Abstract

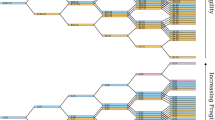

This paper employs a two-step GARCH-M procedure to study price and volatility spillover effects between nine physical commodity futures contracts, as well as transmissions to those commodities from Eurodollars, the S&P500, and the U.S. Dollar Index. Our results show a strong pattern of price spillovers which indicate that price innovations for one commodity tend to have information that is transferred to other commodities. We also document the presence of volatility spillover effects that reflect the transmission of risk-pricing between commodities. Overall, corn was demonstrated to be the commodity that most broadly received and transmitted both price and volatility spillovers, followed by crude oil. In addition, spillover effects are broadly documented within each commodity complex and from the external markets observed. The results demonstrate the need to account for cross-commodity spillovers of both price and volatility when modeling optimal portfolio allocations and also when creating commodity based hedging models.

Similar content being viewed by others

Notes

The ARMA lag lengths are specified by observing the Ljung-Box Q-statistic for the residuals to test for serial correlation in the mean equation and the Ljung-Box Q-statistic for the squared residuals to test for serial correlation in the variance equation. In most cases an ARMA(1,1) specification was called appropriate. Higher order values for p and q in the ARMA specification were required in only a few instances.

References

Black F (1976) “Studies of stock market volatility changes,” Proc Am Stat Assoc Bus Econ Stud Sect pp. 177–181

Bollerslev T, Wooldridge JM (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time varying covariances. Econ Rev 11:143–172

Booth GG, Martikainen T, Yiuman T (1997) “Price and volatility spillovers in Scandinavian stock markets, J Bank Financ 21(6):811–823

Chng M (2009) Economic linkages across commodity futures: hedging and trading implications. J Bank Financ 33:958–970

Conrad J, Gultekin M, Kaul G (1991) Asymmetric predictability of conditional variances. Rev Financ Stud 4:597–622

Driesprong G, Jacobsen B, Maat B (2008) “Striking oil: another puzzle? J Financ Econ 89:307–327

Ewing BT, Malik F (2005) Re-examining the asymmetric predictability of conditional variances: the role of sudden changes in Variance. J Bank Financ 29:2655–2673

Hamao Y, Masulis R, Ng V (1990) Correlation in price changes and volatility across international stock markets. Rev Financ Stud 3:281–308

Kanas A (1998) Volatility spillovers across equity markets: European evidence. Appl Financ Econ 8(3):245–256

King MA, Wadhwani S (1990) Transmission of volatility between stock markets. Rev Financ Stud 3(1):5–13

Koutmos G, Booth GG (1995) Asymmetric volatility transmission in international stock markets. J Int Money Financ 14(n.6):747–762

Lien D, Yang L (2008) Asymmetric effect of basis on dynamic futures hedging: empirical evidence from commodity markets. J Bank Financ 32:187–198

Liu YA, Pan MS (1997) “Mean and volatility spillover effects in the U.S. and Pacific-Basin stock markets, Multinatl Financ J 1(1):47–62

So MKP, Lam K, Li WK (1997) An empirical study of volatility in seven Southeast Asian stock markets using ARV models. J Bus Financ Acc 24(n.2):261–275

Susmel R, Engle RF (1994) Hourly volatility spillovers between international equity markets. J Int Money Financ 13(1):3–25

Theodossiou P, Lee U (1993) Mean and volatility spillovers across major national stock markets: further evidence. J Financ Res 16(4):337–350

Theodossiou P, Kahya E, Koutmos G, Christofi A (1997) Volatility reversion and correlation structure of returns in major international stock markets. Financ Rev 32(2):205–224

Tse Y (1998) International transmission of information: evidence from the Euroyen and Eurodollar futures markets. J Int Money Financ 17(6):909–929

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Grieb, T. Mean and volatility transmission for commodity futures. J Econ Finan 39, 100–118 (2015). https://doi.org/10.1007/s12197-012-9245-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-012-9245-8