Abstract

This paper examines the standard symmetric two-period R&D duopoly model, but with a deterministic one-way spillover structure. Though the two firms are ex-ante identical, one obtains a unique pair of asymmetric equilibria of R&D investments, leading to inter-firm heterogeneity in the industry, in R&D roles as well as in unit costs. We analyze the impact of a change in the spillover parameter and R&D costs on firms’ levels of R&D and profits. We find that higher spillovers need not lead to lower R&D investments for both firms. In addition, equilibrium profits may improve due to the presence of spillovers, and it may be advantageous to be the R&D imitator rather than the R&D innovator.

Similar content being viewed by others

Notes

The literature on R&D cooperation has more recently been extended to other areas of economics, including environmental innovation (McDonald and Poyago-Theotoky 2017), the organization of the firm (Chalioti 2015). Also, see Amir et al. (2017) for an analysis of R&D cooperation in markets characterized by the cost paradox.

That spillovers are an important aspect of firms’ overall business strategy is well-documented (see e.g., Billand et al. 2016 for an overview of the related literature).

This is a priori an important difference between the two models. Indeed, it is an immediate consequence of the basic results from the theory of supermodular games that the AW model always possesses a subgame-perfect equilbrium, simply due to the fact that the R&D game is of strategic substitutes. The same does not extend to the present model, at least not with further assumptions. Therefore, generalizing the present results to a broader formulation might well be a very challenging task. This justifies restricting attention to the case of linear demand and costs, and quadratic R&D costs.

The phrase “symmetry-breaking” is borrowed from theoretical physics.

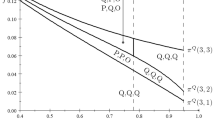

Figure 2 has been drawn with values \(\frac{a}{c}=2.2\).

As is well-known from general existence results in game theory, there exists of course a symmetric mixed-stragegy equilibrium since payoffs are jointly continuous in the actions and stategy spaces are compact intervals. Nevertheless, even under such a symmetric equilibrium, firms would end up getting different realizations of their unit costs.

Indeed, conditional on being a follower, a firm has a dominant strategy of doing no R&D, as reflected by a reaction curve identically equal to 0.

In other words, the cross-partial derivative of each payoff with respect to own R&D level and \(\beta \) is weakly negative.

This ensures that the graph of \(9\gamma =I(\beta )\), represented by the dashed line in Fig. 3 (which shifts upward as \(\frac{a}{c}\) rises), lies above \( \overline{\Gamma }\) (whose position does not depend on a or c). In other words, the area of the interior solution entirely lies in the complementarity of \(\overline{\Gamma }\).

This ensure that the graph of \(9\gamma =I(\beta )\) lies above \(\underline{ \Gamma }\).

References

Acemoglu, D., Robinson, J., Verdier, T.: Asymmetric growth and institutions in an interdependent world. J Polit Econ 125, 1245–1305 (2017)

Amir, R.: Modelling imperfectly appropriable R&D via spillovers. Int J Ind Organ 18, 1013–1032 (2000)

Amir, R., Wooders, J.: Effects of one-way spillovers on market shares, industry price, welfare, and R&D cooperation. J Econ Manag Strategy 8, 223–249 (1999)

Amir, R., Evstigneev, I., Wooders, J.: Noncooperative versus cooperative R&D with endogenous spillover rates. Games Econ Behav 42, 183–207 (2003)

Amir, R., Garcia, F., Knauff, M.: Symmetry-breaking in two-player games via strategic substitutes and diagonal nonconcavity: a synthesis. J Econ Theory 145, 1968–1986 (2010)

Amir, R., Halmenschlager, C., Knauff, M.: Does the cost paradox preclude technological progress under imperfect competition? J Public Econ Theory 19, 81–96 (2017)

Basu, K., Basu, K., Cordella, T.: Asymmetric punishment as an instrument of corruption control. J Public Econ Theory 18, 831–856 (2016)

Bernstein, J., Nadiri, I.: Interindustry R&D spillovers, rates of return, and production in high-tech industries. Am Econ Rev 78, 429–34 (1988)

