Abstract

This work nests the Agent-Based macroeconomic perspective into the earlier history of macroeconomics. We discuss how the discipline in the 70’s took a perverse path relying on models grounded on fictitious rational representative agent in order to try to pathetically circumvent aggregation and coordination problems. The Great Recession was a natural experiment for macroeconomics, showing the inadequacy of the predominant theoretical framework grounded on DSGE models. After discussing the pathological fallacies of the DSGE-based approach, we claim that macroeconomics should consider the economy as a complex evolving system, i.e. as an ecology populated by heterogenous agents, whose far-from-equilibrium interactions continuously change the structure of the system. This in turn implies that more is different: macroeconomics cannot be shrink to representative-agent micro, but agents’ complex interactions lead to emergence of new phenomena and hierarchical structure at the macro level. This is what is taken into account by agent-based models, which provide a novel way to model complex economies from the bottom-up, with sound empirically-based microfoundations. We present the foundations of Agent-Based macroeconomics and we discuss how the contributions of this special issue push its frontier forward. Finally, we conclude by discussing the ways ahead for the fully acknowledgement of agent-based models as the standard way of theorizing in macroeconomics.

Similar content being viewed by others

Notes

A through discussion of emergence in economics is in Lane (1993).

Nonetheless, Friedman was the pusher who first spreaded crack in the economic profession. The monetarist Weltanschauung is so pervasive in modern macroeconomics that (Bernanke 2002) celebrated Friedman’s 90 birthdays saying: “Regarding the Great Depression. You’re right, we did it. We are very sorry. But thanks to you, we won’t do it again.”. And monetarism is the backbone of New Keynesian economics (Mankiw and Romer 1991). In that sense, monetarism has triumphed (De Long 2000).

And the warnings of Kaldor (1982) against the Scourge of Monetarism.

See also the seminal contribution of Leijonhufvud (1968) for an interpretation of Keynesian theory grounded on market disequilibrium processes and coordination failures.

In this respect there has always been a great sense of complementary by Solow with Schumpeter and, later on, Nelson and Winter (1982). And conversely a somewhat reductionist interpretation of Nelson and Winter’s contribution is a long-term microfoundation of Solow’s dynamics.

Exogenous TFP shocks in the production function are modeled in order to deliver a unit root in the productivity and output time series.

An exception was Howitt (2012) who claimed that “macroeconomic theory has fallen behind the practice of central banking” (p. 2).

Chari et al. (2009) put it in the clearest way: “an aphorism among macroeconomists today is that if you have a coherent story to propose, you can do it in a suitably elaborate DSGE model”.

Recently Fukuyama updated his opinion: ‘If you mean [by socialism] redistributive programs that try to redress this big imbalance in both incomes and wealth that has emerged then, yes, I think not only can it come back, it ought to come back. This extended period, which started with Reagan and Thatcher, in which a certain set of ideas about the benefits of unregulated markets took hold, in many ways it’s had a disastrous effect. In social equality, it’s led to a weakening of labour unions, of the bargaining power of ordinary workers, the rise of an oligarchic class almost everywhere that then exerts undue political power. In terms of the role of finance, if there’s anything we learned from the financial crisis it’s that you’ve got to regulate the sector like hell because they’ll make everyone else pay. That whole ideology became very deeply embedded within the Eurozone, the austerity that Germany imposed on southern Europe has been disastrous.” Interview on the New Statesman, 17 Oct 2018, https://www.newstatesman.com/culture/observations/2018/10/francis-fukuyama-interview-socialism-ought-come-back.

A non exhaustive list includes the Bank of England (Braun-Munzinger et al. 2016; Baptista et al. 2016); the European Central Bank (Montagna and Kok 2016; Halaj 2018); Central Bank of Brazil (Da Silva and Tadeu Lima 2015; Dos Santos and Nakane 2017); Central Bank of Hungary (Hosszu and Mero 2017); Bank of Russia (Ponomarenko and Sinyakov 2018); the IMF (Chan-Lau 2017); U.S. Office of Financial Research (Bookstaber and Paddrik 2015); U.S. Internal Revenue Services (Bloomquist and Koehler 2015).

This Section and the next two are partially grounded on Fagiolo and Roventini (2017).

A discussion of the limits of the representative assumption in light of the current crisis is contained in Kirman (2010b).

On this and related points addressing the statistical vs. substantive adequacy of DSGE models, see Poudyal and Spanos (2013).

This is what mainstream macroeconomics consider “sound microfoundations”. However, as Kirman (2016) put it: “the rationality attributed to individuals is based on the introspection of economists rather than on careful empirical observation of how individuals actually behave”.

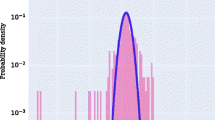

Fagiolo et al. (2008) find that GDP growth rates distributions are well proxied by double exponential densities, which dominate both Student’s t and Levy-stable distributions. In light of such results, the choice of Curdia et al. (2014) to drawn shocks from a Student’s t distribution is not only ad-hoc, but not supported by any empirical evidence.

Lindé and Wouters (2016) also conclude that more non-linearities and heterogeneity are required to satisfactory account of default risk, liquidity dynamics, bank runs, as well as to study the interactions between monetary and macroprudential policies.

For a similar discussion about general equilibrium model, see the classic (Kirman 1989).

