Abstract

The history of a number of industries is marked by a succession of eras, associated with different dominant technologies. Within any era, industry concentration tends to grow. Particular eras are broken by the introduction of a new technology which, while initially inferior to the established one in the prominent uses, has the potential to become competitive. In many case new entrants survive and grow, and the large established firms do not make the transition. In other cases, the established firms are able to switch over effectively, and compete in the new era. This paper explores a model which generates this pattern and has focused on the characteristics of the demand. We argue that the ability of the new firms exploring the new technology to survive long enough to get that technology effectively launched depends on the existence of fringe markets which the old technology does not serve well, or experimental users, or both. Established firms initially have little incentive to adopt the new technology, which initially is inferior to the technology they have mastered. New firms generally cannot survive in head-to-head conflict with established firms on the market well served by the latter. The new firms need to find a market that keeps them alive long enough so that they can develop the new technology to a point where it is competitive on the main market. Niche markets, or experimental users, can provide that space.

Similar content being viewed by others

Notes

These subgroups can be interpreted as collections of consumers having similar preferences or even as individual consumers

References

Abernathy WJ, Utterrback JM (1978) Patterns of industrial innovation. Technol Rev 80:41–47

Adner R (2003) When are technologies disruptive: a demand-based view of the emergence of competition. Strateg Manage J 23(8):667–668

Adner R, Levinthal D (2001) Demand heterogeneity and technological evolution: implications for product and process innovation. Manage Sci 47:611–628

Christensen LM (1997) The innovator's dilemma: when new technologies cause great firms to fail. Harvard Business School Press, Boston, MA

Christensen CM, Rosenbloom R (1995) Explaining the attacker’s advantage: technological paradigms, organizational dynamics, and the value of network. Res Policy 24:233–257

Dalle J-M (1997) Heterogeneity vs. externalities in technological competition: a tale of possible technological landscapes. J Evol Econ 7:395–413

Dawid H (2004) Agent based models of innovation and technological change, Chapter 15 In: Tesfatsion L, Judd K (eds) Handbook of computational economics II: agent-based computational economics, in press

Dawid H, Reimann M (2005) Diversification: a road to inefficiency in product innovations?, Working paper (revised version), University of Bielefeld

Dosi G, Marengo L (1993) Some elements of an evolutionary theory of organizational competence. In: England RW (ed) Evolutionary concepts on contemporary economics. University of Michigan Press, Ann Arbor

Henderson R, Clark KB (1990) Architectural innovation: the riconfiguration of existing product technologies and the failure of established firms. Adm Sci Q 35:9–30

Klepper S (1996) Entry, exit, growth, and innovation over the product life cycle. Am Econ Rev 86:562–583

Langlois R, Steinmueller E (1999) The evolution of competitive advantage in the worldwide semiconductor industry. In: Mowery D, Nelson R (eds) Sources of industrial leadership. Cambridge University Press, Cambridge, UK

Malerba F (1985) The semiconductor business. University of Wisconsin press-F. Pinter, London

Malerba F, Orsenigo L (2002) Innovation and market structure in the dynamics of the pharmaceutical industry and biotechnology: Towards a history friendly model. Ind Corp Change 11(4): 667–703

Malerba F, Nelson R, Orsenigo L, Winter S (1999) History friendly models of industry evolution: the case of computer industry. Ind Corp Change 8(1):3–40

McKnight LW, Bailey JP (eds) (1998) Internet Economics. MIT, Cambridge, MA

Metcalfe JS, Andrew J (2005) Emergent innovation systems and the delivery of clinical services: the case of intra-ocular lenses. Res Policy 43:1283–1304

Nelson R (1994) The coevolution of technology, industrial structure and supporting institutions. Ind Corp Change 3(1):47–64

Nelson R, Winter S (1982) An evolutionary theory of economic change. Belknapp, Cambrige, MA

Prencipe A (2000) Breadth and depth of technological capabilities in complex product systems: the case of the aircraft engine control system. Res Policy 29(7):895–911

Saviotti PP (1996) Technological evolution, variety and the economy. Edward Elgar, Cheltenham

Sutton J (1991) Sunk costs and market structure. Cambridge, MIT.

Sutton J (1998) Technology and market structure. Cambridge, MIT

Shy O (1996) Technology revolutions in the presence of network externalities. Int J Ind Organ 14:785–800

Teece et al (1992) The dynamic capabilities of firms. Industrial and corporate change. Volume 3

Teece DJ, Pisano G, Shuen A (1994) Dynamic capabilities and strategic management. Working paper center for research in management. Berkeley.

