Abstract

This paper studies the problem of updating the super-replication prices of arbitrage-free finite financial markets with a frictionless bond. Any super-replication price is a pricing rule represented as the support function of some polytope of probabilities containing at least one strict positive probability, which captures the closure of the set of risk-neutral probabilities of any underlying market consistent with the given pricing rule. We show that a weak form of dynamic consistency characterizes the full (prior-by-prior) Bayesian updating of pricing rules. In order to study the problem of updating pricing rules revealing incomplete markets without frictions on all tradable securities, we first show that the corresponding polytope of probabilities must be non-expansible. We find that the full Bayesian updating does not preserve non-expansibility, unless a condition of non-trivial updating is satisfied. Finally, we show that the full Bayesian updating of pricing rules of efficient complete markets is completely stable. We also show that efficient complete markets with uniform bid–ask spreads are stable under full Bayesian updating, while efficient complete markets that fulfill the put–call parity are stable only under a Choquet pricing rule computed with respect to a regular concave nonadditive risk-neutral probability.

Similar content being viewed by others

Notes

Given a pricing rule \(C:\mathbb {R}^{S}\rightarrow \mathbb {R}\), the set of frictionless securities is defined by

$$\begin{aligned} F_{C}:=\left\{ x\in \mathbb {R}^{S}:C\left( x\right) =-C\left( -x\right) \right\} , \end{aligned}$$and the set of undominated securities is given by

$$\begin{aligned} L_{C}:=\left\{ x\in \mathbb {R}^{S}:C\left( y\right)>C\left( x\right) ,~\forall y\text { s.t. }y>x\right\} \text {.} \end{aligned}$$A set \(\mathcal{P} \subset \mathbb {R}^n\) is called a polytope if there are \(P_1,\dots ,P_k \in \mathbb {R}^n\) such that \(\mathcal{P}=\mathrm{conv}\{P_1,\dots ,P_k\}\).

In this case \(\mathcal {P}\) is expansible unless \(\mathcal {P}\) is singleton, which captures the standard case of efficient complete markets without bid and ask spreads.

This concave capacity \(v:2^{S}\rightarrow \left[ 0,1\right] \), \(v\left( S\right) =1\), is defined by a pair \(\left( \varepsilon ,p\right) \) composed by a Arrow state price defined by a probability measure Q and a “mistrust index” \(\varepsilon \in \left( 0,1\right) \) on Q: \(\forall E\varsubsetneq S,\)\(v\left( E\right) =\left( 1-\varepsilon \right) Q\left( E\right) \). The corresponding epsilon-contaminated pricing rules can be written as \(C\left( X\right) =\left( 1-\varepsilon \right) E_{Q}\left( X\right) +\varepsilon \max X\). The related set of risk-neutral probabilities is \(\mathcal {P}_{\left( \varepsilon ,P\right) }\)\(\mathcal {P}_{\left( \varepsilon ,Q\right) }=\left\{ \left( 1-\varepsilon \right) Q+\varepsilon P:~P\in \Delta \right\} \).

A capacity \(\nu \) is concave if:

$$\begin{aligned} \nu (A\cup B)+\nu (A \cap B) \le \nu (A)+\nu (B), \forall A,B \subset S. \end{aligned}$$The anticore of the capacity \(\nu \) is the closed, convex and bounded set:

$$\begin{aligned} \mathrm{core}(\nu )=\left\{ P \in \Delta : P(A) \le \nu (A)\ \forall A \in \Sigma \right\} . \end{aligned}$$The Krein–Milman theorem says that any convex and compact set (in \(\mathbb {R}^n\)) is the convex hull of its extremal points [see Corollary 18.5.1, page 167 of Rockafellar (1997)].

