Abstract

Because of the surge in international crop prices in 2008, production of biofuel derived from crops has been criticized for expanding crop demands and threatening food security. In the USA, where corn is the main raw material for bioethanol, the demand for corn has rapidly increased from 18 million tons in 2001 to 100 million tons in 2008. Further, the Renewable Fuel Standard (RFS) included in the Energy Policy Act of 2005 requires refiners, blenders, and importers to use 36 billion gallons of renewable fuels by 2022, including more than 21 billion gallons of second-generation biofuels such as cellulosic ethanol. The use of corn as an energy source is expected to continue further expansion.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

Because of the surge in international crop prices in 2008, production of biofuel derived from crops has been criticized for expanding crop demands and threatening food security. In the USA, where corn is the main raw material for bioethanol, the demand for corn has rapidly increased from 18 million tons in 2001 to 100 million tons in 2008. Further, the Renewable Fuel Standard (RFS) included in the Energy Policy Act of 2005 requires refiners, blenders, and importers to use 36 billion gallons of renewable fuels by 2022, including more than 21 billion gallons of second-generation biofuels such as cellulosic ethanol. The use of corn as an energy source is expected to continue further expansion.

Many studies have simulated the crop price under biofuel production and measured its impact on the market equilibrium. For example, Koizumi and Ohga (2009) measured the impact of expansion of Brazilian FFV (flexible fuel vehicle) utilization and of the US biofuel policy on production, consumption, export, and import of sugar and corn.

However, their studies are confined to simulating the impact on market outcome. This leaves an important question: does higher price really reduce social benefit? It is sure that high crop price declines consumers’ purchasing power and weighs upon their household economy. This is a critical issue, especially for low-income households. However, recent prices of agricultural commodities have been too low for farmers to sustain on. Many developed countries have scrambled to support them through production control and subsidies. Without these measures, farmers would be at a loss because of small revenue. In this regard, ethanol production can be regarded as one of the solutions. Expansion of demand for corn and its higher price will contribute to their revenues and reduction of governmental expenditures. It is misleading to judge for or against biofuel production with the fixed view that higher price is always harmful.

For these reasons, cost-benefit analysis should be carried out. In this study, we aim to find the most economically beneficial policies with regards to the US bioethanol production. The next section overviews the model structure of the US corn market incorporating bioethanol. In the third section, we will show the simulation results across five scenarios. In the fourth section, we will outline the method to calculate the benefits and costs to each stakeholder. Our conclusion is presented in the fifth section.

2 The Model Structure

2.1 Overview of the Model

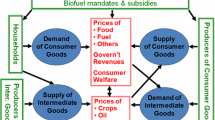

The fundamental concept of our model used in this study is illustrated in Fig. 5.1. The left side of the chart represents the supply of corn, the middle part the demand for edible corn, and the right side the demand for ethanol. This model is a dynamic partial equilibrium model focused on US corn market.

Farmers determine whether they cultivate corn or soybean before planting. If soybean price is relatively high and farmers expect soybean is more profitable, they plant soybean instead of corn. As a result, harvested area of corn will reduce. Similarly, demand for corn is also affected by wheat price because corn as feed can be substituted by wheat. We do not consider fluctuations of their prices to simplify the model’s structure and interpretation of the result of our study. In this model, corn price is determined solely by US domestic supply and demand, and behavior of producers and consumers in other countries are not reflected in the price. Import is omitted from the model because it has been less than 0.22% of production since 1961 (FAOstat n.d.).

2.2 Detailed Model Structure

Equations are either estimated using data published by USDA (n.d.-a) and FAOstat (n.d.) or cited from Oga and Yanagishima (1996).

By the assumption mentioned above, corn supply consists of only the production in the year. Production “Q” can be divided into yield “Y” and harvested area “S”:

where Y and S are represented, respectively, by

where “T” is a trend term equaling the calendar year. “P” is corn price, with (−1), (−2), and (−3) suggesting lagged variables.