Billand, P., Bravard, C., Chakrabarti, S., Sarangi, S.: Business intelligence and multimarket competition. J Public Econ Theory 18, 248–267 (2016)

Burr, C., Knauff, M., Stepanova, A.: On the Prisoner’s dilemma in R&D with input spillovers and incentives for R&D cooperation. Math Soc Sci 66, 254–261 (2013)

Chalioti, E.: Incentive contracts under product market competition and R&D spillovers. Econ Theor 58, 305–328 (2015)

Chatterjee, A.: Endogenous comparative advantage, gains from trade and symmetry-breaking. J Int Econ 109, 102–115 (2017)

Cosandier, C., De Feo, G., Knauff, M.: Equal treatment and socially optimal R&D in duopoly with one-way spillovers. J Public Econ Theory 19, 1099–1117 (2017)

d’Aspremont, C., Jacquemin, A.: Cooperative and noncooperative R&D in duopoly with spillovers. Am Econ Rev 78, 1133–1137 (1988)

d’Aspremont, C., Jacquemin, A.: Erratum. Am Econ Rev 80, 641–642 (1990)

Griliches, Z.: R&D and productivity: econometric results and productivity issues. In: Stoneman, P. (ed.) Handbook of the economics of innovation and technological change. Oxford: Basil Blackwell (1995)

Jin, J.Y., Kobayashi, S.: Impact of risk aversion and countervailing tax in oligopoly. Ann Finance 12, 393–408 (2016)

Jin, J.Y., Troege, M.: R&D competition and endogenous spillovers. Manch Sch 74, 40–51 (2006)

Kamien, M., Muller, E., Zang, I.: Research joint ventures and R&D cartels. Am Econ Rev 82, 1293–1306 (1992)

Katz, M.: An analysis of cooperative research and development. RAND J Econ 17, 527–543 (1986)

Martin, S.: Spillovers, appropriability and R&D. J Econ 75, 1–22 (2002)

Matsuyama, K.: Explaining diversity: symmetry-breaking in complementarity games. Am Econ Rev 92, 241–246 (2002)

McDonald, S., Poyago-Theotoky, J.: Green technology and optimal emissions taxation. J Public Econ Theory 19(2), 362–376 (2017)

Ruff, L.: Research and technological progress in a Cournot economy. J Econ Theory 1, 397–415 (1969)

Salant, S.W., Shaffer, G.: Optimal asymmetric strategies in research joint ventures. Int J Ind Organ 16, 195–208 (1998)

Salant, S.W., Shaffer, G.: Unequal treatment of identical agents in Cournot equilibrium. Am Econ Rev 89, 585–604 (1999)

Sheikh, S.: Threat of termination and firm innovation. Ann Finance 13, 75–95 (2017)

Soubeyran, A., Van Long, N.: Asymmetric contributions to research joint ventures. Jpn Econ Rev 50, 122–137 (1999)

Spence, M.: Cost reduction, competition, and industry performance. Econometrica 52, 101–121 (1984)

Stepanova, A., Tesoriere, A.: R&D with spillovers: monopoly versus noncooperative and cooperative duopoly. Manch Sch 79, 125–144 (2011)

Tesoriere, A.: Endogenous R&D symmetry in linear duopoly with one-way spillovers. J Econ Behav Organ 66, 213–225 (2008)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors are grateful to Rabah Amir for many helpful conversations on the topic of this paper. This research was partially financed by the “Cercle Gutenberg” via the “Chaire Gutenberg: on environmental R&D and imperfect competition” at the University of Strasbourg, France.

Appendix (Proofs)

Appendix (Proofs)

1.1 Proof of Lemma 1

The reaction function r as given by Eq. (2) is not continuous since, letting \(x^{S1}=r_{1}(x^{S1})\) for \(x_{1}\ge x_{2}\) and \( x^{S2}=r_{1}(x^{S2})\) for \(x_{1}\le x_{2}\), one obtains

with \(x^{S1}>x^{S2}\). Hence, the reaction function has a downward jump, and letting \(\widehat{x}\) be the solution to \(U(r_{1}(\widehat{x}), \widehat{x})=L(r_{1}(\widehat{x}),\widehat{x})\), we have that

It is easy to check that \(r_{1}(\widehat{x})\ne \widehat{x}\). Hence, there cannot exist any symmetric Nash equilibria in pure strategies.