References

Acciaio, B., Föllmer, H., Penner, I.: Risk assessment for uncertain cash flows: model ambiguity, discounting ambiguity, and the role of bubbles. Finance Stoch. 16(4), 669–709 (2012)

Al-Najjar, N.I., Weinstein, J.: The ambiguity aversion literature: a critical assessment. Econ. Philos. 25(03), 249–284 (2009)

Araujo, A., Chateauneuf, A., Faro, J.: Pricing rules and Arrow–Debreu ambiguous valuation. Econ. Theory 49, 1–35 (2012). https://doi.org/10.1007/s00199-011-0660-4

Araujo, A., Chateauneuf, A., Faro, J.H.: Financial market structures revealed by pricing rules: efficient complete markets are prevalent. J. Econ. Theory (2017). https://doi.org/10.1016/j.jet.2017.11.002

Castagnoli, E., Maccheroni, F., Marinacci, M.: Insurance premia consistent with the market. Insur. Math. Econ. 31(2), 267–284 (2002). https://doi.org/10.1016/S0167-6687(02)00155-5

Castagnoli, E., Favero, G., Maccheroni, F.: A problem in sublinear pricing along time. Paper presented at VIII Workshop on Quantitative Finance, Università Ca’ Foscari di Venezia, 30123 Venezia, Italy. http://virgo.unive.it/quantitativefinance2007/viewabstract.php?id=129 (2006)

Cerreia-Vioglio, S., Maccheroni, F., Marinacci, M.: Put-call parity and market frictions. J. Econ. Theory 157, 730–762 (2015). https://doi.org/10.1016/j.jet.2014.12.011

Chateauneuf, A., Jaffray, J.Y.: Local möbius transforms of monotone capacities. In: Symbolic and Quantitative Approaches to Reasoning and Uncertainty, pp. 115–124. Springer, Berlin (1995). https://doi.org/10.1007/3-540-60112-0_14

Chateauneuf, A., Kast, R., Lapied, A.: Choquet pricing for financial markets with frictions. Math. Finance 6, 323–330 (1996)

Chateauneuf, A., Gajdos, T., Jaffray, J.Y.: Regular updating. Theory Decis. 71, 111–128 (2011)

Cox, J.C., Ross, S.A.: The valuation of options for alternative stochastic processes. J. Financ. Econ. 3, 145–166 (1976)

Detlefsen, K., Scandolo, G.: Conditional and dynamic convex risk measures. Finance Stoch. 9(4), 539–561 (2005)

Epstein, L., Le Breton, M.: Dynamically consistent beliefs must be Bayesian. J. Econ. Theory 61(1), 1–22 (1993)

Epstein, L.G., Schneider, M.: Recursive multiple-priors. J. Econ. Theory 113, 1–31 (2003). https://doi.org/10.1016/S0022-0531(03)00097-8

Fagin, R., Halpern, J.Y.: A new approach to updating beliefs. In: Proceedings of the Sixth Annual Conference on Uncertainty in Artificial Intelligence (1990)

Faro, J.H., Lefort, J.P.: Dynamic objective and subjective rationality. Insper Working Papers wpe312, Insper Working Paper, Insper Instituto de Ensino e Pesquisa. https://ideas.repec.org/p/ibm/ibmecp/wpe_312.html (2013)

Florenzano, M., Gourdel, P., Van, C.: Finite Dimensional Convexity and Optimization. Studies in Economic Theory. Springer, Berlin (2001)

Galanis, S.: Dynamic consistency and subjective beliefs. Tech. rep., mimeo. https://doi.org/10.2139/ssrn.2756612. https://ssrn.com/abstract=2756612 (2017). Accessed 1 Nov 2017

Ghirardato, P.: Revisiting savage in a conditional world. Econ. Theory 20(1), 83–92 (2002). https://doi.org/10.1007/s001990100188

Ghirardato, P., Maccheroni, F., Marinacci, M.: Revealed Ambiguity and Its Consequences: Updating, Chapter 1, pp. 3–18. Springer, Berlin (2008). https://doi.org/10.1007/978-3-540-68437-4_1

Hansen, L., Jagannathan, R.: Implications of security market data for models of dynamic economies. J. Polit. Econ. 99(2), 225–262 (1991)

Harrison, J.M., Kreps, D.: Martingales and arbitrage in multiperiod securities markets. J. Econ. Theory 20(3), 381–408 (1979)

Huber, P.J.: Robust Statistics. Wiley Series in Probabilities and Mathematical Statistics. Wiley, New York (1981)

Jaffray, J.Y.: Bayesian updating and belief functions. IEEE Trans. Syst. Man Cybern. 22, 1144–1152 (1992)

Jouini, E.: Price functionals with bidask spreads: an axiomatic approach. J. Math. Econ. 34(4), 547–558 (2000). https://doi.org/10.1016/S0304-4068(99)00023-3

Jouini, E., Kallal, H.: Martingales and arbitrage in securities markets with transaction costs. J. Econ. Theory 66, 178–197 (1995)

