Abstract

We study how the optimal degree of conservatism relates to decision-making procedures in a Monetary Policy Committee (MPC). In our framework, central bank conservatism is required to attenuate the volatility of monetary decisions generated by the presence of uncertainty about the committee members’ output objective. We show how this need for conservatism varies according to the number of MPC members, the MPC’s composition as well as its decision rule. Moreover, we find that extra central bank conservatism is required when there is ambiguity about the MPC’s true decision rule.

Similar content being viewed by others

Notes

For a typology of the different aspects of central bank transparency, see Geraats (2002).

A series of papers has used the “robust control” approach initiated by Hansen and Sargent (2005, 2008) to determine optimal monetary policy when the central bank faces some uncertainty. For recent contributions to the robust control literature in general, see for instance Tillmann (2009a) or Tillmann (2014). However, closer to our analysis are the papers by Tillmann (2009b) and Sorge (2013) where the “robust control” approach is adapted to determine the optimal degree of conservatism when the social planner faces some uncertainty, respectively, about cost-push shock persistence and central bank preferences.

Hayo and Mazhar (2014) study the determinants of the degree of MPC transparency. They find that past inflation and the quality of institutional set up significantly influence MPC transparency.

Gersbach and Hahn (2009) argue that the ECB has been right to do so as this opacity helps to protect its committee from national politicians’ interferences.

We assume that the preference shocks \({\epsilon _{t}^{i}}\) are independent of the cost-push shock e t , so that \(E_{t}\left (\epsilon _{t}^{i}e_{t}\right ) =0\). We also assume that there is no systematic relation between λ i and 𝜖 i . That is, the social planner can not set λ C B so as to reduce the influence of 𝜖 i.

We could also assume that uncertainty concerns the weights the central bank attaches to its policy objectives, as for example in Hefeker and Zimmer (2011a). This would render our model less tractable without fundamentally changing the results.

Orphanides and van Norden (2002) show that estimation errors of the output gap are highly persistent over time. In our analysis, however, the policymakers’ preference shock \({\epsilon _{t}^{i}}\) is i.i.d. and thus transitory. For studies where this shock has a persistent component, see Faust and Svensson (2001, 2002) or Westelius (2009).

Obviously, n b +n e x t =n so that the MPC is formed by n+1 members.

Parameter q can also be seen as a binary number where a value of 1 (0) implies that council members resort to averaging (majority voting). Another interpretation of q would be that it represents the probability that the council reaches a consensus; (1−q) being the probability that the council fails to reach a consensus, in which case it has to resort to voting. Obviously, with both interpretations of q, no distinction is made between board and external members within the council so that n b =n e x t =n and \( {\epsilon _{t}^{b}}=\epsilon _{t}^{ext}\).

Studying the properties of this function, we observe that: \(\frac {\partial f(\lambda _{CB})}{\partial \lambda _{CB}}=\frac { 3\alpha ^{2}\beta \rho \left (\lambda _{G}\alpha ^{2}+1\right ) \left (1-\rho ^{2}\right ) \left (\alpha ^{2}\lambda ^{CB}+1-\beta \rho \right )^{2}V\left ({\epsilon _{t}^{j}}\right )}{\left (1-\beta \rho \right ) \left (\alpha ^{2}\lambda _{CB}+1\right )^{4}}>0\). Hence, f(λ C B ) is monotonically increasing in λ C B . Moreover, \(\frac {\partial ^{2}f(\lambda _{CB})}{\partial ^{2}\lambda _{CB}}=\frac {-6\alpha ^{4}\beta \rho \left (\lambda _{G}\alpha ^{2}+1\right ) \left (1-\rho ^{2}\right ) \left (\alpha ^{2}\lambda ^{CB}+1-\beta \rho \right ) \left (\alpha ^{2}\lambda ^{CB}+1-2\beta \rho \right ) V\left ({\epsilon _{t}^{j}}\right )}{\left (1-\beta \rho \right ) \left (\alpha ^{2}\lambda _{CB}+1\right )^{5}}\) becomes negative – implying that f(λ C B ) is concave – for sufficiently low values of β and ρ and/or sufficiently large values of λ C B and α.

