Abstract

Cumulative emissions drive peak global warming and determine the carbon budget needed to keep temperature below 2 or 1.5 °C. This safe carbon budget is low if uncertainty about the transient climate response is high and risk tolerance (willingness to accept risk of overshooting the temperature target) is low. Together with energy costs, this budget determines the optimal carbon price and how quickly fossil fuel is abated and replaced by renewable energy. This price is the sum of the present discounted value of all future losses in aggregate production due to emitting one ton of carbon today plus the cost of peak warming that rises over time to reflect the increasing scarcity of carbon as temperature approaches its upper limit. If policy makers ignore production losses, the carbon price rises more rapidly. If they ignore the peak temperature constraint, the carbon price rises less rapidly. The alternative of adjusting damages upwards to factor in the peak warming constraint leads initially to a higher carbon price which rises less rapidly.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many economic studies derive optimal climate policies from maximizing social welfare subject to the constraints of an integrated assessment model that combines both a model of the global economy and a model of the carbon cycle and temperature dynamics (e.g., Nordhaus 1991, 2010, 2014; Golosov et al. 2014; Dietz and Stern 2015; van den Bijgaart et al. 2016; Rezai and van der Ploeg 2016). The resulting optimal carbon price is (approximately) proportional to world GDP if global warming causes damages that are proportional to world GDP. The factor of proportionality depends on ethical considerations such as intergenerational inequality aversion (the lack of willingness to sacrifice consumption today to curb global warming many decades into the future) and the amount by which welfare of future generations is discounted (impatience). This factor also depends on the carbon cycle and heat exchange dynamics (the fraction of carbon emissions that stays up permanently, the rate at which the remaining parts of the carbon stock return to the surface of the earth, temperature inertia, etc.).

The Paris Climate Agreement within the United Nations Framework Convention on Climate Policy (COP21) signed in April 2016 commits to keep global warming well below 2 °C this century and pursues efforts to limit temperature to 1.5 °C. This has the merit of focusing at a clear and easy-to-communicate target for peak global warming. Since climate change is subject to large degrees of uncertainty, one specifies a probability of say 2/3 that this target must be met which corresponds to a risk tolerance of 1/3. Since cumulative carbon emissions drive peak global warming, the target for peak global warming determines how much carbon can be emitted in total. This is called the safe carbon budget and depends on three key parameters only: maximum permissible global warming, climate uncertainty, and risk tolerance. The path-breaking study by Fitzpatrick and Kelley (2017) also investigates the optimal climate policy under uncertainty with a probabilistic temperature target. I exploit that peak global warming is approximately driven by cumulative carbon emissions. The policy problem can then be separated into two parts: first, determine the safe carbon budget for cumulative emissions and fossil fuel use, and, then, work out how this budget for fossil fuel use is optimally allocated over time taking due account of production losses resulting from global warming. The resulting recommendations are straightforward to communicate to policy makers, and by splitting them in two parts, it helps countries to agree on the required international climate policy.

My main aim is to show the drivers of the optimal time path for the carbon price which ensures that cumulative emissions from now on stay within the safe carbon budget. This carbon price and the time paths for mitigation and abatement are derived from an integrated assessment model and consists of two components: (1) the present discounted value of all future production losses from emitting one ton of carbon today, called the social cost of carbon SCC, which rises at the same rate as world GDP,Footnote 1 and (2) the cost of staying forever within the safe carbon budget which rises at the real interest rate to reflect the increasing scarcity of carbon as its budget gets closer to exhaustion, called the cost of peak warming CPW. Together, these two costs determine the full SCC. The optimal climate policy sets the carbon price, either via a carbon tax or an emissions market, to the full SCC. One can thus determine how fast fossil fuel is phased out and renewable energies are phased in and how much of fossil fuel is abated. Using the safe carbon budget means that ethically loaded concepts such as how much to discount welfare of future generations and the willingness to sacrifice consumption today to curb global warming play no role in determining the safe budget, but do affect the timing of the energy transition and how much of fossil fuel is abated. The estimated damages from global warming that have been used to calculate optimal carbon prices are low and typically lead to peak warming below 2 °C. One reason is that such estimates ignore the damages that occur from the risk of tipping points at higher temperatures.

