects of global oil market shocks on Australian merchandise trade. Econ Anal Policy 50:74–84

Wang Y (2013) Oil price effects on personal consumption expenditures. Energy Econ 36:198–204

Wang Y, Wu C, Yang L (2013) Oil price shocks and stock market activities: evidence from oil-importing and oil-exporting countries. J Comp Econ 41:1220–1239

Zhu H, Guo Y, You W (2015) An empirical research of crude oil price changes and stock market in China: evidence from structural breaks and quantile regression. Appl Econ 47(56):6055–6074

Zhu H, Guo Y, You W, Xu Y (2016) The heterogeneity dependence between crude oil price changes and industry stock market returns in China: evidence from quantile regression approach. Energy Econ 55:30–41

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nusair, S.A., Al-Khasawneh, J.A. Oil price shocks and stock market returns of the GCC countries: empirical evidence from quantile regression analysis. Econ Change Restruct 51, 339–372 (2018). https://doi.org/10.1007/s10644-017-9207-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-017-9207-4