This result implies that the optimal size of the committee is infinite. Incorporating additional effects like efficiency or decision costs would obviously restrict the optimal committee size (Berger 2006). This issue, however, is beyond the scope of our paper.

By contrast with the uncertainty about preferences where the social planner perfectly knows the mean and the variance of 𝜖 – otherwise he would not be able to select the policymakers –, when considering the case of uncertainty about the MPC’s decision structure, we suppose that the social planner is unable to assign any probability measure to this randomness. This can be justified by the fact that he has no possibility to influence the MPC’s decision-making choice and thereby considers the worst possible scenario.

References

Beetsma R, Jensen H (1998) Inflation targets and contracts with uncertain central banker preferences. J Money Credit Bank 30:384–403

Berger H (2006) Optimal central bank design: benchmarks for the ECB. Rev Int Org 1:207–235

Berger H, Nitsch V (2011) Too many cooks?: committees in monetary policy. South Econ J 78:452–475

Besley T, Meads N, Surico P (2008) Expertise and macroeconomic policy insiders versus outsiders in monetary policymaking. Ame Econ Rev: Papers Proc 98:218–223

Blinder A (2004) The quiet revolution. Central banking goes modern. Yale University Press, Yale

Chappell HW, McGregor RR, Vermilyea T (2005) Committee decisions on monetary policy. MIT Press, Cambridge

Clarida R, Gali J, Gertler M (1999) The science of monetary policy: a new Keynesian perspective. J Econ Lit 37:1661–1707

De Grauwe P (2000) Monetary policy in the presence of asymmetries. J Common Mark Stud 38:593–612

Eichler S, Lähner T (2014) Forecast dispersion, dissenting votes, and monetary policy preferences of FOMC members: the role of individual career characteristics and political aspects. Public Choice 160:429–453

Farvaque E, Hammadou H, Stanek P (2011) Selecting your inflation targeters: background and performance of monetary policy committee members. German Econ Rev 12:223–238

Farvaque E, Matsueda N, Méon PG (2009) How monetary policy impacts the volatility of policy rates. J Macroecon 31:534–546

Fatum R (2006) One monetary policy and 18 central bankers: the European monetary policy as a game of strategic delegation. J Monet Econ 53:659–669

Faust J, Svensson LEO (2001) Transparency and credibility: monetary policy with unobservable goals. Int Econ Rev 42:369–397

Faust J, Svensson LEO (2002) The equilibrium degree of transparency and control in monetary policy. J Money Credit Bank 34:520–539

Geraats P (2002) Central bank transparency. Econ J 112:532–565

Gerlach-Kristen P (2006) Monetary policy committees and interest rate setting. Eur Econ Rev 50:487– 507

Gerlach-Kristen P (2008) The role of the chairman in setting monetary policy: Individualistic vs autocratically collegial MPCs. Int J Central Bank 4:119–143

Gerling K, Grüner HP, Kiel A, Schulte E (2005) Information acquisition and decision making in committees: a survey. Eur J Polit Econ 21:563–597

Gersbach H, Hahn V (2009) Voting transparency in a monetary union. J Money Credit Bank 41:831–853

Gersbach H, Hahn V (2012) Information acquisition and transparency in committees. Int J Game Theory 41:427–453

Göhlmann S, Vaubel R (2007) The educational and professional background of central bankers and its effect on inflation: an empirical analysis. Eur Econ Rev 51:925–941

Hahn V (2012) Designing monetary policy committees. Working Paper Series University of Konstanz, 2012–23

Hansen LP, Sargent TJ (2005) Robust estimation and control undercommitment. J Econ Theory 124:258–301

Hansen LP, Sargent TJ (2008) Robustness. Princeton University Press, Princeton

Harris M, Levine P, Spencer C (2011) A decade of dissent: explaining the dissent voting behavior of Bank of England MPC members. Public Choice 146:413–442

