Abstract

India’s commitment to Paris Climate Change Agreement through its Nationally Determined Contribution (NDC) will require the energy system to gradually move away from fossil fuels. The current energy system is witnessing a transformation to achieve these through renewable energy targets and enhanced energy efficiency (EE) actions in all sectors. More stringent global GHG mitigation targets of 2 °C and well below 2 °C regimes would impose further challenges and uncertainties for the Indian energy systems. This paper provides a quantitative assessment using bottom-up optimization model (AIM/Enduse) to assess these until 2050 for meeting carbon mitigation commitments while achieving the national sustainable development goals. Energy transformation trajectories under five scenarios synchronized with climate mitigation regimes are explored—Business As Usual scenario (BAU), NDC scenario, 2 °C scenarios (early and late actions), and well below 2 °C scenario. The key results from the study include (a) coal-based power plants older than 30 years under NDC and older than 20 years for deeper CO2 mitigation will be stranded before their lifetime, (b) increase in renewables of up to 225–280 GW by 2050 will require battery storage with improved integrated smart grid infrastructure, (c) growth in nuclear to 27–32 GW by 2050 is dependent on nuclear supply availability, (d) gradual shift towards electrification in industry, building, and transport sectors, and (e) installation of CCS technologies in power and industry sectors. Cumulative investments of up to 6–8 trillion USD (approximately) will be required during 2015–2030 to implement the actions required to transform the current energy systems in India.

Similar content being viewed by others

1 Introduction

The main targets of India’s Nationally Determined Contribution (NDC) submitted to Paris Climate Change Agreement consist of (a) reduction of emission intensity of its GDP by 33–35% during 2005–2030, (b) increase in share of non-fossil-based energy resources to 40% of installed electric generation capacity, and (c) creation of an additional cumulative carbon sink of 2.5–3 Gt-CO2e through additional forest and tree cover by 2030 (INDC 2015). National sustainable development targets through implementation of policies which include electricity for all by 2019, 25 million LPG connections by 2019, universal public health and universal primary education, and housing for all by 2022 need considerable increase in energy demand, while carbon mitigation targets demand significant emission reductions by 2030. Studies emphasize on GHG mitigation using carbon budget targets as the main goals to be achieved; however, the underlying assets (i.e. energy systems, LULUCF) to reduce GHG emissions differ in every country depending on the major sectors that contribute as sources and sinks of emissions. In India, energy sector (which includes electricity generation, transport, building, agriculture) contributes over 73% of its GHG emissions each year (MOEFCC, 2018). Energy systems transformations therefore would form the bedrock of any GHG mitigation regime for India. Policies and measures to implement these transformations will be multi-fold which could be brought about through innovation (at technology, finance, and policy levels), technology transfer, and adoption accompanied with suitable financial infrastructures.

Energy systems comprise of energy supply (power, refineries) and energy demand (industry, transport, buildings, agriculture, and services) sectors. India consumed 23 exajoules (EJ) of final energy in 2016 with below average primary energy and electricity consumption per capita at 0.65 mtoe/capita and 860 kWh/capita in 2016 (WEO 2018). In power sector, there is an observed slowdown in coal demand due to cancellation of ultra-mega power projects (UMPP). As of May 2019, 220 GW of coal-based plants is in operation, 58 GW is in pipeline, and 36 GW is undergoing construction, while 88 GW of plants has been shelved, and about 491 GW of power plants has been cancelled (Shearer et al. 2019, CEA 2019). Additionally, an increase in coal imports by about 9% has been observed in the first 7 months of 2018 compared with the same period in 2017. With government push for zero imports of non-coking coal, a constant decline has been observed in private import-based coal power plants; however, state generators have increased imports to meet their current shortage (Singh 2018; PTI 2018a, b). Since coal movements account for over a third of total annual revenues of Indian Railways, such transitions have strong implications for coal-associated sectors.

Decoupling economic growth and urbanization from final fossil fuel–based primary energy demand is being achieved through a combination of numerous supply and demand side strategies such as fuel transitions, cleaner technology, modal shifts, and behavioural changes, for example, replacement of inefficient biomass cook stoves with LPG cook stoves in cooking services and conventional lighting with LED lamps for lighting services (technology transitions), coal by natural gas solar and electricity in power and major end use sectors (fuel substitution), and change from non-vegetarian to vegetarian diet (behavioural modification). Similarly, in transport sector, introduction of electric vehicles (technology substitution), metro (modal shift), and telecommuting (behavioural modification) may be observed to reduce overall energy demand (Shukla et al. 2015). Simultaneously, the recent draft electricity plan and energy infrastructure development plans present the need for solar parks, gas pipelines, modernized power transmission and distribution lines, LNG import and regasification terminals, and smart grid development to fulfil the goals of energy access as well as energy and climate security. Concurrently, energy market integration, e-auction of coal mines and other natural resources, time of day pricing, tariff rationalization, and other institutional reforms in energy sectors need to be implemented in parallel (NEP 2017). The costs in power sector and various energy-efficient (EE) technologies have undergone rapid changes since 2010, which are resulting in rapid penetration of renewables (WEO 2018; IRENA 2018). The milieu of transformation in energy sector is therefore much deeper, wider, and more complex taking into consideration the entire life cycle of the systems than dealing with it from a simple end-of-the-pipe perspective alone.