I differ from existing studies on temperature constraints in taking cumulative emissions, peak warming, and the safe carbon budget rather than an explicit temperature constraint as driver of climate policy. This is why the CPW rises at a rate equal to the real interest rate, not the real interest rate plus the rate of decay of atmospheric carbon as in Nordhaus (1982), Tol (2013), and Bauer et al. (2015). Lemoine and Rudik (2017) ignore the SCC and find that temperature inertia leads to an inverse U-shape of the CPW which grows more slowly than exponentially and temporarily overshoots. However, recent results in climate science (e.g., Matthews et al. 2009; Ricke and Caldeira 2014) suggest that temperature inertia is much less than Lemoine and Rudik (2017) assume in which case their rationale for an inverse U-shape of the time path for the CPW disappears and the CPW has to be much higher as in the IPCC Fifth Assessment global mitigation cost scenarios (Clarke et al. 2014). My analysis is closest to Dietz and Venmans (2017) who also find that the optimal price of carbon consists of the SCC plus the CPW.Footnote 2

My other aim is to put forward these results in the simplest possible integrated assessment framework where cumulative emissions drive peak warming. I simplify by abstracting from non-CO2 carbon gases for which the transient climate response to cumulative emissions is not valid, other climate uncertainties, detailed marginal abatement costs, endogenous technology and sectoral transformation strategies, and more convex damage functions. My aim is not to come up with the best numbers for climate policy as this is better left for the much more detailed integrated assessment models (IAMs) (e.g., Clarke et al. 2014). The climate policy/science literature has already addressed the need to tighten climate policy in the light of the 1.5 °C target (e.g., Kriegler et al. 2014; Tahvoni et al. 2015; Rogelj et al. 2015, 2016), the FEEM Limits Project, the 2016 SSP data base on shared socioeconomic pathways, comparison exercises reported in IPCC studies (Clarke et al. 2014), and studies that deal with carbon prices consisting of the CPW only (e.g., Bauer et al. 2015). My analysis is complementary and more modest in that it builds a bridge between the economics literature based on production damages and the climate policy/science literature on temperature constraints. Overshooting a peak warming target bears an unacceptable risk of irreversible tipping points and the CPW of avoiding this must be added to the usual SCC.

2 Paris COP21 target for peak global warming and the safe carbon budget

The key driver of peak global warming measured as deviation from pre-industrial temperature, PGW, is cumulative carbon emissions, E (e.g., Allen et al., 2009,b; Matthews et al. 2009; Gillett et al. 2013; IPCC 2013; Allen 2016), which are measured here from 2015 onwards and, thus, do not contain historical emissions. Cumulative emissions ignore the slow removal of part of atmospheric carbon to oceans and the surface of the earth and, thus, underestimate peak global warming, but only by a small amount (see Appendix A1). Denoting the transient climate response to cumulative emissions by TCRE, a linear reduced-form relationship is:

where α is a constant, \( \overline{TCRE} \) is the mean of TCRE,ε is a lognormally distributed shock to the TCRE with mean set to μ = − 0.5σ2 so E[ε] = 1. The mean of TCRE is thus \( \overline{TCRE} \) and its standard deviation is \( \overline{TCRE}\sqrt{\exp \left({\sigma}^2\right)-1}. \) This is a stochastic extension of the relationship used in Allen (2016), which allows for uncertainty in the TCRE and abstracts from additive uncertainty in PGW. The lognormal distribution has the advantage of analytical convenience and ensures that the TCRE is always positive. Uncertainty in the TCRE may follow from a more complicated stochastic process with dynamics and non-normal features such as skewedness and fat tails or result from a number of underlying shocks to the climate system, but (1) keeps it simple. Paris COP21 has agreed to keep PGW below 2 °C (and to aim for 1.5 °C). I assume that this target has to be met with probability 0 < β < 1:

IPCC typically sets β to 2/3. The safe carbon budget compatible with (2) is deduced from (1) and denoted by \( \overline{E} \). Cumulative emissions at any time t cannot exceed the safe carbon budget:

where F(.; μ, σ2) is the cumulative normal density function with mean μ and variance σ2. Equation (3) indicates that a more ambitious target for peak global warming, say 1.5 °C instead of 2 °C, a higher expected TCRE, or a lower risk tolerance 1 − β, implies that less carbon can be burnt and more fossil fuel must be locked up in the earth. More uncertainty about the TCRE (higher σ2) also cuts maximum tolerated emissions and the safe carbon budget.

Without uncertainty, a safe carbon budget of \( \overline{E}=\left(2-\alpha \right)/\overline{TCRE}=362 \) GtC or 1327 GtCO2 is compatible with PGW of 2 °C given values of α = 1.276 °C and TCRE = 2 °C per trillions ton of carbon (cf. Allen 2016; van der Ploeg and Rezai 2017) if uncertainty is ignored. McGlade and Ekins (2015) suggest that the carbon embodied in reserves and probable reserves (resources) is 3 to 10–11 times higher than the carbon budget compatible with peak temperatures of 2 °C. They calculate that 80% of global coal reserves, half of global gas reserves, and a third of global oil reserves must be left unburnt. In practice, much more needs to be abandoned as many oil and gas reserves are owned by states instead of private companies. Not only carbon assets will be stranded but also energy-intensive irreversible investments in say coal-fired electricity generation. A more ambitious PGW target of 1.5 °C as stated in the Paris COP21 agreement requires tightening the safe carbon budget to 411 GtCO2 if uncertainty is ignored. At current global yearly uses of oil, coal, and gas, this implies the end of the fossil fuel era in one decade instead of four decades.