Recall that in presence of flat likelihood functions as those typically associated to DSGE model, Bayesian estimation simply reduce to a sophisticated calibration exercise. More on that in Section 2.

The increasing supply of big data is likely to considerably improve the input validation of agent-based models. Incidentally, this is not going to apply to representative-agent DSGE models.

According to Moss (2008) one of the advantage of ABMs is that they also allow policy makers to be involved in the development of the model to be employed for policy evaluations.

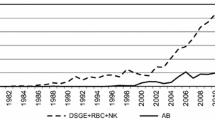

The roots are in Dosi et al. (2010). See also Dosi et al. (2013, 2015a, 2016b) for extensions studying the the possible interactions between credit markets and real dynamics and the impact of different combinations of fiscal and monetary policies. Dosi et al. (2017a) study the role of heterogeneous and adaptive expectations on the performance of the economy. A series of works Dosi et al. (2017b, 2017c, 2018c) extends the K+S model to study the decentralized interactions of firms and workers in the labor markets and the impact of structural reforms. Finally, Lamperti et al. (2018a, 2018b) develop the first agent-based integrated assessment model to jointly account for the coupled climate and economics dynamics.

As we discussed at more length in Dosi and Roventini (2016), this way of theorizing has reached ridiculous levels when economists develop models of rational lovemaking, but even worse, criminal ones, when dynamic models of torture are shamelessly derived to compute the optimal level of punishment!

Romer (2016) also contains a deep discussion on why “post-real” macroeconomics has emerged and why the current norms in the economic profession makes it difficult to jettison it.

We know that even Nobel laureates in economics do not have access to top macroeconomic journals if they submit theoretical papers which are not aligned with orthodoxy.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60:323–351

Akerlof GA (2002) Behavioral macroeconomics and macroeconomic behavior. Am Econ Rev 92:411–433

Akerlof GA (2007) The missing motivation in macroeconomics. Am Econ Rev 97:5–36

Akerlof GA, Shiller RJ (2009) Animal spirits: how human psychology drives the economy, and why it matters for global capitalism. Princeton University Press, Princeton

Akerlof GA, Yellen JL (1985) A near-rational model of the business cycles, with wage and price inertia. Q J Econ 100:823–838

Albert R, Barabasi AL (2002) Statistical mechanics of complex networks. Rev Mod Phys 4:47–97

Alfarano S, Lux T, Wagner F (2005) Estimation of agent-based models: the case of an asymmetric herding model. Comput Econ 26:19–49

Anderson PW (1972) More is different. Science 177 (4047):393–396. http://www.jstor.org/stable/1734697

Anufriev M, Assenza T, Hommes C, Massaro D (2013) Interest rate rules and macroeconomic stability under heterogeneous expectations. Macroecon Dyn 17(08):1574–1604. https://ideas.repec.org/a/cup/macdyn/v17y2013i08p1574-1604_00.html

Anufriev M, Bao T, Tuinstra J (2016) Microfoundations for switching behavior in heterogeneous agent models: an experiment. J Econ Behav Organ 129 (C):74–99. https://doi.org/10.1016/j.jebo.2016.06.00. https://ideas.repec.org/a/eee/jeborg/v129y2016icp74-99.html

Arifovic J (2019) Evolution of sunspot like behavior in the agent based economies of bank runs. J Evol Econ

Ascari G, Ropele T (2009) Trend inflation, Taylor principle, and indeterminacy. J Money Credit Bank 41:1557–1584

Ascari G, Fagiolo G, Roventini A (2015) Fat-tails distributions and business-cycle models. Macroecon Dyn 19:465–476

Assenza T, Delli Gatti D (2013) E pluribus unum: macroeconomic modelling for multi-agent economies. J Econ Dyn Control 37(8):1659–1682

Assenza T, Delli Gatti D (2019) The financial transmission of shocks in a simple hybrid macroeconomic agent based model. J Evol Econ. https://doi.org/10.1007/s00191-018-0559-3

Atkinson AB, Piketty T, Saez E (2011) Top incomes in the long run of history. J Econ Lit 49:3–71

Bak P, Chen K, Scheinkman JA, Woodford M (1992) Aggregate fluctuations from indipendent sectoral shocks: self-organize criticality. Working Paper 4241, NBER

Baptista R, Farmer DJ, Hinterschweiger M, Low K, Tang D, Uluc A (2016) Macroprudential policy in an agent-based model of the UK housing market. Staff Working Paper 619, Bank of England

Barde S (2016) A practical, accurate, information criterion for nth order Markov processes. Comput Econ 50:1–44

Bargigli L, Riccetti L, Russo A, Gallegati M (2016) Network calibration and metamodeling of a financial accelerator agent based model. Working Papers - Economics 2016/01, Universita degli Studi di Firenze, Dipartimento di Scienze per lEconomia e lImpresa

Battiston S, Farmer DJ, Flache A, Garlaschelli D, Haldane A, Heesterbeeck H, Hommes C, Jaeger C, May R, Scheffer M (2016) Complexity theory and financial regulation. Science 351:818–819

Benhabib J, Schmitt-Grohé S, Uribe M (2001) The perils of Taylor rules. J Econ Theory 96:40–69

Bernanke B, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. In: Taylor J, Woodford M (eds) Handbook of macroeconomics. Elsevier Science, Amsterdam

Bernanke BS (2002) On Milton Friedman’s ninetieth birthday. In: Conference to honor Milton Friedman