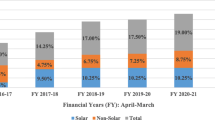

Energy policies since the early 2000s have been trying to enhance energy efficiency and conservation, which will remain the benchmark of energy transitions in India until 2030 (Vishwanathan et al. 2017; Garg et al. 2017a; INDC 2015; Dubash et al. 2015). In the past few years, swift deployment of renewables has occurred due to the revision of India’s cumulative renewable targets from 75 GW (Copenhagen Accord) under National Action Plan on Climate Change (NAPCC) in 2008 to175 GW (Paris Agreement) under NDC targets in 2015. With an additional capacity of 78 GWFootnote 1 of renewables added between 2006 and 2018, the tentative new renewable target of 227 GW, India’s advanced NDC commitments towards clean energy seem “ambitious” especially since coal remains the main energy resource, in addition to providing about 500 million people with cleaner cooking fuels and about 304 million with electricity by 2022 (Saluja and Singh 2018; IRENA 2018; NEP 2017). The decarbonization scenarios consequently require capturing these sustainable development goalsFootnote 2, along with the national objectives of energy security, accessibility, and affordability. This study attempts to cover these transformations for NDC, 2 °C (early and late actions), and well below 2 °C scenarios.

Transitioning towards low-carbon, cleaner energy systemsFootnote 3 from traditional systems will require additional investments. The financial needs for such transitions globally have been estimated at around 343–385 billion USD per year of which 90–120 billion USD need to be invested in developing countries annually (IPCC 2014). The mobilization of funds depends on attractiveness and benefits of investments when compared with competing opportunities since businesses are expected to chase higher risk-free returns on investments. Literature on investment and finance for deep decarbonization in India is scarce; therefore, we have also tried to address this gap to some extent in this study.

Major distinction of this paper from previous studies is the discussion on the impact of early and late actions on final energy demand and subsequent investments required in NDC and deep decarbonization scenarios. The remaining paper explains the methodology, results, and key insights on the implications of required energy systems transformation in India to move towards low-carbon economy.

2 Methodology

2.1 Model description and setup

Asia-Pacific Integrated Model (AIM)/End use, a bottom-up optimization model, captures the techno-economic perspective at the national level with sectoral granularity. The theoretical frame entails a technology selection accounting framework that uses recursive dynamics (Shukla 2013; Kainuma et al. 2003). We have developed the model for India with over 450 technologies in energy supply and demand sectors. The model has been set up for five major sectors (energy supplyFootnote 4, agriculture, industry, buildings, and transport) along with their respective services, technologies, and discount rates. Electricity demand is inter-looped in the model. So, the model estimates sector-wise end use demands and selects the set of power technologies based on economics, technical efficiency, and capacity constraints. The model has been calibrated from 2000 to 2015 and runs in annual time steps until 2050 (Vishwanathan et al. 2017).

2.2 Scenario architecture

The mitigation target for India in terms of cumulative carbon dioxide (CO2) emission budget roughly corresponds to around 8% of global carbon budget (with 50% and 66% likelihood) for deep decarbonization futuresFootnote 5. This is estimated to range from 40 to 140Footnote 6 gigatons CO2 (Gt-CO2) between 2011 and 2050 based on both global cost-optimization implementation and secondary literature (Kriegler et al. forthcoming; Vishwanathan et al. 2018a, b; Dhar et al. 2017; UNEP 2017; Shukla et al. 2015; Tavoni et al. 2014; IPCC 2014). The BAU scenario for India is estimated to be in the range of 165–300 Gt-CO2 (CDLINKS 2017).

Nine scenarios were submitted to CD-LINKS database as a part of project deliverables, differentiated along two dimensions of short-term policy and long-term carbon budgets (Table S1)Footnote 7 (CDLINKS 2017). We explored energy transformation trajectories for India under five scenarios synchronized with climate mitigation regimes—Business As Usual scenario (BAU), NDC scenario, 2 °C scenario (early action, high and low budget), 2 °C scenario (late action, high and low budget), and well below 2 °C scenarioFootnote 8. The BAU scenario assumes continuation of existing policies and energy system dynamics, while the NDC includes policies included in India’s INDC document submitted to the UNFCCC. The remaining three scenario variantsFootnote 9 consist of different policy choices made in order to meet a cumulative carbon budget between 110 and 136 Gt-CO2 for India during 2011–2050 for 2 °C, and well below 2 °C global target. Results for 2 °C scenario early action (high and low budget) are presented in the figures for consistency. We have provided the range for energy consumption (Table 1) and investments (Table S4) for all four 2 °C scenarios.

3 Results

Total primary energy demand (TPED) by fuel source in 2016 was 36 EJ where coal, oil, and gas comprise of 78% of the total share of Indian energy systems. TPED share of power sector in 2016 was 34%, followed by building (24%), industry (22%), and transport (10%), and the remaining 10% include others sector such as agriculture and non-energy use. Table 1 presents the change in share of fuel in primary energy demand in all sectors.