Tushman ML, Anderson P (1986) Technological discontinuities and organizational environments. Adm Sci Q 31:439–465

Von Hippel E (1988) The sources of innovation. Oxford University Press, New York

Windrum P, Birchenhall C (1998) Is product life-cycle theory a special case? Dominant designs and the emergence of market niches through coevolutionary learning. Struc Chang Econ Dyn 9:109–134

Windrum P, Birchenhall C (2005) Structural change in the presence of network externalities: a co-evolutionary model of technological successions. J Evol Econ 15:123–148

Winter S (1987) Knowledge and competences as strategic assets. In: Teece D (ed) The competitive challenge. Ballinger, Cambridge

Acknowledgements

Alessandro Politano has given a significant contribution to the development of the simulations of this paper. Nicoletta Corrocher, Roberto Fontana, Andrea Prencipe and Ed Steinmueller have provided relevant suggestions on empirical comparisons. We whish to thank also an anonymous referee who provided important and useful criticism and comments. The Bocconi University Basic Research Program and the PRIN Program of the Italian Minister of University and Research (MIUR) have provided financial support.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 The model

1.1.1 Firm capabilities: directions in attribute space

The basic firm-specific characteristics in the model are the fractions θ 1, θ 2 of R&D expenditures that are devoted to improving the two product attributes. These are determined for each firm at the start of each run by a draw on the uniform distribution. With total R&D expenditure at t equal to R, the R&D devoted to the improvement of attribute i is R it = θ i R t .

Here, i = 2 denotes performance and i = 1 denotes cheapness.

1.1.2 Firm capabilities: movement along trajectories

Capability trajectories for all firms begin at the attribute point Z = (Z 1, Z 2). For each attribute, the design improvement produced in a single period is an increasing function of R-D devoted to that attribute and the remaining distance, L i − X i , to the maximum value, L i , of that attribute. Specifically,

1.1.3 Firms’ finance, R-D and pricing decisions

New firms starting at point Z have a loan that gets them started. Absent other sources of funds, firms spend a constant fraction of their loan on R-D in each period, so long as there are remaining funds, or revenues from sales, begin to come in. If the funds are exhausted before a marketable design is achieved, firms exit.

If and when a marketable design is achieved before the initial loan is all spent, gross profits become positive. Gross profits are defined as revenues from sales minus the costs of production.

M is the number of units sold, p is their price, and k is unit production cost. A fraction, φ, of this profit is returned to investors each period until the loan is paid off. R&D expenditures are financed out of the remainder.

Production costs, k t , are the inverse of the cheapness attribute of the firm’s current capability. Price is obtained by adding a mark-up, μ, to costs:

The mark-up, μ, is initially set equal for all firms, but subsequently it varies over time as a function of the market share that has been achieved. Specifically:

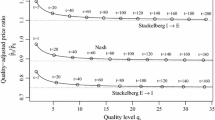

where η is a notional elasticity of demand (equal to 2 in the first market and to 4 in the new market) and m i is the firm’s market share. Thus the mark-up is constant when it is equal to the value appropriate to a firm with market share m in an asymmetric Cournot equilibrium.

R&D expenditures, R, are determined as follows:

The excess gross profits after debt repayment and R-D expenditures, is invested in an account, Bt, that yields the interest rate, r, in each period.

1.1.4 Demand

The overall market consists of a large number of “submarkets,” the number being a parameter of the model. A submarket buys from at most one supplier in each period. If a purchase is made, the number of units purchased equals the merit of design, M, of the product offered by that supplier. For a product with cheapness X 1 = 1/p and performance X 2, the merit of design is given by:

where b 0 is a scale parameter, and X 1min and X 2min are the threshold levels for cheapness and performance. If there is more than one computer that meets threshold demand requirements, that has M greater than zero, the probability that customers in a submarket will buy from a particular supplier is positively related to the merit of that supplier’s design, and to the suppliers overall market share. Specifically:

where c 0 is specified so that the sum of the probabilities adds to one. M denotes the “merit” of a product. “m” is the market share in terms of the fraction of total sales revenues accounted for by that product. The constant “d1” assures that new firms entering the market have a positive probability of making a sale.

In the initial runs, there is a class of customers, who have the same preferences. In the runs that explore what happens after new basic technology becomes available, two additional classes of customers are added to the model. First, there is a group of experimental users. Experimental users are represented by a fraction of the submarkets, determined by a model parameter. Second, there are potential new users, who have very different preferences than the users that had been served previously. In particular, they value cheapness greatly, and place less value on performance.

1.1.5 Long run convergence

If and when the computers using the new component technology achieve threshold levels of merit for the old customers, those computers enter the set being scanned by those submarkets. If those new computers achieve levels of merit exceeding those of the old computers, they can take over the old market as well as the new.

1.1.6 Adoption of new component technologies

Adoption of the new technology takes place in two steps. First, a firm must perceive the new technology. Perception is a stochastic process that depends on the current technological position of the potential adopter in relation to the technological frontier in the old technology and on the progress realized by the new technology:

where Prperc is the probability of perceiving the new technology, zi j is fraction of the old technological frontier covered by firm i and z h is the fraction of the new technology frontier covered by the best-practice new generation’s firms. The parameter λ measures the general difficulty of perceiving the new technology.

Once firms have perceived the possibility of adoption, they have to invest in order to acquire the new technology. Adoption costs (C ad) entail a fixed cost, F ad, equal for all firms, and the payment of a fraction q of firms’ accumulated budget, linked to factors like the training of engineers and the like. Thus,

Firms whose budget does not cover the fixed costs or whose profit rate is negative cannot adopt the new technology.

