Abstract

Why haven’t most western European countries, Canada, and Japan caught up to the United States? This paper develops an economic growth model with endogenous economic institutions, which provides an alternative theoretical explanation for the persistent income differences between the United States and the other high income countries. It argues that because innovation is more skill intensive than imitation, skilled individuals in the US (the leader country) have more human capital than skilled individuals in the other high income countries (the followers). This implies greater willingness and ability by skilled individuals in the US to actively participate in politics. As a result, US voters choose better for growth policies than the voters in the other high income countries, and this prevents the other high income countries from catching up to the United States. The model developed in this paper predicts that follower countries cannot fully catch up to the leader if they have the same or slightly better exogenous characteristics. They can only fully catch up if their exogenous characteristics are significantly better than those of the leader country. This result emphasizes the importance of historically given initial conditions.

Similar content being viewed by others

Notes

Benhabib and Spiegel (2005) show that if a logistic model of technology diffusion is used, then the gap between the leader and the follower can keep growing.

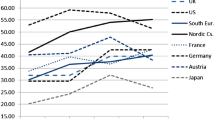

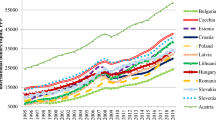

According to Heston et al. (2011), real GDP per capita relative to the US real GDP per capita was in 1990 and 2010 respectively: UK: 78 and 75 %, France: 80 and 70 %, Germany: 82 and 78 %, Italy: 78 and 65 %, Spain: 60 and 58 %, Japan: 90 and 70 %, and Canada: 88 and 86 %. This shows that although all these countries converged to the U.S. between 1950 and 1990, they failed to do so after 1990.

Azarnert (2014) shows that the disadvantage of the follower may be because the leader country chooses policies that give incentives to develop sectors with higher growth potential. As a result, it becomes difficult for followers to catch up. Lawless (2013) argues that the costs of exporting to a market may decrease with experience. This gives an advantage to the leader and makes convergence more difficult.

This paper argues that overcoming the leader is difficult but not impossible. The follower will be able to do that if it has a significant advantage in exogenous characteristics. Until the beginning of the 20th century, the UK was the world leader but then the US was able to catch up and become the new leader. According to Mokyr (1990), the UK was the leader in part because, during the 18th and most of the 19th century, it had a “comparative advantage in entrepreneurs and skilled workers.” According to Goldin and Katz (2008), the US became the leader in the beginning of the 20th century because of the development of public education that succeeded in educating Americans at the secondary level. As a result, the level of education in the US became much higher than that in the UK and the other European countries. Galor et al. (2009) explain what exogenous characteristics may have caused this different approach between the US and the UK. More specifically, they argue that inequality in land ownership determines, to some extent, government support to public education. In countries with less inequality in land ownership the support for public education is greater. Mokyr (1990) argues that the political order in the UK had little to gain from supporting public education and, therefore, the UK lost its initial advantage. We can see from Barro and Lee (2010) that in 1950 the proportion of high school graduates, among adults aged 25 or older, was 35 % in the US and only 4 % in the UK.

This papers emphasizes the effect of institutions on long run growth. Altug and Canova (2014) shows that institutions affect not only the long run growth but also the short run business cycles.

Acemoglu et al. (2002), Vandenbussche et al. (2006), and Howitt and Mayer-Foulkes (2005) assume, also, that innovation is more skill intensive than imitation, and therefore those who innovate have more human capital than those who imitate. For other papers that study endogenous innovation and imitation see Jovanovic and Rob (1989), Grossman and Helpman (1991), Rustichini and Schmitz (1991), Segerstrom (1991), Aghion et al. (2001), and Mukoyama (2003).

Best and Krueger (2012) report, based on exit poll data, that between 2000 and 2010, 74–80 % of voters in the US had at least some college. I did not find similar exit poll data for the major European countries but it is easy to show that the level of education of their voters was much less than that of the US voters. In Germany, the voter turnout between 2000 and 2010 was on average 75 % and the proportion of the population with at least some college during the same period was 20 %. This means that, even if all individuals with some college or more, did vote, only \( \frac{20}{75}=27\% \) of their voters would have college education or more. Similarly, I find that the number for France is \( \frac{19}{81}=23\% \), for the UK is \( \frac{17}{62}=27\% \), for Spain is \( \frac{22}{72}=31\% \), and for Italy is \( \frac{10}{81}=12\% \). These are the maximum numbers for each country. The actual proportion of voters with at least some college is, of course, lower for each European country. As we can see, the difference between the major European countries and the US is very big both because the level of education in the US is greater, but mainly because voter turnout of low education voters is much greater in Europe than in the US. My source for voter turnout is the “International Institute for Democracy and Electoral Assistance” and for the level of education is Barro and Lee (2010).