Beyer A, Farmer REA (2004) On the indeterminacy of New-Keynesian economics. Working Paper Series No. 323, European Central Bank, Frankfurt, Germany

Bloomquist KM, Koehler M (2015) A large-scale agent-based model of taxpayer reporting compliance. J Artif Soc Social Simul 18(2):20. https://doi.org/10.18564/jasss.2621. http://jasss.soc.surrey.ac.uk/18/2/20.html

Bookstaber R (2017) The end of theory: financial crises, the failure of economics, and the sweep of human interaction. Princeton University Press, Princeton

Bookstaber R, Paddrik M (2015) An agent-based model for crisis liquidity dynamics. Working Paper 15-18, OFR

Branch WA, McGough B (2011) Monetary policy and heterogeneous agents. Econ Theory 47:365–393

Braun-Munzinger K, Liu Z, Turrell A (2016) An agent-based model of dynamics in corporate bond trading. Staff Working Paper 592, Bank of England

Brock WA, Durlauf SN (2001) Interactions-based models. In: Heckman J, Leamer E (eds) Handbook of econometrics. North Holland, Amsterdam

Brock WA, Hommes C (1997) A rational route to randomness. Econometrica 65:1059–1095

Brock WA, Durlauf S, Nason JM, Rondina G (2007) Simple versus optimal rules as guides to policy. J Monet Econ 54:1372–1396

Caballero RJ (2010) Macroeconomics after the crisis: time to deal with the pretense-of-knowledge syndrome. J Econ Perspect 24:85–102

Caiani A, Godin A, Caverzasi E, Gallegati M, Kinsella S, Stiglitz J (2016) Agent based-stock flow consistent macroeconomics: towards a benchmark model. J Econ Dyn Control 69:375–408

Caiani A, Russo A, Gallegati M (2019) Does inequality Hamper innovation and growth? an ab-sfc analysis. J Evol Econ. https://doi.org/10.1007/s00191-018-0554-8

Canova F (2008) How much structure in empirical models? In: Mills T, Patterson K (eds) Palgrave handbook of econometrics, vol 2, applied econometrics. Palgrave Macmillan, Basingstoke

Canova F, Sala L (2009) Back to square one: identification issues in dsge models. J Monet Econ 56:431–449

Canzoneri M, Collard F, Dellas H, Diba B (2016) Fiscal multipliers in recessions. Econ J 126:75–108

Cassidy J (2009) How markets fail. Allen Lane, London/New York

Caverzasi E, Russo A (2018) Toward a new microfounded macroeconomics in the wake of the crisis. LEM Working Papers Series 2018/23, Scuola Superiore Sant’Anna

Chan-Lau JA (2017) Abba: an agent-based model of the banking system. IMF Working Paper 17/136

Chari VV, Kehoe PJ, ME R (2009) New Keynesian models are not yet useful for policy analysis. Am Econ J Macroecon 1:242–266

Christiano LG, Motto R, Rostagno M (2013) Risk shocks. Am Econ Rev 104:27–65

Ciarli T, Lorentz A, Savona M, Valente M (2010) The effect of consumption and production structure on growth and distribution. A micro to macro modelroduction structure on growth and distribution. A micro to macro model. Metroeconomica 61:180–218

Ciarli T, Lorentz A, Valente M, Savona M (2019) Structural changes and growth regimes. J Evol Econ. https://doi.org/10.1007/s00191-018-0574-4

Cincotti S, Raberto M, Teglio A (2010) Credit money and macroeconomic instability in the agent-based model and simulator eurace. Economics: the Open-Access, Open-Assessment E-Journal 4(2010-26)

Clarida R, Galí J, Gertler M (1999) The science of monetary policy: a new Keynesian perspective. J Econ Lit 37:1661–1707

Cogley T, Nason JM (1993) Impulse dynamics and propagation mechanisms in a real business cycle model. Econ Lett 43:77–81

Coibion O, Gorodnichenko Y (2015) Information rigidity and the expectations formation process: a simple framework and new facts. Am Econ Rev 105:2644–2678

Colander D, Folmer H, Haas A, Goldberg MD, Juselius K, Kirman AP, Lux T, Sloth B (2009) The financial crisis and the systemic failure of academic economics. Tech. rep., 98th Dahlem Workshop

Cooper RW, John A (1988) Coordinating coordination failures in Keynesian models. Q J Econ 103:441–463

Curdia V, Woodford M (2010) Credit spreads and monetary policy. J Money Credit Bank 42:3–35

Curdia V, Woodford M (2011) The central-bank balance sheet as an instrument of monetary policy. J Monet Econ 58:54–79

Curdia V, Woodford M (2015) Credit frictions and optimal monetary policy. NBER Working paper 21820, National Bureau of Economic Research

Curdia V, Del Negro M, Greenwald D (2014) Rare shocks, great recessions. J Appl Econom 29:1031–1052

Cyert RM, March JG (1992) A behavioral theory of the firm, 2nd edn. Blackwell Business, Oxford

Da Silva MA, Tadeu Lima G (2015) Combining monetary policy and prudential regulation: an agent-based modeling approach. Working paper 394, Banco Central do Brasil

Dawid H, Delli Gatti D (2018) Agent-based macroeconomics. In: Hommes C, LeBaron B (eds) Handbook of computational economics, vol IV. Elsevier

