Abstract

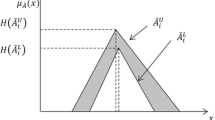

In an uncertain economic decision environment, an expert’s knowledge about discounting cash flows consists of a lot of vagueness instead of randomness. Cash amounts and interest rates are usually estimated by using educated guesses based on expected values or other statistical techniques to obtain them. Fuzzy numbers can capture the difficulties in estimating these parameters. Ill this chapter, the formulas for the analysis of fuzzy present value, fuzzy equivalent uniform annual value, fuzzy future value, fuzzy benefit-cost ratio, and fuzzy payback period are developed and given sonic numeric examples. Then the examined cash flows are expanded to geometric and trigonometric cash flows and using these cash flows fuzzy present value, fuzzy future value, and fuzzy annual value formulas are developed for both discrete compounding and continuous compounding. The fuzzy dynamic programming is applied to the situation where each investment in the set has the following characteristics: the amount to be invested has several possible values, and the rate of return varies with the amount invested. Each sum that may be invested represents a distinct level of investment, and the investment therefore has multiple levels. A fuzzy present worth based dynamic programming approach is used. A numeric example for a multilevel investment with fuzzy geometric cash flows is given. A computer software named FUZDYN is developed for various problems such as alternatives having different lives, different uniform cash flows, and different ranking methods.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Bellman, R., Zadeli, L. A. (1970): Decision-Making in a Fuzzy Environment. Management Science, Vol. 14, 141–164

Berenji, I. R. (1994): Fuzzy Q-Learning: A New Approach for Fuzzy Dynamic Programming. Proceedings of the 3’ d IEEE International Conference ( Al Fuzzy Systems, Vol. I, 486–491

Blank, L. T., Faruin, J. A. (1987): Engineering Economy, Third Edition, McGraw-Hill

Boussabaine, A., Elhag, C. (1999): Applying fuzzy techniques to cash flow analysis. Construction Management, and Economics, Vol. 17, No. 6, 745–755

Buckley, J. U. (1987): The Fuzzy Mathematics of Finance, Fuzzy Sets and Systems, Vol. 21, 257–273

Chang, W. (1981): Ranking of Fuzzy Utilities with Triangular Membership Functions, Proc. lut. Conf. of Policy Anal. and inf. Systems, 263–272

Chin, H. -C. (1995): Optimal Shunt, Capacitor Allocation by Fuzzy Dynamic Programming. Electric Power Systems Research, Vol. 35, No. 2, 133–139

Chiu, C. Y. (1994): Park, C. S., Fuzzy Cash Flow Analysis Using Present, Worth Criterion. The Engineering Economist, Vol. 39, No. 2, 113–138

Dimitrovski, A. D., Matos, M. A. (2000): Fuzzy Engineering Economic Analysis. IEEE Transactions on Power Systems, Vol. 15, No. 1, 283–289

Dubois, D., Prade, H. (1983): Ranking Fuzzy Numbers in the Setting of Possibility Theory. Information Sciences, Vol. 30, 183–224

Esogbue, A. O. (1999): Fuzzy Dynamic Programming: Theory and Applications to Decision and Control. Proceedings of the 18th International Conference of the North American Fuzzy Information Processing Society (NA RIPS’99), 18–22

Esogbue, A. O. (1999): Computational Complexity of Some Fuzzy Dynamic Programs. Computers and Mathematics with Applications 11, 47–51

Fu, C. -C., Wang, F. (1999): Fuzzy Project Management by Team Approach. Proceedings of the [FEE International Fuzzy Systems Conference (FUZZ-IEEE’99), Vol. 3, 1487–1492

Luang, K. Y., Yang, I. T., Liao, C. C., Huang, C. -L. (1998): Fuzzy Dynamic Programming for Robust Direct Load Control. Proceedings of the 2’ ’ International Conference on Energy Management and Power Delivery (EIVIPD’98), Vol. 2, 564–569

Hussein, M. L., Abo-Sinna, M. A. (1995): Fuzzy Dynamic Approach to the Nlulticriterion Resource Allocation Problem. Fuzzy Sets and Systems 2, 11., 124

Walnura, K., Liu, B. (1998): Chance Constrained Integer Programming Models for Capital Budgeting in Fuzzy Environments. Journal of the Operational Research Society, Vol. 49, No. 8, 854–860