Equation (3) indicates that climate risk implies a lower safe carbon budget and more stranded assets, especially if risk tolerance is limited. To assess the magnitude of this effect numerically, estimates of the mean and standard deviation of the TCRE are needed. Allen et al. (2009, b) report a 5–95% probability range of the TCRE of 1.4–2.5 °C per TtC. We calibrate to a slightly wider range of 1.2–3.3 °C per TtC, so get mean and standard deviation of the TCRE of 2 and 0.508 °C per TtC, respectively, with σ = 0.25. IPCC (2013) also reports lower figures for the 5–95% probability range of the TCRE 1.0–2.1 °C per TtC from Matthews et al. (2009) and 0.7–2.0 °C per TtC from Gillett et al. (2013). Again, taking a slightly wider range of 0.8–2.6 °C per TtC, we get mean and standard deviation for TCRE of 1.45 and 0.445 °C per TtC, respectively, and σ = 0.3.

Table 1 reports the safe carbon budget for these two calibrations, peak global warming targets of both 2 and 1.5 °C, and a range of risk tolerance values. The qualitative results are the same for the two calibrations of the TCRE, but the one based on Matthews et al. (2009) and Gillett et al. (2013) yields higher safe carbon budgets due to the lower mean value of the TCRE (despite the slightly higher standard deviation). Below, I focus on the calibration of Allen et al. (2009, b).

Focusing at a PGW target of 2 °C, Table 1 indicates that a risk tolerance of 1/3 (in line with the value reported by the IPCC) gives a safe carbon budget from 2015 onwards of 1228 GtCO2. Tightening up, risk tolerance to 10 and 1% curbs the safe carbon budget to 994 GtCO2 and 766 GtCO2, respectively. Less risk tolerance thus implies that less carbon can be burnt in total. If PGW has to be kept below 1.5 °C, the safe carbon budget drops dramatically from 1228 GtCO2 to 381 GtCO2 if risk tolerance is a third and from 766 GtCO2 to a mere 238 GtCO2 if the risk tolerance is 1%.

3 Optimal energy transition given the safe carbon budget

What is the optimal timing of fossil fuel use and carbon emissions, the mitigation and abatement rates, and when is the end of the fossil fuel era? These depend crucially on the costs of fossil fuel versus those of renewable energy, the cost of abatement, and the various rates of technical progress. It is thus not surprising that the IPCC and climate scientists stress a tight target for PGW with reference to geo-physical conditions and risk. I augment a simple IAM (van der Ploeg and Rezai 2017) with the safe carbon budget constraint (3). This model has constant trend growth in world GDP, g, and constant rates of technological progress in fossil fuel extraction, mitigation of energy (which leads to a gradually rising share of renewable energy), and abatement. It models a permanent and a transitory component of the stock of atmospheric carbon (Golosov et al. 2014) and a lag between temperature and increases in atmospheric carbon concentration (Appendix A1).

Maximizing global welfare subject to the constraint that income net of damages must equal spending on consumption, energy generation, mitigation, and abatement yields the SCC, which corresponds to the unconstrained optimal carbon price. Calculation of the SCC requires additional climate parameters, i.e., the fraction of carbon emissions staying up in the atmosphere forever, β0, the rate of return of remaining emissions to the surface of the earth and oceans, β1, and the mean lag between the temperature rise following an increase in atmospheric carbon, Tlag, and for the ethical considerations, i.e., the rate at which welfare of future generations is discounted, RTI, and intergenerational inequality aversion, IIA. It can be shown that the SCC or unconstrained optimal carbon price is then proportional to world GDP (see Appendix A2)Footnote 3:

where WGDP t denotes world GDP at time t, SDR ≡ RTI + (IIA − 1) × g > 0 is the growth-corrected social discount rate, and d > 0 is the damage coefficient defined as the fraction of world GDP (measured in trillion US dollars) that is lost per trillion ton of carbon in the atmosphere. The damage coefficient d is adjusted to allow for the delayed impact of the carbon stock on global mean temperature (see Appendix A2). The SCC is thus high and climate policy ambitious if a large part of emissions stay up forever (high β0), the absorption rate of the oceans is low (low β1), the temperature lag is small (low Tlag), welfare of future generations is discounted less heavily (low RTI), and there is more willingness to sacrifice current consumption to curb future global warming (low IIA). Higher economic growth (high g) implies that future generations are richer, so current generations are less prepared to curb global warming (especially if IIA is high), but also implies that damages from global warming rise faster, and thus, a higher carbon price is warranted. The net effect of economic growth on the SCC (4) is negative if IIA > 1.