Dawid H, Gemkow S, Harting P, Neugart M (2012) Labor market integration policies and the convergence of regions: the role of skills and technology diffusion. J Evol Econ 22:543–562

Dawid H, Harting P, Neugart M (2014) Economic convergence: policy implications from a heterogeneous agent model. J Econ Dyn Control 44:54–80

Dawid H, Harting P, Neugart M (2018a) Cohesion policy and inequality dynamics: insights from a heterogeneous agents macroeconomic model. J Econ Behav Organ 150:220–255

Dawid H, Harting P, Neugart M (2018b) Fiscal transfers and regional economic growth. Rev Int Econ 26:651–671

Dawid H, Harting P, van der Hoog S, Neugart M (2019) Macroeconomics with heterogeneous agent models: fostering transparency, reproducibility and replication. J Evol Econ

De Grauwe P (2012) Booms and busts in economic activity: a behavioral explanation. J Econ Behav Organ 83:484–501

De Long JB (2000) The triumph of monetarism? J Econ Perspect 14:83–94

Debreu G (1974) Excess demand function. J Math Econ 1:15–23

Dilaver O, Jump R, Levine P (2018) Agent-based macroeconomics and dynamic stochastic general equilibrium models: where do we go from here? J Econ Surv 32:1134–1159

Domar ED (1946) Capital expansion, rate of growth, and employment. Econometrica 14:137–47

Dos Santos T, Nakane M (2017) Dynamic bank runs: an agent-based approach. Working Paper 465, Banco Central do Brasil

Dosi G (2012a) Economic coordination and dynamics: some elements of an alternative “evolutionary” paradigm. LEM Working Papers Series 2012/08, Scuola Superiore Sant’Anna

Dosi G (2012b) Economic organization, industrial dynamics and development. Edward Elgar, Cheltenham. chap Introduction

Dosi G, Roventini A (2016) The irresistible fetish of utility theory: From “pleasure and pain” to rationalising torture. Intereconomics 51:286–287

Dosi G, Roventini A (2017) Agent-based macroeconomics and classical political economy: Some Italian roots. Italian Economic Journal: a Continuation of Rivista Italiana degli Economisti and Giornale degli Economisti 3(3):261–283

Dosi G, Virgillito ME (2017) In order to stand up you must keep cycling: Change and coordination in complex evolving economies. Struct Chang Econ Dyn

Dosi G, Winter SG (2002) Interpreting economic change: evolution, structures and games. In: Augier M, March J (eds) The economics of choice, change, and organizations. Cheltenham, Edward Elgar Publishers

Dosi G, Fagiolo G, Roventini A (2010) Schumpeter meeting Keynes: a policy-friendly model of endogenous growth and business cycles. J Econ Dyn Control 34:1748–1767

Dosi G, Fagiolo G, Napoletano M, Roventini A (2013) Income distribution, credit and fiscal policies in an agent-based Keynesian model. J Econ Dyn Control 37:1598–1625

Dosi G, Fagiolo G, Napoletano M, Roventini A, Treibich T (2015a) Fiscal and monetary policies in complex evolving economies. J Econ Dyn Control 52 (2014/22):166–189

Dosi G, Sodini M, Virgillito ME (2015b) Profit-driven and demand-driven investment growth and fluctuations in different accumulation regimes. J Evol Econ 25:707–728

Dosi G, Napoletano M, Roventini A, Treibich T (2016a) Micro and macro policies in Keynes+Schumpeter evolutionary models. J Evol Econ 27:63–90

Dosi G, Napoletano M, Roventini A, Treibich T (2016b) The short- and long-run damages of fiscal austerity: Keynes beyond Schumpeter. In: Stiglitz J, Guzman M (eds) Contemporary issues in macroeconomics. Palgrave Macmillan, UK

Dosi G, Napoletano M, Roventini A, Stiglitz J, Treibich T (2017a) Rational heuristics? Expectations in complex, evolving economies with heterogeneous, interacting agents. Working Paper Series 2017/31, Laboratory of Economics and Management (LEM), Scuola Superiore SantAnna, Pisa, Italy

Dosi G, Pereira MC, Roventini A, Virgillito ME (2017b) When more flexibility yields more fragility: the microfoundations of Keynesian aggregate unemployment. J Econ Dyn Control 81:162–186

Dosi G, Pereira MC, Roventini A, Virgillito ME (2017c) The effects of labour market reforms upon unemployment and income inequalities: an agent based model. Soc Econ Rev 16:687–720

Dosi G, Pereira MC, Virgillito ME (2017d) On the robustness of the fat-tailed distribution of firm growth rates: a global sensitivity analysis. J Econ Interac Coord 13:173–193

Dosi G, Faillo M, Marengo L (2018a) Beyond “bounded rationality”: behaviours and learning in complex evolving worlds. LEM Working Papers Series 2018/26, Scuola Superiore Sant’Anna

Dosi G, Pereira M, Roventini A, Virgillito ME (2018b) The labour-augmented K+S model: a laboratory for the analysis of institutional and policy regimes. LEM Working Papers Series 2018/24, Scuola Superiore Sant’Anna

Dosi G, Pereira MC, Roventini A, Virgillito ME (2018c) Causes and consequences of hysteresis: Aggregate demand, productivity and employment. Ind Corp Chang 27:1015–1044

