Abstract

Tracking the chain of events generated by an aggregate shock in an Agent Based Model (ABM) is apparently an impossible mission. Employing the methodology described in Assenza and Delli Gatti (J Econ Dyn Control 37(8):1659–1682 2013) (AD2013 hereafter), in the present paper we show that such a task can be carried out in a straightforward way by using a hybrid macro ABM consisting of a IS curve, an Aggregate Supply (AS) curve and a Taylor Rule (TR) in that aggregate investment is a function of the moments of the distribution of firms’ net worth. For each shock (fiscal expansion, monetary tightening, financial shock) we can decompose the change of the aggregate scale of activity (measured by the employment rate) in a first round effect – i.e., the change generated by the shock keeping the moments of the distribution of net worth at the pre-shock level – and a second round effect, i.e., the change brought about by the variation in the moments induced by the aggregate shock. In turn, the second round effect can be decomposed in a term that would show up also in a pure Representative Agent setting (RA component) and a term that is specific to the model with Heterogeneous Agents (HA component). In all the cases considered, the first round effect explains most of the actual change of the output gap. The second round effect is unambiguously negative. The HA component has the same sign of the RA component and explains a sizable fraction of the second round effect.

Similar content being viewed by others

Notes

In the following we show, in fact, that the aggregate EFP is decreasing with the cross-sectional mean of the net worth distribution and increasing with the cross-sectional variance.

A similar procedure, within a different setup, is adopted by Krusell and Smith (1998).

The moments of the distribution of firms’ net worth, therefore, enter as (predetermined) state variables in the reduced form of the IS-AS-TR model.

More precisely, the second round effect is determined by the repercussion of the shock on the average EFP, that in turn is determined by the change of the moments.

The time indicator is t = 0, ... T (with T = 1500 in our simulations).

Where c[wxt + σ(1 − xt)]ma represents consumption of active members of the household, respectively employed and unemployed. While \(\bar c (m-m_{a})\) represents consumption of unemployed members of the household.

Notice that the net worth of the representative firm coincides with the cross-sectional mean when the variance is zero. In other words, the representative firm is the zero-variance average firm.

All the parameters must be intended as positive unless otherwise specified.

We assume that λ > w so that γ > 0.

Equation 2.6 guarantees that individual expected profits are positive; realized profits maybe positive or negative depending on the realization of the idiosyncratic shock uit.

First, we approximate (2.8) around the cross-sectional mean of net worth At− 1 by means of a second order Taylor expansion:

$$\begin{array}{@{}rcl@{}} f_{it}&\approx& \frac{\alpha}{A_{t-1}}+\left.\frac{\partial f_{it}}{\partial A_{it-1}}\right\vert_{A_{t-1}}(A_{it-1}-A_{t-1})+\left.\frac{1}{2}\frac{\partial^{2} f_{it}}{\partial A_{it-1}^{2}}\right\vert_{A_{t-1}}(A_{it-1}-A_{t-1})^{2} \end{array} $$where \(\left .\frac {\partial f_{it}}{\partial A_{it-1}}\right \vert _{A_{t-1}}=-\frac {\alpha }{A_{t-1}^{2}}\) and \(\left .\frac {\partial ^{2} f_{it}}{\partial A_{it-1}^{2}}\right \vert _{A_{t-1}}=\frac {2\alpha }{A_{t-1}^{3}}\). Substituting these derivatives in the expression above, taking the expected value of the RHS and recalling that < Ait− 1 − At− 1 >= 0 and < (Ait− 1 − At− 1)2 >= Vt− 1, we obtain (2.12).

Notice that the output gap, as shown in subsection 3.2, is yt = ηxt − 1.

The nominal interest rate will be determined residually from Eq. 3.3.

These restrictions imply an upper bound on the average EFP, that must be enforced across simulations.

From Eq. 4.3 we infer that the interest rate goes down when the EFP goes up. Hence an increase of the EFP has opposite effects on the cross-sectional mean of the individual interest rates: < rit >= rt + ft, which is the sum of the risk free interest rate and of the average EFP. On impact, by construction, the cross-sectional mean of the individual interest rates increases one to one with an increase of the average EFP but the equilibrium risk free rate decreases. that effect prevails? Using the definition of the equilibrium interest rate, we get: < rit >= rn − βx(ηx2 − 1) + (1 − βxηx3)ft. Notice that, from the definition of x3 it follows that 1 − βxηx3 > 0. Hence we can conclude that the direct effect prevails: an increase of the EFP unambiguously increases the average cost of credit. Since investment in the aggregate is \(K_{t}=\frac {\gamma - (r_{t}+f_{t})}{\omega }\) (see Eq. 2.11), investment unambiguously declines when the EFP goes up.

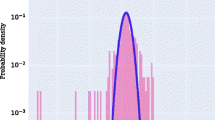

In the simulations, the cross-sectional mean and variance of the distribution of net worth tend to fluctuate around a lsong run value. Therefore, there is a long run mean and a long run variance of the distribution of net worth. We infer from this that the process is ergodic, meaning that there is a tendency for the distribution to achieve a long run shape captured, in our simple framework, by the long run cross-sectional mean and variance.

The assumption on dividend distribution is technical. By assuming that a fraction δ of net worth goes wasted in dividend distribution, we slow down the process of net worth accumulation.