According to the estimation result (5.2), the yield is not affected by corn price and increases as time passes. Equation (5.3) shows that harvested area is positively affected by past 3 years’ corn prices and, ceteris paribus, expanding every year.

Corn demand can be divided into four different usages: for food, for feed, for bioethanol, and for export. “For food” means the corn directly consumed by people. The estimation result of demand for food per capita is

where “Food,” “Pop,” and “GDP” mean demand for food, population of the USA, and real GDP of the USA, respectively. Variables with subscript 0 are their actual values in 2005.

Demand for feed is described by the price of corn and livestock production. Livestock production includes beef, pork, mutton, chicken, egg, and milk. The estimation result of demand for feed in the USA is

where “Feed,” “Beef,” “Pork,” “Chicken,” “Egg,” and “Milk” mean demand for feed, beef production, pork production, chicken production, egg production, and milk production, respectively. Variables with subscript 0 are actual values in 2005. All elasticities in Eqs. (5.4) and (5.5) are estimated by Oga and Yanagishima (1996). In their study, mutton production elasticity of demand for feed in the USA is shown to be insignificant.

The demand for bioethanol is expressed as follows. Since it is ethanol producers who purchase corn for ethanol, the demand function should represent the ethanol producer’s behavior. But there is the final consumer’s behavior to purchase ethanol behind their behavior. That is, if it is interpreted that bioethanol production is as much as consumption, the bioethanol producer’s demand for corn reflects the final consumer’s demand for bioethanol. Therefore, this model does not consider the bioethanol producer as an intermediary but the final consumer who wants “liquid corn” called bioethanol.

In the USA, bioethanol is sold by being added to gasoline. The standard and target rates of blending differ by states. In our model, we assume only two types of vehicle fuel: gasoline and E10. “Gasoline” in the equation indicates the pure gasoline made from crude oil. “E10” is blended gasoline which includes 10% of bioethanol in volume. Since there is no substantial difference between gasoline and blended gasoline as a vehicle fuel, consumers select which fuel to buy according to their own preference. Therefore, the demand for blended gasoline is supposed to depend on the price difference each consumer can accept:

“Eth” means corn consumption for bioethanol production. Corn demand for bioethanol production per capita is explained in this equation. “Pdif” is the retail price difference:

Both “\( {P}_{\mathrm{gas}}^{\ast } \)” and “\( {P}_{E10}^{\ast } \)” represent their own retail prices per gallon. Consumers must convert these prices into those per mile in order to compare accurately their efficiencies because the heating value per gallon of ethanol is about 60% that of gasoline. Our estimations (5.6) showed, however, that the demand was explained better by the price difference per gallon than by that per mile. This was presumably because the heating value ratio of E10 to gasoline was calculated as 1 × 90 % + 0.6 × 10 % = 96%, and thus consumers did not care about such a small efficiency difference.

where “Pgas” is the gasoline price before tax. This is apparently dependent on crude oil price “Pp” as shown in the following equation:

Similarly, retail price of E10 is

“taxcredit” indicates the tax credit for a gallon of E10 that is deducted from federal fuel tax. This was 5.1 cent/E10gallon until 2008. The price of E10 before tax and deducted “PE10” is represented as (5.11)

About 2.7 gallons of bioethanol is produced from a bushel of corn. The term P/2.7 in Eq. (5.11) means the raw material cost to produce a gallon of bioethanol. Since E10 consists of 10% of ethanol and 90% of gasoline, PE10 is calculated by weighted average. Although other costs such as transportation cost and margin of bioethanol producer are not considered here, we view that what is important in our model is not the level of the price difference but the change in the price difference. As the change in bioethanol price is almost explained by its raw material price, this allows us to omit these other costs.

