Abstract

Recent reforms to social security in many countries have sought to delay retirement. Given the family context in which retirement decisions are made, social security reforms have potentially important spillover effects on the labour force participation of spouses. This paper analyses two complementary Australian natural experiments: (i) the 1993 Age Pension reform that increased the eligibility age for social security benefits for women and (ii) the Vietnam veterans pension and compensation schemes, whereby eligibility was conditional on conscription lotteries. We find important within-family spillover effects that are symmetric by gender and independent of whether pension coverage is expanded or withdrawn. Taking account of such within-family spillover effects is important for understanding the behavioural effects of pension programs and for reform impacts on social welfare.

Similar content being viewed by others

Notes

For detailed information on the Australian pension system, see Barrett and Tseng (2008).

Recipients may receive subsidies for health care, pharmaceuticals, public transport, utilities and private rental assistance plus a supplement to compensate for the introduction of the national good and service tax in 2000.

Note that all couples face income test based on family income.

Benefit levels, and the means test thresholds, are adjusted every 6 months in line with changes in the consumer price index or average (ordinary time) male earnings—whichever is greater.

These calculations assume a discount rate of 3% and known lifetime of T= 90 years.

The disability pension (special rate) payment rate is approximately twice the value of the service pension. A recipient of the disability pension (special rate) is eligible also to receive the service pension (invalidity), which has a payment rate equal to the civilian age pension.

‘Married’ includes couples who are either legally married or in a ‘de facto’ (or common law) relationship. In Australia, de facto relationships have comparable legal protections and obligations as legal marriage.

There are no comparable data for the birth cohorts examined prior to 1994. Also, the ABS did not release IHCS for the fiscal years 1998/99, 2001/02, 2004/05 and 2006/07.

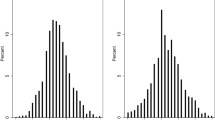

This distribution is consistent with Australian birth registry data. Administrative payment record data confirms that the incidence of age pension receipt is uniform across month of birth.

In the analysis, we have used all available cross sections of the ABS IHCS program, which began with the 1994/95 collection. There are no comparable data for the birth cohorts examined prior to 1993. We are also constrained by the fact that our current data from the IHCS program do not contain any pre-age 60 observations for the ‘before’ (Pre-July 1935) birth cohort.

We obtain very similar results using the probit estimator.

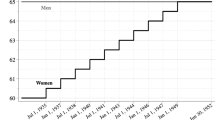

Five affected birth cohorts are identified: \(AC_{1}^{\ast }\) for who the eligibility age is 60.5–61 (those born between 01/07/1935 and 30/6/1938); \( AC_{2}^{\ast }\), for whom the eligibility age is 61.5–62 (those born between 01/07/1938 and 30/06/1941); \(AC_{3}^{\ast }\) for whom the eligibility age is 62.5–63 (those born between 01/07/1941 and 30/06/1944); \(AC_{4}^{\ast }\) for whom the eligibility age is 63.5–64 (those born between 01/07/1944 and 30/06/1947); and \(AC_{5}^{\ast }\) for whom the eligibility age is 64.5–65 (those born after 01/07/1947).

Note that this specification effectively controls for the age difference between spouses as the age of both members of the couple are included.

Our estimated effect of army service on marriage probability at 2006 is + 1.7 percentage points which is statistically significant at the 1% level. We find no evidence that the effect is limited to deployed veterans. Results available on request. See also Siminski and Ville (2012).

For example, the reduced-form effect of draft eligibility on a binary indicator of spouse degree attainment is estimated to be 0.07 percentage points (SE = 0.12 percentage points). In a 2SLS model using our preferred over-identified specification, the effect of deployed service on spouse degree attainment is estimated to be 1.87 percentage points (SE = 1.29 percentage points).

Note that family wealth effects of delayed AP eligibility may impact labour supply (and consumption) profiles beyond the APA threshold hence husbands of women aged 65–69 years are not an ideal control group.