Jouini, E., Kallal, H.: Efficient trading strategies in the presence of market frictions. Rev. Financ. Stud. 14(2), 343–369 (2001)

Luttmer, E.G.J.: Asset pricing in economies with frictions. Econometrica 64(6), 1439–1467 (1996)

Pires, C.P.: A rule for updating ambiguous beliefs. Theory Decis. 53, 137–152 (2002)

Rockafellar, R.: Convex Analysis. Princeton University Press, Princeton (1997)

Ross, S.A.: The arbitrage theory of capital asset pricing. J. Econ. Theory 13, 341–360 (1976)

Ross, S.A.: A simple approach to the valuation of risky streams. J. Bus. 51, 453–475 (1978)

Schmeidler, D.: Integral representation without additivity. Proc. Am. Math. Soc. 97, 255–261 (1986)

Schneider, R.: Convex Bodies: The Brunn–Minkowski Theory. Cambridge University Press, Cambridge (1993)

Siniscalchi, M.: Dynamic choice under ambiguity. Theor. Econ. 6(3). https://EconPapers.repec.org/RePEc:the:publsh:571 (2011). Accessed 15 Aug 2017

Tutsch, S.: Update rules for convex risk measures. Quant. Finance 8(8), 833–843 (2008)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank two anonymous referees for very important suggestions and comments. We also have benefited from comments made by seminar/conference participants at IMPA and RUD Conference 2016 in Paris. The financial support from “Brazilian-French Network in Mathematics” is gratefully acknowledged. Faro also thanks the CNPq (Grant No. 307508/2016-1) of Brazil for financial support. Holanda thanks the CNPq for financial support during his PhD period and the Paris School of Economic for its hospitality during his stay in Paris.

Appendix

Appendix

Proof of Theorem 3

Suppose that \(X \not \in F_C\), and let \(Q_1,Q_2,\dots ,Q_n\) be all the extremal points of \(\mathcal{K}\) such that \(E_{Q_1}(X)=\cdots =E_{Q_n}(X)=C(X)\). That is,

Since \(X \not \in F_C\), there is \(P \in \mathcal{K}\) such that \(C(X)>E_P(X)\). Indeed, by lemma 4 in Araujo et al. (2012), it is known that \(X \in F_C\) if and only if \(E_P(X)=E_Q(X)\) for all \(P,Q \in \mathcal{K}\). Furthermore, by the Krein–Milman theorem,Footnote 8 we can assume without loss of generality that P is also an extremal point of \(\mathcal{K}\). Indeed, if \(C(X)=E_P(X)\) for all \(P \in \mathrm{Ext}(\mathcal{K})\), then \(C(X)=E_P(X)\) for all \(P \in \mathcal{K}\), a contradiction.

Observe that there is a state s such that \(Q_i(s)=0\) for all \(i=1,\dots ,n\). Otherwise, the probability Q defined as \(Q=\sum \frac{1}{n}Q_i\) is a point of the simplex \(\Delta \). Therefore, there will be a positive real \(\varepsilon \) such that \((\varepsilon +1)Q-\varepsilon P \in \Delta \). Furthermore, since \(\mathcal{K}\) is non-expansible, we have that \((\varepsilon +1)Q-\varepsilon P \in \mathcal{K}\).

On the other hand,

And this cannot be true.

Now, if s is a state such that \(Q_i(s)=0\) for all \(i=1,\dots ,n\), define

For any extremal point P such that \(C(X)>E_P(X)\) we can choose \(\delta >0\) sufficiently small such that \(C(X)>E_P(X+\delta \{s\}^*)\). Since the number of extremal points of \(\mathcal{K}\) is finite, we can choose \(\delta >0\) such that \(C(X)>E_P(X+\delta \{s\}^*)\) for all extremal point \(P \not \in \{Q_1,Q_2,\dots ,Q_n\}\).

Therefore, it is possible to choose \(Y=X+\delta \{s\}^*\) such that \(Y>X\) and \(C(Y)=C(X)\). Hence, \(X \not \in L_C\).

Since \(F_C \subset L_C\) for all pricing rules, the first part of the theorem follows.