Back to Eq. (5.6), bioethanol consumption per capita is explained well by the price difference and the trend term. Adding Eqs. (5.7), (5.8) and (5.9) we can clearly see that a rise in crude oil price brings a rise in gasoline retail price, then expansion of the price difference, and, finally, a higher E10 consumption. A rise in corn price diminishes bioethanol consumption in reverse. When the price difference is fixed, bioethanol consumption tends to increase as time passes.

The last part of the model is the demand for export. According to FAOstat (n.d.), the trend of the corn export of the USA has stopped at 45–50 million tons in recent 20 years although there are millions of tons of fluctuation. In addition, the corn production in the USA has reached 300 million tons. Therefore, we round its fluctuation to fix the export at 48 million tons:

Overall, the demand function in total is expressed as

Finally, at the equilibrium, it holds that

3 Simulation

3.1 Overall design

We have to introduce some assumptions for our simulation analysis. Our simulation begins 2007 and ends at 2020. The corn market in 2007 and 2008 was in an unusual situation caused by unexpected factors such as the financial crisis. Since our model is recursive, including these noises prevents us to analyze the mainstream trend in the grain market. Thus we avoid 2009 as the initial year. In addition, this method allows us to see how unusual the actual situation was in 2008 by comparing the actual value with the equilibrium value which is solely determined by supply and demand.

Population, GDP, livestock productions, and crude oil price are exogenous to the model. For population and GDP, projected values from USDA (n.d.-b) are used. Livestock productions are simply explained by the trend term. Their trends through the simulation period are shown in Fig. 5.2. Crude oil price is assumed to rise by 2% a year.

The US livestock production (projection) (Source: Estimation result using data from FAOstat (n.d.))

3.2 Scenarios

We arranged two types of scenarios. The first group consists of the baseline and four scenarios in which the tax credit is shifted as shown.

-

Baseline: taxcredit = 5.1 cent/E10 gallon (actual value in 2008)

-

Scenario 1: No Ethanol Production (NEP)

-

Scenario 2: taxcredit = 0 cent/E10 gallon

-

Scenario 3: taxcredit = 10 cent/E10 gallon

-

Scenario 4: taxcredit = 18.4 cent/E10 gallon (totally offsets the current federal fuel tax)

The policies in Scenarios 1 and 2 are expected to result in less bioethanol production than the baseline level, whereas those in Scenarios 3 and 4 are expected to result in reverse.

The second group of scenarios consists of the baseline and two scenarios in which E10 is replaced with E20. There is a crucial assumption here; the parameters in the bioethanol demand function (5.7) remains unchanged even if the blending rate has changed.

-

Baseline: taxcredit = 5.1 cent/E10 gallon (actual value in 2008)

-

Scenario 5: consumers select gasoline or E20 (low)

-

Scanario 6: consumers select gasoline or E20 (high)

Tax credit is 10.2 cent/E20gallon in both Scenarios 5 and 6. This is because taxcredit is a variable indicating the tax credit for E10. In other words, taxcredit = 5.1 means the tax credit for ethanol is 51 cent/gallon. If this rate is fixed, the one for E20 equals to 10.2 cent/gallon.

The difference between Scenario 5 and Scenario 6 lies in the interpretation of the bioethanol demand function (5.7). If “Eth” in this function is interpreted as the demand for bioethanol proper, that is, the amount of bioethanol in the E10 or E20 mix, the change from E10 to E20 does not alter the consumption because it is determined only by the price difference between gasoline and blended gasoline. This is Scenario 5. However, the demand function (5.7) can also be interpreted as the demand for blended gasoline because the consumption of bioethanol and that of blended gasoline are two sides of the same coin under our assumption. That is, the demand function for blended gasoline is identical regardless of the blending rate. The consumption of bioethanol in the E20 scenario is twice that of baseline if the price difference is the same. This is Scenario 6. These concepts are illustrated in Figs. 5.3 and 5.4. As the result, the demand function is altered as shown.