Maximizing welfare subject to the additional constraint that cumulative carbon emissions cannot exceed the safe carbon budget yields the full social cost of carbon, SCC + CPW, which corresponds in a market economy to the constrained optimal carbon price, P t . If the safe carbon budget constraint (3) bites, this price is given by (see (A17b) in Appendix A2):

where the constant Δ> 0 follows from the constraint \( {E}_{\overline{t}}={\int}_0^{\overline{t}}\left(1-{a}_t\right)\left(1-{m}_t\right){\gamma}_0{e}^{-{r}_{\gamma }t}{WGDP}_t=\overline{E}. \)Here, m(t) is the mitigation rate (the share of renewables in total energy) at time t, a(t) is the abatement rate at time t, \( {\gamma}_0{e}^{-{r}_{\gamma }t} \) is energy use as fraction of world GDP at time t, and \( \overline{t} \) is the date of the end of the fossil fuel era.

The constrained optimal carbon price (5) consists of two terms: (i) the SCC or τU × WGDP t which grows at the same rate as world GDP familiar from the literature on simple rules for the optimal unconstrained carbon price (cf. Golosov et al. 2014; van den Bijgaart et al. 2016; Rezai and van der Ploeg 2016); and (ii) the CPW or ΔeSDR × t × WGDP t which grows at the rate of the real interest rate, i.e., SDR + g = RTI + IIA × g > 0. If policy makers ignore production damages from global warming (cf. Nordhaus 1982; Tol 2013; Bauer et al. 2015; Lemoine and Rudik 2017), the constrained optimal carbon price boils down to the CPW:

where RTI + IIA × g > 0 is the real interest rate and Δ∗ ensures that the safe carbon budget is never violated. The constrained carbon price is simply the CPW, which rises as the carbon budget approaches exhaustion. Matters become more complicated if there is also a substantial temperature lag, since then, the CPW has an inverse U-shape and might overshoot (Lemoine and Rudik 2017). This does not occur if the peak temperature constraint is formulated in terms of cumulative emissions. This is also why the CPW rises at the real interest rate and not at the real interest rate plus the rate of decay of atmospheric carbon.

In a market economy, cost minimization by firms requires that the marginal cost of fossil fuel equals the marginal cost of mitigating fossil fuel plus the price of carbon for using unabated fossil fuel, (1 − a t )P t (see Appendix A3). Mitigation thus increases in the relative cost of carbon-emitting technologies and abatement including the price of non-abated carbon (see eq. (A20)). Cost minimization also requires that the marginal cost of abatement equals the saved cost of carbon emissions. Abatement thus rises as its cost falls or the carbon price rises over time (see (A21)). I assume cost conditions are such that fossil fuel is fully mitigated before it is fully abated.

4 Calibration of carbon stock dynamics, damages, and the economy

The top panel of Table 2 gives the benchmark estimates of the variance of the lognormally distributed shock to the TCRE, the target for PGW, and risk tolerance as discussed in section 2. Although the IPCC typically takes a risk tolerance of 1/3, I have set it to 10% and even this might be on the high side given that the risks of tipping points and the damages done by the ensuing climate catastrophes when temperature exceeds 2 °C are large. The parameters in the bottom two panels excluding (b) come from Rezai and van der Ploeg (2016), van der Ploeg and Rezai (2017) and are based on the DICE-2013R IAM (Nordhaus 2010, 2014). The middle panel gives the parameters needed for finding the optimal energy mix and transition to the carbon-free era from cost minimization given the carbon price, and the bottom panel the additional parameters needed for calculating the SCC.

Global energy use measured in GtC is 0.14% of world GDP, which matches current energy use of 10 GtC and initial world GDP of 73 trillion dollars. We focus at using mitigation and abatement, so set exogenous technical progress in energy needs to be zero. Initial fossil fuel and renewable energy costs are calibrated to give current energy cost shares of 7% of GDP and an additional cost of 5.6% of GDP for full decarbonization. The cost of fossil fuel is set to 515 $/tC and rises at the rate of 0.1% per year to capture resource scarcity. Technical change leading to a reduction in the costs of mitigation and abatement is 1.25% per year, which matches the cost of 1.6% of GDP for full decarbonization in 100 years. The cost of full abatement is calibrated to an initial value of 20% of GDP, which then falls at the rate of non-carbon technologies and decreases to 5.7% of GDP in 100 years.

Turning to the bottom panel, the rate of time impatience is set to 1.5% per year and shows how impatient policy makers are. Intergenerational inequality aversion is set to 1.45 and indicates how little policy makers are prepared to sacrifice utility of current generations for the benefit of future generations. Given a trend growth rate in world GDP of 2% per year, this implies a long-run real interest rate of 4.4% per year. Global warming damages in any year are 1.9% of world GDP per trillion ton of carbon in the atmosphere. These damages rise at the same rate of growth as world GDP and the discount rate to be used is thus the growth-corrected long-run real interest rate, which is 2.4% per year.

