Abstract

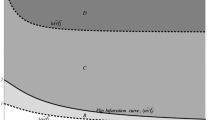

This article tackles the issue of local and global dynamics in a nonlinear duopoly with quantity setting (managerial) firms and horizontal product differentiation. It studies how the dynamics of a two-dimensional discrete time map evolves by focusing on changes either in the degree of product differentiation or the managerial power in the market share bonus. By combining mathematical techniques and numerical experiments, it shows that the Nash equilibrium of the game may not describe the long-term outcomes of the market. This holds because the fixed point of the map may be unstable or because different attractors (simple or chaotic) may capture the long-term dynamics of the model. The article also analyzes market dynamics when a new potential entrant tries to enter or, alternatively, a firm that was already in the market closes down and then tries to re-enter in a context where there is already an incumbent with a strictly positive quantity. The potential entrant may be subject to entry barriers or enters the market depending on the structure of consumers’ preferences and the demands of products of both varieties. In particular, the article analyzes some economic consequences of the non-invertibility of the map in the entry process.

Similar content being viewed by others

Notes

However, it is not uncommon to observe bargaining owners-managers in designing mechanisms of managerial pay (Bebchuk and Fried 2004).

See Fanti et al. (2016) for a critique on this result when the owner bargains the executive pay with his manager.

See Agliari et al. (2006) for a critique of the rational expectations paradigm in economic dynamic models.

A contract that is publicly available implies that firms know the kind of contract agreed upon with the manager as well as the type of manager behavior. In contrast, under private information, there should be problems of signaling and uncertainty related to the available information.

References

Agliari A, Bignami F (2010) Synchronization and on-off intermittency phenomena in a market model with complementary goods and adaptive expectations. Stud Nonlinear Dyn E 14(2):1–15

Agliari A, Chiarella C, Gardini L (2006) A re-evaluation of adaptive expectations in light of global nonlinear dynamic analysis. J Econ Behav Organ 60 (4):526–552

Bebchuk L, Fried J (2004) Pay without performance. The unfulfilled promise of executive compensation. Harvard University Press, Cambridge (MA)

Bebchuk L, Grinstein Y (2005) The growth of executive pay. Oxford Rev Econ Pol 21(2):283–303

Bischi GI, Gardini L (2000) Global properties of symmetric competition models with riddling and blowout phenomena. Discret Dyn Nat Soc 5(2000):149–160

Bischi GI, Gardini L, Mira C (2003) Plane maps with denominator. Part II: noninvertible maps with simple focal points. Int J Bifurcat Chaos 13(8):2253–2277

Bischi GI, Naimzada AK, Sbragia L (2007) Oligopoly games with local monopolistic approximation. J Econ Behav Organ 62(3):371–388

Bischi GI, Stefanini L, Gardini L (1998) Synchronization, intermittency and critical curves in a duopoly game. Math Comput Simulat 44(6):559–585

Cánovas JS, Puu T, Ruíz M (2008) The Cournot–Theocharis problem reconsidered. Chaos Soliton Fract 37(4):1025–1039

Fama EF, Jensen MC (1983) Separation of ownership and control. J Law Econ 26(2):301–325

Fanti L, Gori L, Sodini M (2012) Nonlinear dynamics in a Cournot duopoly with relative profit delegation. Chaos Soliton Fract 45(12):1469–1478

Fanti L, Gori L, Sodini M (2015) Nonlinear dynamics in a Cournot duopoly with isoelastic demand. Math Comput Simulat 108:129–143

Fanti L, Gori L, Sodini M (2016) Managerial delegation theory revisited. Manage Decis Econ, forthcoming

Fanti L, Gori L, Mammana C, Michetti E (2013) The dynamics of a Bertrand duopoly with differentiated products: synchronization, intermittency and global dynamics. Chaos Soliton Fract 52:73–86

Fanti L, Gori L, Mammana C, Michetti E (2014) Local and global dynamics in a duopoly with price competition and market share delegation. Chaos Soliton Fract 69:253–270

Fershtman C (1985) Managerial incentives as a strategic variable in duopolistic environment. Int J Ind Organ 3(2):245–253

Fershtman C, Judd K (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77(5):927–940

Gasmi F, Laffont JJ, Vuong QH (1992) Econometric analysis of collusive behavior in a soft-drink market. J Econ Manage Strat 1(2):277–311

Gori L, Sodini M, Fanti L (2015) A nonlinear Cournot duopoly with advertising. Chaos Soliton Fract 79:178–190

Jansen T, van Lier A, van Witteloostuijn A (2007) A note on strategic delegation: the market share case. Int J Ind Organ 25(3):531–539

Jansen T, van Lier A, van Witteloostuijn A (2009) On the impact of managerial bonus systems on firm profit and market competition: the cases of pure profit, sales, market share and relative profits compared. Manage Decis Econ 30(3):141–153

Miller NH, Pazgal AI (2002) Relative performance as a strategic commitment mechanism. Manage Decis Econ 23(2):51–68

Mira C, Gardini L, Barugola A, Cathala JC (1996) Chaotic dynamics in two-dimensional noninvertible Maps. World Scientific, Singapore

Panchuk A, Puu T (2009) Stability in a non-autonomous iterative system: an application to oligopoly. Comput Math Appl 58(10):2022–2034

Puu T (1991) Chaos in duopoly pricing. Chaos Soliton Fract 1(6):573–581

Ritz RA (2008) Strategic incentives for market share. Int J Ind Organ 26 (2):586–597

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Sklivas SD (1987) The strategic choice of managerial incentives. RAND J Econ 18(3):452–458

Vickers J (1985) Delegation and the theory of the firm. Econ J 95:138–147

Acknowledgments

The authors gratefully acknowledge two anonymous reviewers for valuable comments and suggestions on an earlier draft. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Gori, L., Pecora, N. & Sodini, M. Market share delegation in a nonlinear duopoly with quantity competition: the role of dynamic entry barriers. J Evol Econ 27, 905–931 (2017). https://doi.org/10.1007/s00191-017-0503-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-017-0503-y