Hayo B, Hefeker C (2010) The relationship between central bank independence and inflation. In: Siklos P, Bohl M, Wohar M (eds) Challenges in central banking. Cambridge University Press, Cambridge, pp 179–217

Hayo B, Mazhar U (2014) Monetary policy committee transparency: measurement, determinants, and economic effects, open economies review, forthcoming

Hayo B, Méon P-G (2011) Behind closed doors: Revealing the ECB’s decision rule. J Int Money Financ 37:135–160

Hefeker C (2003) Federal monetary policy. Scand J Econ 105:643–659

Hefeker C, Zimmer B (2011a) Uncertainty and fiscal policy in an asymmetric monetary union. Open Econ Rev 22:163–178

Hefeker C, Zimmer B (2011b) The optimal choice of central bank independence and conservatism under uncertainty. J Macroecon 33:595–606

Jensen H (2002) Optimal degrees of transparency in monetary policymaking. Scand J Econ 104:399–422

Lybek T, Morris J (2004) Central bank governance: a survey of boards and management, IMF Working Paper 04/226

Matsen E, Roisland O (2005) Interest rate decisions in an asymmetric monetary union. Eur J Polit Econ 21:365–384

Méon P-G (2008) Majority voting may not rule (in monetary unions): a comment on Matsen and Risland [Eur. J. Political Economy 21(2005) 365-384]. Eur J Polit Econ 24:269–279

Mihov I, Sibert A (2006) Credibility and flexibility with independent monetary policy committee. J Money Credit Bank 38:23–46

Montoro C (2007) Monetary policy committees and interest rate smoothing’, CEP Discussion Paper 0780, London School of Economics

Muscatelli A (1999) Inflation contracts and in Inflation targets under uncertainty: why we might need conservative central bankers. Economica 66:241–254

Orphanides A, van Norden S (2002) The unreliability of output-gap estimates in real time. Rev Econ Stat 84:569–583

Riboni A, Ruge-Murcia F (2008) The dynamic (in)efficiency of monetary policy by committee. J Money Credit Bank 40:1001–1032

Riboni A, Ruge-Murcia F (2010) Monetary policy by committee: consensus, chairman dominance, or simple majority? Q J Econ 125:363–416

Rogoff K (1985) The optimal degree of commitment to a monetary target. Q J Econ 100:1169–1190

Sibert A (2003) Monetary policy committees: individual and collective reputations. Rev Econ Stud 70:649–665

Siklos P (2008) No single definition of central bank independence is right for all countries. Eur J Polit Econ 24:802–816

Sorge MM (2013) Robust delegation with uncertain monetary policy preferences. Econ Model 30:73–78

Tillmann P (2009a) Optimal monetary policy with an uncertain cost channel. J Money Credit Bank 41:885–906

Tillmann P (2009b) The stabilization bias and robust monetary policy delegation. J Macroecon 31:730–734

Tillmann P (2010) Monetary policy committees and model uncertainty. Discussion Paper MAGKS, 21–2010

Tillmann P (2014) Robust monetary policy, optimal delegation and misspecified potential output. Econ Lett 123:244–247

von Hagen J, Süppel R (1994) Central bank constitution for federal monetary unions. Eur Econ Rev 48:774–782

Westelius NJ (2009) Imperfect transparency and shifts in the central bank’s output gap target. J Econ Dyn Control 33:985–996

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton

Acknowledgments

For helpful comments, we thank two anonymous referees, Ansgar Belke, Lawrence Broz, Sylvester Eijffinger, Etienne Farvaque, Volker Hahn, Nikolaj Harmon, Ummad Mazhar, Pierre-Guillaume Méon, Cornel Oros and Peter Tillmann as well as participants to presentations in Duisburg, Leipzig, Münster, Poitiers, Strasbourg, at the 16th International Conference on Macroeconomic Analysis and International Finance in Rethymno, the 16th T2M Conference in Nantes, the 61st annual meeting of AFSE in Paris, the 2013 Meeting of the European Public Choice Society in Zurich, the INFER Annual Conference 2013 in Orléans, the 13th annual conference of the Viessmann Research Center in Waterloo, and at Ifo-Institute in Munich.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Result 1