For more about strategic and impressionable voters see Grossman and Helpman (2001). Instead of “strategic” we can use the word “informed” and instead of “impressionable” we can use the word “uninformed.”

A similar assumption has been made by Bourguignon and Verdier (2000). They argue that only those with high enough education vote. I argue that education determines not whether people vote or not but whether they are strategic voters or not.

If, instead of one period, there was an infinite life horizon then this would not change the results qualitatively. Again, informed voters would prefer policies that increase their lifetime income and therefore, the country with more informed voters (the leader) would choose better policies. The only difference is that, in this case, policies would also affect the growth rate and, through that, the future income. This would complicate the analysis and would make the model intractable.

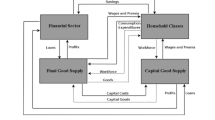

The model presented here is based on Aghion and Howitt (1992, 1998, 2009). The main difference between this model and Aghion and Howitt (1992, 1998, 2009) is that in this model, like Benhabib et al. (2014), growth is deterministic while in their models, growth is stochastic. For other seminal contributions to the endogenous growth theory see Romer (1990) and Segerstrom et al. (1990).

These assumptions and the production function of Eq. (1) are based on Aghion and Howitt (2009, p. 96–98). They assume that each individual invents ψ intermediate goods and fraction \( \varepsilon \) of the intermediate goods disappear in the end of each period. They find that the number of intermediate goods is proportional to the population. For simplicity, I assume that ψ = ε = 1, and therefore, the number of intermediate goods is exactly the same as the population. Also, I assume that the productivity of the newly invented intermediate goods is equal to the average productivity of the existing intermediate goods. Because growth is deterministic all intermediate goods have the same productivity, which is also the average productivity.

Following the relevant literature, I assume that there is no international trade; only technology diffusion.

To simplify the analysis, I assume that innovations (and imitations) are drastic. This means that when technology A t is invented, through innovation or imitation, then the inventor can engage in monopoly pricing. The intermediate good of quality A t-1 will not be produced. See Aghion and Howitt (1992, 1998) for a discussion about drastic and non-drastic innovations.

Alternatively, we could have assumed that, instead of being employed by a research firm, researchers work independently. The size of the innovation depends on the number of researchers because there are positive externalities (they exchange ideas, etc.) but only one researcher will be the innovator, will be granted the patent, and receive the profit Π it . The probability that a researcher will be the innovator is \( \frac{1}{S_{it}} \). In that case, \( {w}_{i,l,s}=\frac{1}{S_{it}}{\varPi}_{it} \) is the expected skilled workers’ wage. If we assume that all the researchers can buy insurance, then this expected wage is also their actual wage. From Eq. (7) we can also see that the number of skilled workers is the same for every intermediate good because if it is higher in some intermediate goods the reward becomes lower in those sectors.

In other words, the number of skilled workers per intermediate sector, denoted by S it , equals the proportion of skilled workers, denoted by s t , because the number of intermediate goods equals population.

Galor (2011) also uses the assumption that the cost of education is proportional to the skilled wage. The results do not change if the cost is proportional to the unskilled wage.

Therefore, I assume that there is not only a monetary cost for education, denoted by θ s w e i,l,s,t , but also a non-monetary, opportunity cost. Skilled workers spend time in order to become educated and this reduces their working time.

See section 3.2 for a discussion of the assumption that r n > r m .

Unskilled workers maximize the same utility function \( {V}_u={\left({c}_u\right)}^{a_s}{\left({h}_u\right)}^{1-{a}_s} \) subject to c u = I u M uw k u and h u + M uw = 1 in order to choose their leisure h u and working time M uw . I u is their income per unit of effective supply of unskilled labor, M uw k u is the effective supply of unskilled labor per unskilled worker, c u is their consumption, and k u is a positive parameter. The solution gives that M uw k u = a s k u . For simplicity, I assume that \( {k}_u=\frac{1}{a_s} \), and therefore, each unskilled worker supplies one effective unit of labor.