Scenario 5:

Scenario 6:

3.3 Results

Figure 5.5 shows the simulation results of corn price in the first group along with the actual values from 1991 to 2006. In all scenarios, the price goes downward. This is especially remarkable in NEP. In all scenarios but NEP, the price settles in the range of 200–300 cent/bushel, the level at which price has actually stayed for more than 30 years.

Expanding demand for corn is met mainly through growing yield. The US corn yield was 9.5 t/ha in 2007 and is expected to be 10.8 t/ha in 2020. Harvested area does not expand so much in any scenario. In 18.4 cent/gallon scenario which needs the largest area of all scenarios tested, it is expected to be 32.3 million ha in 2020. Although it exceeds the maximum area recorded prior to the simulation’s initial year (30.4 million ha in 1985), the difference is not so large relative to its amplitude.

In 2008, the actual corn price jumped up to 497.5 cent/bushel (USDA/ERS n.d.-a). One of the causes was bioethanol production. Because crude oil price in 2008 was $97.26/bbl (BP n.d.), bioethanol consumption must have been promoted. Then, how much impact did the rise in crude oil price have on corn price? We simulated corn price in 2008 by setting crude oil price at the actual value.

The results show that the calculated corn price in 2008 is no more than 257.7 cent/bushel. Even when replacing $97.26/bbl with $147/bbl (the highest crude oil price in 2008), calculated corn price is only 306.8 cent/bushel. The most likely reason for such a surprising result is that a rise in crude oil price brings not only a higher gasoline price but a higher E10 price.

This leaves about 240 cent/bushel of the difference that cannot be explained only by supply and demand. This component is caused by external factors such as the financial crisis and excessive expectation of investors.

The results of the second group simulations are shown in Fig. 5.6. The corn prices in these two scenarios are much higher than that in the baseline. The price in E20 (high) scenario (Scenario 6) almost reaches the actual value in 2008 and that in E20 (low) scenario (Scenario 5) becomes as high as the 18.4 cent/gallon scenario in the first group, but unlike the first group, they do not decline. The price in E20 (low) scenario stays at about 294 cent/bushel and that in E20 (high) scenario rises and reaches 477 cent/bushel in 2020.

According to these results, raising blending rate is expected to have a greater impact on corn price than increasing tax credit.

4 Welfare Analysis

4.1 Overall design

In the previous section, the simulation result of corn price was shown. On the basis of this result, we analyze who benefit by the US bioethanol policy in each scenario and by how much.

Six countries and one region are considered here: the USA, China, Argentina, Mexico, Brazil, EU (consisting of 27 countries), and Japan. All but Japan are main corn producers in the world. Especially, the USA and China produce more than 100 million tons individually and account for about 60% of the whole production in the world between them. Of course, each producer is also a consumer. Japan produces little corn and hence is regarded as a sole consumer.

Corn producers and corn consumers in these countries are assumed to be economic stakeholders. Corn consumers refer to people who consume corn directly as food or indirectly as feed. They are all assumed to be price takers and behave based on an exogenously determined price.

The US government and the US consumers of bioethanol are also included as stakeholders. The US government deducts the federal fueltax for ethanol. Thus, even if bioethanol production improves social welfare, too much support increases the opportunity cost and incurs financial difficulties on the state.

There are other benefits of bioethanol such as CO2 reduction, saving fossil fuels, improvement in energy self-sufficiency ratio, and prevention of air pollution. Although they are regarded as significant sources of positive externalities, there is no consensus on assessment method. Therefore, they are omitted in the subsequent analysis. The value of CO2 reduction, however, will be discussed later using an approach different from the direct evaluation method.

4.2 Detailed Procedures

Benefits for corn producers and corn consumers are evaluated as producers’ surplus and consumers’ surplus, respectively. Supply function and demand function are necessary to calculate surplus in each country.

The structure of the corn demand in non-US countries is almost the same as that of the USA. The only difference is that it does not include a demand for bioethanol (Fig. 5.3). Here we show them in general form below. Subscript i indicates countries.

