Abstract

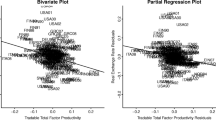

By imposing symmetry and proportionality conditions and using the asymptotic theory of panel-VAR models, this study examines the behavior of real exchange rates and productivity bias hypothesis for New Zealand vis-a-vis her major trading partners and the proposed free trade area. The evidence clearly rejects the strong version of the PPP hypothesis but the weak version of the PPP hypothesis receives some support. The findings also indicate that productivity differentials among countries are one of the major sources that contribute to the deviation of the PPP-based exchange rate from the equilibrium rate. Policy implications for the proposed free trade agreement are offered.

Similar content being viewed by others

Notes

The PPP theorem was developed by Cassel in (1916). The concept is based on the law of one price, where in the absence of transaction costs and official trade barriers, identical goods will have the same price in different markets when the prices are expressed in the same currency.

To establish this asymptotic distribution, one of the important conditions is the existence and finiteness of the first two moments of the asymptotic trace statistic. In their simulation study, Larsson et al. (2001) found out that for panels with small T, the standardized LR-bar test is oversized and has low power. Moreover, the size and the power of the test increase for large T, but the size does not approach the nominal significance level for finite samples.

The source of New Zealand's major trading partner is New Zealand Economic and Financial Overview (2015). China is one of the top trading partners of New Zealand but it is excluded due to lack of data. The proposed free trade area consists of US, Australia, and Japan.

The Ljung-Box test for autocorrelation, the Lagrange multiplier test for residual autocorrelation, and a test of normal distribution in the residual were used.

New Zealand has currently a free trade agreement with Australia and is negotiating with the US and Japan to enlarge the existing free trade agreement.

The Ljung-Box test for autocorrelation, the Lagrange multiplier test for residual autocorrelation, and a test of normal distribution in the residual were used.

The data was taken from OECD Statistics and World Development Indicators (World Bank).

References

Arize AC, Malindretos J, Ghosh D (2015) Purchasing power parity-symmetry and proportionality: evidence from 116 countries. Int Rev Econ Financ 37:69–85

Asea PK, Mendoza E (1994) The Balassa–Samuelson model: a general equilibrium appraisal. Rev Int Econ 2:244–267

Balassa B (1964) The purchasing power parity doctrine: a reappraisal. J Polit Econ 72:584–596

Cassel G (1916) The present situation of the foreign exchanges. Econ J 62–65

Cerrato M, Sarantis N (2008) Symmetry, proportionality and the purchasing power parity: evidence from panel cointegration tests. Int Rev Econ Financ 17(1):56–65

Cheung YW, Lai KK (1993) A fractional cointegration analysis of purchasing power parity. J Bus Econ Stat 11:103–112

Crowder WJ (1996) A reexamination of long-run PPP: the case of New Zealand, the UK, and the US. Rev Int Econ 4(1):64–78

De Gregorio J, Giovannini A, Wolf H (1994) International evidence on tradable and nontradables inflation. Eur Econ Rev 38:1225–1244

Dunaway S (2009) Global Imbalances and prospects for the world economy. New Zealand Institute for Economic Research Working Paper 2009/05

Edison H, Klovland JT (1987) A quantitative reassessment of the purchasing power parity hypothesis: evidence from Norway and the United Kingdom. J Appl Econom 2:309–333

Edison H, Vitek F (2009) Australia and New Zealand exchange rates: a quantitative assessment. IMF Working Paper WP/09/7

Edison HJ, Gagnon JE, Melick MR (1997) Understanding the empirical literature on purchasing power parity: the post-Bretton Wood era. J Int Money Financ 16:1–17

Emirmahmutoglu F, Omay T (2014) Reexamining the PPP hypothesis: a nonlinear asymmetric heterogeneous panel unit root test. Econ Model 40:184–190

Froot K, Rogoff K (1991) The EMS, the EMU, and the transition to a common currency. Natl Bur Econ Res Macroecon Annu 6:269–317