See, for example Aghion and Howitt (1998 and 2009).

See Eq. (29).

I assume that unskilled workers are impressionable voters and they do not take into account the proposed policies when they vote. All the policies that affect them are assumed exogenous in this paper. A more realistic assumption would be that there are strategic and impressionable voters both among skilled and unskilled individuals, and the probability that a skilled individual is a strategic voter is greater than the probability that an unskilled individual is a strategic voter. This assumption does not change the qualitative results, but makes the model intractable.

Benabou (2005) uses a similar way, through a unique tax rate, to represent the set of public policies, like taxes and transfers, minimum wage laws, firing costs, etc.

I assume that if the number of members of each special interest group is equal or less than a small number, denoted by ζ μ , then coordination cost is zero. If it is greater than ζ μ , then coordination cost becomes very high and exceeds the rents. As a result, because special interest groups want to maximize their net rents and political parties their share of votes, both special interest groups will have exactly ζ μ members that vote always for the party their special interest group supports. Because the number of members is the same for the two SIG, their members do not affect the result of the election. Skilled and unskilled workers do not form special interest groups because their number is very high and therefore, if they form a special interest group their coordination cost will exceed any potential benefits.

This timing implies that the SIG will not contribute money in order to directly influence policies. In order for this to happen, the SIG should contribute before the party announces its policy. In this paper, the SIG give their contributions after the parties announce their policies. Thus, the SIG have only electoral motive. Even in this case the SIG influence policies indirectly. Political parties know that in order to attract more campaign contribution they will have to choose policies that benefit the SIG. See Grossman and Helpman (2001) for a detailed discussion about influence and electoral motive.

Grossman and Helpman (1996, 2001) assume uniform distribution, too. The support of the distribution of f j is \( \left(z-\frac{1}{2},z+\frac{1}{2}\right) \), where \( z\in \left(\frac{1}{2},\frac{3}{2}\right) \). The assumption that f j is uniformly distributed is made because the distribution function of a uniform distribution can be expressed analytically and, therefore, we can derive analytically the share of votes for the two parties as a function of the policy variable. This would not be possible if, instead, f j followed, for example, a normal distribution.

Equation (14) is based on the assumption that f j is uniformly distributed. V s A is the proportion of skilled workers with \( {f}_j\le {\left(\frac{w_{st}\left({\tau}_A\right)}{w_{st}\left({\tau}_B\right)}\right)}^{\frac{b}{a}} \).

This assumption is made for simplicity. The results do not change if I assume that the popularity of the two parties is different among strategic and impressionable voters.

If z is not a random variable, then it is difficult to define Nash equilibrium. For example, if z is known and it is greater than one, then party B is more popular, and if the two special interest groups give the same contributions, then party B wins with certainty. This implies that the best choice for SIG A is to give zero. Then, SIG B will be willing to give zero as well. In that case, if SIG A gives a sufficient amount then party A wins the election, and therefore SIG A will change its choice. As a result, SIG B will change its choice, too, and so on.

In the appendix (section 5.1), I show that the results do not change if I assume adaptive expectations, where τ e t = τ t − 1.

The growth rate in this paper is proportional to the fraction of skilled workers. As a result, policies that promote growth are the policies that increase the returns, and thus the fraction, of skilled workers. This is achieved by reducing the value of the policy variable, \( \tau \).

Endogenous economic institutions and policies are the ones that are determined through the political process. The exogenous economic institutions, policies, and other characteristics are not determined by the political process. They are determined by people’s culture, their norms, the location of the country, natural resources, and random events.