1.1.7 Exit

Firms exit the market when their budget becomes negative (because current profits are insufficient to pay back the due fraction of the outstanding debt) and/or when their rate of profit becomes negative and it has been falling faster than a given rate (a parameter of the model) over the past four periods.

Specifically, the rate of profit is defined as:

where \( \overline{\pi } _{{i,t}} \) is the profit rate of firm i at time t, B i,t is the budget of firm i at time t, Debt i,t is the debt of firm i at time t, B 0 is the initial budget, r = 0.025 is the one period interest rate and t b is the birth time of firm i.

Let us then define a weighted change of the rate of profit as

where w = 0.25 is a parameter

Firms then exit the market when

VRP = −0.03 is parameter

Firms exit also when their budget or their R&D expenditures becomes too small. In particular:

Appendix 2

We provide here a complete list of the notation used in the model:

Indices:

-

i index for firms,

-

t index for time periods,

General model parameters

-

T = 150 time horizon

-

T MP = 30 time of introduction of new microprocessor technology

-

T fTR = 0 birth period of first generation firms with transistor technology

-

T fMP = 35 birth period of second generation firms with microprocessor technology

Exogenous industry characteristics

-

F TR = 6 number of first generation firms with transistor technology

-

F MP = 20 number of second generation firms with microprocessor technology

-

r = 0.025 one period interest rate

-

b 0 = 0.02 gives a scale for the utility function

-

b1MF = 0.3, b1PC = 1.15 exponent of cheapness in the utility function

-

b2MF = 1.1, b2PC = 0.35 exponent of performance in the utility function

-

c1MF = 2, c1PC = 2 exponent of utility in the probability of selling function

-

c2MF = 2, c2PC = 0.1 exponent of share in the probability of selling function

-

η PC = 4 , çMF = 2 elasticity of demand

-

Lc TR = 2,000, LcMP = 9,000 limit of cheapness for technology

-

Lp TR = 8,000, Lp MP = 9,000 limit of performance for technology

-

Tc MF = 400, Tc PC = 2,000 minimum value of cheapness for entering the market

-

Tp MF = 4,000, Tp PC = 500 minimum value of performance for entering the market

-

submMF = 100 number of submarkets that create the mainframe market

-

submPC = 100 number of submarkets that create the PC market

Endogenous industry characteristic

-

LeaderPC t leader in PC market at time t

-

LeaderMF t leader in MF market at time t

Exogenous firm characteristics

-

μ 0 = 0.1 initial mark-up of firms

-

ϕ = 0.1 fraction of profits invested in R&D

-

B = 9 initial budget given to first generation firms

-

Br % = 0.45 initial budget reduction factor for second generation firms

-

σ = 0.15 fraction of profit used for debt pay back

-

a1 = 1 exponent of distance from corner in design change function

-

a2 = 0.65 exponent of R&D expenditure in design change function

-

u = 1 exponent of the distance from corner in the function that defines probability of adoption

-

v = 1 exponent of distance of the best-practice new generation’s firm in the function that defines probability of adoption

-

λ = 15 exponent that measures the general difficulty of perceiving the new technology

-

q = 0.6 cost of adoption in terms of budget fraction

-

F ad = 2.5 fixed cost of adoption

Endogenous firm characteristics:

-

M i,t merit of design of a computer produced by firm i at time t

-

X c i,t value of cheapness of computer i at time t

-

X p i,t value of performance of computer i at time t

-

m i,t market share of firm i at time t

-

p i,t price of a mainframe/PC produced by firm i at time t

-

μ i,t mark-up of firm i at time t

-

π i,t profits of firm i at time t

-

R i,t R&D spending of firm i at time t

Appendix 3: Sensitivity and robustness analysis

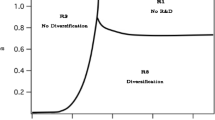

Following Dawid (2004) and Dawid and Reimann (2005), we carried out sensitivity and robustness analysis on the model by generating 100 different profiles of the basic model parameters, except those that are at the centre of our analysis, i.e. the bandwagon (c 1 in Eq. 7) and design sensitivity (c 2.in Eq. 7). The profiles were generated randomly, where each parameter was drawn from a uniform distribution bounded by a conceptually plausible range. Each particular setting for our control parameters was run over all 100 profiles and the results obtained were averaged over these runs. As an additional robustness check we repeated the procedure with another 100 random profiles in the same manner and tested several of our qualitative insights obtained with the initial set of profiles. In all these cases our findings were confirmed by such a check. Summarizing, all the results were found to be very robust under the settings we discussed above, namely 100 distinctly different runs, with profiles based on parameter ranges that were determined by plausibility checks beforehand. (Table 1).

Table 2 reports the essential statistics for the main variables of interest in each of the simulation runs presented in the paper.

Rights and permissions

About this article

Cite this article

Malerba, F., Nelson, R., Orsenigo, L. et al. Demand, innovation, and the dynamics of market structure: The role of experimental users and diverse preferences. J Evol Econ 17, 371–399 (2007). https://doi.org/10.1007/s00191-007-0060-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-007-0060-x