Effective carbon in the atmosphere takes account of the delay between a rise in the stock of carbon and mean global temperature of 10 years (cf. Ricke and Caldeira 2014). A fifth of carbon stays to all intents and purposes permanently up in the atmosphere; the remainder slowly returns to the oceans and the surface of the earth at a rate of 0.23% per year (cf. Golosov et al. 2014).

5 Constrained optimal climate policy simulations with a safe carbon budget

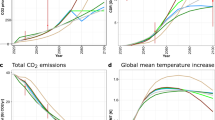

Using this calibration, not pricing carbon at all leads to zero mitigation and zero abatement, cumulative emissions of 6519 GtCO2, 118 years for the end of the fossil fuel era to occur, and PGW of 4.6 °C, which is much too high. The globally best unconstrained climate policy is portrayed by the purple solid lines in Fig. 1 and has a zero CPW. It has an initial carbon price or SCC of $12/tCO2 (or $44/tC), and grows at 2% per annum from then on. The mitigation rate is driven by technological progress and the rising price of carbon, and increases from 20 to 100% in 78 years at which date the carbon-free era starts. The abatement rate rises from a mere 1.5 to 19% at the end of the fossil fuel era. In total, 2328 GtCO2 is burnt, which implies PGW of 2.6 °C. The unconstrained climate policy thus overshoots the 2 °C target agreed at the Paris COP21 conference by 0.6 °C. The safe carbon budget from 2015 onwards corresponding to a risk tolerance of 10% and a peak warming target of 2 °C is 994 GtCO2 (see Table 1).Footnote 4

Figure 1 portrays three policies to ensure that cumulative emissions stay within this budget: (1) the constrained optimal carbon price (5), SCC + CPW, with d calibrated to estimated production damages (black dashed lines); (2) the constrained optimal carbon price (6) ignoring these damages, CPW, and thus with d = 0 (black dotted lines); and (3) the optimal carbon price with damages adjusted upwards to stay within the safe carbon budget (red dashed-dotted lines).

5.1 Constrained optimal carbon price with calibrated damages

The constrained optimal carbon price manages to keep cumulative emissions to 994 GtCO2 and has two components: the SCC and the CPW (the difference between the dashed black and the purple solid line). The SCC rises at the rate of growth of world GDP (2% per year) and the CPW rises at a rate equal to the real interest rate (4.4% per year). The initial CPW is $10/tCO2, so that the initial carbon price has to increase from $12 to $22/tCO2. The carbon era now ends in 49 instead of 78 years. During this period, the mitigation rate rises from 28 to 100% and the abatement rate rises from 2.8 to 34%. Note that a peak warming target of 1.5 °C implies that only 308 GtCO2 can be burnt. It necessitates a much higher path for the constrained optimal carbon price that starts at $58/tCO2 and rises in a mere 28 years to $179/tCO2 at the end of the carbon era (not shown).

5.2 Constrained cost-minimizing carbon price ignoring calibrated damages or CPW

Ignoring production damages of global warming, policy makers set the carbon price to the CPW which ensures that cumulative emissions do not exceed 994 GtCO2. This price rises more rapidly than the path that does take account of damages. It starts somewhat lower at $16 instead of $22/tCO2 and rises in 47 years to a final carbon price of $128 instead of $119/tCO2. As a result, mitigation starts somewhat more modestly (at 24%) too. Abatement is more modest and rises from 2.0 to 29% at the end of the carbon era.

5.3 Welfare-maximizing carbon prices with damages adjusted upwards

Since welfare maximization with calibrated damages leads to overshooting of the peak warming target, this suggests that calibrated damages are an underestimate of the true risk of global warming in that they ignore the risks of tipping points and climate disasters which are captured by the safe carbon budget constraint. Adjusting the damage coefficient upwards by a factor 2.8 (i.e., from 1.9 to 5.4% of world GDP per TtC) ensures that cumulative emissions never exceed the safe carbon budget when welfare is maximized. The end of the fossil fuel era then occurs more than two decades earlier than with the unconstrained optimal carbon price (after 56 instead of 78 years, but more slowly than with the constrained welfare-maximizing carbon price (49 years)). The initial carbon price almost triples from $12 to $34/tCO2, and then rises at 2% per annum in line with the rate of economic growth.Footnote 5 As a result of this more ambitious climate policy, the path for the mitigation rate is higher and starts at 36% and rises to 100% during the fossil fuel era. Abatement is also higher; it starts at 4.2% and rises to 21% towards the end of the fossil fuel era.