Jain. R. (1976): Decision Making in the Presence of Fuzzy Variables. [1111E Trans. on Systems Man (l).:bernet, Vol. 6, 698–703

Kacprzyk, I., Esogbue, A. O. (1996) Fuzzy Dynamic Programming: plain Developments and Applications. Fuzzy Sets and Systems, Vol. I. No. 81, 3145

Kahraman. C. (2001): Capital Budgeting Techniques Using Discounted 1 ‘uzzy Cash Flows, in Soft Computing for It.isk Evaluation and:Management: Applications in Technology Environment, and Finance, Ruaai. D., Kacprzy I., Fedrizzi, M. (Eds.), Physica- Verlag, 375: 396

Kahraman, C. (2001): Fuzzy Versus Probabilistic Benelit/Cost Ratio Analysis for Public Works Projects. International.Journal of Applied V’Iathemat cs and Computer Science 3, 101— 114

Kahraman, C., Iluan, I., Tolga, E. (2001): Capital Budgeting Techniques [sing Discounted Fuzzy Versus Probabilistic Cash Flows, Information Sciences.. forthcoming

Kahraman, C., Iolga, E., Ilukan, Z. (2000): Justification of Manufacturing ‘technologies Using Fuzzy Benelit/Cost Ratio Analysis. International Journal of Production Economics L 5–52

Kahraman, C., Ulukan, Z., Tolga, E. (1998): Combining Equal-Life Alultilevel Investments Using Fuzzy Dynamic Programming. Proceedings of the Third Asian Fuzzy Systems Symposium (Ar SS’98), 347 351

Kahraman, C,, Ulukan, Z. (1997): Continuous Compounding in Capital Budgeting Using Fuzzy Concept. In: Proceedings of 6tß’ IEEE International Conference on Fuzzy Sy,teras (FUZZ-IFEE’97), 13e11aterra-Spain, 1951 11. 5

Kahraman, C, Elukan, Z. (1997): Fuzzy Cash Flows Under Inflation. In: Proceedings of Seventh International Fuzzy Systems Association World (’ougress (IFSA’97), University of Economics. Vol. IV, 10I 108

Karsak, E. E. (1998): Aleasures of Liquidity Risk Supplementing Fuzzy Discounted Cash Flow Arralysi. Engineering Economist, Vol. 93, No. 1, 331–3. 19

Kaufmann, A. (1988): Fuzzy Mathematical Idodels in Engineering and anagement Science. Elsevier Science Publishers II. V.

Kuchta, T. (2000): Fuzzy capital budgeting, Fuzzy Sets a ud Systems, Vol. 111, 367

Kurtz, N. (1995): Calculations for Engineering Economic Analysis. iIcGrawHill

Lai, K. K. Li, I,. (1999): A Dynamic Approach to Multiple-Objective Resource Allocation Problem, European.Journal of Operational Research. Vol. 117. No. 2. 293–309

Li, L., Lai, K. K. (2001): Fuzzy Dynamic Programming Approach to hybrid Multi-objective Multistage Decision Slaking Problems, Fuzzy Sets and Systems, Vol. 117, No. I, 13–25

Iiou. Y-S., Vang H-I. (1992): Ranking Frizzy Numbers with Integral Value, Fuzzy Sets and Systems, 247–255

Newnan, D. (1958) Engineering Economic Analysis,:3 Engineering Press

Ward, I. L. (1985): Discounted Fuzzy Cash Flow Analysis, in 1985 Fall Industrial Engineering Conference Proceedings, 176–481

Winston, W. I,. (1999): Operations Research: Applications and Algorithms. Duxbury Press

Vager, R. I. (1980): On Choosing Between Fuzzy Subsets, Kybernetes. 151 154

Zadeh, L. A. (1965): Fuzzy Sets, Information and Control, Vol. 8, 338-353

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2004 Springer-Verlag Berlin Heidelberg

About this chapter

Cite this chapter

Kahraman, C., Bozdağ, C.E. (2004). Fuzzy Investment Analysis Using Capital Budgeting and Dynamic Programming Techniques. In: Chen, SH., Wang, P.P. (eds) Computational Intelligence in Economics and Finance. Advanced Information Processing. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-06373-6_3

Download citation

DOI: https://doi.org/10.1007/978-3-662-06373-6_3

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-642-07902-3

Online ISBN: 978-3-662-06373-6

eBook Packages: Springer Book Archive