3.1 Energy supply (power sector)

The demand for electricity has been increasing considerably at a rate of 5–7% across all the sectors during the last two decades in India. The power generation mix had 78% coal, 2% oil, 4% each gas and hydro, 3% nuclear, and 7% bioenergy, and the remaining 2% comes from other renewables in 2016. The shift in generation mix in total primary energy supply (TPES) under different scenarios is presented in Table 1. Figure 1 shows the electricity generation by fuel in power sector under all scenarios as it is a direct indicator for CO2 emissions from a plant.

Investing in early action escalates energy demand from solar during 2020 and 2030, while late action the demand from coal and installation of CCS increases after 2030 to enforce faster carbon reduction as coal continues to remain the dominant energy resource. This impacts generation capacity (Figure S1), fuel mix, final carbon emission trajectories (Figure S3) between 2020 and 2030, and total investments. Increase in energy efficiency through retrofitting of EE coal technologies across sectors, super critical coal combustion technology for all new power plants, and phasing out of relatively inefficient plants older than 30 years under NDC scenario and even those older than 20 years in deep CO2 mitigation scenarios lead to decrease in overall demand. The overall energy demand decreases by 78 EJ during 2011–2050 under NDC scenario. The decrease is less in deep decarbonization scenarios (38–71 EJ) which is due to a combination of EE technologies and policies and switch to cleaner fuels; however, addition of CCS increases the overall energy demand in power sector.

On the renewable energy front, considering that 1 MW of solar photovoltaic (PV) may require around 1–1.5 hectare (ha) of land, 60 GW of solar powerFootnote 10 would require about 600–900 km2 of land areaFootnote 11 at an all-IndiaFootnote 12. However, site location for solar PV plants may require land acquisition in quasi-habituated areas for shorter grid evacuation infrastructure, which may pose a challenge. Further installing 40 GW of solar rooftop is a challenge, mainly due to diminishing financial returnsFootnote 13 as solar prices are falling rapidly, reducing high-end customer base, and increased supplier competition. Solar PV have to be therefore integrated with other value-added services and initiatives such as smart micro-grids, battery storage, and charging of EV. The model estimates solar generation capacity of 100 GW by 2030 under NDC scenario and 155–185 GW by 2050 under deep CO2 mitigation scenarios. These results do not differentiate between grid connected and rooftop solar power. The present differentiation would in fact not exist as smart grids come in and rooftop solar could be fed onto the grid and traded.

Studies have shown that renewable power technologies (solar, wind) offer cheaper abatement than fossil fuel CCS (Vishwanathan et al. 2018a; IRENA 2018; WEO 2017). Reduction in current storage prices and installation of load-responsive smart grids and deeper efficiency technologies along with flexible coal power plants with higher thermal efficiency as peaker plants are required to integrate high ambitious renewable targets in the current national electricity plan (Annaluru et al. 2017). Other studies however project much higher potentials for non-fossil-based power technologies than assumed here (WEO 2017).

Figure 2 presents the electricity consumption and its rate of growth between 2010 and 2050 in major end use sectors of the economy. The share of electricity was 15% in the final energy consumption (FEC) mix in 2015 and is projected to grow to a range 17–24% in 2050 in NDC and deep decarbonization scenarios. This is due to increase in electrification of buildings (e.g. housing for all, income effect, and climate change effect leading to rise in space cooling) and transport (e.g. metro rail and electric vehicles). Agriculture shows a decrease due to a combination of shifting towards solar pumps and increase in adoption of micro-irrigation technologies across deep decarbonization scenarios.

3.2 Energy end use demand sectors

Figure 3 presents the FEC by sectors and fuel type in major energy end use demand sectors (industry, building, and transport). The decrease in energy demand during 2011–2050 by implementing appropriate policies has been estimated to be 45 EJ (18 Gt-CO2 reductions). Energy efficiency enhancements followed by renewables across supply and demand sectors are the main contributors for this reduction. The decrease in cumulative energy demand for deep decarbonization scenarios over BAU is between 75 and 92 EJ (29–45 Gt-CO2 reductions)Footnote 14.

3.2.1 Industry

Industry is the second largest energy consumer in Indian economy. Perform, achieve, and trade (PAT)Footnote 15 scheme has reduced overall energy consumption by targeting large point sources (LPS) that have been identified as energy-intensive designated consumers by reducing their specific energy intensities. There is 6% reduction in cumulative energy consumption from 2011 to 2050 between BAU and NDC scenarios, which amounts to decrease of 43 EJ over 40 years. The decrease in energy consumption from BAU to deep decarbonization scenarios ranges from 43 to 55 EJ. This is based on the assumption that PAT becomes more stringent in current sub-sector (deeper) and will be introduced in more than 11 sub-sectors (wider) in the next few decades by shifting towards best available technologies (BAT). For example, cement industry in India has been a pro-active industry and has incorporated best technologies to become one of the most energy-efficient industries in the world. The increase in energy demand in well below 2 °C scenario is also contributed majorly by addition of CCS technologies in energy industries (such as cement, iron and steel, fertilizers). Since Indian economy is projected to remain in a positive growth trajectory until 2050 with substantial contributions by the industry, absolute industrial energy consumption increases even though the industiral sub-sectors become more energy efficient. The CO2 emission mitigation under deep decarbonization scenarios is contributed by enhanced energy efficiency, fuel switching, demand deceleration, and mainly CCS.

