Abstract

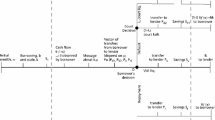

This paper assesses the impact of legal institutions on firm dynamics in a model where entrepreneurs have heterogeneous risk aversion, credit constraints and may default. Entrepreneurs choose firm size, capital structure, consumption, default and whether to incorporate. We find that less risk-averse entrepreneurs tend to incorporate while more risk-averse entrepreneurs do not; this occurs because leaving some personal assets exposed by not incorporating allows more risk-averse borrowers to credibly commit to lower default rates. We show that incorporation is determined by two effects: the standard effect that bankruptcy insures low firm returns and a new “scale effect”—more risk-averse entrepreneurs run smaller firms and default more often. The more risk-averse choose to leave some personal assets unshielded in bankruptcy due to a commitment problem that dominates the value of insurance. The less risk-averse run larger firms, default less and incorporate.

Similar content being viewed by others

Notes

The U.S. Bankruptcy Code permits firms to be liquidated (Chapter 7) or to operate (Chapter 11) under receivership. The owner cannot manage the firm in either case.

Incorporation costs and tax treatment are important, but they cannot be the only determinants of an entrepreneur’s choice of legal status. For example, unincorporated S-corporations impose low reporting costs on entrepreneurs. As a consequence, if costs were the only barrier to incorporation, a lower fraction of unincorporated firms should have been observed after legal changes made S-corporations more advantageous. However, Herranz et al. (2009) and Campbell and DeNardi (2009) document there was no significant decrease in unincorporated firms. Instead, there was a shift from C-corporations to S-corporations, i.e., firms that were incorporated took advantage of the tax advantages of S-corporations. Entrepreneurs whose firms were unincorporated did not change their legal status. Therefore, we abstract from taxes and incorporation costs.

The option value of maintaining the firm to realize future returns limits default. Owners will “bail out” a firm today with personal funds if they expect sufficient future returns, which is the firm’s option value.

See Quadrini (2009) for an excellent survey of three branches of entrepreneurship: (1) factors that affect the decision to become an entrepreneur, (2) aggregate and distributional implications of entrepreneurship for savings and investment, and (3) how entrepreneurship affects economic development and growth.

The risky technology and \(w_0\) are ex-ante identical, but net-worth (and consumption) evolve stochastically over time due to differences in risk aversion and return realizations. As \(b\rightarrow \infty \), borrowing is unconstrained.

A firm may default if it is unable to repay \(A \bar{v}\) (firm plus personal assets are less than A) or unwilling to repay. Owners can “bail out the firm” with personal assets to forestall bankruptcy, but cannot be forced to do so. In our model personal credit histories affect business loans, causing a credit interruption. Mester (1997) p. 7 finds that in small business loan scoring models, “the owner’s credit history was more predictive than net-worth or profitability of the business” and “owners’ and businesses’ finances are often commingled.”

This has two interpretations. First, the firm may be liquidated (Chapter 7 in the U.S. Bankruptcy Code). Because bankruptcy remains on a credit record for a period of time, creditors and customers would be unwilling to do business with the entrepreneur during this period. Second, the firm may continue to operate, but is owned by the debt holders who make investments and receive payments, or shut it down (Chapter 11). After T periods the credit record is clean, and the entrepreneur can either restart a new firm or regain control of the original firm, in Chapter 7 or 11, respectively.

This is the monthly data for T-Bill rates, adjusted by the monthly CPI reported by the BLS.

The U.S. Small Business Association and many banks require business owners to pledge their house as part of the loan collateral. See http://blog.projectionhub.com/how-much-collateral-does-the-bank-need-for-a-business-loan/.

The U.S. Bankruptcy Code is a federal law, but the exemptions are determined at the state level.

Some papers identify a role for the government to provide collateral when collateral is in short supply.

Looney and Yannelis (2015) construct a novel data set for the U.S. student loan market. They show that students from selective institutions have significantly larger loans but much lower default rates. Selective institutions are a proxy for higher quality schools, higher quality students, or both, and students at more selective institutions have significantly higher median annual earnings. In our model, better earnings potential corresponds to “better projects.” They also find that borrowers with smaller loans have significantly higher default rates, as our model predicts. This appears to be an empirical example of our “scale effect.” They do not identify an insurance effect. As noted in the introduction, Livshits et al. (2007), among others, focus on the insurance effect.

References

Athreya, K.: Welfare implications of the bankruptcy reform act of 1999. J. Monet. Econ. 49, 1567–1595 (2002)

Boyd, J., Smith, B.: How good are standard debt contracts? Stochastic versus non stochastic monitoring in a costly state verification environment. J. Bus. 67, 539–561 (1994)

Bris, A., Welch, I., Zhu, N.: The cost of bankruptcy: chapter 7 liquidation versus chapter 11 reorganization. J. Finance 111, 1253–1303 (2006)

Calomiris, C., Larrain, M., Liberti, J., Sturgess, J.: How collateral laws shape lending and sectoral activity. J. Financ. Econ. 123(1), 163–188 (2017)

Campbell, J.R., DeNardi, M.: A conversation with 590 nascent entrepreneurs. Ann. Finance 5, 313–340 (2009)

Chatterjee, S., Corbae, D., Nakajima, M., Rios-Rull, V.: A quantitative theory of unsecured consumer credit with risk of default. Econometrica 75, 1525–1589 (2007)

Davila, E.: Using elasticities to derive optimal bankruptcy exemptions. Working Paper, NYU Stern (2016)

Evans, D.S., Jovanovic, B.: An estimated model of entrepreneurial choice under liquidity constraints. J. Polit. Econ. 97, 808–827 (1989)

Fay, S., Hurst, E., White, M.: The household bankruptcy decision. Am. Econ. Rev. 92, 706–718 (2002)