These findings contrast with the results of Stancanelli (2013) who analysed the retirement behaviour of French couples when reaching the statutory pension eligibility age. Stancanelli (2013) found large increases in own probability of retirement when reaching pension eligibility age, though little response when their partner reaches the eligibility age. Stancanelli (2013, p.18) attributes the small cross-retirement effects found for French couples to the strong financial penalty, in terms of forgone pension benefits, when an individual retires prior to their own pension eligibility age. Selin (2017) also found small within-couple cross-responses to an occupational pension affecting a subgroup of female local government workers in Sweden. Selin (2017) findings may be specific to the narrow treatment group targeted by the pension reform.

The first-stage results are essentially the same as those in Siminski (2013), differing only due to our exclusion of the 16th birth cohort, for whom there is no first-stage effect of the ballot outcome.

The effect of non-deployed service can also be estimated directly, by restricting the sample to the youngest three birth cohorts (i.e. the non-deployed cohorts). For these cohorts, the estimated effect of service on spouse employment is positive, but small (2.2 percentage points) and statistically insignificant (standard error of 1.7 percentage points). This supports the conclusion of no effect for non-deployed service.

The labour supply and self-reported health of the treated veterans were found to be unaffected by the reform.

Including the assumption of full benefit receipt, a 3% discount rate and known lifetime of 90 years.

Drawing on Siminski (2013), we assume that 57% of deployed married veterans received DP-SR, from the age of 55, which is the approximate mean age at which DP-SR was granted. The combination of DP-SR and the service pension payments was 3.12 times higher than a regular pension. For the remaining 43% of veterans, SSW was increased only through an earlier eligibility age of 5 years.

We only have a direct estimate of the effect on LFP for wives at one point in time—2006. We assume that the magnitude of this effect was proportional to the effects for veterans during 1998–2009 (Siminski 2013). We do not have estimates for veterans for years after 2009, at which time they were 60–64 years old. An assumption of zero effect beyond 2009 generates the lower bound of 1.5 years. Assuming the effect stays at 2009 levels for 5 further years generates the upper bound of 2.6 years.

For this calculation, we ignore the direct effect of husbands’ service on wife’s own SSW which comes through earlier eligibility for a pension, paid at the same rate as a civilian pension. Whilst this direct effect is substantial (we estimate it to be 44%), it is much smaller than the effect on the husband’s SSW (248%), discussed above. Ignoring this direct effect suggests that our estimated semi-elasticity with respect to husband’s SSW is likely to be biased upwards.

See Appendix B for detailed calculations.

This estimate includes lost earnings between 1996 and 2010 for wives of Vietnam veterans from the 1945–1952 birth cohorts. It assumes that the spouse employment effect in each year is proportional to the veterans’ own employment effects estimated by Siminski (2013). It also assumes that the proportion of veterans who are married is constant in each year at 71% and that counterfactual earnings are equal to female average weekly earnings at each point in time.

References

Angrist JD (1990) Lifetime earnings and the vietnam era draft lottery: evidence from social security administrative records. Am Econ Rev 80:313–336

Angrist JD, Pischke J-S (2009) Mostly harmless econometrics. Princeton University Press, Princeton

Angrist D, Imbens GW, Rubin D (1996) Identification of causal effects using instrumental variables. J Am Stat Assoc 91:444–455

Angrist JD, Chen SH, Frandsen BR (2010) Did Vietnam veterans get sicker in the 1990s? The complicated effects of military service on self-reported health. J Public Econ 94:824–837

Angrist JD, Chen SH, Song J (2011) Long-term consequences of Vietnam-era conscription: new estimates using social security data. Am Econ Rev Pap Proc 101:334–338

Atalay K, Barrett GF (2015) The impact of age pension eligibility age on retirement and program dependence: evidence from an Australian experiment. Rev Econ Stat 97(1):71–87

Autor D, Duggan M, Greenberg K, Lyle DS (2016) The impact of disability benefits on labor supply: evidence from the VA’s disability compensation program. Am Econ J Appl Econ 8(3):31–68

Baker M (2002) The retirement behavior of married couples: evidence from the spouse’s allowance. J Hum Resour 37(1):1–34

Banks J, Blundell R, Rivas MC (2010) The dynamics of retirement behavior in couples: reduced-form evidence from England and the US. Working paper, Department of Economics UCLA

Barrett GF, Tseng Y-P (2008) Retirement saving in Australia. Canadian Public Policy 34(1):177–193