References

Acemoglu D, Zilibotti F (2001) Productivity differences. Q J Econ 116:563–606

Acemoglu D, Aghion P, Zilibotti F (2002) Distance to frontier, selection, and economic growth. J Eur Econ Assoc 4:37–74

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–51

Aghion P, Howitt P (1998) Endogenous growth theory. The MIT Press

Aghion P, Howitt P (2009) The economics of growth. The MIT Press, Cambridge

Aghion P, Harris C, Howitt P, Vickers J (2001) Competition, imitation and growth with step-by-step innovation. Rev Econ Stud 68:467–492

Alesina A, Glaeser E (2004) Fighting poverty in the US and Europe: a world of difference. Oxford University Press, Oxford

Altug S, Canova F (2014) Do institutions and culture matter for business cycles? Open Econ Rev 25:93–122

Ansolabehere S, Iyengar S (1996) Going negative: how political advertisement shrink and polarize the electorate. Free Press, New York

Azariadis C, Drazen A (1990) Threshold externalities in economic development. Q J Econ 105:501–26

Azarnert LV (2014) Agricultural exports, tariffs and growth. Open Econ Rev 25:797–807

Barro R, Lee J (2010) A new data set of educational attainment in the world, 1950–2010. J Dev Econ 104:184–98

Barro R, Sala-i-Martin X (2003) Economic growth. MIT Press, Cambridge

Basu S, Weil DN (1998) Appropriate technology and growth. Q J Econ 113:1025–54

Baumol WJ (1986) Productivity growth, convergence, and welfare. Am Econ Rev 76:1072–85

Becker G, Barro RJ (1989) Fertility choice in a model of economic growth. Econometrica 76:481–501

Benabou R (2000) Unequal societies: income distribution and the social contract. Am Econ Rev 90:96–129

Benabou R (2005) Inequality, technology, and the social contract. In: Aghion P, Durlauf SN (eds). Handbook of economic growth. Elsevier

Benabou R, Tirole J (2006) Belief in a just world and redistributive politics. Q J Econ 121:699–746

Benhabib J, Spiegel MM (2005) Human capital and technology diffusion. In: Aghion P, Durlauf SN (eds). Handbook of economic growth. Elsevier.

Benhabib J, Perla J, Tonetti C (2014) Catch-up and fall-back through innovation and imitation. J Econ Growth 19:1–35

Best SJ, Krueger BS (2012) Exit polls, surveying the American electorate, 1972–2010. CQ Press

Bourguignon F, Verdier T (2000) Oligarchy, democracy, inequality, and growth. J Dev Econ 62:285–313

Dee TS (2004) Are there civic returns to education? J Public Econ 88:1697–720

Delli Carpini MX, Keefer S (1996) What Americans know about politics and why it matters. Yale University Press, New Haven

Durlauf SN, Johnson PA (1995) Multiple regimes and cross-country growth behavior. J Appl Econ 10:365–84

Easterly W, Kremer M, Pritchett L, Summers LH (1993) Good policy or good luck? Country growth performance and temporary shocks. J Monet Econ 32:459–83

Franz MM, Ridout TN (2007) Does political advertising persuade? Polit Behav 29:465–491

Freedman P, Franz MM, Goldstein K (2004) Campaign advertising and democratic citizenship. Am J Polit Sci 48:723–741

Galor O (1996) Convergence? Inferences from theoretical models. Econ J 106:1056–69

Galor O (2011) Unified growth theory. Princeton University Press

Galor O, Tsiddon D (1997a) The distribution of human capital and economic growth. J Econ Growth 2:93–124

Galor O, Tsiddon D (1997b) Technology, mobility, and growth. Am Econ Rev 87:363–382

Galor O, Weil DN (1996) The gender gap, fertility, and growth. Am Econ Rev 86:374–87

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60:35–52

Galor O, Moav O, Vollrath D (2009) Inequality in landownership, the emergence of human-capital promoting institutions, and the great divergence. Rev Econ Stud 76:143–179

Gerschenkron A (1952) Economic backwardness in historical perspective. In: Hoselitz BF (ed) The progress of underdeveloped areas. University of Chicago Press, Chicago

Gill IS, Raiser M (2012) Golden growth: restoring the lustre of the European economic model. The World Bank, Washington, DC

Glaeser EL, Ponzetto GAM, Shleifer A (2007) Why does democracy need education? J Econ Growth 12:77–99

Goldin C, Katz LF (2008) The race between education and technology. The Belknap Press of Harvard University Press, Cambridge

Grossman GM, Helpman E (1991) Quality ladders in the theory of growth. Rev Econ Stud 58:43–61

Grossman GM, Helpman E (1996) Electoral competition and special interest politics. Rev Econ Stud 63:265–86

Grossman GM, Helpman E (2001) Special interest politics. The MIT Press, Cambridge

Hassler J, Rodriguez Mora J (2000) Intelligence, social mobility, and growth. Am Econ Rev 90:888–908

