Abstract

This paper investigates the relationship between growth and inequality from a demographic point of view. In an extended model of the accidental bequest with endogenous fertility, we analyze the effects of a decrease in old-age mortality rate on the equilibrium growth rate as well as on the income distribution. We show that the relationship between growth and inequality is at first positive and then may be negative in the process of population aging. The results are consistent with the empirical evidence in some developed countries.

Similar content being viewed by others

Notes

In an influential study, Kotlikoff and Summers (1981) estimate that a large fraction of the US capital stock was attributable to intergenerational transfers.

Bowles and Gintis (2002) decompose a correlation between parent income and offspring income, which is estimated to be 0.32, into several causal channels. Wealth accounts for 0.12, which is much higher than schooling (0.07), race (0.07), and IQ (0.04).

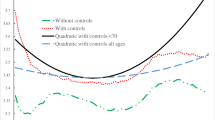

In an endogenous growth model à la Romer (1986), the growth rate of per capital income is related positively to the aggregate saving rate and negatively to the fertility rate. It can be shown below that the fertility rate decreases with population aging, which is well known as the demographic transition in the modern growth regime (Galor and Weil 1998, 2000). Combining the saving effect and the fertility effect, we can derive a hump-shaped pattern of the growth rate.

See, for example, Bénabou (1996).

Precisely, the total number of types in period t is equal to t+1, which must be a finite number. Assume that the model economy starts at period 1. Assume also that a fraction (1−p) of individuals who are born at the beginning of period 1 do not receive bequests (type 0), and that the rest of the generation receive some bequests (say, type 1). In the next period, the population share of types 0, 1, and 2 is, respectively, given by 1−p, (1−p)p, and p 2. In the same way, the population share of type i (i=0, 1,...t−1) in period t is (1−p)p i, and that of type t is given by p t. However, the economic impact of type t in period t may be measured zero if t is sufficiently large.

If the assumptions are relaxed, the population distribution becomes complex, since the fertility rate depends on the wealth accumulation. One can incorporate fertility decision into a computational general-equilibrium method, such as Huggett’s (1996) and Huggett and Ventura’s (2000), although it is beyond the scope of the paper.

We assume f′>0, f″<0, f(0)=0, limk→+0 f′(k)=+∞, and limk→∞ f′(k)=0.

Zhang et al. (2003) derives a similar hump-shaped pattern in a Lucas-type endogenous growth model. The reason is that it is the aggregate saving rate that determines the growth rate if the public schooling is not controlled (p. 91).

It is assumed that α 1=0.5, α 2=0.2, v=0.1, η=10, and β=0.05. From Eq. 35, the critical value is β g=0.122.

References

Abel AB (1985) Precautionary saving and accidental bequests. Am Econ Rev 75(4):777–791

Abel AB, Mankiw NG, Summers LH, Zeckhauser RJ (1989) Assessing dynamic efficiency: theory and evidence. Rev Econ Stud 56(1):1–20

Aghion P, Bolton P (1992) Distribution and growth in models of imperfect capital markets. Eur Econ Rev 36(2/3):603–611

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(1):155–173

Atkinson AB (1999) The distribution of income in the UK and OECD countries in the twentieth century. Oxf Rev Econ Policy 15(4):56–75

Banerjee AV, Duflo E (2000) Inequality and growth: what can the data say? NBER Working paper No. 7793

Bénabou R (1996) Inequality and growth. In: Bernanke BS, Rotemberg JJ (eds) NBER macroeconomics annual 1996. MIT Press, Cambridge, 11–74

Bowles S, Gintis H (2002) The inheritance of inequality. J Econ Perspect 16(3):3–30

Castañeda A, Díaz-Giménez J, Ríos-Rull J-V (2003) Accounting for the US earnings and wealth inequality. J Polit Econ 111(4):818–857

Checchi D, García-Peñalosa C (2004) Risk and the distribution of human capital. Econ Lett 82(1):53–61

Cipriani GP (2000) Growth and unintended bequests. Econ Lett 68(1):51–53

Dahan M, Tsiddon D (1998) Demographic transition, income distribution, and economic growth. J Econ Growth 3(1):29–52

De Nardi M (2004) Wealth inequality and intergenerational links. Rev Econ Stud 71(3):743–768

Ehrlich I, Lui FT (1991) Intergenerational trade, longevity, and economic growth. J Polit Econ 99(5):1029–1059

Fuster L (1999) Effects of uncertain lifetime and annuity insurance on capital accumulation and growth. Econ Theory 13(2):429–445