Dosi G, Napoletano M, Roventini A, Treibich T (2019) Debunking the granular origins of aggregate fluctuations: from real business cycles back to Keynes. J Evol Econ. https://doi.org/10.1007/s00191-018-0590-4

Edelman GM, Gally JA (2001) Degeneracy and complexity in biological systems. Proc Natl Acad Sci 98:13763–13768

Eggertsson GB, Krugman P (2012) Debt, deleveraging, and the liquidity trap: a fisher-minsky-koo approach. Q J Econ 127:1469–1513

Evans GW, Honkapohja S (2001) Learning and expectations in macroeconomics. Princeton University Press, Princeton

Fagiolo G, Roventini A (2012) Macroeconomic policy in DSGE and agent-based models. Revue de l’OFCE 124:67–116

Fagiolo G, Roventini A (2017) Macroeconomic policy in DSGE and agent-based models redux: new developments and challenges ahead. J Artif Soc Social Simul 20 (1):1

Fagiolo G, Napoletano M, Roventini A (2008) Are output growth-rate distributions fat-tailed? some evidence from oecd countries. J Appl Econom 23:639–669

Fagiolo G, Guerini M, Lamperti F, Moneta A, Roventini A (2017) Validation of agent-based models in economics and finance. In: Beisbart C, Saam NJ (eds) Computer simulation validation. Fundamental concepts, methodological frameworks, philosophical perspectives. also available as Scuola Superiore Sant’Anna LEM Working Papers Series 2017/23. Springer International Publishing

Farmer DJ, Foley D (2009) The economy needs agent-based modeling. Nature 460:685–686

Favero C (2007) Model evaluation in macroeconometrics: from early empirical macroeconomic models to dsge models. Working Paper 327, IGIER, Bocconi University, Milan, Italy

Fernandez-Villaverde J, Levintal O (2016) Solution methods for models with rare disasters. Working Paper 21997, National Bureau of Economic Research

Fitoussi J, Saraceno F (2010) Inequality and macroeconomi performance. Document de Travail 2010-13, OFCE, Science Po

Fitoussi JP, Saraceno F (2013) European economic governance: the Berlin–Washington consensus. Camb J Econ 37:479–496

Forni M, Lippi M (1997) Aggregation and the microfoundations of dynamic macroeconomics. Oxford University Press, Oxford

Forni M, Lippi M (1999) Aggregation of linear dynamic microeconomic models. J Math Econ 31:131–158

Friedman M (1968) The role of monetary policy. Am Econ Rev 58:1–17

Fukac M, Pagan A (2006) Issues in adopting dsge models for use in the policy process. Working Paper 10/2006, CAMA

Fukuyama F (1992) The end of history and the last man. Penguin, London

Gabaix X (2011) The granular origins of aggregate fluctuations. Econometrica 79(3):733–772

Gabaix X (2014) A sparsity-based model of bounded rationality*. Q J Econ 129(4):1661–1710. https://doi.org/10.1093/qje/qju024

Galí J, Gertler M (2007) Macroeconomic modelling for monetary policy evaluation. J Econ Perspect 21:25–46

Gennaioli N, Ma Y, Shleifer A (2015) Expectations and investment. NBER Working paper 21260, National Bureau of Economic Research

Gertler M, Karadi P (2011) A model of unconventional monetary policy. J Monet Econ 58:17–34

Gertler M, Kiyotaki N (2010) Financial intermediation and credit policy in business cycle analysis. In: Friedman BM, Woodford M (eds) Handbook of monetary economics. North Holland, Amsterdam

Ghironi F (2018) Macro need micro. Oxf Rev Econ Policy 34:195–218

Gigerenzer G (2007) Gut feelings the intelligence of the unconscious. Viking, New York

Gigerenzer G, Brighton H (2009) Homo heuristicus: why biased minds make better inferences. Top Cogn Sci 1:107–143

Goodfriend M (2007) How the world achieved consensus on monetary policy. J Econ Perspect 21:47–68

Goodhart CAE (2009) The continuing muddles of monetary theory: a steadfast refusal to face facts. Economica 76:821–830

Goodwin RM (1950) A nonlinear theory of the cycle. Rev Econ Stud 32:316–320

Goodwin RM (1951) The nonlinear accelerator and the persistence of business cycles. Econometrica 19:1–17

Grazzini J, Richiardi M (2015) Estimation of ergodic agent-based models by simulated minimum distance. J Econ Dyn Control Control 51(C):148–165. http://EconPapers.repec.org/RePEc:eee:dyncon:v:51:y:2015:i:c:p:148-165

Grazzini J, Richiardi M, Sellad L (2013) Indirect estimation of agent-based models. an application to a simple diffusion model. Complex Econ 2:25–40

Grazzini J, Richiardi MG, Tsionas M (2017) Bayesian estimation of agent-based models. J Econ Dyn Control 77(C):26–47. http://ideas.repec.org/a/eee/dyncon/v77y2017icp26-47.html

Greenwald B, Stiglitz J (1993a) Financial market imperfections and business cycles. Q J Econ 108:77–114

Greenwald B, Stiglitz J (1993b) New and old Keynesians. J Econ Perspect 7:23–44

Gualdi S, Mandel A (2019) Endogenous growth in production networks. J Evol Econ. https://doi.org/10.1007/s00191-018-0552-x

Guerini M, Moneta A (2017) A method for agent-based models validation. J Econ Dyn Control 82:125–141