3.2.2 Buildings

There is 12% increase in cumulative FEC in NDC scenario over BAU between 2011 and 2050 (about 37 EJ). The increase in cumulative FEC in deep decarbonization mitigation scenarios ranges from 26 to 44 EJ (2011–2050) over BAU. This is due to rapid urbanization and increased levels of income that will create demands for an improved quality of life. Rising penetration of cleaner fuels and electrical appliances has resulted in increasing energy demand in building sector. With 60% urban population in 2050, household energy demand is set to rise in future. Standards and labelling programmes are in place for energy-intensive appliances, 10 appliances in India currently—8 being in building sector such as air conditioners, washing machines, refrigerators, LEDs, and fans (BEE 2018). The energy intensity of these appliances is projected to gradually reduce in future with today’s 5-star appliances (most energy efficient) becoming the new 4-star in 4–5 years, and more efficient appliance becoming the new 5-star appliances. Intensive carbon regimes change the appliance-mix in the modelling output so as to meet the required end use demand at the lowest possible net present cumulative energy and appliance costs. This study does not take into consideration the ‘cooling action plan’ long-term vision to address the cooling requirement across sectors released by the government in 2018. This will result in drastic increase in electricity demand especially in building sector.

3.2.3 Transport

The transport sector’s energy share is expected to increase to about 10–12% in 2030 and 13–15% in 2050 in NDC and deep decarbonization scenarios. The decrease in cumulative FEC in NDC scenario over BAU is 17 EJ. The decrease in cumulative FEC in deep decarbonization scenarios ranges from 36 to 76 EJ (2011–2050) over BAU. Road has been the most preferred transport choice carrying almost 2/3rd of passenger and freight traffic each. On the one hand, Euro-VI equivalent standards will kick in by 2020, electric cars being policy driven will become norm by 2030, and metro rails are being built in 15 large Indian cities, while on the other hand, a myriad of vintage technologies co-exist on Indian roads that remain deeply congested. It is therefore a challenge to model the Indian transport sector.

The increase in energy demand from this sector presents a challenge to energy security, since more than 95% of demand is met by oil, almost 75% of which is imported. India’s crude oil import bill is expected to increase by almost 25% in 2018–2019 to touch US$87.8 billion (PTI 2018b). Changes in crude oil prices as well as fluctuations in currency exchange rate severely impact the import bill. For example, change in crude oil prices by $1 per barrel puts additional US$130 million per year burden on Indian economy. Another looming concern in this sector is local air quality, especially in urban areas. About 30–50% of urban local air pollution is attributed to road vehicles, which have been proved to adversely impact human health (Garg et al. 2017b; Garg et al. 2018).

Overall under well below 2 °C scenario, building sector and transport (Fig. 2) indicate a net savings in energy in lieu of urban transformations assuming society cultivates liveable communities that encourage transit-oriented development to catalyse smart growth of cities (Dhar et al. 2017; Litman 2010). The scenario incorporates decrease in transport demand, and increase in work from home. The total building energy demand is managed with construction of EE buildings and use of smart EE technologies such as smart meters. While it is projected to reduce transport sector emissions, the buildings, especially in residential sector, will be used more intensifying the load of air conditioning; therefore, this societal transformation is projected to increase building sector energy and subsequent emissions under well below 2 °C scenario.

3.3 Investments

3.3.1 Transitions in power sector

Power sector transformation attracts the maximum investments across various sectors. The average annual investment in energy supply in India since 2010 has been US$77 billion, while over a 15-year period it has been around US$48 billion (IEA 2015; IMF 2015). During 2006 and 2016, about 194 GW power generation capacities has been installed, 47% of which is thermal based. About US$90 billion has been invested in coal-based power plants between 2006 and 2014, with the government share being about 50% or more. These mainly cover construction of power plant, fuel, and transmission infrastructure.

The power sector investment trends are projected to increase under all the scenarios during 2015–2030 (Fig. 4). Under NDC scenario, a cumulative investment of US$2.37 trillion is required averaging around US$120 billion per year. Around 24% each would go to coal and solar power, 12% to gas, and around 8% each to modern bioenergy and nuclear. For deep decarbonization scenarios, investments in solar (including with storage) and CCS technologies increase. Wind investment also increases mainly driven by reengineering and off-shore wind farms. Early action supports higher share of solar and lower share of CCS. However, for a late transition to a 2 °C pathway, more CCS will have to come in due to (a) less time frame for CO2 emission reduction and (b) presence of coal and gas in the primary energy mix. The average annual investments under 2 °C early action scenario during 2015–2030 are projected to be US$270 billion per year, while for 2 °C late action and well below 2 °C scenarios during the same period, these are around US$160 billion per year. This is because early action is driven by high solar and wind investments with storage and CCS, while late action has higher share of CCS.