Galor O, Tsiddon D (1997) The distribution of human capital and economic growth. J Econ Growth 2(1):93–124

Galor O, Weil DN (1998) Population, technology, and growth: from the Malthusian regime to the demographic transition. NBER Working paper No. 6811

Galor O, Weil DN (2000) Population, technology, and growth: from Malthusian stagnation to the demographic transition and beyond. Am Econ Rev 90(4):806–828

Galor O, Zang H (1997) Fertility, income distribution, and economic growth: theory and cross-country evidence. Japan World Econ 9(2):197–229

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60(1):35–52

Grossman GM, Yanagawa N (1993) Asset bubbles and endogenous growth. J Monet Econ 31(1):3–19

Hazan M, Berdugo B (2002) Child labour, fertility, and economic growth. Econ J 112(482):810–828

Huggett M (1996) Wealth distribution in life-cycle economies. J Monet Econ 38(3):469–494

Huggett M, Ventura G (2000) Understanding why high income households save more than low income households. J Monet Econ 45(2):361–397

Kalemli-Ozcan S, Ryder HE, Weil DN (2000) Mortality decline, human capital investment, and economic growth. J Dev Econ 62(1):1–23

Kotlikoff LJ, Summers LH (1981) The role of intergenerational transfers in aggregate capital accumulation. Am Econ Rev 89(4):706–732

Lucas RE Jr (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

OECD (1998) Maintaining prosperity in an ageing society. OECD, Paris

Owen AL, Weil DN (1998) Intergenerational earnings mobility, inequality and growth. J Monet Econ 41(1):71–104

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Yakita A (2001) Uncertain lifetime, fertility and social security. J Popul Econ 14(4):635–640

Zhang J, Zhang J (2001a) Longevity and economic growth in a dynastic family model with an annuity market. Econ Lett 72(2):269–277

Zhang J, Zhang J (2001b) Bequest motives, social security, and economic growth. Econ Inq 39(3):453–466

Zhang J, Zhang J, Lee R (2003) Rising longevity, education, savings, and growth. J Dev Econ 70(1):83–101

Acknowledgments

I would like to thank Junsen Zhang, the editor of this journal, and three anonymous referees for their useful suggestions and comments. I am grateful to Frank Cowell, Akira Yakita, Hikaru Ogawa, Makoto Hirazawa, Yuji Nakayama, Akira Momota, Yoshinao Sahashi, and workshop participants at Chukyo University and Osaka Prefecture University for helpful comments on an earlier version of the paper. The hospitality at STICERD, LSE is gratefully acknowledged. The research is supported by grants from the Japan Society for the Promotion of Science (No. 13630023) and the Pache Research Subsidy I-A-2 (Nanzan University, 2006). All errors are the author’s.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Appendix

Appendix

Proof of Proposition 2

Differentiating Eq. 32 with respect to p, we have

We know

Since the numerator of \(d\widehat{s}/dp\) is a quadratic function of p with a positive coefficient of the quadratic term, the saving rate has an interior maximum if and only if \(d\widehat{s}/dp\left| {_{{p = 0}} } \right. > 0\), that is,

Proof of Proposition 3

From Eq. 33, we know

where

Note that G(0) > 0, which contrasts with Fuster (1999) and Cipriani (2000). First, we show that the growth rate is concave with respect to p, that is, G′′ < 0. Then, we show that G′(0) > 0 is equivalent to Eq. 35. Since G(1) = 0 and G(0) > 0, g has an interior maximum if and only if the condition (Eq. 35) is satisfied because of the concavity.

We know

and

First, we have

which implies that G is concave.

Second, we have

Thus, ϕ′(0) > 0 is equivalent to Eq. 35.

Proof of Proposition 4

From Eq. 36, we have γ = (1−p)f 1(p)f 2(p), where

First, we have γ(0) = γ(1) = 0.

Second, we have f 1′ > 0, f 1″ < 0, f 2′ < 0, and f 2″ < 0 for p∈[0, 1], and

Since γ(p) is continuous in [0,1] and γ(p) > 0 for ∀p∈(0, 1), there exists at least one solution p*∈(0, 1), such that it maximizes γ . The necessary condition, γ′(p*) = 0, requires

which implies γ″(p*) < 0. Therefore, we know that γ does not have any local minimums in (0,1). It proves the uniqueness of p*.

Rights and permissions

About this article

Cite this article

Miyazawa, K. Growth and inequality: a demographic explanation. J Popul Econ 19, 559–578 (2006). https://doi.org/10.1007/s00148-005-0047-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-005-0047-6