6 Conclusion

Climate uncertainty, a higher transient climate response to cumulative emissions and a tighter risk tolerance, implies a lower safe carbon budget and that less fossil fuel can be burnt in total, thus requiring a more ambitious climate policy. The relatively modest identified damages from global warming in integrated assessment models imply that the unconstrained welfare-maximizing carbon price set to the SCC leads to overshooting of the peak warming target and thus that the safe carbon budget constraint bites. There are three options of staying within the safe carbon budget. The first option occurs if policy makers take account of production damages from global warming and ensure that the safe carbon budget constraint is never violated. The carbon price then consists of the SCC based on calibrated damages which rises at a rate equal to the growth rate of world GDP and the CPW which rises at a faster rate equal to the real interest rate. The second option occurs if policy makers ignore damages, as in the cost-minimizing temperature constraint literature. This leads to a more rapidly rising carbon price equal to the CPW. The third option is to acknowledge that damages are underestimated and adjust them upwards by factoring in the peak warming constraint. This leads to a less rapidly rising carbon price than the first option.

The safe carbon budget is easy to negotiate and communicate, and does not depend on ethical considerations regarding welfare of current and future generations. Once policy makers have agreed on what the appropriate risk tolerance is, the safe carbon budget follows directly from the climate physics. If production damages are ignored and the carbon price is set to the CPW, no further information on intergenerational fairness is needed if the carbon price results from a competitive market for emission permits. However, if the price is implemented via carbon taxes, policy makers need to specify the interest rates at which carbon taxes have to grow and these depend on ethical considerations.

More generally, carbon prices are affected by a wide range of other climate and economic uncertainties with some of them resolved not until the distant future. The solution then requires sophisticated stochastic dynamic programming algorithms. Uncertainty about future growth of aggregate consumption then depresses the social discount rate used by prudent policy makers and pushes up the SCC even more (e.g., Gollier 2012). Other types of uncertainty about future damage flows resulting from atmospheric carbon, the climate sensitivity, and sudden release of greenhouse gases into the atmosphere boost the risk-adjusted SCC even more and take account of hedging risks (e.g., Dietz et al. 2017; Hambel et al. 2017; Bremer and van der Ploeg 2017). Mitigating the risks of future interacting, multiple tipping points can push up the carbon price by a further factor of 2 to 8 (Lemoine and Traeger 2016; Cai et al. 2016). As uncertainty about the climate sensitivity has the biggest effect on carbon prices,Footnote 6 it may not be bad to start with the risk-adjusted safe carbon budget. For future research it is important to extend the literature on risk-adjusted carbon prices with resolution of a wide range of future uncertainties to allow for peak warming constraints.

It has been argued that an approach based on probabilistic stabilization targets is ad hoc and incurs welfare costs of 5% as the targets are inflexible and do not respond to changes in climatic conditions, the resulting policies tend to overreact to transient shocks, and the temperature ceiling is lower than the unconstrained optimal temperature under certainty (Fitzpatrick and Kelley 2017).Footnote 7 The relatively small welfare costs may be a price worth paying if an easy-to-communicate temperature target prompts policy makers into action. In fact, the IPCC approach of focusing attention at cumulative emissions and the safe carbon budget focuses at what matters most for global warming. The role of economics is to show how these cumulative budgets translate in the most cost-efficient manner to time paths of fossil fuel use, renewable use, and abatement. This paper has extended the IPCC approach to allow for various forms of climate uncertainty, since these curb the safe carbon budget significantly. This is related to the point-of-no return approach (van Zalinge et al. 2017), which prompts the question what to do once the climate has moved outside the viable region and can no longer be moved with traditional carbon pricing policies into the viable region. Negative carbon emissions and, therefore, unconventional policies such as geo-engineering are then called for (e.g., Keith 2000; Crutzen 2006; McCracken 2006; Bala et al. 2008; Lenton and Vaughan 2009; Barrett et al. 2014; Moreno-Cruz and Smulders 2016) and some argue that they are already called for to keep global warming below 2 °C (e.g., Gassler et al. 2015). Such policies act as insurance and are needed before the climate moves outside the viable set and reaches the point of no return. More work is needed on the reversible and irreversible uncertainties driving the climate (both the stock of carbon in the atmosphere and temperature) and what they imply for the safe carbon budget, climate mitigation and adaptation policies, and the need for negative-emissions policies.

Notes

Barbier and Burgess (2017) take a user cost approach to the 2 °C target. They show that for constant (declining at 2/6% per year) emissions, global welfare increases by 6% (19%) of global GDP and the carbon’s budget life time increases from 18 to 21 (30) years compared with growing emissions under business as usual.

Our formulation of damages extends to that of Golosov et al. (2014) by adding a temperature lag. The carbon price (4) is independent of the carbon stock. With more convex damages, the carbon price (4) will increase with global warming as well as world GDP. Convex damages capture the risk of tipping points but this risk is already captured by having an explicit additional temperature constraint. This justifies our specification with flat marginal damages.