Geanakoplos, J., Zame, W.: Collateral equilibrium I: a basic framework. Econ. Theory 56, 443–492 (2014)

Glover, A., Short, J.: Bankruptcy, incorporation, and the nature of entrepreneurial risk. 2011 Meeting Paper No. 836, Society for Economic Dynamics (2011)

Herranz, N., Krasa, S., Villamil, A.: Small firms in the SSBF. Ann. Finance 5, 341–359 (2009)

Herranz, N., Krasa, S., Villamil, A.: Entrepreneurs, risk aversion and firm dynamics. J. Polit. Econ. 123, 1133–1176 (2015)

Hovenkamp, H.: Enterprise and American Law. Harvard University Press, Cambridge (1991)

Krasa, S., Villamil, A.: Optimal contracts when enforcement is a decision variable. Econometrica 68, 119–134 (2000)

Krasa, S., Villamil, A.: Optimal contracts when enforcement is a decision variable: a reply. Econometrica 71, 391–393 (2003)

Livshits, I., MacGee, J., Tertilt, M.: Consumer bankruptcy: a fresh start. Am. Econ. Rev. 97, 402–418 (2007)

Looney, A., Yannelis, C.: A crisis in student loans? The consequences of non-traditional borrowers for delinquency. Brook. Pap. Econ. Act. 2, 1–89 (2015)

Lustig, H., Nieuwerburgh, S.: Housing collateral, consumption insurance and risk premia: an empirical perspective. J. Finance 60, 1167–1219 (2005)

Mann, B.: Republic of Debtors: Bankruptcy in the Age of American Independence. Harvard University Press, Cambridge (2003)

Meh, C., Terajima, Y.: Unsecured debt, consumer bankruptcy and entrepreneurship. Working Paper, Bank of Canada (2008)

Mester, L.: What’s the point of credit scoring? Bus. Rev. 3, 3–16 (1997)

Quadrini, V.: Entrepreneurship in macroeconomics. Ann. Finance 5, 295–311 (2009)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Cristina De Nardi, Jamsheed Shorish and Yiannis Vailakis for useful discussions. We also thank an anonymous referee and seminar participants at Cambridge, Oxford, University of Iowa, University of London, Conference on GE at Warwick University, the SAET Conference, the SWET Conference at the University of Paris 1, and the Midwest Economic Theory Conference at the University of Kansas. We gratefully acknowledge financial support from National Science Foundation Grant SES-031839, NCSA computation Grant SES050001, the Academy for Entrepreneurial Leadership at the University of Illinois and Kauffman Foundation Grant 20061258. Any opinions, findings, and conclusions or recommendations expressed in this paper are those of the authors and do not necessarily reflect the views of the National Science Foundation or any other organization.

Appendix

Appendix

We now show that problem 1 is equivalent to problem 3. As a first step, we show that the value function has the form \(V_S(w)=w^{1-\rho }v_S\) and \(V_B(w)=w^{1-\rho } v_B\).

In order to see this, substitute these functional forms into problem 1. Thus,

Note that \(v_S=V_S(1)\) is the continuation utility from starting with an initial net-worth of one unit. Since utility is of the form \(u(x)=x^{1-\rho }/(1-\rho )\) it follows that \(v_S>0\) if \(\rho <1\) and \(v_S<0\) if \(\rho >1\). The right-hand side of (11) is therefore strictly increasing in x. Thus, \(\mathfrak {B}\) must be a lower interval, i.e., there exists \(x^*\) such that \(\mathfrak {B}=\left\{ x \bigm | x <x^*\right\} \). Further, for \(x=x^*\) Eq. (11) must hold with equality, i.e.,

Solving (12) for \(x^*\) yields constraint (6) of Problem 3.

Now let \(\lambda >0\). We show that \(V_S(\lambda w) = \lambda ^{1-\rho } V_S(w)\). Note that if we replace w by \(\lambda w\), A by \(\lambda A\) and c by \(\lambda c\) then the right-hand side of (10) becomes

Similarly, this substitution multiplies both sides of Eq. (12) by \(\lambda \), and hence \(x^*\) and the bankruptcy set \(\mathfrak {B}\) do not change. Constraint (1) does not change, since w, c and A enter the expression only as ratios w / A and c / A and are therefore unchanged. Replacing A by \(\lambda A\) and w by \(\lambda w\) in (3) multiplies both sides by \(\lambda >0\), and hence this equations are also unchanged. Finally, the non-negativity constraints in (4) also remain valid.

Thus, \(\lambda c\), \(\lambda A\), \(\epsilon \) and \(\bar{v}\) satisfy the constraints of our optimization problem at net-worth level \(\lambda w\). Equation (13) therefore implies that \(V_S(\lambda w)\le \lambda ^{1-\rho } V_S(w)\) for all \(\lambda ,w>0\). Now let \(\tilde{w}=w/\lambda \). Then

Hence \(V_S(w)=w^{1-\rho }v_S\). The argument for \(\rho =1\), i.e., for utility \(u(x)=\log (x)\) is similar.

We can apply the same argument to Problem 2 to show that \(V_B(w)=w^{1-\rho }v_S\). It is now immediate that Problem 1 is equivalent to Problem 3.

Rights and permissions

About this article

Cite this article

Herranz, N., Krasa, S. & Villamil, A.P. Entrepreneurs, legal institutions and firm dynamics. Econ Theory 63, 263–285 (2017). https://doi.org/10.1007/s00199-016-1026-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-1026-8

Keywords

- Entrepreneur

- Legal environment

- Incorporated

- Unincorporated

- Endogenous default

- Bankruptcy

- Commitment

- Insurance

- Firm size

- Risk aversion

- Heterogeneity

- Credit constraints

- Capital structure

- Debt