Hahn F (1991) The next hundred years. Econ J 101:47–50

Halaj G (2018) Agent-based model of system-wide implications of funding risk. Working Paper Series 2121, European Central Bank

Haldane A (2012) The dog and the frisbee. Central Bankers Speeches, BIS

Haldane AG, Turrell AE (2019) Drawing on different disciplines: macroeconomic agent-based models. J Evol Econ. https://doi.org/10.1007/s00191-018-0557-5

Harcourt GC (2007) The structure of post-Keynesian economics. Hist Econ Rev 45:95–105

Harcourt GC, Karmel PH, Wallace RH (1967) Economic activity. Cambridge University Press, Cambridge

Harrod RF (1939) An essay in dynamic theory. Econ J 49:14–33

Heckman J, Moktan S (2018) Publishing and promotion in economics: the tyranny of the top five. Working Paper 25093, NBER

Hendry D, Minzon G (2010) On the mathematical basis of inter-temporal optimization. Economics Series Working Papers 497, University of Oxford

Hicks JR (1937) Mr. Keynes and the “Classics”: a suggested interpretation. Econometrica 5:147–159

Hommes C (2013) Behavioral rationality and heterogeneous expectations in complex economic systems. Cambridge University Press, Cambridge

van der Hoog S, Dawid H (2017) Bubbles, crashes, and the financial cycle. The impact of banking regulation on deep recessions. Macroecon Dyn

Hosszu S, Mero B (2017) An agent based Keynesian model with credit cycles and countercyclical capital buffer. MNB Workin Papers 5, Magyar Nemze Bank

Howitt P (2012) What have central bankers learned from modern macroeconomic theory? J Macroecon 34:11–22

Johansen S (2006) Confronting the economic model with the data. In: Colander D (ed) Post Walrasian macroeconomics. Cambridge University Press, Cambridge

Juselius K, Franchi M (2007) Taking a dsge model to the data meaningfully. Economics: the Open-Access, Open-Assessment E-Journal 1 (2007-4)

Kaldor N (1957) A model of economic growth. Econ J 67(268):591–624. http://www.jstor.org/stable/2227704

Kaldor N (1982) The scourge of monetarism. Oxford University Press, London

Kaplan G, Moll B, Violante GL (2018) Monetary policy according to hank. Am Econ Rev 108:697–743

Kay J (2011) The map is not the territory: an essay on the state of economics. Tech. rep., Institute for New Economic Thinking

Keynes JM (1921) Treatise on probability. Macmillan and Co, London

Keynes JM (1936) The general theory of employment, interest and money. Prometheus Books, New York

Kirman AP (1989) The intrinsic limits of modern economic theory: the emperor has no clothes. Econ J 99:126–39

Kirman AP (1992) Whom or what does the representative individual represent? J Econ Perspect 6:117–136

Kirman AP (2010a) Complex economics individual and collective rationality. Routledge, London

Kirman AP (2010b) The economic crisis is a crisis for economic theory. CESifo Econ Stud 56:498– 535

Kirman AP (2014) Is it rational to have rational expectations? Mind and Society 13:29–48

Kirman AP (2016) Ants and nonoptimal self-organization: lessons for macroeconomics. Macroecon Dyn 20:601–621

Kirman AP, Vriend NJ (2001) Evolving market structure: an ace model of price dispersion and loyalty. J Econ Dyn Control 25 (3):459–502. https://doi.org/10.1016/S0165-1889(00)00033-6. http://www.sciencedirect.com/science/article/pii/S0165188900000336, agent-based Computational Economics (ACE)

Klamer A (1984) The new classical macroeconomics conversations with the new classical economists and their opponents. Wheatsheaf Books, Brighton

Knight F (1921) Risk, uncertainty and profits. Chicago University Press, Chicago

Krugman P (2009) How did economics get it so wrong? N Y Times Mag (9):36–44

Krugman P (2011) The profession and the crisis. East Econ J 37:307–312

Kumhof M, Ranciere R, Winant P (2015) Inequality, leverage, and crises. Am Econ Rev 105:1217–45

Kydland FE, Prescott EC (1982) Time to build and aggregate fluctuations. Econometrica 50:1345–70

Lamperti F (2018) Empirical validation of simulated models through the gsl-div: an illustrative application. J Econ Interac Coord 13(1):143–171

Lamperti F, Dosi G, Napoletano M, Roventini A, Sapio A (2018a) And then he wasn’t a she: climate change and green transitions in an agent-based integrated assessment model. LEM Working Papers Series 2018/14, Scuola Superiore Sant’Anna

Lamperti F, Dosi G, Napoletano M, Roventini A, Sapio A (2018b) Faraway, so close: coupled climate and economic dynamics in an agent-based integrated assessment model. Ecol Econ 150:315–339

Lamperti F, Roventini A, Sani A (2018c) Agent-based model calibration using machine learning surrogates. J Econ Dyn Control 90:366–389

Landes DS (1969) The unbound prometheus: technological change and industrial development in Western Europe from 1750 to the present. Cambridge University Press, Cambridge

Lane DA (1993) Artificial worlds and economics, part i and ii. J Evol Econ 3:89–107 and 177–197

Lavoie M (2009) Introduction to Post-Keynesian economics. Palgrave Macmillan, London