The converse is also true: If C is a pricing rule such that \(F_C=L_C\), by lemma 21 proved in Araujo et al. (2012), then

Note that \(\mathcal{Q}_C\) is a non-expansible set. Indeed, if \(P_1,P_2\in \mathcal{Q}_C\) and \(\alpha \in \mathbb {R}\) such that \(\alpha P_1 +(1-\alpha )P_2 \in \Delta \), it is immediate to see that we also have \(\alpha P_1 +(1-\alpha )P_2 \in \mathcal{Q}_C\). Therefore, \(\mathcal{K}\) is a non-expansible set. \(\square \)

Proof of Proposition 1

Given a pricing rule C and the corresponding set \(F_C\), recall that \(X \in F_C\) if and only if \(E_P(X)=E_Q(X)\) for all \(P,Q \in \mathcal{Q}\). Now, suppose that \(X \in F_{\widetilde{C}}\). Then, \(E_P(X)=E_Q(X)\) for all \(P,Q \in \widetilde{\mathcal{K}}\). Since \(\mathcal{K} \subset \widetilde{\mathcal{K}}\), we have \(E_P(X)=E_Q(X)\) for all \(P,Q \in \mathcal{K}\). Therefore, \(X \in F_{{C}}\).

Now, if \(X \in F_{{C}}\), we have \(E_{Q_i}(X)=E_{Q_j}(X)\) for all extremal points \(Q_i,Q_j \in \mathcal{K}\). Then, for every two vectors \(\alpha \in \mathbb {R}^n\) and \(\beta \in \mathbb {R}^m\) such that \(\sum _{i=1}^n \alpha _i = \sum _{i=1}^m\beta _i=1\) and \(\sum _{i=1}^n \alpha _iQ_i \in \Delta \), \(\sum _{i=1}^m \beta _iQ_i \in \Delta \), we have

Therefore, \(X \in F_{\widetilde{C}}\). \(\square \)

Proof of Theorem 4

\((ii) \Rightarrow (i)\). It is straightforward to see that \(C^E(\cdot )\) given by the full Bayesian update rule fulfills all properties which define a pricing rule. That is, \(C^E(\cdot )\) is sublinear, arbitrage-free, normalized, monotonic and constant additive. To prove the DCC property, we first assume that \(C(XE^*)\ge 0\). Then, there is \(P_0 \in \mathcal{K}\) satisfying

Since \(P_0(E)>0\) by hypothesis, then \(E_{P_0^E}(X) \ge 0\). Therefore, \(C^E(X) \ge 0\).

To show the converse, start assuming that \(C^E(X) \ge 0\). Then, there is \(P_0 \in \mathcal{K}\) such that \(P_0^E \in \mathcal{K}^E\) and

Since \(P(E)>0\), then \(\sum _{s \in E}{P_0(s)}X(s) \ge 0\). Therefore, \(C(X) \ge 0\). Since \(C^E(X)=C^E(XE^*)\), we obtain that \(C(XE^*) \ge 0\) as a particular case when \(X \leftarrow XE^*\).

\((i) \Rightarrow (ii)\). First, observe that the DCC property is equivalent to \(C(XEk)\ge k \Leftrightarrow C^E(X)\ge k\), for any asset X and any real number k. Indeed, since C is constant additive, \(C(XEk)\ge k\) is equivalent to \(C(XEk-kS^*)\ge 0\). By the DCC property, \(C(XEk-kS^*)\ge 0\) is equivalent to \(C^E(XEk-kS^*) \ge 0\) and by constant additivity, \(C^E(XEk-kS^*) \ge 0\) is equivalent to \(C^E(X) \ge 0\). Using a similar argument, we show the converse. Now, let us continue with the main proof:

Since \(C^E(\cdot )\) is a pricing rule, there is a closed and convex set \(\mathcal{L}\) of probabilities on E, where at least one element has full support and

We must show that \(\mathcal{L}=\mathcal{K}^E\). Suppose that there is \(P_0 \in \mathcal{L}{\setminus }\mathcal{K}^E\). By the hyperplane separation theorem, there is X such that \(E_{P_0}(X)>E_Q(X)\) for all \(Q \in \mathcal{K}^E\). Taking \(k=E_{P_0}(X)\), we have that \(C^E(X) \ge k\). Therefore, by the DCC property, \(C(XEk)\ge k\). On the other hand,

for some \(P_1 \in \mathcal{K}\). Using the hypothesis \(P_1(E)>0\), then \(E_{P_1^E}(X) \ge k\), a contradiction, since \(k>E_Q(X)\) for all \(Q \in \mathcal{K}^E\).