Bloom DE, McKinnon R (2014) The design and implementation of pension systems in developing countries: issues and options. In: Harper S, Hamblin K (eds) International handbook on ageing and public policy. Cheltenham, Edward Elgar

Bound J, Burkhauser RV (1999) Economic analysis of transfer programs targeted on people with disabilities. In: Ashenfelter O, Card D (eds) Handbook of labor economics, vol 3. New Holland, Amsterdam

Boyle MA, Lahey JN (2016) Spousal labor market effects from government health insurance: evidence from a veterans affairs expansion. J Health Econ 45:63–76

Card D, Krueger AB (1992) Does school quality matter? Returns to education and the characteristics of public schools in the United States. J Polit Econ 100(1):1–40

Chen SE (2012) Spousal labor supply responses to government programs: evidence from the Disability Insurance Program. University of Michigan Retirement Research Center, WP 2012–261

Casanova M (2010) Happy together: a structural model of couples’ joint retirement choices. Working paper, Department of Economics UCLA

Coile C (2004) Retirement incentives and couples’ retirement decisions. Topics in Economic Analysis and Policy 4. Article 17

Conley D, Heerwig J (2012) The long-term effects of military conscription on mortality: estimates from the Vietnam era draft lottery. Demography 49:841–855

Cribb J, Emmerson C, Tetlow G (2016) Signals matter: large retirement responses to limited financial incentives. Labour Econ 42(1):203–212

Cullen JB, Gruber J (2010) Does unemployment insurance crowd out spousal labor supply?. J Labor Econ 18(3):546–572

Danzer AM (2013) Benefit generosity and the income effect on labour supply: quasi-experimental evidence. Econ J 123(571):1059–1084

Duggan M, Rosenheck R, Singleton P (2010) Federal policy and the rise in disability enrollment: evidence for the veterans affairs’ disability compensation program. J Law Econ 53(2):379–398

Gruber J, Wise D (2004) Social security programs and retirement around the world: micro-estimation. University of Chicago Press, Chicago

Gustman AL, Steinmeier TL (2000) Retirement in dual career families. J Labor Econ 18(3):503–545

Gustman AL, Steinmeier TL (2004) Social security, pensions and retirement behaviour within the family. J Appl Econ 19:723–737

Hanel B, Riphahn RT (2012) The timing of retirement: new evidence from Swiss female workers. Labour Econ 19(5):718–728

Inoue A, Solon G (2010) Two-sample instrumental variables estimators. Rev Econ Stat 92:557–561

Johnston D, Shields M, Siminski P (2016) Long-term health effects of Vietnam-era military service: a quasi-experiment using Australian conscription lotteries. J Health Econ 45:12–26

Lundberg S (1985) The added worker effect. J Labor Econ 3:11–37

Mastrobuoni G (2009) Labor supply effects of the recent social security benefit cuts: empirical estimates using cohort discontinuities. J Public Econ 93(11-12):1224–1233

OECD (2011) Pensions incentives to retire. In: Pensions at a glance 2011: retirement-income systems in OECD and G20 countries. OECD Publishing

Selin H (2017) What happens to the husband’s retirement decision when the wife’s retirement incentives change?. Int Tax Public Financ 24:432–457

Staubli S, Zweimüller J (2013) Does raising the retirement age increase employment of older workers?. J Public Econ 108:17–32

Siminski P (2013) Employment effects of army service and veterans’ compensation: evidence from the australian Vietnam-era conscription lotteries. Rev Econ Stat 95 (1):87–97

Siminski P, Ville S (2012) I was only nineteen, 45 years ago: what can we learn from Australia’s conscription lotteries?. Econ Rec 88(282):351–371

Siminski P, Ville S (2011) Long-run mortality effects of Vietnam-era army service: evidence from Australia’s conscription lotteries. Am Econ Rev Pap Proc 101 (3):345–349

Stancanelli E (2013) Retiring together or apart: a twofold regression discontinuity study of spouses’ retirement and hours of work outcomes. Mimeo, Paris School of Economics

Stancanelli E (2017) Couples’ retirement under individual pension design: a regression discontinuity study for France. Labour Econ 49:14–26

Vestad OL (2013) Labor supply effects of early retirement provision. Labour Econ 25:98–109