Lavoie M, Stockhammer E (eds) (2013) Wage-led growth. Palgrave Macmillan, London

LeBaron B, Tesfatsion L (2008) Modeling macroeconomies as open-ended dynamic systems of interacting agents. Am Econ Rev 98:246–250

Leijonhufvud A (1968) On Keynesian economics and the economics of Keynes: a study in monetary theory. Oxford University Press, New York

Leijonhufvud A (2000) Macroeconomic instability and coordination: selected essays. Edward Elgar, Cheltenham

Lindé SF, Wouters R (2016) Challenges for central banks’ macro models. In: Taylor JB, Uhlig H (eds) Handbook of macroeconomics. North Holland

Lorentz A, Ciarli T, Savona M, Valente M (2016) The effect of demand-driven structural transformations on growth and technological change. J Evol Econ 26:219–246

Lucas J (2003) Macroeconomic priorities. Am Econ Rev 93(1):1–14. https://doi.org/10.1257/000282803321455133, http://www.aeaweb.org/articles?id=10.1257/000282803321455133

Lucas REJ, Sargent TJ (1978) After Keynesian macroeconomics. In: After the Phillips curve: persistence of high inflation and high unemployment. Federal Reserve Bank of Boston, Boston, MA

Mankiw GN, Romer D (eds) (1991) New Keynesian economics. MIT Press, Cambridge

Mantel R (1974) On the characterization of aggregate excess demand. J Econ Theory 7:348–353

Massaro D (2013) Heterogeneous expectations in monetary dsge models. J Econ Dyn Control 37:680–692

Meijers H, Nomaler Ö, Verspagen B (2019) Demand, credit and macroeconomic dynamics. a micro simulation model. J Evol Econ. https://doi.org/10.1007/s00191-018-0553-9

Mishkin FS (2007) Will monetary policy become more of a science. Working Paper 13566, NBER

Montagna M, Kok C (2016) Multi-layered interbank model for assessing systemic risk. Working Paper Series 2121, European Central Bank

Moss S (2008) Alternative approaches to the empirical validation of agent-based models. J Artif Soc Social Simul 11:(1). http://jasss.soc.surrey.ac.uk/11/1/5.html

Muth JF (1961) Rational expectations and the theory of price movements. Econometrica 29:315–335

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. The Belknap Press of Harvard University Press, Cambridge

Orphanides A, Williams JC (2008) Robust monetary policy with imperfect knowledge. J Monet Econ 54:1406–1435

Pasinetti LL (1974) Growth and income distribution: essays in economic theory. Cambridge University Press, Cambridge

Pasinetti LL (1983) Structural change and economic growth: a theoretical essay on the dynamics of the wealth of nations, vol 7. Cambridge University Press, Cambridge

Pesaran HM, Chudik A (2011) Aggregation in large dynamic panels. Working Paper Series 3346, CESifo

Piketty T, Zucman G (2014) Capital is back: wealth-income ratios in rich countries, 1700-2010. Q J Econ 129:1155–1210

Ponomarenko A, Sinyakov A (2018) Impact of banking supervision enhancement on banking system structure: conclusions from agent-based modeling. Russian J Money Finance 77(1):26–50. https://ideas.repec.org/a/bkr/journl/v77y2018i1p26-50.html

Ponta L, Raberto M, Teglio A, Cincotti S (2018) An agent-based stock-flow consistent model of the sustainable transition in the energy sector. Ecol Econ 145:274–300. https://doi.org/10.1016/j.ecolecon.2017.08.022 . http://www.sciencedirect.com/science/article/pii/S0921800916310138

Poudyal N, Spanos A (2013) Confronting theory with data: model validation and dsge modeling. Working paper Department of Economics, Virginia Tech, USA

Prigogine I (1980) From being to becoming: time and complexity in the physical sciences. Freeman, San Francisco

Raberto M, Teglio A, Cincotti S (2012) Debt deleveraging and business cycles. an agent-based perspective. Economics - The Open-Access, Open-Assessment E-Journal 6 (1-49)

Raberto M, Ozel B, Ponta L, Teglio A, Cincotti S (2019) From financial instability to green finance: the role of banking and credit market regulation in the eurace model. J Evol Econ. https://doi.org/10.1007/s00191-018-0568-2

Ramsey FP (1928) A mathematical theory of saving. Econ J 38:543–559

Rengs B, Scholz-Wäckerle M (2019) Consumption & class in evolutionary macroeconomics. J Evol Econ. https://doi.org/10.1007/s00191-018-0592-2

Romer P (1990) Endogenous technical change. J Polit Econ 98:71–102

Romer P (2016) The trouble with macroeconomics. The American Econ

Rosser BJ (2011) Complex evolutionary dynamics in urban-regional and ecologic-economic systems: from catastrophe to chaos and beyond. Springer, New York

Saari D, Simon CP (1978) Effective price mechanisms. Econometrica 46:1097–1125

Salle I, Yıldızoğlu M (2014) Efficient sampling and meta-modeling for computational economic models. Comput Econ 44(4):507–536

Salle I, Sénégas MA, Yıldızoğlu M (2019) How transparent about its inflation target should a central bank be? J Evol Econ. https://doi.org/10.1007/s00191-018-0558-4

Schmitt-Grohé S, Uribe M (2000) Price level determinacy and monetary policy under a balanced-budget requirement. J Monet Econ 45:211–246

