Abstract

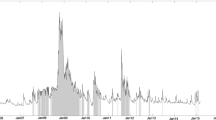

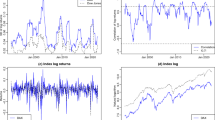

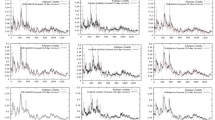

Corridor implied volatility introduced in Carr and Madan (Volatility: new estimation techniques for pricing derivatives, 1998) and recently implemented in Andersen and Bondarenko (Volatility as an asset class, 2007) is obtained from model-free implied volatility by truncating the integration domain between two barriers. Corridor implied volatility is implicitly linked with the concept that the tails of the risk-neutral distribution are estimated with less precision than central values, due to the lack of liquid options for very high and very low strikes. However, there is no golden choice for the barrier levels, which are likely to change depending on the underlying asset risk neutral distribution. The latter feature renders its forecasting performance mainly an empirical question. The aim of the paper is to investigate the forecasting performance of corridor implied volatility by choosing different corridors with symmetric and asymmetric cuts, and compare the results with the preliminary findings in Muzzioli (CEFIN working paper no 23, 2010b). Moreover, we shed light on the information content of different parts of the risk neutral distribution of the stock price, by using a model-independent approach based on corridor measures. To this end we compute both realized and model-free variance measures accounting for both falls and increases in the underlying asset price. The forecasting performance of volatility measures is evaluated both in a statistical and an economic setting. The economic significance is assessed by employing trading strategies based on delta-neutral straddles. The comparison is pursued by using intra-day synchronous prices between the options and the underlying asset.

Similar content being viewed by others

References

Ait-Sahalia Y., Lo A. W. (1998) Nonparametric estimation of state-price densities implicit in financial asset prices. Journal of Finance 53(2): 499–547

Andersen T. G., Bollerslev T. (1998) Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review 39(4): 885–905

Andersen T. G., Bollerslev T., Diebold F. X., Labys P. (2001) The distribution of realized exchange rate volatility. Journal of the American Statistical Association 96(453): 42–55

Andersen T. G., Bondarenko O. (2007) Construction and interpretation of model-free implied volatility. In: Nelken I. (eds) Volatility as an asset class. Risk Books, London, pp 141–181

Andersen, T. G., & Bondarenko, O. (2010). Dissecting the market pricing of volatility. Working paper, Northwestern University.

Ang A., Chen J., Xing Y. H. (2006) Downside risk. Review of Financial Studies 19(4): 1191–1239

Bandorff-Nielsen O. E., Kinnebrock S., Sheppard N. (2010) Measuring downside risk-realized semivariance. In Volatility and Time Series Econometrics 21: 117–137

Bandorff-Nielsen O. E., Sheppard N. (2004) Power and bipower variation with stochastic volatility and jumps. Journal of Financial Econometrics 2: 1–48

Black F., Scholes M. (1973) Pricing of options and corporate liabilities. Journal of Political Economy 81(3): 637–654

Bollerslev T., Tauchen G., Zhou H. (2009) Expected stock returns and variance risk premia. Review of Financial Studies 22(11): 4463–4492

Britten-Jones M., Neuberger A. (2000) Option prices, implied price processes, and stochastic volatility. Journal of Finance 55(2): 839–866

Campa J. M., Chang P. H. K., Reider R. L. (1998) Implied exchange rate distributions: Evidence from OTC option markets. Journal of International Money and Finance 17(1): 117–160

Carr P., Lewis K. (2004) Corridor variance swaps. Risk 17(2): 67–72

Carr P., Madan D. (1998) Towards a theory of volatility trading. In: Jarrow R. (eds) Volatility: New estimation techniques for pricing derivatives. Risk Books, London, pp 417–427

Carr P., Madan D. (2005) A note on sufficient conditions for no arbitrage. Finance Research Letters 2: 125–130

Carr P., Wu L. (2006) A tale of two indices. Journal of Derivatives, Spring 13(3): 13–29

Carr P., Wu L. R. (2009) Variance risk premiums. Review of Financial Studies 22(3): 1311–1341

Coval J. D., Shumway T. (2001) Expected options returns. Journal of Finance 56: 983–1009

Demeterfi, K., Derman, E., Kamal, M., & Zou, J. (1999). More than you ever wanted to know about volatility swaps. Goldman Sachs quantitative strategies research notes. New York: Goldman Sachs.

Derman E., Kani I. (1994) Riding on a smile. Risk 7(2): 32–39

Diebold F. X., Mariano R. S. (1995) Comparing predictive accuracy. Journal of Business & Economic Statistics 13(3): 253–263

Hansen, C., Christensen, B., & Prabhala, N. (2001). Accounting for the overlapping data problem in the implied-realized volatility regression. Center for analytical finance working paper. University of Aarhus, Aarhus, Denmark.

Hansen P. R., Lunde A. (2006) Consistent ranking of volatility models. Journal of Econometrics 131(1-2): 97–121

Harvey D., Leybourne S., Newbold P. (1997) Testing the equality of prediction mean squared errors. International Journal of Forecasting 13(2): 281–291

Jiang G. J., Tian Y. S. (2005) The model-free implied volatility and its information content. Review of Financial Studies 18(4): 1305–1342

Jiang G. J., Tian Y. S. (2007) Extracting model-free volatility from option prices: An examination of the VIX index. Journal of Derivatives 14(3): 35–60

Moriggia V., Muzzioli S., Torricelli C. (2009) On the no-arbitrage condition in option implied trees. European Journal of Operational Research 193(1): 212–221. doi:10.1016/j.ejor.2007.10.017

Muzzioli S. (2010a) Option-based forecasts of volatility: An empirical study in the DAX-index options market. European Journal of Finance 16(6): 561–586

Muzzioli, S. (2010b). Towards a volatility index for the Italian stock market. CEFIN working paper No 23, University of Modena and Reggio Emilia.

Patton, A. (2010). Volatility forecast comparison using imperfect volatility proxies. Journal of Econometrics. doi:10.1016/j.jeconom.2010.03.034.

Patton, A., Sheppard, K. (2009) Evaluating volatility and correlation forecasts. , Handbook of Financial Time Series.

Poon S. H., Granger C. W. J. (2003) Forecasting volatility in financial markets: A review. Journal of Economic Literature 41(2): 478–539

Rompolis, L. S., & Tzavalis, E. (2010). Retrieving risk neutral moments and expected quadratic variation from option prices. Working paper, University of Cyprus.

Tsiaras, L. (2009). The forecast performance of competing implied volatility measures: The case of individual stocks. Finance research group working papers.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Muzzioli, S. The Forecasting Performance of Corridor Implied Volatility in the Italian Market. Comput Econ 41, 359–386 (2013). https://doi.org/10.1007/s10614-012-9343-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-012-9343-x