Demand for food:

Demand for feed:

Demand in total:

The values of elasticity (superscripts a-j) are sourced from Oga and Yanagishima (1996). Livestock productions are assumed to be exogenous to the system.

Supply:

where k and m are also the parameters peculiar to each country.

Producers’ surplus and consumers’ surplus in country i are calculated by integrating the supply function and the demand function, respectively. In order to allow the result converge and compare them among the scenarios, each surplus is expressed as the differential between the baseline scenario and the concerned scenario.

The relative producers’ surplus:

The relative consumers’ surplus:

where PI and PII indicate the corn price in the baseline scenario and in the concerned scenario, respectively. Note that both supply function and demand function are fixed across the scenarios.

The benefit to ethanol consumers is also calculated as ethanol consumers’ surplus. The surplus is calculated with

The lower limit of integral “pe” is the equilibrium price, and the upper limit “pi” is the intercept of the inverse demand function. Therefore, the relative surplus to that of the baseline is derived with the following formula.

The relative bioethanol consumers’ surplus:

where the second term in this equation is the bioethanol consumers’ surplus at the baseline.

The last to consider is the opportunity cost of the US government. As mentioned above, the US government loses the tax revenue by deducting the federal fuel tax. Since the tax credit increases as the government promotes the bioethanol production, the negative effect on the government is larger in such scenarios. Although rise in the corn price provides a positive aspect to the government of reduction of the agricultural subsidies, this effect is not included in this study.

The assumption at calculating the opportunity cost is that the domestic energy consumption in the given year is constant across the scenarios.

Suppose that consumption of gasoline is V gallon and that of ethanol is W gallon in a certain year. They are equivalent to V + 0.6 W gallon of gasoline in terms of energy since the heating value ratio is gasoline/ethanol = 1:0.6. Therefore, the tax revenue would be (V + 0.6 W) × fueltax if there were no ethanol consumption. The actual tax revenue is V × fueltax + W × (fueltax-10taxcredit). The opportunity cost is the differential between them. It is calculated with

This value shows the loss of revenue comparing with NEP. To compare with baseline, we use the following equation:

where superscript I indicates the baseline. The relative loss in the concerned scenario compared with baseline is calculated with the relative loss for the government:

We are aware that including ∆Gov in social welfare is debatable, and whether it should for part of the analysis or not depends on to whom this revenue is ultimately attributed. If the revenue of the US government gained by reducing tax credit is used for corn producers, corn consumers, or bioethanol producers, ∆Gov should be included. Otherwise, all amount of ∆Gov should not be necessarily included. We assume that all revenues are used exclusively for those associated with corn markets, hence include all of ∆Gov in our calculations.

The total relative benefit of China, Argentina, Mexico, Brazil, and EU is evaluated as ΔPSi + ΔCSi. Those of the USA and Japan are ΔPSu + ΔCSu + ΔCSeth + ΔGov and ∆CDj, respectively.

4.3 Results

The results for 2020 are shown in Table 5.1. The unit is million US$.

Among the first group, the total welfare of the world is the largest in the 0 cent/gallon scenario. Figure 5.7 is the scatter plot between taxcredit and the sum of benefits. This figure shows that the sum is likely maximized at taxcredit = 0 under the constraint that taxcredit ≧0. The result that 0 cent/gallon scenario brings more total benefit to the whole world than NEP implicates the significance of bioethanol production. When the US benefit is excluded from the total, NEP brings the maximum benefit among five scenarios.

For all scenarios, the values of the US subtotal are 0 or less. This result stands consistently from 2008 through 2020. This means the actual US policy in 2008 has economic rationality. Figures 5.8 and 5.9 are the scatter plots between tax credit and the US benefit in 2020. These figures show the US benefit is maximized when taxcredit = 3.6, the level very close to the current level of 5.1 cent/gallon.