Seppecher P (2012) Flexibility of wages and macroeconomic instability in an agent-based computational model with endogenous money. Macroecon Dyn 16:284–297

Seppecher P, Salle I (2015) Deleveraging crises and deep recessions: a behavioural approach. Appl Econ 47:3771–3790

Seppecher P, Salle I, Lang D (2019) Is the market really a good teacher? J Evol Econ. https://doi.org/10.1007/s00191-018-0571-7

Simon HA (1955) A behavioral model of rational choice. Q J Econ 69:99–118

Simon HA (1959) Theories of decision-making in economics and behavioral science. Am Econ Rev 49:253–283

Simon HA (1977) An empirically based microeconomics. Cambridge University Press, Cambridge

Sims CA (2010) Chapter 4 - rational inattention and monetary economics. Handbook of Monetary Economics, vol 3, Elsevier, pp 155–181. https://doi.org/10.1016/B978-0-444-53238-1.00004-1. http://www.sciencedirect.com/science/article/pii/B9780444532381000041

Smets F, Wouters R (2003) An estimated dynamic stochastic general equilibrium model of the euro area. J Eur Econ Assoc 1:1123–1175

Smets F, Wouters R (2007) Shocks and frictions in us business cycles: a bayesian dsge approach. Am Econ Rev 97:586–606

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70:65–94

Solow RM (2005) Reflections on growth theory. Handbook of Economic Growth 1:3–10

Solow RM (2018) A theory is a sometime thing. Rev Keynesian Econ 6:421–424

Sonnenschein H (1972) Market excess demand functions. Econometrica 40:549–556

Steffen W, Rockström J, Richardson K, Lenton TM, Folke C, Liverman D, Summerhayes CP, Barnosky AD, Cornell SE, Crucifix M, Donges JF, Fetzer I, Lade SJ, Scheffer M, Winkelmann R, Schellnhuber HJ (2018) Trajectories of the earth system in the anthropocene. Proc Natl Acad Sci 115(33):8252–8259. https://doi.org/10.1073/pnas.1810141115. http://www.pnas.org/content/115/33/8252.full.pdf

Stiglitz J (2011) Rethinking macroeconomics: what failed, and how to repair it. J Eur Econ Assoc 9:591–645

Stiglitz J (2015) Towards a general theory of deep downturns. Working Paper 21444, NBER

Stiglitz JE (2017) Structural transformation, deep downturns, and government policy NBER. Working Papers 23794, National Bureau of Economic Research, Inc

Storm S, Naastepad CWM (2012a) Macroeconomics beyond the NAIRU. Harvard University Press, Cambridge

Storm S, Naastepad CWM (2012b) Wage-led or profit-led supply: wages, productivity and investment. Conditions of Work and Employment Series 36, ILO

Taylor J (2007) The explanatory power of monetary policy rules. Working Paper 13685, NBER

Teglio A, Mazzocchetti A, Ponta L, Raberto M, Cincotti S (2017) Budgetary rigour with stimulus in lean times: policy advices from an agent-based model. J Econ Behavior Org. https://doi.org/10.1016/j.jebo.2017.09.016

Tesfatsion L (2006) Ace: a constructive approach to economic theory. In: Tesfatsion L, Judd K (eds) Handbook of computational economics II: agent-based computational economics. North Holland, Amsterdam

Tesfatsion L, Judd K (eds) (2006) Handbook of computational economics II: agent-based computational economics. North Holland, Amsterdam

Turner A (2010) The crisis, conventional economic wisdom, and public policy. Ind Corp Chang 19:1317–1329

Turrell A (2016) Agent-based models: understanding the economy from the bottom up. Bank of England Quarterly Bulletin Q4

Windrum P, Fagiolo G, Moneta A (2007) Empirical validation of agent-based models: alternatives and prospects. Journal of Artificial Societies and Social Simulation 10(2):8. http://jasss.soc.surrey.ac.uk/10/2/8.html

Winker P, Gilli M, Jeleskovic V (2007) An objective function for simulation based inference on exchange rate data. J Econ Interac Coord 2:125–145

Woodford M (1990) Learning to believe in sunspots. Econometrica 58:277–307

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton

Woodford M (2013) Macroeconomic analysis without the rational expectations hypothesis. Ann Rev Econ 5:303–346

Woodford M (2018) Monetary policy analysis when planning horizons are finite. University of Chicago Press, Chicago

Zarnowitz V (1985) Recent works on business cycles in historical perspectives: a review of theories and evidence. J Econ Lit 23:523–580

Zarnowitz V (1997) Business cycles observed and assessed: why and how they matter. Working Paper 6230, NBER

Acknowledgments

Thanks to Giorgio Fagiolo, Mattia Guerini, Francesco Lamperti, Alessio Moneta, Maria Enrica Virgillito. All usual disclaimers apply. This study was funded by European Union’s Horizon 2020 grants: No. 649186 - Project ISIGrowth. The authors declare that they have no conflict of interest.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dosi, G., Roventini, A. More is different ... and complex! the case for agent-based macroeconomics. J Evol Econ 29, 1–37 (2019). https://doi.org/10.1007/s00191-019-00609-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-019-00609-y

Keywords

- Macroeconomics

- Economic policy

- Keynesian theory

- New neoclassical synthesis

- New Keynesian models

- DSGE models

- Agent-based evolutionary models

- Complexity theory

- Great recession

- Crisis