Abstract

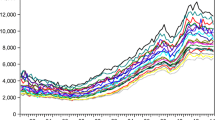

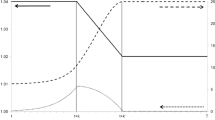

We examine the long-run convergence across 12 UK regional house prices using a pairwise approach. The time period spans from 1983:1 to 2012:4. Linear, nonlinear and asymmetric unit root tests are considered for assessing the stationarity of all possible pairs. The test statistic for convergence is based on the percentage of unit root test rejections across all regional house price differentials. The percent of the pairs that reject the null increase from 6% in the linear ADF case to 53% for the nonlinear unit root. Probit analysis reveals that house price differentials in the South are more likely to be stationary and as a result tend to converge more compared to the North.

Similar content being viewed by others

Notes

This is usually the case when panel unit root tests are employed.

See Chandler and Disney (2014) for a comparison of the different indices.

Assessment of the demeaned data is carried out following KSS. Evidence of convergence based only on demeaned data should be treated with caution.

Lopes (2016) proposes replacing trend stationarity with level stationarity as the alternative hypothesis in unit root tests for (income) convergence.

The South pairs are EA-LD, EA-SE, EA-SW, LD-SE, SE-SW and the North pairs are: NE-SC, NE-NW, NE-IR, NW-YR, NW-SC, NW-IR, YR-SC, YR-IR, SC-IR.

References

Abbott A, Vita G (2012) Pairwise convergence of district-level house prices in London. Urban Stud 49:721–740

Alexander C, Barrow M (1994) Seasonality and Cointegration of regional house prices in the UK. Urban Stud 31:1667–1689

Ashworth J, Parker S (1997) Modeling regional house prices in the UK. Scott J Polit Econ 44:225–246

Chandler and Disney (2014) Measuring house prices: a comparison of different indices, IFS Briefing Note BN146. Available at: www.ifs.org.uk/bns/bn146.pdf

Clapp JM, Tirtiroglu D (1994). Positive feedback trading and diffusion of asset price changes: Evidence from housing transactions. J Econ Behav Organ 24(3):337–355

Clark SP, Coggin TD (2009) Trends, cycles and convergence in U.S. regional house prices. J Real Estate Financ Econ 39:264–283

Cook S (2003) The convergence of regional house prices in the UK. Urban Stud 40:2285–2294

Cook S (2005) Regional house price behaviour in the UK: application of a joint testing procedure. Physica A Stat Mech Appl 345:611–621

Cook S (2006) A disaggregated analysis of asymmetrical behaviour in the UK housing market. Urban Stud 49:2067–2074

Cook S (2012) β-convergence and cyclical dynamics of UK regional house prices. Urban Stud 49:213–218

Cook S (2015) Finite-sample size distortion of the AESTAR unit root test: GARCH, corrected variance-convariance matrix estimators and adjusted critical values. Appl Econ Lett 22:1–6

Cook S, Vougas D (2009) Unit root testing against an ST-MTAR alternative: finite-sample properties and an application to the UK housing market. Appl Econ 41:1397–1404

Drake L (1995) Testing for convergence between UK regional house prices. Reg Stud 29(4):357–366

Elliott G, Rothenberg TJ, Stock J (1996) Efficient Tests for an Autoregressive Unit Root. Econometrica 64:813–36

Goodhart C, Hofmann B (2007) House prices and the macroeconomy. Oxford University Press, Oxford

Holly S, Pesaran MH, Yamagata T (2011) The spatial and temporal diffusion of house prices in the UK. J Urban Econ 69(1):2–23

Holmes MJ, Grimes A (2008) Is there long-run convergence among regional house prices in the UK? Urban Stud 45:1531–1544

Holmes MJ, Otero J, Panagiotidis T (2011) Investigating regional house price convergence in the United States: evidence from a pair-wise approach. Econ Model 28:2369–2376

Holmes MJ, Otero J, Panagiotidis T (2017) A pair-wise analysis of intra-city price convergence within the Paris housing market. J Real Estate Financ Econ 54:1–16

Holmes MJ, Otero J, Panagiotidis T (2018) Climbing the property ladder: an analysis of market integration in London property markets. Urban Stud forthcoming

Kapetanios G, Shin Y, Snell A (2003) Testing for a unit root in the nonlinear STAR framework. J Econ 12:359–379

Kyriazakou E, Panagiotidis T (2014) Linear and nonlinear causality in the UK housing market: a regional approach. Econ Bus Lett 3:288–297

Leung C (2004) Macroeconomics and housing: a review of the literature. J Hous Econ 13:249–267

Lopes AS (2016) A simple proposal to improve the power of income convergence tests. Econ Lett 138:92–95

Mac Donald R, Taylor M (1993) Regional house prices in Britain: long-run relationships and short-run dynamics. Scott J Polit Econ 40:43–55

Meen G (1999) Regional house prices and the ripple effect: a new interpretation. Hous Stud 14:733–753

Meen G (2016) Spatial housing economics: a survey. Urban Stud 53(10):1987–2003

Ng S, Perron P (2001) LAG Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 69:1519–1554

Pesaran MH (2007) A pair wise approach to testing for output and growth convergence. J Econ 138:312–355

Pollakowski HO, Ray TS (1997) Housing price diffusion patterns at different aggregation levels: an examination of housing market efficiency. J Hous Res 8:107–124

Sollis R (2009) A simple unit root test against asymmetric STAR nonlinearity with an application to real exchange rates in Nordic countries. Econ Model 26:118–125

Toda HY, Yamamoto T (1995) Statistical inferences in vector autoregressions with possibly integrated processes. J Econ 66:225–250

Zhang D (2010) Testing convergence on uk regional house prices: A fractional integration approach. In: International Conference On Applied Economics–ICOAE, p 845

Acknowledgements

We would like to thanks participants in the EEFS 2015 conference that took place in Brussels (CEPS).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Kyriazakou, E., Panagiotidis, T. A nonlinear pairwise approach for the convergence of UK regional house prices. Int Econ Econ Policy 15, 467–481 (2018). https://doi.org/10.1007/s10368-017-0399-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-017-0399-x