Heston A, Summers R, Aten B (2011) Penn world table version 7.0. Center for International Comparisons of Production, Income, and Prices at the University of Pennsylvania

Howitt P, Mayer-Foulkes D (2005) R&D, implementation, and stagnation: a Schumpeterian theory of convergence clubs. J Money Credit Bank 37:147–77

Hubbard GR, O’Brien AP (2013) Macroeconomics. Pearson

Jovanovic B, Rob R (1989) The growth and diffusion of knowledge. Rev Econ Stud 56:569–582

Klenow PJ, Rodriguez-Clare A (2005) Externalities and growth. In: Aghion P, Durlauf S (eds). Handbook of economic growth. Amsterdam: North-Holland

Lawless M (2013) Marginal distance: does export experience reduce firm trade costs? Open Econ Rev 24:819–841

Lucas RE Jr (1988) On the mechanics of economic development. J Monetary Econ 22:3–42

Mankiw GN, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107:407–37

McCarthy NM, Poole KT, Rosenthal H (2006) Polarized America: the dance of ideology and unequal riches. The MIT Press, Cambridge

Milligan K, Moretti E, Oreopoulos P (2004) Does education improves citizenship? Evidence for the United States and the United Kingdom. J Public Econ 88:1667–95

Mokyr J (1990) The level of riches. Oxford University Press, New York

Mukoyama T (2003) Innovation, imitation, and growth with cumulative technology. J Monetary Econ 50:361–380

Quah DT (1993) Empirical cross-section dynamics in economic growth. Eur Econ Rev 37:426–34

Quah DT (1997) Empirics for growth and distribution: stratification, polarization, and convergence clubs. J Econ Growth 2:27–59

Romer P (1990) Endogenous technological change. J Polit Econ 98:71–102

Rustichini A, Schmitz JA (1991) Research and imitation in long-run growth. J Monetary Econ 27:271–292

Segerstrom PS (1991) Innovation, imitation, and economic growth. J Polit Econ 99:807–827

Segerstrom PS, Anant T, Dinopoulos E (1990) A Schumpeterian model of the product life cycle. Am Econ Rev 80:1077–92

Vandenbussche J, Aghion P, Meghir C (2006) Growth, distance to frontier and composition of human capital. J Econ Growth 11:97–127

Acknowledgments

I wish to thank two anonymous referees of this journal for their comments and suggestions. They helped me significantly improve the quality of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 The Case with Adaptive Expectations

In this section, I assume that τ e t = τ * t − 1 . This is the simplest form of adaptive expectations, where individuals are myopic. Equation (11) becomes:

And from Eq. (29) we get:

We combine Eqs. (11’) and (29’) and we get:

The equilibrium proportion of skilled workers can be found if we set s t = s t − 1 = s*:

ASSUMPTION 3

\( \frac{\xi_t\overset{^{\prime }}{\alpha }{h}_l\beta {\left({\xi}_t\overset{\prime }{\alpha }{h}_l+{h}_l\left(1-\beta \right)\right)}^2}{{\left(\left({\xi}_t\overset{\prime }{\alpha }{h}_l-\beta \right){h}_l\left(1-\beta +{\xi}_t\overset{\prime }{\alpha}\right)+\beta \right)}^2}<1 \)

Assumption 3 guarantees that the equilibrium of Eq. (30’) is stable.

The equilibrium is stable if for s = s*, \( 0<\frac{\partial {s}_t}{\partial {s}_{t-1}}<1 \)

Simple algebra gives that \( 0<\frac{\partial {s}_t}{\partial {s}_{t-1}}\to 0<\frac{\xi_t\overset{^{\prime }}{\alpha }{h}_l\beta {\left({\xi}_t\overset{\prime }{\alpha }{h}_l+{h}_l\left(1-\beta \right)\right)}^2}{{\left(\left({\xi}_t\overset{\prime }{\alpha }{h}_l-\beta \right){h}_l\left(1-\beta +{\xi}_t\overset{\prime }{\alpha}\right)+\beta \right)}^2}\to {\xi}_t\overset{^{\prime }}{\alpha }{h}_l>\beta \). This is always true when s t > 0.

