Abstract

We compare the welfare of different combinations of monetary and currency policies in an open-economy macroeconomic model that incorporates two important features of many small open economies: a high level of vertical international trade and a high degree of exchange rate pass-through. In this environment, a small economy prefers a fixed exchange rate regime over a flexible regime, while the larger economy prefers a flexible exchange rate regime. There are two main causes underlying our results. First, in the presence of sticky prices, relative prices adjust through changes in the exchange rate. Multiple stages of production and trade make it more difficult for one exchange rate to balance the whole economy by adjusting several relative prices simultaneously throughout the vertical chain of production and trade. More specifically, there is a tradeoff between delivering an efficient relative price between home and foreign final goods and delivering an efficient relative price between home and foreign intermediate goods. Second, because the small economy faces a high degree of exchange rate pass-through under a flexible regime, it suffers from a lack of efficient relative prices in vertical trade. The larger economy, however, does not face this problem because its level of exchange rate pass-through is low.

Similar content being viewed by others

Notes

An alternative measurement of vertical trade is the production-sharing intensity of trade, defined as the ratio of affiliate sales of manufactured goods to the U.S. parent as a share of total manufacturing exports to the United States in a country (or region). Based on trade flows between U.S. multinationals and their affiliates, Burstein et al. (2008) reported that the production-sharing intensity of trade was approximately 50 % for Canada and 25 % for Mexico in 2003. When maquiladoras were included, the production-sharing intensity of trade increased dramatically from 25 % to 55 % for Mexico. As the authors explained in their paper, these data likely understated the degree of production sharing because they captured only intra-firm trade and omitted arm’s-length production sharing.

Up to 2004, there were fifteen member states in the EU: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxemburg, Netherland, Portugal, Spain, Sweden, and the United Kingdom. Out of them, the most important trading partner with the CEECs has been Germany, which accounted for 39.4 % of CEEC total parts imports and 49.7 % of their total parts exports.

Kaminski and Ng (2001) focused on ten CEECs: the Czech Republic, Estonia, Hungary, Poland, Slovenia, Bulgaria, Romania, Slovakia, Latvia, and Lithuania.

To facilitate the comparison of our results with those of the standard new open-economy macroeconomic models, we assume that the financial market is complete and that a production subsidy exists in each stage of production. Consequently, we abstract away from distortions caused by incomplete international risk-sharing and monopolistic competition and focus on a single friction: nominal price rigidity.

Corsetti and Pesenti (2007) provided a graphical representation of optimal monetary policy in open economy models.

As we will discuss in details in Section 5, introducing labor mobility is unlikely to affect our results because migration is unlikely to affect the presence of vertical trade, a critical feature necessary for our results.

Our results will hold in an infinite horizon model because of complete risk-sharing and price stickiness.

Notice that although the price markup is the same for all goods produced at different stages and in different countries, PPP does not generally hold in our model because home firms practice LCP and set different prices in advance for home and foreign markets based on their expected demand in the corresponding market.

We have assumed that no capital is required in either stage of production. Because there is no saving-investment decision in a one-period model, capital would be given exogenously in our simple model. Although the initial level of capital stock may have some impact on welfare, this is not an interest of this paper.

We ignore the reverse of case (2), which is that the foreign country pegs unilaterally to the home currency. This is because the foreign economy is much larger in size, and it would not be optimal for the foreign country to engage in a unilateral peg.

Benigno (2004) showed that, if two regions in a currency union have the same degree of nominal rigidity, it is optimal for the central bank to target the average inflation rate weighted by the economic sizes of the two regions. In practice, the European Monetary Union targets the average CPI of member countries, weighted by their consumption shares.

The size of the home country does not affect our main results. For all n ≤ 0. 5, the results are qualitatively the same and available upon request.

Ruhl (2008) reconciled the difference by suggesting that in the international macroeconomics literature, the smaller values of 𝜃 correspond to the responses of quantities to transitory shocks, while the larger estimates in the trade literature often rely on responses of quantities to permanent changes in tariff and trade cost.

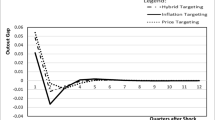

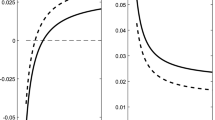

The literature suggests the relevant range for 𝜖 is [1,25]. We plot welfare for 𝜖 in [1,10] because we want to illustrate clearly the welfare comparison at lower values of 𝜖 and because the welfare ranking of the three regimes for all 𝜖 in [10,25] is the same as that for 𝜖 = 10.