This is not too different from the 1 TtCO2 from 2011 onwards reported in the IPCC Fifth Assessment Report given a historical carbon budget of 2900 GtCO2 and cumulative emissions during 1870–2011 of 1900 GtCO2.

The average adjusted carbon price over 2015–2100 is $89/tCO2 for a safe carbon budget of 994 GtC02. The initial and average adjusted carbon price for a budget of 1327 GtCO2 (i.e., ignoring uncertainty; see Table 1) are $25 in 2015 and $65/tCO2, respectively. These are lower than the 2020 carbon prices in 2010 US dollars reported by Working Group III of the IPCC Fifth Assessment Report (Clarke et al. 2014) of $50–60 at a 5% discount rate.

Van den Bijgaart et al. (2016) point out that if the multiplicative factors determining the optimal unconstrained price of carbon are lognormally distributed, the price of carbon is lognormally distributed too. This allows one to get the difference between the mean and the median of the optimal unconstrained carbon price and see how this is driven by uncertainties in the carbon cycle, temperature adjustment, climate sensitivity, damages, and discount rate. Table 2 of this study indicates that uncertainties about climate sensitivity and damage shocks give the largest adjustments to the risk-adjusted carbon price.

This study allows for Bayesian learning and stochastic weather shocks, but the optimal policy with learning is close to that without learning as learning about the climate sensitivity is a slow process. This study uses an infinite-horizon version of the integrated assessment model DICE with a sophisticated model for temperature dynamics and carbon exchange.

References

Allen M (2016) Drivers of peak warming in a consumption-maximizing world. Nat Clim Chang 6:684–686

Allen MR, Frame D, Frieler K, Hare W, Huntingford C, Jones C, Knutti R, Lowe J, Meinshausen M, Meinshausen N, Raper S (2009) The exit strategy. Nat Rep Clim Change 3(May):56–58

Allen MR, Frame DJ, Huntingford C, Jones CD, Lowe JA, Meinshausen M, Meinshausen N (2009) Warming caused by cumulative emissions towards the trillionth tonne. Nature 458:1163–1166

Bala G, Duffy PB, Taylor KE (2008) Impact of geoengineering schemes on the global hydrological cycle. Proc Natl Acad 105:7664–7669

Barbier EB, Burgess JC (2017) Depletion of the global carbon budget: a user cost approach. Environ Dev Econ:1–16

Barrett S, Lenton TM, Millner A, Tavoni A, Carpenter S, Anderies JM, Chapin FS, Crepin A-S, Daily G, Ehrlich P, Folke C, Galaz V, Hughes T, Kautsky N, Lambin EF, Naylor R, Nyborg K, Polasky S, Scheffer M, Wilen J, Xepapadeas A, de Zeeuw AJ (2014) Climate engineering reconsidered. Nat Clim Chang 4(7):527–529

Bauer N, Bosetti V, Hamdi-Cheriff M, Kitous A, McCollum D, Mjean A, Rao S, Turton H, Paroussos L, Ashina S, Calvin K, Wada K, van Vuuren D (2015) CO2 emission mitigation and fossil fuel markets: dynamic and international aspects of climate policy. Technol Forecast Soc Chang 90(A):243–256

Bremer TS, van der Ploeg F (2017) Pricing economic and climatic risks into the price of carbon: leading-order results from asymptotic analysis, mimeo. Edinburgh University

Cai Y, Lenton TM, Lontzek TS (2016) Risk of multiple climate tipping points should trigger a rapid reduction in CO2 emissions. Nat Clim Chang 6:520–525

Clarke L, Jiang K, Akimoto K, Babiker M, Fisher-Vanden K, Hourcade J-C, Krey V, Kriegler E, Löschel A, McCollum D, Paltsev S, Rose S, Shukla PR, Tahvoni M, van der Zwaan BCC, van Vuuren DP (2014) Assessing transformation pathways. In: Edenhofer O et al (eds) Climate change 2014: mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the International Panel on Climate Change. Cambridge University Press, Cambridge

Crutzen P (2006) Albedo enhancement by stratospheric sulfur injections. Clim Chang 77:211–219

Dietz S, Gollier C, Kessler L (2017) The climate beta. J Environ Econ Manag Forthcom

Dietz S, Stern N (2015) Endogenous growth, convexity of damages and climate risk: how Nordhaus’ framework supports deep cuts in emissions. Econ J 125(583):574–620

Dietz S, Venmans F (2017) Cumulative carbon emissions and economic policy: in search of general principles, Working Paper No. 283, Grantham Research Institute on Climate Change and the Environment, LSE, London, U.K

Fitzpatrick LG, Kelley DL (2017) Probabilistic stabilization targets. J Assoc Environ Resour Econ 4(2):611–657