The US producers’ surplus is more subject to the bioethanol policy than consumers’ surplus. Therefore, ΔPSu + ΔCSu is positive when the government adopts pro-bioethanol policy. Such policy also improves ∆CSeth. ∆Gov, however, is decreased considerably, whereas NEP brings relatively small gain. As the result, maximization of the total US benefit is accomplished at the intermediate tax credit.

The benefit for Argentina becomes larger as bioethanol production is promoted, while that of China, Brazil, and Mexico decreases. In Japan, the benefit is necessarily decreased because of the assumption that there is no corn producer. The benefit of EU does not have simple trend. NEP is expected to bring more benefit than the current situation. EU has insisted that the bioethanol production derived from crops should be abandoned. Their argument is that the higher food price brought by bioethanol production would cause hunger to the poor. The evaluation result shows that it is rational for EU itself as well. However, it also gains more benefit in the 5.1 cent/gallon scenario than in NEP, and the benefit increases as tax credit becomes larger.

E20 scenarios in the second group are expected to bring larger benefits to the world. However, almost all of them belong to the USA, especially the US corn producers. This means the E20 policy might cause a greater gap in international distribution of the benefit; on the one hand, the USA gains enormous benefit, but, on the other hand, China loses their share. Domestic gaps in distribution also tend to be wider under these scenarios; for example, in China under E20 (high) scenario, corn consumers have to tolerate a great loss, while corn producers gain a large benefit. Such scenarios will likely be unacceptable unless benefit transfer is implemented.

4.4 Value of CO2 Reduction

In the previous subsection, it was shown that the most rational E10 scenario differs for the whole world (0 cent/gallon) and the USA (3.6 cent/gallon). Those values, however, include only economic factors and for others are omitted. Now we attempt to introduce the value of CO2 reduction. As it is difficult to evaluate the value of CO2 reduction, we will apply another approach.

Table 5.2 shows the volume of CO2 reduction. Bioethanol also emits CO2 through its life cycle. There is no consensus how much CO2 is reduced by substituting gasoline with bioethanol as a whole. Some studies insist the use of bioethanol rather than increase new CO2. However, we adopt the following formula here.

where CO2 is the amount of reduction (million tons). The coefficient 9.99/25,400 is the conversion rate from corn consumption for bioethanol production (1000 tons) to CO2 reduction (million tons). Because the amount of CO2 reduction is proportional to bioethanol consumption, it increases as the tax credit becomes larger (Table 5.3).

Since the largest benefit is brought under no tax credit, the threshold value of CO2 reduction to make an alternative scenario superior is calculated as

where B means benefit. The superscript 0 means “0 cent/gallon” scenario.

These values are shown in Table 5.4. Because both the benefit and the CO2 reduction of NEP are less than those of the 0 cent/gallon scenario, NEP can never exceed the 0 cent/gallon scenario. Therefore, the result is described as “inferior (-).” The value for “Average” in Table 5.4 is calculated as

The smallest average is $116.9/CO2t in the 3.6 cent/gallon scenario. This means 3.6 cent/gallon scenario is more rational than any other scenarios for the world if the value of the CO2 reduction is evaluated to be greater than $116.9/t. In other words, the most rational policy for the USA becomes acceptable by the world. Note, however, that we use the word “acceptable” in a narrow sense that the most rational tax credit for the world is not necessarily 3.6 cent/gallon even in this case.

5 Conclusion

In this study, we simulated corn price under the current and alternative sets of bioethanol policy and then analyzed the social benefit associated with each scenario.

First, the simulation result showed the following:

-

(a)

Corn price in any scenario will decline even if crude oil price rises 2% a year.

-

(b)

Although too much support for bioethanol production might induce higher corn price than the usual level, the current policy of tax concession will contribute to support the price. On the contrary, suspension of bioethanol production might cause price slashing.

-

(c)

Switching E10 to E20 has a much larger impact on corn price than changing the level of the tax credit policy.

-

(d)

The hike in corn price in 2008 is scarcely explained by supply and demand only, which indicates that the major cause was not expansion of bioethanol production but external factors. Thus, although bioethanol production induced excessive expectation of investors, it will unlikely persist.