The second part of the inequality, \( \frac{\partial {s}_t}{\partial {s}_{t-1}}<1 \), is not always true, but there are values of the time-invariant parameters \( \left({h}_l,\overset{^{\prime }}{\alpha },\beta \right) \) such that the inequality holds ∀ ξ t ∈ [0, 1].

Numerical analysis shows that if, for example, 0 ≤ h l ≤ 0.8 then this inequality holds for all the possible values of the other parameters. Thus, I restrict the values of h l , such that the above inequality holds and the equilibrium is stable.

Both the Propositions of the main text hold under the assumption that τ e t = τ * t − 1 .

1.2 Proof of Proposition 1

The growth rate in the follower country is: g F,t = (1 − d)δ m φ * m s * F (ξ F ). It is zero if s * F (ξ F ) = 0. It is positive if \( {s}_F^{*}\left({\xi}_F\right)>0\to \frac{\xi_F\overset{^{\prime }}{\alpha }{h}_m-\beta }{\xi_F\overset{^{\prime }}{\alpha }{h}_m+{h}_m\left(1-\beta \right)}>0\to {\xi}_F\overset{^{\prime }}{\alpha }{h}_m-\beta >0\to {\xi}_F>\frac{\beta }{\overset{^{\prime }}{\alpha }{h}_m} \).

The growth rate of the follower country is maximized when d = 0. The maximum growth rate for the follower country is: g max F,t = δ m φ * m s * F (ξ F ). If this is greater than the growth rate of the leader country, then, initially, there is convergence. If this is less or equal to the growth rate of the leader country there is no convergence between the two countries. Formally:\( {g}_{F,t}^{max}\le {g}_{L,t}\to {\delta}_m{\varphi}_m{s}_F^{*}\left({\xi}_F\right)\le {\lambda}_n{\varphi}_n{s}_L^{*}\left({\xi}_L\right)\to {s}_F^{*}\left({\xi}_F\right)\le \frac{\lambda_n{\varphi}_n}{\delta_m{\varphi}_m}{s}_L^{*}\left({\xi}_L\right) \), and from Assumption 1 we get: \( \frac{\lambda_n{\varphi}_n}{\delta_m{\varphi}_m}{s}_L^{*}\left({\xi}_L\right)<{s}_L^{*}\left({\xi}_L\right) \).

From Eqs. (32) and (33) we get:

The follower country cannot fully converge to the leader if it improves its technology through imitation. As it converges to the leader, the growth rate decreases, eventually becomes equal to that of the leader, and convergence stops. In other words, there is a steady state distance to the frontier, d*, where 0 ≤ d* ≤ 1, for the follower country: \( {g}_{F,t}={g}_{L,t}\to \left(1-{d}^{*}\right){\delta}_m{\varphi}_m{s}_F^{*}\left({\xi}_F\right)={\lambda}_n{\varphi}_n{s}_L^{*}\left({\xi}_L\right)\to {d}^{*}=1-\frac{\lambda_n{\varphi}_n{s}_L^{*}\left({\xi}_L\right)}{\delta_m{\varphi}_m{s}_F^{*}\left({\xi}_F\right)} \), and d* < 1, ∀ ξ L , such that s * L (ξ L ) > 0.

In the follower country, individuals first choose whether to become skilled or unskilled, and then, if they are skilled, they choose to innovate or imitate. The two decisions are independent with each other. Skilled individuals will choose to innovate if this implies greater expected wage.

Assume that until period t the follower country grows through imitation. In period t, if skilled workers choose to innovate, their expected wage is:

If they choose to imitate, their expected wage is:

where s * t is the proportion of skilled workers, which has been determined before the decision to innovate or imitate.

Skilled individuals will choose to innovate if g F,n,t ≥ g F,m,t , where g F,m,t = (1 − d)δ m φ m s * t and g F,n,t = λ n φ n s * t . g F,m,t depends on 1 − d, and its lowest value is when d = d*. As a result, skilled individuals will choose to innovate if:

In this case, the follower country’s growth rate is greater than the leader’s, the follower will fully catch up, overtake the leader, and, eventually, the former leader country’s skilled workers will switch to imitation.

Rights and permissions

About this article

Cite this article

Pargianas, C. Endogenous Economic Institutions and Persistent Income Differences among High Income Countries. Open Econ Rev 27, 139–159 (2016). https://doi.org/10.1007/s11079-015-9363-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-015-9363-y