Ville S, Siminski P (2011) A fair and equitable method of recruitment? Conscription by ballot into the Australian army during the Vietnam war. Aust Econ Hist Rev 51(3):277–296

Acknowledgements

Funding from the Australian Research Council is gratefully acknowledged. We thank Junsen Zhang (the editor) and two anonymous referees for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Appendices

Appendix A: Additional summary statistics

With regard to retirement trends, Fig. 2 depicts the labour force participation rates over time for men and women in Australia between the ages of 60 and 69 years. The solid lines for men and women plot aggregate time series data from the Australian Bureau of Statistics Labour Force Survey, and the connected lines plot calculations based on the IHCS data. Our sample of pooled cross sections replicates the aggregate trends. This figure shows that the labour force participation rates of older women in Australia have increased substantially over the last two decades. Since the mid-1980s, the labour force participation rates of men display a similar trend to that of women. An increase in female participation rates occurs for both married and single women. However, this trend does not apply to the participation rates of men. In particular, the participation rates of single men remain fairly constant through the last decade of the observation period, in contrast to the increasing participation rates for married men.

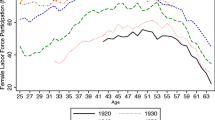

We investigate the direct impact of AP reform on the labour force participation of married women. Figure 3 shows the participation rates by age for selected birth cohorts of married men and women in our sample. For women, each cohort encounters a different pension eligibility age. Figure 3 shows that the labour force participation rates of the more recent cohorts of women are substantially higher than those of the earlier cohorts. Another important trend from this figure is that, contrary to the finding for married women, there are no cohort differences across the married male birth cohorts defined by own birth date.

To investigate differences in the participation rate of married women by birth cohort, we estimate a linear probability model for labour force participation using the specification simillar to paper but with the women labour force as dependent variable. Table 6 reports the sum of the coefficients on the age indicators for each birth cohort for the sample of couples where both are aged 60–64 years. The estimates imply that a hypothetical 1-year increase in the AP eligibility age induced an approximate 22 percentage point increase in married women’s likelihood of labour force participation. The second column of the table uses the same specification for married men, with the cohorts defined by men’s own birth date, to assess differences in participation rates across the male birth cohorts. The results indicate that although married men exhibited time trends that are similar to those of women (as seen in Fig. 3), the effects are smaller and less statistically significant. Even so, the point estimates for cohorts AC3 and AC4 are large. With this more homogenous sample of married men (both partners are aged 60–64 years), there is a high correlation between the age, and birth cohort, of spouses and hence these estimates may partly reflect spill-over effects. A cleaner placebo test is presented in the third column which contains estimates for the same specification based on the sample of single males aged 60–64 years; it is clear that the male cohort effects are highly insignificant.

Appendix B: Aggregate implications

The economic significance of the within-family spillover effects in retirement behaviour may be gauged by considering the aggregate implications of the measured treatment effects. Estimates for the preferred model specification (1), presented in Table 3 are used to predict the labour force participation of married men aged 60–69 years, for a range of scenarios. Figure 4 plots the average predicted probability of labour force participation across the 17 calendar years covered by the sample of pooled cross-sections. The average model prediction closely tracks the raw sample average across the observation period, capturing the strong upward trajectory in the participation rate for this group of men, which increased from 0.30 to 0.49 between 1994 and 2010. The estimated model is then used to predict the probability of labour force participation for the hypothetical scenario that their wife’s APA has remained constant at age 60 years. For this counterfactual, the within-family spillover effects are shut down, with the predictions based on the parameters estimates with the treatment effects turned off. The plot of the average simulated labour force participation rate shows a minor increase (from 0.30 to 0.36) over the observation period. The counterfactual participation rate is a substantial 13.2 percentage points lower than the observed participation rate in 2010. The divergence between the observed and counterfactual participation rate grows over time due to the larger fraction of the sample of men being married to women who received the most intense treatment.

Rights and permissions

About this article

Cite this article

Atalay, K., Barrett, G.F. & Siminski, P. Pension incentives and the joint retirement of couples: evidence from two natural experiments. J Popul Econ 32, 735–767 (2019). https://doi.org/10.1007/s00148-018-0725-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-018-0725-9