3.3.2 Transitions in other sectors

Increase in electrification of road vehicles and railways results in both private and public expenditures. Fuel switch is observed strongly after 2030 to electricity, with gas as the transition fuel mainly during 2020–2030. These trends are discernible with the Government of India announcing to invest US$108 billion for construction of new roads and highways over the next 5 years (IBEF 2018), all cars to be electric beyond 2030, metro railways being constructed in 15 large Indian cities at an around US$150 million/km underground and around US$30 million/km elevated, building another 100 airports at US$60 billion in next 15–20 years (GCR 2018), new ports and 142 cargo terminals at major ports at around US$100 billion to harness India’s 7157-km coastline (Sood 2018), and first high-speed train corridor on the anvil at US$20 billion. The transport sector investments are projected to be around US$1 trillion during 2015–2030, with different phasing based on scenarios. A late entry of metro in the 2 °C_late action and well below 2 °C scenarios will correspond to high upfront capital costs, when compared with 2 °C_early action scenario. The rate of penetration of EVs in India will depend on how fast the supporting infrastructure will be developed in major tier I and IIFootnote 16 cities.

Similarly, in industry sector, energy efficiency enhancements through deepening and widening of PAT in medium- and small-scale enterprises of each major energy-intensive industry will require upfront capital investments. Fuels switching to gas from coal, automation and electrification of industry, modernization of old plants, and CCS in steel and cement plant clusters are some of the measures. The model estimates project around US$1.45 trillion cumulative investments in industry over 2015–2030. India still has to build around 1000 million m2 commercial space and around a million houses under Housing for All by 2022 targets. For around 30 kWh savings/m2/year at US$15 of investment over 10 years (Garg et al. 2017c), the total energy sector transition investment for commercial space alone is around US$30 billion over 2015–2030. The building sector investments will be high investment during 2020 and 2030 due to new building construction; however, the benefits through reduction in FEC and decrease in CO2 emissions will be observed until 2050. The agriculture sector investment is projected to be around US$320 billion over 2015–2030, mainly for water use efficiency, mechanization, electrification, and use of solar power.

4 Discussions and conclusions

Indian energy system is witnessing systems transformation through cleaning up coal use, 175 GW renewable energy targets, and enhanced energy efficiency actions. Our results indicate stranding of coal plants with cumulative generation capacity of 30 GW during 2015–2030 and another 59 GW by during 2030–2050 under NDC scenario (Fig. 5). Since the environmental clearances, coal linkages and power evacuation grids are locale specific; these retirements may catalyse building up of newer but more efficient coal plants at the same locations. The model results do show constructing super critical power plant capacities to the tune of 82 GW by 2030 and another 42 more GW by 2050. CCS technologies form an integral part of the solution space for transiting to a deeper CO2 mitigation scenario. Its potential has been estimated as 780 Mt/year below 60 USD/t-CO2 in 2 °C scenarios and further 250 Mt/year up to 75 USD/t-CO2 in well below 2 °C scenario by us (Vishwanathan et al. 2018a; Garg et al. 2017d). However, they have not yet deployed at any commercial level in India and would need specific policy support for R&D deployment. Moreover, labour transitions in coal and power sectors will need to be handled through compensations for job losses, re-training, and natural wastages. These measures will require deeper policy analyses at socio-economic and political levels. On the other spectrum, ambitious solar push will require improved grid infrastructure which includes deeper efficiency enhancement, load-responsive smart grids, and availability of battery storage.

Nuclear power additions of 27–32 GW under deep CO2 mitigation scenarios are projected from current capacity of 6.8 GW. Although being a necessity for lower carbon growth and energy reliance needs, India may have challenges on fuel supply since it is not a member of nuclear suppliers group (NSG) and site selection due to delayed land acquisition processes. New nuclear power capacity of 6.7 GW is under construction presently and another 9 GW has been approved for construction by the Indian Government. Some experts project 63 GW of cumulative nuclear power possibility in India (Grover 2017)Footnote 17; however, the government has informed that they will be able to achieve only 22.5 GWe by 2031 (GOI 2018).

Energy efficiency enhancements are happening in India through PAT scheme for 11 energy-intensive sectors covering around 45% of energy consumption. The scheme provided 3-year running targets for around 778 plants across 11 sectors (BEE, 2017; Garg et al. 2017a) for a cumulative energy savings of 3.5% over 2016–2019 for the PAT cycle II. Each plant could therefore take a decision to build energy efficiency or buy the required energy savings from other plants. Our results indicate average annual energy efficiency enhancement across the sectors to be around 1.1% per year until 2030, which increases to up to 2% per year for steeper targets that happen under deep CO2 mitigation regimes. The scheme as of July 2018 will also include petrochemical industry as well as commercial enterprises (hotels).

The government’s domestic policy of housing for all by 2022, 100 Smart cities, 500 AMRUT cities, and income effects in Indian urban centres is under implementation. So, building sector is projected to witness an overall increase in energy consumption mainly due to construction of almost 65% new floor space until 2030. The overall air-conditioned space will also increase over time. It is also noted that standards and labelling programmes are running strongly in India covering appliances such as air conditioners, washing machines, motors, lighting, and super-efficient fans (Vishwanathan et al. 2018b; Garg et al. 2017a). Increasing penetration of energy-efficient appliances moderates the energy consumption in buildings to a certain extent. Building and transport infrastructure planning of current and upcoming cities need to foster deep decarbonization on both supply side (through smart grids, infrastructure to support EVs) and demand side (through hybrid vehicles, EVs, energy-efficient, zero-energy buildings, and building technologies).