In fact we set αx = απ = 0.5. Moreover, the inflation target is set, for simplicity, at πT = 0.

Notice that the long run averages are determined as the average of the time series shown in Fig. 2, that in turn are the time series derived from the Monte Carlo simulations.

The fiscal multiplier in the absence of monetary tightening would be \(\frac {dx_{0}}{dG}\).

The empirical distribution of net worth is endogenously determined (by means of the artificial data generated by the ABM) and evolving over time. It has support (\(A_{t}^{min}\), \(A_{t}^{max}\)) where \(A_{t}^{min}\) is the minimum level of net worth and coincides with the exit threshold (that is the same for all the firms) and \(A_{t}^{max}\) is the maximum level of net worth, i.e., the net worth of the wealthiest firm. The distribution is affected by the fiscal expansion through the effect of the latter on the interest rate rt. Since the interest rate goes up, \(A_{t}^{min}\) will increase. Some firms that would survive if the shock did not occur will go bankrupt. Moreover, profit and net worth of the surviving firms will go down. Hence the first moment of the distribution (the cross-sectional mean) goes down. The probability mass shifts towards the exit threshold. In this case it is perfectly possible that \(A_{t}^{max}\) will go down, i.e., even the wealthiest firm will be poorer. The variance therefore will go down.

The first round crowding out effect is due to the increase of the interest rate when we keep the distribution unchanged, as shown by comparing M to L0.

Fiscal and monetary parameters are incorporated in x3.

References

Agliari A, Delli Gatti D, Gallegati M, Gardini L (2000) Global dynamics in a non-linear model of the equity ratio. J Solitons Fractals 11:961–985

Assenza T, Delli Gatti D (2013) E Pluribus Unum: macroeconomic modelling for multi-agent economies. J Econ Dyn Control 37(8):1659–1682

Assenza T, Delli Gatti D, Grazzini J (2015) Emergent dynamics of a macroeconomic agent based model with capital and credit. J Econ Dyn Control 50:5–28

Bernanke B, Gertler M (1989) Agency costs, net worth, and business fluctuations. Am Econ Rev 79(1):14–31

Bernanke B, Gertler M (1990) Financial fragility and economic performance. Q J Econ 105(1):87–114

Cincotti S, Raberto M, Teglio A (2010) Credit, money and macroeconomic instability in the Agent-based Model and simulator Eurace. Econ: Open-Access Open-Assess E-J 4:26

Cincotti S, Raberto M, Teglio A (2012) Debt deleveraging and business cycles. n agent-based perspective. Econ Open-Access Open-Assess E-J 4:26

Dawid H, Neugart M (2011) Agent-based models for economic policy design. East Econ J 37(1):44–50

Dawid H, Gemkow S, Harting P, van der Hoog S, Neugarty M (2012) The Eurace @UnibiModel: an agent-based macroeconomic model for economic policy analysis. Bielefeld Working Papers in Economics and Management No. 05–2012

Delli Gatti D, Diguilmi C, Gaffeo E, Gallegati M, Giulioni G, Palestrini A (2005) A new approach to business fluctuations: heterogeneous interacting agents, scaling laws and financial fragility. J Econ Behav Org 56(4):489–512

Delli Gatti D, Gaffeo E, Gallegati M, Giulioni G, Palestrini A (2008) Emergent macroeconomics: an agent-based approach to business fluctuations. Springer, Berlin

Delli Gatti D, Desiderio S, Gaffeo E, Cirillo P, Gallegati M (2011) Macroeconomics from the bottom-up. Springer, Berlin

Dosi G, Fagiolo G, Roventini A (2006) An evolutionary model of endogenous business cycles. Comput Econ 27(1):3–24

Dosi G, Fagiolo G, Roventini A (2010) Schumpeter meeting Keynes: a policy friendly model of endogenous growth and business cycles. J Econ Dyn Control 34(9):1748–1767

Dosi G, Fagiolo G, Napoletano M, Roventini A (2013) Income distribution, credit and fiscal policies in an agent-based Keynesian model. J Econ Dyn Control 37 (8):1598–1625

Gaffeo E, Delli Gatti D, Desiderio S, Gallegati M (2008) Adaptive microfoundations for emergent macroeconomics. East Econ J 34(4):441–463

Gallegati M, Palestrini A, Delli Gatti D, Scalas E (2006) Aggregation of heterogeneous interacting agents: the variant representative agent. J Econ Interac Coord 1:5–19

Greenwald BC, Stiglitz JE (1993) Financial market imperfections and business cycles. Q J Econ 108(1):77–114

Krusell P, Smith AA (1998) Income and wealth heterogeneity in the macroeconomy. J Polit Econ 106(5):867–896

Acknowledgments

Earlier versions of this paper have been presented at conferences and seminars in Ancona, Roma, Guildford, New York, Castellon, Nice and Berlin. We would like to thank participants for useful comments and discussions. We are also grateful to two anonymous referees and the Editor for their detailed comments on an earlier draft, that have led to significant improvements. None of the above are responsible for errors in this paper.

Funding

The authors declare they have received no funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Assenza, T., Delli Gatti, D. The financial transmission of shocks in a simple hybrid macroeconomic agent based model. J Evol Econ 29, 265–297 (2019). https://doi.org/10.1007/s00191-018-0559-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-018-0559-3