Abstract

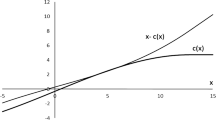

The setting up of a new partnership involves negotiation. Would-be partners must agree on a scheme for dividing uncertain future profits (or losses). We consider partnerships of two or more partners where initial investment is equal, and the negotiated division depends only on the partners’ attitudes toward risk, their beliefs concerning future profit, and their alternatives (i.e., the disagreement point). We propose several schemes. First, an asymmetric approach starts with one party making a decision that maximizes its expected utility while respecting the other’s individual rationality. The other two schemes are symmetric and based on negotiation; they rely on the Nash bargaining solution and the Kalai-Smorodinsky bargaining solution, respectively, and their unbalanced versions. We provide general definitions and highlight some special cases.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Binmore K, Rubinstein A, Wolinsky A (1986) The Nash bargaining solution in economic modelling. Rand J Econ 17(2):176–188

Borch K (1962) Equilibrium in a reinsurance market. Econometrica 30(3):424–444

Brousseau E, Glachant J-M (2002) The economics of contracts: theory and applications. Press, Cambridge University

Dubra J (2001) An asymmetric Kalai-Smorodinsky solution. Econ Lett 73:131–136

Friedman JW (1986) Game theory with applications to economics. Oxford University Press, Oxford, UK

Gerchak Y, Khmelnitsky E (2019a) Partnership’s profit sharing: linear and non-linear contracts. Int Game Theory Rev 21. https://doi.org/10.1142/S0219198919400085

Gerchak Y, Khmelnitsky E (2019b) Bargaining over shares of uncertain future profits. EURO J Decis Processes 7:55–68

Gerchak, Y, Khmelnitsky E (2019c) Profit sharing via the Kalai-Smorodinsky solution, working paper

Hartl RF, Sethi SP, Vickson RG (1995) A survey of the maximum principles for optimal control problems with state constraints. SIAM Rev 37:181–218

Kadan O, Swinkels JM (2013) On the moral hazard problem without the first-order approach. J Econ Theory 148(6):2313–2343

Kalai E (1977) Nonsymmetric Nash solutions and replications of 2-person bargaining. Int J Game Theory 6(3):129–133

Kalai E, Smorodinsky M (1975) Other solutions to Nash’s bargaining problem. Econometrica 43(3):513–518

Khmelnitsky E (2002) A combinatorial, graph-based solution method for a class of continuous-time optimal control problems. Math Oper Res 27:312–325

Kihlstrom R, Roth AE, Schmeidler D (1981) Risk aversion and solutions to Nash’s bargaining problem. In: Moeschlin O, Pallaschke D (eds) Game theory and mathematical economics. Elsevier North-Holland Publishing Company, Amsterdam, pp 65–71

Levin J, Tadelis S (2005) Profit sharing and the role of professional partnerships. Q J Econ 120(1):131–171

Muthoo A (1999) Bargaining theory with applications. Cambridge University Press, Cambridge

Nash J (1950) The bargaining problem. Econometrica 21(1):128–140

Rubinstein A (1982) Perfect equilibrium in a bargaining model. Econometrica 50(1):97–109

Ward GC, Burns K (2000) Jazz: a history of America’s Music. Knopf. Random House Inc., New York

Weinstock R (1974) Calculus of variations with applications to physics and engineering. Dover Publications, New York

Wilson R (1968) The theory of syndicates. Econometrica 36(1):119–132

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this entry

Cite this entry

Gerchak, Y., Khmelnitsky, E. (2021). Sharing Profit and Risk in a Partnership. In: Kilgour, D.M., Eden, C. (eds) Handbook of Group Decision and Negotiation. Springer, Cham. https://doi.org/10.1007/978-3-030-49629-6_46

Download citation

DOI: https://doi.org/10.1007/978-3-030-49629-6_46

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-49628-9

Online ISBN: 978-3-030-49629-6

eBook Packages: Behavioral Science and PsychologyReference Module Humanities and Social SciencesReference Module Business, Economics and Social Sciences