Gadea M, Montanes A, Reyes M (2004) The European Union and the US dollar: from post–Bretton-Woods to the Euro. J Int Money Financ 23(7–8):1109–1136

Grossmann A, Simpson M, Ozuna T (2014) Investigating the PPP hypothesis using constructed U.S. dollar equilibrium exchange rate misalignments over the post-Bretton Woods period. J Econ Financ 38:235–268

Hsieh D (1982) The determination of the real exchange rate: the productivity approach. J Int Econ 12:355–362

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussioan vector autoregressive models. Econometrica 59:1551–1580

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Koedijk KG, Tims B, van Dijk MA (2004) Purchasing power parity and the Euro area. J Int Money Financ 23(7–8):1081–1107

Kouretas GP (1997) The Canadian dollar and purchasing power parity during the recent float. Rev Int Econ 5(4):467–477

Krichene N (1998) Purchasing power parties in five east African countries: Burundi, Kenya, Rwanda, Tanzania, and Uganda. IMF Working Paper. African Department (WP/98/148)

Larsson R, Lyhagen J, Löthgren M (2001) Likelihood-based cointegration tests in heterogeneous panels. Econom J 4:109–142

Lopez C, Papell DH (2007) Convergence to purchasing power parity at the commencement of the Euro. Rev Int Econ 15(1):1–16

Mark NC, Choi DY (1997) Real exchange rate prediction over long horizons. J Int Econ 43:29–60

The Treasury (2015) New Zealand Economic and Financial Overview. New Zealand Debit Management Office, Wellington, p 52

Nusair S (2012) Nonlinear adjustment of Asian real exchange rates. Econ Change Restruct 45(3):221–246

O’Connell PHJ (1998) The overvaluation of purchasing power parity. J Int Econ 44:1–19

Obstfeld M (1993) Modelling trending real exchange rates. Centre for International and Development Economics Research. Working Paper No. C93-011, University of California at Berkeley

Oh KY (1996) Purchasing power parity and unit root tests using panel data. J Int Money Financ 15:405–418

Papell D (1997) Searching for stationarity: purchasing power parity under the current float. J Int Econ 43:313–332

Pedroni P (1996) Fully modified OLS for heterogeneous cointegrated panels and the case of purchasing power parity. Working paper (Indiana University)

Rogers JH, Jenkins M (1995) Haircuts or hysteresis? Sources of movements in real exchange rates. J Int Econ 38:339–360

Rogoff K (1992) Traded goods consumption smoothing and the random walk behavioral of the real exchange rate. NBER Working Paper No. 4119

Rogoff K (1996) The purchasing power parity puzzle. J Econ Lit 34:647–668

Samuelson PA (1964) Theoretical notes on trade problems. Rev Econ Stat 46:145–164

Stephen D (2004) The equilibrium exchange rate according to PPP and UIP. Discussion Paper Series, DP 2004/03, Reserve Bank of New Zealand

Taylor MP (1988) An empirical examination of long-run purchasing power parity using cointegration techniques. Appl Econ 20:1369–1381

Taylor AM (1996) International capital mobility in history: purchasing-power parity in the long run. NBER Working Paper No. 5742

Tiwari A, Shahbaz M (2014) Revisiting purchasing power parity for India using threshold cointegration and nonlinear unit root test. Econ Change Restruct 47(2):117–133

Zhou S, Bahmani-Oskooee M, Kutan AM (2008) Purchasing power parity before and after the adoption of the Euro. Rev World Econ 144:134–150

Acknowledgments

The author would like to thank two anonymous referees for their valuable comments and suggestions. Remaining errors are my responsibility.

Author information

Authors and Affiliations

Corresponding author

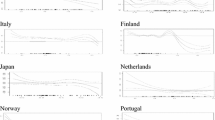

Appendix: Impulse-response functions

Appendix: Impulse-response functions

Rights and permissions

About this article

Cite this article

Irandoust, M. Symmetry, proportionality and productivity bias hypothesis: evidence from panel-VAR models. Econ Change Restruct 50, 79–93 (2017). https://doi.org/10.1007/s10644-016-9185-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-016-9185-y