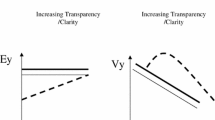

From expression (15), it is easy to see that \(\frac {\partial f}{ \partial V\left ({\epsilon _{t}^{j}}\right )}>0\). Hence, a rise in \(V\left ({\epsilon _{t}^{j}}\right )\) causes an upward shift of the function f and thereby a shift to the right of the intersection point between the 45∘ line and the function f curve, implying an increase in λ C B∗.

As \(\epsilon _{t}^{AR}={{\sum }_{i}^{n}}{\epsilon _{t}^{i}}/n\), the aggregation process implies: \(E\left (\epsilon _{t}^{AR}\right )=0\) and \(V\left (\epsilon _{t}^{AR}\right )=\sigma _{\epsilon }^{2}/n\). Further, since \(\epsilon _{t}^{MR}=\text {median} \left [{\epsilon _{t}^{1}},...,{\epsilon _{t}^{n}}\right ]\), we have \(E\left (\epsilon _{t}^{MR}\right )=0\) and \(V\left (\epsilon _{t}^{MR}\right )=\frac {\Pi }{2n}\sigma _{\epsilon }^{2}\).Footnote 18

-

i)

It is obvious from Eq. 15 that λ C B∗ > λ G even if ρ = 0.

-

ii)

Since \(V\left (\epsilon _{t}^{CBi}\right )=\sigma _{\epsilon }^{2}\) , it follows that \(V\left (\epsilon _{t}^{CBi}\right )>V\left (\epsilon _{t}^{MR}\right )\) and \( V\left (\epsilon _{t}^{CBi}\right )>V\left (\epsilon _{t}^{AR}\right )\). Consequently, \(\lambda _{CB\ast }^{CBi}>\lambda _{CB\ast }^{MR}\) and \(\lambda _{CB\ast }^{CBi}>\lambda _{CB\ast }^{AR}\).

-

iii)

Since \(\frac {\partial V\left (\epsilon _{t}^{AR}\right )}{ \partial n}<0\) and \(\frac {\partial V\left (\epsilon _{t}^{MR}\right )}{\partial n}<0\), \( \lambda _{CB\ast }^{AR}\) and \(\lambda _{CB\ast }^{MR}\) depend negatively on n.

-

iv)

Finally, as \(V\left (\epsilon _{t}^{AR}\right )<V\left (\epsilon _{t}^{MR}\right )\) we have \(\lambda _{CB\ast }^{AR}<\lambda _{CB\ast }^{MR}\), according to the graphical analysis.

□

Proof of Result 2

To demonstrate result 2, we begin by deriving \(V\left (\epsilon _{t}^{GEN}\right )\):

Differentiating this expression with respect to p yields:

This derivative is negative if \(p<\frac {q^{2}\frac {{\sigma _{b}^{2}}}{n_{b}} +(1-q)^{2}\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}{\sigma _{chair}^{2}+q^{2} \frac {{\sigma _{b}^{2}}}{n_{b}}+(1-q)^{2}\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}} }=p_{\min }\) and becomes positive otherwise. Hence, \(p_{\min }\) minimises \( V\left (\epsilon _{t}^{GEN}\right )\) and the optimal degree of conservatism \(\lambda _{CB\ast }^{GEN}\) as well.