The second step of our study aimed to measure the impact of the US bioethanol production on household economy. The result of this step showed the following:

-

(a)

The current policy of tax concession (5.1 cents) is at a rational level for the US society.

-

(b)

The USA is expected to gain another 11.3 million dollars of benefit (average of 2011–2020) by reducing the tax credit to 3.6 cent/gallon, the theoretical maximum.

-

(c)

Ethanol production without tax credit brings most beneficial result for the whole world combined.

-

(d)

The value of CO2 reduction must be more than $116.9/t in order for the 3.6 cent/gallon scenario to become acceptable to the world.

-

(e)

Although the E20 policy might produce much more benefit for the world than the tax credit policy, the distribution of benefit will likely to be less equal than the current situation.

Overall, three observations can be made in relation to the present analysis.

First, the most rational policy is not exactly the same as the most appropriate policy. Any policy change generates winners and losers both internationally and domestically. The problem can be solved if benefit transfer is carried out successfully, however it is very difficult especially to dissolve international inequality. It is a critical problem when low-income countries or such households become “losers” even if the policy is the most efficient for the whole world or for the USA.

Second, an increase in producers’ surplus does not necessarily mean improvement of famers’ revenue. In case when there is imbalance of market power among farmers, wholesalers, and retailers, it is possible that the surplus does not come back to farmers at all. Even if it is not the case, their surplus is partially offset when expansion of bioethanol utilization is caused by a surge in crude oil price. This is because higher crude oil price means an increase in production cost of corn as well as dominance of blended gasoline against pure gasoline. Therefore, part of their additional revenue flows out as an additional cost. A higher price in agricultural commodities does not immediately benefit farmers in many cases.

Finally, we have to consider the impact on individuals. More specifically, we need additional studies at domestic level to answer the following questions.

-

(a)

Are there any ways to transfer their benefit appropriately?

-

(b)

How much loss can each stakeholder tolerate?

-

(c)

Who, ultimately, receives the benefit?

-

(d)

How much impact does policy impose on each household?

References

BP Global (n.d.) http://www.bp.com/bodycopyarticle.do?categoryId=1&contentId=7052055. Last access 27 Jul 2010

FAOstat (n.d.) http://faostat.fao.org/. Last access 27 Jul 2010

Koizumi T, Ohga K (2009) Impact of the expansion of Brazilian FFV utilization and U.S. biofuel policy amendment on the world sugar and Corn Markets: an econometric simulation approach. Jpn J Rural Econ 11:9–32

Oga, Yanagishima (1996) International food and agricultural policy simulation model

USDA/ERS (U.S. Department of Agriculture/ Economic Research Service) (n.d.-a) Feed grains database http://www.ers.usda.gov/Data/FeedGrains/. Last access 27 July 2010

USDA/ERS (U.S. Department of Agriculture/ Economic Research Service) (n.d.-b) International macroeconomic data set http://www.ers.usda.gov/Data/Macroeconomics/. Last access 27 July 2010

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution-NonCommercial 2.5 International License (http://creativecommons.org/licenses/by-nc/2.5/), which permits any noncommercial use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2018 The Editor(s) (if applicable) and the Author(s)

About this chapter

Cite this chapter

Takagi, H., Takahashi, T., Suzuki, N. (2018). Welfare Effects of the US Corn-Bioethanol Policy. In: Takeuchi, K., Shiroyama, H., Saito, O., Matsuura, M. (eds) Biofuels and Sustainability. Science for Sustainable Societies. Springer, Tokyo. https://doi.org/10.1007/978-4-431-54895-9_5

Download citation

DOI: https://doi.org/10.1007/978-4-431-54895-9_5

Published:

Publisher Name: Springer, Tokyo

Print ISBN: 978-4-431-54894-2

Online ISBN: 978-4-431-54895-9

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)