Detailed figures are in the technical appendix (available upon request).

Another necessary feature is a high degree of exchange rate pass-through. Labor mobility is unlikely to change the choice of pricing currency, hence allowing for labor mobility would not affect the degree of exchange rate pass-through or our main results.

References

Bacchetta P, van Wincoop E (2005) A theory of the currency denomination of international trade. J Int Econ 67(2):295–319

Backus DK, Kehoe PJ, Kydland FE (1994) Dynamics of the trade balance and the terms of trade: the j-curve?Am Econ Rev 84(1):84–103

Benigno P (2004) Optimal monetary policy in a currency area. J Int Econ 63:293–320

Bettin G, Lo Turco A (2012) A cross-country view on south-north migration and trade: dissecting the channels. Emerg Mark Financ Trade 48(4):4–29

Burstein A, Kurz C, Tesar L (2008) Trade, production sharing, and the international transmission of business cycles. J Monet Econ 55:775–795

Chari VV, Kehoe PJ, McGrattan ER (2002) Can sticky price models generate volatile and persistent real exchange rates? Rev Econ Stud 69:533–563

Collard F, Juillard M (2001) Accuracy of stochastic perturbation methods: the case of asset pricing models. J Econ Dyn Control 25:979–999

Corsetti G, Pesenti P (2007) The simple geometry of transmission and stabilization in closed and open economies. In: Clarida R, Giavazzi F (eds) NBER international seminar on macroeconomics 2007. University of Chicago Press, Chicago

Devereux MB, Engel C (2003) Monetary policy in the open economy revisited: price setting and exchange-rate flexibility. Rev Econ Stud 70:765–783

Devereux MB, Lane PR, Xu J (2006) Exchange rates and monetary policy in emerging market economies. Econ J 116:478–506

Donnenfeld S, Haug AA (2008) Currency invoicing of US imports. Int J Finance Econ 13:184–198

Dunlevy JA, Hutchinson WK (1999) The impact of immigration on american import trade in the late nineteenth and early twentieth centuries. J Econ Hist 59(4):1043–1062

Ekanayake EM, Veeramacheneni B, Moslares C (2009) Vertical and horizontal intra-industry trade between the US and NAFTA partners. Rev Anál Econ 24(1):21–42

Feenstra RC (1998) Integration of trade and disintegration of production in the global economy. J Econ Perspect 12:31–50

Felbermayr GJ, Toubal F (2012) Revisiting the trade-migration nexus: evidence from new OECD data. World Dev 40(5):928–937

Friedman M (1953) The case for flexible exchange rates. In: Essays in positive economics. University of Chicago Press, pp 157–203

Ghatak S, Pop Silaghi MI, Daly V (2009) Trade and migration flows between some CEE countries and the UK. J Int Trade Econ Dev 18(1):61–78

Girma S, Yu Z (2002) The link between immigration and trade: evidence from the United Kingdom. Weltwirtschaftliches Archiv 138(1):115–130

Goldberg LS, Tille C (2008) Vehicle currency use in international trade. J Int Econ 76:177–192

Goldberg LS, Tille C (2009) Micro, macro, and strategic forces in international trade invoicing. NBER Working Paper No. 15470

Gould DM (1994) Immigrants links to the home country: empirical implications for U.S. bilateral trade flows. Rev Econ Stat 76(2):302–316

Hanson GH, Mataloni RJ, Slaughter MJ (2005) Vertical production networks in multinational firms. Rev Econ Stat 87(4):664–678

Head K, Ries J (1998) Immigration and trade creation: econometric evidence from Canada. Can J Econ 31(1):47–62

Huang K, Liu Z (2001) Production chains and general equilibrium aggregate dynamics. J Monet Econ 48:437–462

Huang K, Liu Z (2004) Multiple stages of processing and the quantity anomaly in international business cycle models. Federal Reserve Bank of Philadelphia Working Paper 04-8

Huang K, Liu Z (2005) Inflation targeting: what inflation rate to target? J Monet Econ 52:1435–1462

Huang K, Liu Z (2006) Sellers local currency pricing or buyers’ local currency pricing: does it matter for international welfare analysis? J Econ Dyn Control 30:1183–1213

Hummels D, Rapoport D, Yi KM (1998) Vertical specialization and the changing nature of world trade. Federal Reserve Bank of New York Economic Policy Review, June