Now, suppose that there is \(P^E_0 \in \mathcal{K}^E{\setminus }\mathcal{L}\), where \(P_0 \in \mathcal{K}\). By the hyperplane separation theorem, there is X such that \(E_{P^E_0}(X)>E_Q(X)\) for all \(Q \in \mathcal{L}\). In this case, \(k>C^E(X)\), where \(k=E_{P^E_0}(X)\). Observe that

Then,

Since \(C(XEk) \ge k\) implies \(C^E(X) \ge k\) by the DCC property, we have a contradiction. \(\square \)

To make the demonstration of Theorem 5 smoother, we first present some useful results. The first can be found in Jaffray (1992) and shows that the set of conditional risk-neutral probabilities \(\mathcal{K}^E\) of a convex and compact set \(\mathcal{K}\) is also a convex and compact set.

Lemma 1

Let \(P,Q \in \Delta \) be two probabilities such that \(P(E),Q(E)>0\) and \(\alpha \in (0,1)\) a real number. Then, for the real number \(\beta \) defined by

we have \((\beta P+(1-\beta )Q)^E=\alpha P^E + (1-\alpha )Q^E\).

Proof

It is not difficult to verify that

for all events \(F \subset \Delta \). Indeed, if \(P(F \cap E)=x\), \(Q(F \cap E)=y\), \(P(E)=z\) and \(Q(E)=w\), then \(\beta =\frac{\alpha w}{z+\alpha (w-z)}\). Therefore,

Changing back the variables x, y, z, w we have the desired result. \(\square \)

Using induction over the number of probabilities, it is possible to demonstrate the following important corollary:

Corollary 1

Let \(\mathcal{K}=\mathrm{conv}\{P_1,\dots ,P_m\}\) be the convex hull of the probabilities \(P_1\), \(P_2,\dots , P_m\). If \(P_i(E)> 0\) for all \(1 \le i \le m\), then \(\mathcal{K}^E=\mathrm{conv}\{P_1^E,\dots ,P_m^E\}\).

Observe that the previous lemma can be extended for values of the parameter \(\alpha \) outside the interval (0, 1) and for signed probabilities:

Lemma 2

Let P, Q be two signed probabilities such that \(P(E)\cdot Q(E) \ne 0\) and \(P(E) \ne Q(E)\). Let \(\alpha \ne \frac{P(E)}{P(E)-Q(E)}\) be a real number. Then, for the real number \(\beta \) defined by

we have \((\beta P+(1-\beta )Q)^E=\alpha P^E + (1-\alpha )Q^E\).

Proof

Identical to Lemma 1. In fact, to demonstrate the previous lemma, it was not necessary to use the hypothesis of positive probabilities measures. Now, let us contrast useful relations between \(\alpha \) and \(\beta \):

- (i)

If \(P(E)\cdot Q(E) >0\), then

$$\begin{aligned} \frac{\partial \beta }{\partial \alpha }=\frac{P(E)\cdot Q(E)}{((1-\alpha )P(E)+\alpha Q(E))^2}>0. \end{aligned}$$ - (ii)

If \(P(E)> Q(E) > 0\) and \(\alpha =\lambda \cdot \frac{P(E)}{P(E)-Q(E)}\) with \(\lambda \in \left( \frac{P(E)-Q(E)}{P(E)},1\right) \), then \(\beta =\frac{\lambda }{1-\lambda }\frac{Q(E)}{P(E)-Q(E)}>1\) and \(\beta P(E)+(1-\beta )Q(E)>0\).

- (iii)

If \(Q(E)>P(E)>0\) and \(\alpha =\lambda \cdot \frac{P(E)}{Q(E)-P(E)}\) with \(\lambda \in \left( \frac{Q(E)-P(E)}{P(E)},1\right) \), then \(\beta =\frac{\lambda }{1+\lambda }\frac{Q(E)}{Q(E)-P(E)}>1\) and \(\beta P(E)+(1-\beta )Q(E)>0\).