Furthermore, \(\hat{x}\) is unique since both U and L are monotonic in \( x_{2}\). U is decreasing in \(x_{2}\) for all \(\beta \in [0,1]\), while L either increases with \(x_{2}\) for \(\beta >1/2\) or decreases with \(x_{2}\) slower than U.

1.2 Proof of Proposition 1

A lengthy but simple computation establishes that \(\bar{x},\underline{x}\) as given by Eqs. (3) and (4) satisfy \(\overline{x}>\widehat{x}\) if \(9\gamma >I_{1}\) and \(\underline{x}<\widehat{x}\) if \(9\gamma >I_{2}\), with \(\hat{x}\) as defined by Eq. (5) and

Straightforward computations then establish that \(I(\beta )>I_{1}\) and \( I(\beta )>I_{2}\). Hence, if assumptions (A1) through (A4) hold, the pair of PSNE \((\overline{x},\underline{x})\) and \(\left( \underline{x},\overline{x} \right) \), with \(\bar{x},\underline{x}\) as given by Eqs. (3) and (4), is unique.

1.3 Proof of Proposition 2

-

(i)

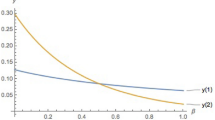

Differentiating \(\bar{x}\) with respect to \(\beta \) and collecting terms yields

$$\begin{aligned} \frac{d\bar{x}}{d\beta }=-\frac{6\left( a-c\right) \gamma L_{1}}{\left( 3\gamma \left[ 9\gamma -2\left( 5\beta ^{2}-12\beta +8\right) \right] +8\left( 2-\beta \right) \left( \beta -1\right) ^{2}\right) ^{2}} \end{aligned}$$where \(L_{1}=27\gamma ^{2}-6\gamma \left( 13\beta ^{2}-28\beta +14\right) +8\left( 5\beta ^{2}-12\beta +8\right) \left( \beta -1\right) ^{2}\). Thus, \( \frac{d\bar{x}}{d\beta }>0\) if and only if \(L_{1}<0\), which holds for \( (\beta ,9\gamma )\) such that \(\beta <0.04\) and \(9\gamma \in \bar{\Gamma } =\left( \gamma _{1}(\beta ),\gamma _{2}(\beta )\right) \), where

$$\begin{aligned} \gamma _{1}(\beta )=&13\beta ^{2}-28\beta -\sqrt{260\beta ^{2}-112\beta -200\beta ^{3}+49\beta ^{4}+4}+14 \\ \gamma _{2}(\beta )=&13\beta ^{2}-28\beta +\sqrt{260\beta ^{2}-112\beta -200\beta ^{3}+49\beta ^{4}+4}+14 \end{aligned}$$ -

(ii)

In a similar fashion, differentiating \(\underline{x}\) with respect to \(\beta \) and collecting terms yields

$$\begin{aligned} \frac{d\underline{x}}{d\beta }=-\frac{12\left( a-c\right) \gamma L_{2}}{ \left( 3\gamma \left[ 9\gamma -2\left( 5\beta ^{2}-12\beta +8\right) \right] +8\left( 2-\beta \right) \left( \beta -1\right) ^{2}\right) ^{2}}, \end{aligned}$$where \(L_{2}=27\gamma ^{2}-6\gamma \left( 4\beta ^{2}-14\beta +11\right) +4\left( \beta -1\right) ( 18\beta -15\beta ^{2}+5\beta ^{3}-10)\). Thus, \(\frac{d\underline{x}}{d\beta }>0\) if and only if \(L_{2}<0\), which holds if \((\beta ,9\gamma )\) is such that \(9\gamma \in \underline{\Gamma } =\left( \gamma _{3}(\beta ),\gamma _{4}(\beta )\right) \), where

$$\begin{aligned} \gamma _{3}(\beta )= & {} \left( 4\beta ^{2}-14\beta +11\right) -\sqrt{28\beta -112\beta ^{2}+128\beta ^{3}-44\beta ^{4}+1} \\ \gamma _{4}(\beta )= & {} \left( 4\beta ^{2}-14\beta +11\right) +\sqrt{28\beta -112\beta ^{2}+128\beta ^{3}-44\beta ^{4}+1} \end{aligned}$$ -