Preparing Indian energy systems for a deep decarbonization future without compromising the national sustainable development goals will therefore require major transformations until 2030. The paper presented results for energy use and investments under NDC that encourage implementation of current measures such as phasing out old, inefficient coal power plants, installing super critical technologies, shift towards cleaner fuels, renewables forms of energy, and increase in electrification of demand side sectors (industry, building, transport, agriculture) in addition to energy conservation efforts through energy efficiency mission. Deep decarbonization scenarios will not only need ratcheting up of these measures but also require installation and scaling up of CCS, more so if measures are taken after 2030. These transformations will need investments of US$6–8 trillion between 2015 and 2030 (Table S4), 39–52% of which will be shared by power sector followed by industry (19–25%), transport (13–17%), and building sector (11–14%). This is about two to three times more than the estimate provided by McCollum et al. (2018), since it takes into account almost all sectors in both supply and demand sides with more technological and sectoral granularity. Another major difference may be that share of CCS technologies and the cost of storage technologies are higher in our scenarios. The study also ascertains that major portion of the investment need to be made during 2020–2030 especially in power, industry, and transport sectors followed by building sector. Further analysis is needed not only on the capital investments required for various actions but also on the mobilization of funds and on sculpting financial instruments for enabling technologies/measures throughout the country.

Notes

Solar (27 GW), wind (29 GW), other renewables (22 GW).

These goals are an extension to the millennium development goals (2000–2015). The paper focusses on SDG 7 which ensures access to affordable, reliable, sustainable, and modern energy for all, and SDG 13 which aims to take urgent action to combat climate change and its impacts.

These include clean coal (as defined in NDC document), renewable energy, electric vehicles, battery storage, smart grids, and energy efficiency enhancements.

Energy supply represents power sector in this study.

Deep decarbonization futures in this paper refer to 2 °C (early and late actions) and well below 2 °C scenarios. These scenario names are used to present a set of India’s deep decarbonization pathways that are presented in CDLINKS database.

The carbon budget for future emission is based on a discourse between national and global modelling teams (part of CDLINKS) taking into account regionalized budget estimates from global cost-effective well below 2 °C pathways. CDLINKS project from its set of IAMs provides a carbon budget range of 90–126 Gt-CO2 for India. Additionally, the range also takes into account the carbon budgets for India discussed in literature (Vishwanathan et al. 2018a, b for higher limit; Dhar et al. 2017 for lower limit).

Supplementary information.

Deep decarbonization mitigation scenarios in this study refer to 2 °C_early action, 2 °C_late action, and well below 2 °C scenarios.

Out of 100 GW target by 2022, around 60 GW is projected to be grid-connected solar farms and 40 GW as rooftop solar plants.

1 km2 = 100 hectares.

Technically speaking, this is not much considering that almost 90% of each of the Indian districts in high solar irradiance areas is larger than this.

The current projects are not sustainable from business perspective (low ROI for developers).

Figure S3 in Supplementary information.

PAT is a market mechanism, administered by BEE covering 478 facilities from seven energy-intensive sectors, namely aluminium, cement, chlor-alkali, fertilizer, iron and steel, pulp and paper, and textiles. PAT cycles run every three years.

Classification of Indian cities based on population.

This appears to be an optimistic projection and is not included in the current model.

References

Annaluru R, Garg A (2017) Managing the power grid ramping challenges critical to success of India’s renewable energy targets. Indian Institute of Management Ahmedabad. http://vslir.iima.ac.in:8080/xmlui/bitstream/handle/11718/20216/WP_2017_08_01.pdf?sequence=1&isAl lowed=y

BEE (2017) PAT Cycle I Notification for Sector Table the Energy Conservation and Energy Consumption Norms and Standards for Designated Consumers. The Gazette of India, Government of India, New Delhi (2012). https://beenet.gov.in/GuideLine/PAT_Rules_English.pdf. Accessed in March 2017

BEE (2018) National Mission on Energy Efficiency–Gazette Notifications for Standards and Labelling on Mandatory and Voluntary appliances. https://beeindia.gov.in/content/notifications. Accessed in September 2018

Bowen A, Cherp A, Calvin K, Marangoni G, McCollum D, van der Zwaan B, Kober T, and Rosler H (2014) Limiting Global Warming to 2 degree C–Policy findings from Durban Platform scenarioanalyses. Low climate Impact Scenarios and the implications of required tight emission control strategies Project. http://services.feem.it/userfiles/attach/20141215160104PB2_9_c.pdf

CDLINKS (2017) Linking Climate and Development Policies-Leveraging International Networks and Knowledge Sharing Database (CDLINKS Database)

CEA (2019) Monthly Report on Brad Status of Thermal Power Projects in the Country. Accessed in August 2019

Dhar S, Pathak M, Shukla PR (2017) Transformation of India’s transport sector under global warming of 2°C and 1.5°C scenario. JClean Prod 172:417–427. https://doi.org/10.1016/j.jclepro.2017.10.076