We then turn to the council and differentiate \(V\left (\epsilon _{t}^{GEN}\right )\) with respect to q. In doing this, we obtain:

This derivative is negative for \(q<q_{\min }=\frac {\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}{\frac {{\sigma _{b}^{2}}}{n_{b}}+\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}\) and positive otherwise. As a consequence, \(q_{\min }\) minimises \(V\left (\epsilon _{t}^{GEN}\right )\) and thereby the optimal degree of conservatism \(\lambda _{CB\ast }^{GEN}\). □

Proof of Result 3

To solve problem (16), the first stage is to identify the realizations of (p UN,q UN) that maximise the expected social loss:

Note that \(E\left [{L_{t}^{G}}\left (\epsilon _{t}^{UN}\right )\right ]\) only depends on p UN and q UN via \(E\left (\epsilon _{t}^{UN}\right )^{2}\). The social planner first determines the allocation of decision power within the council that maximises the expected social loss. Differentiating \(E\left (\epsilon _{t}^{UN}\right )^{2}\) with respect to q UN yields

As has already been demonstrated, for a given p, \(E\left (\epsilon _{t}^{UN}\right )^{2} \) attains its minimum for \(q_{min}=\frac {\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}{\frac {{\sigma _{b}^{2}}}{n_{b}}+\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}\) and thus its maximum for extreme values of q in the interval [0,1]. We finally compare \(E\left (\epsilon _{t}^{UN}|_{q=0}\right )^{2}= \frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}\) with \(E\left (\epsilon _{t}^{UN}|_{q=1}\right )^{2}=\frac {{\sigma _{b}^{2}}}{n_{b}}\) to show that if \(\frac { {\Pi } \sigma _{ext}^{2}}{2n_{ext}}>(<)\frac {{\sigma _{b}^{2}}}{n_{b}}\), q m a x – i.e. the value of q that maximises \(E\left (\epsilon _{t}^{UN}\right )^{2}\) and thus \(E\left [{L_{t}^{G}}\left (\epsilon _{t}^{UN}\right )\right ]\) – is equal to 0 (1).

Once q m a x has been determined, the social planner turns to p m a x , the value of p that maximises \(E\left (\epsilon _{t}^{UN}\right )^{2}\) and thus \( E\left [{L_{t}^{G}}\left (\epsilon _{t}^{UN}\right )\right ]\).

Taking the derivative of \(E\left (\epsilon _{t}^{UN}\right )^{2}\) with respect to p UN yields

For a given q=q m a x , \(E\left (\epsilon _{t}^{UN}\right )^{2}\) has its minimum at \( p_{min}=\frac {q^{2}\frac {{\sigma _{b}^{2}}}{n_{b}}+(1-q)^{2}\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}{\sigma _{chair}^{2}+q^{2}\frac {{\sigma _{b}^{2}}}{n_{b}} +(1-q)^{2}\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}}\) and its maximum for extreme values of p in the interval [0,1]. We thus compare \(E\left (\epsilon _{t}^{UN}|_{p=0}\right )^{2}=\left (q_{max}\right )^{2}\frac {{\sigma _{b}^{2}}}{n_{b}} +(1-q_{max})^{2}\frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}\) with \(E\left (\epsilon _{t}^{UN}|_{p=1}\right )^{2}=\sigma _{chair}^{2}\).

If \(\left (q_{max}\right )^{2}\frac {{\sigma _{b}^{2}}}{n_{b}}+(1-q_{max})^{2} \frac {\Pi \sigma _{ext}^{2}}{2n_{ext}}>\sigma _{chair}^{2}\), then p m a x =0 , otherwise p m a x =1. In both cases, \(E\left (\epsilon _{t}^{UN}\right )^{2}=V\left (\epsilon _{t}^{UN}\right )>V\left (\epsilon _{t}^{GEN}\right )\) – the latter being defined by Eq. 19 – which means that the optimal degree of conservatism, \(\lambda _{CB\ast }^{UN}\), when the MPC’s decision procedure is unknown is higher than \(\lambda _{CB\ast }^{GEN}\), the one obtained under transparency about the decision procedure. □

Rights and permissions

About this article

Cite this article

Hefeker, C., Zimmer, B. Optimal Conservatism and Collective Monetary Policymaking under Uncertainty. Open Econ Rev 26, 259–278 (2015). https://doi.org/10.1007/s11079-014-9329-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-014-9329-5