The above condition stating that \(\beta P(E)+(1-\beta )Q(E)>0\) for \(\alpha \in \left( 1,\frac{P(E)}{\Vert P(E)-Q(E)\Vert }\right) \) will be useful to prove Theorem 5. To make the proof of this theorem smoother, we will present first the following lemma:

Lemma 3

If \(\mathcal{K}\) is a convex polytope and expansible set, there are probabilities \(P, Q \in \mathcal{K}\) and a real number \(\bar{\alpha }>1\) such that \(\alpha P+(1-\alpha )Q \in \Delta {\setminus } \mathcal{K}\) for all \(\alpha \in (1,\bar{\alpha }]\).

Proof

Since \(\mathcal{K}\) is expansible, there are \(Q,R \in \mathcal{K}\) and \(\hat{\theta }\) such that \(\hat{\theta }R+(1-\hat{\theta })Q \in \Delta {\setminus }\mathcal{K}\). Now, let \(\bar{\theta }\) be the extremal value for the parameter \(\theta \) in the following sense:

Since \(\mathcal K\) is a convex polytope, the condition \(\theta R +(1-\theta )Q \in \mathcal{K}\) can be expressed as a linear system \(A\theta \le b\). So, problem (2) has a solution and by linearity this solution is unique. Therefore, \(\bar{\theta }\) is well defined.

Now, observe that

- (i)

\(\theta R +(1-\theta )Q \in \mathcal{K}\) for all \(\theta \in [1,\bar{\theta }]\);

- (ii)

\(\theta R +(1-\theta )Q \in \Delta {\setminus } \mathcal{K}\) for all \(\theta \in (\bar{\theta },\hat{\theta }]\).

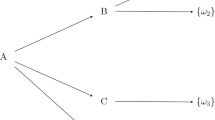

This assertion can be visualized as shown in Fig. 5. Taking \(P=\bar{\theta }R+(1-\bar{\theta })Q\) and \(\bar{\alpha }={\hat{\theta }}/{\bar{\theta }}\), we have the desired result. \(\square \)

Geometric representation of Lemma 3

Remark 1

When \(\mathcal K\) has at least one strictly positive element, then the probabilities P and Q can be taken strictly positive.

Proof of Theorem 5

\((i) \Rightarrow (ii)\): Suppose that \(\mathcal K\) is a non-expansible polytope and that \(\mathcal{K}^E\) is an expansible set. Since \(\mathcal K\) has at least one strictly positive element, \(\mathcal{K}^E\) has a probability on \(\Delta (E)^+\). By Lemma 3, there are \(P^E, Q^E \in \mathcal{K}^E\) strictly positive and a parameter \(\bar{\alpha } >1\) such that \(\alpha P^E + (1-\alpha )Q^E \in \Delta {\setminus } \mathcal{K}^E\) for all \(\alpha \in (1,\bar{\alpha }]\). By the non-trivial updating condition, there are two probabilities \(P,Q \in \mathcal{K}\) such that \(P^E,Q^E\) are its respective Bayesian updates and \(P(s)>0\), \(Q(s)>0\) for all \(s \in E^C\). Now, we have two cases to be considered:

- (i)

Case 1 If \(P(E)=Q(E)\): It is immediate that \(\alpha P^E+(1-\alpha )Q^E=(\alpha P+(1-\alpha )Q)^E\). Therefore, \((\alpha P +(1-\alpha )Q)(s) \ge 0\) for all \(\alpha \in (1,\bar{\alpha }]\). By the non-trivial updating condition, P(s) and Q(s) are positive for every \(s \in E^C\). Observe that if \(P(s)=Q(s)\) for some \(s \in E^C\), then \((\alpha P +(1-\alpha )Q)(s) \ge 0\). Otherwise, if \(P(s) < Q(s)\) notice that

$$\begin{aligned} (\alpha P +(1-\alpha )Q)(s) \ge 0 \iff \alpha \le \frac{Q(s)}{Q(s)-P(s)}, \end{aligned}$$or, if \(P(s) > Q(s)\), then

$$\begin{aligned} (\alpha P +(1-\alpha )Q)(s) \ge 0,\ \ \forall \alpha > 0. \end{aligned}$$Thus, there is \(\hat{\alpha }>1\) sufficiently small such that \(\alpha P +(1-\alpha )Q \in \Delta \). Since \(\mathcal{K}\) is non-expansible, we must have that \(\alpha P +(1-\alpha )Q \in \mathcal{K}\), so \(\alpha P^E +(1-\alpha )Q^E \in \mathcal{K}^E\), a contradiction.