Gassler T, Guivarch C, Tachiiri K, Jones CD, Ciais P (2015) Negative emissions physically needed to keep global warming below 2 °C. Nat Commun 6:7958–7965

Gillett NP, Arora VK, Matthews D, Allen MR (2013) Constraining the ratio of global warming to cumulative CO2 emissions using CMI5 simulations. J Clim 26:6844–6858

Gollier C (2012) Pricing the planet’s future: the economics of discounting in an uncertain world. Princeton University Press, Princeton

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82(1):48–88

Hambel C, Kraft H, Schwartz E (2017) Optimal carbon abatement in a stochastic general equilibrium model with climate change, mimeo. Goethe University Frankfurt

IPCC (2013) Long-term climate change: projections, commitments, and irreversibilities, Chapter 12, Sections 5.4.2 and 5.4.3, Working Group 1, Contribution to the IPCC 5th Assessment Report, International Panel of Climate Change

Keith DW (2000) Geoengineering the climate: history and prospect. Annu Rev Energy Environ 25:245–284

Kriegler M, Weyant JP, Blanford GJ, Krey V, Clarke L, Edmonds J, Fawcett A, Luderer G, Riahi K, Richels R, Rose SK, Tahvoni M, van Vuuren DP (2014) The role of technology for achieving climate policy objectives: overview of the EMF 27 study on global technology and climate policy strategies. Clim Chang 123(3–4):353–367

Lemoine D, Rudik I (2017) Steering the climate system: using inertia to lower the cost of policy. Am Econ Rev Forthcom

Lemoine D, Traeger CP (2016) Economics of tipping the climate dominoes. Nat Clim Chang 6:514–519

Lenton T, Vaughan N (2009) The radioactive forcing potential of different climate engineering options. Atmos Chem Phys 9:5539–5561

Matthews HD, Gillett NP, Stott PA, Zickfeld K (2009) The proportionality of global warming to cumulative carbon emissions. Nature 459:829–832

McCracken MC (2006) Geoengineering: worthy of cautious evaluation? Clim Chang 77:235–243

McGlade C, Ekins P (2015) The geographical distribution of fossil fuels used when limiting global warming to 2 °C. Nature 517:187–190

Moreno-Cruz JB, Smulders JA (2016) Revisiting the economics of climate change: the role of geoengineering. Res Econ, in press

Nordhaus W (1982) How fast should we graze the global commons? Am Econ Rev 72(2):242–246

Nordhaus W (1991) To slow or not to slow: the economics of the greenhouse effect. Econ J 101(407):920–937

Nordhaus W (2010) Economic aspects of global warming in a post-Copenhagen world. Proc Natl Acad Sci 107(26):11721–11726

Nordhaus W (2014) Estimates of the social cost of carbon: concepts and results from the DICE-2013R model and alternative approaches. J Assoc Environ Resour Econ 1:273–312

Rezai A, van der Ploeg F (2016) Intergenerational inequality aversion, growth and the role of damages: Occam’s rule for the global carbon tax. J Assoc Environ Resour Econ 3(2):493–522

Ricke KL, Caldeira K (2014) Maximum warming occurs about one decade after a carbon dioxide emission. Environ Res Lett 9(12):124002

Rogelj J, Luderer G, Pietzcker RC, Kriegler E, Schaeffer M, Krey V, Riahi K (2015) Energy system transformations for limiting end-of-century warming to below 1.5 °C. Nat Clim Chang 5:519–527

Rogelj J, van den Elzen M, Höhne N, Fransen T, Fekete H, Winkler H, Schaeffer R, Sha F, Riahi K, Meinshausen M (2016) Paris agreement climate proposals need a boost to keep warming well below 2 °C. Nature 534:631–639

Tahvoni M, Kriegler E, Riahi K, van Vuuren DP, Aboumahboub T, Bowen A, Calvin K, Campiglio E, Kober T, Jewell J, Luderer G, Marangoni G, McMcCollum D, van Sluisveld M, Zimmer A, van der Zwaan B (2015) Post-2020 climate agreements in the major economies assessed in the light of global models. Nat Clim Chang 5:119–126

Tol RSJ (2013) Targets for global climate policy: an overview. J Econ Dyn Control 37(5):911–928

van den Bijgaart IM, Gerlagh R, Liski M (2016) A simple formula for the social cost of carbon. J Environ Econ Manag 77:75–94

van der Ploeg F, Rezai A (2017). Climate policy with declining discount rates in a multi-region world—back-on-the-envelope calculations, mimeo. University of Oxford

van Zalinge BC, Feng Q, Dijkstra HA (2017) On determining the point of no return in climate change. Earth Syst Dyn 8:707–717

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

ESM 1

(DOCX 176 kb)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

van der Ploeg, F. The safe carbon budget. Climatic Change 147, 47–59 (2018). https://doi.org/10.1007/s10584-017-2132-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-017-2132-8