(iii)

The sum of autonomous cost reductions is given by

$$\begin{aligned} \frac{d}{d\beta }(\overline{x}+\underline{x})=\frac{6\gamma \left( a-c\right) L_{3}}{\left( 3\gamma \left[ 9\gamma -2\left( 5\beta ^{2}-12\beta +8\right) \right] +8\left( 2-\beta \right) \left( \beta -1\right) ^{2}\right) ^{2}} \end{aligned}$$where

$$\begin{aligned} L_{3}= & {} -81\gamma ^{2}+6\gamma \left( 21\beta ^{2}-56\beta +36\right) +16\left( 1-\beta \right) \left( 19\beta -16\beta ^{2}+5\beta ^{3}-9\right) \\&<0\text { for all }\beta \in \left[ 0,1\right] \end{aligned}$$It is easy to verify that the sum \((\overline{x}+\underline{x})\) is decreasing in \(\beta \).

-

(iv)

As to the fact that \((1+\beta )\overline{x}+(1-\beta )\underline{ x} \) is also decreasing in \(\beta \), a direct computation shows that\( \frac{d}{d\beta }((1+\beta )\overline{x}+(1-\beta )\underline{x})<0\) (the details are left out).

1.4 Proof of Proposition 3

-

(i)

From Eq. (1), the innovator’s equilibrium profit is given by

$$\begin{aligned} F(\overline{x},\underline{x})=\frac{\left( a-c+\overline{x}\left( 2-\beta \right) -\underline{x}\left( 1-\beta \right) \right) ^{2}}{9}-\frac{\gamma }{ 2}\overline{x}^{2} \end{aligned}$$Plugging \(\bar{x}\) and \(\underline{x}\) as given by Eqs. (3) and (4) and differentiating totally \(F(\overline{x},\underline{x})\) with respect to \( \beta \) yields

$$\begin{aligned} \frac{d}{d\beta }F(\overline{x},\underline{x})=-\frac{12\left( 3\gamma -4\left( 1-\beta \right) ^{2}\right) \gamma ^{2}\left( a-c\right) ^{2}L_{4}}{ \left( 3\gamma \left[ 9\gamma -2\left( 5\beta ^{2}-12\beta +8\right) \right] +8\left( 2-\beta \right) \left( \beta -1\right) ^{2}\right) ^{3}} \end{aligned}$$where \(L_{4}=27\gamma ^{2}\left( 3\beta -2\right) -6\gamma \left( 13\beta ^{3}-48\beta ^{2}+58\beta -22\right) +8( 5\beta ^{3}-16\beta ^{2}+20\beta -10) \left( 1-\beta \right) ^{2}.\) Under assumption (A4), the denominator is strictly positive and \(3\gamma >4\left( 1-\beta \right) ^{2}\) for any \(\beta \in [0,1]\). Therefore, we have that \(\frac{\text { d}}{\text {d}\beta }F(\overline{x},\underline{x})>0\) if and only if \(L_{4}<0\) , which holds for \(\beta <2/3\) and \(9\gamma \in \bar{\Gamma }^{\prime }=(\gamma _{5}(\beta ),\infty )\), where

$$\begin{aligned} \gamma _{5}(\beta )=\frac{22-58\beta +48\beta ^{2}-13\beta ^{3}+\sqrt{ 4+88\beta -572\beta ^{2}+1348\beta ^{3}-1540\beta ^{4}+864\beta ^{5}-191\beta ^{6}}}{\left( 2-3\beta \right) }. \end{aligned}$$ -

(ii)