- (ii)

Case 2 If \(P(E) \ne Q(E)\): From Lemma 2, we know there is a parameter \(\beta =\beta (\alpha ) >1\) such that \((\beta P+(1-\beta )Q)^E=\alpha P^E + (1-\alpha )Q^E\) for each \(\alpha \in (1,\bar{\alpha }]\). Let us assume without loss of generality that \(\bar{\alpha } \in \left( 1,\frac{P(E)}{\Vert P(E)-Q(E)\Vert }\right) \). Our objective is to ensure that \(\beta P+(1-\beta )Q\) is a positive probability for some \(\hat{\alpha }>1\) sufficiently small. We have to consider the following possibilities:

- (a)

If \(s \in E\): We know that

$$\begin{aligned}&\beta P(s)+(1-\beta )Q(s)\\&\quad =\underbrace{\left[ \beta P(E)+(1-\beta )Q(E) \right] }_{\ge 0}\cdot \underbrace{\left[ \alpha \frac{P(s)}{P(E)} + (1-\alpha )\frac{Q(s)}{Q(E)} \right] }_{\ge 0}, \end{aligned}$$then \(\beta P(s)+(1-\beta )Q(s) \ge 0.\)

- (b)

If \(s \in E^C\) and \(\frac{P(s)}{P(E)}-\frac{Q(s)}{Q(E)}\ge 0\), the above argument is sufficient to show the nonnegativity of \(\beta P(s)+(1-\beta )Q(s)\). Otherwise, it is possible to find a small value \(\hat{\alpha }\) such that

$$\begin{aligned} 1 \le \hat{\alpha } < \frac{Q(s)P(E)}{Q(s)P(E)-P(s)Q(E)}, \end{aligned}$$for all \(s \in E^C\) in which \(\frac{P(s)}{P(E)}<\frac{Q(s)}{Q(E)}\). In fact, it is possible to assume this constraint because we have that \(\frac{Q(s)P(E)}{Q(s)P(E)-P(s)Q(E)}>1\) by assumption and that \(Q(s) > 0\) for all \(s \in E^C\) by the non-trivial updating condition. Then, for any \(\alpha \in (1,\hat{\alpha })\) we have that

$$\begin{aligned} \alpha \frac{P(s)}{P(E)} + (1-\alpha )\frac{Q(s)}{Q(E)} \ge 0. \end{aligned}$$

- (a)

Therefore, the existence of a positive probability \(\beta P+(1-\beta )Q\) with \(\beta >1\) is incompatible with the hypothesis that \(\mathcal{K}\) is non-expansible; we must have that \(\mathcal{K}^E\) is also a non-expansible set.

\((ii) \Rightarrow (i)\): Suppose that there is \(R \in \mathcal{K}^E\) such that there is no \(\widetilde{R} \in \mathcal{K}\) where \(\widetilde{R}^E=R\) and \(\widetilde{R}(s)>0\) for all \(s \in E^C\). Let \(P \in \mathcal{K}\cap \Delta (S)^+\) and \(P^E\) its Bayesian update. By hypothesis, \(P^E \ne R\). Since \(\mathcal{K}^E\) is non-expansible and \(P^E,R \in \Delta (E)^+\), there is \(\bar{\alpha }>1\) such that \(Q=\bar{\alpha }R+(1-\bar{\alpha })P^E \in \mathcal{K}^E\). In this case, \(R=\frac{1}{\bar{\alpha }}Q+(1-\frac{1}{\bar{\alpha }})P^E\). Now, since \(Q \in \mathcal{K}^E\), there is \(\widetilde{Q} \in \mathcal{K}\) such that \(\widetilde{Q}^E=Q\). By Lemma 1, since \(\widetilde{Q}(E)>0\) there is \(\beta \in (0,1)\) such that \((\beta \widetilde{Q}+(1-\beta )P)^E=R\). However, \(\beta \widetilde{Q}+(1-\beta )P \in \mathcal{K}\) and \((\beta \widetilde{Q}+(1-\beta )P)(s)>0\) for all \(s \in E^C\), a contradiction. \(\square \)

Proof of Proposition 2

The demonstration is straightforward from Corollary 1. \(\square \)

Proof of Theorem 6

Suppose that a market with uniform bid–ask spreads is represented by the set of risk-neutral measures \(\mathcal{K}\) such that