Dubash N, Khosla R, Rao ND, Sharma RK (2015) Informing India’s Energy and climate debate: Policy lessons from modelling studies. Centre for Policy Research, Climate Initiative, Research Report. Centre for Policy Research, New Delhi. http://pure.iiasa.ac.at/id/eprint/11644/1/Informing%20India%27s%20Energy%20and%20Climate%20Debate_CPR-IIASA.pdf

Garg A, Bharatan K (2017) Air Pollution in Delhi: Climate Change, Local Air Pollution and Human Health. Norwegian Institute of Public Health (NIPH), Centre for International Climate Research (CICERO) and Indian Institute of Management- Ahmedabad (IIMA) video case study

Garg A, Kankal B, Mohan P, Dhar S (2017a) Good Practice and Success Stories on Energy Efficiency in India. Copenhagen Centre on Energy Efficiency: Copenhagen, UNEP DTU Partnership. https://unepdtu.org/publications/good-practice-and-success-stories-on-energy-efficiency-inindia/

Garg A, Maheshwari J, Shukla PR, Rawal R (2017c) Energy appliance transformation in commercial buildings in India under alternate policy scenarios. Energy 140(1):952–965. https://doi.org/10.1016/j.energy.2017.09.004

Garg A, Shukla PR, Parihar S, Singh U, Kankal B (2017d) Cost-effective architecture of carbon capture and storage (CCS) grid in India. Int Greenhouse Gas Emissions 66:129–146. https://doi.org/10.1016/j.ijggc.2017.09.012

Garg A, Avashia V, Parihar S (2018) Land use change trends of Indian cities: a bird’s eye view–Vulnerabilities of unplanned urban growth. Sage Publications, New Delhi

GCR (2018) India plans to build 100 new airports to deal with surge in demand, Global Construction Review, April 20, 2018. Accessed in September 2018. http://www.globalconstructionreview.com/markets/indiaplans-build-100-new-airports-deal-surge-dema/

GOI (2018) Issues Concerning Installation of new NPPs, Government of India, Department of Atomic Energy, Lok Sabha unstarred question no. 4226 answered on 21.03.2018

Grover RB (2017) Opening up international civil nuclear cooperation with India and related developments. Prog Nucl Energy 101:106–167

IBEF (2018) Road Infrastructure in India–Introduction. India Brand Equity Foundation, Industry, Roads. Accessed in September 2018. https://www.ibef.org/industry/roads-india.aspx

IEA (2015) India Energy Outlook, World Energy Outlook Special Report International Energy Agency, Paris, France

IMF (2015) India 2015 Article IV Consultation–Staff Report; Press report and Statement by the Director for India. International Monetary Fund, Washington, DC

INDC (2015) India’s Intended Nationally Determined Contribution: Working towards climate justice. UNFCCCsubmission. http://www4.unfccc.int/submissions/INDC/Published%20Documents/India/1/INDIA%20INDC%20TO%20UNFCCC.pdf

IPCC (2014) Summary for Policymakers. In: Edenhofer O et al (eds) Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University press, Cambridge and New York

IRENA (2018) Renewable capacity statistics 2018. International Renewable Energy Agency (IRENA), Abu Dhabi

Kainuma M, Matsuka Y, Morita T (2003) Climate policy assessment. Springer, Tokyo

Kriegler E, Ueckerdt F, Luderer G, Schaeffer R, Chen W, Gi K, Iyer G, Jiang K, Krey V, Mathur R, Oshiro K, Roelfsema M, Safonov G, van Soest H, Vishwanathan SS, Vrontisi Z, Després J, Drouet L, Harmsen M, Köberle A, van Vuuren D, Bertram C, Bosetti V, Capros P, Edmonds J, Emmerling J, Evangelopoulou S, Frank S, Fricko O, Fujimori S, Garg A, He C, Huppmann D, Kitous A, Li N, Potashnikov V, Shekhar S, Stevanovic M, Wang H, Baumstark L, Rochedo P, den Elzen M., Höhne N, Iacobuta G, Riahi K. (n.d.) (Forthcoming) Making ends meet: Collective national mid-century strategies staying well below 2 °C. Nature Climate Change (under review)

Litman T (2010) Affordable-Accessible Housing in a Dynamic City: Why and How to Support Development of More Affordable Housing In Accessible Locations, Victoria Transport Policy Institute (www.vtpi.org)

McCollum D, Zhou W, Bertram C, de Boer H, Bosetti V, Busch S, Després J, Drouet L, Emmerling J, Fay M, Fricko O, Fujimori S, Gidden M, Harmsen M, Huppmann D, Iyer G, Krey V, Kriegler E, Nicolas C, Pachauri S, Parkinson S, Poblete-Cazenave M, Rafaj P, Rao N, Rozenberg J, Schmitz A, Schoepp W, van Vuuren D, Riahi K (2018) Energy investments needs for fulfilling he Paris Agreement and achieving the Sustainable Development Goals. Nat Energy 3:589–599. https://doi.org/10.1038/s41560-30-0179-z

MoEFCC (2018) India Second Biennial Update Report to the United Nations Framework Convention on Climate Change. Ministry of Environment, Forest and Climate Change, Government of India. https://unfccc.int/sites/default/files/resource/INDIA%20SECOND%20BUR%20High%20Res.pdf