Hummels D, Ishii J, Yi KM (2001) The nature and growth of vertical specialization in world trade. J Int Econ 51:75–96

Kaminski B, Ng F (2001) Trade and production fragmentation: central European economies in EU networks of production and marketing. Working Paper, University of Maryland and World Bank

Kamps A (2006) The euro as invoicing currency in international trade. ECB Working Paper No. 665

Kim J, Kim H (2003) Spurious welfare reversals in international business cycle models. J Int Econ 60:471–500

Ligthart JE, Werner SEV (2010) Has the euro affected the choice of invoicing currency? CESifo Working Paper No. 3058

Markusen JR (1983) Factor movements and commodity trade as complements. J Int Econ 14:341–356

Mundell RA (1957) International trade and factor mobility. Am Econ Rev 47(3):321–335

Murray J, Powell J, Lafleur LR (2003) Dollarization in Canada: an update. Bank of Canada Review, Summer 2003

Obstfeld M, Rogoff K (1995) Exchange rate dynamics redux. J Polit Econ 103(3):624–660

Obstfeld M, Rogoff K (1998) Risk and exchange rates. NBER Working Paper No. 6694

Obstfeld M, Rogoff K (2000a) New directions for stochastic open economy models. J Int Econ 50(1):117–153

Obstfeld M, Rogoff K (2000b) The six puzzles in international macroeconomics: is there a common cause? NBER Working Paper No. 7777

Obstfeld M, Rogoff K (2002) Global implications of self-oriented national monetary rules. Q J Econ 117:503–535

Peri G, Requena-Silvente F (2010) The trade creation effect of immigrants: evidence from the remarkable case of Spain. Can J Econ 43(4):1433–1459

Rauch JE (1999) Networks versus markets in international trade. J Int Econ 48:7–35

Rauch JE (2001) Business and social networks in international trade. J Econ Lit 39(4):1177–1203

Rauch JE, Casella A (2003) Overcoming informational barriers to international resource allocation: prices and ties. Econ J 113:21–42

Rauch JE, Trindade V (2002) Ethnic Chinese networks in international trade. Rev Econ Stat 84(1):116–130

Ruhl KJ (2008) The international elasticity puzzle. Working Paper, University of Texas-Austin

Saito M (2004) Armington elasticities in intermediate inputs trade: a problem in using multilateral trade data. Can J Econ 37(4):1097–1117

Schmitt-Grohe S, Uribe M (2004) Solving dynamic general equilibrium models using a second-order approximation to the policy function. J Econ Dyn Control 28:755–775

Senay O, Sutherland A (2005) Foreign money shocks and the welfare performance of alternative monetary policy regimes. Manuscript, Middle East Technical University and University of St. Andrews

Senay O, Sutherland A (2011) The timing of asset trade and optimal policy in dynamic open economies. Working Paper, University of St Andrews

Shi K, Xu J (2007) Optimal monetary policy with vertical production and trade. Rev Int Econ 15(3):514–537

Sutherland A (2004) International monetary policy coordination and financial market integration. CEPR Discussion Paper No. 4251

Tille C (2002) How valuable is exchange rate flexibility? Optimal monetary policy under sectoral shocks. Federal Reserve Bank of New York

Wagner D, Head K, Ries J (2002) Immigration and the trade of provinces. Scott J Polit Econ 49(5):507–525

Yeats AJ (2001) Just how big is global production sharing? In: Arndt SW, Kierzkowski H (eds) Fragmentation: new production patterns in the world economy. Oxford University Press, Oxford

Yi KM (2003) Can vertical specialization explain the growth of world trade? J Polit Econ 3(1):52–102

Yi KM (2010) Can multistage production explain the home bias in trade? Am Econ Rev 100(1):364–393

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to SSHRC, Wilfrid Laurier University, and Bowdoin College for financial support. We thank the anonymous referee and the editor for insightful suggestions. We also thank Shutao Cao, Julian Diaz, Wei Dong, Kevin Huang, Larry Schembri, Pierre Siklos, Jian Wang, and seminar participants at the Canadian Economic Association Meeting in Ottawa, Shanghai University of Finance and Economics, Wilfrid Laurier University, and Zhejiang University for helpful comments.

Rights and permissions

About this article

Cite this article

Pang, K., Tang, Y. Vertical Trade, Exchange Rate Pass-Through, and the Exchange Rate Regime. Open Econ Rev 25, 477–520 (2014). https://doi.org/10.1007/s11079-013-9286-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-013-9286-4