Let \(P_1,P_2,\dots ,P_n\) be the extremal points of \(\mathcal{K}\), that is, \(P_i=(1-\varepsilon )Q+\varepsilon \delta _i\). Now, suppose that an event E is observed. In this case, the conditional probabilities of \(P_i\) given E are such that

when \(i \not \in E\). And

when \(i \in E\). Now, observe that for all \(i \in E\), \(P_i^E=(1-\varepsilon ^E)Q^E+\varepsilon ^E\delta _i\), where \(\varepsilon ^E \in (0,1]\) is a parameter defined as

Therefore, \(\mathcal{K}^E\) also represents a market with uniform bid–ask spreads, since \(\mathcal{K}^E=(1-\varepsilon ^E)Q^E+\varepsilon ^E\Delta ^E.\)\(\square \)

Proof of Theorem 7

\((ii) \Rightarrow (i)\): Since \(\nu \) is regular, for every non-empty E we have \([\mathrm{acore}(\nu )]^E=\mathrm{acore}(\nu ^E)\). Then,

Following Chateauneuf and Jaffray (1995), we know that \(\nu ^E\) must be a concave capacity. Using the dual version of Theorem 3 in Schmeidler (1986), it is clear that \(C^E(X)=\int X \mathrm{d}\nu ^E\).

\((iii) \Rightarrow (ii)\): It is known from Chateauneuf et al. (2011) that \([\mathrm{acore}(\nu )]^E \subset \mathrm{acore}(\nu ^E)\). Suppose that \([\mathrm{acore}(\nu )]^E \subsetneq \mathrm{acore}(\nu ^E)\) for some event \(E\ne S\). Then, there is a probability \(P_0 \in \mathrm{acore}(\nu ^E) {\setminus } [\mathrm{acore}(\nu )]^E \). From Jaffray (1992) we know that \([\mathrm{acore}(\nu )]^E\) is a convex compact set. By the strong version of the hyperplane separation theorem (see Rockafellar 1997), there is \(X\in \mathbb {R}^S\) such that \(E_{P_0}(X)>E_{P}(X)\) for every \(P \in [\mathrm{acore}(\nu )]^E\). On the other hand, the hypothesis ensures that \(\displaystyle C^E(X)=\max _{P \in [\mathrm{acore}(\nu )]^E} E_P(X)=\max _{P \in \mathrm{acore}(\nu ^E)} E_P(X)\) for every \(X \in \mathbb {R}^S\), a contradiction. Using the same argument, it is possible to show that \([\mathrm{acore}(\nu )]^E \supsetneq \mathrm{acore}(\nu ^E)\) cannot be true. Therefore, \([\mathrm{acore}(\nu )]^E = \mathrm{acore}(\nu ^E)\).

\((i) \Rightarrow (iii)\): First, take \(E=S\). Then \(C(X)=\max _{P \in \mathcal{K}}\) is a Choquet integral for some capacity \(\nu \). Furthermore, \(C(A^*)=\nu (A)\) for all \(A \subset S\). Therefore, \(\nu \) is unique.

Since C is subadditive, we obtain that

for all \(X,Y \in \mathbb {R}^S\). From the dual version of theorem 3 in Schmeidler (1986), we conclude that \(\nu \) must be concave. Moreover, \( C(X)=\max _{P \in \mathcal{K}} E_P(X)=\max _{P \in \mathrm{acore}(\nu )} E_P(X)\). Then, using again the strong version of the hyperplane separation theorem, we have that \(\mathcal{K}=\mathrm{acore}(\nu )\).

Suppose that \(C^E(\cdot )\) is a Choquet integral with respect to a concave capacity \(\mu _E\). Since \(\nu \) is concave, we know from Chateauneuf et al. (2011) that \(\nu ^E(A)=\sup \{P^E(A) \mid P \in \mathrm{acore}(\nu )\}, \forall A \subset E\), can also be written as

and that \(\nu ^E\) is concave for every event E compatible with \(\mathcal K\). And by the uniqueness in the representation, we must have \(\mu _E=\nu ^E\). This completes the proof. \(\square \)

Rights and permissions

About this article

Cite this article

Araujo, A., Chateauneuf, A., Faro, J.H. et al. Updating pricing rules. Econ Theory 68, 335–361 (2019). https://doi.org/10.1007/s00199-018-1125-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-018-1125-9