NEP (2017) Draft National Energy Policy. Niti Aayog, Government of India. http://niti.gov.in/writereaddata/files/new_initiatives/NEP-ID_27.06.2017.pdf. Accessed in September 2017

PTI (2018a) India’s coal import rises 12% to 79 million tonnes in April-July. The Economic Times, September 02, 2018. https://economictimes.indiatimes.com/news/economy/foreign-trade/indias-coal-import-rises-12-to-39-million-tonnes-in-april-july/articleshow/65642286.cms. Accessed in September 2018

PTI (2018b) India’s oil import bill to jump by 25% in FY18. The Economic Times, March 26, 2018. https://economictimes.indiatimes.com/industry/energy/oil-gas/indias-oil-import-bill-tojump-by-25-in-fy18/articleshow/63464408.cms. Accessed in August 2018

Saluja N, Singh S (2018) Renewable energy target now 227 GW, will need $50 billion more in investments, The Economic Times, June 05, 2018 https://economictimes.indiatimes.com/industry/energy/power/india-will-add-225-gw-renewableenergy-project-capacity-by-2022-r-k-singh/articleshow/64461995.cms. Accessed in September 2018

Shearer C, Shah-Matthew N, Myllyvirta L, Yu A, Nace T (2019) ‘Boom and Bust 2019 - Tracking the Global Coal Plant Pipeline.’Coalswarm, Greenpeace USA and Sierra Club. https://endcoal.org/wpcontent/uploads/2019/03/BoomAndBust_2019_r6.pdf

Shukla PR (2013) Review of linked modelling of low carbon development, mitigation and its full costs and benefits. MAPS Research Paper, Indian Institute of Management Ahmedabad, India; Tianjin University of Finance and Economics, China

Shukla PR, Dhar S, Pathank M, Mahadevia D, Garg A (2015) Pathways to deep decarbonization in India, SDSN – IDDRI. http://deepdecarbonization.org/wp-content/uploads/2015/09/DDPP_IND.pdf

Singh RK (2018) Decline in Indian power plants imports signals distress, Bloomberg Markets, July 9, 2018. https://www.bloomberg.com/news/articles/2018-07-09/decline-inindian-power-plant-coal-imports-shows-hidden-distress. Accessed in September 2018

Sood J (2018) Modi govt signs off on radical makeover for ports sector, Livemint, January 04, 2018. https://www.livemint.com/Home-Page/yOlyrKfVKe71Ts8Xdm6jGJ/Modigovt-signs-off-on-radical-makeover-for-ports-sector.html. Accessed in September 2018

Tavoni M, Kriegler E, Riahi K, van Vuuren D, Petermann N, Jewell J, Martinez SH, Rao S, van Sluisveld M, UNEP (2017) The Emission Gap Report 2017. United Nations Environment Programme (UNEP), Nairobi

Vishwanathan SS, Garg A, Tiwari V, Kankal B, Kapshe M, Nag T(2017) Enhancing energy efficiency in India: assessment of sectoral potentials. Copenhagen Centre on Energy Efficiency, UNEP DTU Partnership, Copenhagen. https://www.researchgate.net/publication/331589446_Enhancing_Energy_Efficiency_in_India_Assessment_of_Sectoral_Potentials

Vishwanathan SS, Garg A, Tiwari V, Shukla PR (2018a) India in 2 deg C and well below 2 deg C worlds: opportunities and challenges. Carbon Manag. https://doi.org/10.1080/17583004.2018.1476588

Vishwanathan SS, Fragkos P, Fragkiadakis K, Paroussos L, Garg A (2018b) Energy system transitions and macro-economic assessment of the Indian building sector transformation to meet INDC targets. Building Research and Information 47(1):38–55. https://doi.org/10.1080/09613218.2018.1516059

WEO (2018) World energy outlook. International Energy Agency, Paris

Acknowledgements

We would also like to acknowledge Dr. Vineet Tiwari and Dr. Manmohan Kapshe during the initial development of reference and NDC scenarios. We are grateful to Dr. Volker Krey for the guidance provided during the development of 2 °C stabilization scenarios for CDLINKS project. We would like to acknowledge National Institute for Environmental Studies for supporting AIM/Enduse model. Finally, we sincerely thank the reviewers for their comments and suggestions that has helped us significantly improve the paper.

Funding

This study was partly funded by European Union’s Horizon 2020 research and innovation programme under grant agreement 821471 (ENGAGE), grant agreement no. 642147 (CD-LINKS), UNEP-DTU Partnership under UNEP-DTU High Impact Opportunities (HIO) project and Indian Institute of Management-Ahmedabad.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Saritha S. Vishwanathan started working at NIES since November 1, 2019.

This article is part of a Special Issue on 'National Low-Carbon Development Pathways' edited by Roberto Schaeffer, Valentina Bosetti, Elmar Kriegler, Keywan Riahi, Detlef van Vuuren, and John Weyant.

Electronic supplementary material

ESM1

(PDF 866 kb)

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Vishwanathan, S.S., Garg, A. Energy system transformation to meet NDC, 2 °C, and well below 2 °C targets for India. Climatic Change 162, 1877–1891 (2020). https://doi.org/10.1007/s10584-019-02616-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-019-02616-1