Likewise, the imitator’s equilibrium profit is given by

$$\begin{aligned} F(\underline{x},\bar{x})=\frac{\left( a-c+2\underline{x}\left( 1-\beta \right) +\bar{x}\left( 2\beta -1\right) \right) ^{2}}{9}-\frac{\gamma }{2} \underline{x}^{2} \end{aligned}$$Differentiating totally \(F(\underline{x},\bar{x})\) with respect to \(\beta \) yields

$$\begin{aligned} \frac{d}{d\beta }F(\underline{x},\overline{x})=\frac{12\left( a-c\right) ^{2}\left( 3\gamma -2\left( 1-\beta \right) \left( 2-\beta \right) \right) \gamma ^{2}L_{5}}{\left( 3\gamma \left[ 9\gamma -2\left( 5\beta ^{2}-12\beta +8\right) \right] +8\left( 2-\beta \right) \left( \beta -1\right) ^{2}\right) ^{3}}, \end{aligned}$$where \(L_{5}=\)\(27\gamma ^{2}+6\gamma \left( -14+40\beta -45\beta ^{2}+16\beta ^{3}\right) -8( -8+24\beta -27\beta ^{2}+10\beta ^{3}) \left( 1-\beta \right) ^{2}\). Again, if (A4) holds, the denominator is strictly positive and \(3\gamma >2\left( 1-\beta \right) \left( 2-\beta \right) \) for any \(\beta \in [0,1]\). Hence, the imitator’s profit is strictly decreasing in \(\beta \) if and only if \(L_{5}<0\) , which holds for \(9\gamma \in \underline{\Gamma }^{\prime }=\left( \gamma _{6}(\beta ),\gamma _{7}(\beta )\right) \), where

$$\begin{aligned}&\gamma _{6}(\beta ) =45\beta ^{2}-40\beta -16\beta ^{3}\\&\quad +14-\sqrt{868\beta ^{2}-160\beta -1936\beta ^{3}+2177\beta ^{4}-1200\beta ^{5}+256\beta ^{6}+4}\\&\gamma _{7}(\beta ) =45\beta ^{2}-40\beta -16\beta ^{3}\\&\quad +14+\sqrt{868\beta ^{2}-160\beta -1936\beta ^{3}+2177\beta ^{4}-1200\beta ^{5}+256\beta ^{6}+4} \end{aligned}$$

1.5 Proof of Proposition 4

Under (A1)–(A4), computations show that the inequality \(F(\overline{x}, \underline{x})>F(\underline{x},\overline{x})\) in the light red area is defined by the inequalities \(9\gamma >I(\beta )\), \(0<\beta <2/3\), and \(9\gamma > \displaystyle \frac{6(1-x)^2(4-5x)}{2-3x}.\) Likewise, \(F(\overline{x}, \underline{x})<F(\underline{x},\overline{x})\) in the light blue area is defined by the inequalities \(9\gamma >I(\beta )\) and either (1) \(0<\beta <2/3\), and \(9\gamma <\displaystyle \frac{6(1-x)^2(4-5x)}{2-3x}\) or (2) \(\beta \ge 2/3 \).

1.6 Proof of Proposition 5

Consumer surplus at the noncooperative interior equilibrium reduces to

Differentiating \(CS(\bar{x},\underline{x})\) with respect to \(\beta \) yields

where

and

We have that \(K_{1}.K_{2}<0\) since \(K_{1}<0\) and \(K_{2}>0\) for all \(9\gamma >I(\beta )\). Since the denominator is strictly positive, it follows that \( \frac{d}{d\beta }CS(\bar{x},\underline{x})<0\).

Likewise, we have that

where

Observe that \(K_{2}.K_{3}>0\) since \(K_{2}>0\) and \(K_{3}>0\) for all \(9\gamma >I(\beta ).\) Hence, \(\frac{d}{d\gamma }CS(\bar{x},\underline{x})<0\).

Rights and permissions

About this article

Cite this article

Gama, A., Maret, I. & Masson, V. Endogenous heterogeneity in duopoly with deterministic one-way spillovers. Ann Finance 15, 103–123 (2019). https://doi.org/10.1007/s10436-018-0329-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-018-0329-0